Good afternoon everyone. A few weeks ago, I did a mini App-O-Rama and applied for 3 business credit cards. One of those cards was the Capital One Spark Cash Select Business Credit Card. That credit card currently has a sign up bonus of $500 cash back after spending $4,500 in 3 months. I applied for this credit card and was instantly approved. The only problem… my credit limit was exactly $5,000 and I needed to make a $5,000+ charge. Before continuing, please read my post from this morning: My Positive Experience Moving / Reallocating Credit Limits / Prepaying Bill with Bank of America Business Credit Card.

A few weeks prior, I closed an old Capital One Spark Miles Business Credit Card (that had a $10,000 credit limit), so I decided to call Capital One and see if they could increase the $5,000 credit limit on my new credit card. Unfortunately, since my new account “is too new,” the rep wasn’t able to process a credit limit increase. I also asked if it was possible to move some of the $20,000 credit limit on my Capital One Venture X Credit Card, but I was told that Capital One cannot move credit limits from personal to business, or vice versa. Believe it or not, the rep suggested that I try to make the purchase that was over $5,000 and see if it would go through. Here is the letter I received from Capital One a few days later explaining why my credit limit increase was rejected.

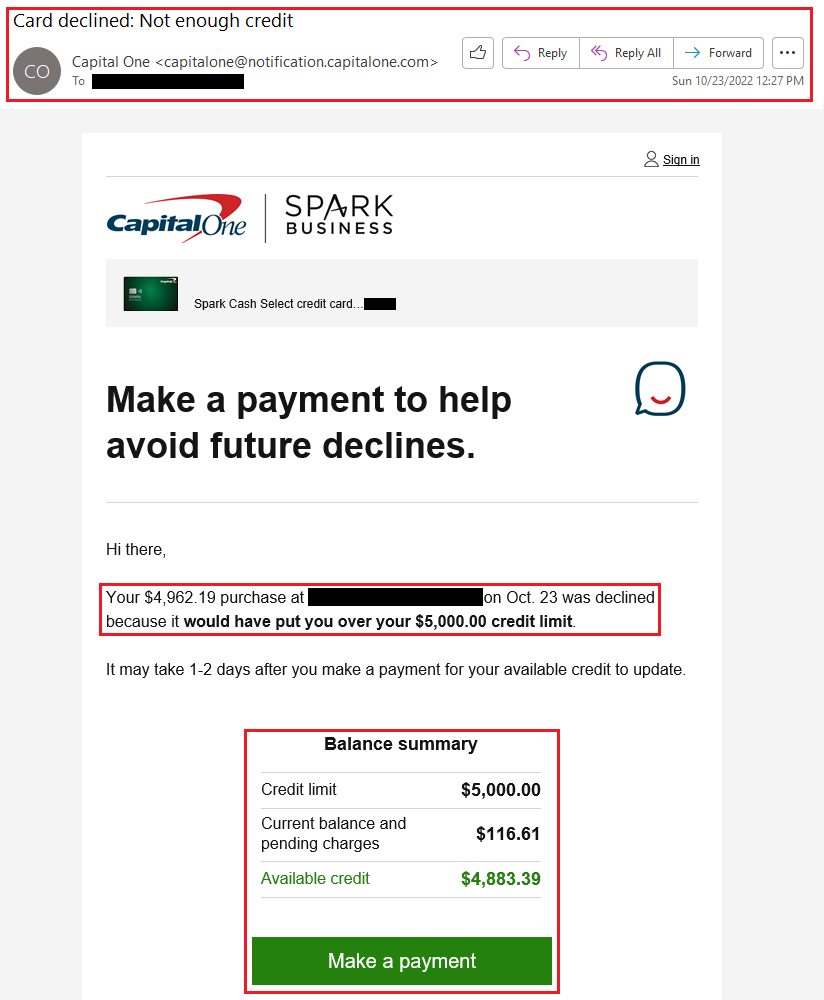

After my call to Capital One, I tried the rep’s advice, but my charge was declined because I didn’t have enough credit. No surprise here. I was trying to make a property tax payment, but the way the process works, the credit card processor authorizes the service fee first, and then attempts the property tax payment. So even though the property tax payment amount is less than $5,000, it fails because the service fee + property tax payment is more than $5,000.

