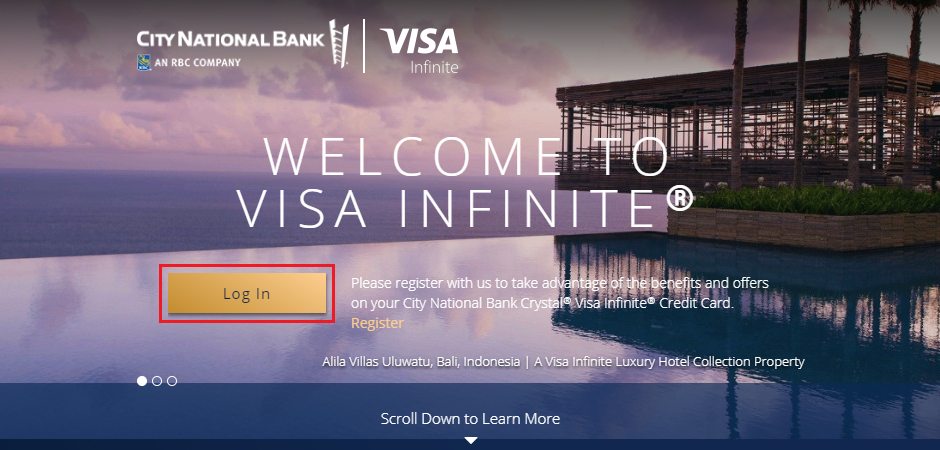

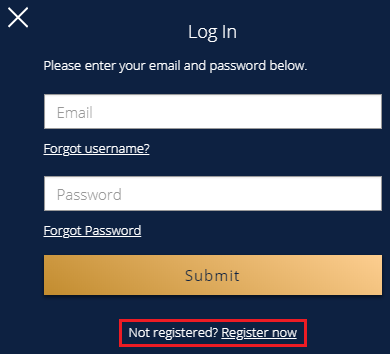

Good morning everyone. A few days ago, I wrote Unboxing My CNB City National Crystal Visa Infinite Credit Card: Card Art, Welcome Letter & Brochure. In that post, I mentioned a few of the credit card benefits, but I was surprised to learn that there are tons of card benefits. In this ultimate guide to the CNB City National Crystal Visa Infinite Credit Card benefits, I will go through every single lifestyle (aka travel) benefit and share my thoughts on each benefit. Forewarning, this post is really long and probably really boring, so proceed with caution. Let’s get started by going to the CNB Visa Infinite page and click the Log In button.

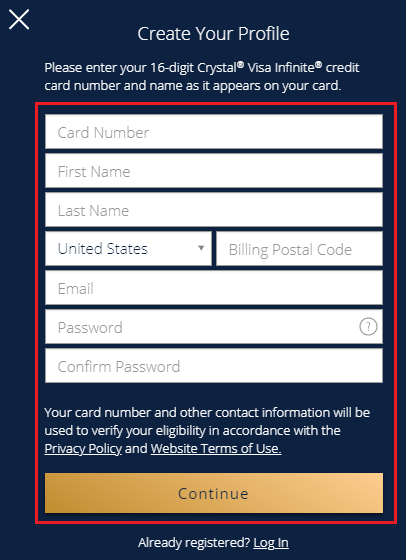

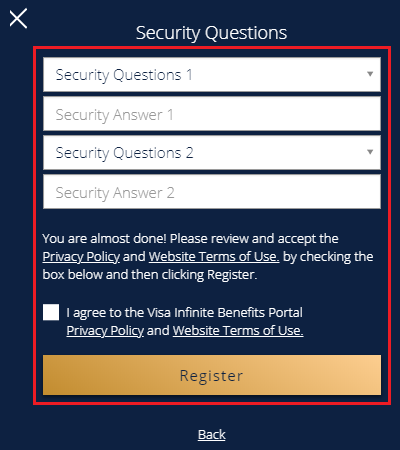

Click the Register Now link, then fill in your personal information, answer your security questions, agree to the terms, and click the Register button.

There are 3 main sections of credit card benefits: Lifestyle (which I will go into extensive detail), Protection, and Services.

Here is a brief overview of all the Lifestyle benefits. I will go into more detail below.

Here are the Protection benefits. Primary car rental insurance, emergency evacuation, and hotel theft protection, among other benefits.

Here are the Services benefits. Concierge, customer service, and emergency cash disbursements, among other benefits.

$250 Airline Incidental Fees Statement Credit

$250 per card, per calendar year. Primary cardholder + 3 authorized users = $1,000 in airline incidental fees per calendar year. See Doctor of Credit’s post to see what counts.

Here are the complete terms and conditions for this benefit:

Under the Airline Incidental Fees Statement Credit benefit, each cardholder under the Crystal® Visa Infinite® Card account (“Account”) may receive a discount up to $250 per calendar year for Qualifying Airline Purchases (as defined below) charged to the cardholder’s Crystal Visa Infinite Card (“Cardholder Card”).

The discount will be in the form of a statement credit to the Account and will appear on the billing statement as “Travel Fee Rebate” under the transactions for the Cardholder Card. To receive the statement credit, both the Cardholder Card and the Account must be open and in good standing (i.e., not in default) on the date the statement credit is posted to the Cardholder Card. Please allow 6 to 8 weeks after a Qualifying Airline Purchase is charged for a statement credit to be posted to the Account. Until such time as the statement credit has posted to the Account, the Crystal Visa Infinite Account holder is responsible for the payment of the Qualifying Airline Purchase that has been charged to Cardholder Card and appears on the billing statement.

Qualifying Airline Purchases are defined as incidental airline fee transactions made at eligible US-Domestic Airline Carriers (each an “Eligible Airline”) on domestic itineraries and include: ticket change/cancellation fees, checked baggage fees, in-flight entertainment, onboard food and beverage charges, airport lounge membership fees and day passes, onboard wireless charges (excluding Gogo Wireless), and TSA Pre?® membership application fee1 transactions, and may vary depending on the airline.

Airline ticket purchases, mileage point purchases, mileage points, transfer fees, gift cards, duty free purchases, award tickets and fees incurred with airline alliance partners do not qualify as Qualifying Airline Purchases. Airport lounge fees not affiliated with airlines and transactions made with travel agencies are also not deemed to be Qualifying Airline Purchases. All incidental airline fees must be separate charges from airline ticket charges and must be made with an Eligible Airline.

To qualify as a Qualifying Airline Purchase, the transaction must:

Be completed using the full 16-digit City National Bank Crystal Visa Infinite Card number of the Cardholder Card;

Post to the Account during the calendar year; and

Be identified as a Qualifying Airline Purchase, based on the information available on Visa’s proprietary network (VisaNet). The Eligible Airline must submit the incidental airline fee transaction under the appropriate merchant code, industry code, or required service or product identifier for the transaction to be identified as a Qualifying Airline Purchase transaction. City National Bank and Visa rely on the airlines to submit the correct information on airline transactions, so please call (800) 998-6205 if a statement credit has not posted to the Account within 6 to 8 weeks from the date the Qualifying Airline Purchase was charged to the Cardholder Card

This benefit cannot be combined with any other City National Bank promotional reward offers. The maximum statement credit amount for each Cardholder Card under the Account per calendar year is $250.

City National Bank and Visa reserve the right to modify or cancel this benefit at any time and without notice. Qualifying Airline Purchases made prior to the cancellation of this offer and charged to the Cardholder Card will receive the statement credit as stated above. This benefit may be subject to taxation and/or Form 1099 reporting. Taxes, if any, are the responsibility of the Crystal Visa Infinite Cardholder.

