Updated 12:00pm PT on 7/11/22: The prorated annual fee refund posted on my US Bank Altitude Go on 7/5 in the amount of $31.25. That represents a prorated amount of 5 months (5 / 12 x $75 = $31.25). I haven’t see the prorated annual fee refund on my new US Bank Business Triple Cash Rewards yet. I called US Bank and they said I should see the statement credit on my August statement.

Good afternoon everyone, I hope you had a great Father’s Day Weekend. 2 months ago, US Bank sent out letters to cardholders who had personal and business Radisson Rewards credit cards alerting them that their credit cards were going to be changing in June. A few days ago, we learned that Choice Hotels will acquire Radisson Americas for $675 million, which explains why US Bank is changing the credit cards.

My US Bank Radisson Rewards Premier Credit Card became the US Bank Altitude Go Credit Card and my US Bank Radisson Rewards Business Credit Card became the US Bank Triple Cash Rewards Business Credit Card. The new credit cards arrived over the weekend, so I wanted to share the card art, welcome letters, brochures, and activation process for both credit cards. First, a moment of silence for the retired personal and business Radisson Rewards credit cards…

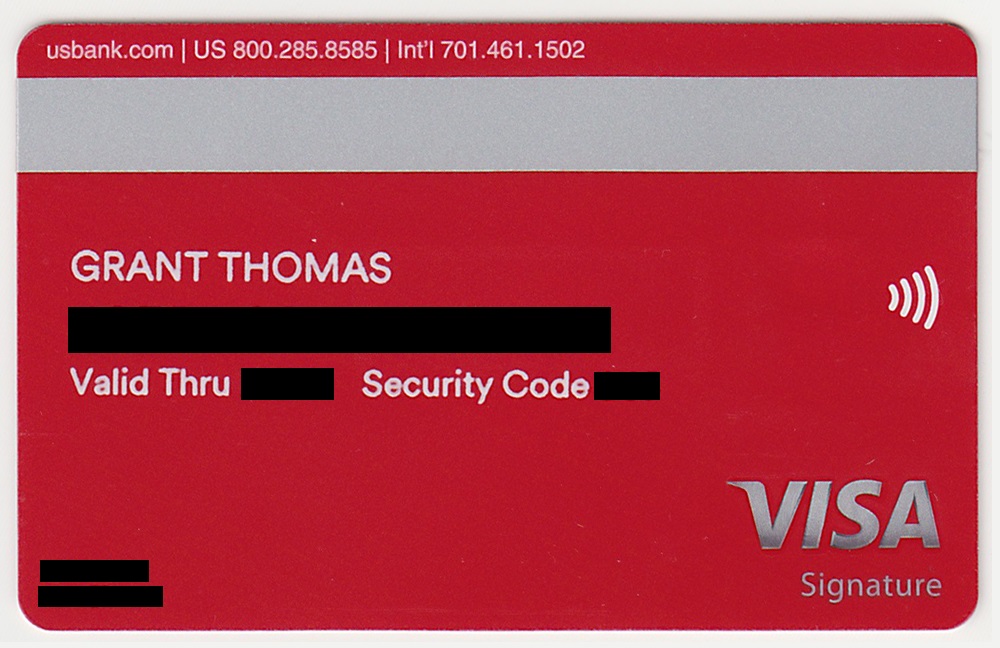

Here is the front and back of the US Bank Altitude Go. I’m not a fan of the vertical and horizontal text on the front of the card, but the rest of the card is very simple and clean.

