Good afternoon everyone. A few month ago, I wrote My Experience Product Changing / Converting / Downgrading to the Citi Custom Cash Credit Card. In that post, I shared my experience product changing from the Citi AT&T Access More Credit Card to the Citi Custom Cash Credit Card. At the beginning of this year, I had 3 Citi AT&T Access More cards but by mid June, I had converted them all to Citi Custom Cash cards. In this post, I will share why I loved the Citi AT&T Access More and why I stopped loving the cards over the years.

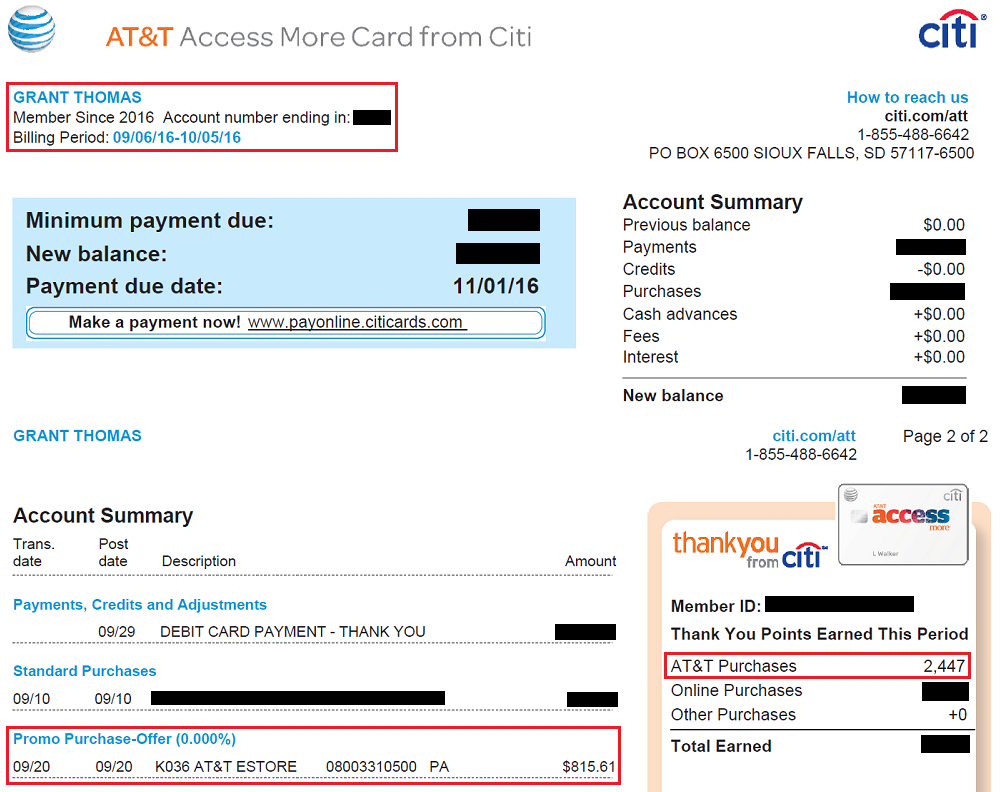

First things first, the Citi AT&T Access More is no longer available to new applicants and Citi recently stopped allow people to product change to this card. With that info out of the way, here is why I used to love this card. Instead of a traditional sign up bonus, this card offered a $650 statement credit after you purchased a new AT&T phone. On September 20, 2016, I purchased a new AT&T phone (I honestly can’t remember which phone it was, but that’s not important). This card earns 3x Citi ThankYou Points on AT&T purchases and online purchases; 1x on everything else.

