Good morning everyone, I hope your weekend is going well. It is supposed to rain on and off all weekend in San Francisco, so I hope the weather is better wherever you are. Yesterday was not a very good day for most Bluebird and AMEX Serve Card holders (Round 2 of AMEX Serve Card Account Closures (March 4, 2016)), but the second round of shutdowns ironically occurred at a great time for this post.

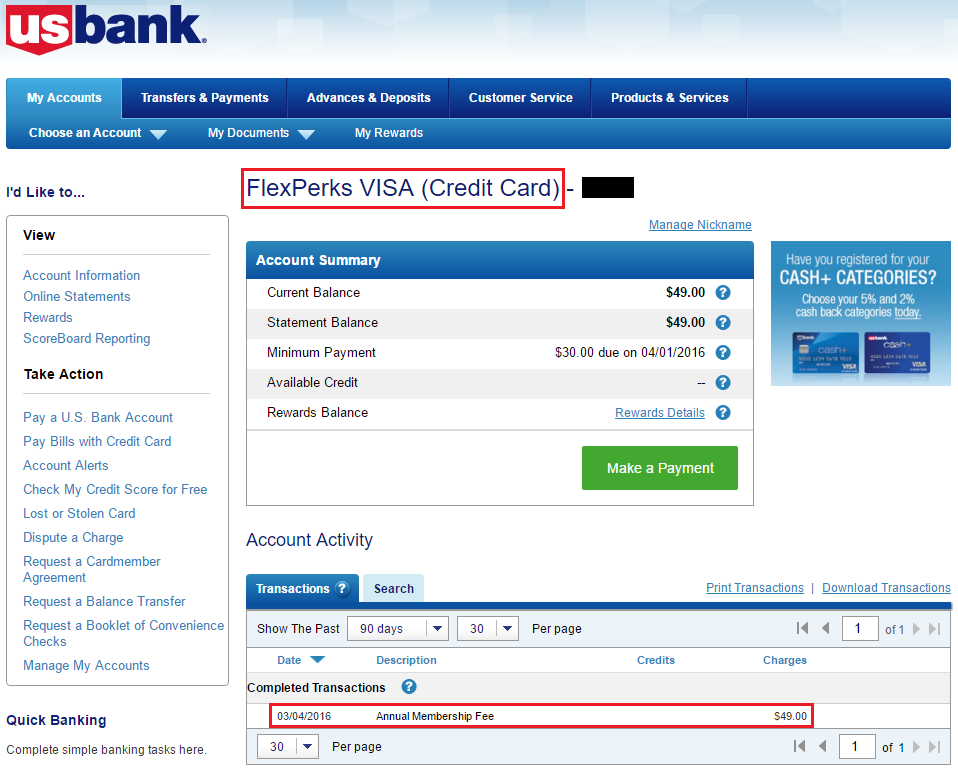

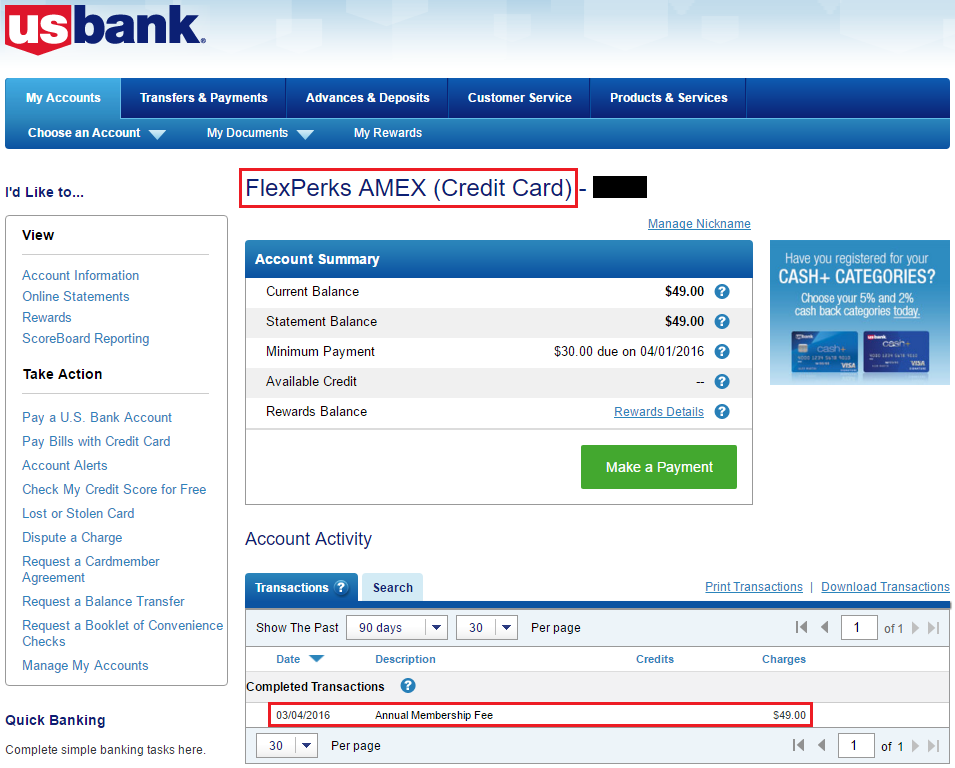

When I logged into my US Bank online account this morning, I saw a $49 annual fee post on both of my US Bank FlexPerks Credit Cards (Visa Signature and American Express). I was exclusively using my US Bank FlexPerks AMEX Credit Card for AMEX Serve Card online reloads, but since that avenue is no longer available, I