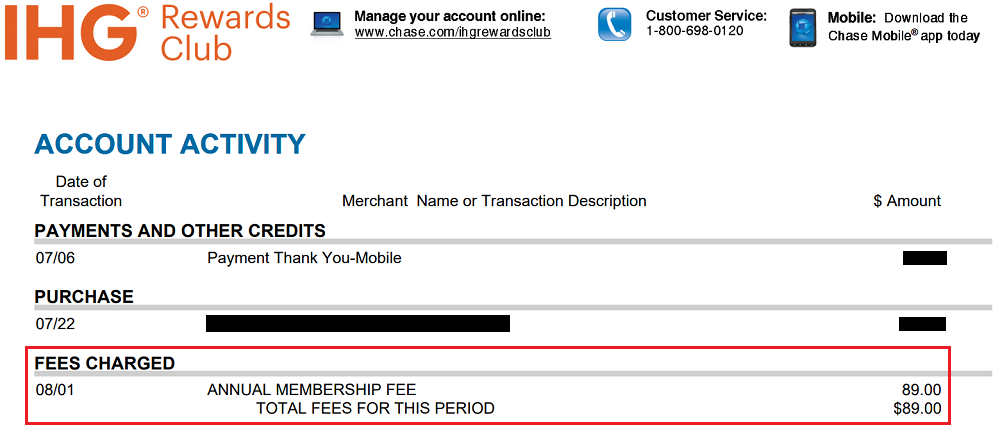

Good morning everyone, happy Friday! Last week, I was checking my Chase IHG Rewards Premier Credit Card (currently offering a sign up bonus of 125,000 IHG Rewards Points after spending $3,000 in 3 months) statement and saw that the $89 annual fee posted to my account. As part of my “Keep, Cancel or Convert?” series, I like to evaluate and reevaluate credit cards to make sure they still deserve a spot in my wallet (or credit card drawer). There are 3 main reasons to keep this credit card: 1 free night certificate good for any IHG property up to 40,000 IHG Rewards Points, 4th night free when you pay for your entire stay with IHG Rewards Points, and 10x IHG Rewards Points when paying for IHG hotels (if you are a new credit card holder, you will get 25x at IHG Hotels for the first 12 months).

This card is a keeper for me, but I decided to call Chase and see if they had any retention offers available. I mentioned to the Chase rep that I also have the Chase IHG Rewards Select Credit Card and was hoping they would waive the annual fee on this credit card. The rep looked at my account and said there were no retention offers available. At that time, I thanked her for looking and told her I would keep the credit card open.