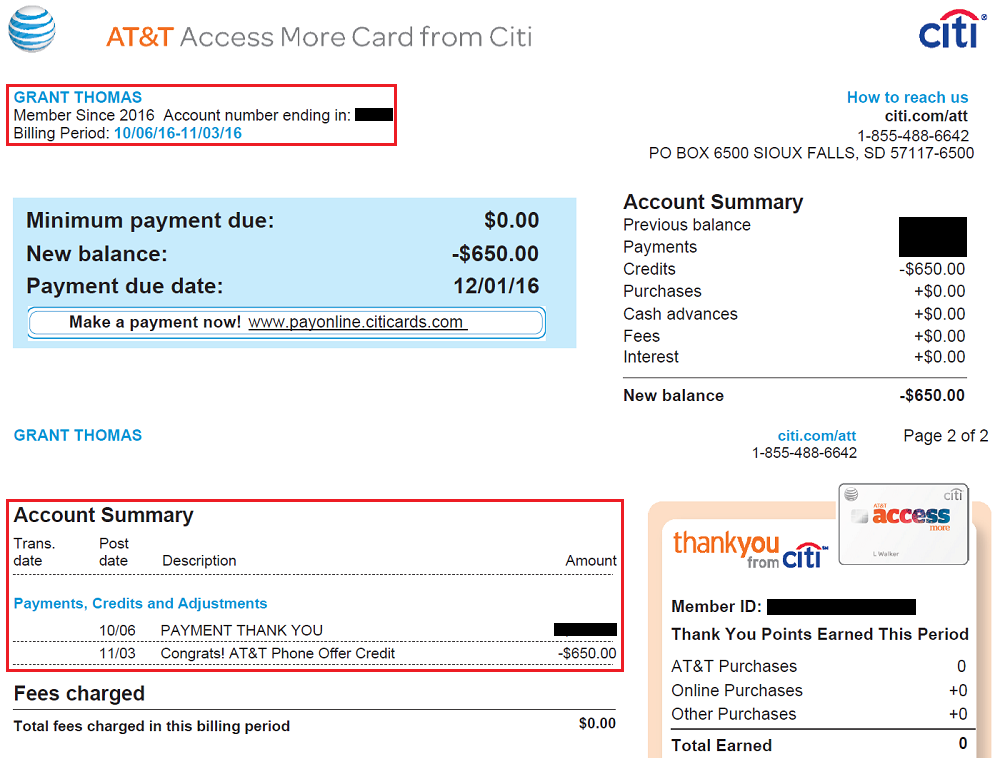

About a month and half later, on November 3, 2016, I received the $650 AT&T Phone Offer Credit.

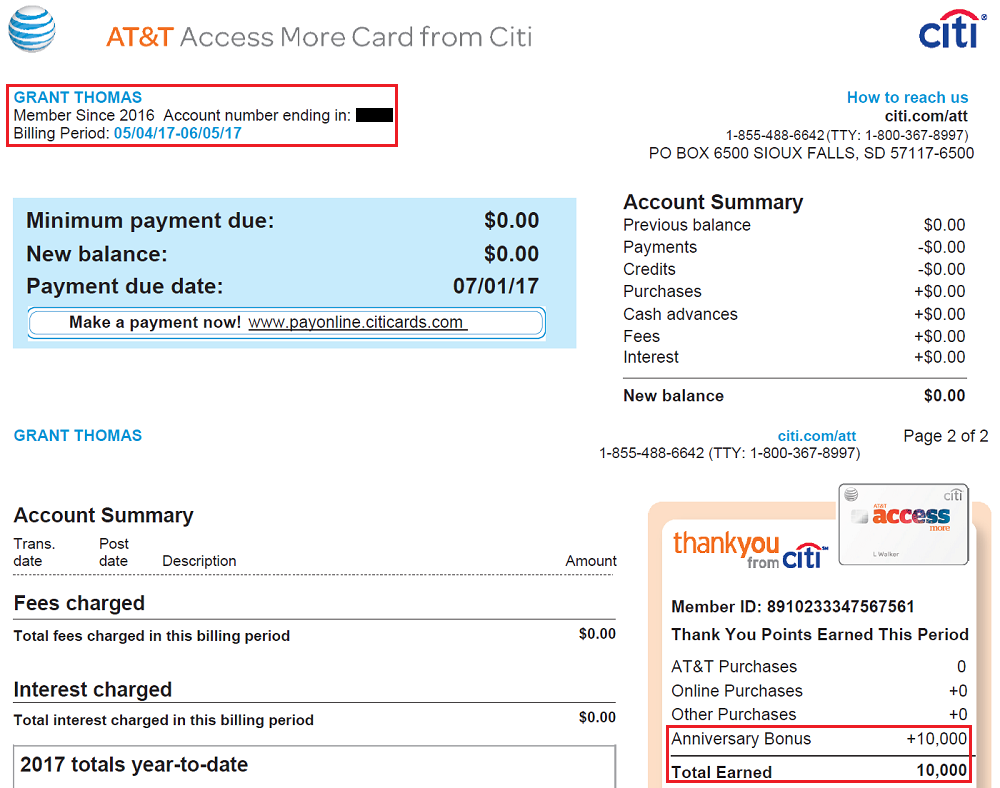

Every cardmember year when you spend at least $10,000 on this card, you would earn 10,000 Citi ThankYou Points as an anniversary bonus. This would usually post 1-2 months after your annual fee posted.

