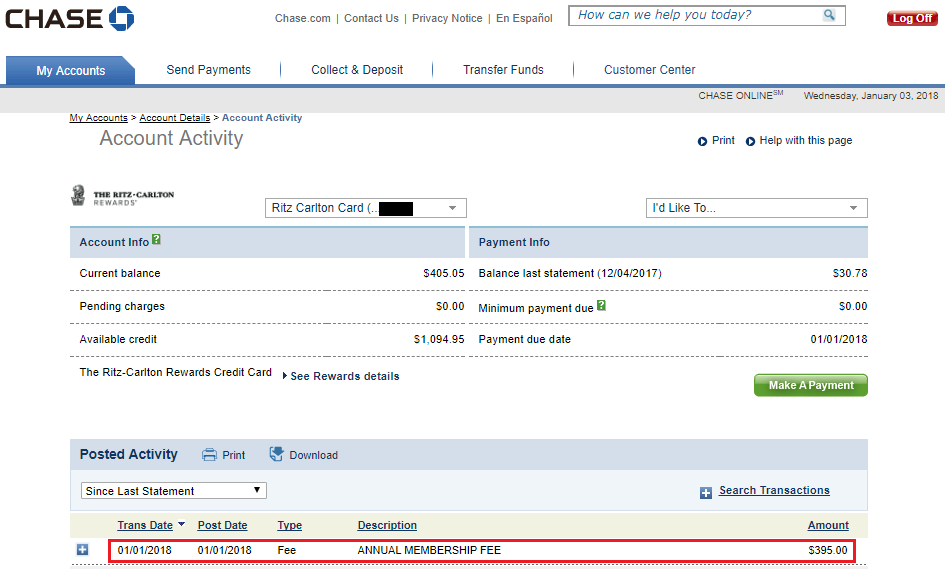

Good morning everyone. A few days ago, the $395 annual fee posted to my JPMorgan Chase Ritz Carlton Credit Card. A few months ago, I wrote this post: Should I Keep Both Chase Sapphire Reserve & JPMorgan Chase Ritz Carlton Credit Cards? In that post, I basically decided that the $300 travel incidentals credit and unused Ritz Carlton perks were not worth the $395 fee. So when the $395 annual fee posted on my JPMorgan Chase Ritz Carlton Credit Card, I knew I had to call Chase and see what options were available. I didn’t bother asking for a retention offer since I probably spent about $350 on the credit card during the past year, and $300 of that was reimbursed due to the travel credits. Instead, I asked the JPMorgan Chase rep what my conversion options were. He said there were 2 credit cards I could convert to…

The rep said there were 2 Chase credit cards I could product change to:

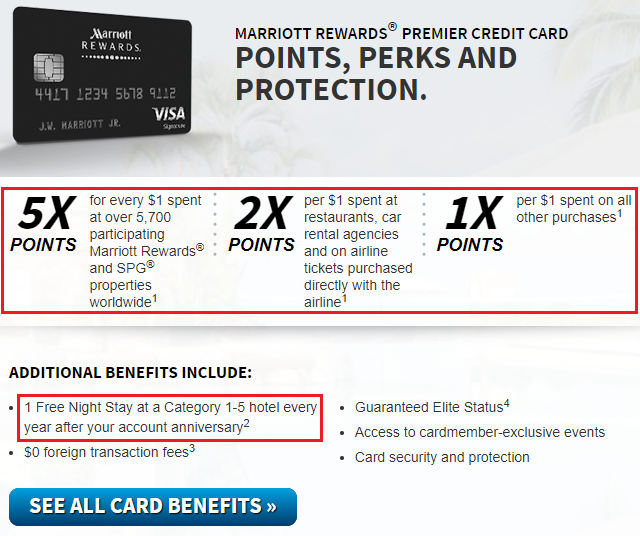

- Chase Marriott Rewards Premier Credit Card – 5x at Marriott; 2x on restaurants, car rentals and airlines; 1x everywhere else; free night certificate at category 1-5 hotels; $85 annual fee (landing page)