really have no other use for the US Bank FlexPerks AMEX Credit Card. I originally got both US Bank FlexPerks Credit Cards when they were offering large sign up bonuses (Winter Olympics in 2014 for the US Bank FlexPerks Visa Signature Credit Card and the standard 20,000 FlexPoints for the US Bank FlexPerks AMEX Credit Card).

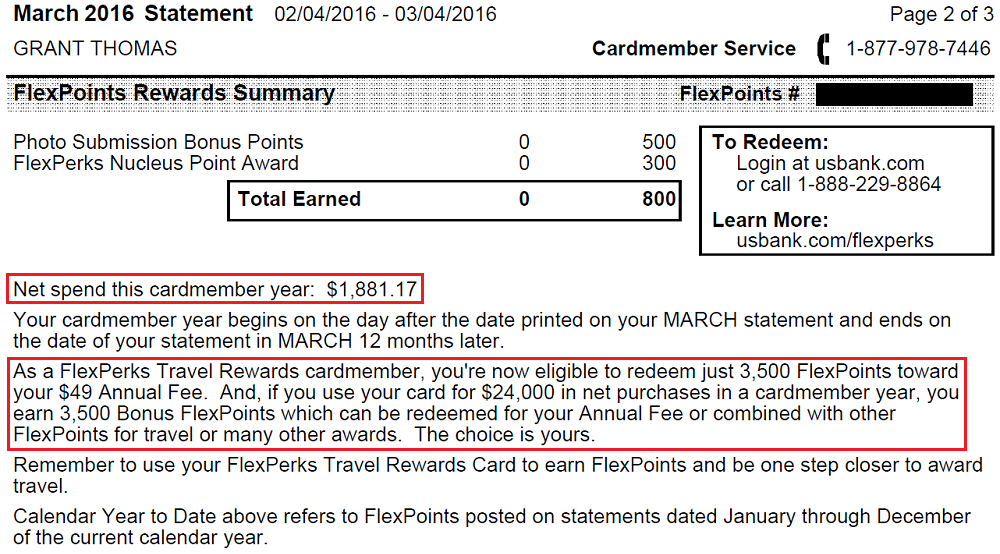

On my recent US Bank FlexPerks Visa Signature Credit Card statement (left), you can see that I did not spend very much on the credit card in 2016. I used that card a lot last year when you could load your Target Redbird Card with a US Bank FlexPerks Visa Signature Credit Card and get 2x FlexPoints. Since the Target Redbird Card died a few months ago, I haven’t used my US Bank FlexPerks Visa Signature Credit Card this year.

