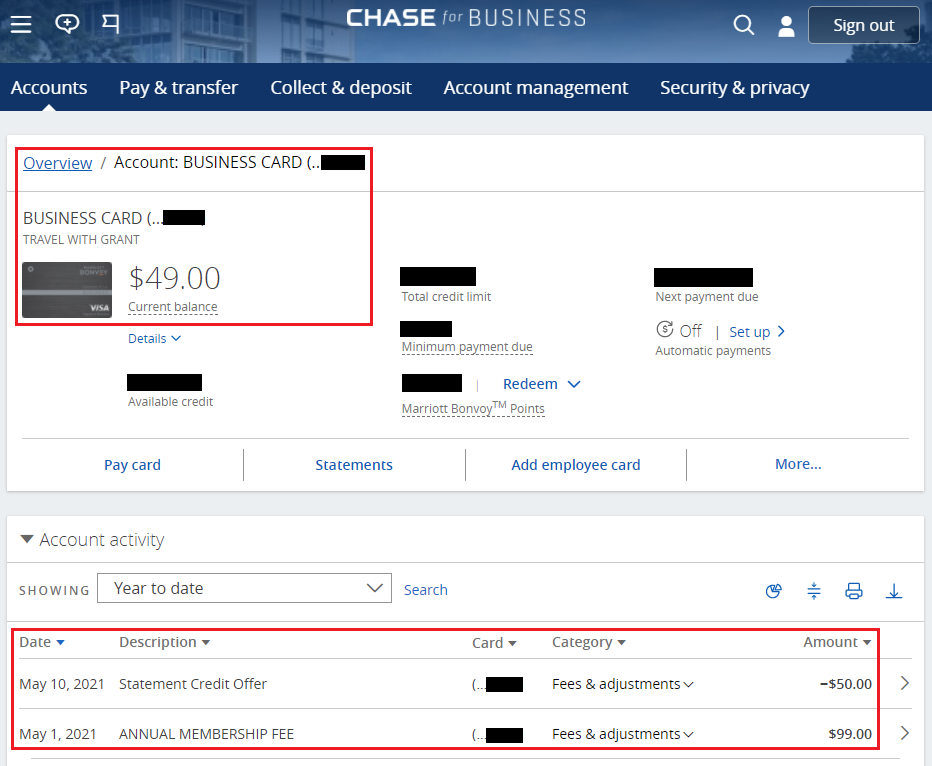

Good afternoon everyone, I hope your week is going well. Last week, the $99 annual fee posted to my legacy / grandfathered Chase Marriott Bonvoy Premier Plus Business Credit Card (no longer available for new members). The only reason I keep this credit card is for the 35K Marriott Free Night Certificate, which I value slightly more than $99. I decided to call Chase to see if I was eligible for a retention offer. I explained to the Chase rep that I wasn’t travelling much this year and asked if the annual fee could be waived. The Chase rep said I could get a $50 statement credit or product change to the no annual fee Chase Marriott Bonvoy Bold Credit Card. I gladly accepted the $50 statement credit and that credit posted to my account about a week later.

