Good morning everyone, happy Friday! Over the last few months, I have written about several changes regarding Wells Fargo checking and savings accounts:

- Changes to Wells Fargo Everyday Checking $10 Monthly Fee Waiver Requirements (Effective October 8)

- Wells Fargo Discontinues Instant Issue Debit Cards (Effective November 30)

- Wells Fargo Discontinues Temporary Debit Cards & ATM Access Code Feature (Effective April 1)

- Wells Fargo Changes: New Statement Ending Dates, TTY/TDD Numbers Retired & More

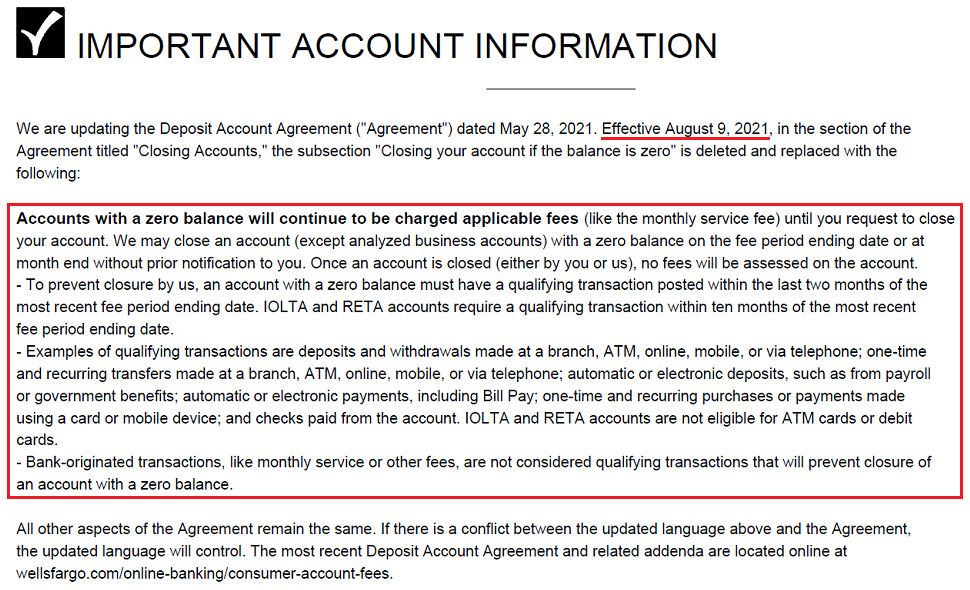

In today’s post, Wells Fargo made changes to closing accounts and charging fees on accounts with a zero balance. These changes are effective August 9, 2021 (so they are already live and should appear on your next monthly statement). The key part of this change is:

“Accounts with a zero balance will continue to be charged applicable fees (like the monthly service fee) until you request to close your account. We may close an account (except analyzed business accounts) with a zero balance on the fee period ending date or at month end without prior notification to you. Once an account is closed (either by you or us), no fees will be assessed on the account.”

If your Wells Fargo account has a zero balance, you will need to have at least 1 “qualifying transaction posted within the last two months of the most recent fee period ending date” and “IOLTA and RETA accounts require a qualifying transaction within ten months of the most recent fee period ending date.” I had to google IOLTA and RETA and found out that they stand for Interest on Lawyers’ Trust Account (IOLTA) and Real Estate Trust Account (RETA).

Here is what counts as a qualifying transaction: “deposits and withdrawals made at a branch, ATM, online, mobile, or via telephone; one-time and recurring transfers made at a branch, ATM, online, mobile, or via telephone; automatic or electronic deposits, such as from payroll or government benefits; automatic or electronic payments, including Bill Pay; one-time and recurring purchases or payments made using a card or mobile device; and checks paid from the account. IOLTA and RETA accounts are not eligible for ATM cards or debit cards. Bank-originated transactions, like monthly service or other fees, are not considered qualifying transactions that will prevent closure of an account with a zero balance.”