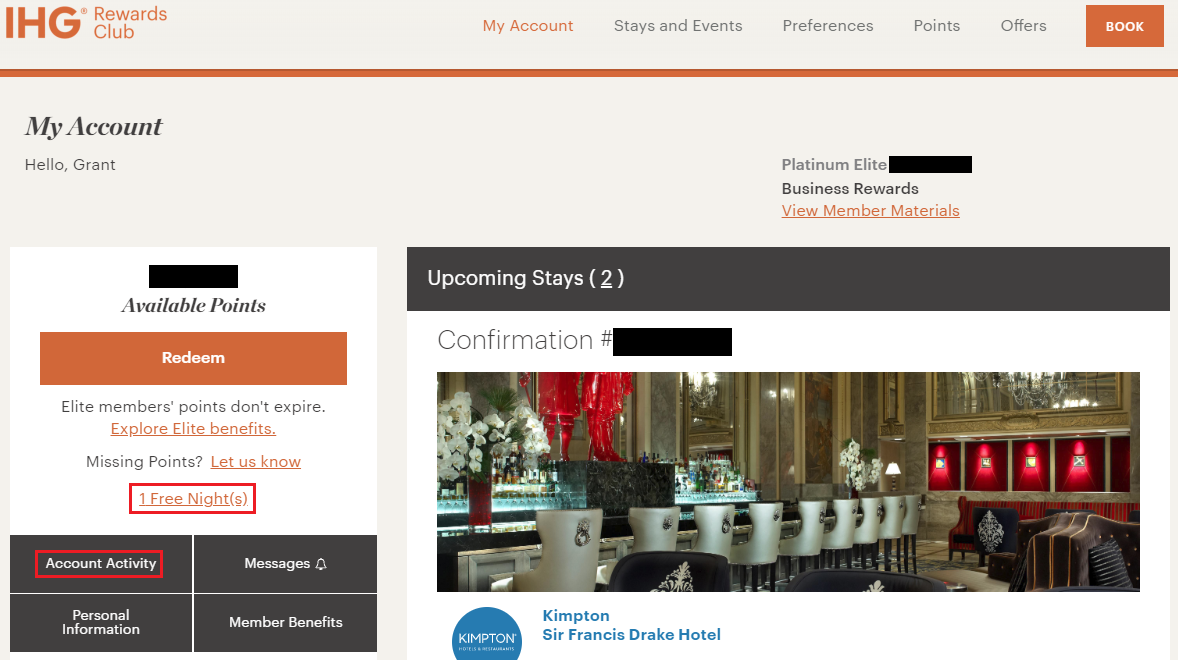

I logged into my IHG Rewards Club account and saw the 1 Free Night message.

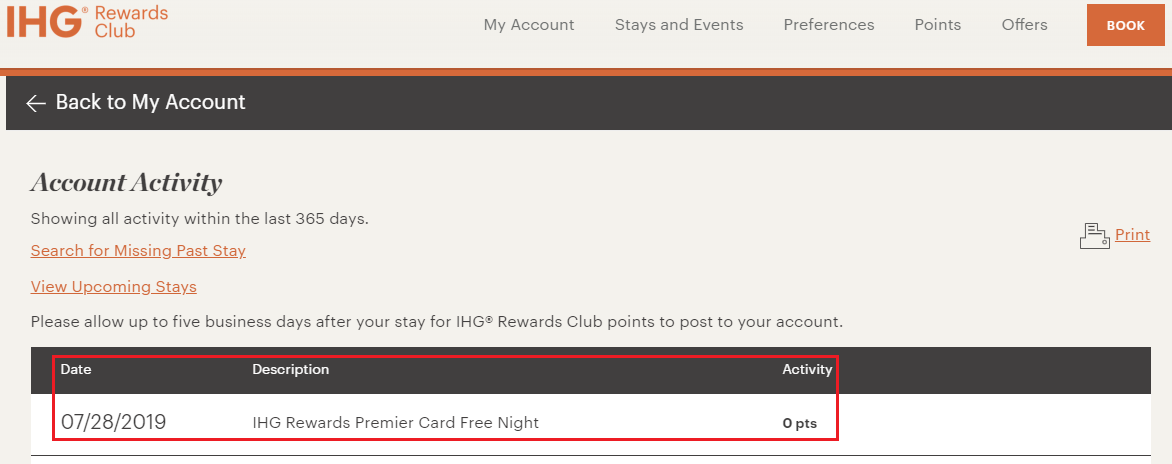

I went to my Account Activity page and saw that the free night certificate posted on July 28, which is 3 days before the annual fee posted to my credit card.