On my recent US Bank FlexPerks AMEX Credit Card statement (right), I was racking up the FlexPoints by loading 4 AMEX Serve Cards via online credit card reloads. During the good days (before January 8, 2016), I was spending $4,000 a month via online AMEX Serve Card reloads. Between January 9 and March 4, I was still able to spend $1,000 per month reloading my last AMEX Serve Card. With the closure of my last AMEX Serve Card, I no longer have a need for the US Bank FlexPerks AMEX Credit Card.

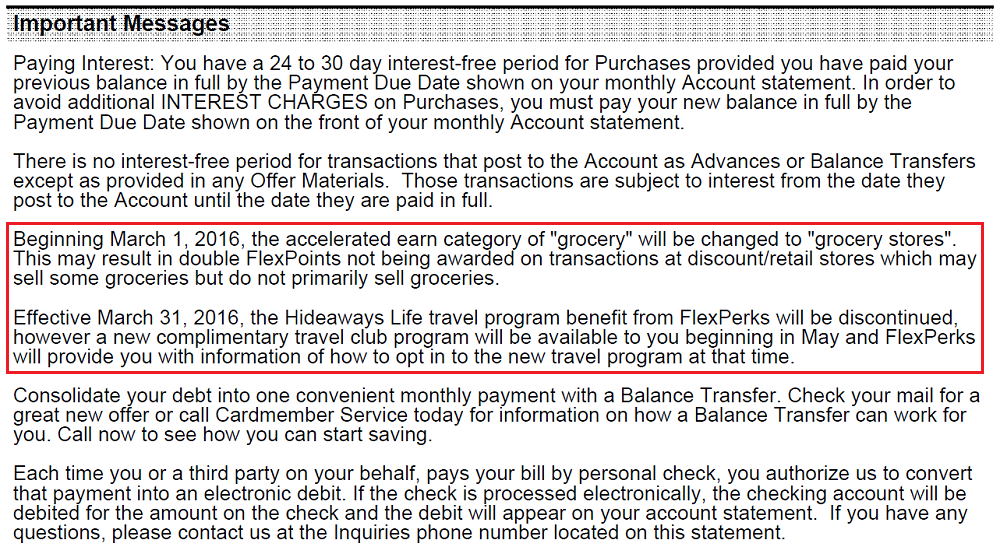

Last month I wrote about Upcoming US Bank FlexPerks Visa/AMEX Credit Card Changes to “Grocery”; FlexPoints Purchase & Transfer Limits. Those changes are now in effect and there is another change coming, but one that probably no one cares about. Hideaway Life is a complimentary benefit (aka worthless) that US Bank FlexPerks Credit Card holders can use. I wrote about that in Lesser Known Perks of the US Bank FlexPerks Travel Rewards Credit Card. It was free, so I signed up, but it is totally worthless for me. Does anyone read Hideaway Life?

Before I even consider paying the annual fee, my first plan is to call the retention department and ask them to waive the annual fee or give me a $49 statement credit to offset the annual fee. It is a long shot, but “you miss all the shots you don’t take” (aka call and you have a shot at getting the annual fee waived or a statement credit).

If that doesn’t go well, I have a few other options to consider:

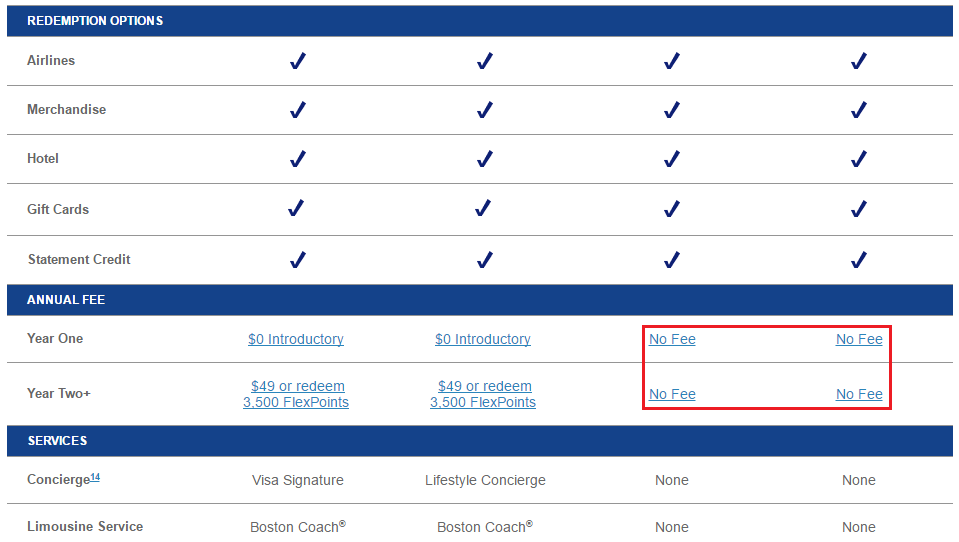

- Pay the $49 annual fee

- Pay the $49 annual fee with 3,500 US Bank FlexPoints ($49 / 3,500 = 1.4 CPP value)

- Downgrade to a no annual fee credit card

- Close the credit card

Since I no longer actively earn FlexPoints, I’m not really interested in keeping the current cards open. I’m more focused on spending down my FlexPoints account balance. I strongly recommend never closing a credit card if there is no annual fee credit card you can downgrade or convert to, so that is the route I am going to pursue.

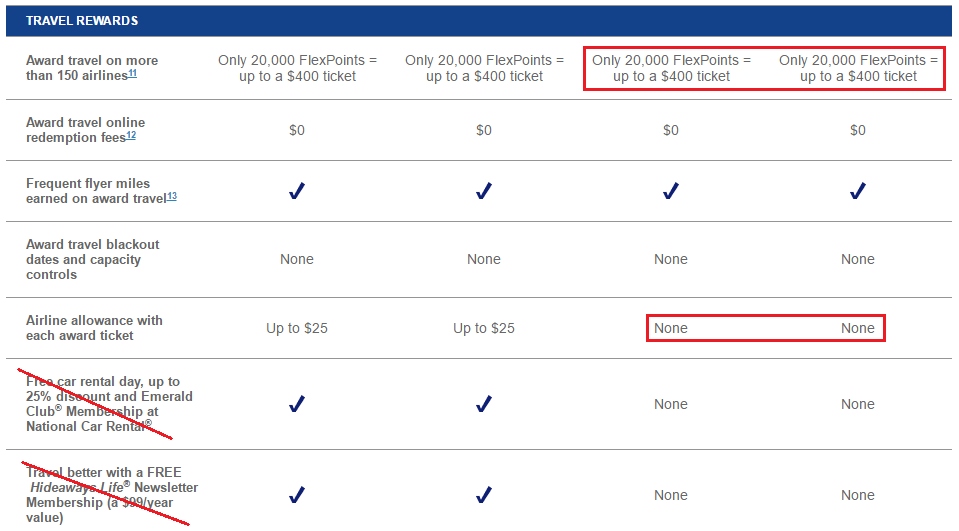

On the US Bank FlexPerks Credit Card comparison page, there are 4 options (2 annual fee credit cards and 2 no annual fee credit cards). Since I have both of the annual fee credit cards, let’s look at the no annual fee credit cards and see how they compare.

