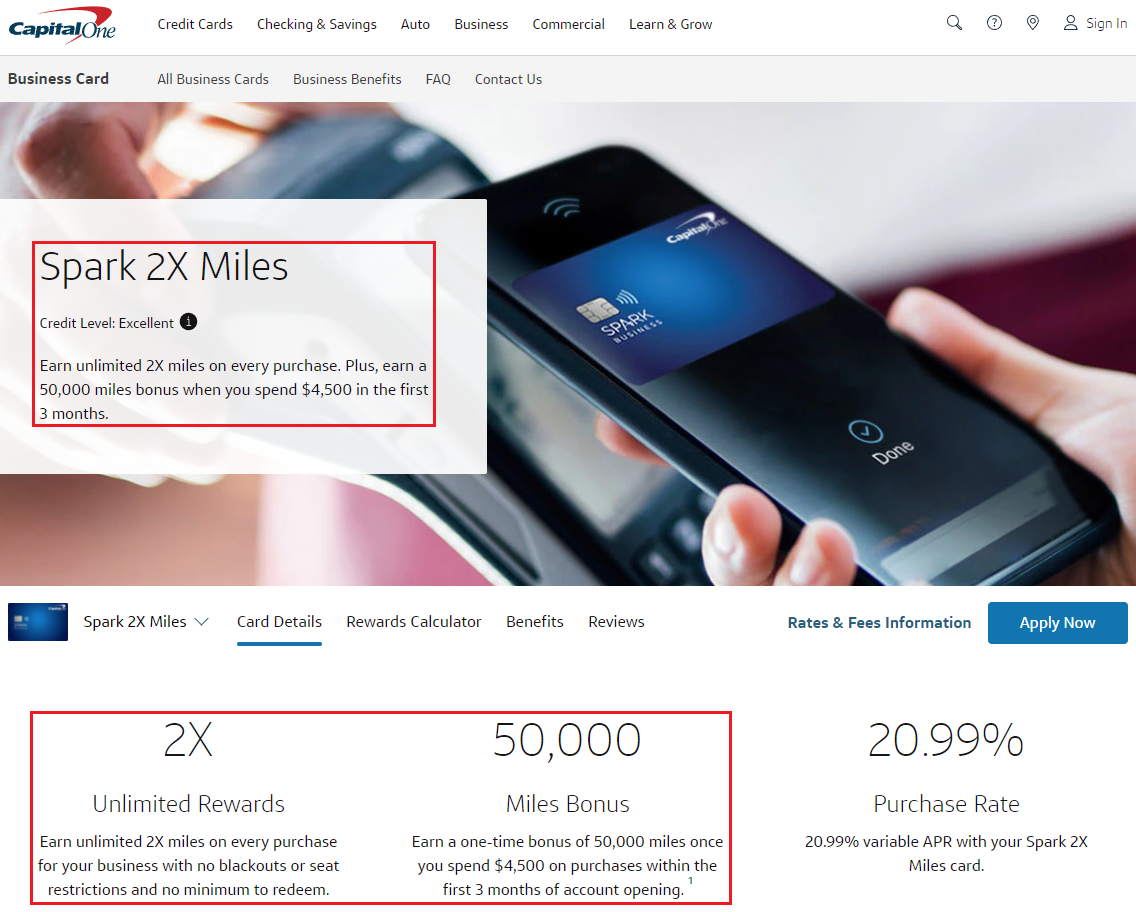

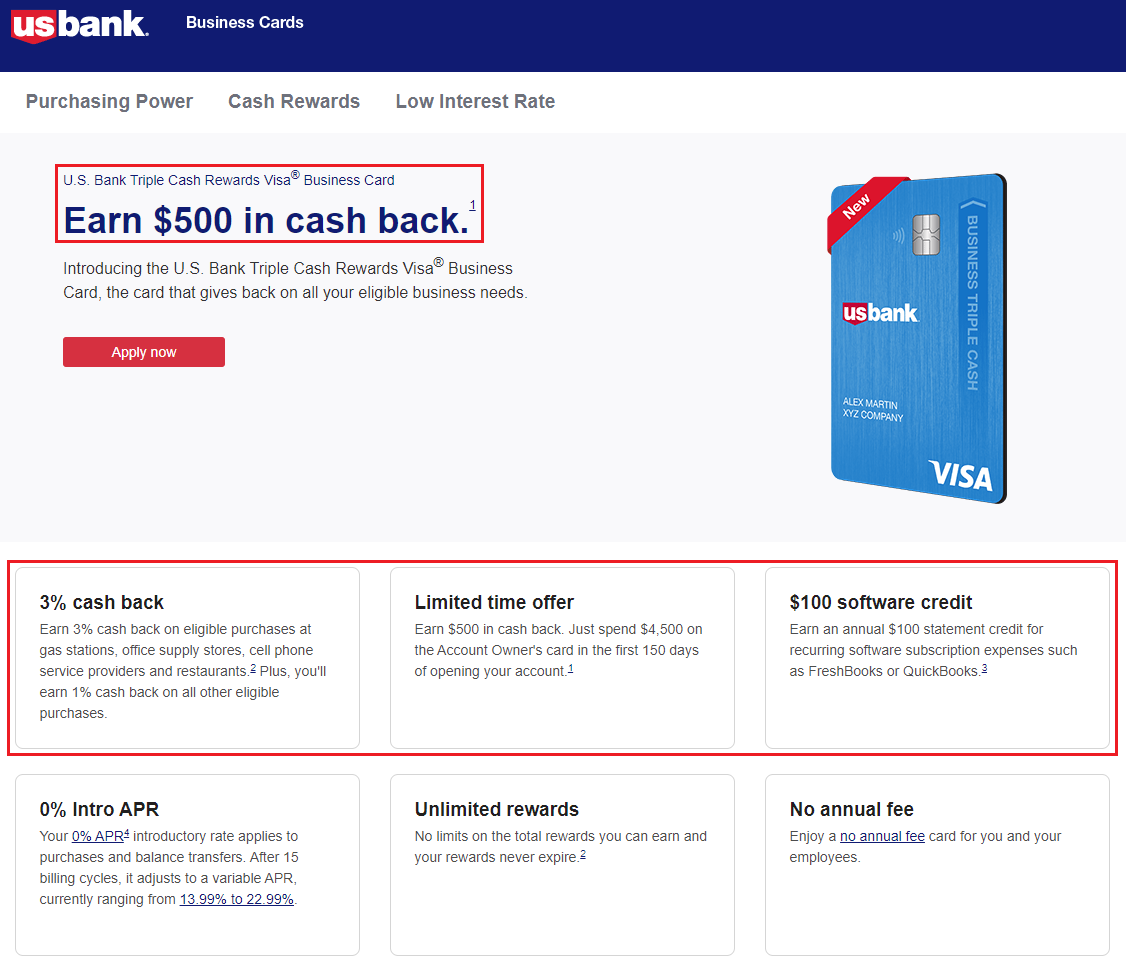

Good morning everyone, happy Friday! I hope you had a great Veteran’s Day Holiday yesterday. Last month, I applied for 2 business credit cards and I wanted to share the details of how quickly the sign up bonuses posted for each credit card. Up first, let’s talk about the Capital One Spark Miles Business Credit Card, which is currently offering 50,000 miles after spending $4,500 in 3 months. Up next, I will cover the US Bank Business Triple Cash Rewards Credit Card, which is currently offering $500 cash back after spending $4,500 in 5 months.