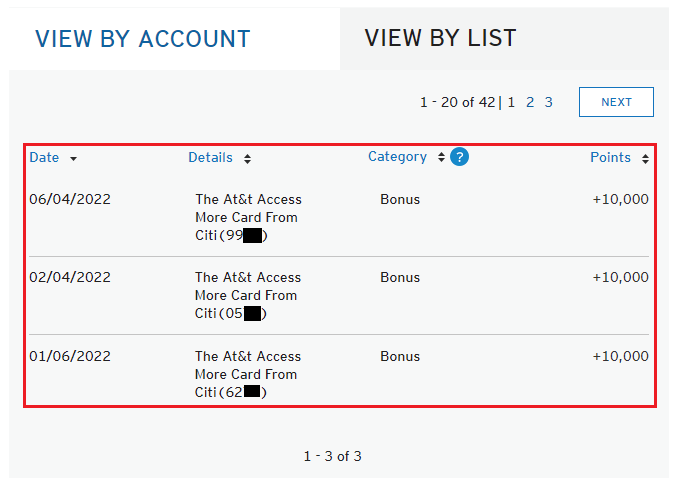

Like I said earlier, I had 3 Citi AT&T Access More cards and would make sure to spend at least $10,000 on each card to earn the 10,000 anniversary bonus points.

Unfortunately my love for these 3 cards has decreased over the years. Firstly, the 3x category of “online purchases” seemed to get more restrictive year after year to the point where you wouldn’t know if a specific online purchase would trigger the 3x category bonus. Secondly, Citi ThankYou Points decreased in value over the years with the loss of the Citi Prestige 1.6 CPP toward American Airlines tickets and the loss of the Citi Premier 1.25 CPP toward airline tickets. Points are now only worth 1 CPP toward gift cards, travel, statement credit, etc. and the only way to get more value is through Citi’s transfer partners. Lastly, these credit cards each have $95 annual fees and no other perks. By the end, I was spending $10,000 per cardmember year, earning mostly 1x, and paying a $95 annual fee in order to earn 10,000 points that are worth $100. The math just didn’t make sense. Enter the Citi Custom Cash cards.

