Good afternoon everyone, I hope you all had a great weekend. 2 weeks ago, I called Citi to convert 1 of my 3 Citi AT&T Access More Credit Cards into a Citi Custom Cash Credit Card. Earlier today, I wrote Unboxing Citi Custom Cash Credit Card: Card Art, Welcome Letter, Directory of Services & Terms and Conditions Booklets. In this post, I will talk about my experience product changing to the Citi Custom Cash, the prorated annual fee refund, my 61,607 expiring ThankYou Point scare, and how to unlink the closed credit card from your Citi online account.

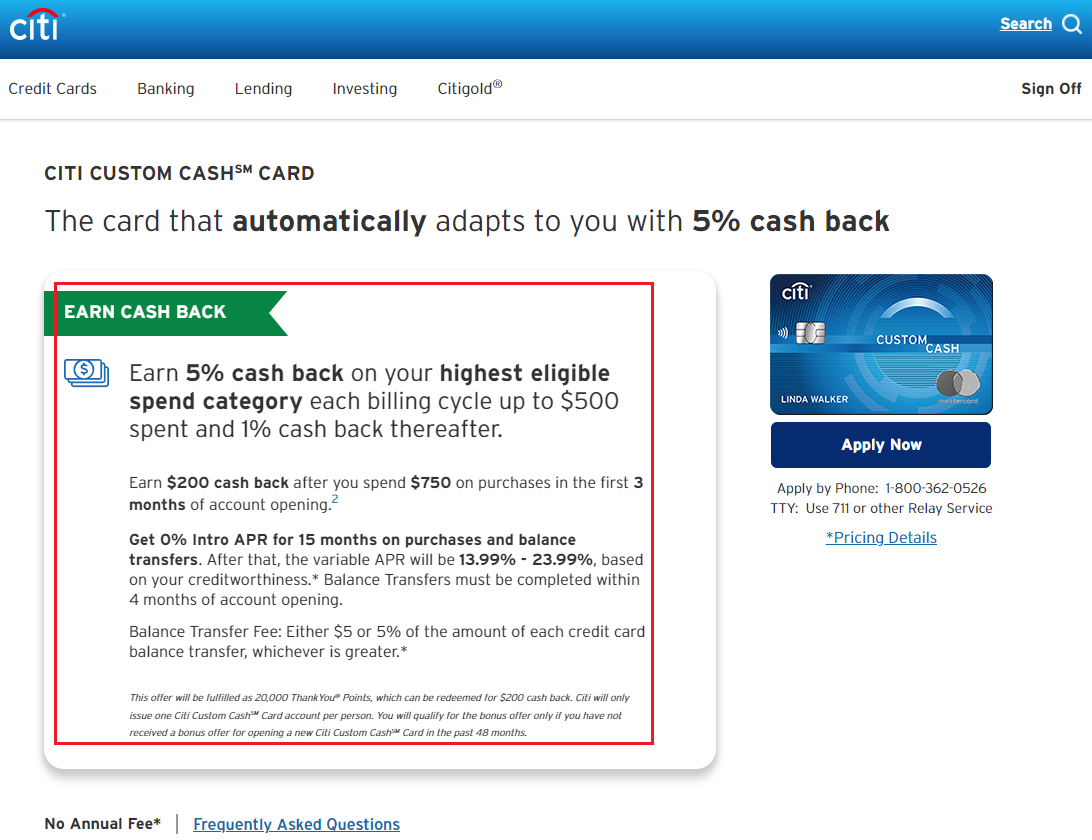

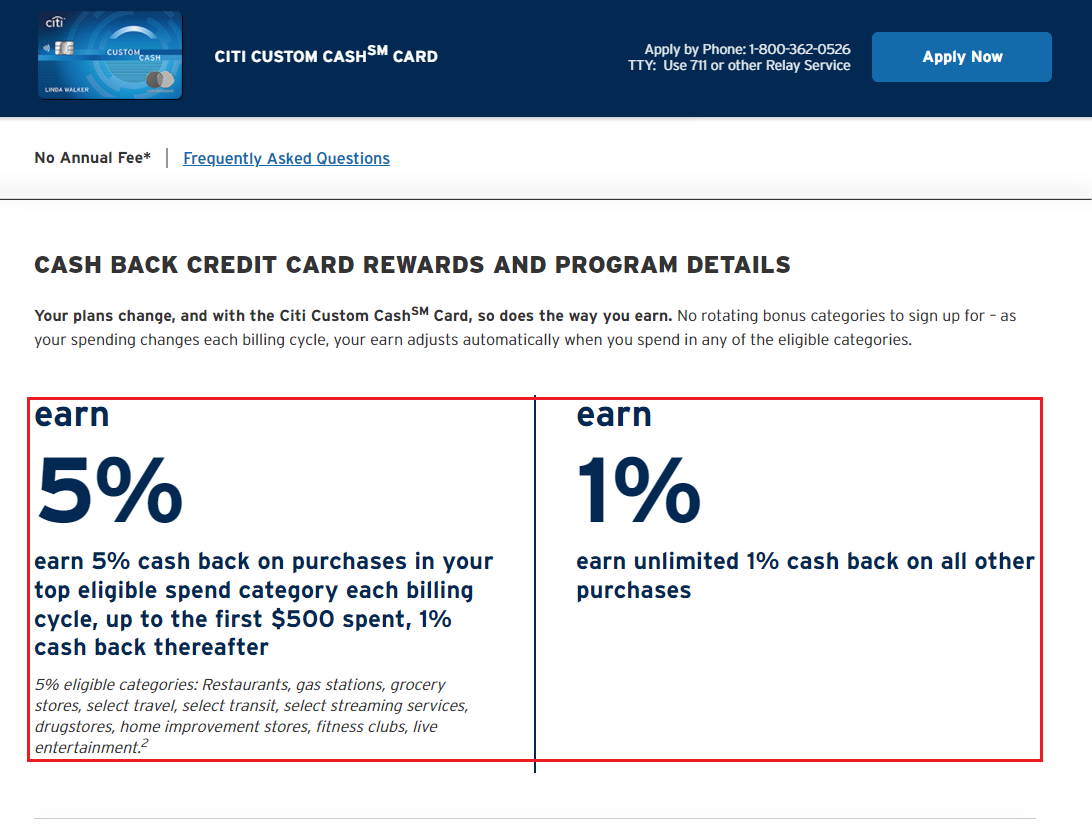

Let me briefly explain the Citi Custom Cash. This credit card offers 5% cash back (in the form of Citi ThankYou Points) on the first $500 spent each month in a specific category and 1% cash back on everything else. The current sign up bonus is $200 cash back (actually 20,000 Citi ThankYou Points) after spending $750 in the first 3 months. Unfortunately, the sign up bonus is only available for new card members, not for product changes. In a few months, I plan to convert my second Citi AT&T Access More to a second Citi Custom Cash and use each credit card for 1 specific category only (grocery stores on one and restaurants on a second). I will still have 1 Citi AT&T Access More available to use for online purchases that earn 3x Citi ThankYou Points.

