Good afternoon everyone, happy Friday. A few months ago, I was in Southern California and driving my Hertz rental car to Disneyland when a small rock struct my windshield, causing a long crack on the driver’s side of the windshield. I’ve never had to file an in insurance claim for a rental car before, so this was a new experience for me. In this post, I will share details of the claims process and what I learned along the way, so if you are ever in a similar situation, you know what to expect.

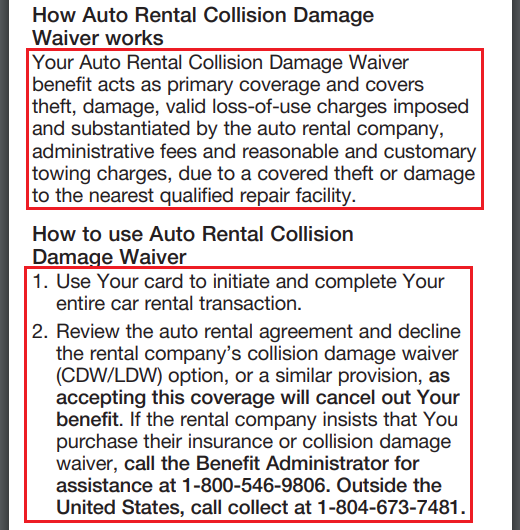

There are many premium travel credit cards out there that offer free primary coverage for auto rental collision damage waiver (CDW), but my go to for the last few years has always been my US Bank Altitude Reserve Credit Card. Here is the link to view Guide to Benefits PDF for this credit card offers (backup link). You should be able to find a similar benefits guide for any credit card on Google by searching for the credit card name and “benefits guide.” To be covered, you need to pay for your rental with this credit card and decline the rental car company’s CDW coverage.

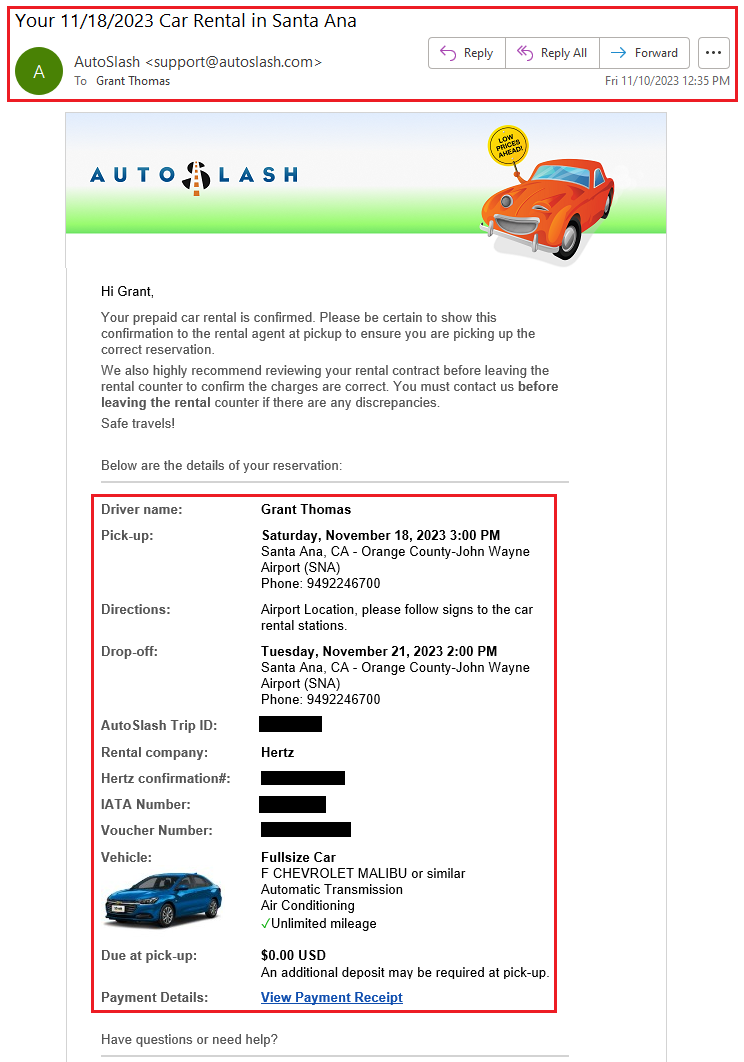

Before we go through the claims process, let’s back up to the beginning of the story. I booked my Hertz rental car through AutoSlash (read how AutoSlash works) on November 10 and the car rental was for November 18-21. This was a prepaid rental through AutoSlash where the payment was made directly to AutoSlash before picking up my rental car.