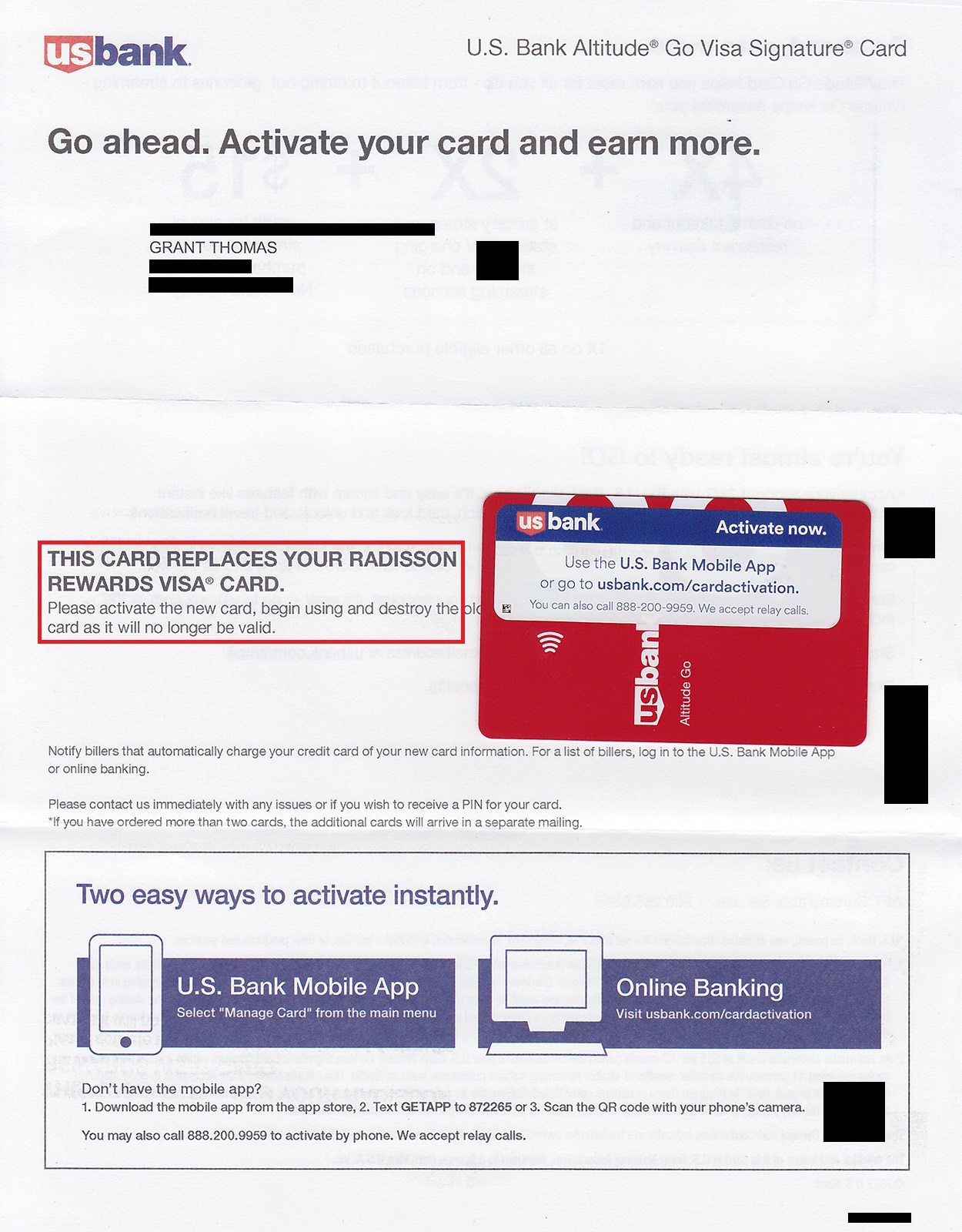

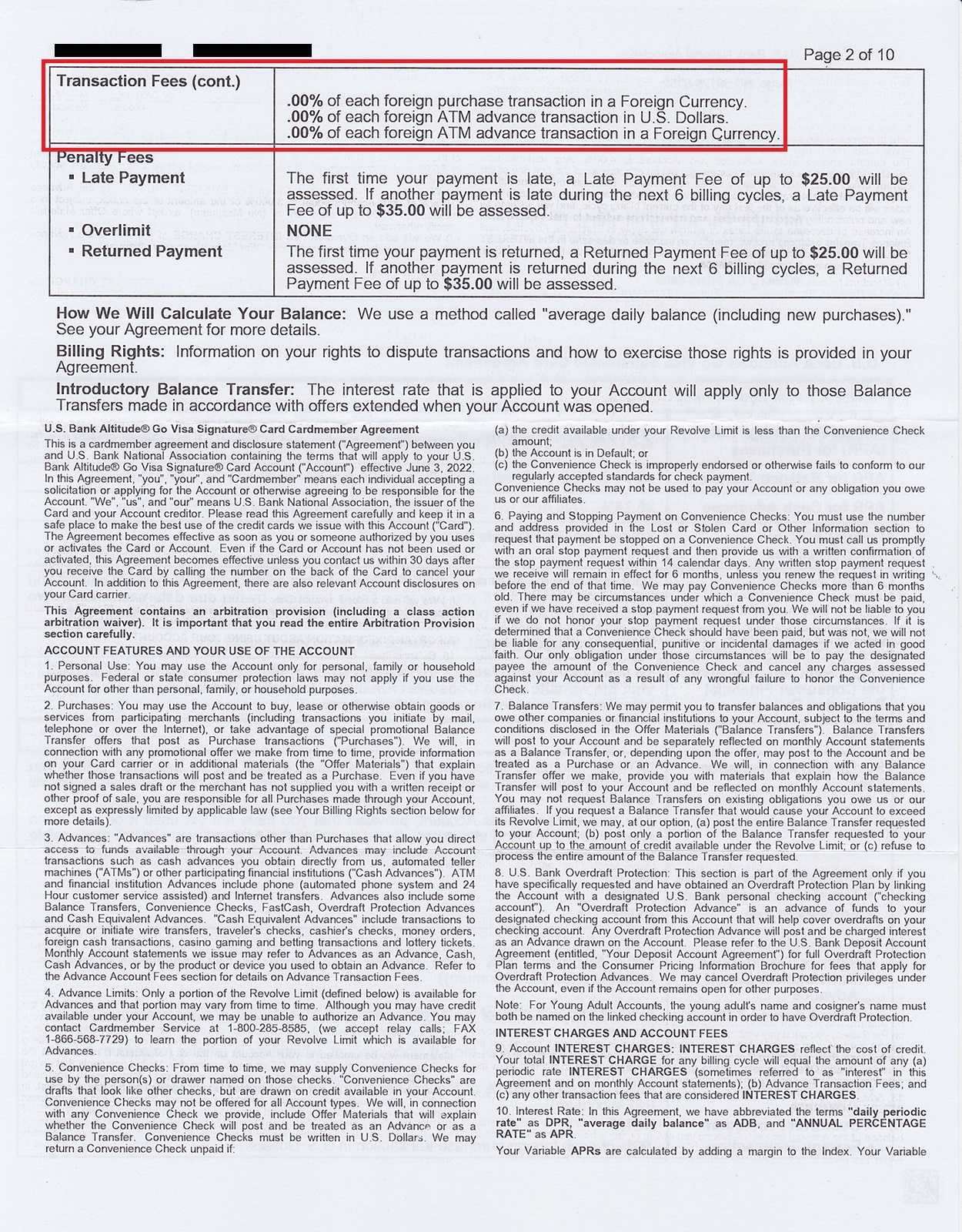

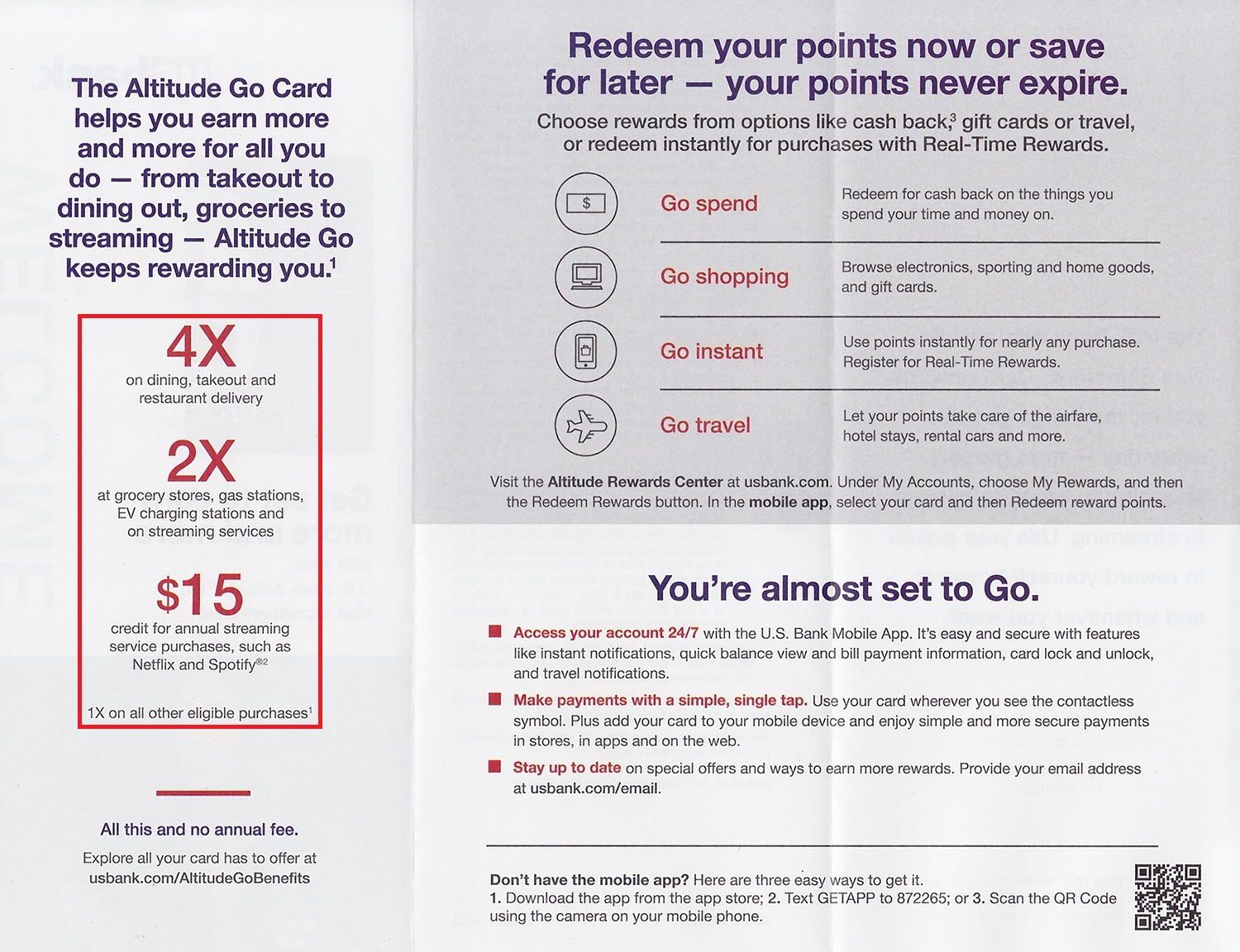

Here is the welcome letter that highlights the 4x and 2x categories and the $15 streaming service credit.