On January 13, I called the phone number on the back of my Citi AT&T Access More and asked if I could product change to a different Citi credit card. The rep said yes and asked me which credit card I wanted. My first choice was the Citi Dividend which offers 5% cash back in rotating categories, but I was told that card is no longer available for product changes. Since I already have a Citi Double Cash Credit Card and Citi Rewards+ Credit Card, I asked if I could product change to the Citi Custom Cash. Yes, that was possible. We proceeded with the product change and I agreed to all the new terms.

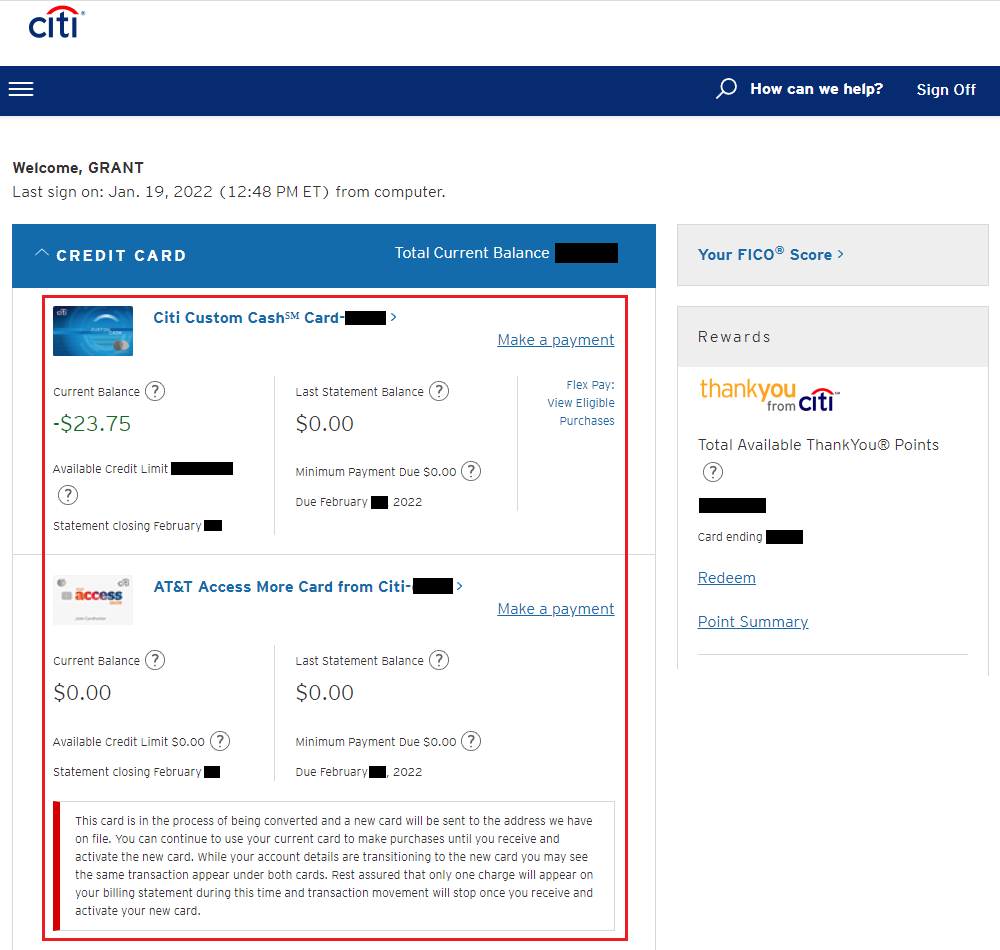

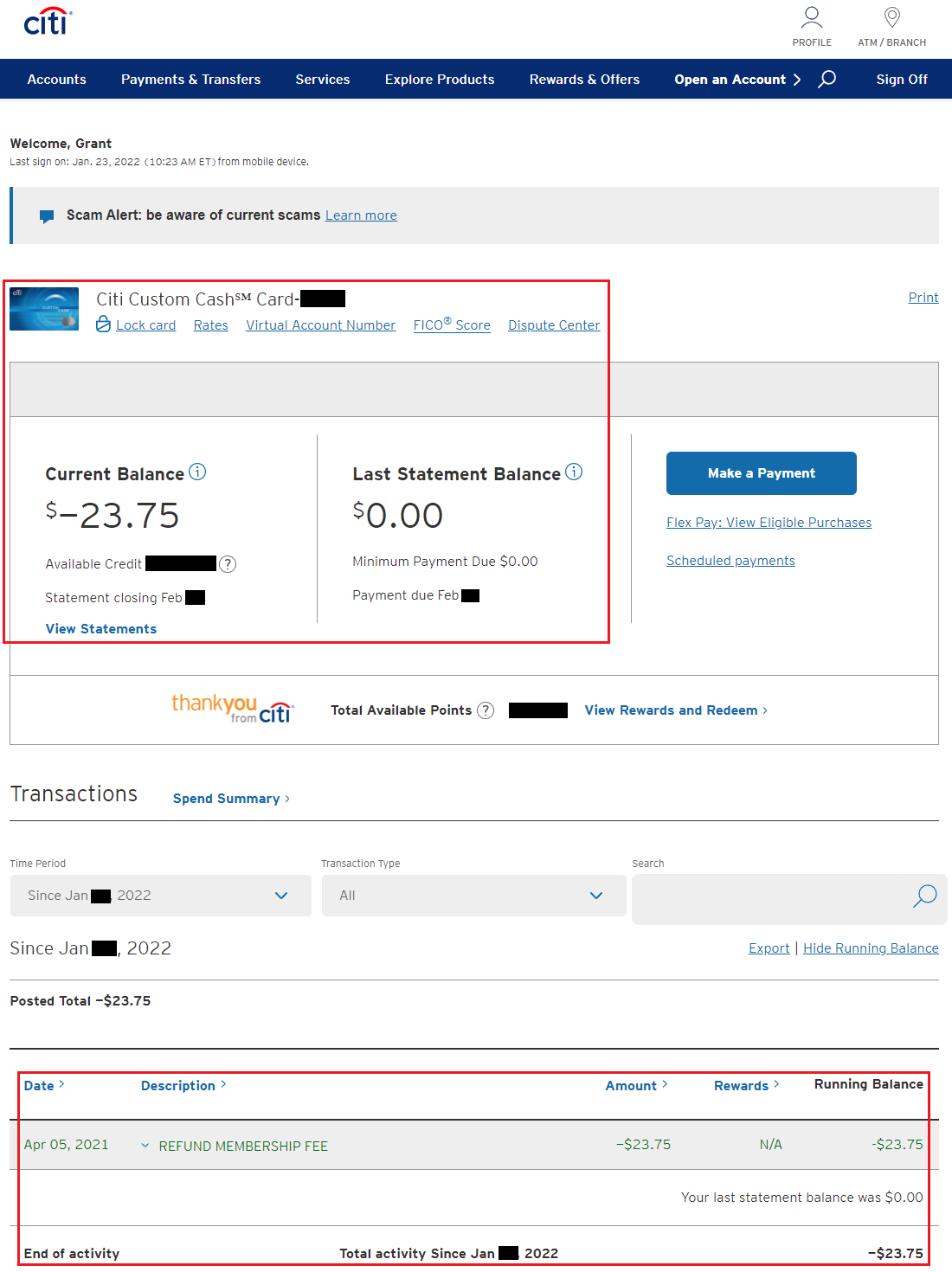

A few days later, I signed into my Citi online account and saw a message that my Citi AT&T Access More was in the process of being product changed and a new Citi Custom Cash appeared. The card numbers are different which surprised