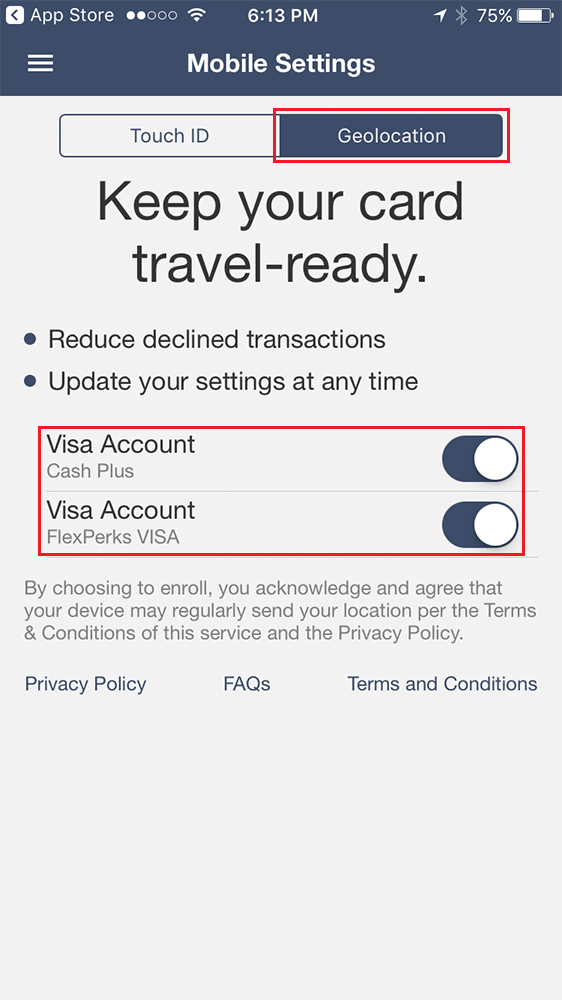

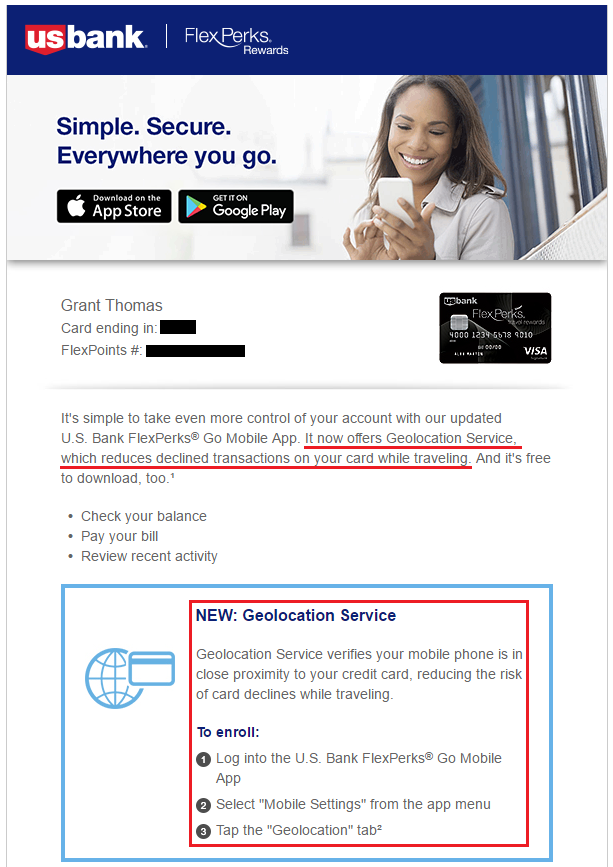

Good morning everyone. Yesterday afternoon, I received a few emails from US Bank regarding a new feature called Geolocation Service. According to the email, “Geolocation Service verifies your mobile phone is in close proximity to your credit card, reducing the risk of card declines while traveling.” Here is the email I received from US Bank:

I believe the use case for this service works like this: if you are in the US and get a purchase alert from London, the app would flag the transaction because your phone is located in the US. However, if you are in London, the app would know you are in London based on the mobile network or Wifi network you are/were connected to. This is the response I received from US Bank on Twitter:

I believe the use case for this service works like this: if you are in the US and get a purchase alert from London, the app would flag the transaction because your phone is located in the US. However, if you are in London, the app would know you are in London based on the mobile network or Wifi network you are/were connected to. This is the response I received from US Bank on Twitter:

@travelwithgrant When not connected to the mobile network or Wi-Fi, the info could be outdated, we’ll still analyze the transaction. ^at

— U.S. Bank (@AskUSBank) October 4, 2016

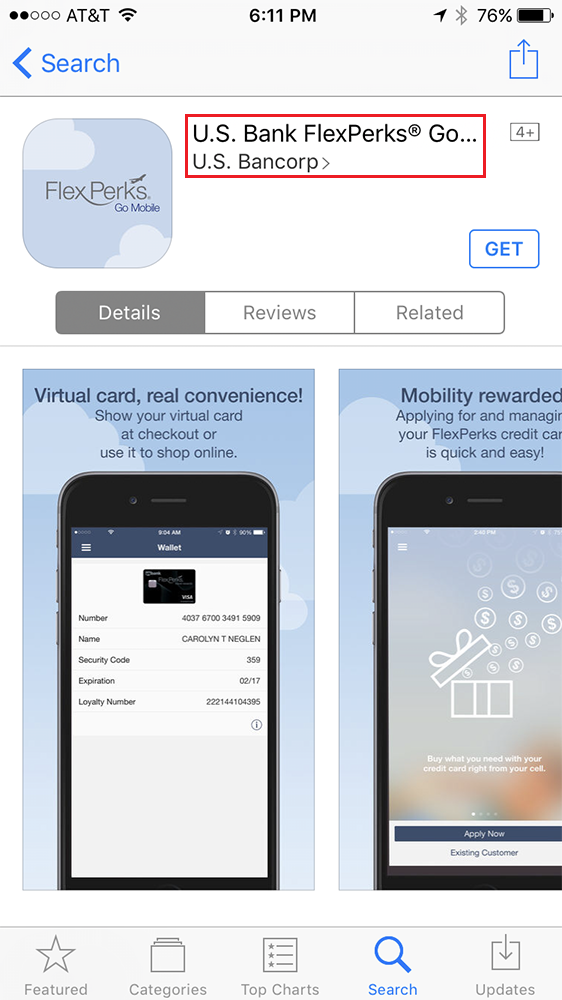

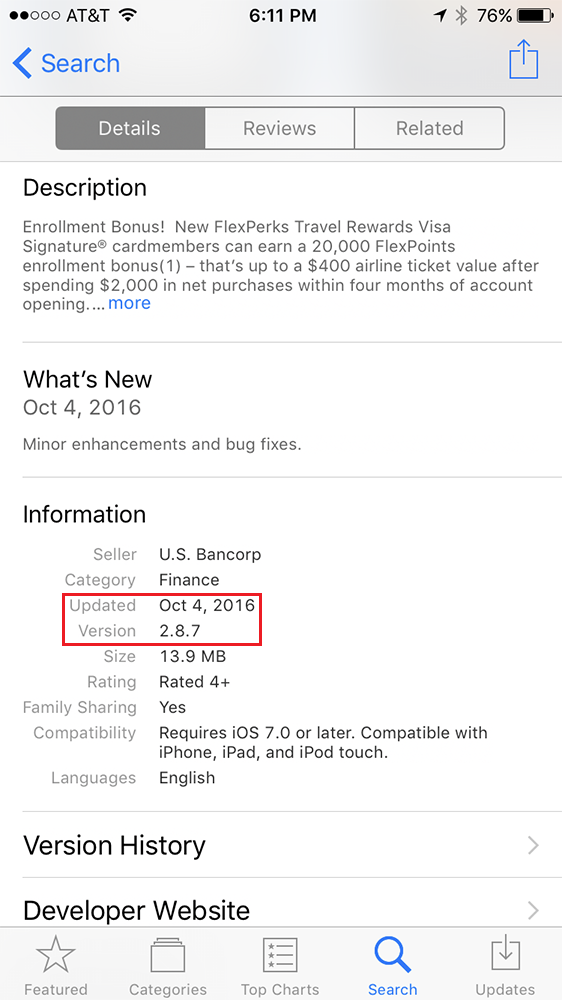

Even though I do not have any international trips coming up until January (Colombia, Argentina, Brazil & Paraguay), I decided to download the US Bank FlexPerks Go App (iOS, Android) and test it out. The newest version of the app in the Apple App Store came out October 4.

Since I have a US Bank FlexPerks Visa Credit Card, I clicked the Existing Customer button and signed into my account using my US Bank online username and password.