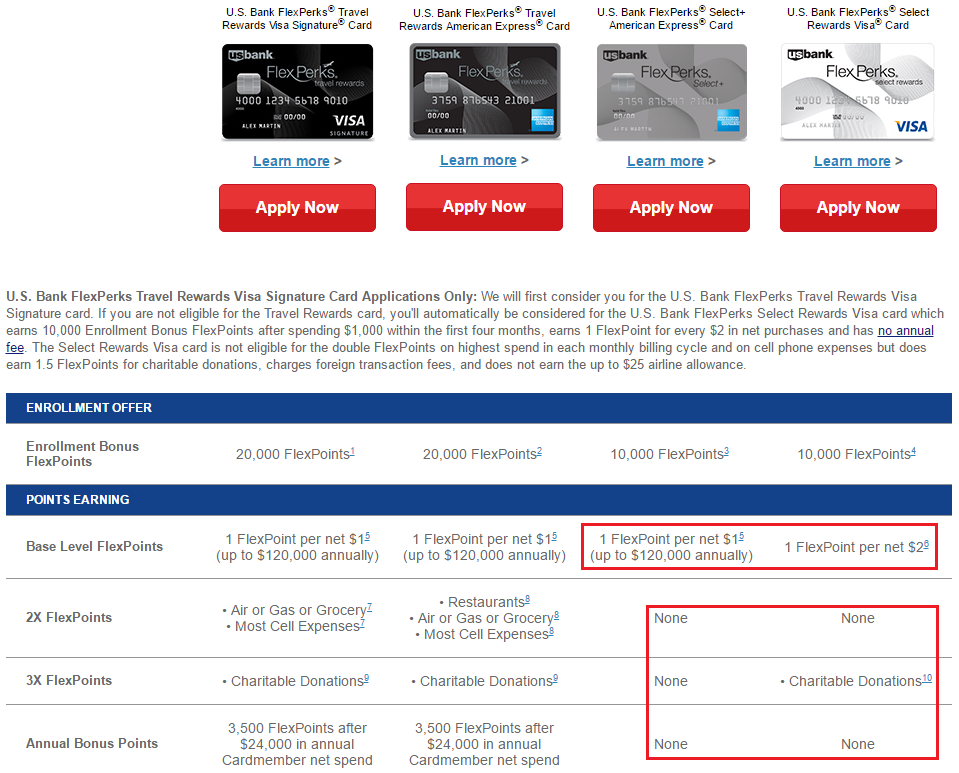

There is a no annual fee American Express credit card that earns 1x everywhere and a no annual fee Visa credit card that earns 0.5x everywhere (aka 1 FlexPoint per $2) and 1.5x for charitable donations.

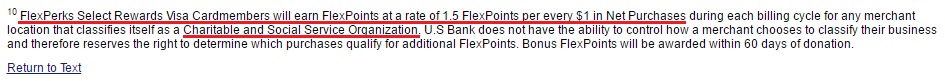

Here is the small print on the charitable donations category for the no annual fee Visa credit card.

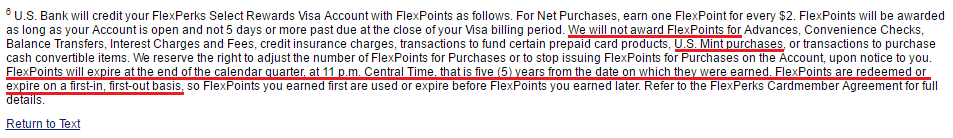

Fun fact, I was reading through the FlexPerks program rules and it specifically says that FlexPoints will not be awarded for US Mint purchases (hehe). I also learned that FlexPoints expire approximately 5 years after you earn them, on a first-in, first out basis.

Back to the comparison. Both no annual fee credit cards have the ability to redeem FlexPoints for travel (20,000 FlexPoints = up to $400 in airline travel), but they do not come with the $25 airline allowance. Assuming you book 2 award tickets with FlexPoints and max out the $25 airline allowance, that basically negates the annual fee. I recommend reading the comments on my post about US Bank FlexPerks $25 Airline Allowance Reimbursement Process & Timeline.