me and may cause issues with the 24 month clock that Citi has for new ThankYou Point earning credit cards. I also noticed a $23.75 credit balance which is a prorated annual fee refund from my Citi AT&T Access More. I will provide more info later on.

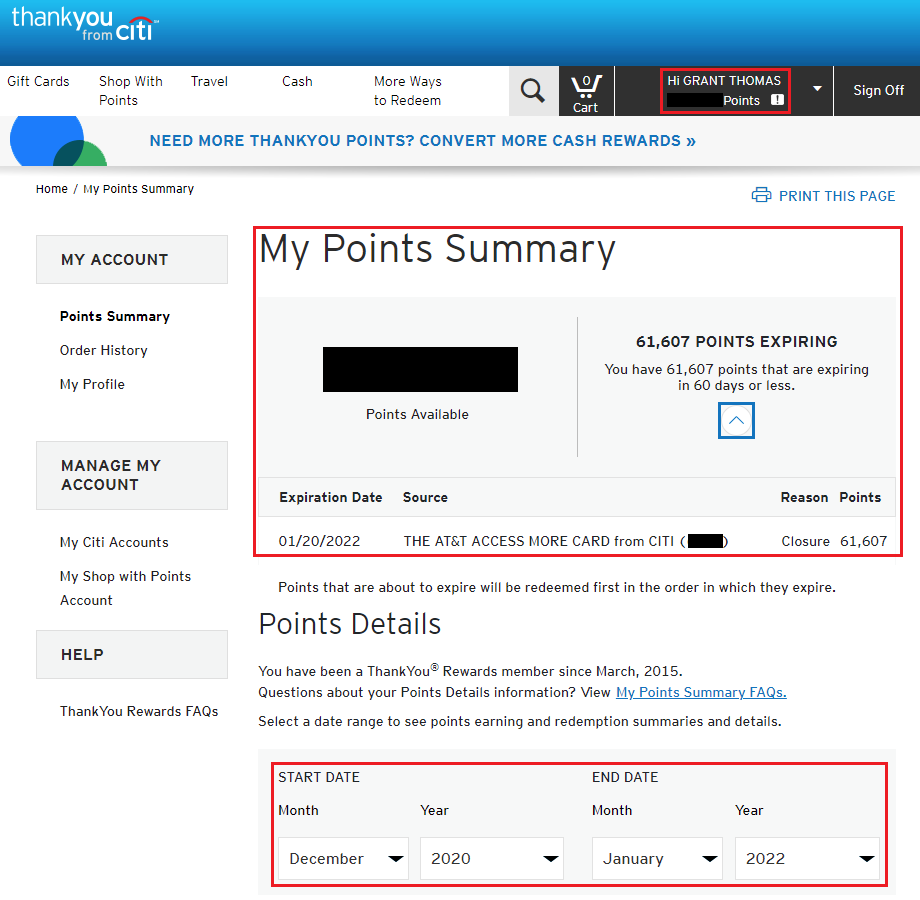

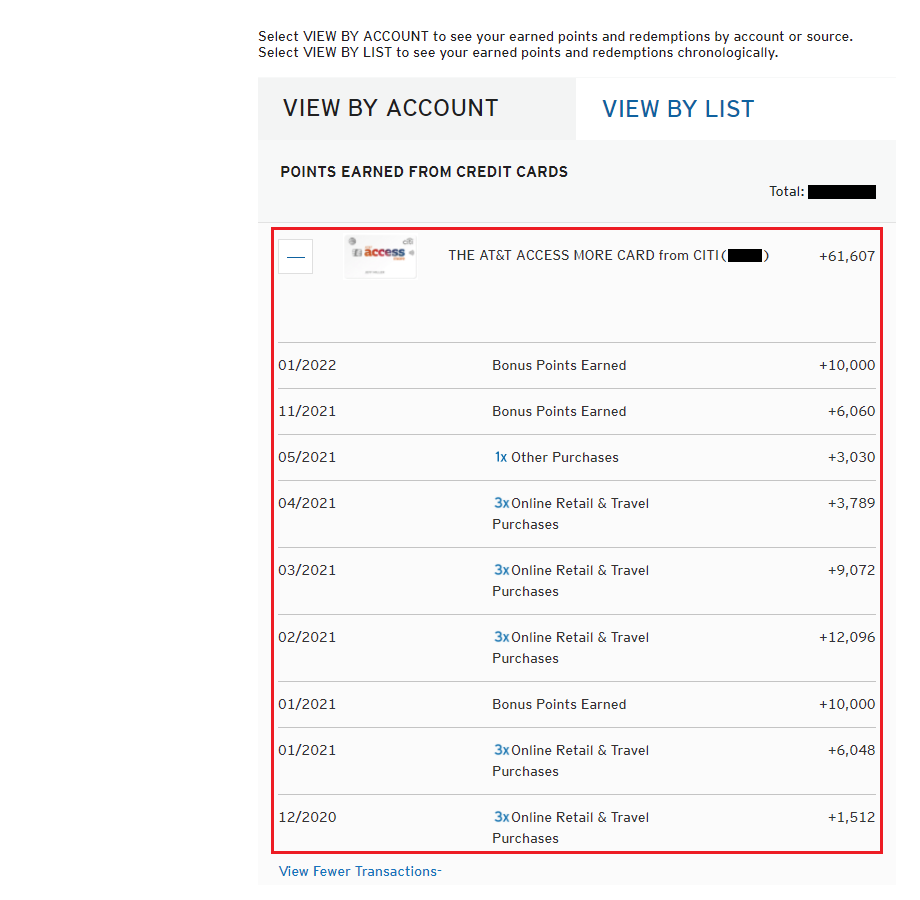

I went to my Citi ThankYou Points portal to check my account and noticed an exclamation mark (!) icon next to my points balance. I went to my Points Summary page and saw an alarming message that my 61,607 Citi ThankYou Points from my Citi AT&T Access More were set to expire the next day on January 20. 61,607 points is the exact number of points I earned on this credit card from December 2020 through January 2022. It said that the points were expiring because of an account closure, but I did not close my Citi AT&T Access More, I product changed it to a Citi Custom Cash.