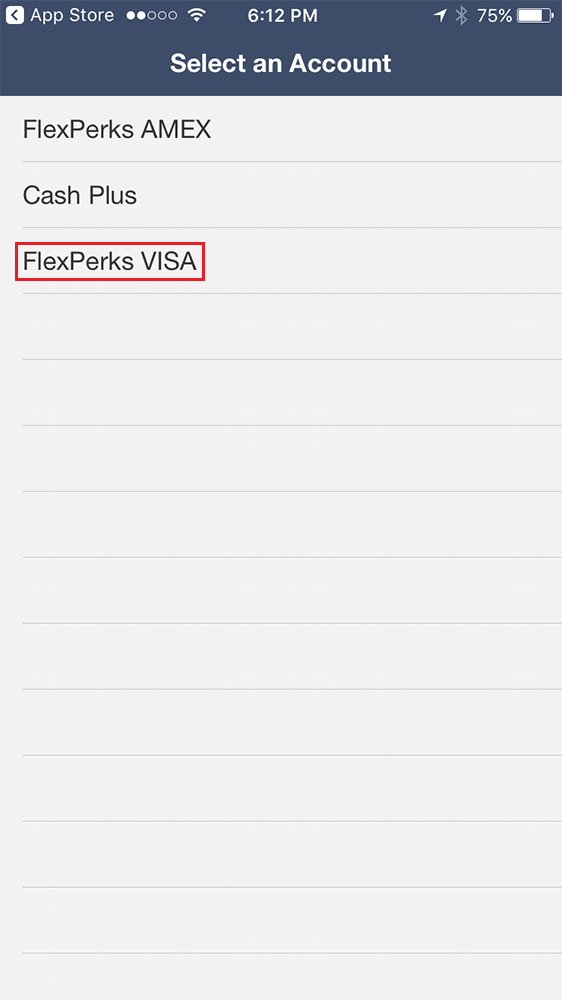

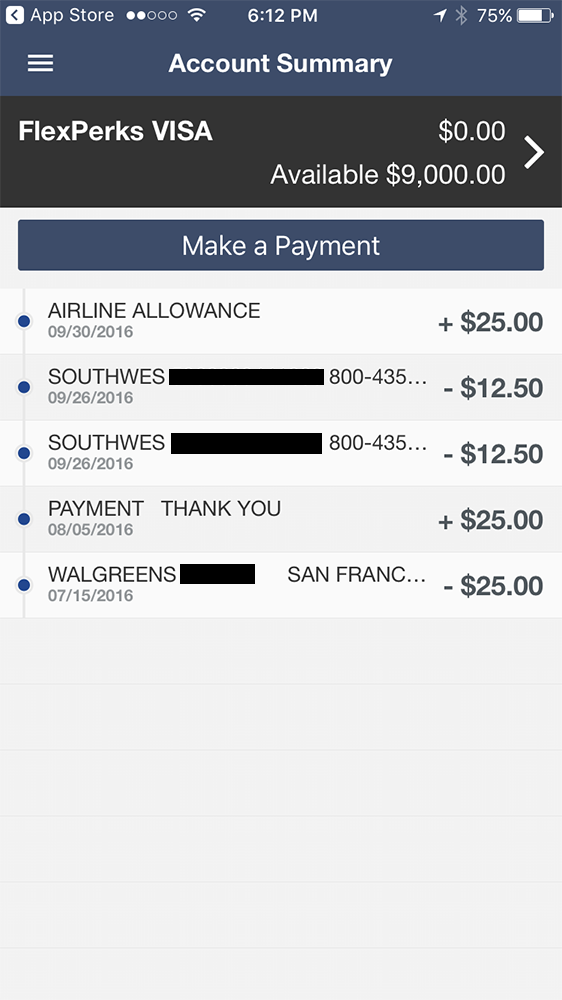

Apparently, I have 3 US Bank credit cards that work with the US Bank FlexPerks Go App. The names of the cards were pulled from my US Bank online account since I manually renamed the cards to those names. I selected my FlexPerks VISA account and saw all recent transactions. If I wanted to, I could make a payment directly from the app. FYI, I recently redeemed my US Bank FlexPoints for a trip on Southwest Airlines and got a $25 airline allowance (reimbursed travel expenses).