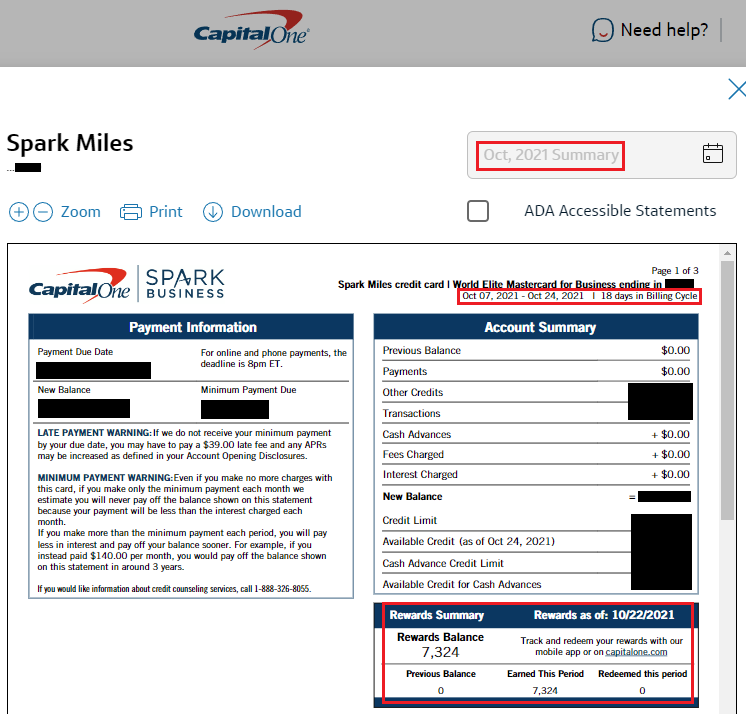

My first Capital One Spark Miles Business Credit Card statement closed on October 24 (not sure why this statement period was only 18 days long) and I had not yet completed the $4,500 minimum spending requirement.