I was worried, so I called the Citi ThankYou customer service department right away (1-800-842-6596). I explained the issue to the rep and they were as surprised as I was to see that message. After putting me on hold for 10 minutes to research the issue, the rep said that this is how the system processes product changes and how the system moves points from the old card to the new card. The rep assured me that after January 20, the process would be completed and no points would expire. The rep also reassured me that they added notes to these 2 accounts and for me to call back after January 20 if the points expired and that they could reinstate the expired points. I was hopefully optimistic and checked back a few days later.

Thankfully, after January 20, all was good with my points. No points expired and the expiring points notification was gone. Note to Citi: you should hide the expiring points notice from cardmembers so you do not freak them out.

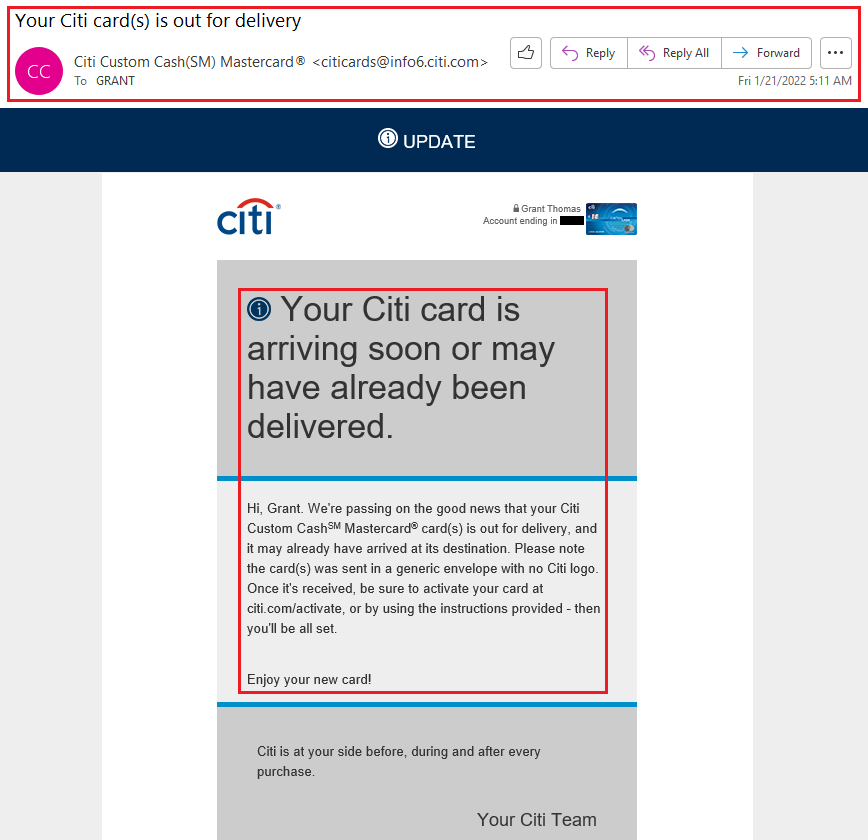

On January 21, I received an email from Citi stating my new Citi Custom Cash was in the mail and should arrive soon.

On January 22, my shiny new Citi Custom Cash arrived in the mail.

