Good evening everyone, I hope your week is going well. A few weeks ago, I started using my Chase Sapphire Reserve Credit Card as my go to restaurant and grocery store card. Both categories earn 3x Chase Ultimate Rewards Points on the CSR. That sounds pretty good until I explain that I could use my American Express Gold Card to earn 4x American Express Membership Rewards Points on those same categories. Why would I want to earn 3x instead of 4x? The answer is simple: Chase Ultimate Rewards Points are much easier for me to redeem.

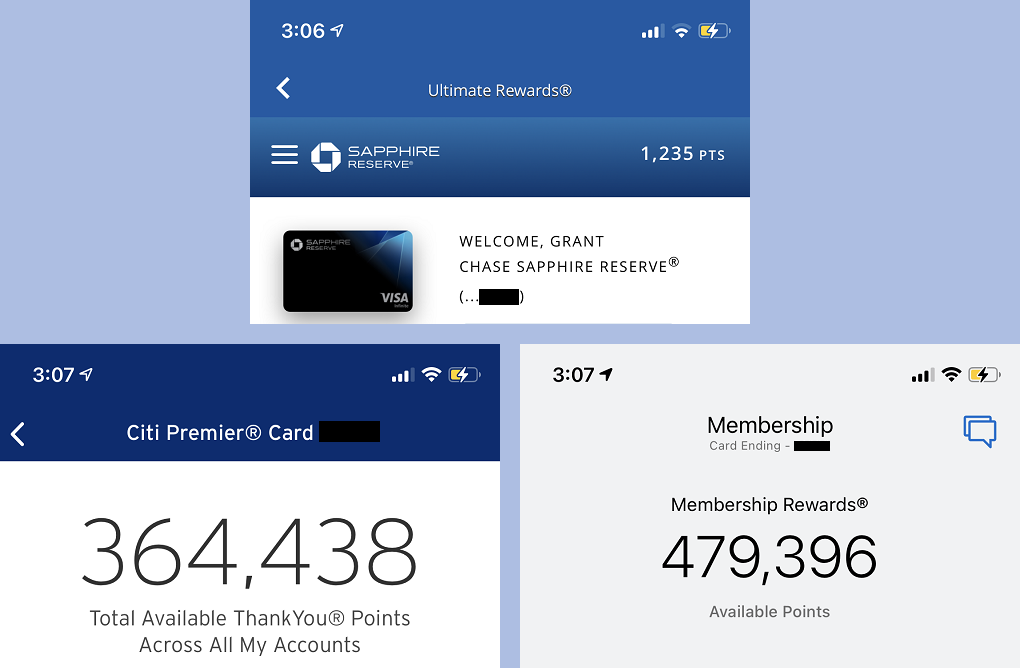

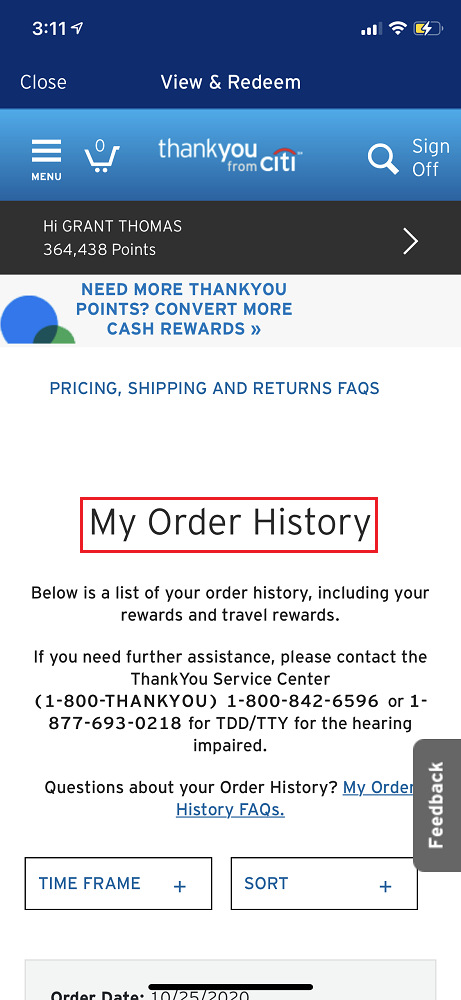

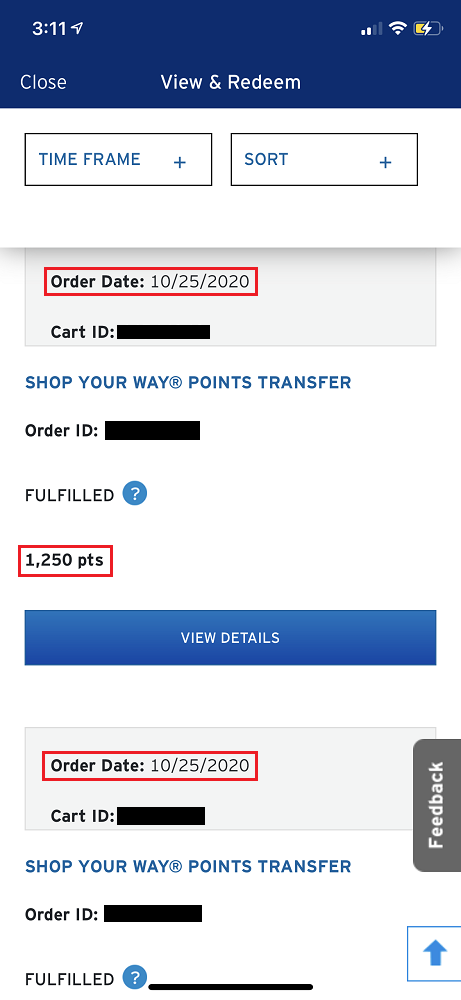

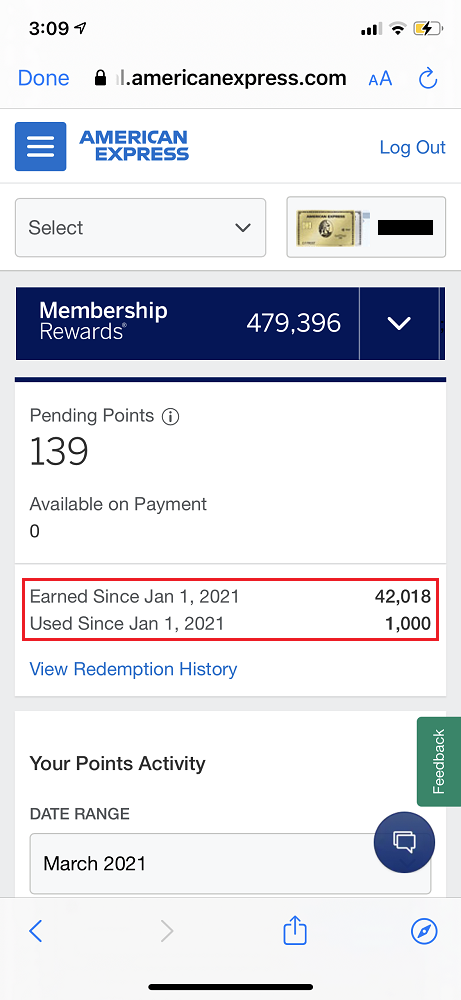

As you can see by these screenshots that I took today, I only have 1,235 Chase Ultimate Rewards Points, compared to 364K Citi ThankYou Points and 479K American Express Membership Rewards Points. Let me dig a little deeper into the reasons why the points balances are so different.