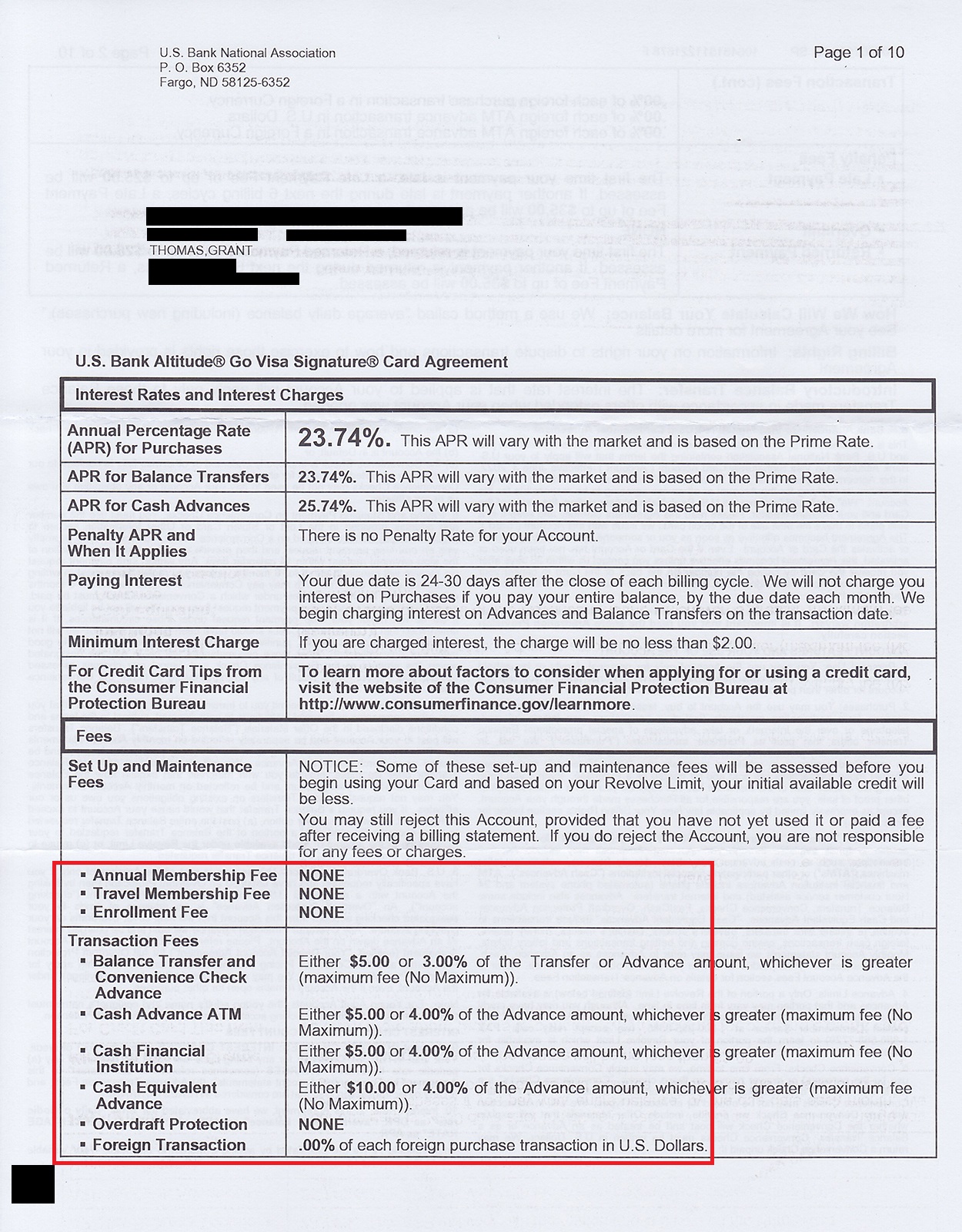

This credit card has no annual fee and no foreign transaction fees, which is great for a no annual fee credit card.

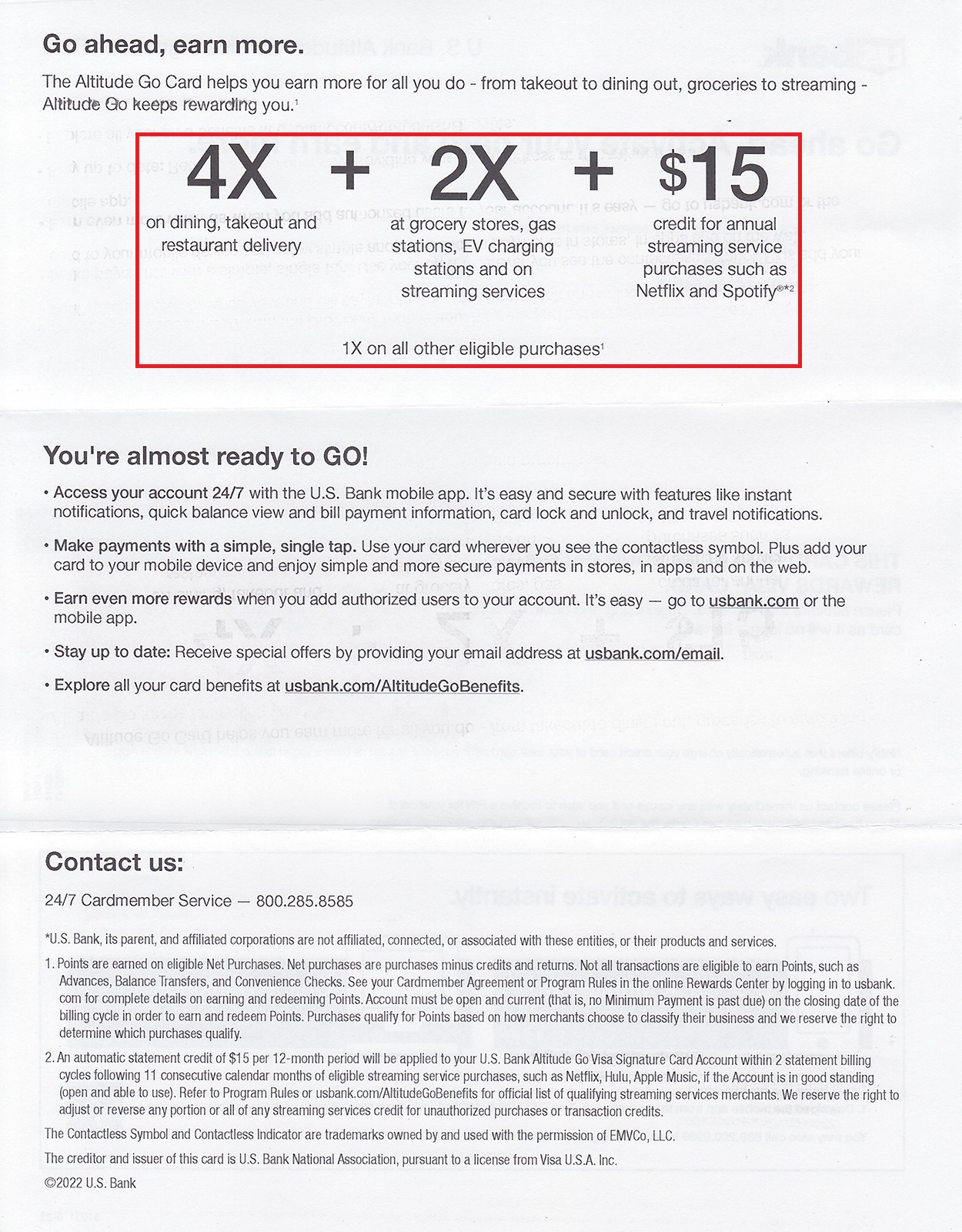

Here is the brochure that explains the bonus categories and $15 streaming credit.