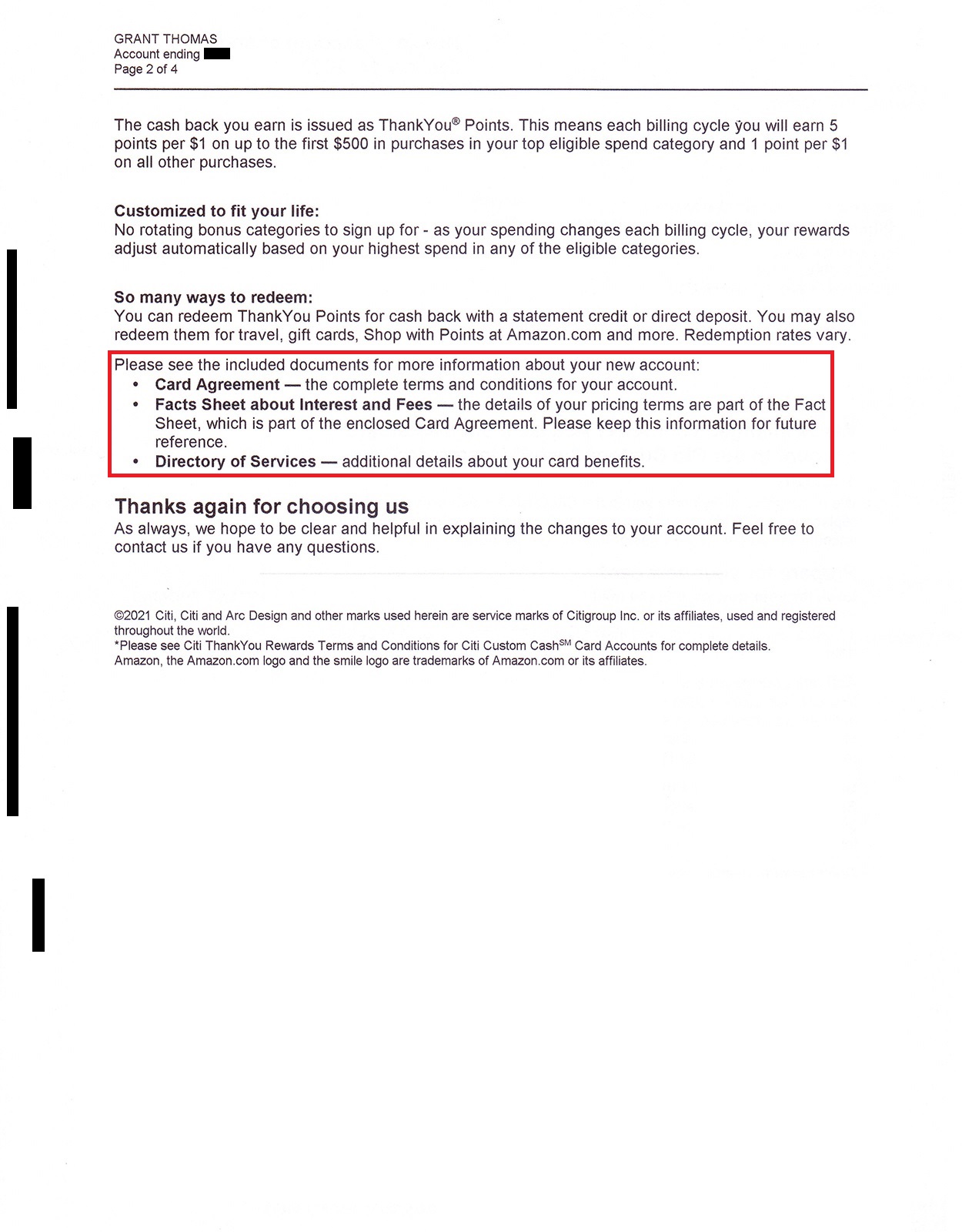

Here is the notice of account change letter that came in a separate letter on the same day. The letter says I should receive my card by February 11, which would be almost a month after originally calling into Citi to request the product change, but I am glad the card arrived much sooner than that.