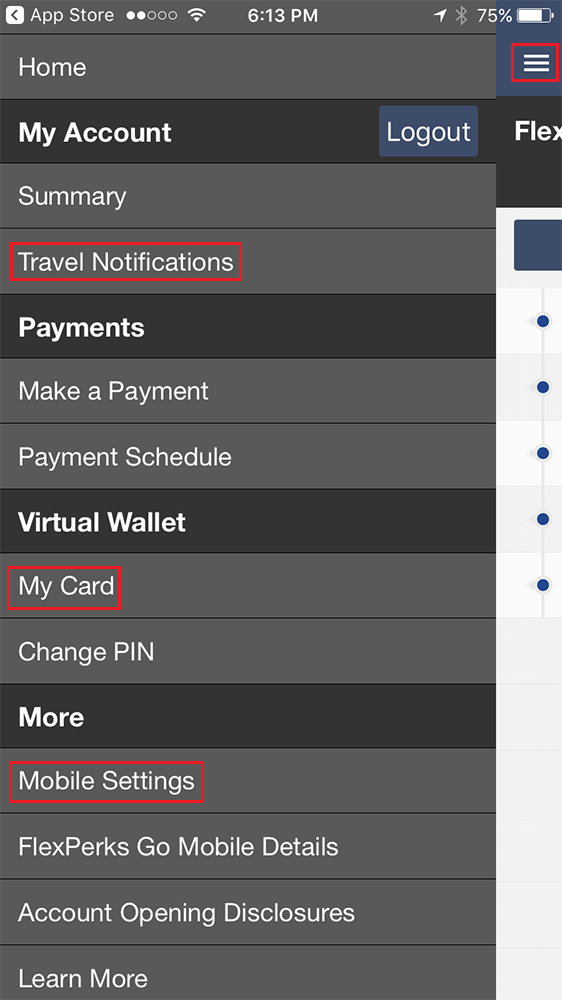

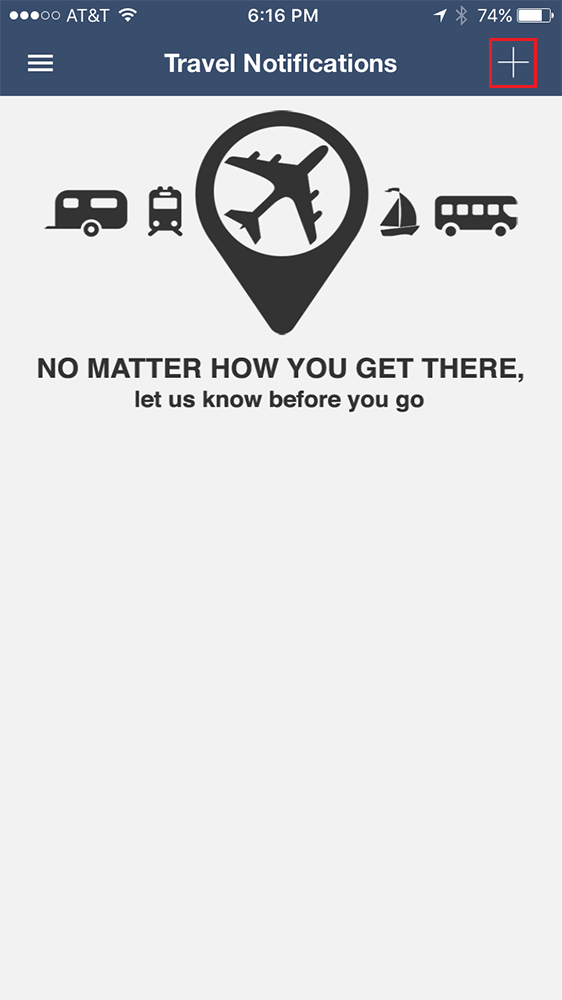

I clicked the 3 little bars in the upper left corner of the app to view more app options. I went through all the options and I will show you what I learned from Travel Notifications, My Card, and Mobile Settings. Up first, the Travel Notifications section lets you enter details for your upcoming trip.