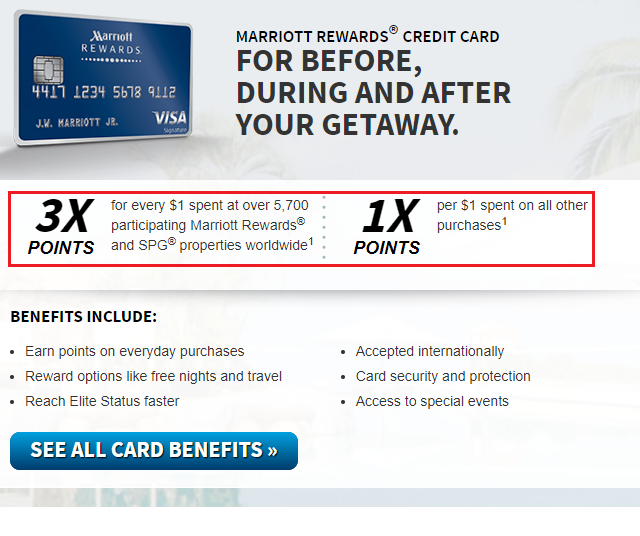

- Chase Marriott Rewards Credit Card – 3x at Marriott; 1x everywhere else; $45 annual fee (landing page)

Because the annual fee was only $40 more and came with a free night certificate (even though finding a decent category 1-5 Marriott hotel is a challenge), I decided to go with the Chase Marriott Rewards Premier Credit Card. I also wanted to check out the sweet Chase Offers available for Chase Marriott Rewards Premier Credit Card holders.

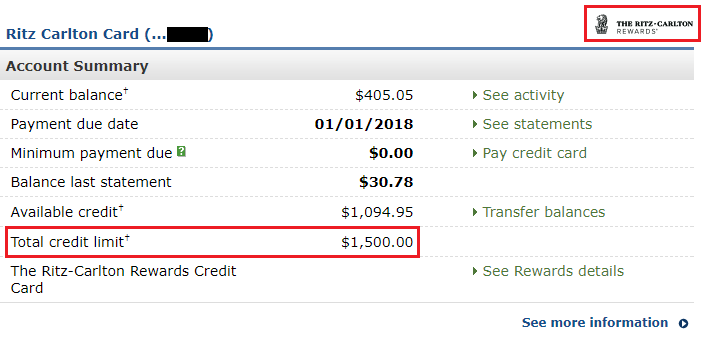

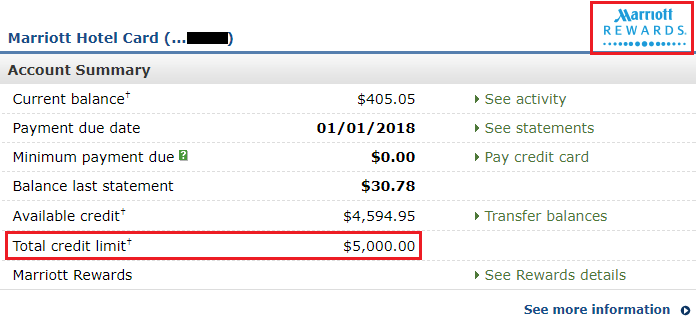

Before the JPMorgan Chase rep could process the product change, he told me I had to have a minimum $5,000 credit line to get the Chase Marriott Rewards Premier Credit Card. My current JPMorgan Chase Ritz Carlton only had a $1,500 credit line (CARD Act hack only worked for the first year), so I had to move some of my credit line from my Chase Sapphire Reserve Credit Card. Here is before the product change…

Here is after the product change…

In a few days, I should receive my new Chase Marriott Rewards Premier Credit Card. I am excited to set up Chase Offers and see how well that works and how much money that saves or makes me. If you have any questions about the JPMorgan Chase Ritz Carlton Credit Card product change options, please leave a comment below.

Didn’t know this PC option was available though I did get targeted for the Marriott premier bonus of 120k with $12k spend but am over 5/24.

Thanks for posting this!

You’re welcome. I have had the Chase Marriott Rewards Premier Credit Card in the past and am way over 5/24 as well.

So wait, the CARD act trick worked year 1 (same year as approval)? How soon after did you lower, any push back? Feel free to PM if this isn’t supposed be raved about…

I think I was billed the annual fee when I was approved, but I lowered my credit limit during the middle of my first year and then got the annual fee waived at the start of the second year. It didn’t work the rest of the time I had the card. I think I sent Chase a SM to move part of my credit limit around.

IMO, this is pretty risky if you have or want to have a relationship with Chase. Maybe it wouldn’t make a difference in the big picture, but if you’re maxing out two years of airline incidentals after getting the bonus, I’d be pretty pissed if I was chase and not getting at least an annual fee.

You are right, I did this a few years ago, and Chase never said anything. But I would be a little more risk-averse now.

No judgment here, I did it too on my card and my (now ex) wife’s card. It was part of the 140k bonus, which got us the Companion pass for 22 months, and ultimately somewhere near $8k in value from 2 sign-ups and no fees. Without a doubt the best card(s) I ever had. It was a simpler time then. Bluebird, redbird, no such thing as 5/24, basically no rules at all with Citi and BOA. Capital One still sucked though, so there’s always that…

A nice little walk down memeory lane. Thank you :)

I like your blog and most of your posts, but I don’t think the part about the act adds anything to the post; why not just mention that you have a low credit limit?