1 TSA Pre?® is a U.S. Government program operated by U.S. Department of Homeland Security (“DHS”) through the Transportation Security Administration (“TSA”) service. It is an expedited security screening program available for select travelers who are traveling domestically within the United States and for international travel when departing from a U.S. airport that participates in the program. The airline also must be participating in the program. Selection for TSA Pre?® expedited screening is made on a per flight basis and is not guaranteed. Eligible Crystal Visa Infinite Cardholders can apply for membership in the TSA Pre?® program and must pay the application fee (currently $85) with their Crystal Visa Infinite Card to receive the statement credit. Acceptance into the TSA Pre?® program is at the sole discretion of the TSA. Neither City National Bank nor Visa has any control over the TSA Pre?® program including, without limitation, application, approval process or enrollment and no liability with regards to the TSA Pre?® program. For complete details on the TSA Pre?® program, including full terms and conditions, go to www.tsa.gov. The TSA Pre?® trademark is used with the permission of the U.S. Department of Homeland Security.

Airline Lounge Club Membership Fee Statement Credit

Spend $50,000+ per calendar year and you can get a lounge membership reimbursed.

Here are the complete terms and conditions for this benefit:

If the Total Spend (as defined below) on your Crystal Visa Infinite Card account is $50,000 or greater in either the current calendar year or the prior calendar year, you may claim and request a Qualifying Airline Lounge Club Membership Fee Statement Credit of up to $550.

If at the time you purchase an airline lounge club membership that is also eligible for a statement credit under the Airline Incidental Fees Statement Credit benefit (“Eligible Airline Membership”), the Airline Incidental Fees Statement Credit will be applied first. Any amount that is not credited to you as part of the Airline Incidental Fees Statement Credit benefit remains available to you as part of the Airline Lounge Club Membership Fee Statement Credit benefit. For example, if you purchase an Eligible Airline Membership for $900, and you have $150 of Airline Incidental Fees Statement Credit available, the $150 will be applied to the Airline Incidental Fees Statement Credit first. Of the remaining $750 of your $900 Eligible Airline Membership purchase, you can submit a claim for a Qualifying Airline Lounge Club Membership Fee Statement Credit up to the $550 available under this benefit.

The statement credit will not exceed the amount of the Qualifying Airline Lounge Club Membership Fee posted to your Crystal Visa Infinite Card account. All or any part of the Total Spend used to qualify for and receive the statement credit cannot be reused to qualify for another Qualifying Airline Lounge Club Membership Fee Statement Credit. Any unused portion of the $550 Qualifying Airline Lounge Club Membership Fee Statement Credit cannot be carried over to the next calendar year.

A “Qualifying Airline Lounge Club Membership Fee” is defined as the annual fee charged by any airline for a Crystal Visa Infinite cardholder’s membership in that airline’s lounge club, and does not include any other amounts charged for use or services obtained at that airline lounge club, including day passes. Airport lounge club fees not affiliated with an airline and any transactions made with travel agencies are not deemed to be a Qualifying Airline Lounge Club Membership Fee.

To qualify as a Qualifying Airline Lounge Club Membership Fee, the transaction must:

Be completed using the full 16-digit City National Bank Crystal Visa Infinite Card number of a cardholder under your Crystal Visa Infinite Card account;

Be for an annual membership to an airline lounge club in the name of the cardholder under your Crystal Visa Infinite Card account;

Post to your Crystal Visa Infinite Card account during the same calendar year in which your claim and request for the Qualifying Airline Lounge Club Membership Fee Statement Credit is received by City National Bank. For example, if you purchase an airline lounge club membership using your Crystal Visa Infinite Card on December 21, and the transaction posts to your account on December 26, we must receive your claim and request for the Airline Lounge Club Membership Fee Statement Credit by December 31 of the same year in which the transaction posts to your Crystal Visa Infinite Card account. City National Bank does not control when a merchant posts a transaction. Please call Customer Service at (800) 998-6205 if you have any questions regarding the posting of a transaction to your Crystal Visa Infinite Card account; and

Be identifiable to, and verifiable by, City National Bank as a Qualifying Airline Lounge Club Membership Fee. City National Bank does not determine whether airlines correctly bill and identify the transaction as an airline lounge club membership fee.

“Total Spend” means the aggregate amount of the net purchases (purchases less returns and credits) on your Crystal Visa Infinite Card account for all cardholders, and excludes cash advances, PIN-based and ATM transactions, and any interest, fees and charges posted to the account.

To claim and request a Qualifying Airline Lounge Club Membership Fee Statement Credit, please call Customer Service at (800) 998-6205. When making your request, you must supply all of the following information: (a) the name of the airline lounge membership program, (b) the airline lounge membership number, (c) the fee paid for the annual airline lounge membership, and (d) the date the annual fee posted to your Crystal Visa Infinite Card account. We will contact you if we need additional information. Please allow 4 to 6 weeks after your request is verified by City National Bank for the statement credit to be posted to your Account. The statement credit will appear as “Lounge Membership Credit” on your account.

You may claim and receive the Qualifying Airline Lounge Club Membership Fee Statement Credit only once for each calendar year in which you qualify for this benefit. If you do not claim the benefit in a calendar year, it will not carry over into subsequent calendar years.

In addition, your Account must be open and in good standing at the time you are to receive the Qualifying Airline Lounge Club Membership Fee Statement Credit in order for it to be posted to your Crystal Visa Infinite Card account.

The Qualifying Airline Lounge Club Membership Fee Statement Credit benefit cannot be combined with any other City National Bank promotional reward benefits. City National Bank reserves the right to modify or cancel this benefit at any time and without notice. Any Qualifying Airline Lounge Club Membership Fee Statement Credit claimed under this benefit prior to the date of cancellation of this benefit by City National Bank will receive the Qualifying Airline Lounge Club Membership Fee Statement Credit subject to the terms and conditions stated above. The Qualifying Airline Lounge Club Membership Fee Statement Credit may be subject to taxation or Form 1099 reporting. Taxes, if any, are the responsibility of the Crystal Visa Infinite Card account holder.

Avis

Up to 30% off Avis car rental reservations with AWD S107100 and up to 10% off Avis Signature Series reservations with AWD S107100.

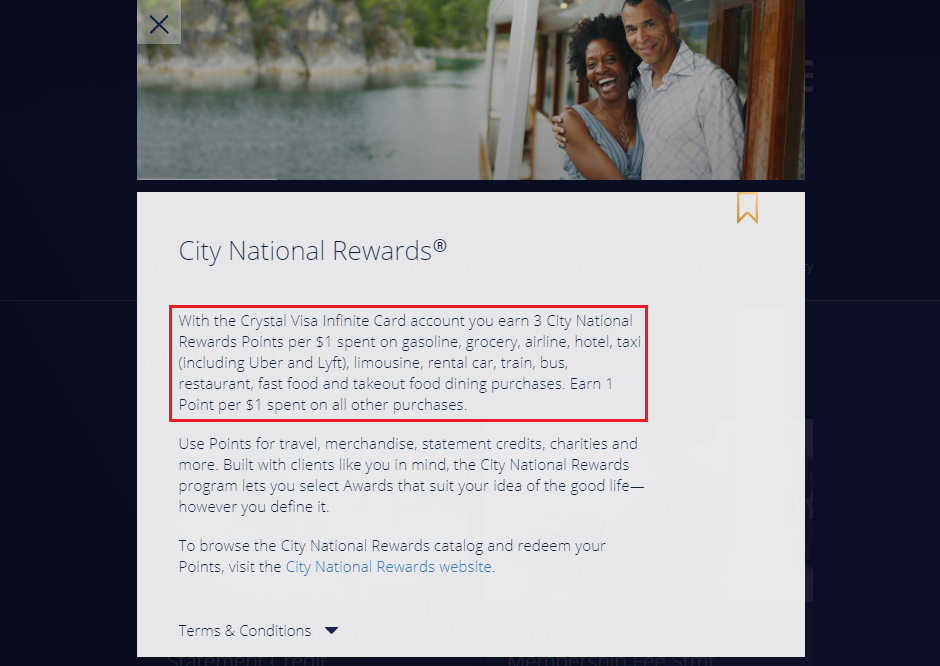

City National Rewards

3x on gas, groceries, travel, and restaurants.

