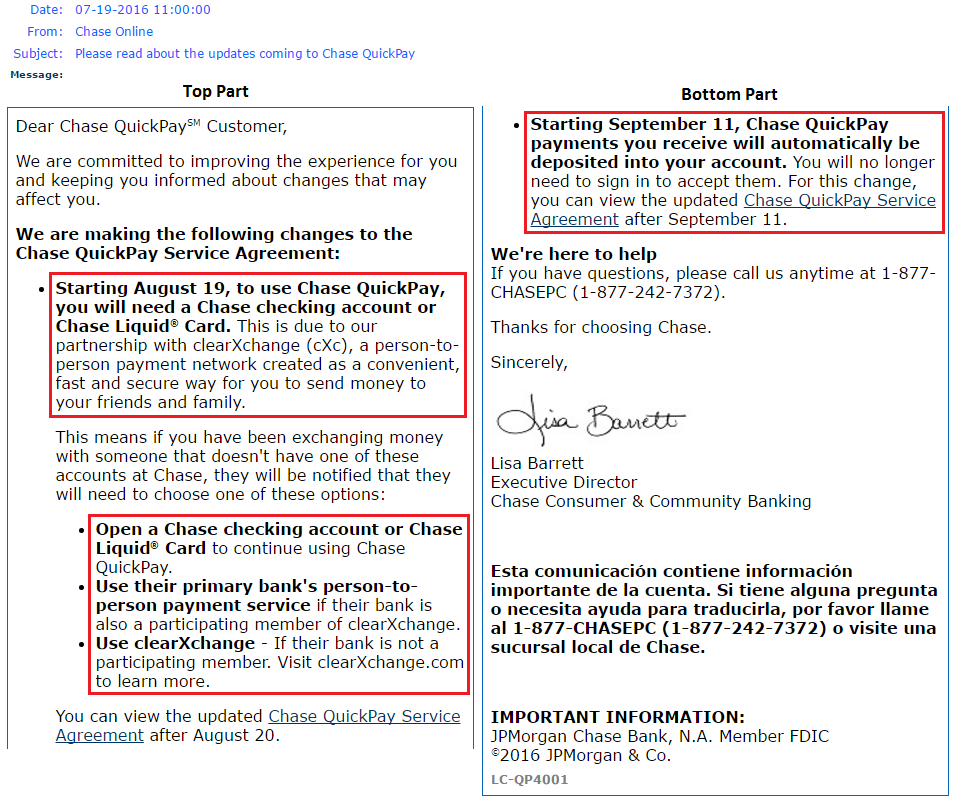

Good afternoon everyone, I just received an email from Chase that said I had just received a Chase Secure Message (SM). I logged into my Chase online account and went to my Secure Messages window. Chase is making a few changes to the way Chase QuickPay will work for both sending and receiving money. Starting August 19, 2016, users will need to have a Chase checking account or a Chase Liquid Prepaid Card. This change is related to how Chase sends and receives money with a service called clearXchange. I wrote about clearXchange (cXc) last year in this post: Email Address Issues Regarding clearXchange Network Payments from Chase, Wells Fargo, and Bank of America. One positive improvement starting on September 11, 2016, is that all Chase QuickPay payments will automatically be received and deposited into your account, you will no longer need to manually sign in to accept Chase QuickPay payments.