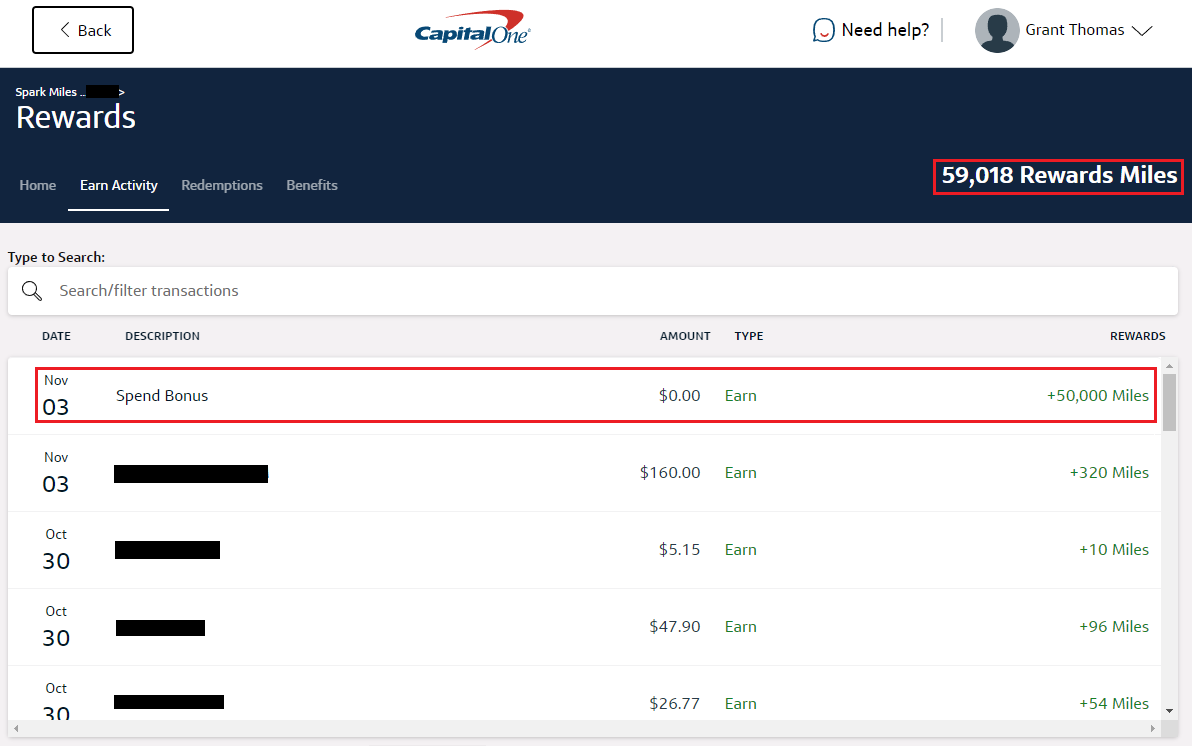

I am a little lot OCD when it comes to credit cards and minimum spending requirements, so I like to track every purchase in a spreadsheet to see how close I am to meeting the minimum spending requirement without going way over. I completed my minimum spending requirement in early November and when the purchase posted on November 3, I crossed the threshold and received the 50,000 miles sign up bonus on the same day. I love when you receive the sign up bonus on the day you complete the minimum spending requirement and not on the day the statement closes. This could be good news for those who have applied for the new Capital One Venture X Credit Card. Once you complete the $10,000 minimum spending requirement, you should receive your 100,000 miles sign up bonus the same day or shortly afterward.

Now, let’s talk about the US Bank Business Triple Cash Rewards Credit Card. The minimum spending requirement is the same as above ($4,500) and the sign up bonus is basically the same to ($500 vs 50,000 miles).

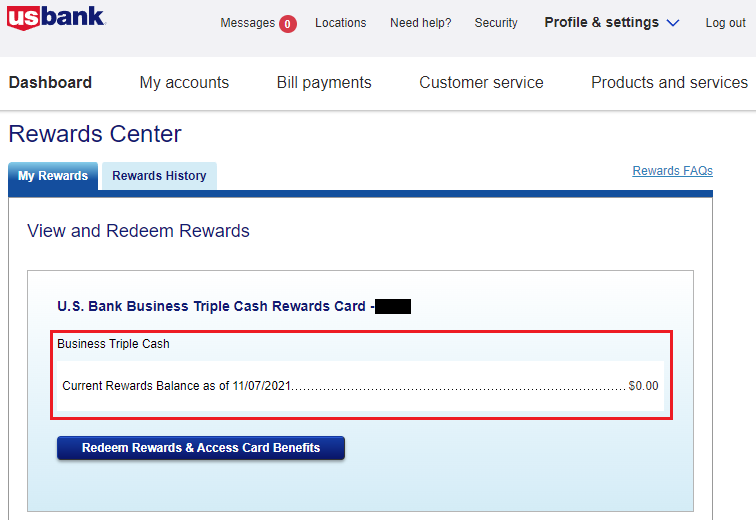

I have a few different reward earning credit cards from US Bank and they all appear separately in the Rewards Center. As of November 7, my Rewards Balance was $0.