Crystal Card Experiences

Invite only access to signature events.

Apparently this page disappeared and no one knows where it went.

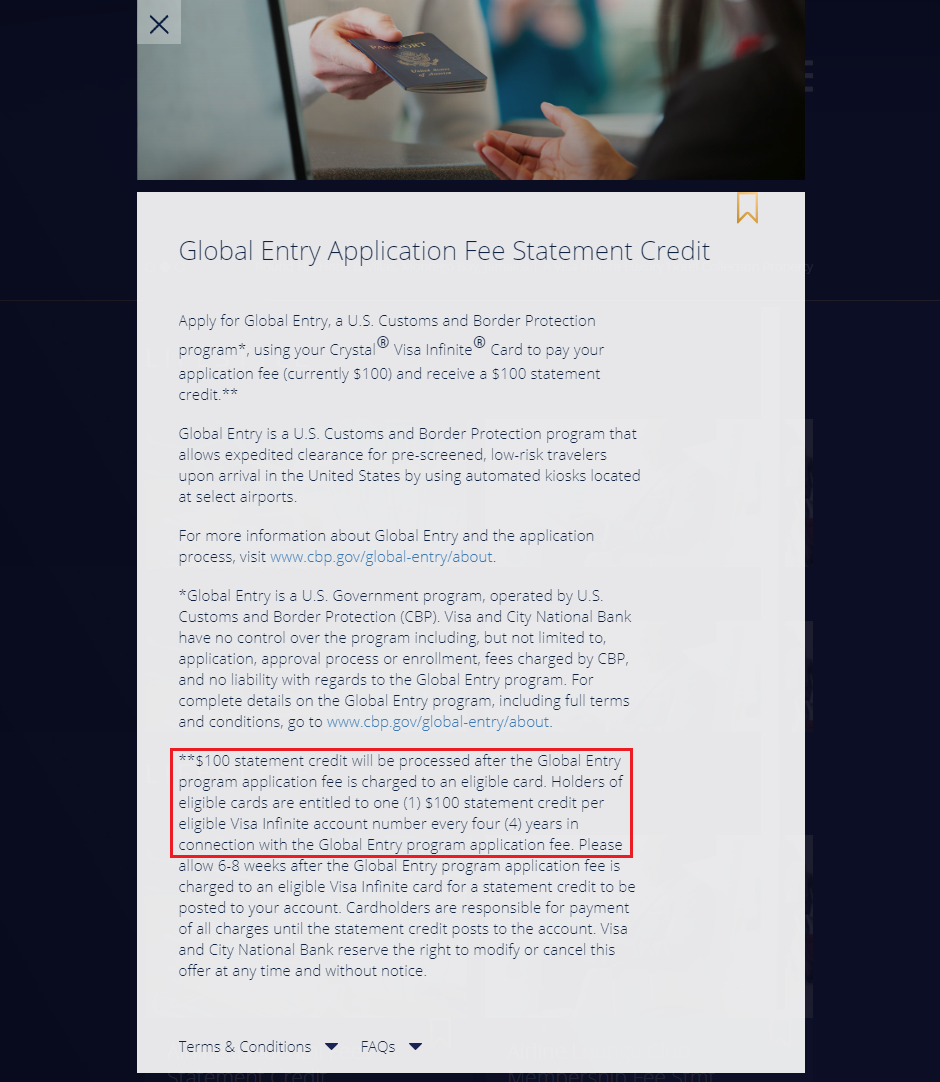

Global Entry Application Fee Statement Credit

$100 Global Entry credit, valid every 4 years. Follow these instructions for enrolling in Global Entry.

Here are the complete terms and conditions for this benefit:

You must be an eligible U.S. Crystal® Visa Infinite® Cardholder to participate in this offer.

You must use the U.S. Crystal Visa Infinite Card to complete the Global Entry application and pay a $100 application fee with your Crystal Visa Infinite Card.

Global Entry is a U.S. Government program, operated by U.S. Customs and Border Protection (CBP). Visa and City National Bank have no control over the program including, but not limited to, application, approval process or enrollment, fees charged by CBP, and no liability with regards to the Global Entry program. For complete details on the Global Entry program, including full terms and conditions, go to globalentry.gov.

$100 statement credit will be processed after the Global Entry program application fee is charged to an eligible Crystal Visa Infinite Card. Holders of eligible Crystal Visa Infinite Cards are entitled to one (1) $100 statement credit per card every 4 years in connection with the Global Entry program application fee. Please allow 6 to 8 weeks after the Global Entry program application fee is charged to an eligible Crystal Visa Infinite Card for a statement credit to be posted to the Crystal Visa Infinite Card account.

Cardholders are responsible for payment of all charges until the statement credit posts to the account.

Visa and City National Bank reserve the right to modify or cancel this offer at any time and without notice.

This benefit may be subject to taxation and/or Form 1099 reporting. Taxes, if any, are the responsibility of the Crystal Visa Infinite Cardholder.

