Good afternoon everyone, I hope you had a great weekend. Doctor of Credit has a Best Bank Account Bonuses page that he keeps up to date with the best offers each month. In that master post, he links to individual bank account bonuses with helpful information regarding the bonus details, how to avoid monthly fees, when to close the account, how often you can open a new account, and much more. For the last 7 years, I have been opening new checking accounts, savings accounts, brokerage accounts, and cash management accounts for the new member bonuses. Tt the end of each year, I share my results on the blog. Over the last 7 years, I have made $15,850 in bank account bonuses. You will receive 1099-INT tax forms every year, so you have to pay taxes on the bank account bonuses, but sometimes you can fund the opening deposit with a credit card and earn miles, points, or cash back. If you are lucky, you can meet a minimum spending requirement by funding a new checking account or reach a high spending target to earn more rewards. Here are my results from the last 7 years with links to corresponding blog post summaries:

- 2015: $1,175 (no post)

- 2016: $2,850 (summary)

- 2017: $3,700 (summary)

- 2018: $2,725 (summary)

- 2019: $1,000 (summary)

- 2020: $800 (summary)

- 2021: $3,600 (this post)

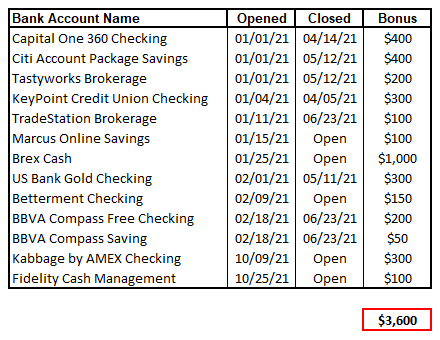

Drum roll please… Here are the 13 new accounts I opened in 2021:

The above list includes traditional checking accounts, savings account, brokerage accounts, and cash management accounts. I include everything above since the process is basically the same. The Tastyworks Brokerage bonus was in the form of 100 shares of stock that was worth about $2 per share. The Betterment Checking bonus was in the form of American Express Membership Rewards Points from Rakuten. The requirements vary quite a bit between the accounts: deposit $10,000 for 3 months, to having a few direct deposits, to making a few debit card purchases, to funding the account with $100. I don’t mind jumping through hoops to open new accounts (funding accounts, moving money around, changing direct deposits, keeping track of bonuses, and then closing accounts), but I don’t get very excited about earning $50 or $100 in Swagbucks or MyPoints for opening new accounts from small online banks.

As you can see, I only have 5 accounts still open today (December 13). The Kabbage by AMEX Checking is currently paying 1.1% interest, so that will probably become my go to online savings account for 2022. The Marcus Online Savings account is currently paying 0.7% interest since I referred a few people, but that rate is not as competitive as Kabbage. I keep my Brex Cash and Betterment Checking accounts open since there is no monthly fee, but I am not using them right now. I will probably close my Fidelity Cash Management account in the next month or so.

If you are interested in bank account bonuses, I recommend checking out Doctor of Credit’s Best Bank Account Bonuses page. If you did any bank account bonuses in 2021, please let me know how much you made this year and whether your total is higher or lower than previous years. Thanks for reading and have a great day everyone!

2018 $2,100

2019 $8,675

2020 $5,450

2021 $9,000

Hi Charles, wow, those are impressive numbers! What were you biggest winners in 2021?

How do you manage to get your direct deposit to new accounts?

Hi Rahulk, I can easily switch my direct deposits with work to be split into several different accounts.

Keep in mind the results are 2 player and one business.

Business accounts:

Huntington $750

Chase $300

BMO Harris $500

B of A $500

Brex Cash $1,100

Personal accounts:

Huntington $500 x 2

Capital One $400

Fifth Third $250 x 2

US Bank $400

Discover Savings $200 x 2

Central Bank $350

Associated $500

Midland States $250 x 2

Monifi $275 x 2

Tastyworks $500 x 2

Fidelity $100 x 2

Go2Bank $50

Total: $9,000

Pending:

Citibank $400 x 2

Amex Bus. $300

Kabbage Bus. $300

US Bank Bus. $300

Tradestation $150 x 2

Wells Fargo $200 x 2

Go2Bank $50

Jefferson Bank $250

Chase $225 x 2

Pending Total: $3,150

Fails:

Regions Bank $200 x2 (Promo code fail due to incorrect code secondary to a computer hack)

Central Bank $250 (Tried to get bonus despite one per household rule)

Hi Charles, thanks for sharing your successes and 2 fails. I hope the remaining pending account bonuses post soon. Happy holidays!

1st United $200

Abra $19

Air Academy $110

Albert $217

All of Us $111

Alt $35

Axos $315

Bakkt $99

Bank of America $100

Bank of the West $250

BBVA $103

Bitflyer $15

Bitmo $13

Bitstamp $30

BlockFI $24

Boro $6

Brinks $20

CakeDefi $44

Cash App $137

Celsius $602

Chase $750

Cheese $90

CIT $42

Citi $1,170

Citizens Equity First $25

Coinbase $86

Coinlist $13

Concreit $255

DCU $50

Delta Community $149

Diamond App $27

Door $2

Dough $4

Ent $200

ErisX $510

Fairwinds $520

Fidelity $200

First Commerce $300

First Tech $500

Firstrade $18

Gatsby $23

Gemini $10

GO2Bank $100

Groundfloor $1,080

H-E-B $10

HappyNest $25

Hodlnaut $40

HSBC $300

Idaho Central $50

Invstr $5

Kabbage $300

KeyBank $275

LBS $100

Lili $442

M1 Finance $45

Makara $25

Marcus $100

Midland States $250

MoneyLion $3

Moomoo $69

Mountain West $30

Mos $6

MyConstant $29

Nadex $1,186

Navy Federal $40

Nearside $266

Nexo $42

NorthOne $100

OKCoin $631

One $236

onJuno $125

Outlet $7

Oxygen $105

Parked $13

Pentagon Federal $95

Pennsylvania State Employees $270

Plynk $120

Podercard $10

Point $492

Porte $100

Public $54

PrizePool $20

Radius $60

Redstone $300

Revolut $512

Robinhood $193

Sable $80

SoFi $961

Southland $200

Spiral $50

Step $6

StreetBeat $41

Strike $6

Sunflower Bank $200

Tastyworks $172

Technology $100

Titan $9

Tornado $62

TradeStation $100

TradeUp $242

Varo $100

Voyager $60

Washington Federal $100

WeBull $66

Wescom $500

Western Union $23

Wise $19

Wolfpack $1

Yieldstreet $400

Yotta $4

ZenGo $41

Sum $19,197

Dang, that is impressive! $19k in a single year, that beats my 7 year combined total.

Davis,

Nicely done!

I plan on checking out these different accounts. There are many of these that I have never heard of.

Congrats!