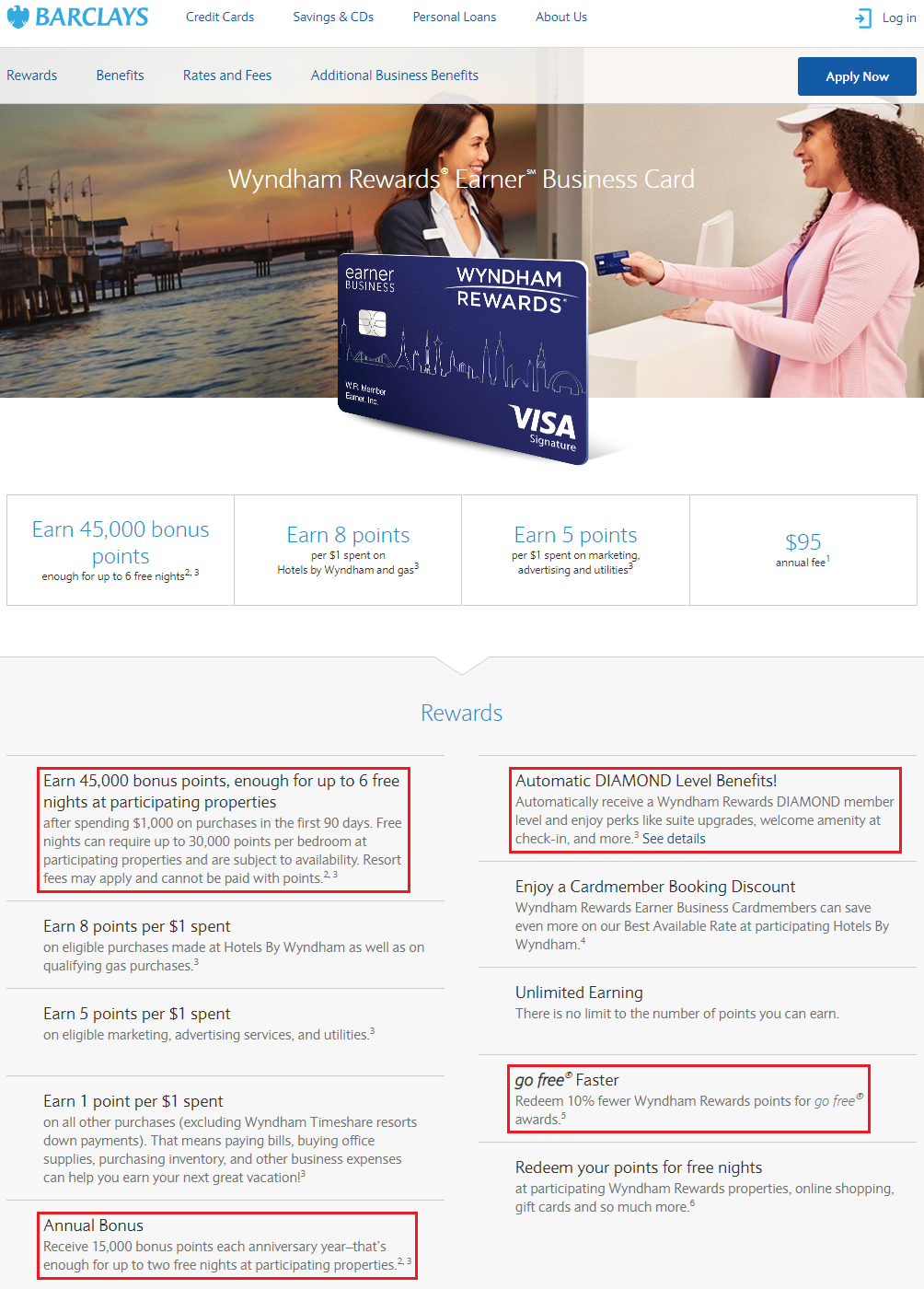

Good morning everyone. Earlier today I wrote Chase Marriott Bonvoy Boundless Credit Card Application Process & Reconsideration Phone Call. In today’s post, I will write about the Barclays Wyndham Rewards Earner Business Credit Card, my application process, and the hoops I had to jump through to get approved via the reconsideration process. First off, the Barclays Wyndham Earner Business is a relatively new credit card from Barclays but the credit card has some great features. The sign up bonus is 45,000 Wyndham Rewards Points after spending $1,000 in 3 months. You also get Wyndham Diamond Elite Status (great for matching to Caesar’s Diamond Elite Status), 10% rebate on redeemed points toward free nights, and 15,000 points every anniversary you keep your credit card, all for a $95 annual fee. I was hoping for an instant approval on my credit card application, but Barclays had other plans for me.