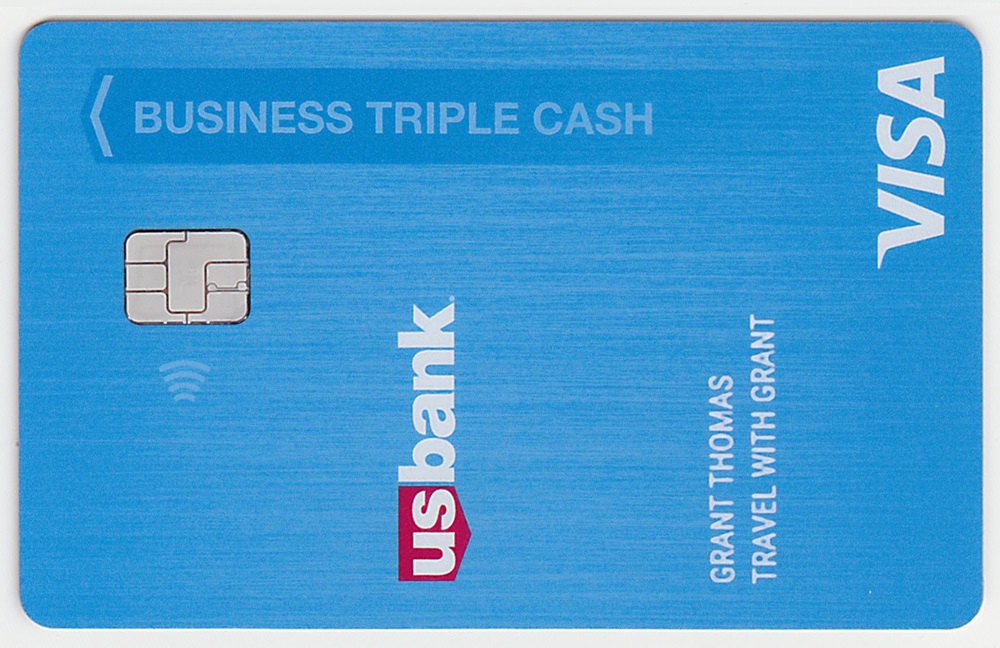

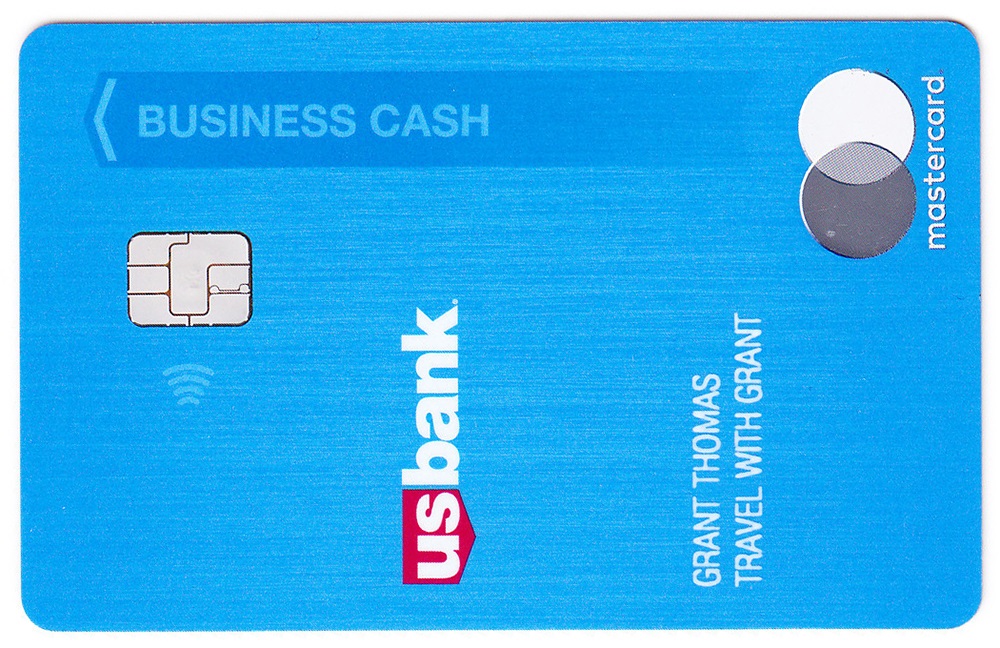

Up next, here is the front and back of the US Bank Business Triple Cash Rewards. Did I mention that I’m not a fan of the vertical and horizontal text on the front of the card? The back of the card seems like it is missing some information, but it is very simple and clean.

Fun fact, it looks like US Bank replaced the MasterCard version (on the right), with the new Visa version (on the left). As far as I can tell, the earning categories and redemption options are the same. Having both a Visa and MasterCard could come in handy, so I plan to keep both credit cards open.

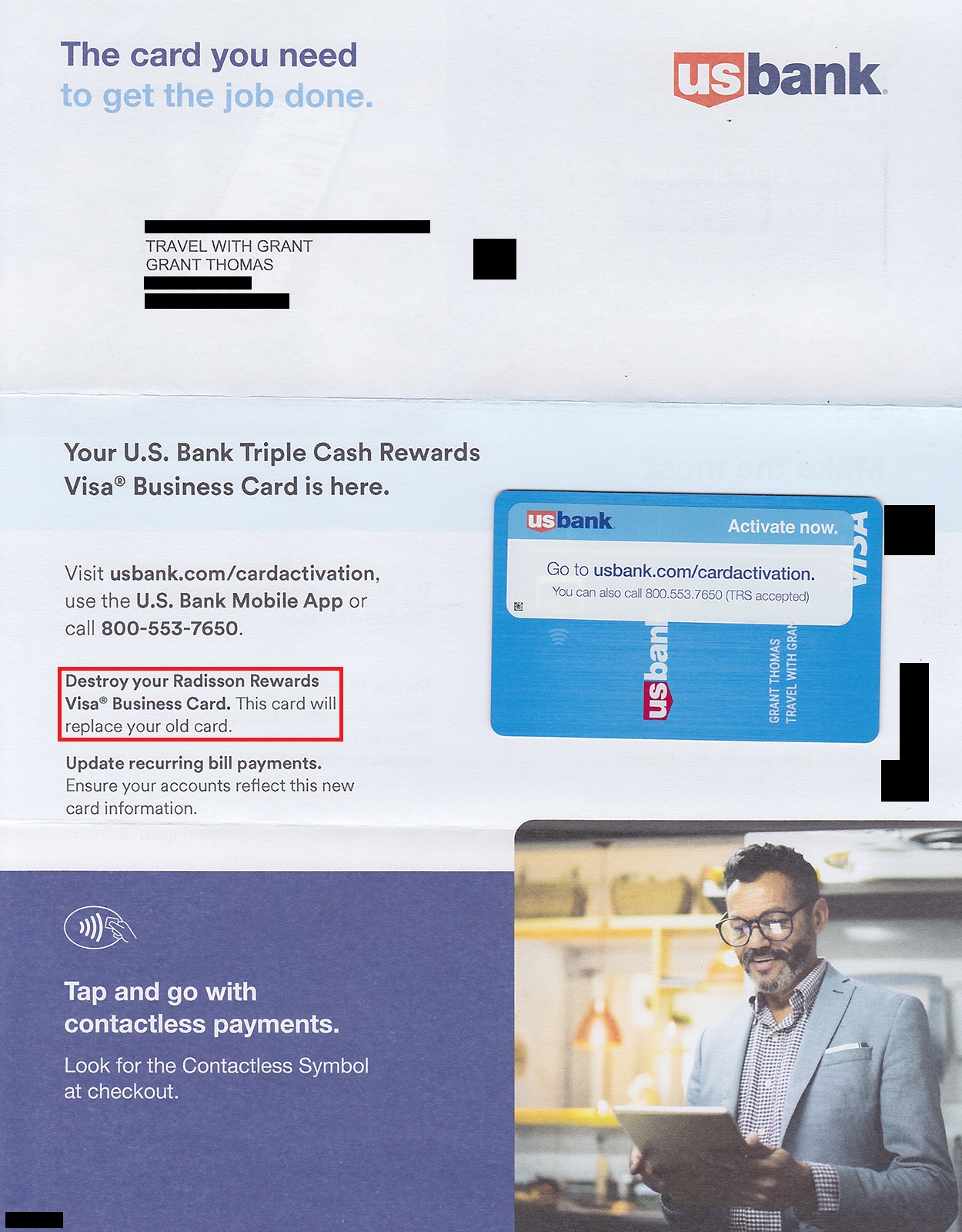

Here is the welcome letter. The thing that caught my attention was the “Destroy your Radisson Rewards Visa Business Card.” The language seemed harsh to me, I’m not sure why.

