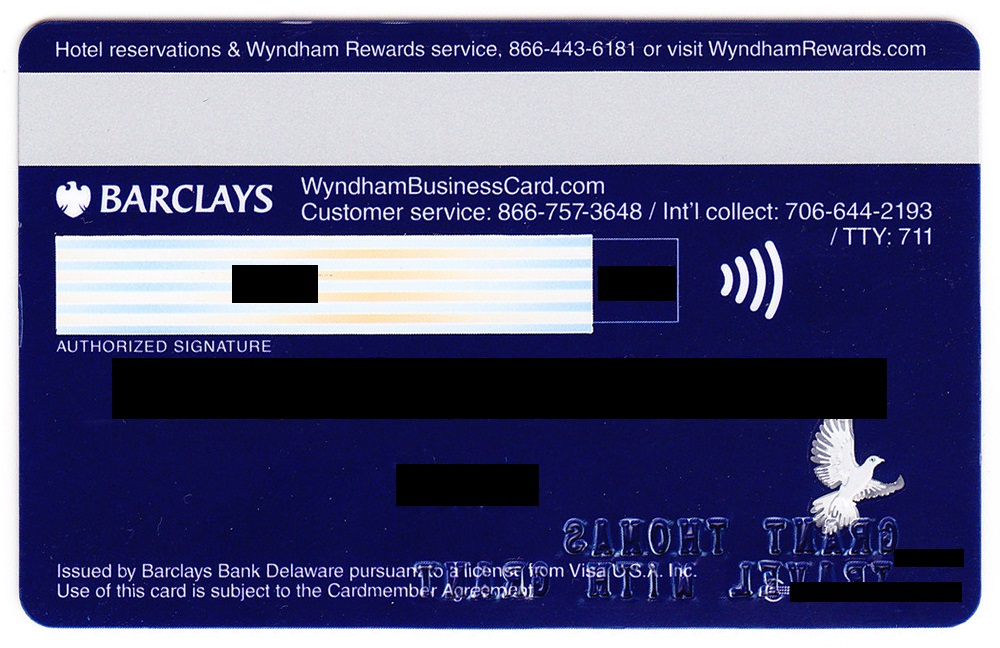

Good morning everyone, I hope your week is going well. A few days ago, I wrote Barclays Wyndham Rewards Earner Business Credit Card Application & Reconsideration Process. In that post, I wrote about my application, reconsideration, and approval process to get the new Barclays Wyndham Rewards Earner Business Credit Card. Long story short, I had to send physical copies of my driver’s license, social security card, and a utility bill in my name to Barclays to verify my identity (even though I am an existing Barclays credit card holder). That was just the first of many strange things related to this credit card. In this post, I will go through some of the other strange things I noticed. But first, here is the front and back of the credit card (nothing strange here).

