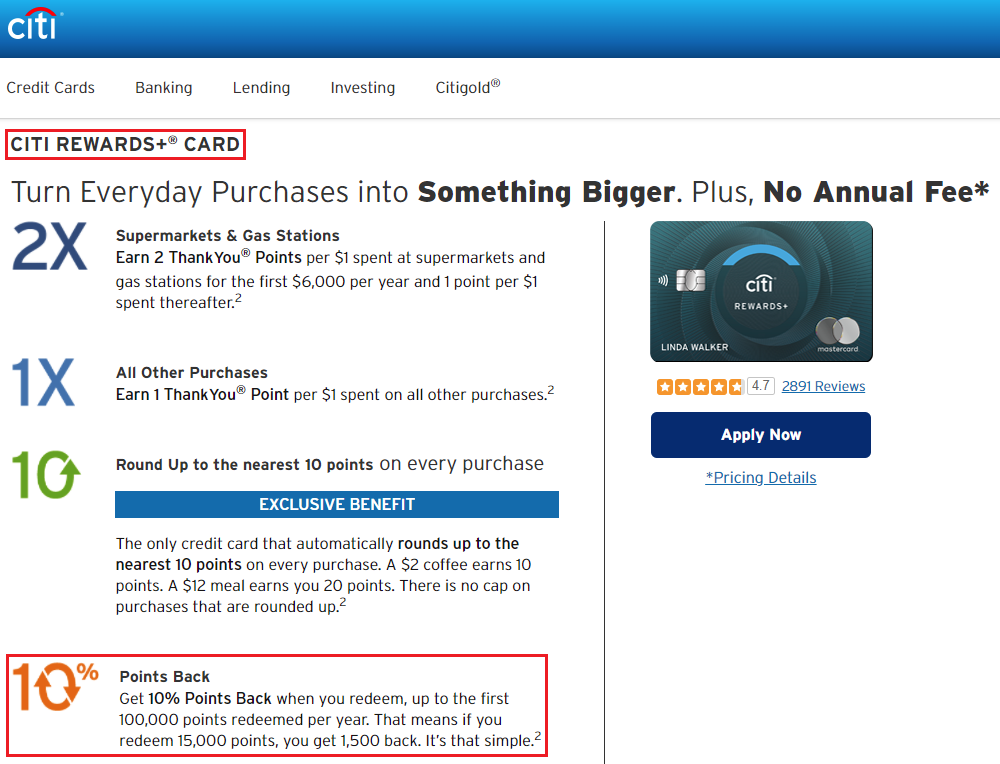

Good afternoon everyone, I hope you had a great weekend. I wrote a similar post in 2021 and thought I should publish a similar reminder post for 2022. One of my favorite sock drawer credit cards is the Citi Rewards+ Credit Card. This credit card has a pretty decent sign up bonus at the moment (20,000 Citi ThankYou Points after spending $1,500 in 3 months), but my favorite feature of this credit card is the 10% rebate on redeemed Citi ThankYou Points. You can receive up to 10,000 Citi ThankYou Points rebated each calendar year, you just need to redeem at least 100,000 Citi ThankYou Points in a calendar year.

So why am I reminding you about this today? The 10% rebate posts to your Citi ThankYou Points account when your statement closes. If your statement closes on or after January 1, that will count toward your calendar year 2023 10,000 Citi ThankYou Point limit. Therefore, you probably only have 1 or 2 more statements between now and December 31, 2022. I will show you how to calculate how many rebated Citi ThankYou Points you have already received this year.