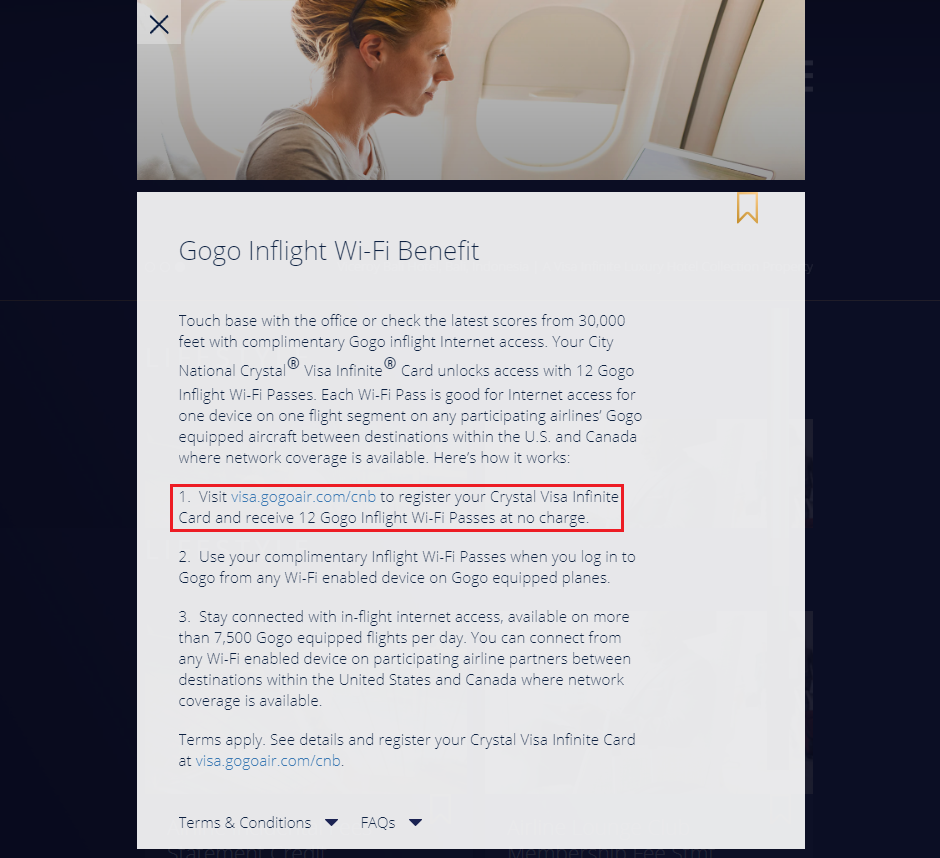

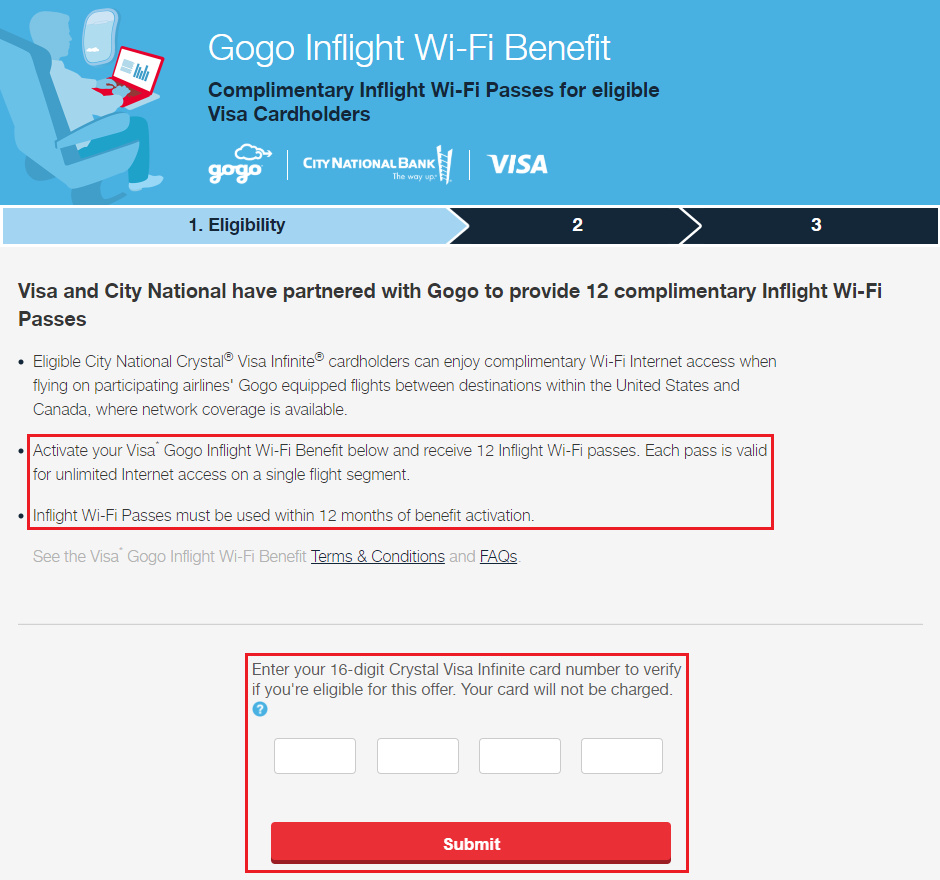

Gogo Inflight Wi-Fi Benefit

Get 12 Gogo inflight Wi-Fi passes every year. Click here to enroll.

Don’t do this now, do this right before your next Gogo equipped flight since the codes are only good for 12 months from the date you activate this benefit.

Here are the complete terms and conditions for this benefit:

You must be an eligible U.S. Crystal® Visa Infinite® Cardholder and register your card at visa.gogoair.com/cnb to take advantage of the Gogo Inflight Wi-Fi Benefit.

Eligibility for this benefit is determined by City National Bank. Provided you meet the City National Bank’s eligibility requirements (i.e., the Crystal Visa Infinite Card account must be open and in good standing), your 12 complimentary Inflight Wi-Fi Passes will be available to you at no additional cost after you complete the online registration.

Each Inflight Wi-Fi Pass provides for complimentary inflight Wi-Fi Internet access for one device at a time on one flight segment on any participating airlines’ Gogo equipped aircraft between destinations within the United States and Canada where network coverage is available.

Participating airlines are listed at https://promotions.gogoair.com/promotion/static/visa/participating-airlines.html. Please note that these participating airlines are subject to change at any time without notice. Check the linked page regularly for the most up-to-date list of airlines on which the Inflight Wi-Fi Passes are valid.

Registration for this benefit is not available in flight — you must complete registration prior to your flight to access your Inflight Wi-Fi Passes.

If you have an existing subscription with Gogo, you will have to suspend or cancel the subscription before you can credit your Gogo account with the 12 Inflight Wi-Fi Passes. To suspend or cancel your subscription simply:

Chat with Gogo via Live Help; or

Email Gogo at CustomerCare@gogoair.com; or

Call Gogo at 877-350-0038.

Each Gogo Inflight Wi-Fi Pass may be redeemed on any Wi-Fi enabled laptop, tablet, or smartphone for inflight Wi-Fi internet access on one (1) flight segment (a segment is defined as a takeoff and a landing).

Gogo Inflight Wi-Fi Passes are valid for 12 months from the date that you register your card for the Gogo Inflight Wi-Fi Benefit. Any unused Inflight Wi-Fi Passes at the end of the 12 month period will expire.

At the end of your initial 12 month period, provided the Gogo Inflight Wi-Fi Benefit is still being offered, and you continue to meet City National Bank’s eligibility requirements (i.e., the Crystal Visa Infinite Card account must be open and in good standing), you will receive an email inviting you to re-register for the benefit at visa.gogoair.com/cnb to receive another 12 Gogo Inflight Wi-Fi Passes.

The use of the passes within this benefit is subject to Gogo’s Terms of Use and Privacy Policy.

Visa and/or City National Bank reserve the right to modify or cancel this benefit at any time and without notice.

This benefit is non-transferable.

The Gogo Inflight Wi-Fi Benefit is provided by Gogo, LLC and none of Visa or its issuers is responsible for any claims or damages arising from use of the Gogo services

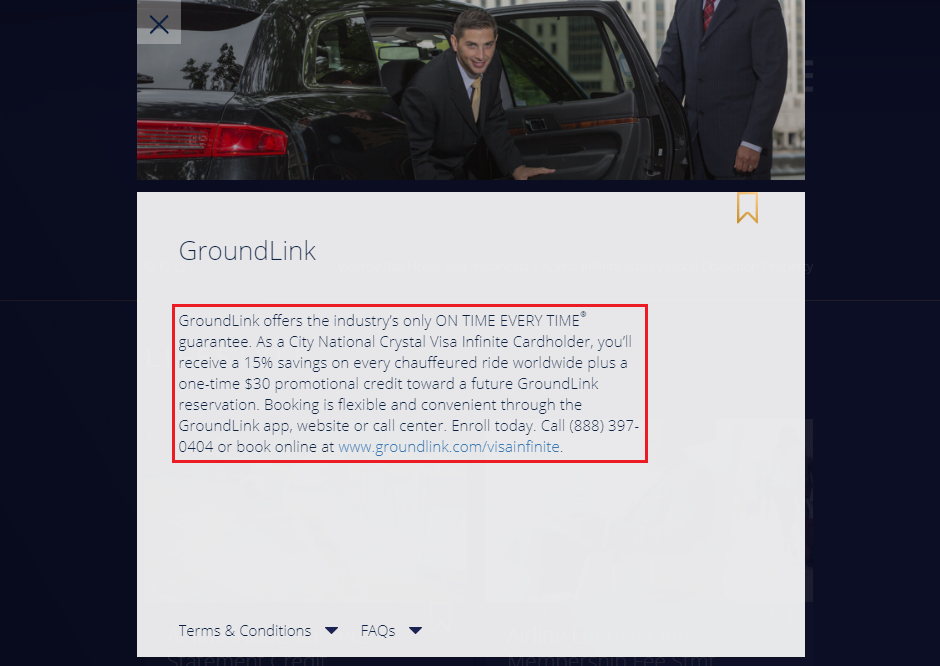

GroundLink

15% off chauffeured rides and $30 off your first reservation.