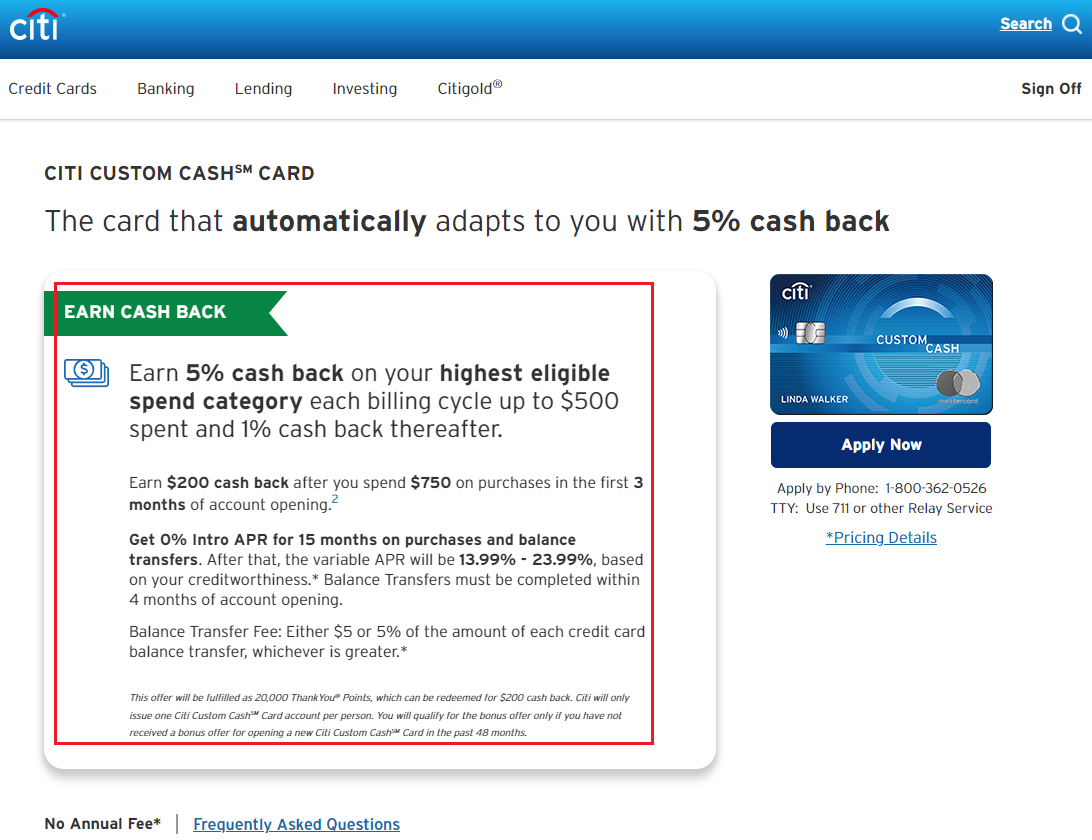

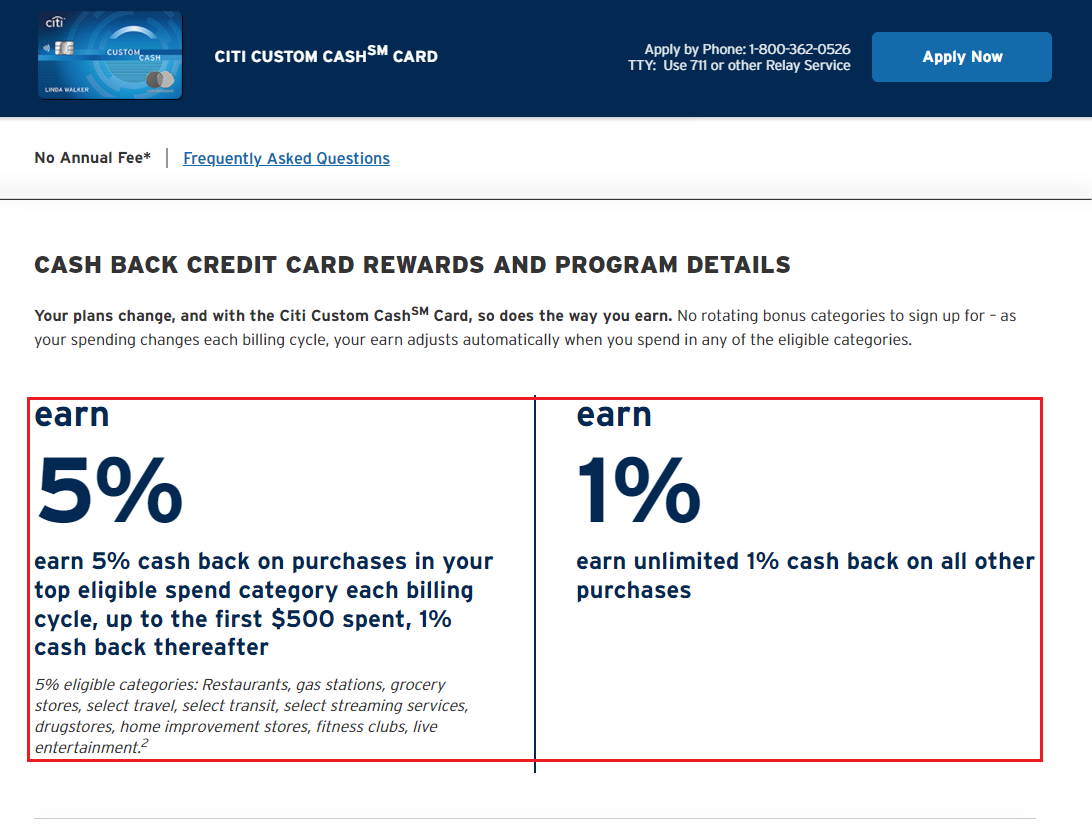

The Citi Custom Cash cards offer 5% cash back (in the form of Citi ThankYou Points) on the first $500 spent each month in a specific category and 1% cash back on everything else. The current sign up bonus is $200 cash back (actually 20,000 Citi ThankYou Points) after spending $750 in the first 3 months. Unfortunately, the sign up bonus is only available for new card members, not for product changes.

Since the Citi Custom Cash has no annual fee or large spending bonus, I can hold onto these cards and use them when it works best for me. For example, if I knew I had a large restaurant bill (say $1,500) coming up, I could charge $500 to each of the 3 cards and earn 5% cash back across all 3 cards. Likewise, if I had a large home improvement project or long distance road trip with lots of stops at gas stations, I could spend $500 on each card to max out the monthly bonus. I could also designate 1 card to be my grocery card, another card to be my restaurant card, and the last card to be my gas station card. The possibilities are endless.

If you have any questions about product changing to the Citi Custom Cash Credit Card or about the 5% cash back bonus categories, please leave a comment below. Have a great day everyone!