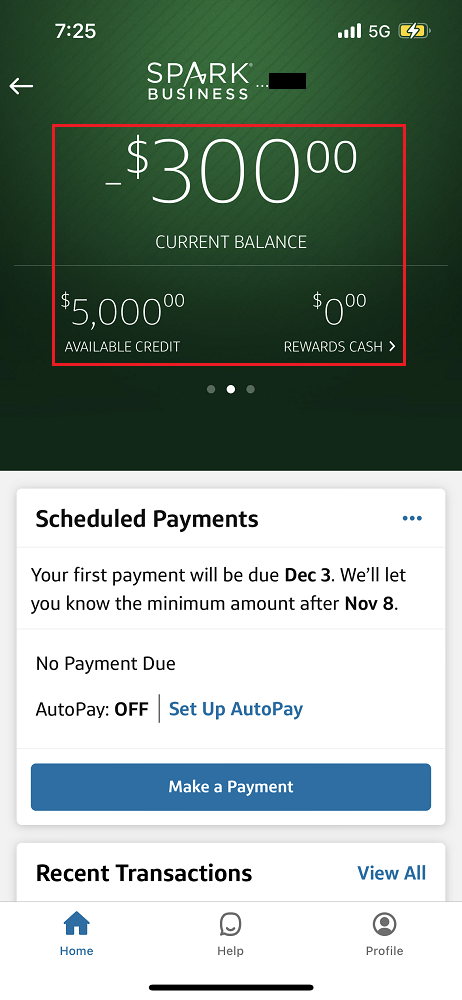

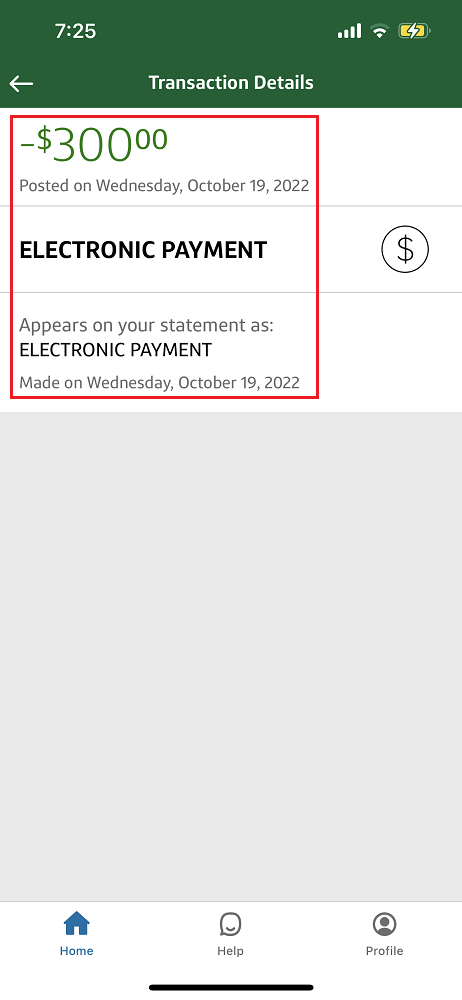

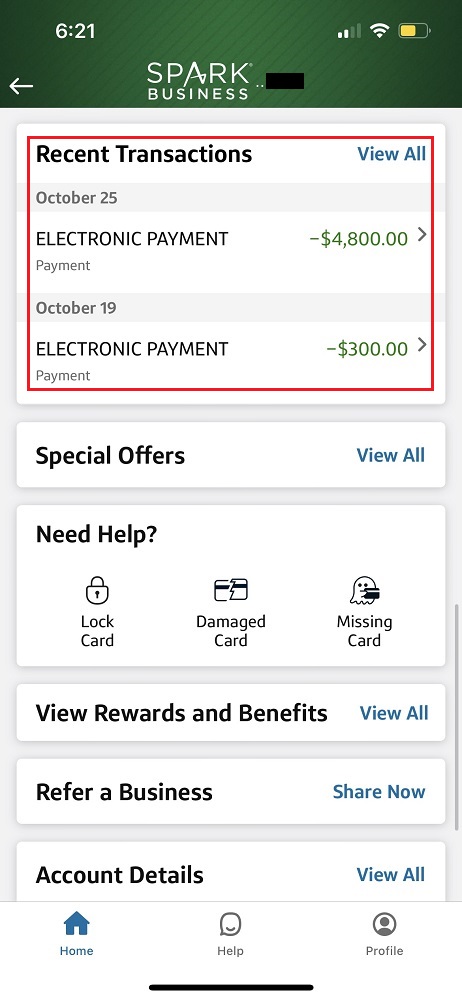

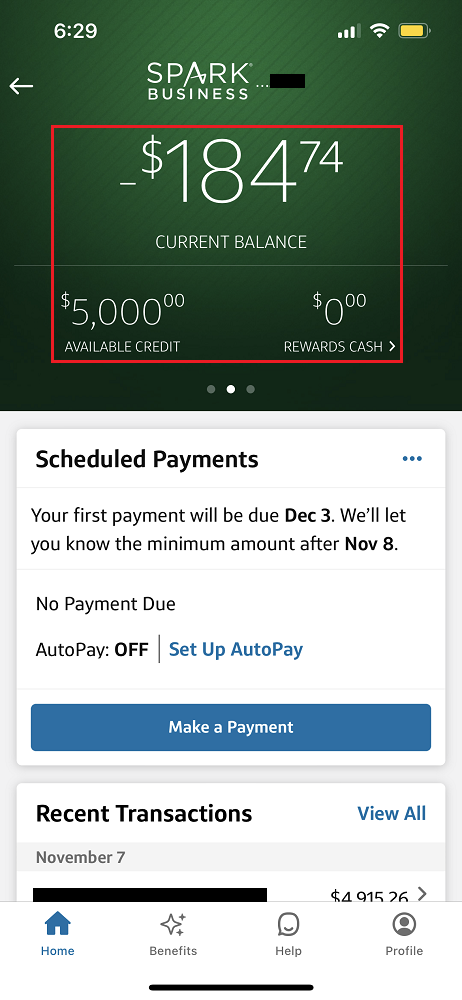

Since I was only a few hundred dollars off, I decided to make a $300 payment to my credit card (bill payment from Wells Fargo, not from Capital One) and see if my credit limit would increase from $5,000 to $5,300. Even though the $300 bill payment post and my current balance was -$300, my credit limit stayed at $5,000.

I tried to make the property tax payment again, but it was declined again due to not having enough credit.

Not to be deterred, I made another bill payment of $4,800 to my credit card. That increased my current balance to -$5,100 but my credit limit stayed at $5,000.

I tried to make the property tax payment a third time, but it was declined again due to not having enough credit.