National Car Rental

Get free Emerald Club Executive level membership and 25% off qualifying car rentals with code 5030849.

Premium or House Seats for Broadway Shows

Backstage tours and “meet and greets” with the performers.

Priority Pass Select

Unlimited guests for every visit and 2 cardholders can join Priority Pass with one CNB account.

Here are the complete terms and conditions for this benefit:

What is the Priority Pass Select membership and how do I receive the benefit?

Through the Priority Pass Select program, up to two (2) of the Crystal® Visa Infinite® Cardholders and their accompanying guests have access to over 850 airport VIP lounges in more than 120 countries and 400 airports worldwide currently participating in the Priority Pass Select program, regardless of their choice of airline, class of ticket or membership in an airline lounge program.1

City National Bank will enroll up to two (2) of the Crystal Visa Infinite Cardholders as members in the Priority Pass Select program, and each such enrolled cardholder is hereinafter referred to as a “Member”.2

Each Member will receive a Priority Pass Select membership card for lounge access and a listing of the participating lounges. Priority Pass Select membership will be for an initial period of one year and will be renewed each year by City National Bank, without charge of a membership fee, provided the Crystal Visa Infinite Card account is open and in good standing.3 Changes to cardholders enrolled as a Member in the Priority Pass Select program may only occur on an annual basis during the anniversary month in which the Crystal Visa Infinite Card account was opened. If the Crystal Visa Infinite Card account is closed for any reason, all memberships for that account in the Priority Pass Select program will be cancelled, and each Member cardholder shall destroy the cardholder’s Priority Pass Select membership card, or return the membership card, cut in two, to City National Bank – Attn: Credit Card Operations, 555 S. Flower Street, 22nd Floor, Los Angeles, CA 90071.

What benefits do Crystal Visa Infinite Cardholders receive with their Priority Pass Select membership?

Priority Pass Select offers Members the following benefits:

Access for Members and their accompanying guests to over 850 participating airport VIP lounges across 120 countries and over 400 airports worldwide, regardless of the class of travel or airline.1

Relaxing ambience — for both Members and guests.

Complimentary refreshments and snacks at many lounges.

High-speed internet service, meeting rooms and other amenities at many lounges.

City National Bank will also cover the access charge for visits by each Member and their accompanying guests

Please review the Terms and Conditions of use in the Lounge Listing accompanying your Priority Pass Select membership card, or at www.prioritypass.com.

1 Priority Pass Select is an independent airport lounge access program and is neither owned nor otherwise affiliated with City National Bank or Visa. The Priority Pass Select membership benefit is subject to change and cancellation at any time. Membership in the Priority Pass Select program is not transferable and is only valid up to the date of membership expiration and when the Priority Pass Select membership card has been signed by the Member. All participating lounges are owned and operated by third party organizations, and none of Priority Pass Select, City National Bank or Visa are or will be liable for any loss to a Member or any accompanying guests, arising from the provision or non- provision of any of the benefits, services and facilities. Lounge benefits, services and facilities differ by location and some may only be available at an additional charge. Certain lounges may restrict access due to space constraints and may have limits on the number of guests who can enter with a Member. Members must adhere to all rules of participating lounges. See participating lounge rules in the lounge listing sent to you with the Priority Pass Select membership card or visit www.prioritypass.com. For access to a participating airport lounge, the Member must present his or her Priority Pass Select membership card and a boarding pass or valid flight ticket (depending on the lounge) for the same day of travel. Note: Presentation of a Crystal Visa Infinite Card will not gain the Member access into a lounge. In some cases, a Member must be 21 years of age to enter a participating lounge without a parent or guardian, in which event personal identification also may be required.

2 A maximum of two (2) memberships per Crystal Visa Infinite Card account is permitted in the Priority Pass Select program. The owner(s) of the Crystal Visa Infinite Card account as well as authorized users on the account are eligible for the two (2) available memberships. The owner(s) of the Crystal Visa Infinite Card account will determine to which cardholders the two (2) memberships will be provided.

3 To be in “good standing” the Crystal Visa Infinite Card account must not be (i) delinquent or otherwise in default, (ii) have been cancelled or closed by you or City National Bank, or (iii) otherwise not available as a source for funding. The Crystal Visa Infinite Card account owner(s) may change the cardholders enrolled in the Priority Pass Select program on an annual basis by contacting their Relationship Manager.

Relais & Chateaux

Special benefits and VIP amenities, including VIP welcome and complimentary breakfast.

Silvercar

Up to 30% off Silvercar rentals.

Troon

10% off Troon Rewards to save on golf fees and merchandise.

Here are the complete terms and conditions for this benefit:

Troon Rewards Terms and Conditions

Crystal Visa Infinite Cardholders are entitled to receive complimentary Silver status in the Troon Rewards program. Existing Troon Rewards members who have already attained Silver status or higher will be upgraded to the next membership level. An eligible Crystal Visa Infinite Card is required for tee time reservations. At the Silver, Gold, and Platinum membership levels, the Cardholder will be entitled to a 10%, 15% and 20% discount, respectively, on golf fees reserved on the Visa Infinite Troon website or on merchandise purchases made at the golf properties when using their Crystal Visa Infinite Card. None of Troon, Visa, City National Bank and any of its concierge providers are responsible for any claims or damages arising from this benefit. By reserving through Troon, the Crystal Visa Infinite Cardholder consents to be bound by all of the above terms and conditions. Troon, City National Bank and Visa reserve the right to modify or cancel this benefit at any time without notice.

Troon Privé Terms & Conditions

Crystal Visa Infinite Cardholders are invited to reserve tee times at participating Troon Privé private clubs at a rate of $99 (plus tax where applicable) per player per round. Cardholders may bring up to three (3) guests at the same rate on each tee time they make and may play each Troon Privé course up to two (2) times per year at the $99 per player per round rate. Crystal Visa Infinite Cardholders may request a round by using the form provided at www.troongolfrewards.com/visainfinite. Restrictions on course availability may apply. An eligible Crystal Visa Infinite Card is required for tee time reservations. None of Troon, City National Bank, Visa and any of its concierge providers are responsible for any claims nor damages arising from this benefit. By reserving through Troon, the Crystal Visa Infinite Cardholder consents to be bound by all the above terms and conditions. Troon, City National Bank and Visa reserve the right to modify or cancel this benefit at any time without notice.

Troon Rewards and Troon Privé Limitations of Liability: The Crystal Visa Infinite Cardholder and all guests of the cardholder agree to comply with all applicable venue regulations with respect to the above benefits. In redeeming these benefits, the Crystal Visa Infinite Cardholder and each guest of the cardholder, on behalf of himself/herself and his/her immediate family members (spouse, parents, children and siblings and their spouses) and individuals living in the same households of such participants, whether or not related, agrees to release and hold harmless officers, directors, employees, agents and assigns of City National Bank, Troon, Visa Inc., Visa U.S.A. Inc., Visa International Service Association, Qualfon Inc. and their respective parents, subsidiaries, successors, affiliates, and related companies, client financial institutions, prize suppliers, and advertising, promotion and marketing agencies, including International Merchandising Company LLC, (collectively, the “Released Parties”) from any and all liability or damage of any kind (including personal injury) resulting from or arising from participation in the event or acceptance, possession, use, misuse or nonuse of the benefits (including any travel or travel-related activity thereto).