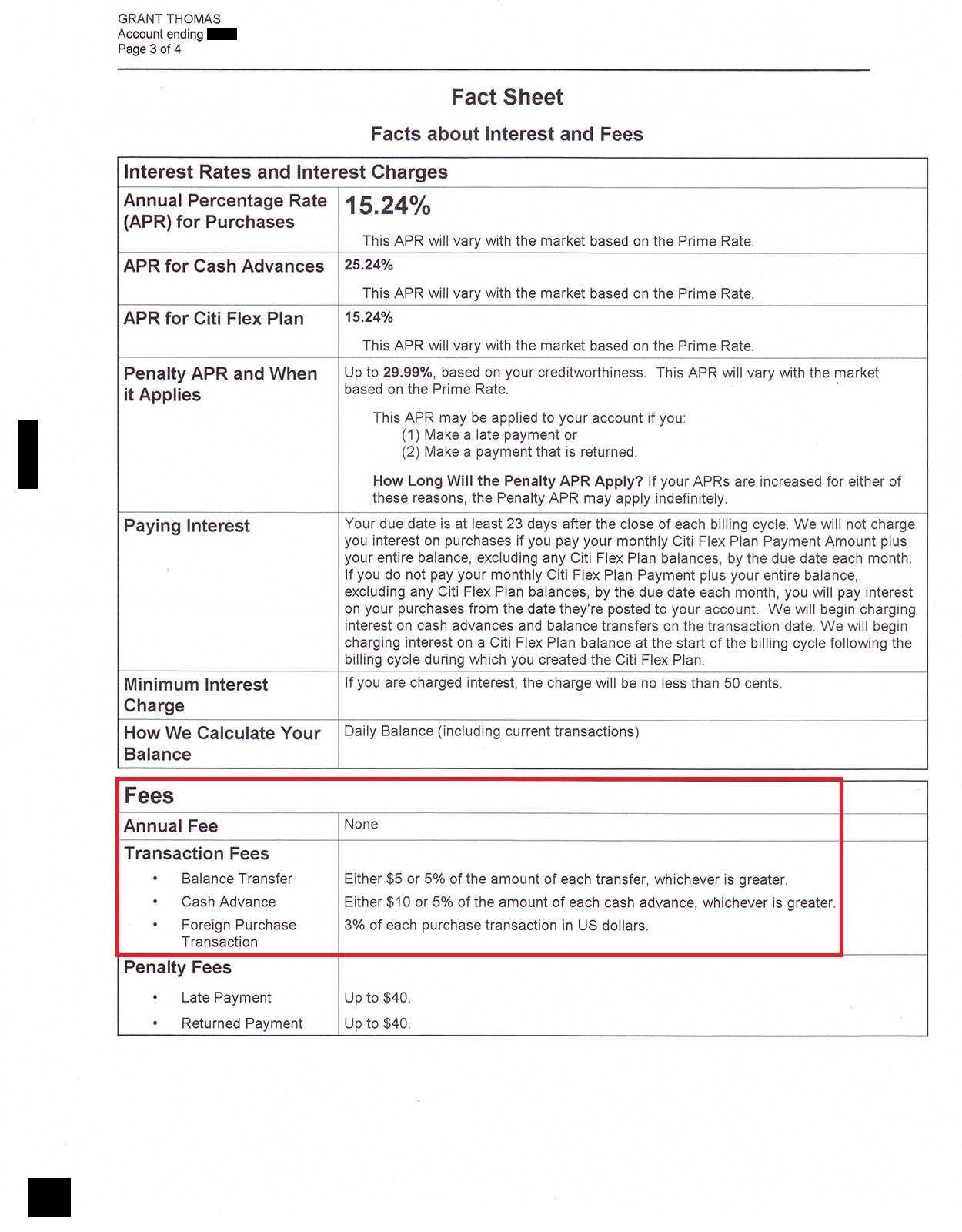

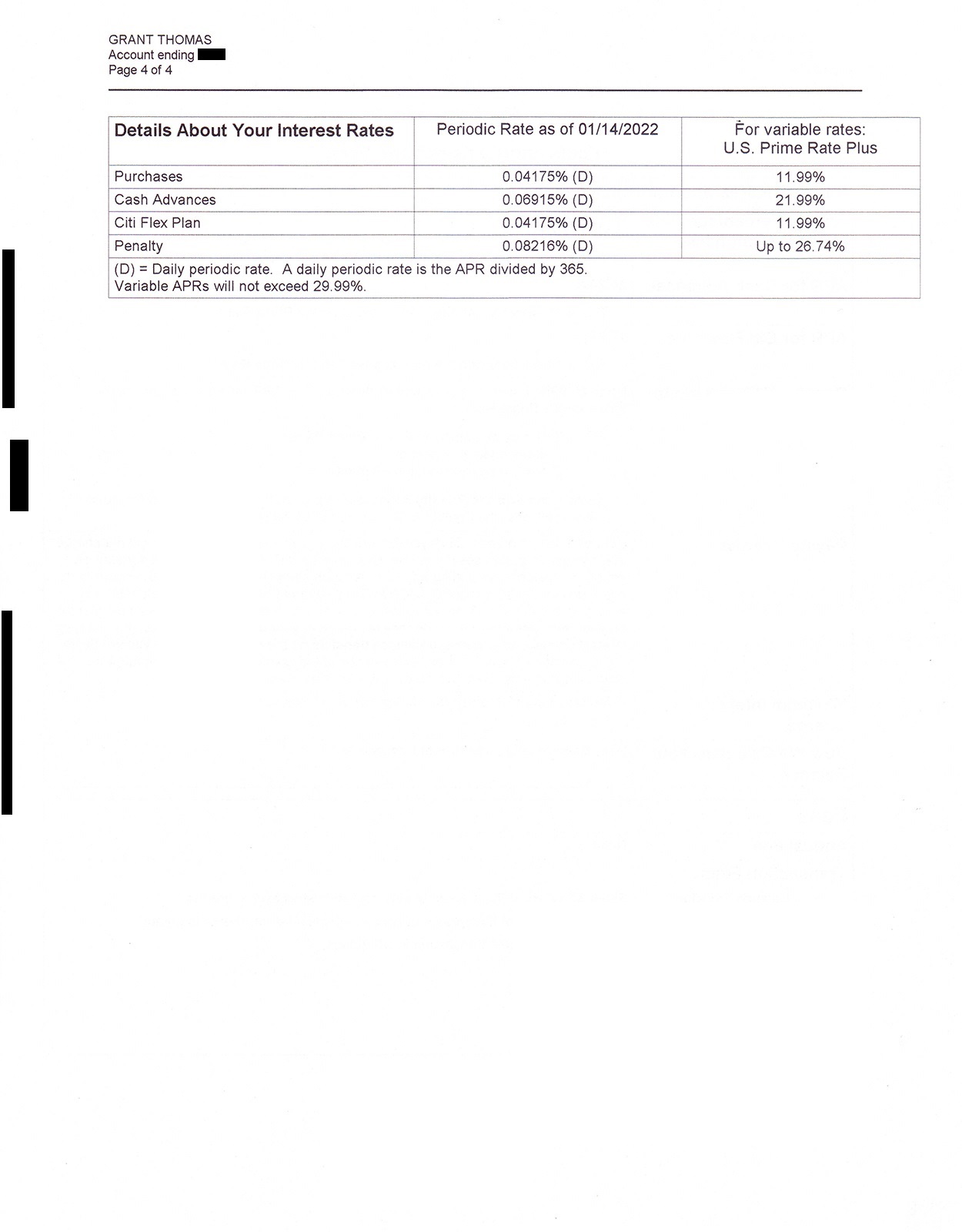

Here is the Fact Sheet with the APR and fees. The Citi Custom Cash has no annual fee but does change 3% foreign transaction fees.

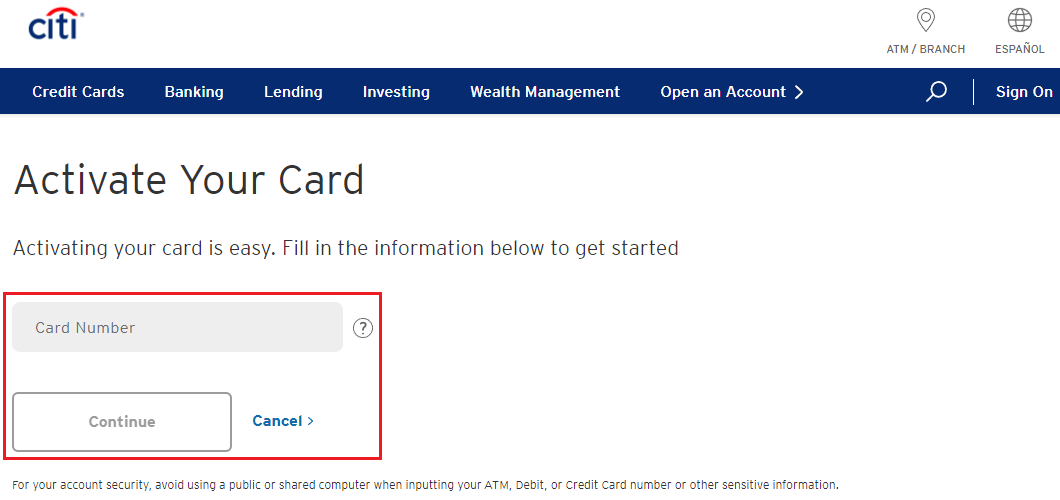

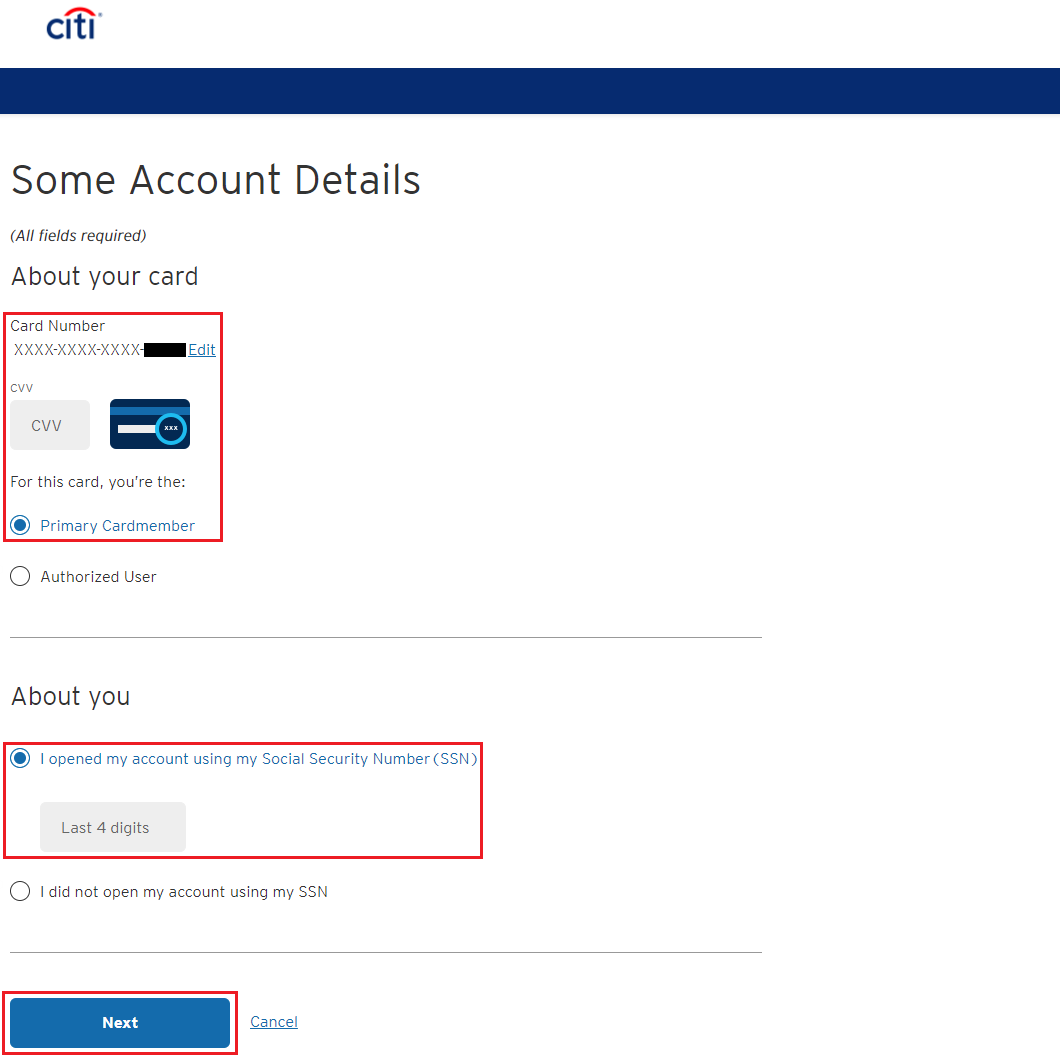

To activate your Citi Custom Cash online, go to the activation page, enter your 16 digit credit card number, and click the Continue button.

