Good afternoon everyone. Doctor of Credit has a Best Bank Account Bonuses page that he keeps up to date with the best offers each month. In that master post, he links to individual bank account bonuses with helpful information regarding the bonus details, how to avoid monthly fees, when to close the account, how often you can open a new account, and much more. For the last 5 years, I have been opening new checking accounts for the new member bonuses. And at the end of each year, I share my results on the blog. Over the last 5 years, I have made $11,450 in bank account bonuses. You will receive 1099-INT tax forms every year, so you have to pay taxes on the bank account bonuses, but sometimes you can fund the opening deposit with a credit card and earn miles, points, or cash back. If you are lucky, you can meet a minimum spending requirement by funding a new checking account or reach a high spending target to earn more rewards. Here are my results from the last 5 years with links to corresponding blog post summaries:

- 2015: $1,175 (no post)

- 2016: $2,850 (summary)

- 2017: $3,700 (summary)

- 2018: $2,725 (summary)

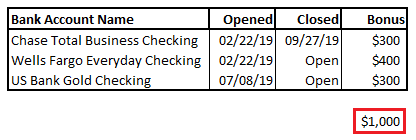

- 2019: $1,000 (this post)

Drum roll please… Here are the 3 new checking accounts I opened in 2019:

There are 3 main reason why my 2019 total is so much lower than previous years. For starters, there are only so many nationwide bank account bonuses (much fewer than previous years) and only so many local banks and credit unions in Northern California. Smaller banks and credit unions only want customers near their branches and in their region. Secondly, most banks implement rules where you cannot open, then close, then reopen a new checking account within a certain amount of time (usually 1-2 years). And lastly (and probably more importantly), my wife did not want me to open so many new checking accounts (happy wife = happy life). I don’t mind jumping through hoops to open new checking accounts (funding accounts, moving money around, changing direct deposits, keeping track of bonuses, and then closing accounts). That might not sound fun to you (or my wife), but I enjoyed the process.

If you do bank account bonuses, let me know how much you made this year and whether your total is higher or lower than previous years. Thanks for reading and have a great day.

Nice start ! after taxese deduction maybe like $800 ish depends on your income bracket

Ya, sounds about right to me. Did you do any bank account bonuses this year?

Typical year for me. Chase business, $300, US Bank 300, HSBC $750. My efforts are similarly throttled by my wife’s objections. However, due to the large $750 offer I was able to convince her to also open the HSBC. Now she’s concerned about the unrest in HKG and “are we making a mistake putting money into a hong kong bank?” Sheesh, what I go through.

I did the HSBC bonus last year or the year before that and it was such a headache. I told myself to never open another HSBC account after that. The $750 bonus was tempting. I think my largest bonus was $1,000 from a BofA Biz checking account. I’m glad to hear that my wife is not the only one who objects about opening new checking accounts.

Yes I’d heard some negative feedback about HSBC. I was swayed by the positive results in the comments on DoC’s page. Both my wife and I were able to open the accounts online in about 15 minutes—didn’t need to send or fax anything in. Going smoothly so far, hopefully the bonuses will payout. My wife moved her DD from employer to HSBC so she should be ok. I’m doing pushes from another account to meet the monthly DD requirement. Not sure what the time requirement between bonuses is, but this $750 offer runs through Dec 31 this year.

Not sure what our wives objections to bank account bonuses are. But, on the plus side, after several years I have trained her to accept some MS. Always a joy when she comes home from grocery shopping and says “I got a $500 vgc and used the Gold amex.”

Part of the the training program was flying F on Singapore, Cathay Pacific, JAL, KAL.

I do hope your HSBC bonus posts on time without issue. I just remember it was such a headache for me last time. I’m glad to see that your wife is learning how to MS and enjoying the perks of travel hacking. My wife helps me with the occasional AMEX Offer or Chase Offer and knows which CC to use for restaurants and grocery stores too (AMEX Gold Card). She said she’s glad that she is not the only wife that feels this way. She definitely enjoys the perks of travel hacking too :)

Guess I’m the odd wife here who opens accounts for myself and hubby. Plus, he doesn’t object! Lol

There is nothing odd about that. Glad your husband doesn’t mind and I’m sure he enjoys the perks of the travel rewards.

$4200 Earned in 2019 between P1 & P2.

PNC, Varo, Scwab, Wells Fargo x2, Chase Biz, Aspiration, So-Fi x2 (referred as well), M&T x2, plus a couple local banks

Earned 2018 $3,850

Earned 2017 $3,300

Dang you guys are raking in the big bucks. Let’s see if you can make it 4 years in a row :)