Visa Infinite Discount Air Benefit

Save $100 on roundtrip, domestic airline tickets when you purchase 2-5 tickets.

Click here to get started. I wrote about this service with my JPMorgan Chase Ritz Carlton Visa Infinite Credit Card – see the post here.

Here are the complete terms and conditions for this benefit:

Crystal® Visa Infinite® Cardholders are entitled to receive a $100 discount on the purchase of 2 to 5 qualifying round-trip, domestic coach airline tickets on the same itinerary purchased through the Visa Infinite Discount Air website using their Crystal Visa Infinite Card. The $100 discount is applied to the total cost of the itinerary, not per ticket.

Tickets must be purchased in full using a U.S.-issued Crystal Visa Infinite Card. No other form of payment will be accepted. The Crystal Visa Infinite cardholder purchasing the tickets must be the primary traveler on the itinerary. Visa or Propp Corp (“Propco”) may cancel any booking or suspend the Visa Infinite Discount Air benefit if the Crystal Visa Infinite cardholder is not the primary traveler on the itinerary.

Fare prices are not guaranteed and are subject to change until booking is confirmed and ticketed.

This offer is valid only for round-trip travel between U.S. cities within the 50 states with participating airlines. Bookings are generally accepted within eleven (11) months of travel date and inventory is determined solely by the airlines.

This $100 discount is not retroactive and may not be applied to previously booked tickets.

This $100 discount may not be combined with or applied to other certificates, promotions or special offers, including but not limited to: upgrades, government fares, tour/travel packages, group, convention/company meeting fares, bereavement, companion fares, senior citizen discounts, corporate agreements, student fares, child fares, travel industry discounts, frequent flyer discounts or any unpublished programs. Standard taxes and fees will apply. Open tickets, open returns, open jaws, multi-leg, same-day travel and circle trips are not permitted. Stopovers are not allowed.

Any changes to an itinerary, including but not limited to cancellations, must be made through Crystal Card® Concierge at 1-800-595-8950 from the U.S. or Canada, or 00-800-2797-8251 from outside North America.

Tickets are non-transferable and non-refundable except where expressly permitted by the applicable airlines. Name changes are not permitted.

Airline participation varies from market to market and seat inventory is based on availability.

Propco administers and manages the Visa Infinite Discount Air Benefit.

Visa or Propco may cancel or suspend the Visa Discount Air benefit and any travel reservations associated with the cardholder’s name, email address or account and close any associated Visa Infinite Discount Air accounts at any time with immediate effect and without written notice, for any reason in Visa and Propco’s sole discretion, including, without limitation, if Visa and Propco believe the cardholder has (i) breached or violated any of these terms and conditions, (ii) engaged in any fraudulent, suspicious or dishonest behavior, gaming, theft, staking of credits, misconduct or wrongdoing in connection with the Visa Infinite Discount Air benefit, or (iii) acted in an inappropriate, fraudulent or abusive manner. If the cardholder has conducted any fraudulent activity, Visa and Propco reserve the right to take any necessary legal action and the cardholder may be liable for monetary losses to Visa and Propco, including litigation costs and damages.

Modification and Cancellations:

Modification: To modify a booking, you are required to contact Crystal Card Concierge to cancel the booking and rebook with the modification. Tickets may be rebooked for a future date using the same passenger names based on applicable airline rules and availability, and subject to applicable airline fare rules, fees/penalties and fare differences.

If tickets are canceled after purchase, you will receive a credit for the canceled tickets that is held by the airline.

This credit is valid for one (1) year from the original date of purchase.

At the time the credit is redeemed, the airline charges a change/cancellation fee per person plus any difference in airfare in accordance with applicable airline rules.

To redeem that credit, contact Crystal Card Concierge.

If the reservation/booking is not canceled prior to departure and the passengers do not travel, the tickets will be forfeited completely.

Cancellation: To cancel a booking, you are required to contact Crystal Card Concierge, as follows:

Within 24 hours of ticket purchase for a full-refund by calling Crystal Card Concierge at 1-800-595-8950 from the U.S. or Canada, or 00-800-2797-8251 from outside North America. Crystal Card Concierge will contact the airline on your behalf and request a refund equal to the amount you paid for the tickets; or

After 24 hours of ticket purchase (up to the scheduled time of departure) for a travel credit by calling Crystal Card Concierge at 1-800-595-8950 from the U.S. or Canada, or 00-800-2797-8251 from outside North America. Crystal Card Concierge will contact the airline on your behalf and request a credit. Travel credit will be for the amount paid for the tickets less any cancellation fees the airline may charge. Travel credits are generally valid for one (1) year from the original date of purchase. Please refer to the specific airline regarding their travel credit policies as they vary by airline and fare type purchased; or

Due to a medical event by contacting Crystal Card Concierge at 1-800-595-8950 from the U.S. or Canada, or 00-800-2797-8251 from outside North America. In all cases, airlines will request documentation confirming the medical event. The respective airline policy will dictate whether a refund or waiver will be granted.

Cancellation due to a Medical Event

When you contact Crystal Card Concierge to cancel any tickets due to a medical event, you must fax the requested documentation confirming the medical event to 1-818-878-9320.

Propco will contact the airline on your behalf and will request a full refund and/or waiver of any change/cancellation fees per ticket.

The respective airline policy will dictate whether a refund or waiver will be granted.

If the airline issues a credit, the airline may impose a change/cancellation fee plus any difference in airfare per person at the time the credit is applied to future travel.

If the airline issues a refund, a credit for the after-discount amount paid for canceled tickets less fees will be refunded and posted to your account within 30 days from the date of cancellation.

Visa, City National Bank and Propco are not responsible for any changes made by a cardholder to a confirmed reservation, including upgrades. Visa, City National Bank and Propco will not replace or refund any of the value of items such as miles, points or currency used for such changes.

Redeeming Travel Credit

To redeem travel credit, the cardholder must contact Crystal Card Concierge at 1-800-595-8950 from the U.S. or Canada, or 00-800-2797-8251 outside North America. At the time of redeeming travel credit, the airline may charge a change/cancellation fee per person plus any difference in airfare in accordance with applicable airline rules. Name changes are not permitted.

Additional Terms and Conditions

Visa, City National Bank and Propco 1) are not responsible for any changes made by a cardholder to a confirmed reservation, including upgrades; and 2) will not replace or refund any portion of the value of miles, points, currency, etc. used for reservation changes or upgrades if the cardholder does not use the changed or upgraded ticket for any reason including, but not limited to, an airline schedule change, airline delay or cancellation or additional changes made by the cardholder, including cancellation of a confirmed reservation.

Propco is the final authority on the interpretation of these terms and conditions. This program is void where prohibited by law. This discount offer may not be sold or resold. Any such sale will invalidate any redemption rights hereunder. This offer cannot be exchanged for cash or other consideration. No refunds will be provided for any unused portion of this offer. This offer has no cash value and is subject to applicable federal, state and local laws.

Neither Propco nor Visa assumes any responsibility for any verbal or written representation made by any third party that varies the terms and conditions of this offer.

Propco and its agents, and any other company or individual participating in the creation, distribution or redemption of this offer, act only as agents for the airlines and Propco, its agents, Visa and City National Bank do not, and will not assume any liability or responsibility for damage, expense, inconvenience, loss, injury, accidental death or damage to any persons or property whatsoever on any aircraft or in transit to and from said aircraft, or for any cause whatsoever due to delays, cancellations, nature, mechanical breakdown, strikes, war, acts of God, arising from or in conjunction with services provided by a travel agent or other third party in connection with the travel provided and for any verbal or written representation made in conjunction with the travel booked by redeeming this offer. When issued, your electronic reservation constitutes the sole contract between the airline and the passengers. For information regarding airline liability limitations, baggage liability and other regulations of the Warsaw Convention, as modified by the Montreal Convention, and other regulations, please consult your air carrier.

