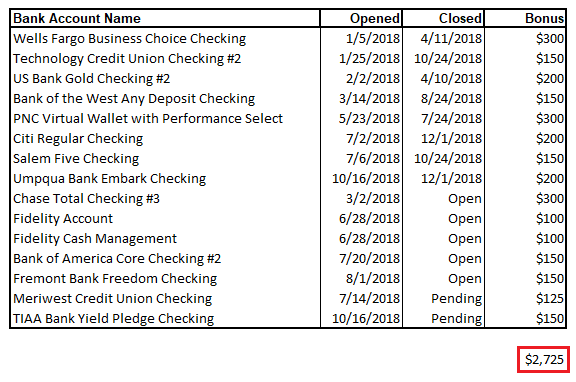

Good afternoon everyone, this is a sequel to my 2017 post titled How Much Money Did I Make from Bank Account Bonuses in 2017? and from my 2016 post titled My 2016 Roundup of Bank Account Bonuses (1099-Int Tax Season). To recap, in 2015, I made $1,175 in bank account bonuses. In 2016, I made $2,850 in bank account bonuses. And in 2017, I made $3,700 in bank account bonuses. Would 2018 be a record breaking year… unfortunately not.

In 2018, I opened a total of 15 bank accounts (split between checking, savings, and brokerage cash accounts). 8 of those accounts are now closed, 7 accounts are still open, and I am still waiting for bonuses from 2 of those accounts to post. Here are all the bank accounts I opened, the date they were closed and the bonus I received. To be fair, I am still waiting for the $125 bonus to post to my Meriwest Credit Union Checking Account and the $150 bonus to post to my TIAA Bank Yield Pledge Checking Account, but I met the requirements already, so now I just need to wait. Doctor of Credit keeps a very detailed and up-to-date bank account bonuses page.

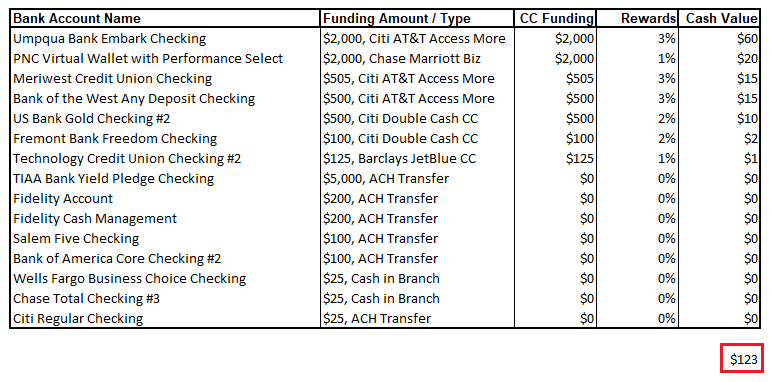

One of the great features of opening a new bank account is that you are often allowed to fund the opening deposit with a credit card. As you can see, I used a variety of credit cards for my opening deposit. I was able to meet my minimum spend on my Chase Marriott Rewards Business Credit Card by charging the opening deposit to that credit card. I did not include the value of the sign up bonus, but if I did, it would be several hundred dollars more. To calculate the $123 in credit card rewards, I multiplied the opening deposit amount by the value of the miles, points or cash back earned to get the cash value of paying the opening deposit with a credit card. Also, not all bank accounts let you fund the opening deposit with a credit card, so I had to do a bank transfer (ACH) instead, which earned $0 cash back.

If you like the idea of funding bank accounts with a credit card to earn rewards, Doctor of Credit has a great resource that shows which banks allow credit card funding. Don’t worry, 99% of the time the charge codes as a purchase, not a cash advance, so you will earn miles, points, or cash back on the opening deposit. If you are worried about being hit with a cash advance fee, call your credit card company and tell them to lower your cash advance limit to $0 before you charge the opening deposit.

Lastly, most of the bank accounts have requirements to meet in order to earn the bonus. That can range from just making you first deposit, to receiving a direct deposit, to keeping a minimum daily balance, to making purchases on their debit card (or a combination of those requirements). Make sure you read the requirements carefully and do everything they tell you to do. You also need to be on top of what the requirements are to waive the monthly fee. If you pay monthly fees, you are giving part of your sign up bonus back to the bank. Don’t do that!

Have you received any bank account bonuses this year? What was your total haul this year? If you have any questions about bank account bonuses, please leave a comment below. Have a great day everyone!

Great Post Grant. Thanks for the Data

You’re welcome Rick, glad you liked the post :)

I saw another person’s spreadsheet that follows DoC. it was in 2018 from Jan1-Sept 1 and they already had earned, or was incoming, $6770. Maybe many of those banks don’t work for the region I live in, but a lot is possible here! Personally, I’m going to be checking into which accounts can also work for trusts and minor accounts, and hit the business accounts too, and see if I can dip multiple times…

If you can do multiple accounts with family members, you can definitely make a lot of cash, but it all depends on your state, since most bonuses are state-specific.

Thanks Grant. If you can blog at the time you sign up for accounts and when you can fund with CC, that would be great info. I am also in northern CA, so your data is very helpful. Thanks again and congrats on the great returns.

The best place to learn about bank account bonuses is on Doctor of Credit. I don’t post about my checking accounts very often.

Grant, how have all those new accounts affected your credit profile & score? Great post

They should have no impact on my score since I am not applying for credit. The only thing that might affect your score is if you enroll in overdraft protection on your checking account, but I always decline that service.

I tried to apply for 4 bank accounts with bonuses totaling $800 but I only got approved for one, so I decided to focus investing the money in stocks during the second half of 2018. A lot of good that did!

Did you have to fight for your Citi bonus? I hear Citi makes it hard to get it if it’s not automatic and you have to call in.

I did not have to fight for my Citi bonus, but Citi did take a long time to post the bonus. Which other bank accounts did you apply for last year?

Big thanks for sharing your data trend going back several years. Like most Creditors, I fear Banks offering bonuses for checking/savings accounts will also implement some type of throttling rule as Chase did in 2018 with their new 24month rule for checking accounts. But until others follow suit, WEEEEE! Looking forward to next year GT!

The good thing is that there are many more banks offering decent bank account bonuses than there are credit card companies offering decent credit cards sign up bonuses.

Even if some banks start implementing and enforcing 12-24 month rules, you can easily sit out and wait for your toner to reset.