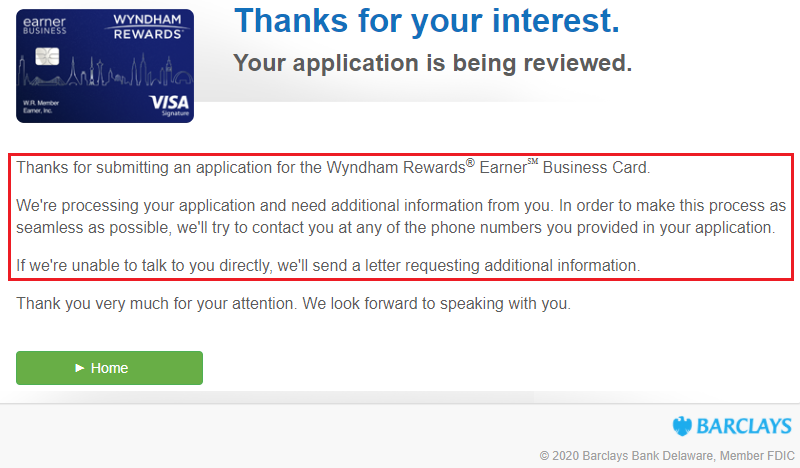

Unfortunately, my credit card application went to pending, so I decided to check back later to see if Barclays had made a decision on my application.

Later that day, the online application status checker said that my application was declined and that I would receive a letter with the details of the declined offer.

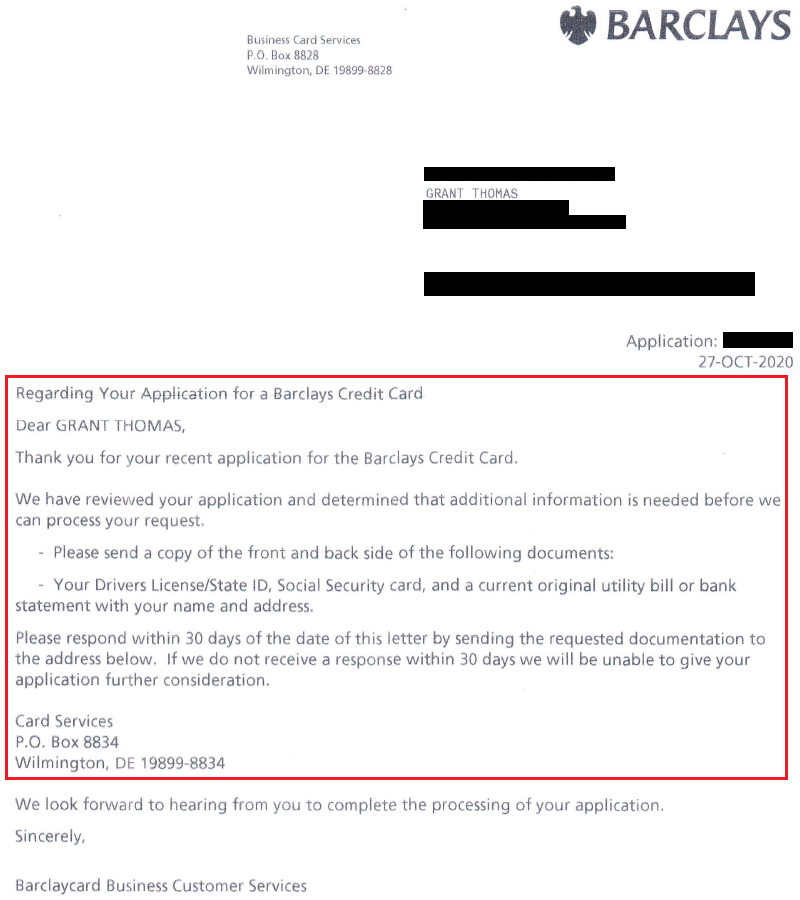

A few days later, I received this letter from Barclays. Barclays needed more information about me to approve me for this credit card (even though I am an existing Barclays customer was another Barclays personal credit card). The letter stated that I needed to send a copy of the front and back of my driver’s license, social security card, and a recent utility bill showing my name and address. I then had to mail these documents to Barclay’s address for review. I decided to call the Barclays reconsideration department (866-408-4064) and see if there was a way to email or fax the documents to Barclays so that they would receive the documents sooner. Unfortunately, the rep said mailing the documents was the only method possible. The rep also said that the only utility bills they would accept were “lights, water, gas, and sewer” and that all other utility bills “would not be accepted.” Shortly after that call, I made copies of those documents and mailed them to Barclays.