I still have my Access More card. It’s not the greatest earn, but I find it works decently well. I’ve sort of always found a pretty decent redemption eventually. For a period of time, they allowed TY pt transfers to AA so I maxed that out. Then the year before, they had the Jetblue bonus transfer so I did that. With the Citi Rewards+ card, that made that transfer 10% less and with the Jetblue plus cc that gave me another 10% back on the redemption side. I’ve been thinking about Sinagpore Airlines eventually so earning them via this way seems like a decent way.

Most of my online transactions seem to post as 3x so I can’t complain.

Hey Danny, thanks for sharing your experience with the ATTAM. I’m glad most of your purchases are earning 3x. The Citi Rewards+ 10% rebate is a great CC perk that everyone with TYPs should have.

Keep in mind that Singapore Airlines Miles expire after 3 years with no way to extend expiration date.

I had a good run with the More Access card. Best was when it paid out 3x on Plastiq and another merchant that sold Visa gift cards online (that could be used to pay off the Citi card). I guess I hit it too hard because my account got cancelled. Still have too many Singapore miles in my account than I can burn thanks to this card.

Hi Robert, bummer that your account got closed but enjoy your stockpile of Singapore Airlines Miles.

Can the Citi Premier be changed to the Custom Cash?

Hi Christian, yes, but you will lose the ability to transfer TYPs to transfer partners after you product change.

I completely understand why you changed and it’s for the same reason that I did a while ago. The 3x on the card was just to inconsistent and I got tired of babysitting the transactions trying to figure out what coded as 3x and what didn’t.

Most folks thought that I was crazy for changing the card as they wish they had the opportunity to get it, but if they knew just how few things coded properly, they’d understand my reason for changing.

Of the transferrable currencies that I have, TYPs don’t rank high enough on my list of care for me to want to spend any amount of time babysitting them or the coding process of how they’re earned so a product change was in order….and it’s one, to this day, I don’t regret.

Kudos to you Grant on riding yourself on the chance of earning a decent amount of TYPs for the guaranteed earnings of $900 across the 3 cards if you max out the $500 in spend each month.

I’m glad we both came to the same conclusion on the ATTAM. Did you convert to the Citi custom Cash CC?

I did indeed and don’t regret it at all. I had 2 ATTAM and PC’c both to Custom Cash and love the consistency of it. Both are way more profitable than the ATTAM cards were.

I’m still holding on to my Prestige card against my better judgement holding thinking they’ll one day do something to revive the card but it too may meet its fate.

Sounds like great minds think alike here. I’m glad you are enjoying your Citi Custom Cash CCs. Do you also have a Citi Premier? If not, would you convert your Citi Prestige to a Citi Premier? If it’s been 2+ years since you got a TYP CC, you should be eligible for another Citi Premier sign up bonus.

I do. My current Citi lineup is Custom Cash(2), Premier, Double Cash, Prestige, and AAdvantage MileUp. Thought about PCing one of my ATTAM to a Rewards+ and then the other to the Custom Cash but decided to just go with 2 Custom Cash cards in the end.

You can probably convert your AA MileUp or Citi Prestige to a Rewards+ I make sure to redeem 100k TYPs every year to max out the Rewards+ 10% rebate.

Interesting I have been thinking of making this move for the past few months. My ATTM has been rescued from the chopping block several times because I have found decently lucrative ways to use the online bonus earn but generally some combination of Citi nerfing online earn for the method and/or the method dying for other reasons (most recent method) kills it so when you average it out I’d probably be better just doing the Custom Cash and focusing my efforts elsewhere. During COVID I got a limited online bonus offer twice on my Prestige and it worked so many more places than the ATTM because of Citi nerfing so many vendors on the latter card. I also find the 3x earn highly variable to the effect that a lot of times I just one of my 2x cards unless I know I have had good luck with the vendor in the past.

Hi Philco, I felt the same as exact way. Instead of risking 3x with the ATTAM, I would go for the guaranteed 2x on DC or BBP.

Similar experiences with the Citi ATTAM… lots of places are online to me, but Citi thinks they’re not. Ebay purchases are inconsistent. Annoyingly the DirectTV (fka AT&T TV) only earns 1%, not 3%.

With BoA Preferred Awards, and Chase Sapphire reward options, Citi is often not the first card I reach for.

@CardShark I agree. Things were just too inconsistent for me to rely on the card and that was the major reason I got rid of it. When I have to start babysitting a card and I’ve giving it more of my time and it’s returning in value, then it has to go…and that’s the reason I cut ties with the ATTAM.

I 100% agree. You shouldn’t have to check every single purchase to make sure it posted correctly. At a certain point, the headache of that outweighs the card benefits.