US Bank also clarifies what no annual fee means by explaining that no annual fee will be billed for year 1 and year 2. What about year 3? Is there going to be an annual fee? I don’t want to wait and find out…

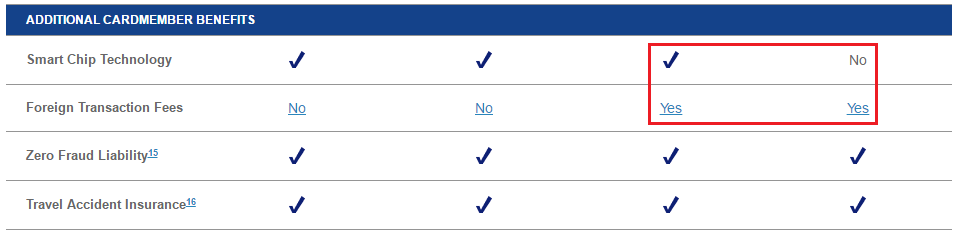

Both no annual fee cards have foreign transaction fees, so don’t use these cards outside the United States. Last but not least, the no annual fee AMEX has a smart chip, while the no annual fee Visa does not have a smart chip. Way to call out the no annual fee Visa as a slacker… shesh!

So what is my game plan? My plan is to call US Bank and ask for a retention offer on my US Bank FlexPerks AMEX Credit Card. If that doesn’t work, I will downgrade/convert to the no annual fee AMEX credit card. After looking at the list of Team USA 2016 olympic sponsors, it doesn’t look like US Bank will participate. I did see Citi, Visa, and Hilton all mentioned, so there *may* be a promo surrounding the Citi Hilton HHonors Visa Signature Credit Card. That is all speculation at this point.

With that said, I will call US Bank and ask for a retention offer on my US Bank FlexPerks Visa Signature Credit Card. If that doesn’t work, I will downgrade/convert to the no annual fee Visa credit card. If US Bank does decide to be a sponsor, they will most likely offer a higher sign up bonus for their US Bank FlexPerks Visa Signature Credit Card like they did for the 2012 Summer Olympics and 2014 Winter Olympics. If that is the case, I will then close my no annual fee Visa credit card and try applying for the US Bank FlexPerks Visa Signature after the 2016 Summer Olympics are over.

If you have any questions, please leave a comment below. Have a great weekend everyone!

Look at this another way instead of CPM redemption … The 3500 pts to cover the annual fee can be ‘earned’ specifically for that purpose. I dunno about you, but I can earn 4000 pts at a grocery store for about $20 (4x $500 GCs, at ~$5 each; at 2x FP = 4000+ FP).

So, you annual fee actually only **costs** less than $20 out of pocket.

That is definitely true, but I haven’t used my FlexPerks credit card at a grocery store/Target in several months, so that option is off the table for me.

Grant, please save us a phone call each and report what is the cutoff for canceling and getting the annual fee refunded, I am in the same boat and it doesn’t say anything on the statement.

I’ve read a few other CC statements and most say that if you call to cancel with 30 days of when the statement is mailed out (or available online), you can have the AF refunded (if paid) or the car closed without penalty. I’m still waiting for my last Serve payment to post to my FlexPerks AMEX then I will ask about cancelling or downgrading the cards.

I spoke with a US Bank supervisor who saw a retention offer for 3,500 bonus FlexPoints for both my Visa and AMEX. I accepted both offers and will pay the annual fees with cash, not FlexPoints.

Do you use the card much (if at all)? I called to try to downgrade my wife’s card and was told that it could not be done. Then I asked if there was any way to avoid the annual fee and was told no. I did not ask for a supervisor or threaten to cancel it. We have not used the card since getting the signup bonus. I don’t really want to cancel at this point since I have 47,000 points in the account and would need to redeem them first.

If I could get the 3500 point retention offer, then I could pay the $49 and then redeem 3500 points to be reimbursed for the fee.

I used to use the US Bank FlexPerks Visa Credit Card a lot at Target to load my Redbird cards, but since then, I haven’t used the card much. I think it was a combination of credit history, card portfolio at US Bank, the supervisor’s generosity, and whatever random offers were added to my credit card. I would probably pay the annual fee to keep the points alive. You can also transfer the points to another FlexPerks account for free.