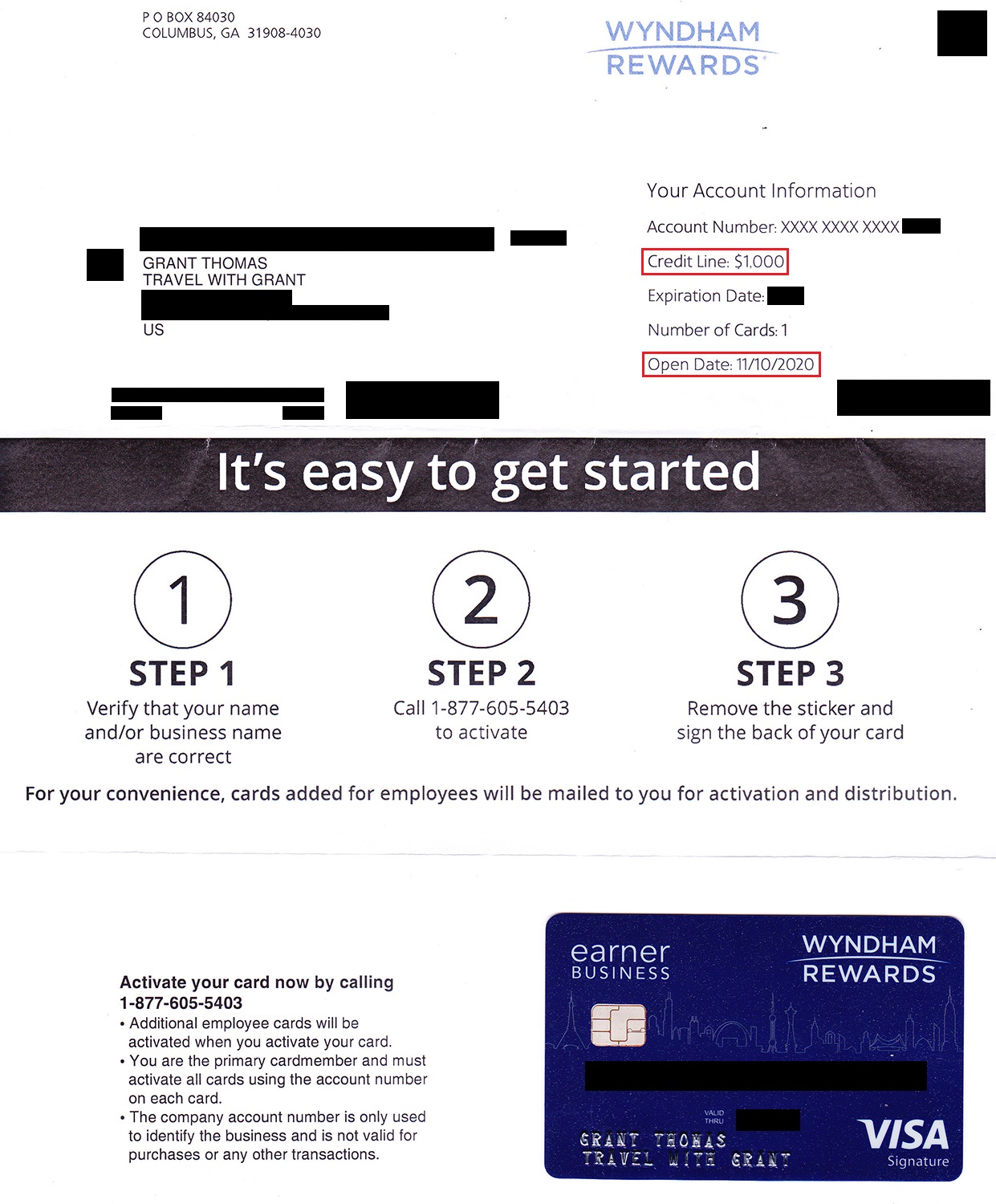

Here is the welcome letter that came with my new credit card. As you can see, my credit limit is only $1,000 (which is a bit small considering the minimum spending requirement is $1,000). Even though I applied for this credit card on October 25, I was not approved for this credit card until November 10, which is the date printed on the letter. I wonder if that is my anniversary date (I will find out in 12 months).

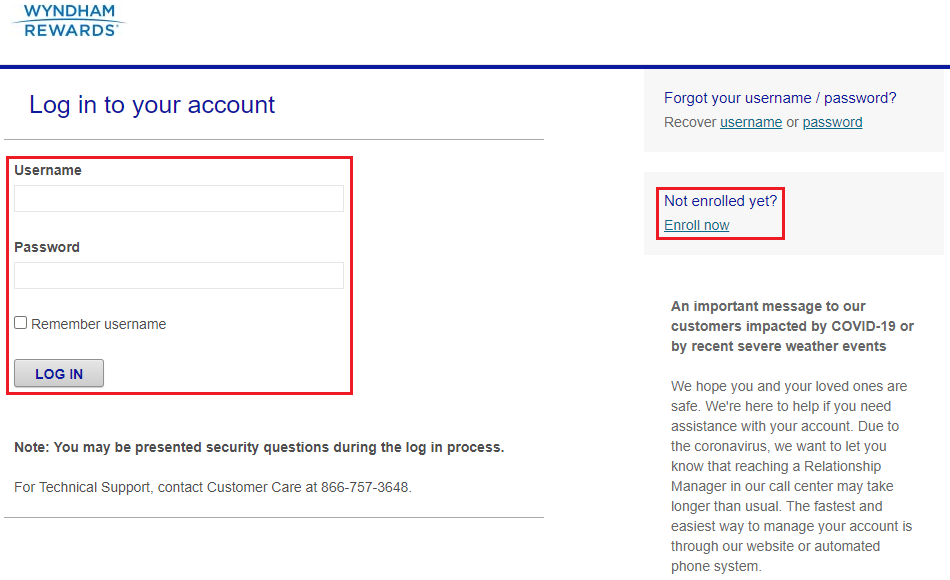

Strangely, you need to create a separate online account at WyndhamBusinessCard.com to manage this credit card. If you have other Barclays credit cards, you cannot see this credit card in the same login (I confirmed this with 2 Barclays reps). To get started, click the Enroll Now link to create an account and then sign in.