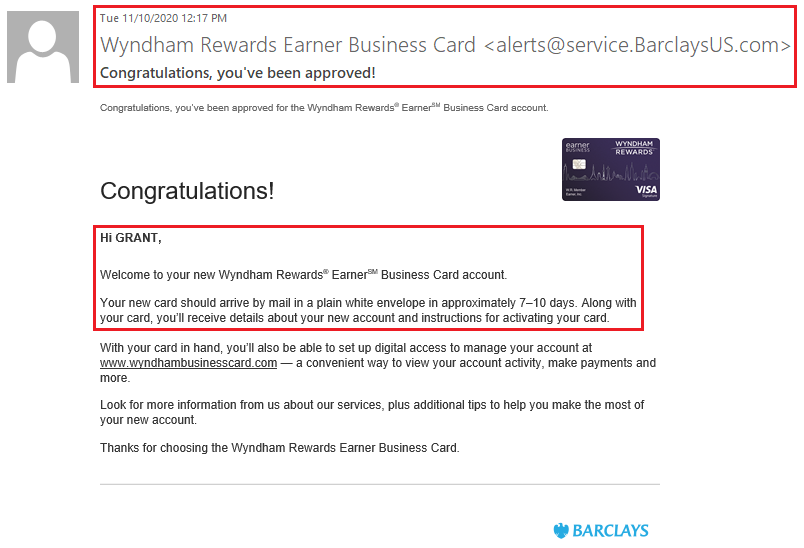

I waited a week for Barclays to call or email me and let me know that they received the documents, but I had not heard anything. I called the reconsideration department again to see if they had received my documents. Yes, in fact, they received the documents a few days ago and added notes in my account to approve me for the credit card. If not for calling back in, I am not sure if my credit card would have been approved (lesson learned – call Barclays a few days after mailing the documents to get the ball rolling). The rep said that I was approved for the credit card with a $1,000 credit limit (so generous Barclays!). I asked if I could move some credit over from my personal Barclays credit card and the rep said that she would need to transfer me to another department. I said I would just call back after I received the card in the mail. Shortly after the call, I received an approval email from Barclays. I should receive my new credit card in the next few days.

If you have any questions about the Barclays Wyndham Rewards Earner Business Credit Card or the reconsideration process, please leave a comment below. Have a great weekend everyone!

I got approved with an $8k credit line – it wasn’t instant but I didn’t have to submit any documents. However, I haven’t been able to use the card – it has some sort of security alert that has to be cleared by “leadership” at Barclays and after multiple attempts (including one stretch of over an hour on hold) I haven’t been able to reach the appropriate department. Pretty crummy customer service all around.

Also FYI my understanding is that there’s no way to set up automatic payments for Barclays business cards except sending a letter by mail – just so you’re aware.

Hi Tonei, that is crazy that the CC has a security alert on it making the card unusable. That is like when Banco Popular approved me for a Avianca Vuela CC, sent me the CC, and then told me to provide ID docs to verify my identity.

Have you tried reaching out to Barclays via Twitter or FB? Thanks for the heads up about the automatic payments. I always make manual payments, so that won’t affect me, but their policies seem really strange.

Wyndham use to be a marginally decent program before devaluation. Just sayin.

Ya, I know, I am still sitting on 75k Wyndham Rewards Points from the original sign up bonus on the personal CC. There are a few vacation properties in Hawaii that are only 15K points / night (https://clubwyndham.wyndhamdestinations.com/us/en/resorts/resort-search-results) that I have my eyes on.

There is another property in AZ (Club Wyndham Sedona) that looks interesting.

You can convert Wyndham Rewards Points into Caesars Rewards Points (https://www.wyndhamhotels.com/wyndham-rewards/caesars-rewards/points-transfer), but I haven’t done that either.

Pingback: Strange Things About my New Barclays Wyndham Rewards Earner Business Credit Card | Travel with Grant

Barclays is hard to get approved if you have lot of cards or received too many inquiries. How many appl and cards did you have in last 24months? Also, did they pull from one credit burau?

Hi Travel For Life, before I applied for 3 business credit cards on October 25, I had applied for 8 personal credit cards in the last 2 years, but my last new credit card was approved in July 2019. 2 inquires came from TransUnion (Barclays & BofA) and the other inquiry came from Experian (AMEX). Let me know if you have any other questions.

Pingback: Category Bonus Points Not Posting Correctly for Barclays Wyndham Rewards Earner Business Credit Card

Pingback: Here's All Of The American AAdvantage Co-Brand Credit Cards Open To New Applicants - Your Mileage May Vary

2 years later and their business processes haven’t improved. My online app went through the same process, except that the letter I received said that I my debt to income was too high. I called the reconsideration line and explained how real estate investment works. They asked some questions then gave me a $4500 credit line pending security review. I get forwarded to security and they said call back in a few hours because their system is down. I call back a few hours later, answer a few questions, they call me back to verify my phone number, and say I am approved and should receive my card in 7 to 10 days. One week later I received a letter saying that they need DL, SSA card, and utility statement. I call them back, they forward me to card services where I am on hold for 30 minutes. The card services person says that they don’t know why I received the letter since they, card services, are the last phase of the review process and they have already started that. She conferences in security and security says that the security person who worked with me the last call didn’t follow the proper procedure and that I still need to provide the docs. I asked if there was a quicker way to get the docs to them and they said I could fax them to 866-836-9595. I also asked if I could provide my 1040 instead of my SSA card (who keeps their SSA card around!?) and they said yes. So now I wait, again.

Hi Ed, wow, what a hassle. I’m not sure why Barclays hasn’t improved the application process over the years. I love my Barclays Wyndham Rewards Earner Business Credit Card, so it should be worth the hassle for you when your new credit card finally arrives in the mail.

Pingback: The Tale of My Business Card Application From A Difficult Bank - Your Mileage May Vary

I had to order replacement social security card. Havent had one since high school. Gonna suck if i still ger denied.

I hope you’re able to get approved :)