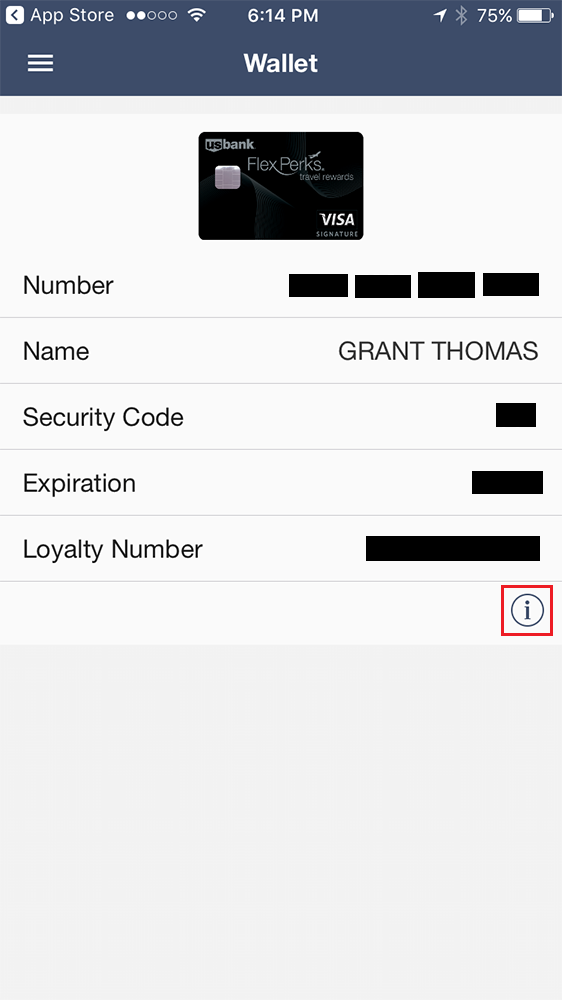

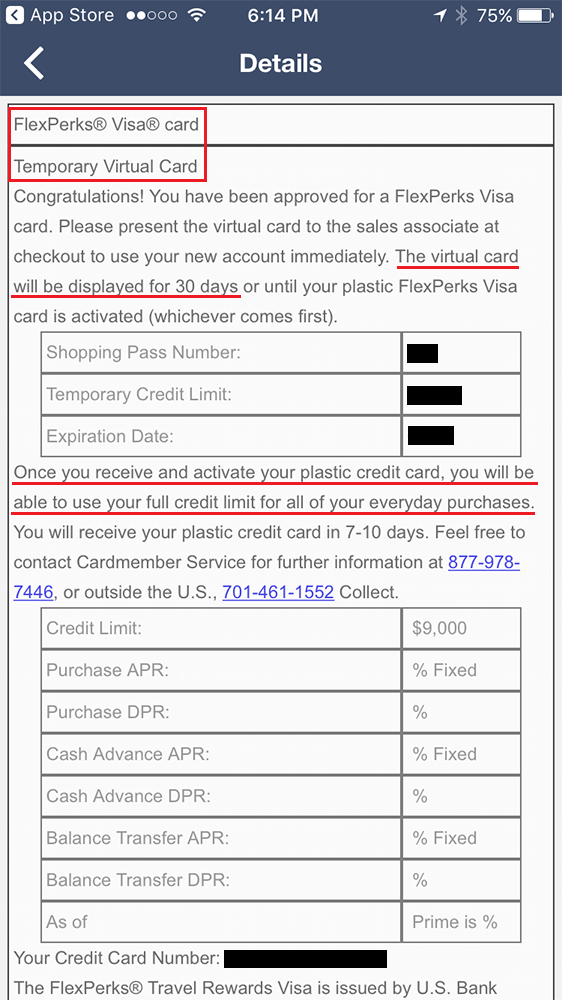

Up next, the My Card feature lets you view a virtual version of your credit card. This feature is somewhat similar to the Citi Virtual Account Numbers program. All purchases made online with the virtual card should code as if you were using the real card (any travel purchases should earn 2x FlexPoints). This screen also shows your full FlexPoints loyalty number. I tried to use the virtual card feature with my US Bank FlexPerks AMEX and US Bank Cash Plus, but I was only able to view my US Bank FlexPerks VISA.