Either the airline, or in some instances Travel Services, will appear as the merchant of record on your card statement for purchases made through Propco. None of Propco, Visa, City National Bank or any of their concierge providers are responsible for any claims or damages arising from this benefit or related travel.

As a courtesy, Crystal Card Concierge is available to assist you with basic itinerary changes and cancellations prior to departure. In case of a travel emergency, such as airline flight cancellations and missed connections while you are traveling, please contact the airline directly for immediate support.

By booking travel through Propco, the Crystal Visa Infinite cardholder and all travelers on the travel itinerary consent to be bound by all the terms and conditions, as stated herein.

Visa reserves the right to modify or cancel this offer at any time and without notice.

Seller of Travel Registration Numbers

Propco, who acts only as an agent for the airlines, makes the travel arrangements for you on behalf of Visa. Its California Seller of Travel number is 2080494-40. Registration as a Seller of Travel in California does not constitute approval by the State of California. Its Florida Seller of Travel number is ST39796, its Iowa Seller of Travel number is 1241 and its Washington Seller of Travel number is 603 449 394. Propp Corp, 8750 W. Bryn Mawr Avenue, Suite 1020E, Chicago, IL 60631.

Disclosures Related to Tickets Booked:

Hazardous Materials

Federal law forbids the carriage of hazardous materials aboard aircraft in your luggage or on your person. A violation can result in five years’ imprisonment and penalties of $250,000 or more (49 U.S.C. 5124). Hazardous materials include explosives, compressed gases, flammable liquids and solids, oxidizers, poisons, corrosives and radioactive materials. Examples: Paints, lighter fluid, fireworks, tear gases, oxygen bottles, and radio-pharmaceuticals. There are special exceptions for small quantities (up to 70 ounces total) of medicinal and toilet articles carried in your luggage and certain smoking materials carried on your person. For further information contact the airline directly. Please go to http://www.dot.gov/office-policy/aviation-policy/aircraft-disinsection-requirements to learn about the use of insecticides in certain aircraft.

Overbooked Flights

Airline flights may be overbooked, and there is a slight chance that a seat will not be available on a flight for which you have a confirmed reservation. If this occurs, the airline will make alternative arrangements for you.

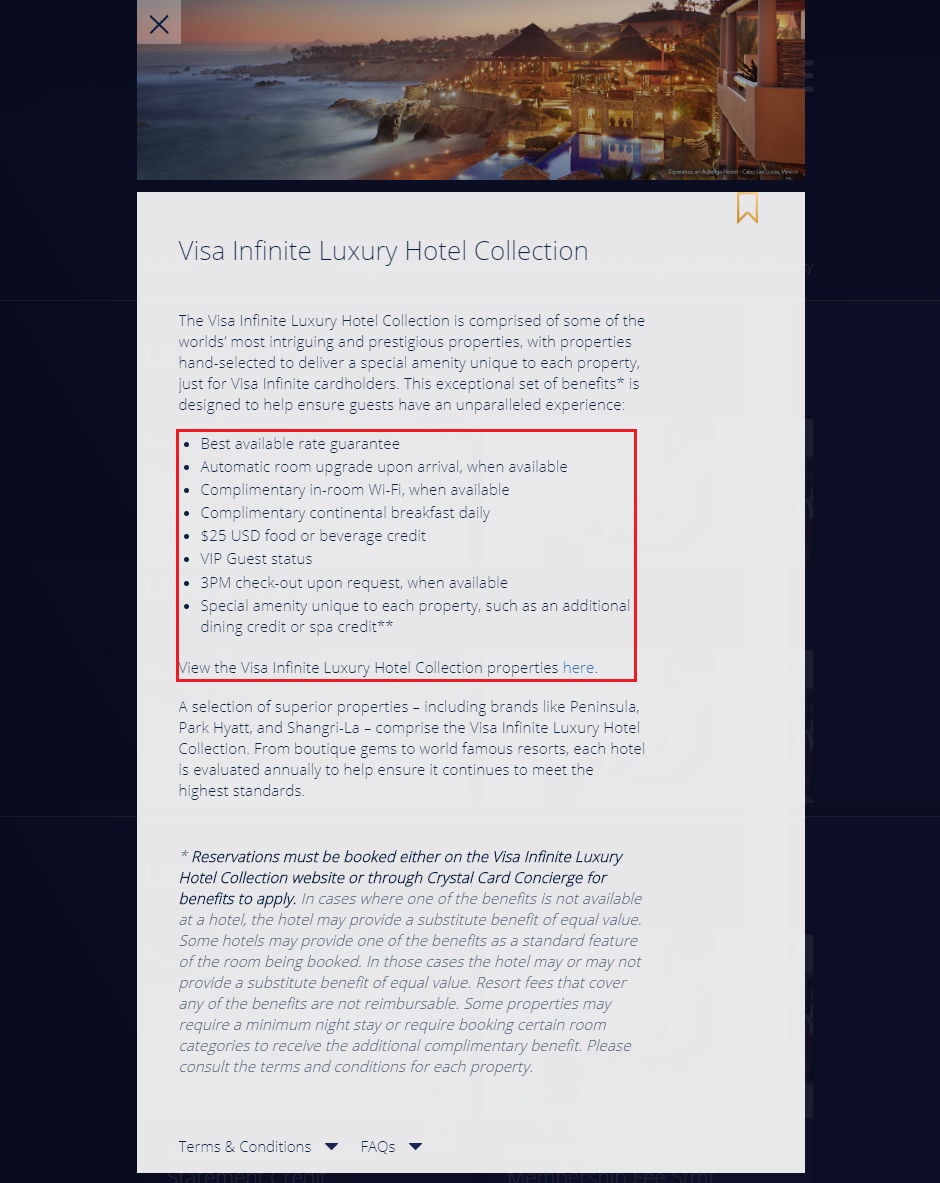

Visa Infinite Luxury Hotel Collection

Get great deals and luxury hotels, including room upgrades, $25 food and beverage credit, late checkout, and more.

See the latest collection here. Click the cloud icon to download a PDF or scroll through the pages.

Here are the complete terms and conditions for this benefit:

CARD ELIGIBILITY

Eligible Crystal® Visa Infinite® Cards may book hotels at www.visainfinitehotels.com/welcome/cnb and receive special Visa premium card benefits.

BEST AVAILABLE RATE GUARANTEE

The best publicly available rates are guaranteed whenever you book with the Visa Infinite Luxury Hotel Collection. If you find a lower room rate** on another website within 24 hours of making a booking with us, we will match the rate.

** The lower rate found must:

Have identical booking requirements and policies for payment and cancellation as your Visa Infinite Luxury Hotel Collection booking

Be for the same hotel, room type, stay dates/length, and number of guests

Be publically viewable and verifiable on the other website

Be for room only, exclusive of other benefits or perks

Full terms & conditions are below.

To make a claim, simply complete the Best Available Rate Guarantee online claim form within 24 hours of making your Visa Infinite Luxury Hotel Collection booking. We will review your claim and contact you within 48 hours.

Please note: hotel cancellation policies vary greatly. Many of our hotels are flexible and allow cancellation up to 24 hours in advance of your stay. The Visa Infinite Luxury Hotel Collection understands that sometimes travel plans change, and therefore does not charge additional change or cancel fees.