Then enter the credit card CVV number, the last 4 digits of your social security number, and click the Next button.

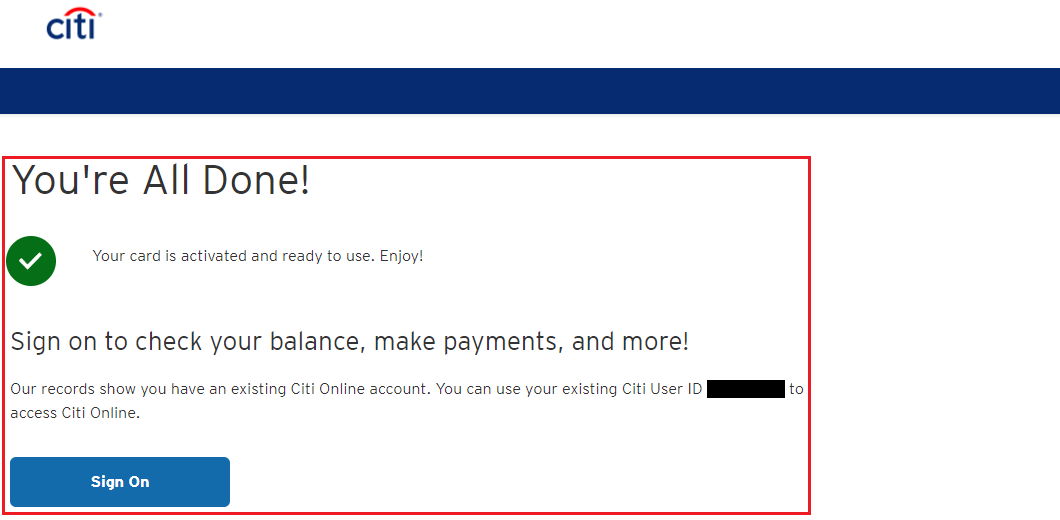

Congratulations, your new card is activated. If you have an existing Citi online account, you should see the new card the next time you sign in.

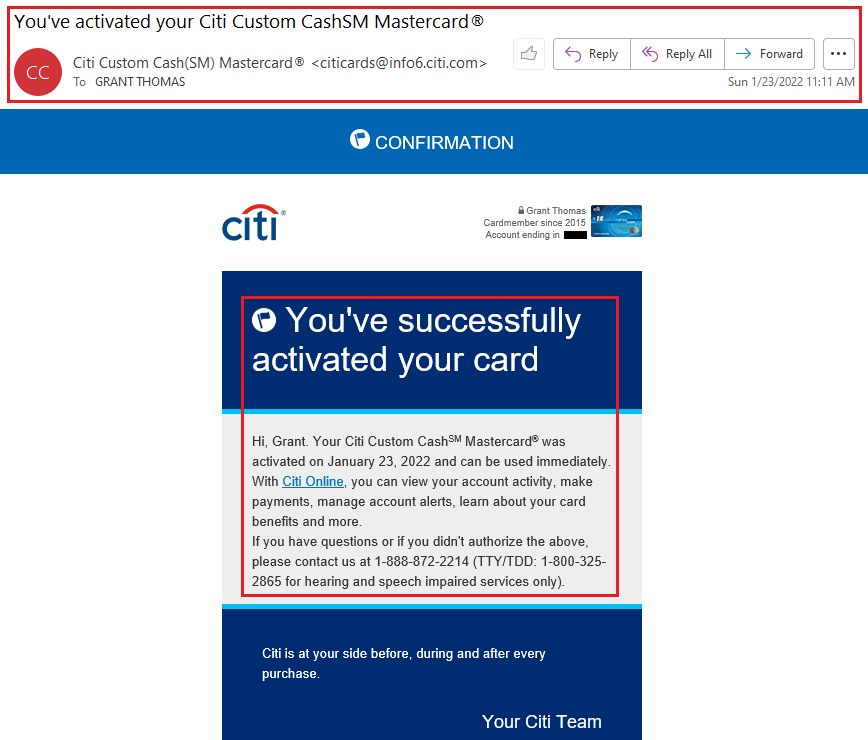

You will also receive a confirmation email after activating your card.

After signing into my Citi online account, I went to my Citi Custom Cash account. The $23.75 credit balance was backdated to April 5, 2021, when I originally paid the $95 annual fee on my Citi AT&T Access More. $23.75 / $95.00 = 25%, so I got a 25% refund on my annual fee which makes sense since I had the AT&T Access More for 75% of the year (9 out of 12 months). If you call within the first 30 days of when the annual fee posted, you can get a 100% refund. You can also use this trick if you paid an annual fee on any Citi credit card more than 30 days ago. If you call to close the card, you will most likely not get any refund on the annual fee. Instead, call to product change to a no annual fee Citi credit card, you should receive a prorated portion of the annual fee.

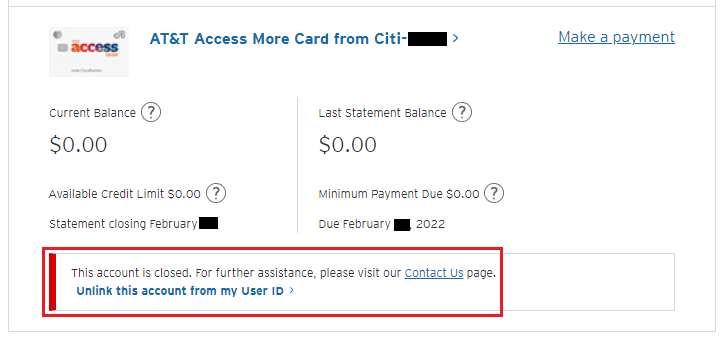

After I activated my Citi Custom Cash online, my Citi AT&T Access More account is now closed. To remove the closed account from your Citi online account, click the Unlink this account from my User ID link (the link only works if you are signed into your Citi online account).