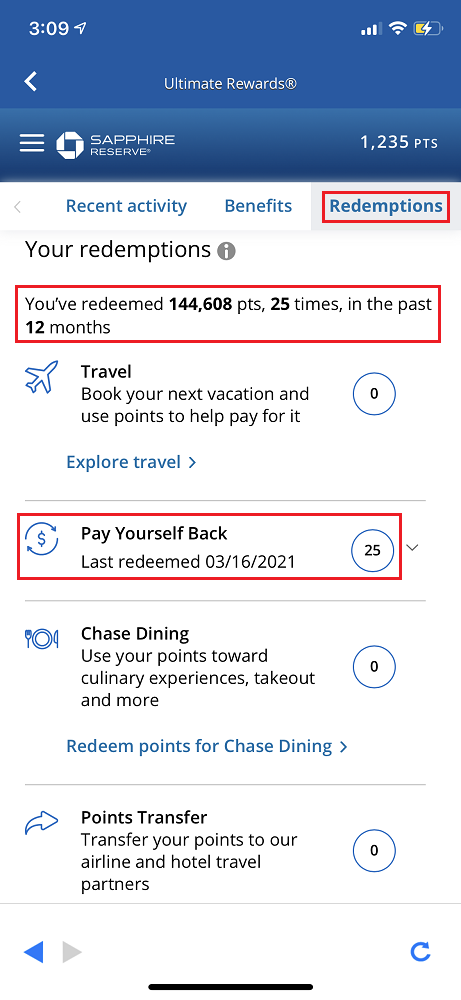

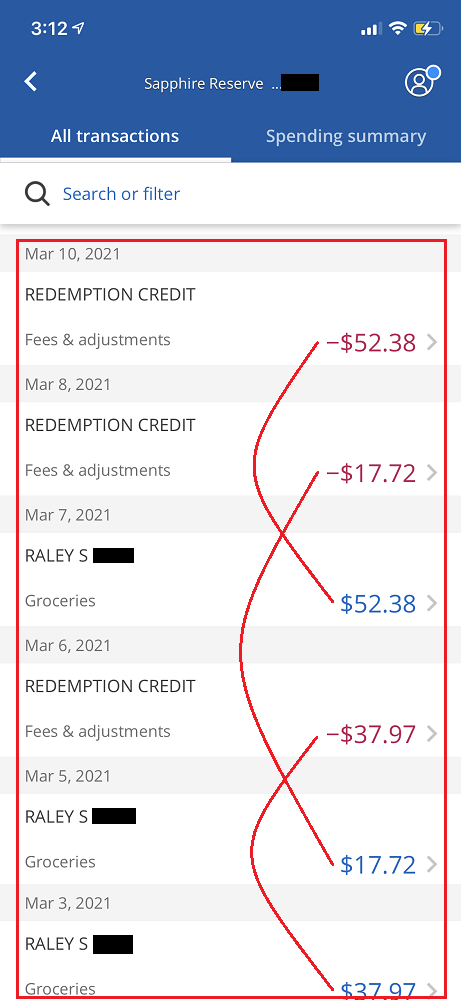

In the last 12 months, I have redeemed a total of 144K Chase Ultimate Rewards Points in 25 redemptions. All 25 of those redemptions were with Chase’s Pay Yourself Back, which I wrote about here: Why I Redeemed 1/3 of my Chase Ultimate Rewards Points with the Pay Yourself Back Feature. My process is very simple. I transfer / combine all Chase Ultimate Rewards Points from my Chase Sapphire Reserve, Chase Ink Plus, and Laura’s Chase Freedom to my Chase Sapphire Reserve, make a grocery or restaurant purchase with my Chase Sapphire Reserve, and then use Pay Yourself Back to wipe out the charge. Chase Ultimate Rewards Points are worth 1.5 cents per point when you use Pay Yourself Back on eligible purchases on the Chase Sapphire Reserve. 1.5 cents per point x 144K points = $2,160 in Pay Yourself Back redemptions in the last 12 months.

In comparison, Citi ThankYou Points does not have a great way to get more than 1 cent per point in value, unless you book travel with your Citi ThankYou Points (1.25 cents per point until April 10, 2021, then travel redemptions drop to 1 cent per point). My last Citi ThankYou Points redemptions were back in October 2020 when I transferred ThankYou Points to Sear’s Shop Your Way Points and bought gift cards. At the time, you could get 1.2 cents per points (or up to 1.3 cents per point if you had a Citi Rewards+ Credit Card). I’m holding onto my Citi ThankYou Points until I start travelling again and hopefully I can make some travel redemptions before April 10.