BEST AVAILABLE RATE GUARANTEE TERMS & CONDITIONS

The Visa Infinite Luxury Hotel Collection guarantees the best publicly available rates for all of our hotels, subject to the following terms and conditions:

The Best Available Rate Guarantee online claim form must be completed in full within 24 hours of making your Visa Infinite Luxury Hotel Collection booking

Claim must include the lower rate and exact link (URL) where it can be confirmed

The following rates do not qualify:

Pre-paid, non-cancellable, and/or non-refundable rates

Rates available on auction or flash sale websites like (but not limited to) Priceline or Hotwire

Reward program rates, corporate/group rates, government rates and/or other rates not available to the general public

Packaged rates that include the room with other travel and/or entertainment goods and services such as (but not limited to) airline tickets, car rentals, or show tickets

If we verify the lower rate, your nightly rate will be adjusted to reflect it

The rate and/or benefits cannot be combined with hotel specific special offers or packaged promotions or other rates not publically viewable.

The Visa Infinite Luxury Hotel Collection has the sole right to determine the validity of any claim.

The Visa Infinite Luxury Hotel Collection has the discretion to determine if a competing rate is genuinely available.

In the case of a dispute, the Visa Infinite Luxury Hotel Collection’s decision is final.

The Visa Infinite Luxury Hotel Collection reserves the right to modify this Best Available Rate Guarantee at any time.

AUTOMATIC ROOM UPGRADE UPON ARRIVAL

Upon availability at check-in, you will be upgraded to the next highest room class for the duration of your stay.

COMPLIMENTARY IN-ROOM WI-FI

Upon check-in you will be provided with complimentary in-room Wi-Fi, if available, for the duration of your stay.

COMPLIMENTARY CONTINENTAL BREAKFAST DAILY

For the length of your stay, you and one guest will receive complimentary continental breakfast daily. If the hotel does not offer continental breakfast, they will offer another dining or other benefit of equal value based on local market rate.

$25 U.S. DOLLARS (USD) FOOD OR BEVERAGE CREDIT

During your hotel stay you will receive a $25 USD credit at check-out. Limit of one $25 USD credit per room, per stay. A stay is defined as consecutive nights spent at the same hotel, regardless of check-in/check-out activity. Any charges over and above the credit described above will be applied directly to your account to settle upon departure. Credit has no cash value and is not valid on room rate or third party services.

VIP GUEST STATUS

As a guest through the Visa Infinite Luxury Hotel Collection, you will be recognized within the hotel as a VIP Guest. VIP Guest services and amenities differ by property.

3PM CHECKOUT UPON REQUEST

Late checkout is available upon request, upon availability by the hotel. At the time of check-in, or during the course of your stay, you may contact the front desk and request late checkout up to 3 p.m.

SPECIAL AMENITY UNIQUE TO EACH PROPERTY

Enjoy an additional complimentary benefit available at a special collection of properties in the Visa Infinite Luxury Hotel Collection. Some properties may require a minimum night stay or require booking certain room categories. Please consult the terms and conditions for each property.

The complimentary benefit* may be one of the following, but not inclusive, to:

An additional $75 Food & Beverage credit, on top of the existing $25 Food & Beverage credit

A $100 spa or golf credit

A $100 credit towards room rate

Guaranteed room upgrade at time of booking with a minimum value of $100.

(All credits are USD.)

*In cases where one of the benefits is not available at a hotel, the hotel may provide a substitute benefit of equal value. Some hotels may provide one of the benefits as a standard feature of the room being booked. In those cases the hotel may or may not provide a substitute benefit of equal value. Resort fees that cover any of the benefits are not reimbursable. Reservations must be booked either on a Visa Infinite Luxury Hotel Collection website or through Crystal Card Concierge for benefits to apply. Some properties may require a minimum night stay or require booking certain room categories to receive the additional complimentary benefit. Please consult the terms and conditions for each property.

Visa Signature Perks

Visa Infinite cardholders still get access to Visa Signature benefits.

Please let me know if this blog post was useful or just a big waste of time. If you have any questions about any of the benefits listed above, please leave a comment below. Have a great day everyone!

You basically just cut & paste the T&C so pretty useless. I thought there would be a bit more actual content/opinion.

That’s what I was afraid of. I spent too much time on the images and making them look good, so I rushed the analysis part.

I still have opinions if you want to ask me a question about any of benefits. Thank you for your feedback, Mark.

Agreed.

So just for counterpoint I figured I’d provide some slightly more constructive feedback.

1) Too long with limited information that isn’t accessible elsewhere. I actually think having the a lot of the terms pasted in is useful except that it makes the document so long that I can’t find anything I want. To solve this you can use boxes that expand with the relevant terms in each subsection.

2) The images are largely not helpful: for example the silvercar image doesn’t really provide any useful information that couldn’t be summarised in 2 sentences of text (something like: 30% discount on Silver Car but here are the restrictions and if you want the details here is the link to that page). I get that some of the images provide information that isn’t on a public facing site and that is data you have access to that you are trying to share but many of the links (that contain the actual useful information) that I see in the images are not actually protected and are publicly accessible.

3) Consider your audience: Did we really need a full breakdown of priority pass terms. Tell me what is new or different or that it is exactly the same as everything else. I don’t need to know they have 850+ lounges because I’ll bet the vast majority of your audience knows that. Also considering your audience I can’t believe you included the TSA hazardous materials section of the flight benefits…

I hope I’m not being overly critical. I am genuinely curious about your thoughts. Would love to know about your cost benefit analysis on the card. How justifiable the card is in a portfolio that may already include other duplicated benefits. Is it a 1 year pump and dump or a long term keeper. How are you maximizing your airline credits and are you going to go for the club membership reimbursement. I ask because I’m also a bay area resident and am interested in this card but this document doesn’t answer any questions I couldn’t easily find somewhere else.

Hi Murugu, thank you very much for the constructive feedback. Let me try my best to answer some of your questions and provide reasons why I included long T&Cs.

1. My hope was that users could find (CTRL + F) any relevant info for the benefit they were looking for. I don’t know of a plugin that is useful for hiding/expanding text.

2. I agree that most of the images are not very useful, since you can’t search an image.

3. I think the only difference about Priority Pass issued by CNB is that you get unlimited guests, which is not offered on Priority Pass cards issued by other credit card companies. TSA hazardous materials is not helpful.

4. I have no plans to spend $50K on the CNB CC to get the $550 lounge reimbursement, but my long term plan is to get 3 AU CCs, each with their own $250 airline travel reimbursement and do my best to max those out every calendar year. I have heard airline taxes, award taxes, cheap airfare, and some GCs trigger the bonus, but I haven’t gotten any reimbursements yet. If the reimbursements are easy, I plan on keeping the CC long term, if not, I will probably not renew the CC another year.

Let me know if you have any other questions about the CC. Have a great day :)

Hi Grant,

Thanks for the post. Wanted to let you know that the National Rental Car link is going to the wrong place.

Good catch, I added the correct link to the post (https://legacy.nationalcar.com/en_US/car-rental/partners/partner-details/affinity/5030849-visa-infinite.html)

Thanks – what about the rental car insurance? Is it primary in the US and overseas, or just overseas?

Not sure, it would best to call CNB to confirm coverage.

What’s the process to add authorized users?

Call your specific banker or stop by your branch. You will need to provide lots of personal information for each AU.

What charges trigger the airlines reimbursement. Please do not curt and oaste the T&C. For e.g. if a make a smalle reservationn charge at southwest for 53.26. Will the reimbursement go through?

Check out this DOC post for all the data points on what purchases trigger the reimbursement: https://www.doctorofcredit.com/charges-triggers-city-national-bank-crystal-visa-infinite-250-airline-credit/