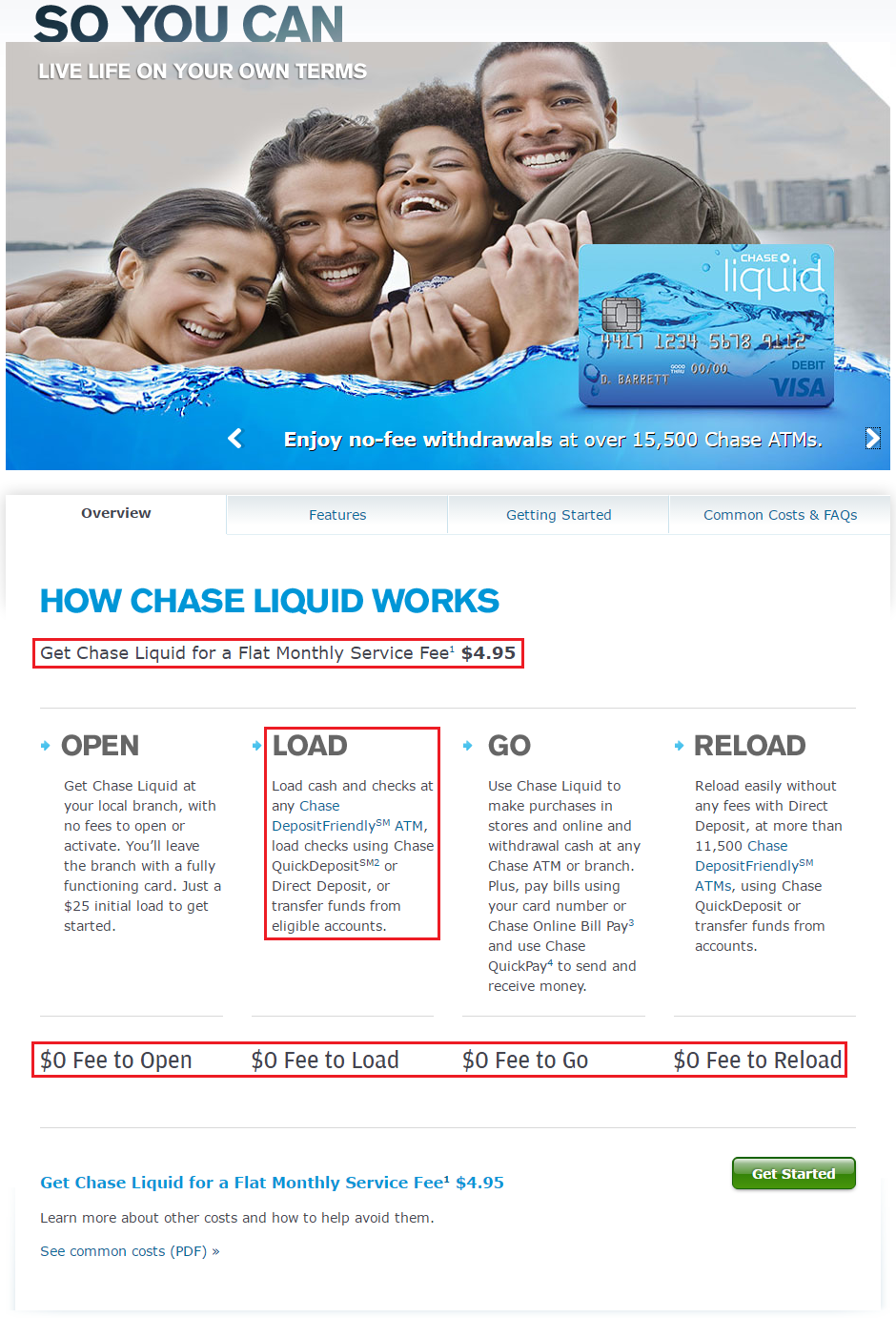

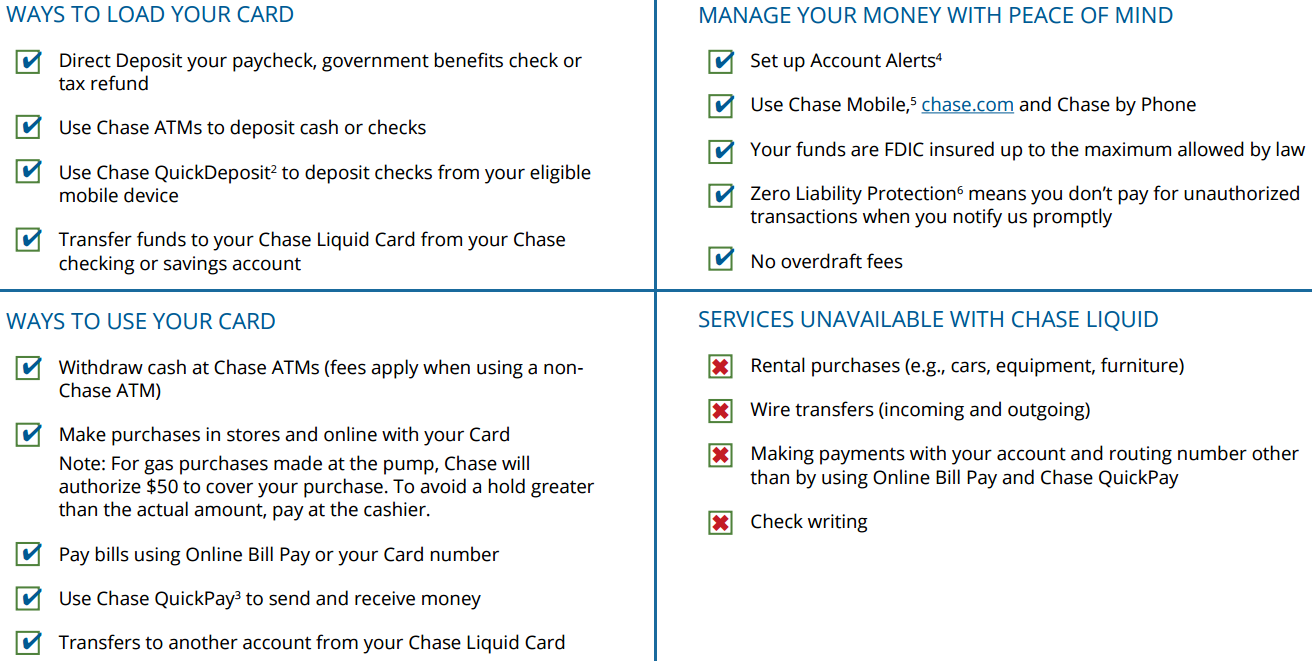

So what is the Chase Liquid Prepaid Card? You can read all about the card here, but the idea is simple. For $4.95 per month (not waived), you can load money (checks and cash) directly to the prepaid card and use the prepaid card anywhere Visa debit cards are accepted. This is perfect for people who want a debit card, do not have a bank account, and like paying monthly fees. If you do not fit that description, stay away from Chase Liquid. To waive the $4.95 monthly fee, you need to “link a qualifying Chase checking account,” which begs the question, why not just use your free Chase debit card (PDF fees and penalties)?

Here is some more information about the Chase Liquid card:

Long story short, Chase wants to encourage people to sign up for a Chase checking account or a Chase Liquid card to continue using Chase QuickPay. Alternatively, Chase wants people who use Chase QuickPay to stop using Chase QuickPay if they do not have a Chase checking account or a Chase Liquid card. I’ve only received 2 Chase QuickPay payments in the last 5 years, so this change does not affect me. Nowadays. everyone uses Venmo or Square Cash to send money.

If you have any questions, please leave a comment below. Have a great day everyone!

Thanks for the heads-up, Grant. I have one friend who sends me $$ every month with this service. She’s not a techie and has resisted using the (to me) better alternatives since QP is easy for Chase customers to use. Looks like I’ll have a valid reason to convert her now.

Good luck on convincing her.

Haha, no kidding. I got her to use Square Cash once. It seemed to work fine, but she found it too complicated and immediately deleted the app after the payment posted.

Apparently since I included emoji after that first paragraph, everything after it was silently discarded. GTK.

I’d just added that she uses her Chase DEBIT card for virtually everything even though she has phenomenal credit. It’s amazing how hard it is to convince people to use even no-brainer cards like Freedom. To her it would just be a hassle as that would be another bill to pay.

People are stubborn and don’t like to change their behavior. More points for the rest of us :)

Boo. Square Cash does not have a great user experience.

It’s also a reminder of why people can’t grasp how I travel. They presume I either have a huge bank account and/or am being compensated as a paid reviewer, etc. When I explain that it’s “points & miles,” it’s like a foreign language that no one wants to learn.

It’s good that most people don’t grasp the concept. Less competition for award seats and nights is good for us, they can continue paying full price for their travel.

I have no worries about competition for award seats. I’m just amazed by the number of people (particularly Millennials) who won’t sign up for even basic frequent flier or loyalty programs that involve no cost or effort. (Or something like Chase Freedom, which doesn’t take anything away from anyone except the bank.)