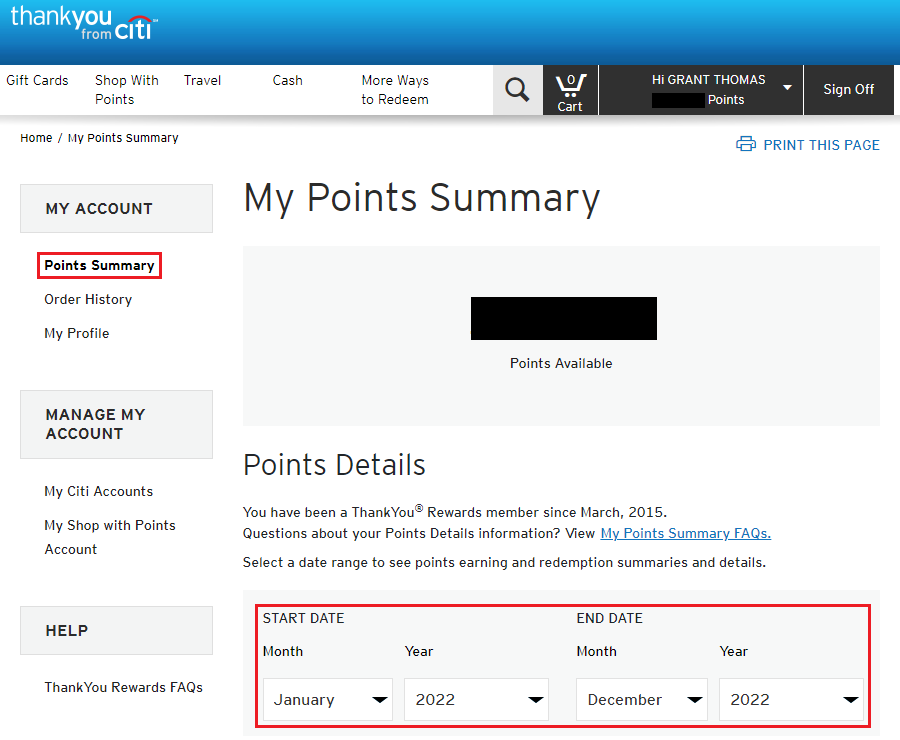

To get started, sign into your Citi ThankYou Points account and go to your Points Summary page. Then under the Points Details header, set the start date to January 2022 and the end date to December 2022.

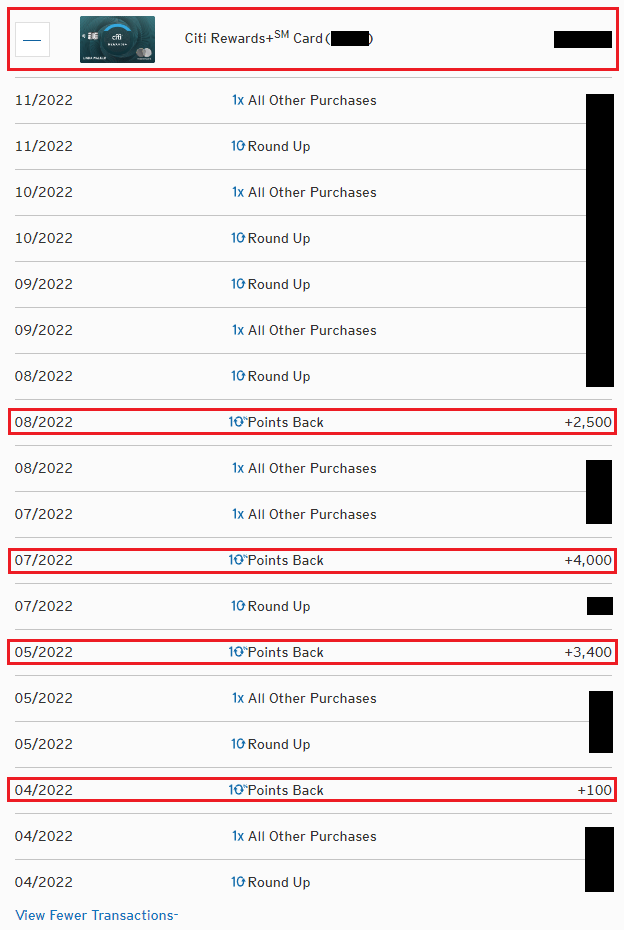

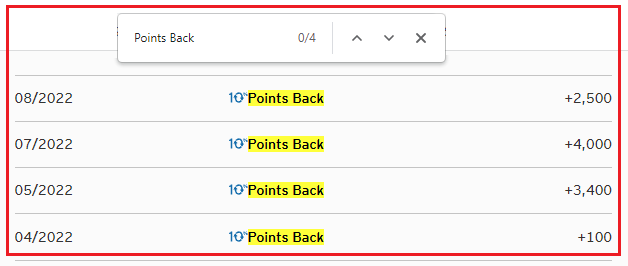

Scroll down until you see your Citi Rewards+ and click the ‘+’ symbol to show all your transactions. Then add up all the “10% Points Back” transactions to see how many rebated Citi ThankYou Points you have received. If you already maxed out this benefit, the numbers should add up to exactly 10,000 points.