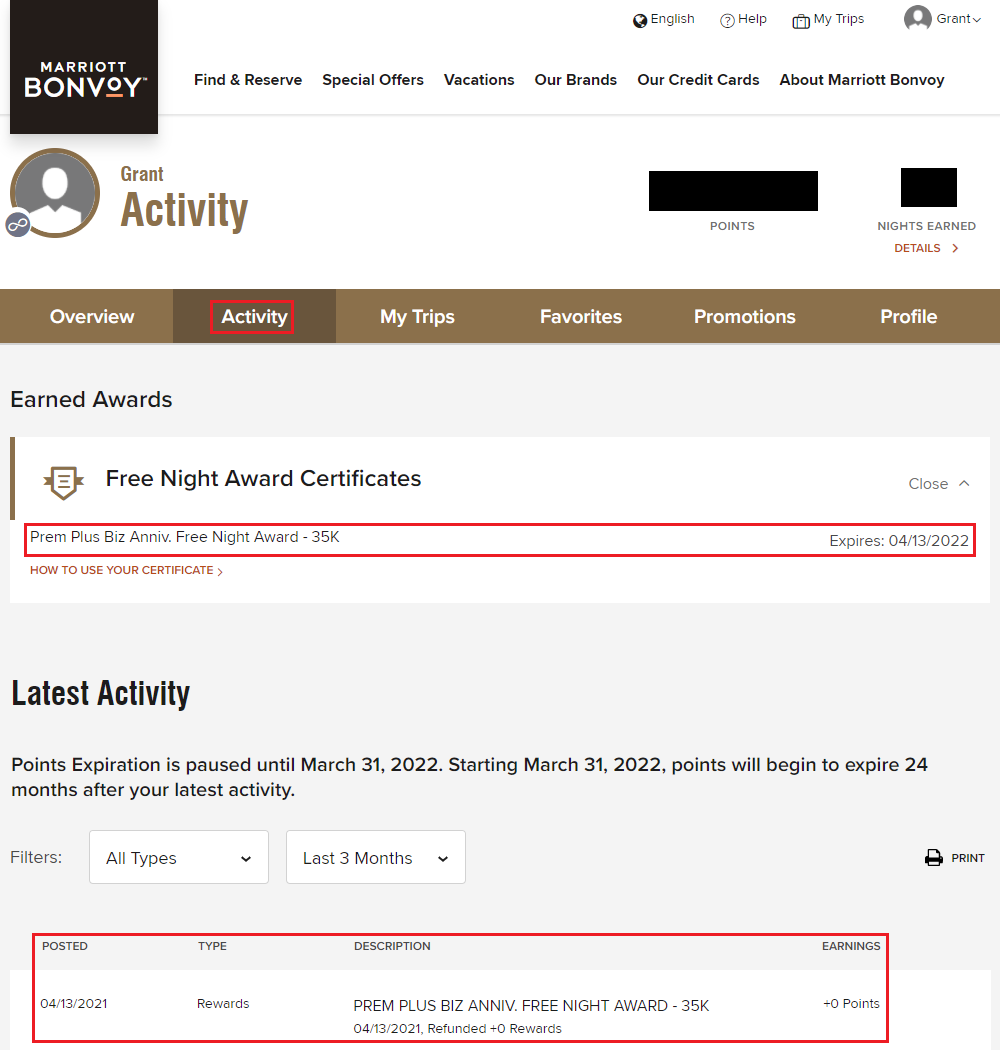

When I signed into my Marriott Bonvoy account, I can see that the 35K Marriott Free Night Certificate posted on April 13 (~17 days prior to the annual fee posting). I have 1 year to use the certificate, unless Marriott extends the certificates before I can redeem the certificate.

Long story short, if you have an annual fee that posted to your credit card, call the credit card company to see if they have a retention offer available. It only takes a few minutes and you might receive $50, or $100, or more in value from a single call. That is a great return on investment :) If you have any questions, please leave a comment below. Have a great day everyone!

Hey Grant, looks like you’re Lifetime Gold! Are you going for Lifetime Platinum? I mattress ran myself up to Titanium for under $300 due to the carry over elite nights, credit card elite nights, double elite nights and ultra cheap rates late last year. I’m only 2 years and 2 nights away from Lifetime Platinum, so I hope it tracks correctly. It seems there has been some questions about that. Of course, recent reports are that Marriott Platinum isn’t doing much for guests these days. What is the very best Marriott property you’ve every stayed in?

Hi Brant, I just checked my Marriott lifetime status in the app and it says I am Lifetime Silver with 285 nights stayed and 11 years as gold or higher. These numbers are higher than reality due to the SPG and Marriott merger.

I think in order to be Lifetime Gold, I will need 400 nights (115 nights to go).

I don’t think I will ever get to Lifetime Platinum since that requires 10 years of platinum status and I only have 3 years. But who knows what will happen in the future.

How close are you to Lifetime Platinum?

Hmm, best Marriott property I’ve ever stayed at is tricky. I don’t stay at many fancy Marriott hotels – do you consider Ritz Carlton and previous SPG hotels? My parents have a Marriott timeshare and they traded weeks or points to stay at the Marriott hotel next to the London Eye Ferris wheel, that was pretty cool :)

They offered you a downgrade path from a Marriott business card to the no annual fee Bonvoy Bold personal card? Isn’t that very odd? I thought most card issuers (including Chase) would not let people product change a business card to a personal one.

Hmm, you make a good point, maybe I misheard the agent. The only other option might have been to close the credit card to avoid paying the annual fee. Good catch!

Hello Grant – Thanks for this article. I wanted to let you know as a data point that I just called Chase to see if they can offer a retention on this card for the annual fee that just posted in Aug 2022. I was offered a $50 credit as well.

That is excellent, thank you for sharing your data point and for the decent retention offer. I also got a $50 statement credit retention offer on my Chase IHG Premier CC.