At this point, I remembered I had Plastiq Fee Free Dollars (FFDs) to spend, so I used some of those and was able to get the property tax payment to go through. Finally!

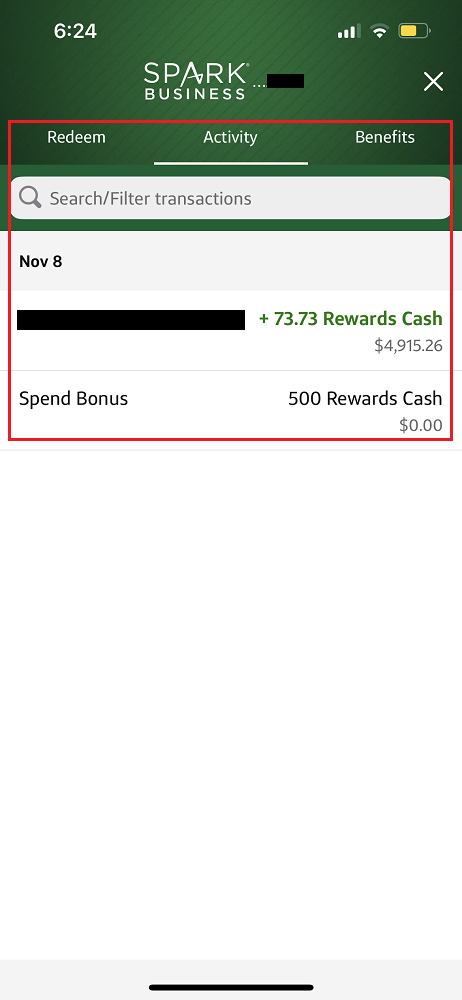

A few days after the Plastiq payment posted, my $500 sign up bonus posted too.

The entire process with Capital One was frustrating and I wish they had a better system to increase credit limits or move credit limits between personal and business credit cards. I was also disappointed that prepaying my credit card bill did not increase my credit limit either. I learned a lot through this process and hopefully some of my readers can avoid the frustration that I experienced. If you have any questions about moving / reallocating credit limits with Capital One, please lease a comment below. Have a great day everyone.

Pingback: My Positive Experience Moving / Reallocating Credit Limits / Prepaying Bill with Bank of America Business Credit Card