I don’t know, I figured if I said I had a low credit limit, people would ask about it and then I would tell them about the CARD Act. Thank you for reading and have a great weekend.

I’m glad u mentioned the Act. U didn’t spoon feed anything, u just mentioned what ur strategy was. Great post, I cancelled my ritz because I didn’t know this was an option. Now thanks to u, I know for next time!

The more info you have, the better decisions you can make. Have a great weekend.

I understand that if you never pay to stay at RC you don’t want their card. But if you do pay to stay it is really valuable. With Club Lounge access you can eat and drink for free all day (like 7 AM to 10 PM) with four meal changes daily PLUS $100 room credit for a 2 night stay. With the annual travel credit we are saving a ton and staying at a very nice urban hotel.

That’s great, I’m glad you are getting a ton of value out of the Ritz Carlton CC. I’ve stayed in them before, but my parents paid for it :)

Like others I had no idea about these PC options. Thanks for writing about them. I just got mine couple of weeks ago and this info will be helpful at the end of the year.

About the ACT, I have read bunch of FT & My FICO posts and I was under the impression that as soon as you lower the CL, your AF will be refunded. You sure you had to wait till the beginning of your 2nd year for the AF refund? Thanks!

I’m not 100% sure of the timing but I’ve had the Ritz Carlton CC 3 years and paid the annual fee 2 of those years.

Interesting, currently have the premier Marriott and the business marriott cards and I don’t believe it’s possible to apply for the cheaper Marriott card anymore.

The intriguing part is that the personal and business both give you 15 annual night credits that also count toward lifetime status; the cheaper one comes with 10. Getting 40 cheap status nights a year makes earning yearly and lifetime status a lot more attainable

I believe Marriott Reward has a rule that you can only receive one bonus CC stay credit per Marriott account per year. For example, if you have the Marriott Premier and the Marriott Premier business CC, you are supposed to get 30 stay credits (15 +15) towards your status. But Marriott only gives you 15 night regardless. The stay credit from spending on the card has no limit ($3000 per night).

Good to know, thank you Peter.

I get 30 elite night credits every year from those 2 cards and have been for 5-6 years.

Hmm, very interesting, maybe you are grandfathered in to get 15 nights per Marriot credit card.

Yes, you can only downgrade to the low annual fee Chase Marriott Rewards Credit Card. The elite nights don’t matter to me since I’m happy with Marriott Gold / SPG Gold.

You’ve made a short sighted mistake. The Ritz-Card is easily the best credit card on the market in terms of both benefits and customer service. It has a sleugh of benefits, some of which you can’t even get with the Sapphire Reserve.

For example, travel medical/dental insurance if you have to seek medical or dental attention when more than 100 miles away from your house and you bought at least part of the air/train/bus/taxi fare to get to site of duress with the Ritz Card, then if your primary medical insurance doesn’t cover the 100% of the costs, the Chase insurance administrator will pay you the difference up to $3000.

A year ago, my sister, who is an authorized user on my account, used the card to buy her plane ticket to Denver for Christmas. She ate a marijuana brownie before going out bar hopping in Denver. Well, she slipped on ice while in a drunken stupor and cut her face. The bar called an ambulance for her and because she too catatonic to think straight she took it to the emergency room. The ambulance fee was around $1500 and her medical deductible was also around $1500- both not covered by her medical insurance. The Chase insurance administrator covered both.

Last month, while the Turkey electronic visa program had been suspended for American citizens due to an ongoing diplomatic row caused by our expert President, I had to apply for a sticker visa in person at the Consulate in LosAngeles. One of the requirements for most sticker visas is possessing international medical insurance. Because I purchased my Turkish Airlines ticket with the Ritz-Card, I printed out the page from the Card’s benefit handbook describing the travel medical insurance coverage and used that as proof of international medical insurance. It worked as proof with the Consulate. Had I not done that, I would be out another $50, as well as time and research, to buy medical coverage for use outside of the US.

I believe the Ritz-Card is the only American card that includes medical insurance.

That is very interesting, I never new either of those benefits existed, let alone on the Ritz Carlton Credit Card. Would you be interested in doing a guest post about the medical/dental insurance benefit? I hardly ever used the Ritz Carlton Credit Card when I had it, so I’m glad I never needed to use either of those features. Thank you.