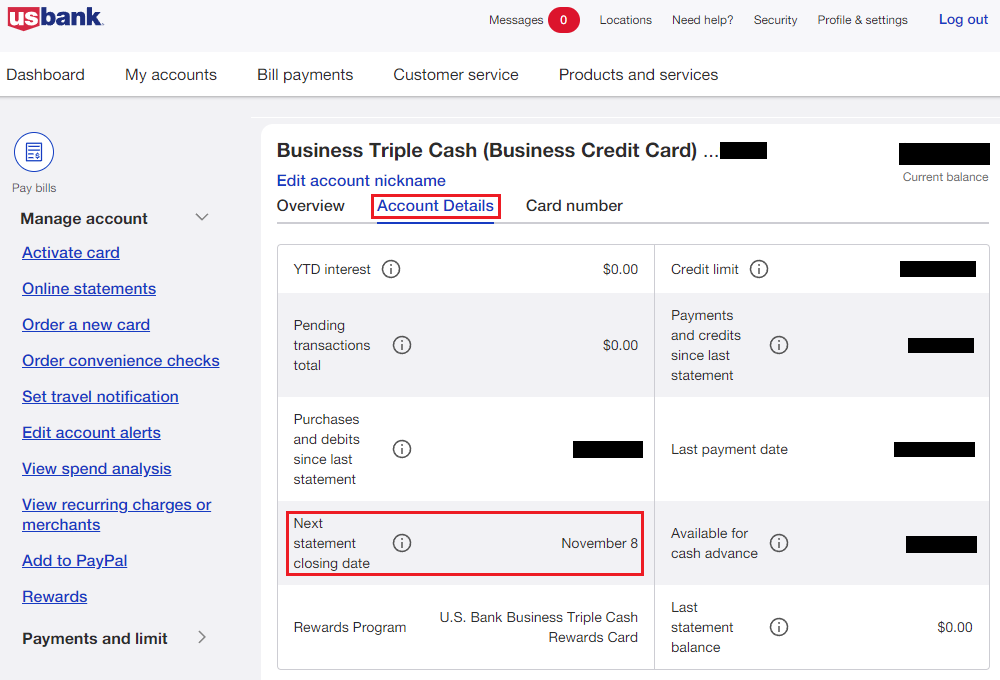

When I clicked on the Account Details tab, it showed that my next credit card statement would close on November 8.

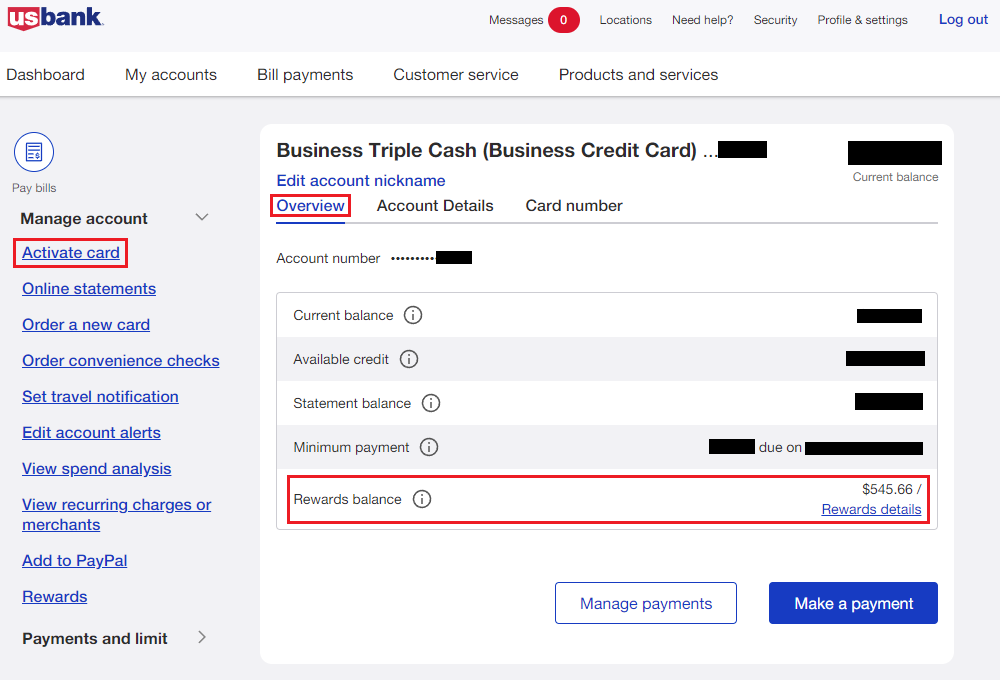

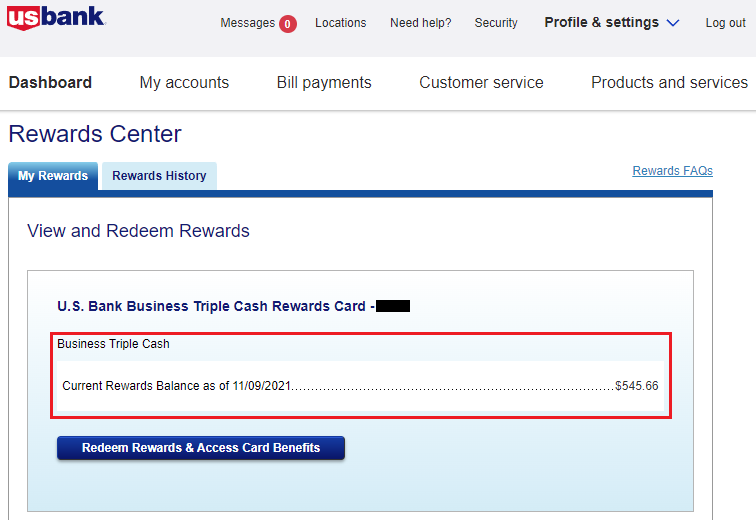

On November 9, I logged back into my US Bank account and saw that the Rewards Balance had increased from $0 to $545.66. The funny thing is that US Bank still shows a link on the left side to activate my credit card. You would think that the system would be able to tell that the credit card is already activated.

