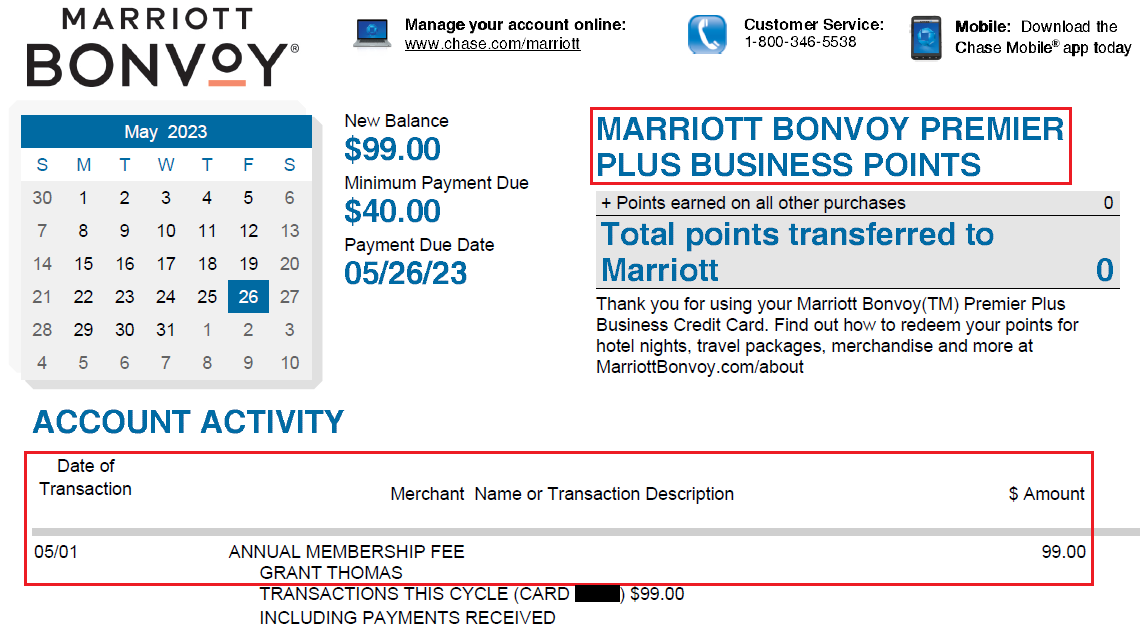

Good morning everyone, I hope your week is going well. Yesterday, I called Chase and American Express about 2 credit cards that had annual fees that just posted. When I called Chase about my Chase Marriott Bonvoy Premier Plus Business Credit Card (no longer available for sign up or product change), I told the rep that the $99 annual fee just posted to my account and that I wasn’t using this credit card very much since I use my JPMorgan Chase Ritz Carlton Credit Card (no longer available for sign up, but can be product changed into) for my Marriott purchases. I asked the rep if they were able to waive the annual fee. The rep looked for retention offers and said there were no offers available. For reference, in past years, I have received retention offers of $50 or $100.

Generally, I prefer to keep credit cards that are no longer available, unless there is a very good reason to close or product change them to another credit card, so I decided to keep the card open. With that said, I can easily get more than $99 of value with the 35K Marriott Free Night Certificate that comes with this credit card each year. In fact, I already redeemed my 35K FNC for a stay later this month that costs more than $200.

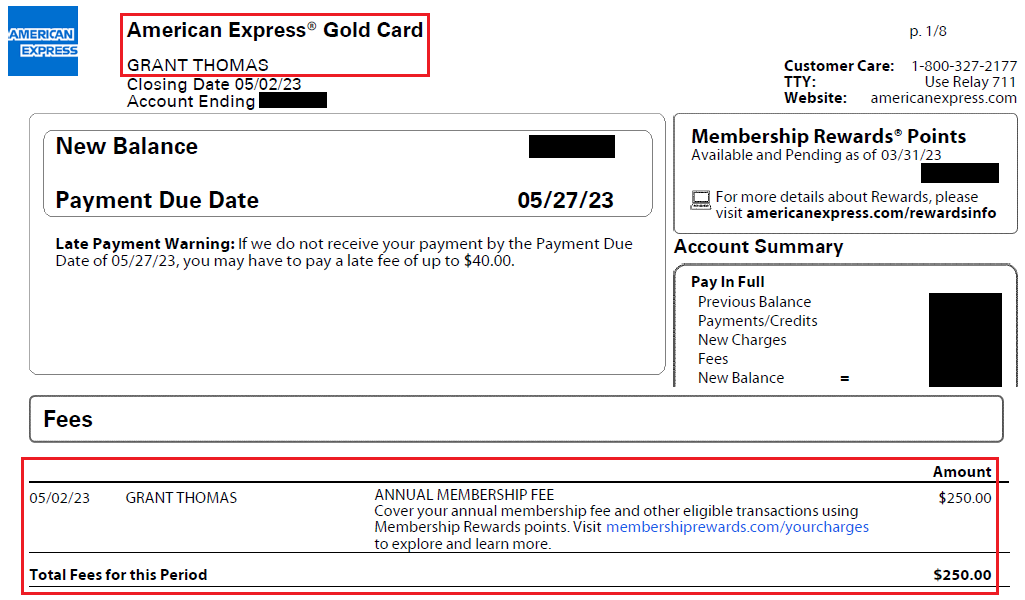

My next call was to American Express regarding the $250 annual fee that just posted to my American Express Gold Card. I told the agent that I currently have 2 American Express Business Platinum Cards and an American Express Business Gold Card, so I was paying a lot in annual fees ($1,685 total, to be exact), so I was trying to save some money on annual fees. I asked if it were possible to waive the annual fee, otherwise I would need to close the card. The agent checked for retention offers and said that I accepted a retention offer 12 months ago (for 20K AMEX MR Points), so there were no retention offers available to me. The agent reminded me that I earned 30K AMEX MR Points at restaurants and grocery stores with this card over the last 12 months and tried to convince me to keep the card open. Even though I was able to use all 12 months of the $10 Uber / Uber Eats Credit and the $10 Grubhub credit, I don’t like paying $250 for the privilege of jumping through hoops to receive $240 of Uber and Grubhub credit, therefore, I decided to close the account.

For more background, I currently have 500K AMEX MR Points plus another 150K AMEX MR Points on the way once I complete the minimum spending requirement on my new American Express Business Platinum Card. Since I have so many AMEX MR Points, I really don’t need many more (for now, at least). My plan after I meet the minimum spending requirement is to use my 3 Citi Custom Cash Credit Card to pay for restaurants, grocery stores, and gas stations to build up my Citi ThankYou Point balance. I currently have 123K Citi ThankYou Points, so I’m trying to build that up to around 200K Citi ThankYou Points.

I have had mixed results with retention calls over the years, but like the saying goes, “you miss 100% of the shots you don’t take.” If you have any questions about my 2 retention calls, or my point earning strategy going forward, please leave a comment below. Have a great day everyone.

If you received a retention offer last year on your gold don’t you have to keep it open longer than this or they’ll clawback?

Hi DB, that’s a good question. I accepted the last retention offer around May 2, 2022, so I believe I have completed the requirement to keep the account open for another year.

When I spoke to the rep on the phone, they never mentioned anything about clawing back the retention offer either, so I think I should be in the clear.

A good reminder. I try to call every card at every anniversary where I’m charged the fee. last year I had very good luck with Amex Business gold card ($250 credit) and Chase Ritz card ($150 credit). Doubt that they will repeat this year.

Yes, that exactly my strategy too. Some years I get great retention offers and other years I get nothing. But you don’t know until you call and ask :)