If you need help, search for all references to “Points Back” and that will highlight your transactions. As you can see, I have 4 transactions that add up to 10,000 points, so I have maxed out this benefit for the year.

If you haven’t maxed out this benefit yet for 2022, you can redeem your Citi ThankYou Points for statement credits, gift cards, or transfer points to Citi’s transfer partners (if you have a Citi Premier or Citi Prestige). If you have any questions about the 10% rebate from the Citi Rewards+ Credit Card, please leave a comment below. Have a great day everyone!

This is such a great card. It’s unusual to get a card which essentially pays you to have it. No annual fee plus a rebate is a great deal.

It’s also nice having a small purchases card as they pop up.

With that being said, I’ve been thinking of converting this card to a Citi no fee AA mileup card so i can earn those loyalty points. Then switch back to the Rewards+ next year in October to take advantage of the 10% back for TY pts.

Hi Danny, yes, I totally agree with you. No annual fee plus 10K free Citi TYPs (worth $100) is a great day. I use it on my 99 cent and $2.99 Apple purchases since it works well with the 10 point roundup feature.

I think your strategy to product change to the Citi AA Mileup card and then product changing back to the Citi Rewards+ in October would be a good strategy.

In order to get the 10% back on points earned with a different Citi card, do I need to link the other Thankyou account to the Rewards+ account before I make the reempton?

Hi Joseph, if you have multiple Citi credit cards that earn ThankYou Points under the same Citi log in, your points should all pool together. If you are not sure, call Citi to request all your cards to be linked and points pooled together. Once that is done, you are all set to redeem points and earn the 10% rebate.

“The 10% rebate posts to your Citi ThankYou Points account when your statement closes. If your statement closes on or after January 1, that will count toward your calendar year 2023 10,000 Citi ThankYou Point limit.”

Well that stinks to not go by calendar year, but it’s very on brand for Citi to do something confusing.

For future reference, which statement date do you mean? I redeemed TYP for a statement credit to my Rewards+, but the points were earned from my checking account, my Premier, and my Rewards+, maybe even from a second Rewards+ card. They all have different statement dates, and one was even 12/9 meaning little chance of a Dec redemption counting for the same year.

Hi Nun, the date and the credit card or checking account where you earned the TYPs doesn’t matter, it only matters what date your Citi Rewards+ CC statement closes. The last statement that will count for the current year will close between December 1 and 31. Does that make sense? Do you know when your Citi Rewards+ CC statement closes?

Yes but I have 2 Rewards+ cards, so I’ll go by the earlier of the 2. Here I thought I was getting in my last 2022 redemption and shot myself in the foot. Oh well. Thanks

From what I’ve read online, there is no benefit to having 2 Rewards+ CC since you cannot double up on the 10,000 rebated ThankYou Points. You might want to look at converting one of those Rewards+ CC to a Double Cash CC or Custom Cash CC.

The 2nd R+ was due to a Premier card PC and Custom Cash didn’t exist then. Already have double cash but I will look into this. Thanks.

One reason I never considered the statement date is that the Dividend card goes by calendar year, making me think R+ does also, “You can earn 300 Dividend Dollars per calendar year. “

I used to have a Citi Dividend, but closed it for some reason. Wish I still had that card. The Citi Custom Cash could be a great addition to your Citi credit card line up :)

hi how are very informitive post

do i get the 10k rebate for just transeffering over the points without reedeming them or do i have to redeem the points to get the rebate??

You need to redeem the TYPs for a statement credit or gift card, or transfer them to a travel partner.

Pingback: Yearly Reminder: Max Out 10% Citi ThankYou Points Rebate on Citi Rewards+ Credit Card (10K Annual Limit)