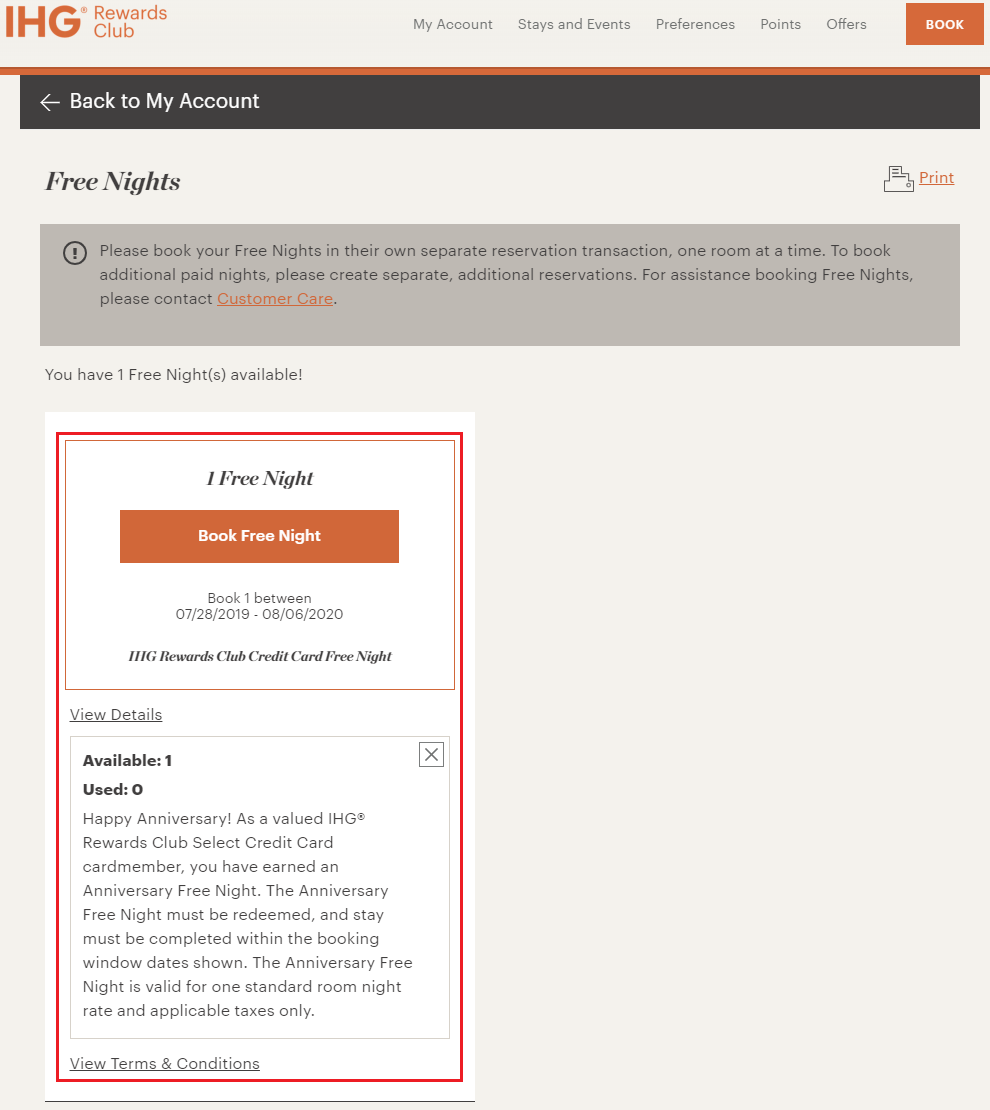

I then went to the Free Nights page and looked at the details of my free night certificate. The free night certificate is valid for a little longer than 1 year, going from July 28, 2019 through August 6, 2020. I then decided to click the Book Free Night button.

Here are the complete Terms & Conditions:

Free Night: Anniversary Free Night will be available for redemption on your account renewal anniversary date each year. (“Anniversary” is the date that is twelve months after your enrollment date, and the same date each twelve months thereafter.) Annual fee applies after the first year. For pricing details, please see Pricing & Terms. Chase may close your credit card account or suspend your right to use your credit card account, at any time for any reason, including account inactivity. You must maintain a current, valid email address in your Member Profile and opt in to receive IHG® Rewards Club Credit Card Offers and Promotions e-communications in order to receive communications regarding your Anniversary Free Night. Anniversary Free Night is valid at hotels in the IHG®Rewards Club Family of Brands and must be redeemed, and stay must be completed, within 12 months from date of issue. Anniversary Free Night is valid for one standard room night rate and applicable taxes only. Rooms are limited, subject to prior sale and availability of allocated resources and may be unavailable during high demand periods. All reservations that will utilize the Anniversary Free Night can be booked online at ihgrewardsclub.com or by calling the IHG® Rewards Club Service center at 1-877-318-5890. Anniversary Free Night may not be transferred, extended beyond the expiration date, redeemed for cash, or re-credited for points. Individual hotel’s cancellation policy applies to the use of the Anniversary Free Night. Cancellation fees apply if cancellation is made outside of the hotel’s cancellation time period. Anniversary Free Night rules and regulations are subject to change. Chase is not responsible for offer fulfillment.