Very true, they will realize one day…

I thought I’d just missed the email notification, so I logged into my Chase account to check Alerts and my Secure Message Center. Nada. Not one mention of this change, even though I faithfully receive payments every single month that get sent to another bank as soon as I click Accept. So, thanks again for the notification.

You’re welcome. The email might be going out in waves/batches.

I do business every month with someone who has a Chase account. They “Quick-pay” me at another bank where I already have a business account. Quick pay has worked very well but now I understand since it’s not a Chase bank, I’m going to have to pay a monthly fee (I already have a Chase account for personal use so won’t be switching my business account over to Chase for free service)…Guess my

business partner will now have to find a less convenient way to pay me.

Very disappointed with this change implemented by Chase…what happened to customer service?, guess it’s just one more way for the bank to make money from it’s customers?…………

Yup, just another fee from the banking side of Chase :(

Read this new post: http://www.wsj.com/articles/americas-biggest-banks-have-a-new-name-for-their-venmo-killer-zelle-1472047872

Thanks for posting! I literally thought I had gone insane yesterday when I tried to pay my landlord rent through Quickpay on my Chase account, as I have been doing for the last year, and could not find the option anywhere. I have a Chase credit card but not a checking account, therefore Quickpay magically disappeared from my app and my desktop login.

What I find irritating is how there was zero mention of this to me via email or in my actual account/notifications etc. I found your site after digging around google, before I even found it on Chase’s own site. This definitely doesn’t entice me to open a checking account with them, which i was actually thinking of doing.

The other funny thing is that I was trying to exercise my options for alternatives to Quickpay without requiring some sort of new account registration (I have Wells Fargo/Sure Pay, and my landlord is not onboard with Venmo), and I came across the whole ClearXchange thing. So apparently I can send money through my Wells Fargo account (Sure Pay) and it will end up in his Chase account (Quick Pay). Super confusing, especially since you used to have to register an ‘e’-pay account with each bank’s system if you didn’t have a checking account.

Im glad my site was able to help you figure out the Chase QuickPay change. I heard out about it by looking at my Chase Secure Messages (SM). If you want to stick it to Chase, there are a few Chase bank account bonuses you can get. Check out this post for more info: http://www.doctorofcredit.com/best-bank-account-bonuses/

Pingback: Why is Chase QuickPay Not Working & Upcoming Changes to Citi ATMs at 7-Eleven Stores | Travel with Grant

Pingback: Year in Review: My Top Blog Posts of 2016 and Lifetime

Pingback: Send Money to Friends (or Other Bank Accounts) Instantly with Zelle (Formerly Chase QuickPay / clearXchange)

Obviously this comment is a year later, but I noticed the difference in payment abilities when I opened up savings accounts with Chase and BofA in Jan 2017.

BofA savings only – supports Zelle (clearXchange) payments just fine!

Chase savings only – does not support QuickPay with Zelle (clearXchange)

I’ve sent & received instant payments with my BofA savings account to/from Chase QuickPay users since Jan 2017 without issue (though this has been possible since June 2016). Obviously Chase made a business decision to attempt to force people to open checking accounts, not because there was a technical issue/limitation.

Savings only accounts are a low balance way to get fee-free accounts while getting ATM & branch access, plus instant payments with BofA.

On the other comments, I don’t see the attraction of Venmo (owned by PayPal), as it is basically just PayPal with a social pay feed added as it works the same on the backend. If you know the long list of historical shady PayPal issues, incl lockouts/holding money hostage/etc (esp as an eBay seller), you shouldn’t trust them either. I suppose if you only do $40 here and there for meal sharing, it is no big deal, but once people use it for bigger amounts like rent, etc it can be a big deal, especially if people have no savings to spare if money gets tied up in limbo.

I’d rather have free & instant transfers between banks, than PayPal, Square, etc acting as a parking place for the money before you transfer out at slower speed (free) or instant (fee).

I totally agree with everything you said. I’m glad Zelle / clearXchange has been working very well for your BofA and Chase bank accounts.