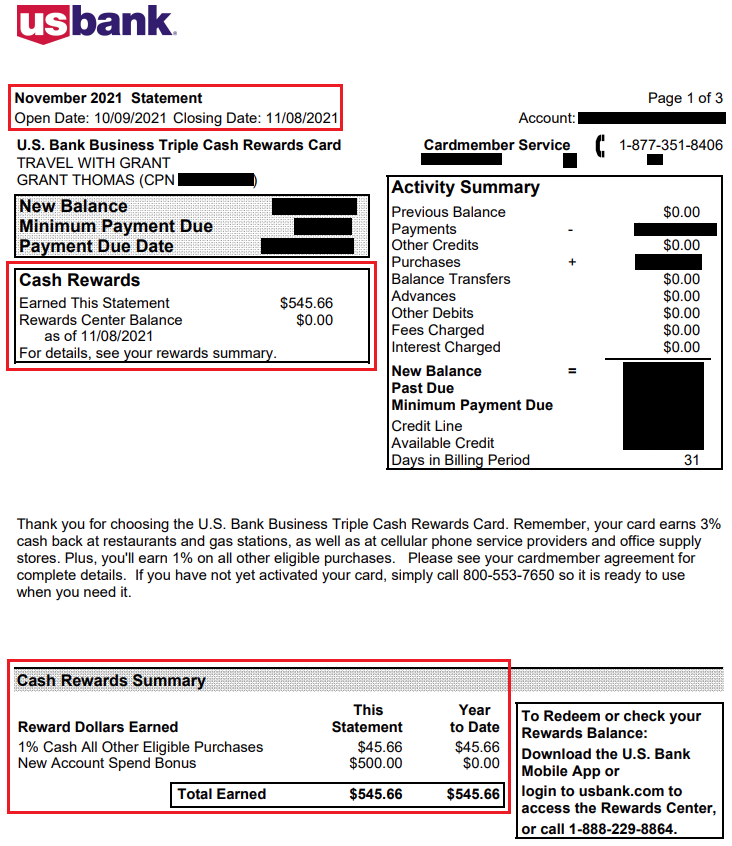

Here is my credit card statement showing the $545.66 Rewards Balance. The Cash Rewards Summary shows that none of my purchases earned 3% cash back, just the base 1% cash back.

I then went back to the Rewards Center and saw that my Rewards Balance increased to $545.66. I clicked on the Redeem Rewards & Access Card Benefits button to see what I could do with my Rewards Balance.