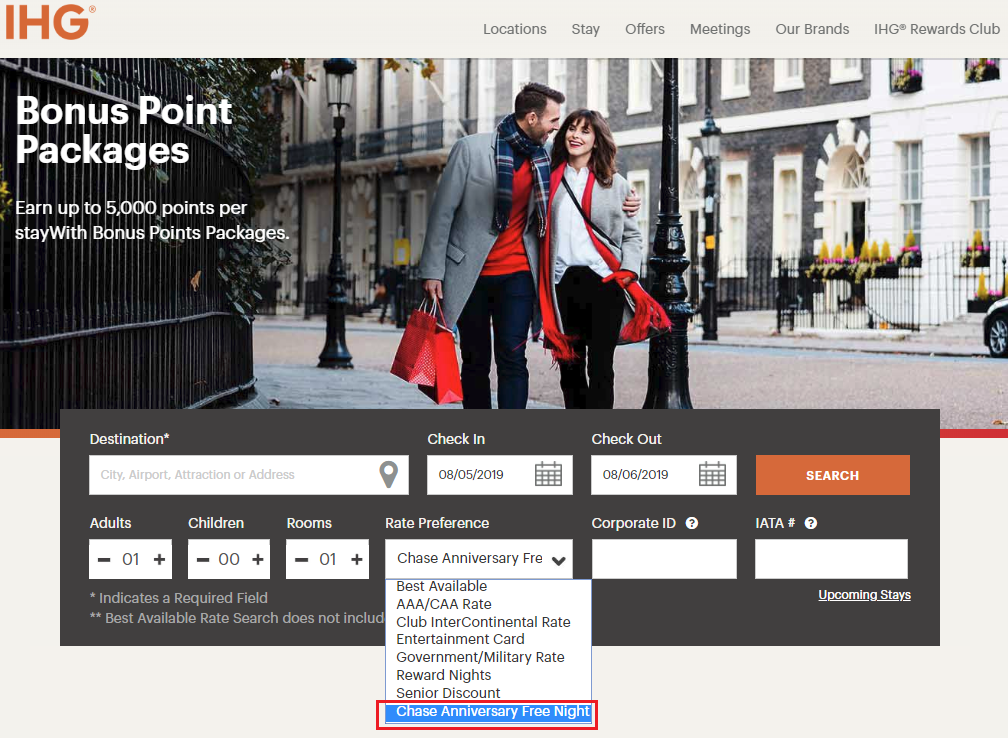

I was transferred to the IHG homepage with the Chase Anniversary Free Night rate preference selected.