Pointchasers are so focused on frontend savings they often times loose sight of backend costs. Before cancelling a credit card, it’s important to read the Card’s benefits guide to know what you have: http://www.chasebenefits.com/ritzcarltonVW1

For the Ritz Card these are the benefits:

Unlimited free authorized users

Priority Pass Select for all authorized users

$100 Visa Air Discount for all authorized users

JP Morgan Palladium Card Concierge

Rental car collision damage waiver

Trip cancellation/interruption $10000

Lost Laggage $3000

Trip delay $500 after 12 hours

Baggage delay $100

Accidental death and dismemberment

$1million die while traveling / $100thou die within 24hours of traveling. Becomes any 2: blind, deaf, mute, looseth hand, looseth foot recieved %100 of latter. Become any 1 of latter receive %50

Emergency medical and dental benefit $2500

Emergency evac and transportation $100thou

Travel emergency assistance hotline

Roadside assistance

Purchase protection extended warrenty $50000/yr

Price protection 90days@$2500/yr

Return protection 90days@$1000/yr

$300 airline fee credit

Global Entry fee reimbursement

3 Ritz-Carlton Club Level certificates $3000@21days

$100 Ritz-Carlton 2-day stay incidental fee waiver

Complimentary room upgrade Marriott-Ritz-SPG

Unthrottled WiFi at Marriott-Ritz-SPG

Welcome gift at Marriott-Ritz-SPG

Marriott-Ritz-Spg platinum after $75thou spend/yr

United Airlines Silver after $75thou spend/yr

Marriott-Ritz-SPG Plat Premier = UA Gold

5X points at Marriott-Ritz-SPG

2X points on airlines

%25 bonus on all ritz-marriott-spg points earned-

%50 bonus as earned Platinum

%10 bonus on all points earned annually

0% foreign transaction fee

National/Avis/Silvercar status

Troon Prive golf course status $99/yr value

The Ritz Card should be seen as a travel safety net for you friends and family. I have 8 authorized users so far, and they all have Priority Pass and Visa Air Discount, plus all the insurances when putting airline, hotel, car rental, and cruises on the card. Authorized users don’t have to be approved. Plus I get Platinum Status and a ton of points by funneling their volume through my account.

Disputing charges with confidence is another favorite of mine with this card. Chase works it out for you and you dont have to waste time trying to fight for what’s yours.

Wow, you have a great system. I’m glad the 8 AUs are not causing any problems for you and I’m sure you enjoy their points. Thanks for sharing all the benefits of the card.

The emergency evac insurance is pretty cool. It’s the same insurance and service used by all major international airlines called “International SOS.” The come in a LeerJet to rescue you.

I know some pilots who flew into Monrovia Liberia and fell sick at a hotel. One of the pilots fell into a coma. Their company had the same evac insurance and International SOS flew in to Liberia to evac them to Paris France. They were in a hospital in Paris within 24hours of pulling the evac trigger. The guy in a coma stayed in a coma for two weeks before coming around.

That girl who died in Cambodia after taking pills should have just contacted The Ritz Card’s travel assistance hotline and they could have sent the LeerJet to evac her to Tokyo:

https://www.google.com/amp/s/nypost.com/2017/11/15/backpacker-dies-after-taking-diarrhea-pills-from-cambodian-pharmacist/amp/

Dang, that’s impressive. I just hope I never need that service :/

Pingback: Secret Marriott cards, and how to get them - Frequent Miler

Pingback: Which Purchases Qualify for JPMorgan Chase Ritz Carlton Credit Card Travel Benefits?

Pingback: How to Signup, View & Activate Chase Offers (Currently Only Available for Marriott & Slate Cardholders)

May I confirm once you changed to Marriott Premier and paid the annual fee, whether you got the one free night for that year? Thank you!

I have not been charged an annual fee (yet), but I do believe you get the free night certificate after your 1 year anniversary of having the Chase Marriott Rewards CC.

So it means once changed to Marriott Premier and paid the annual fee, I need to wait for one year to get that free night, even though I have kept that card one year as Ritz-Calrton?

I think you wait 1 year, then get billed your annual fee, then you get the free night certificate.

I see. Thank you!

May I ask how long did you wait for your annual fee bill after you change your Ritz card to Marriott Premier?

I don’t remember the number of days, but you usually have until your credit card bill that has the annual fee to cancel/convert the credit card.

Pingback: Help! Can you Convert AARP, Disney, or Amazon to Chase Freedom Credit Card?

Can you still use the metallic card? The numbers changed?

You should be able to continue using the metal Ritz Carlton credit card. I don’t remember if the credit card number changed though.

Can you still use the metal card? The numbers changed?

Pingback: 15 Elite Nights Credit from Ritz Carlton Conversion & 15 Elite Nights from Marriott Business Credit Card

Pingback: How to Combine SPG & Marriott Accounts (Points, Lifetime Status & Free Night Certificates)