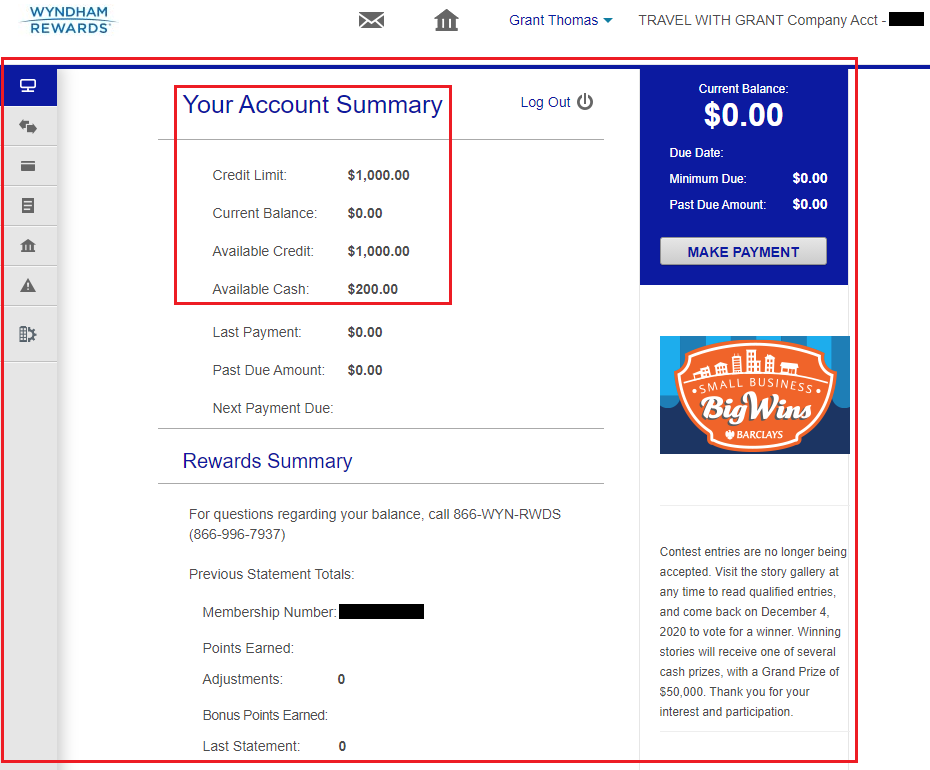

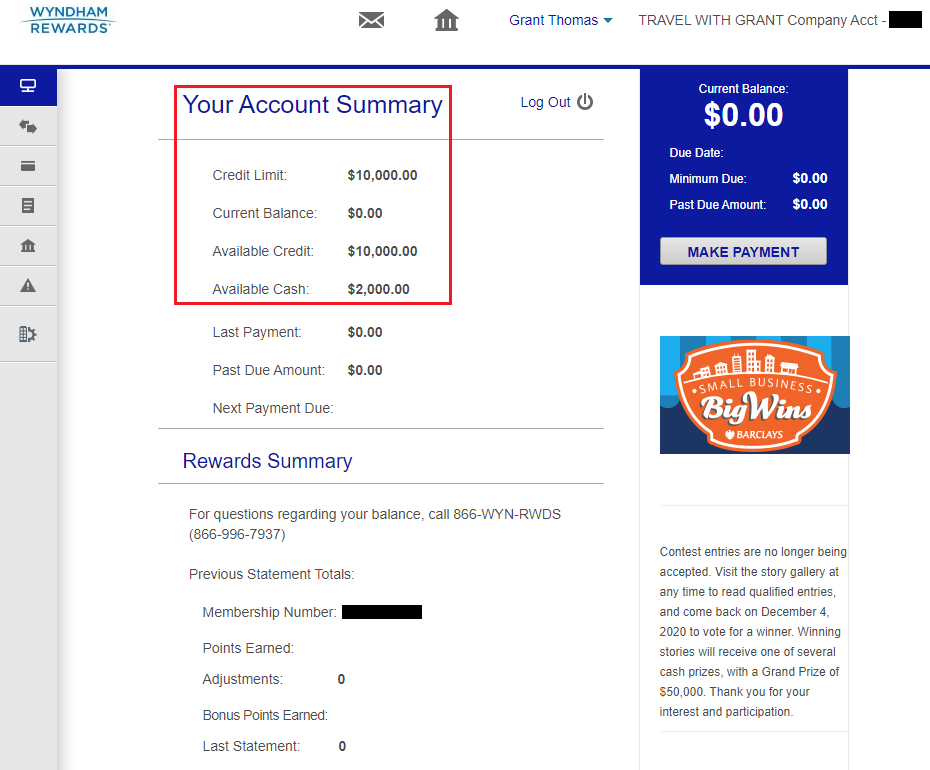

Here is the online account for the business credit card. To be honest, the layout is kind of ugly and uses the same backend design that TD Bank and Banco Popular use. As you can see, my business credit card has a measly $1,000 credit limit.

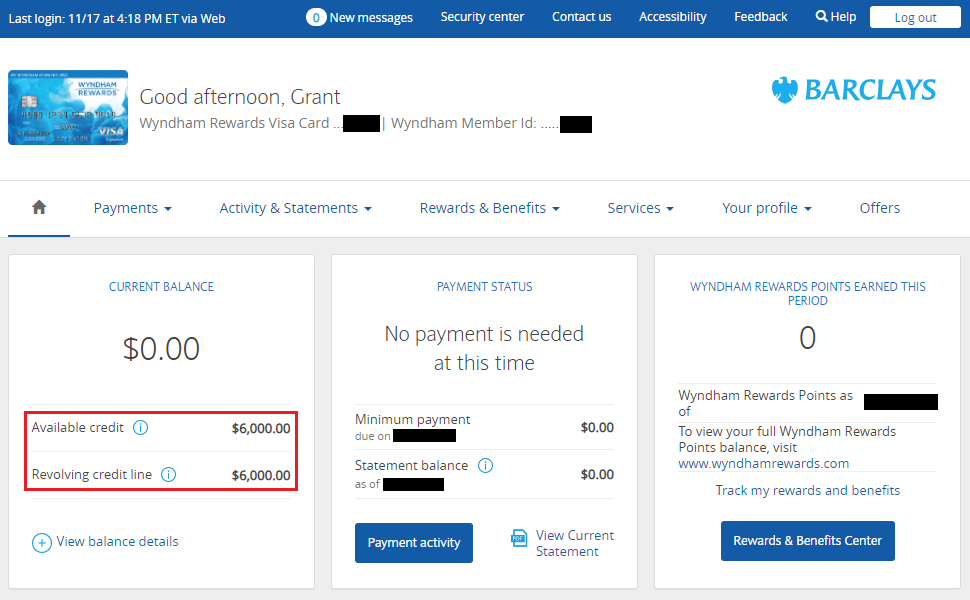

Meanwhile, my personal no annual fee Barclays Wyndham Rewards Visa Credit Card gets to use the nice Barclays online account. This credit card has a $15,000 credit limit.

I called the customer service number on the back of my business credit card (1-866-757-3648) and explained that I wanted to move credit from my personal credit card to my business credit card. The rep said that I would need to speak with someone in the credit department (their phone number is 1-866-567-9946). The credit department rep was easily able to move $9,000 from my personal credit card to my business credit card and said that the credit limits would be updated within 5 minutes. After the call, I waited 5 minutes and logged back in. The credit move was completed and my personal credit card now had a $6,000 credit limit.

I logged back into my business credit card online account and saw that my credit limit was now $10,000. At least moving credit lines between personal and business credit cards was an easy process.

If you have any questions about the Barclays Wyndham Rewards Earner Business Credit Card, creating an online account, or moving credit between credit cards, please leave a comment below. Have a great day everyone!

Just an observation, it might be a coincidence, most if not all (mid to southern) East Coast banks (Capital One, BoA, Barclays, etc.) are weird about this. Some go as far as asking about citizenship status which if they use to determine credit, it would be unlawful.

Hi Kalboz, I have noticed that question on a few recent credit card applications. I didn’t realize that using your citizenship to approve / denial a CC application was unlawful – thanks for sharing that info.

So long as the person has a lawfully obtained social security number, good credit standing, income (job), contributing to our society, etc. why ask such a question? Many credit-worthy and great people to boot have permanent residence status and happy & proud to call America their permanent home. It would a shame to deny them credit because of their immigration status.

That is a very good point. As long as they have a SSN and a good credit score/report, the citizen status shouldn’t matter. Thanks for the insights Kalboz.