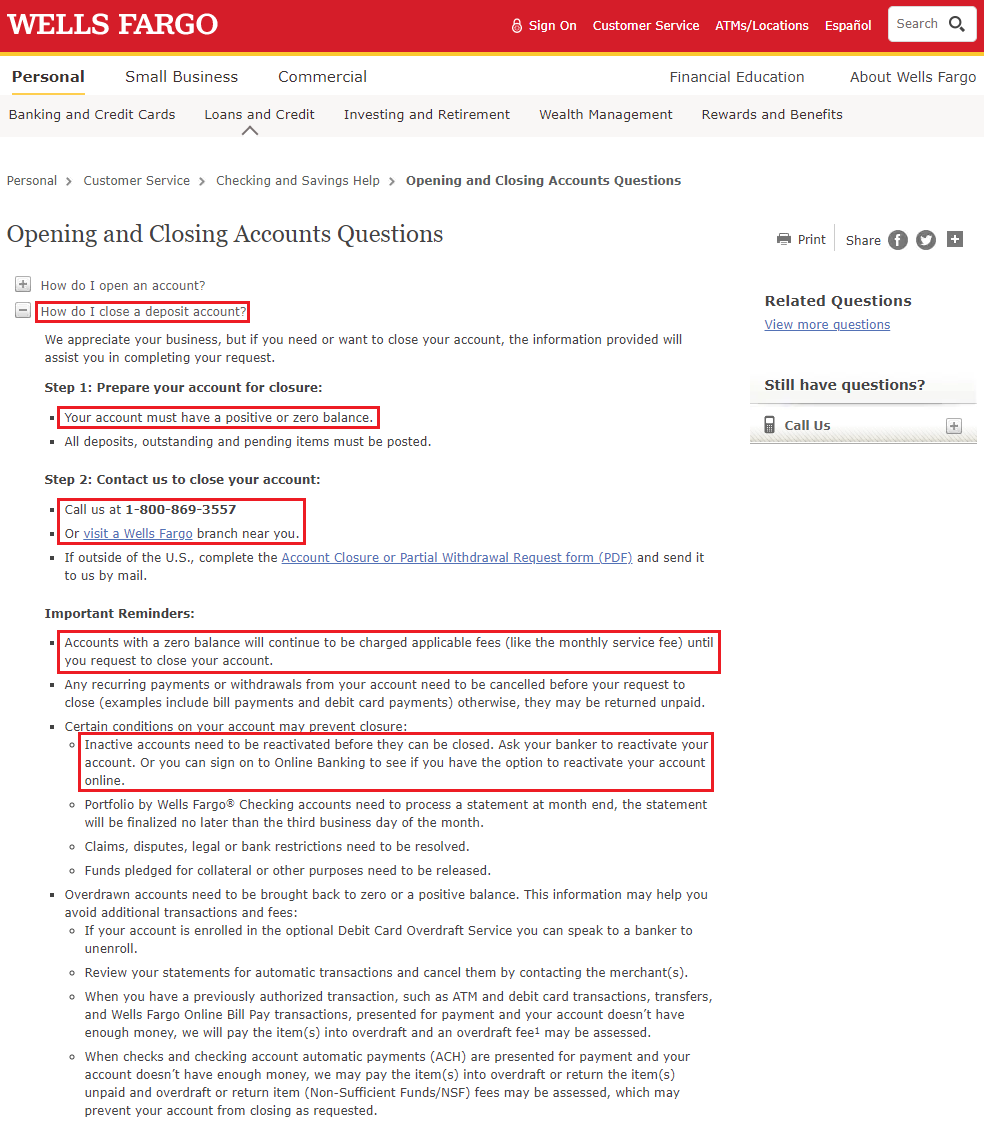

I did some more digging and found the Opening and Closing Accounts Questions page on the Wells Fargo website. In order for you to close your Wells Fargo account, your account must have a positive or zero balance (not a negative balance) and you will need to call Wells Fargo at 1-800-869-3557 or go into a Wells Fargo branch to request to have your account closed. If you keep your account at $0 expecting Wells Fargo to automatically close your account, just be warned that “accounts with a zero balance will continue to be charged applicable fees (like the monthly service fee) until you request to close your account.” And if your account becomes dormant / inactive, you will need to have your account “reactivated before they can be closed. Ask your banker to reactivate your account. Or you can sign on to Online Banking to see if you have the option to reactivate your account online.”

If you want to close your Wells Fargo account, here are the steps I would recommend. I would bring the account down to $0 and wait for any pending transfers and transactions to post. I would then call Wells Fargo to request to have my account closed. I would then keep my eye out for the confirmation email or confirmation letter to arrive from Wells Fargo. If you have any questions about these new changes, please leave a comment below. Have a great weekend everyone!

Pingback: Recap: FounderCards 20% Discount At InterContinental, Wells Fargo $0 Balance Closure & More - Doctor Of Credit

Pingback: Have you Read my Most Popular Posts of 2021?