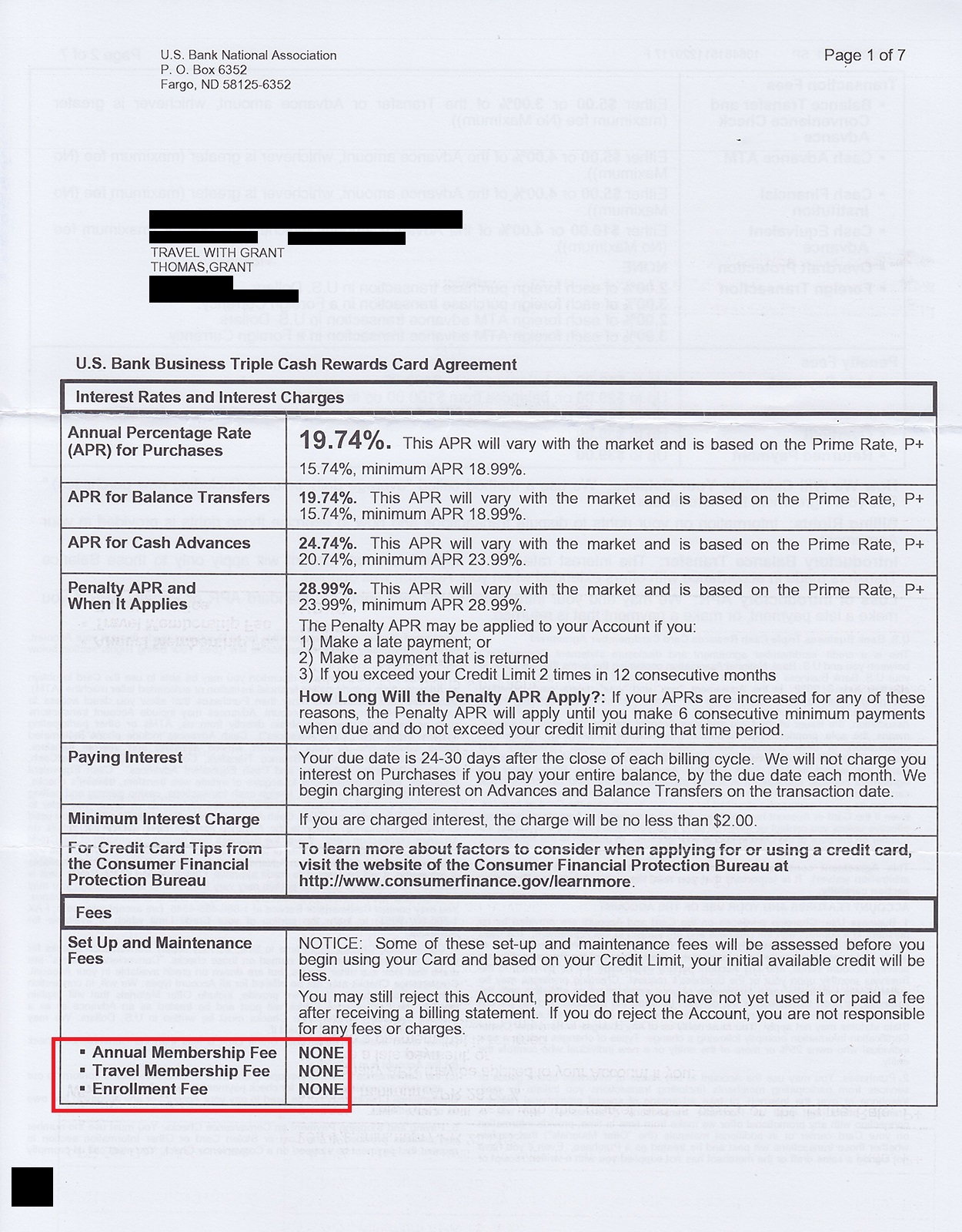

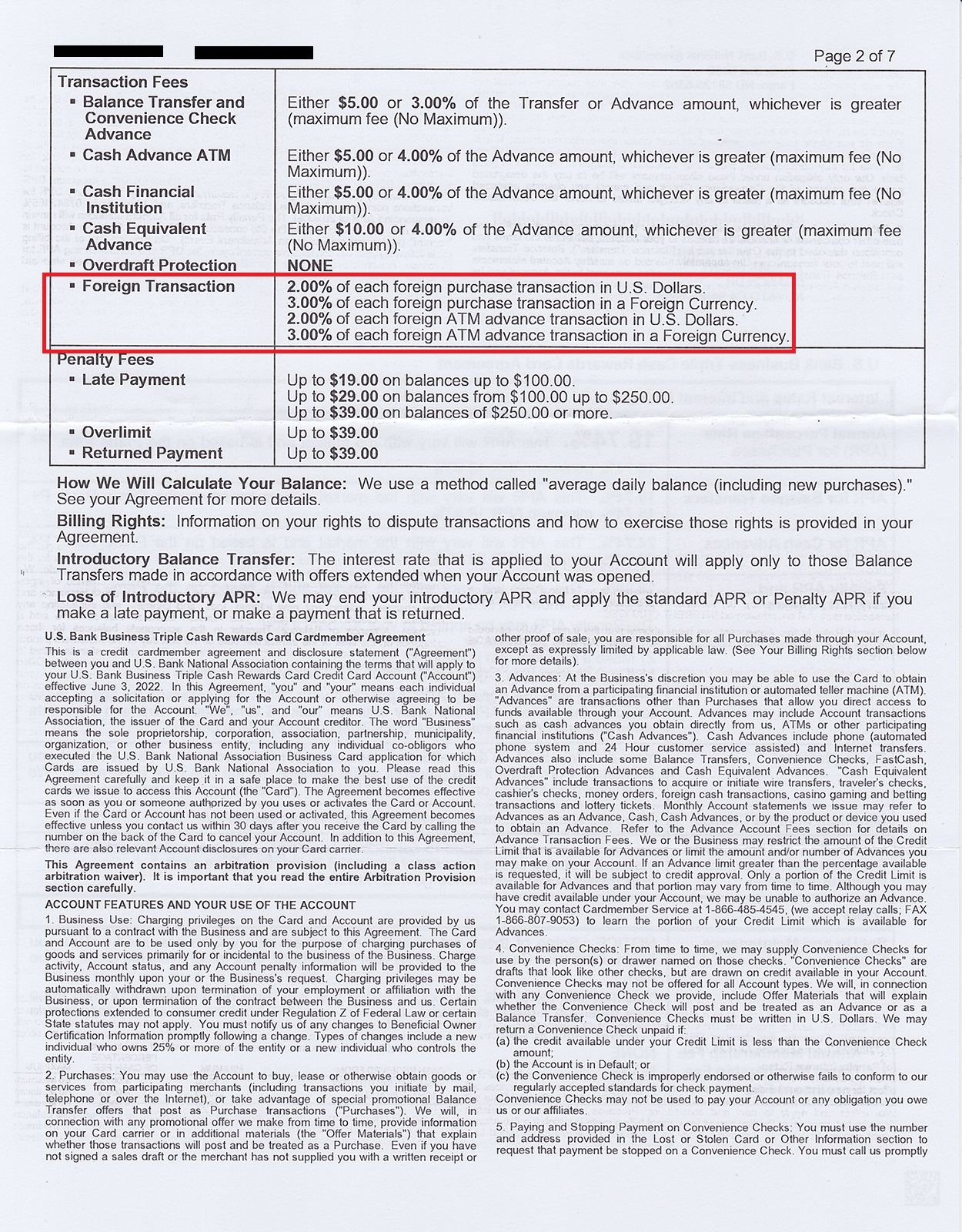

This credit card has no annual fee, but does charge a 2-3% foreign transaction fee.