I discovered that you cannot transfer more than 20,000 points per year (it’s in the FAQ on their site) and I have 47,201 (some of which came from a previous card that I closed). I suspect that the limit is new because I believe that more than 20,000 came from the other card.

Because you have to redeem them in 5,000 chunks (other than for airfare, which I have no need for at the moment), I will probably end up cashing out 30,000 of them and then transfer 17,201 to my other account. That account, BTW, was opened with a “$49 relationship bonus” offer that makes it free if I have other accounts there (which I do, including Gold checking) but “customer service” claims to know nothing about. I paid the annual fee on that one last month and I am waiting for the fee to be credited back as the T&C on the back of the application stated. If it doesn’t, I will have a fight on my hands with US Bank since I saved the information they sent me offering the bonus (but it’s not in the T&C I got when I opened the card).

“On February 15, 2016, the maximum number of FlexPoints you can transfer in a calendar year is changing from 120,000 FlexPoints to 20,000 FlexPoints” – http://travelwithgrant.boardingarea.com/2016/02/04/upcoming-us-bank-flexperks-visa-amex-credit-card-changes-to-grocery-flexpoints-purchase-transfer-limits/

Good luck with customer service :)

So..I ended up automatically getting the relationship bonus credited on my card, much to my surprise. I paid the $49 annual fee on my wife’s card to keep the points alive. In late December, I transferred 20k points to my free card, with the plan to transfer more this year and cash out the rest before closing the card. Then yesterday I was looking for airline tickets for March and found a price just under $400, which was the perfect use for these points (20k for up to $400). I was down to 27,000 points on my wife’s account (I was buying 2 tickets), so I transferred the exact number needed to get it back up to 40,000 and bought the tickets. It worked out well, since I will get $50 in credit towards baggage fees, and that should be around $60 for the 2 of us round-trip on JetBlue. I wasn’t thrilled about paying that much for the tickets, but flying out of my preferred airport was expensive, and the points were only going to be worth a penny if I cashed them out.

So now my wife’s account is down to zero points, presumably whatever small number of points it gets for charging baggage fees to the card can be transferred to my no-fee card, and I can close this one before the next annual fee hits.

Good work, that’s the best way to use FlexPoints. Have a great trip.

Pingback: US Bank Now Offering Retention Offers on FlexPerks Cards - Rapid Travel Chai

Called just now to switch FlexPerks Amex to FlexPerks Visa because a) many places we frequent don’t take Amex and b) no need for Serve. CSR said no dice. Pooh.

Ya, that is unfortunate. I did not think converting from AMEX to Visa would be possible.

Pingback: You Cannot Convert Chase British Airways Credit Card to Chase Freedom Unlimited | Travel with Grant

What about downgrading from Flexperks Amex to Cash Plus Visa? Think that’s possible?

It might be possible since they are both US Bank CCs that are not cobranded with other reward programs. Give it a try and let me know.

Dave, did you try converting to a Cash+ card?

My wife has the $49 FlexPerks AMEX card and got billed the annual fee. I called to have it converted to the no-fee Flexperks Select+ AMEX and I was told that it was not possible. has anyone had success downgrading to the free AMEX card? This would be the first bank I’ve dealt with that did not allow a downgrade to a lesser free card. But then again, US Bank’s “customer service” has been terrible from the first time I contacted them. I’ve never seen a bank with reps who refuse to do anything to placate the customer as much as these people do.

Yes, US Bank’s customer service could definitely be improved. I would just hang up and call back. Most of the time, the card has to be open at least 12 months before it can be downgraded.

I tried to downgrade my AMEX as well and was told by a supervisor that there is some regulatory block on doing this due to the foreign transaction fee changing between charges. Sounded like bullshit but regardless they wouldn’t downgrade me.

Hmm, that sounds bogus to me too. I bet if you wanted to product change to the VIsa Signature CC that has an annual fee, they would have no problem doing that…

Pingback: Is US Bank Eliminating Credit Card Retention Offers?