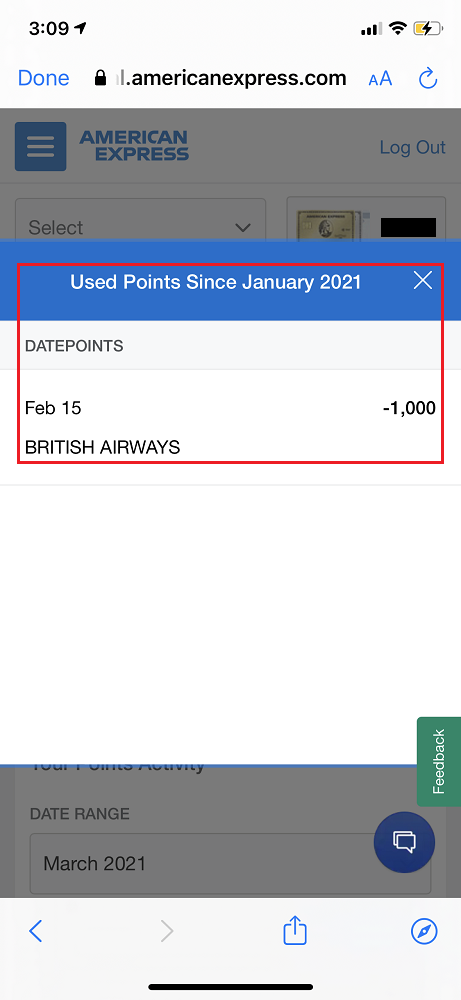

Last but not least, I have way more American Express Membership Rewards Points than I know what to do with. As you can see, in 2021, I earned 42K points and spent only 1K points (a small transfer to British Airways to keep my Avios from expiring). I have an American Express Business Platinum Card but not an American Express Schwab Platinum Card which would give me the ability to cash out American Express Membership Rewards Points at 1.25 cents per point to a Charles Schwab investment account. Like my stash of Citi ThankYou Points, I will hold onto these points until I start travelling again. But in the meantime, I am holding off on earning more points.

Do you agree or disagree with my logic that I should keep earning and redeeming Chase Ultimate Rewards Points with my Chase Sapphire Reserve and forgo earning more points on my AMEX Gold? Please let me know what you think in the comments section. Have a great day everyone!

I am dumping my amex gold… MR points are worthless compared to Chase. I will take the 3 points per dollar anyway of the 4 worthless amex points.

Hi Ryan, great minds think alike on the CSR 3x :)

UR points would be the last points I redeem for credit statements. To me, they have the greatest value outside the Covid times. Park Hyatts and Singapore Airlines Suites are what I save them for. Used to redeemed for LH F, but not lately – 110K United points one way is a bit too much. But it is good to have an option to transfer them to United for partner awards. Never have enough, always hungry for UR points. Too bad Chase Freedom excluded Grocery from its typical x5 points in Q2.

Hi Katrina, before the coronavirus pandemic, I would never consider redeeming Chase UR points for statement credits but Pay Yourself Back has come in very handy for me the last 12 months.

Is the grocery category a temp perk for CSR or is is a “here to stay” perk?

Is there anyway that you could provide a full rss feed for this site? I used to check it all the time, but have gotten out of the habit for the last six or seven months since its not convenient to read in feedly. Thanks.

Hi Lorie, thank you for the feedback. I apologize for the inconvenience but I do not support the full RSS feed.

Hi Marty, sadly, the 3x grocery bonus category is a temporary benefit through April 30, 2021. Here are the terms of the benefit: “ Earn 3 total points (“3X total points”) at Grocery Stores through 4/30/21: You’ll earn a total of 3 points for each $1 spent on up to $1,000 in total purchases each month during the promotional period in the grocery store category from 11/1/2020 through 4/30/2021. That’s 2 points on top of the 1 point you already earn on grocery store purchases with your card. For more information about Chase rewards categories, see chase.com/RewardsCategoryFAQs”

I agree with your plan and usage but for me it doesn’t work. The whole reason for collecting the points of any kind is to redeem for travel. It’s a game for me, it’s not because I can’t afford to pay cash for travel but it’s a chance to travel at a slightly higher level at times and I enjoy the hunt. All that being said I do value Chase UR’s higher than MR’s.

Hi Dan, I totally understand and that was my philosophy before the coronavirus pandemic. Maybe when the world gets safer and back to normal I will get back to that mindset.

I have cancelled the Amex gold. I prefer to use my money my way. To make Gold card worth it, the card forces you in to Uber credits over a 12 month period – and restaurants that don’t exist near me.

All that for what? To spend $250/yr on a card that earns 4x instead of 2x at grocery stores…..

Otoh, Citi prestige will give you 5x at grocery(temporary), let you use travel credits where you spend your time traveling, and offer a 4th night free on any hotel stay. Those rewards are on my terms. Whereas Amex wants to make it in their terms.

The value proposition of the Platinum card is also quite questionable. You really need to value those amex lounges + delta lounges. It is incredibly hard to justify it.

To make matters worse, as others point out – the MR point isn’t worth what it used to be worth. Ultimate rewards and thank you points are just as valuable, if not more.