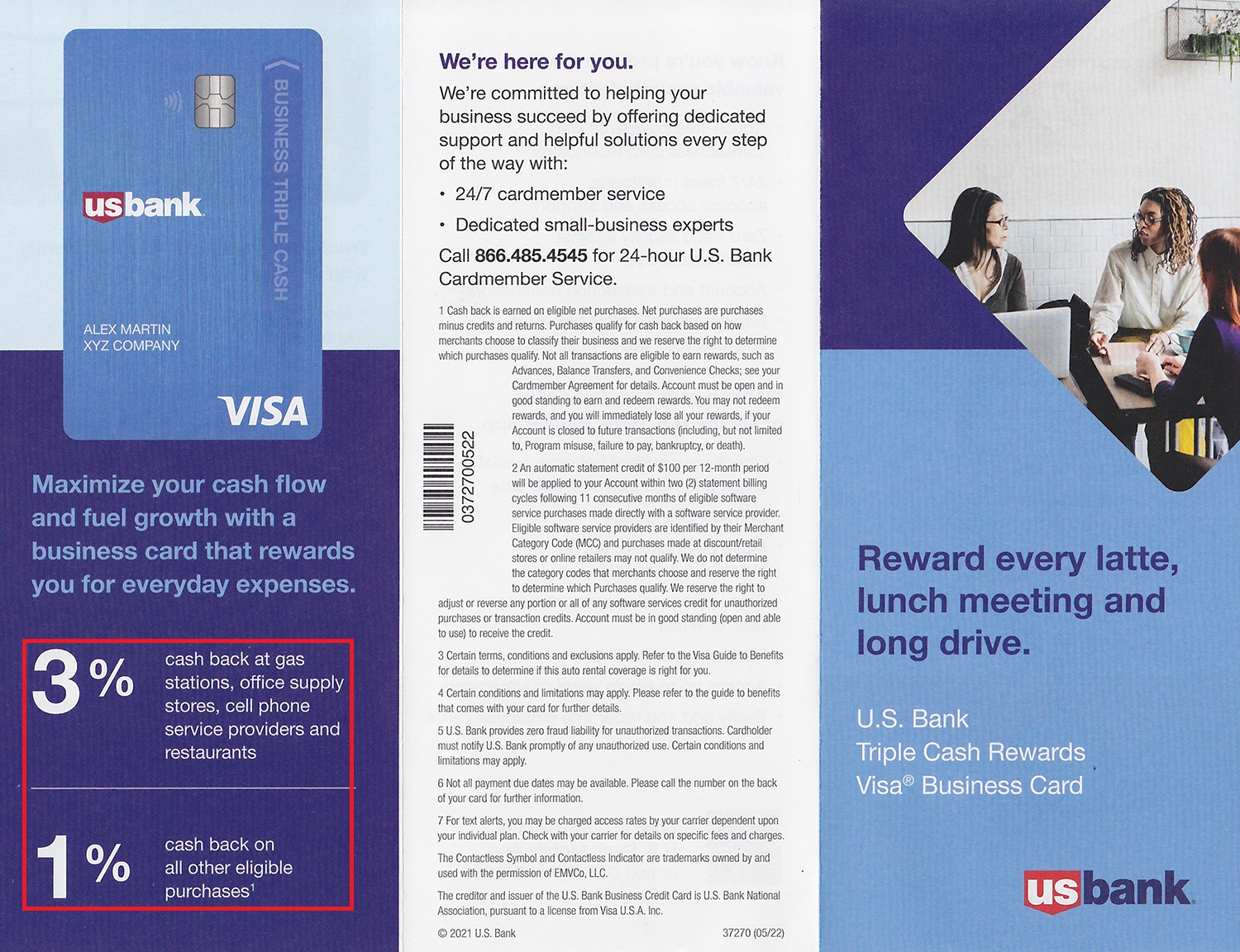

Here is the brochure that explains the 3% bonus categories and the $100 statement credit for certain software transactions.

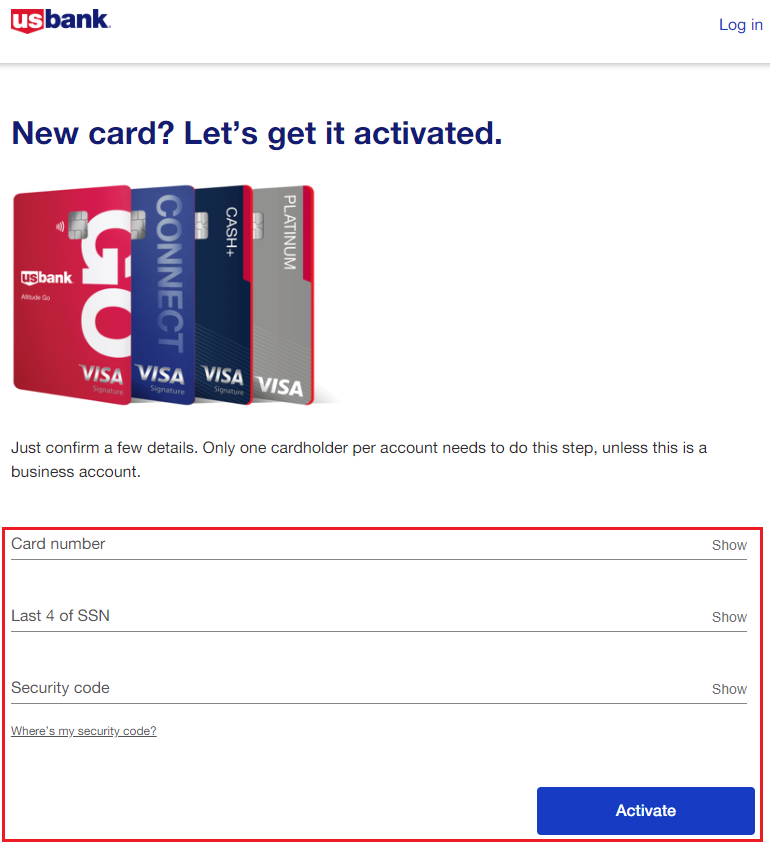

Activating both of the new credit cards was easy on the US Bank activation website.