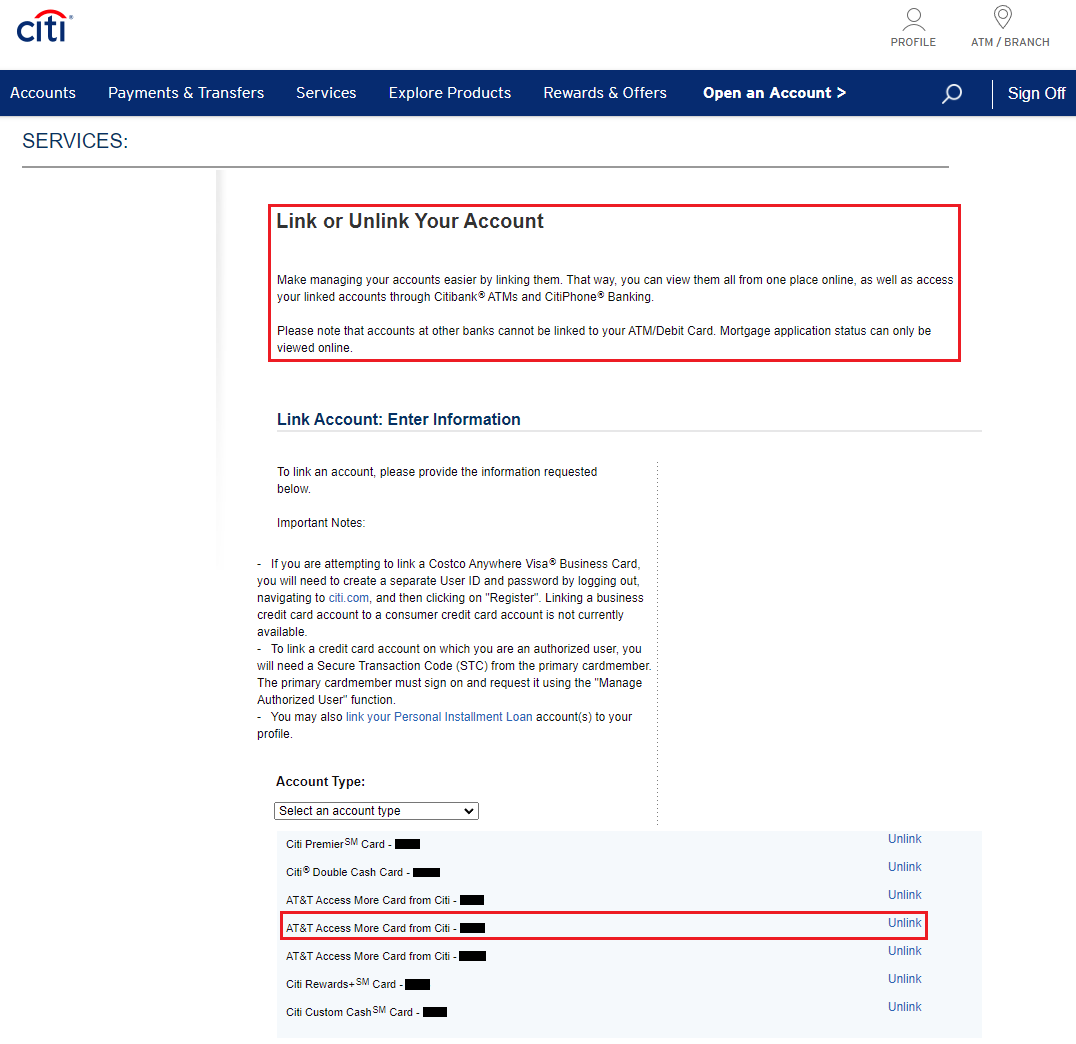

On this page, find the closed account from the list of accounts and carefully click the Unlink link for the correct account.

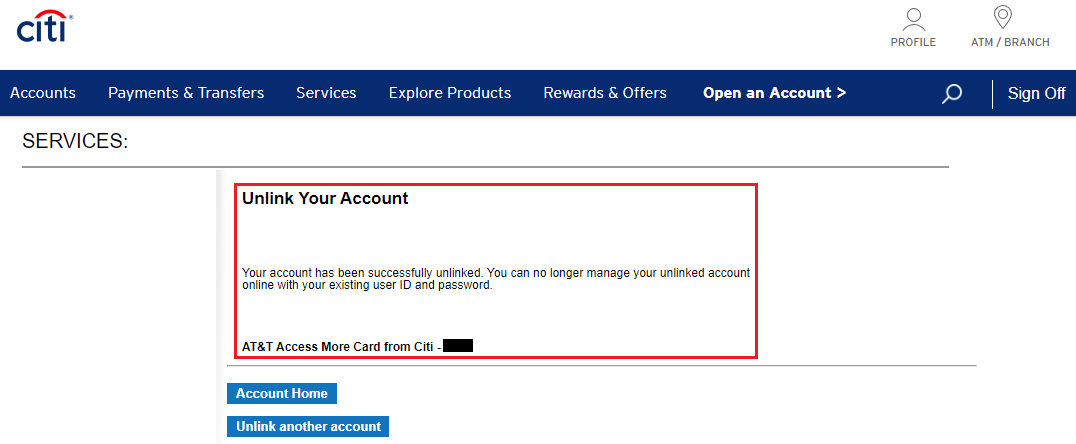

Congratulations, you have successfully unlinked the closed account from your Citi online account. You may need to sign off and sign back in to see the change in your Citi online account.

If you have any other questions about the Citi Custom Cash Credit Card, please leave a comment below. Have a great day everyone!

Pingback: Unboxing Citi Custom Cash Credit Card: Card Art, Welcome Letter, Directory of Services & Terms and Conditions Booklets

Did you ask the CSR whether or not the product change would generate a new card number prior to giving them the greenlight?

Hi HoKo, I did not ask the rep directly. The rep may have said “your card number may change blah blah blah” while reading the disclosures that I wasn’t paying super close attention to.

Ah gotcha, yeah I always ask them repeatedly to confirm because I want to avoid these annoying situations

That is a good idea :)

Pingback: Brainstorming New Credit Card Ideas for Citi – Check Out the Citi Adulting is Hard Rewards Credit Card

Do you have any idea on whether my special APR from my current card will transfer over to the upgraded Custom Cash card? I have 2 large purchases that have 0% APR until the end of Oct so I don’t want to lose that if I make the upgrade

Hi Nicole, I would check with the Citi rep during the call to see what will happen to your special APR if you complete the product change.

Pingback: Why I Converted my 3 Citi AT&T Access More Credit Cards to 3 Citi Custom Cash Cards