Thanks for your posts on this, G, so keep up the great work. I called next day after receiving the “letter will be mailed” decision and was approved after a phone call (and verification of application information). I was granted a $2.5 line, but was told by the credit approval rep that he could transfer credit to the new business account from an existing personal account (AA); however, it’s irreversible and cannot be returned to personal; perhaps this changes in the future, but I’m excited to spend with the Earner Business — meh, Aviator.

Hi NonRevGuy, I’m glad you were able to get approved via a phone call instead of mailing in the verification documents. I’m not sure how often you will use the Earner Biz CC, but maybe a $5k credit limit will be sufficient.

All of Barclays business cards requires separate log-ins to its unique site. And the backend of this one looks just like the Jet Blue business and AA Advantage Business backends.

Weirdly I applied for this card, went pending, 2 weeks later i receive in the mail this card which i literarily forgot i applied for.

Haha, I’m glad you were approved for the CC. Do you still want to keep the card? I hate the ugly backend, it just looks cheap.

I applied 2 weeks ago and today on I went online to check the application status and it showed approved for $5K Limit. Will have to call them when I get the card and transfer some limits from my Personal Cards. Plan to use this for Utility bills for 5X as I have no other card that offers that on Utilities such as Electric, Gas and Water. Maybe can use Wyndham points some day for some redemption. Not sure what redemption options they have but will keep some points handy in case. Thanks for all your articles on this card.

Hi Sam, I’m glad you got approved for the biz CC. The US Bank Cash+ CC also earns 5% cash back on utilities. I just wrote a post about using Wyndham Rewards Points for Vacasa vacation rentals in Hawaii: https://travelwithgrant.boardingarea.com/2021/04/14/my-experience-booking-vacasa-vacation-rentals-with-wyndham-rewards-points/

Thank you! Is the 5% on utilities have a CAP on earnings? Also, is the 5% on Utilities available each quarter of the year or is it only available in one quarter? I believe there are revolving categories each quarter. Thanks again!

I believe the cap is $1500 per quarter. Every quarter, you have to select your 2 5% categories and a 2% category, but the categories are always the same.

Hi Grant, thanks for your VERY helpful write-ups here relating to your experience(s) with this new Business Earners card. I too had hoped for an instant decision nearly a week ago, but got the same “we need to review further” message…. As we have upcoming hoped for stay with an outer banks spot, your alerts of trouble prompted me to hazard calling to see if there was anything I could do to advance the process. (or even offer to shift credit lines from a sock-drawered Frontier card, etc.) Turns out, all the rep. needed to do was to call me back live to confirm I wasn’t another scammer they have to weed out. (Guessing my long term relationship with Barclay’s ironically was the source of the pause… as I had different old cell #’s on file in earlier records)

So we were approved…. (That was relatively simple, compared to your experience) But then I went through an utter nightmare of four separate calls, then the last call being bounced (over an hour long call) through SEVEN (sic – 7) different representatives til I was at last transitioned to a rep. handling the Barclay’s Business cards… (and Wyndham in particular, not Jetblue)…. What lunacy…. final rep. at last had good english and assured us all was well and car on the way…

Alas, last hurdle: We’ve been waiting now several days for our Wyndham Rewards status to turn from “Blue” to “Diamond.” (Read somewhere this should happen within a business day or so? Was that your experience? Others here?) Really matters to us — as we’d get the 10% discount on use of WR points (up front), plus better the chances of the suite upgrades…. But am worried about waiting to long …. and hotel filling up while we wait…

Hi Escot, wow, that sounds like an ordeal to get approved for the card. As far as the Wyndham Rewards Diamond elite status, I think I had already status matched from Caesars Rewards Diamond, so I don’t know how long it will take for the status to update. I would guess by the time your first credit card statement closes, you should see the points and have the updated status. Let me know if you find out when your status is updated :)

thanks for the reply, and will update

(Re. the ordeal, to clarify, that came after the “approval”…. a day after the approval, I just was trying to find out a. if I could arrange for the card to be express shipped to me / or b. if it was already shipped…. Bit bewildering how such a simple question was so hard to get answered. (For anybody else reading this, your post above does note the correct best # to use for all inquiries about the Wyndham business card…. 866-757-3648. (as I don’t have the card yet, didn’t have this #…. wish I’d seen your post sooner) :-)

Thank you for clarifying and pointing it the best phone number to call to reach the right department.

Diamond status was pretty much the next day after approval. So kind of instant

That is great to hear, I’m glad it was so fast.

Does this card have a mobile app?

Hi Dave, not that I am aware of, just a website.