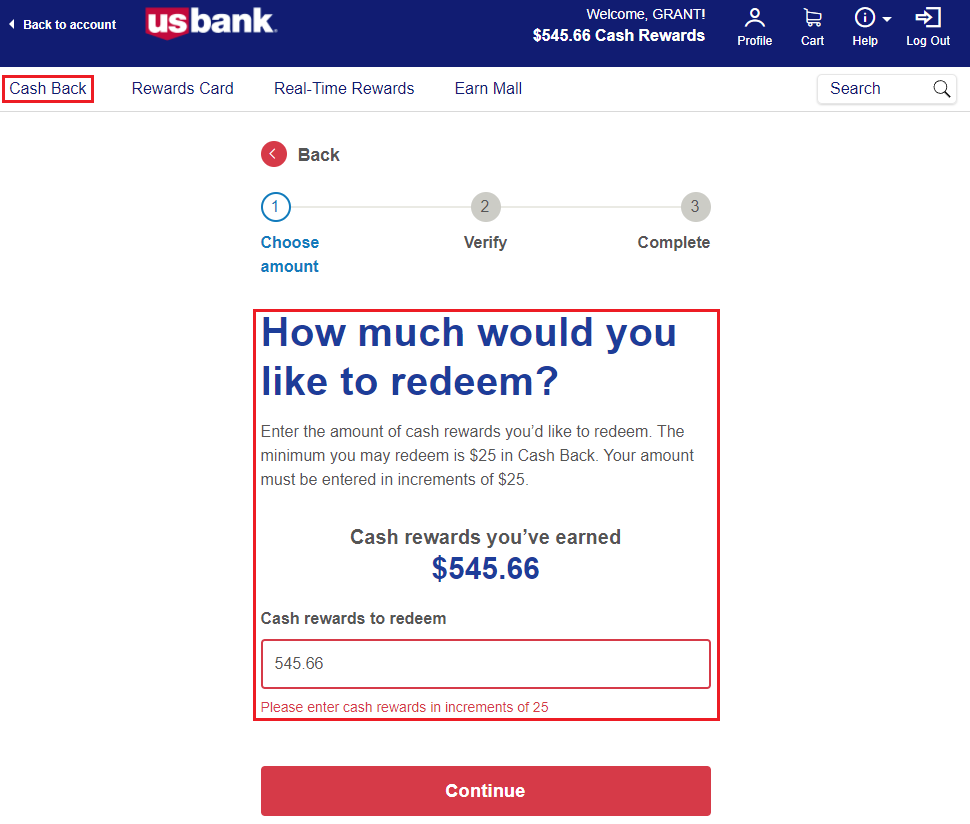

There are 3 main redemption options: Cash Back, Rewards Card, and Real-Time Rewards. Let’s review these 3 redemption options. For Cash Back, you can redeem your rewards for statement credits in $25 increments. There is no upper limit as long as it is an increment of $25.

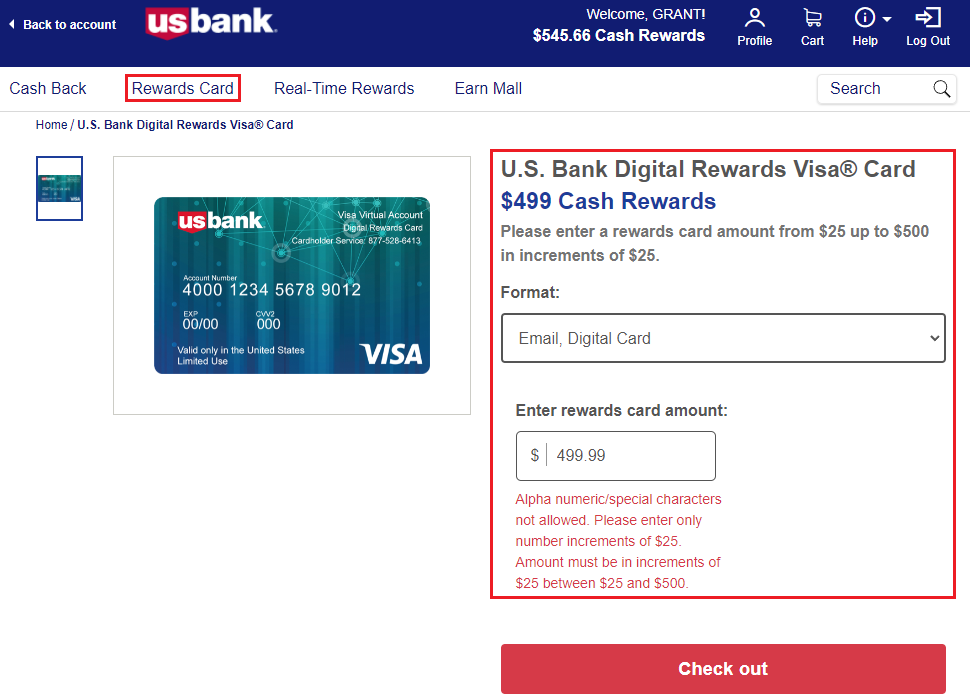

For Rewards Card, you can redeem your rewards for a physical or virtual Visa gift card in $25 increments, up to $500 per Visa gift card.