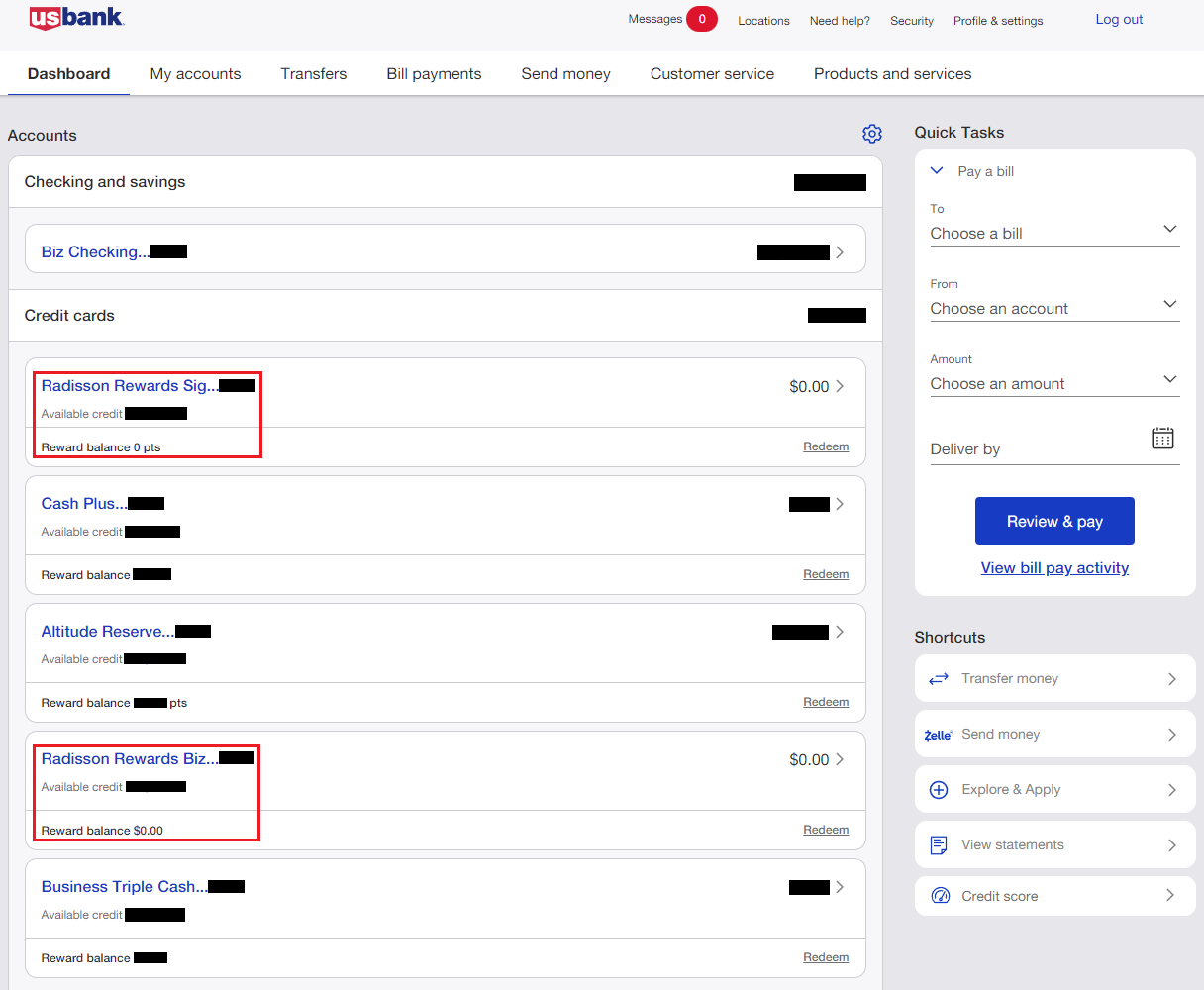

I then signed into my US Bank online account and saw the old credit card names were still listed.

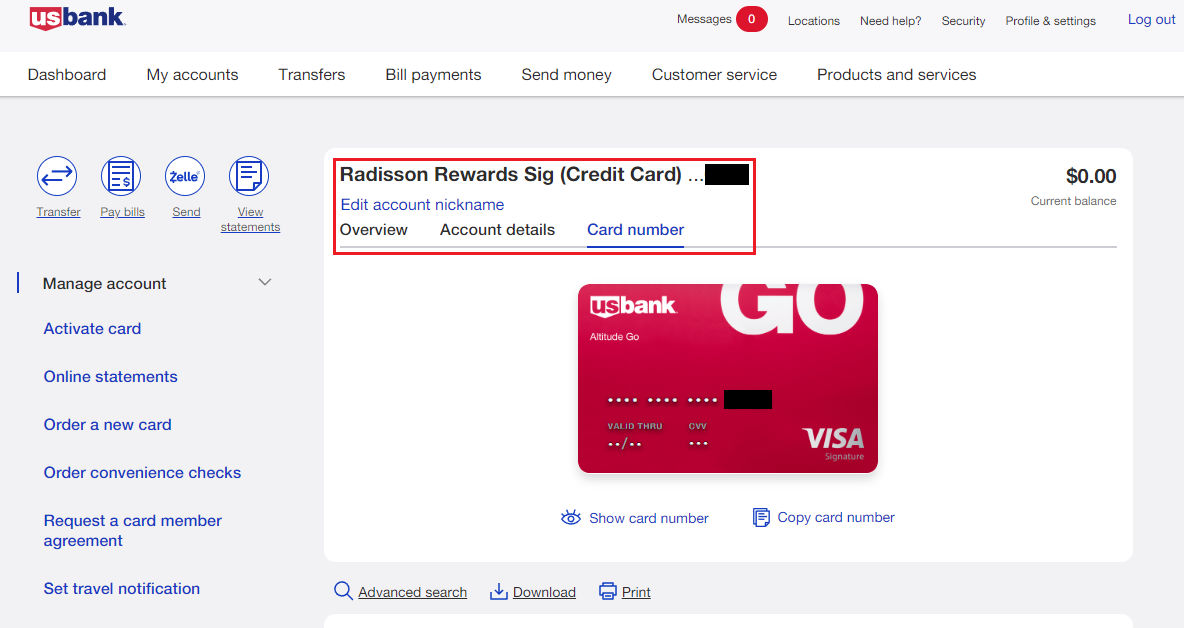

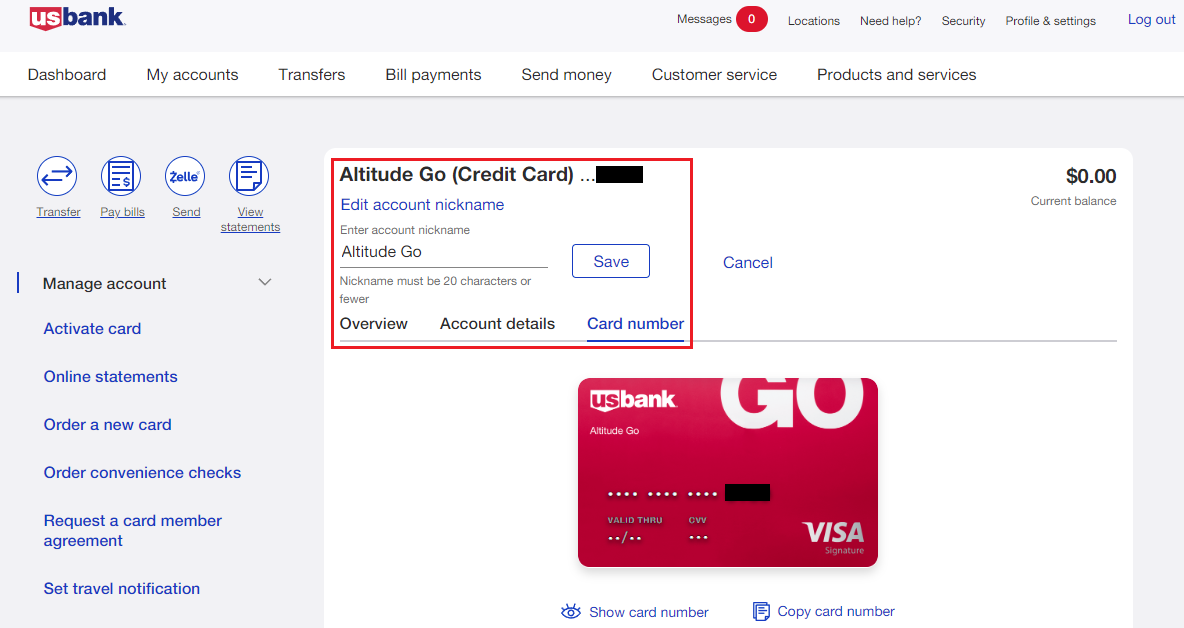

Clicking on the old Radisson Rewards credit card, I then clicked the Edit Account Nickname button and renamed the card to Altitude Go. The new card art shows up on the Card Number tab.