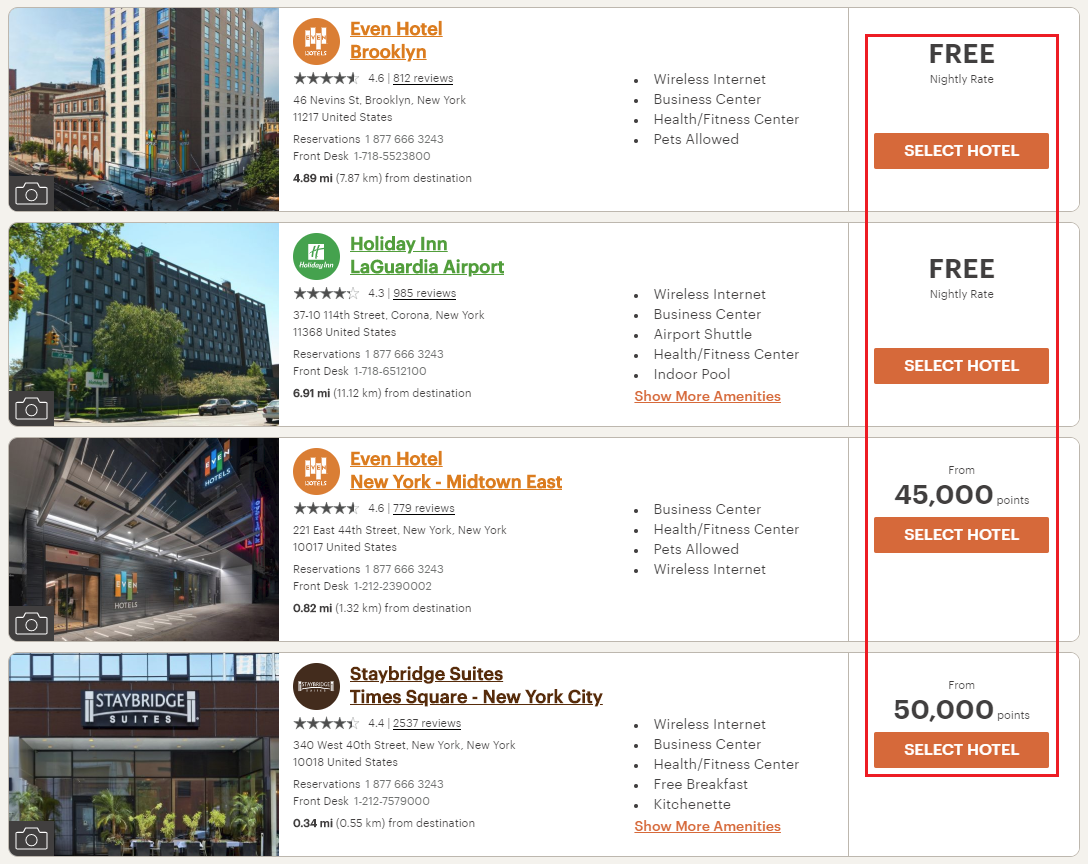

I decided to look at hotels in New York City and sorted them from cheapest to most expensive (in terms of points). As you can see, all the hotels that cost 40,000 IHG Rewards Points or less show up as a free night, but all the hotels that cost more than 40,000 IHG Rewards Points show up as their standard points price.

If you have any questions about the Chase IHG Rewards Premier Credit Card or the free night certificate, please leave a comment below. Have a great weekend everyone!

P.S. If you need help tracking your hotel free night certificates, please check out this post: Track Hotel Free Night Certificates & Credit Card Annual Fees with my Spreadsheet

Hi do you know if free night is booked for a date after card cancellation, the free booking will still remain? Not going to keep a card where they pulled a previous free night before expiration date and they refused to reinstate. Their customer service is horrendous, both ihg & chase.

As far as I know, when the free night certificate posts to your IHG account, that certificate is yours, regardless if you keep or cancel the CC.

Usually when I try to book the IHG free night, I get a message that the hotel is not accepting free nights. Probably becasue I’m trying to book a weekend night, or because they have 2 night minimum stays. The reason I got the IHG card originally was to use a free night up in Lincoln NH, and yet I’ve never used my free night there because of their restrictions. Of course I did find many places that would take it!!

Hi James, that sounds frustrating. I’m glad you were able to use your IHG free night certificate at other IHG properties. Not that the FNC are more flexible, you shakeups have better luck using them in the future.

Do I lose free nights and points if I cancel IHG credit card?

No, the IHG points and free night certificates are in your IHG account to use until they expire, you don’t lose totem if you close your Chase IHG CC.

If I had canceled my IHG premier card in past 2 months, and as per the terms if I earned the signup bonus more than 24 months ago, will I be eligible for the bonus? I think I may be denied the card as well.

Hi Kunal, according to Doctor of Credit (https://www.doctorofcredit.com/18-things-everybody-should-know-about-chase/), “You can get the sign up bonus on Chase cards more than one time. If you look at the fine print on any Chase card, you’ll see it say you can get the sign up bonus again as long as it’s been at least 24 months since you last received the bonus.”

Thanks Grant! Do I have to wait for the 24 months to complete to even apply for new card or can I apply now ? I will complete 24 months since I received bonus in December. I can apply now and it will take couple of months for me to meet spending requirements.

To be safe, I would wait 24 months since the date you received the last bonus before applying for the Chase IHG CC. So if you received the bonus on Jan 1, 2019, I would wait until after Jan 1, 2021 before applying for the card again.

thanks again!