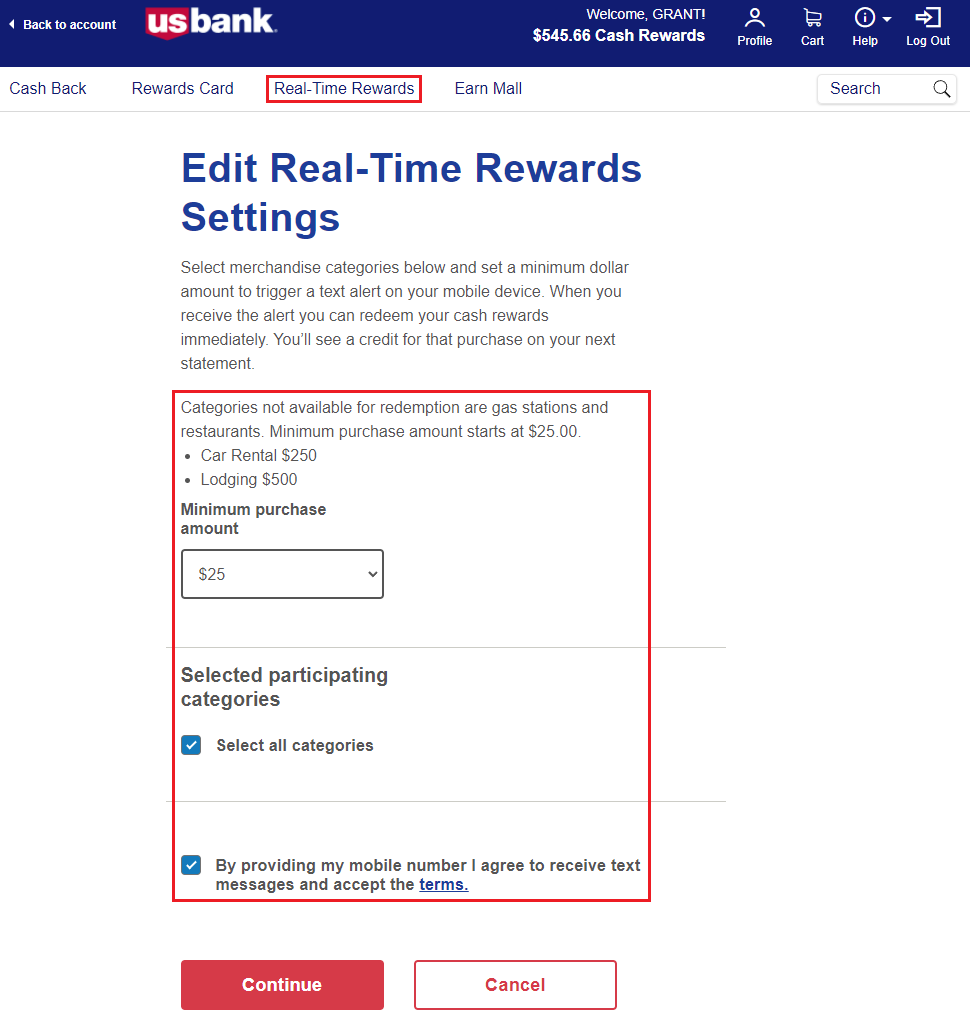

Lastly, for Real-Time Rewards, you can redeem your rewards for any purchase greater than $25, with the exclusion of car rentals ($250 minimum) and lodging ($500 minimum). I have used Real-Time Rewards many times with my US Bank Altitude Reserve Credit Card and it has always worked smoothly.

Since this is the only option that exists where you can redeem rewards outside of a $25 increment, my plan is to redeem $500 as a statement credit and then make a $45.66 purchase that would trigger the Real-Time Rewards. I will report back on my plan in a few days. If you have any questions about either credit card or sign up bonus, please leave a comment below. Have a great weekend everyone!