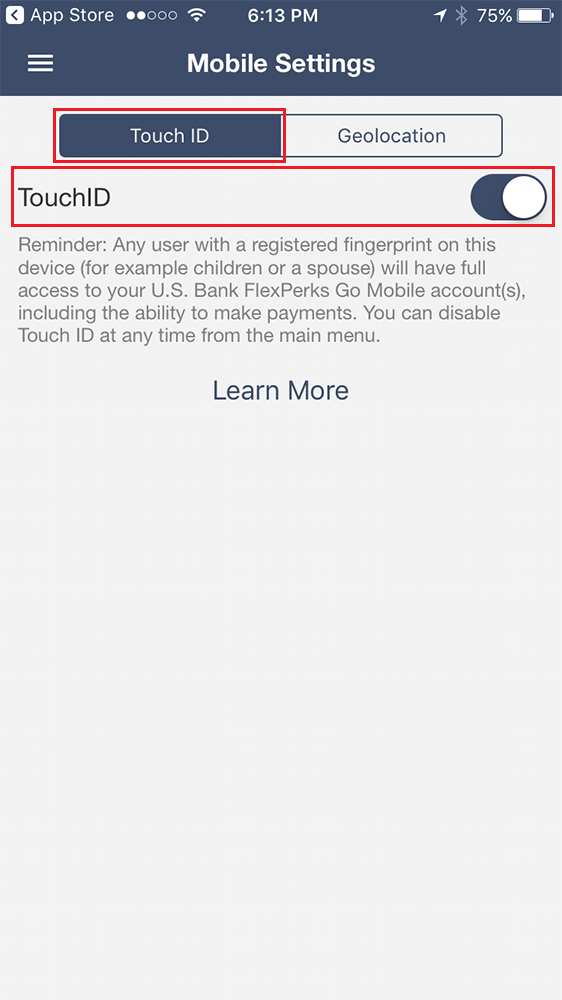

Last but not least, the Mobile Settings section lets you log in with TouchID (fingerprint login) and enable Geolocation. I can enable Geolocation on my US Bank Cash Plus and US Bank FlexPerks VISA, but not on my US Bank FlexPerks AMEX. Strange. I won’t get to test out Geolocation until January, but if you do, please share your experiences below.

If you have any questions, please leave a comment below. Have a great day everyone!