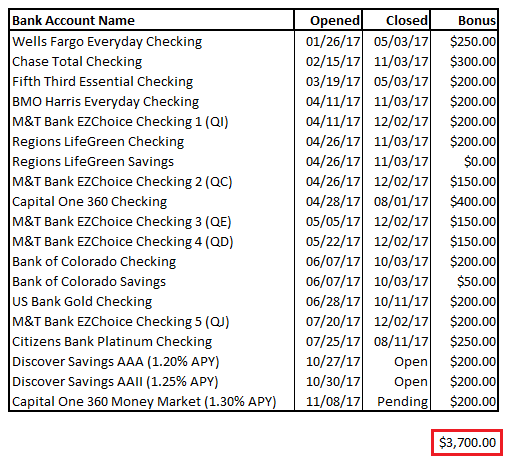

Good morning everyone, happy last Friday of the year! A long, long time ago, before Doctor of Credit was as popular as he is now, he did a guest post for me back in March 2014: Guest Post from Doctor of Credit: Bank Account Sign Up Bonuses. DOC has always been a big fan of bank account bonuses, but it took me a long time to get on the bandwagon and now I am hooked. Earlier this year, I wrote about my 2016 Roundup of Bank Account Bonuses. In 2015, I made $1,175 in bank account bonuses. In 2016, I made $2,850 in bank account bonuses. And this year, I made $3,700 in bank account bonuses.

Here are all the bank accounts I opened, the date they were closed and the bonus I received. To be fair, I am still waiting for the $200 bonus to post from my Capital One 360 Money Market account, but I met the requirements already, so now I just need to wait. I learned about all of these bonuses on DOC and he keeps a very detailed and up-to-date bank account bonuses page.

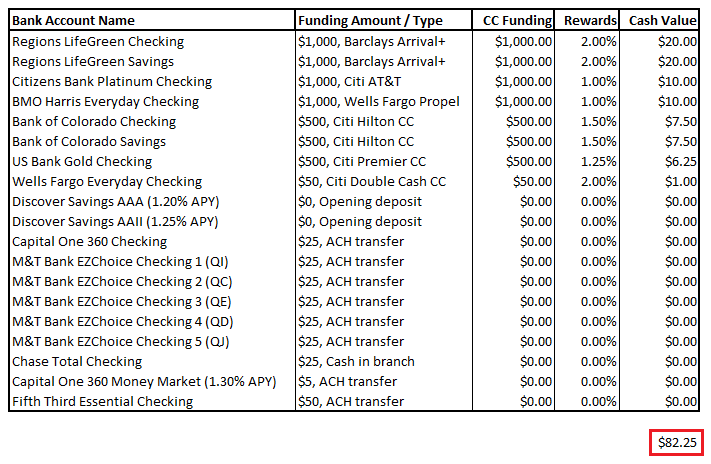

One of the great features of opening a new bank account is that you are often allowed to fund the opening deposit with a credit card. As you can see, I used a variety of credit cards for my opening deposit. I was able to meet my minimum spend on my Barclays Arrival Plus Credit Card and Wells Fargo Propel Credit Card by charging the opening deposit to those credit cards. I did not include the value of the sign up bonus, but if I did, it would be several hundred dollars more. To calculate the $82.25 in credit card rewards, I multiplied the opening deposit amount by the value of the miles, points or cash back earned to get the cash value of paying the opening deposit with a credit card. Also, not all bank accounts let you fund the opening deposit with a credit card, so I had to do a bank transfer (ACH) instead, which earned $0 cash back.

If you like the idea of funding bank accounts with a credit card to earn rewards, DOC has a great resource that shows which banks allow credit card funding. Don’t worry, 99% of the time the charge codes as a purchase, not a cash advance, so you will earn miles, points, or cash back on the opening deposit. If you are worried about being hit with a cash advance fee, call your credit card company and tell them to lower your cash advance limit to $0 before you charge the opening deposit.

Lastly, most of the bank accounts have requirements to meet in order to earn the bonus. That can range from just making you first deposit, to receiving a direct deposit, to keeping a minimum daily balance, to making purchases on their debit card (or a combination of those requirements). Make sure you read the requirements carefully and do everything they tell you to do. You also need to be on top of what the requirements are to waive the monthly fee. If you pay monthly fees, you are giving part of your sign up bonus back to the bank. Don’t do that!

Have you received any bank account bonuses this year? What was your total haul this year? If you have any questions about bank account bonuses, please leave a comment below. Have a great day everyone!

Hi, Grant

Great to see you have collected so many bank bonuses. Among these bonuses, I see some seem to be very selective to regions, how could you do that? Thanks!

Best,

X Wang

I have a few addresses in other states, that’s how I got some Bank account bonuses from around the country.

Hi,

If you don’t mind, would you say rent a few PO Boxes can satisfy these or not? Thanks and happy new year!

Best,

X Wang

That might work, but it depends how much weight the bank puts on that address. If you have no credit history related to that address, you might not get approved for the new account.

This is very impressive. How much money/cash is needed to replicate this?

That is a great question. Unfortunately, I do not have a specific answer for you. If you had a lot of cash and didn’t mind having it sit in checking and savings accounts and not earn much interest, you could meet most of the requirements pretty easily. Since I do not have a lot of cash sitting around, I set up direct deposits and automated transfers to move money around. If you have access to $2,000, you can probably do most of these bank account bonuses. The Discover savings accounts required the most cash, so you would need more cash on hand to receive those bonuses.

Nice job Grant. I made a little over $1,000 this year and the legwork is pretty minimal. It makes things much easier if you can change your direct deposit online without having to submit paperwork.

Here’s to a bonus filled 2018!

Yes, the direct deposit is the most challenging part, but if you can change it online, it makes the process much better. Congrats on your 2017 haul and have a happy new year!

Great job! Howewer why one bank didn’t pay the bonus? I had opened Chase and HSBC this year and got a bonuses but BoA didn’t pay even though I met the criteria;/

Oh, the one bank account that didn’t have a bonus was the Bank of Colorado Savings Account, but I was able to fund the account up to $1,000 with a credit card. You should contact BofA and see why you didn’t receive the bonus. Some banks post the bonuses very slowly and may require a manual review of your account. Don’t give up on the money you are owed!

I tried opening a savings account at Chase online. I was shocked to discover that they wanted me to reveal what accounts I had with other banks and how much was in each of them. Have you encountered this? If so, how did you respond?

That is strange. I’ve never opened a Chase savings account (the $15,000 minimum deposit has always scared me off). If you apply for a Chase savings account in-branch, they shouldn’t ask you that question.

Pingback: Missing Capital One Money Market $200 Sign Up Bonus? Just Ask for it!

Can you open accounts at the same bank more then once in different years? IE, can you receive the same bonuses year after year if you keep opening and closing the same type of accounts? Or do banks get weary of this and only offer you a one-time bonus?

Yes and no. It depends on the terms of the bonus. Some banks, like Chase, you can get 1 bank bonus per calendar year. So if you open an account in 2018, get the bonus in 2018, and close the account in 2018, you can open a new account in 2019. Just make sure you read the terms of every bank account bonus offer.

I had the same experience with Chase asking me to reveal my other accounts and how much I had in them. In branch the banker stated that that was the law. I passed on the savings account.

The savings account requires too much cash on hand to get the bonus.

Pingback: How Much Money Did I Make from Bank Account Bonuses in 2018?