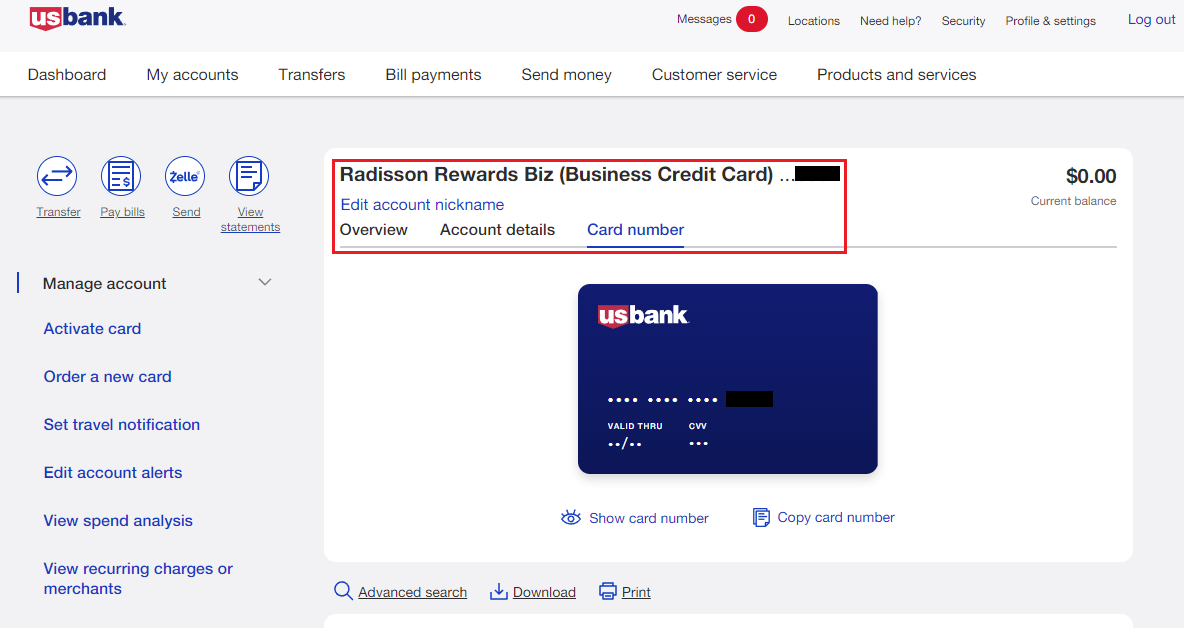

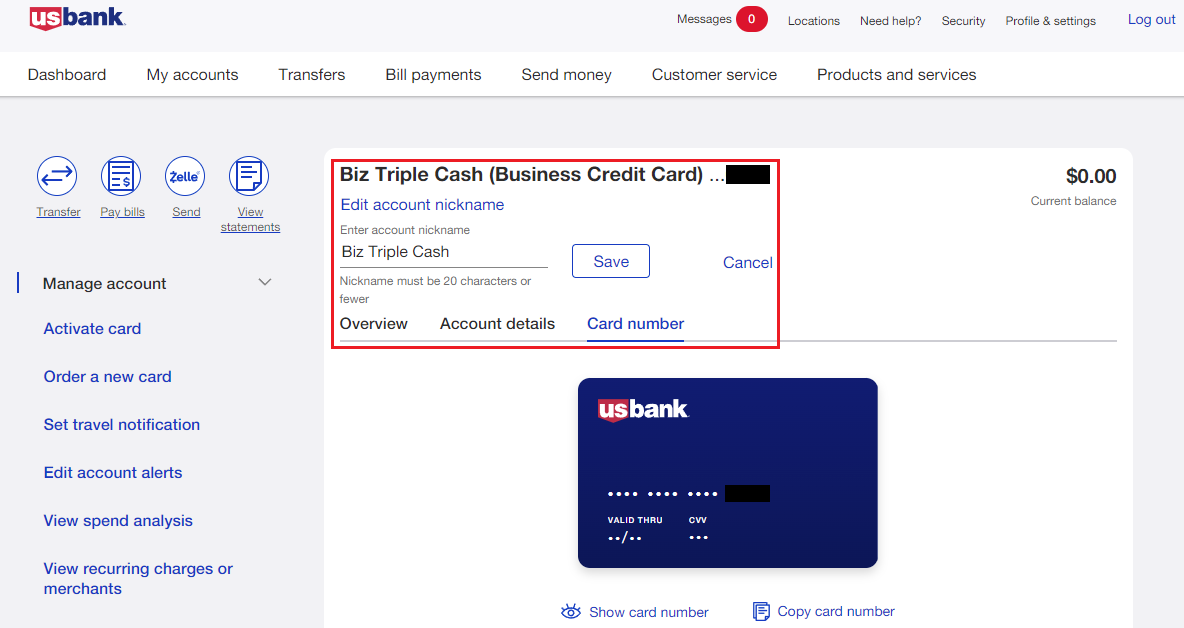

Clicking on the old Radisson Rewards Business credit card, I then clicked the Edit Account Nickname button and renamed the card to Biz Triple Cash. The new card art shows a generic card and sometimes shows the old Radisson Rewards Business card art.

Last but not least, US Bank stated in their previous letters that they would prorate the annual fee refunds for both credit cards. I haven’t seen those prorated annual fee refunds yet, but they should post soon. With that in mind, I would not recommend product changing or closing either of these credit cards until you receive your prorated annual fee refund first. If you have any questions about either of the US Bank Altitude Go Credit Card or US Bank Triple Cash Rewards Business Credit Card, please leave a comment below. Have a great day everyone!

@grant If I don’t activate the new cards I received, will I still get the prorated annual fee credit? I have no intention of using the new cards or getting involved with another award program. (I plan to concentrate on the other travel cards I already have.) How about you?

Hi Rick, that is a good question. If you want to gamble and see if the prorated annual fee refunds post without activating your new credit cards, you can go that route. If you want to play it safe, activate the new credit cards, wait for the prorated annual fee refunds to post, and then close those cards. See my upcoming post this afternoon on why the US Bank Altitude Go might be worth keeping open long term.

I did not activate my card and received the prorated annual fee refund on my statement cycle. I then called and closed the card. They will mail me a check for the refund.

Hi Jason, did the prorated annual fee refund post on your normal statement closing date? Thanks for sharing your data point :)

Pingback: Use US Bank Cash Plus Credit Card or Altitude Go to Pay for Streaming Services?

I’m in the same boat with these cards. The $15 streaming benefit is a joke because it’s 12 months service commitment on this card. That is is like a $1 a month. I’d rather have it hit my Amex or other cards. Sad.

I know it’s not the most practical streaming credit out there, but if you have a cheap streaming subscription, it’s a free $15.

I agree it’s a joke. They expect a lot of breakage on this benefit. Keeping track of which streaming service is on which card and making sure I keep it for 12 months is way too much trouble for $15. For example: we were paying for Apple TV, but then they announced family sharing, so I dropped mine and a family member added me. If I was 8 months in when this happened, I’d have lost the benefit.

Yes, I totally agree on the breakage aspect. From my understanding, it doesn’t have to be the same streaming service or amount every month, as long as there is at least one qualifying streaming service charge per month you would keep the streak alive.

Were these cards compelling enough to product change and forgo the signup bonuses on each? I plan on cancelling my Radissons (RIP) and maybe apply for these down the road.

Hi Piotter, if you currently have a personal or business Radisson Rewards credit card, your replacement card should already be in the mail or delivered to you. I’m not sure if it is too late to get the sign up bonus for either card, you would need to ask a US Bank rep. By allowing the product change, you are eligible for a prorated annual fee refund, which is why I left both of my cards complete the product change.

Interesting that the old Business Cash/Business Triple Cash was a World Elite mastercard whereas the Visa is just a Visa. No Signature/Signature Business.

Ya, that is interesting. Not sure when that card changed.

The old “Business Cash” card was a MC, yes. The new “Triple Cash” is offered on the website as a Visa. If you convert a card (e.g. Leverage, after the first year), you get the choice to PC to either MC or Visa.

That is good to know, thank you. From your point of view, is a MasterCard or Visa better?