If I’m not using the prestige card for it’s temp 5x grocery bonus, I am using a chase sapphire preferred.

IMO, Amex needs to add Hyatt as a transfer partner. That alone could bolster the case to earn MR points. In this household, with travel non-existent, these fringey cards are getting cancelled left and right as annual fees come up.

Hi Ryan, I appreciate your perspective on these CC. I agree that the AMEX Gold is kind of annoying with the use it or lose it monthly credits (you forgot the $10 GrubHub / select restaurant credit), which means I have to remember to use the $10 Uber / Uber Eats credit every month along with the $10 GrubHub / select restaurant credit every month.

Chase just makes it so much easier to use and you don’t need to keep track of as many things.

REALLY …..how hard is it to redeem your monthly 20.00 …..order a pizza once a month from Uber eats and I go to shake shack once a month …..there’s 240.00 back ……now you have AMEX offers which I earned 285.00 last year

NOT to mention getting 55,000 points on referral offers …..how much are 55,000 amex points …800.00 to 1100.00 ……I get more value from business class flights

What does Citi give you ? No referrals ……..I do like the Citi Premier card but will get ride of Prestige as I can’t justify the fees because I’m not using 4th night free because I lose all my elite benefits When using prestige 4th night free

Guess we see things thur different glasses

Hi CJ, I live in a smaller town with less (quality) restaurants on Uber Eats / GrubHub / Doordash, but I always make it a point to use every credit, to stick it to AMEX. I do love the AMEX referral bonuses (except the 1099-MISC tax forms that come with them). I never use my Citi Premier, I only keep it so that I can transfer TYPs to travel partners. I generate the majority of my TYPs from my 3 Citi AT&T Access More CCs.

Why my post didn’t post ?

Hi Cj, I’m not sure why it didn’t go through right away. I just approved your original comment :)

How hard is it to order a pizza once a month and use your Uber eats credits and for me I hit shake shack once a month …..that’s 240.00 a year

Then you earn 4x on supermarkets and dining but the kicker and sealer are the 55,000 points I earn thur referrals ….which has a value of 800.00 to 1,100.00 ….what can you earn with Citi ? Zero ……

I guess we all see things thur different glasses……Amex Gold is a awesome card

Hi CJ, if your goal is to rack up a lot of AMEX MRs and get a lot of statement credits from the monthly dining bonuses, the AMEX Gold Card is a great card (and tough to beat). The problem is I have too many AMEX MRs and too few redemptions in mind right now :(

Grant …I was talking with Jim and he mentioned you may help me …..I have 250,000 Citi points and will cancel my Prestige card next month …..trying to figure out how to use there partners for best value ………..any suggestions……overseas flights is where I use my miles ….just have about 2 million with many airlines …..almost thought of cashing them in for cash ( can’t believe I’m saying that ) any help ?

Hmm, tough is a great question. If Citi put a gun to my head and told me to transfer all my TYPs out today, I would probably split them up between Turkish Airlines, Avianca LifeMiles, Virgin Atlantic, and maybe KLM / Air France. It really depends how comfortable you are with those programs and what your existing balances are with those programs.

Grant …..I just got the Citi Premier card so I’ll be earning more Citi points

Also I’m going to downgrade the Prestige card to ? Double cash or rewind or ?

What do you think

I would product change your Citi Premier to a Citi Rewards+ to get the 10% rebate on redeemed TYPs (up to 10K TYPs per calendar year). If you already have that CC, I might consider the Citi Double Cash for 2% everywhere or the Citi Dividend for 5% rotating cash back categories.

hi grant. my take looks to be quite different from most responders to this post. while i value ur points quite highly for their flexibility, i get tons of value from mr points by transferring them to ba and using avios to book flights on as. with groceries earning 4x and a healthy 25k cap, the value proposition in my case is such that it makes sense for both p2 and myself to both have gold cards and use them for all our grocery purchases. the admittedly annoying monthly credits are pure upside. to be sure, living in an as hub greatly impacts the value calculation. i’d think most u.s. west coast readers would similarly benefit, however.

given the heavy use the gold cards get at the market, i do typically use my csr when dining out as i typically accrue ur points much more slowly. also, i have taken advantage of the temporary market benefit on the csr as well.

Hi Kevin, I’m glad you are able to transfer MR points to BA and book AS award tickets. I haven’t booked AS flights with BA Avios in years, but it was always a great redemption option.