Before I dropped off the rental car on November 21, I called the phone number on the back of my US Bank Altitude Reserve and asked how the process worked for filing a car rental insurance claim. The rep was very knowledgeable about the process and instructed me to keep all paperwork, documents, and emails related to the rental until Hertz sent me the bill. Armed with that information, I dropped off the rental car and showed the damage to the Hertz employee. He filled out the paperwork and had me sign the form. He said I would hear back from Hertz in a few week. The whole process took only a few minutes, which was a relief since I was anxious about returning a “damaged car” and I half jokingly said “I love Hertz and don’t want to be banned from life due to the cracked windshield.”

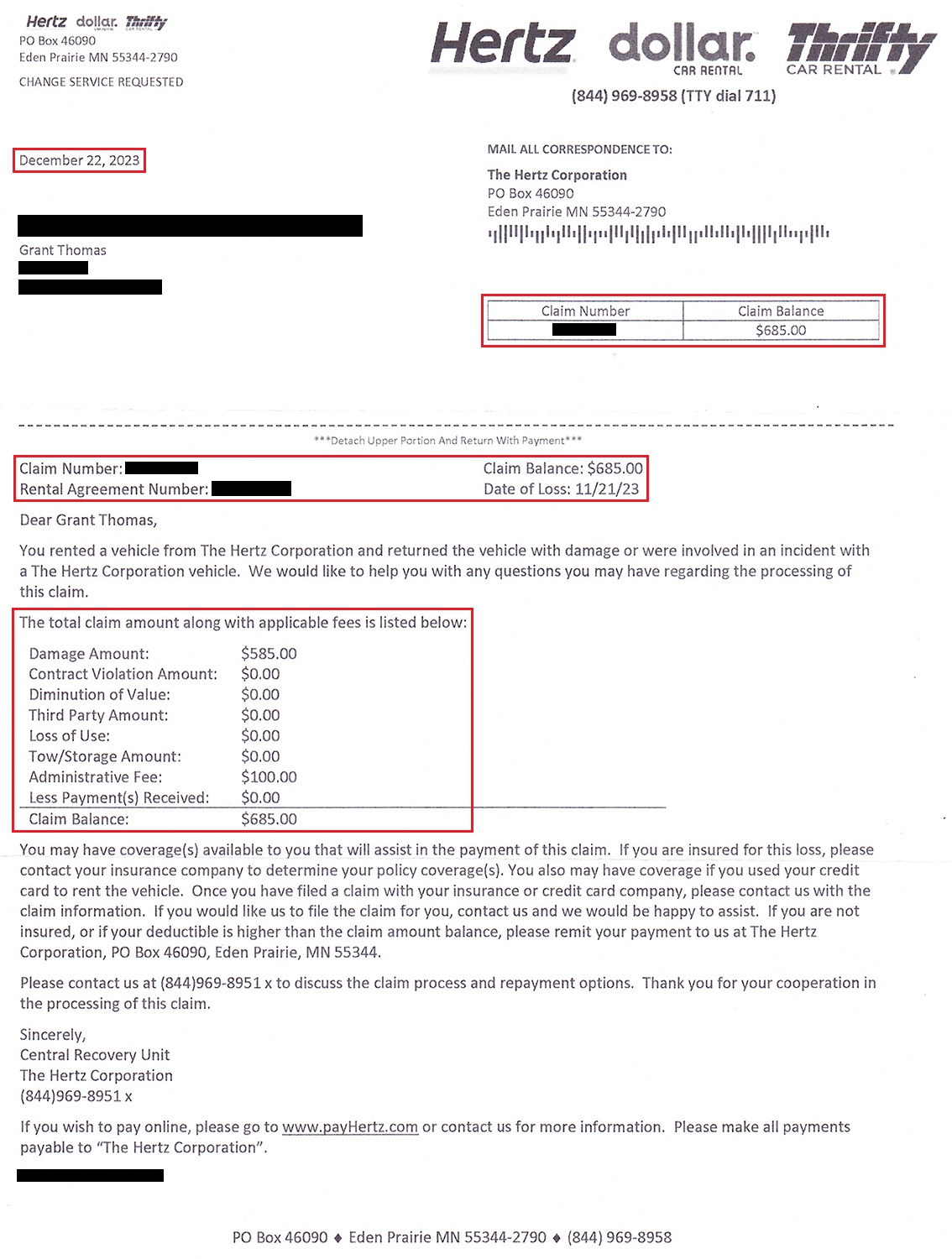

At the end of December, I received this letter from Hertz with a total repair bill for $685.00. I’ve never had to replace a damaged windshield before, so I am not sure how that price compares.

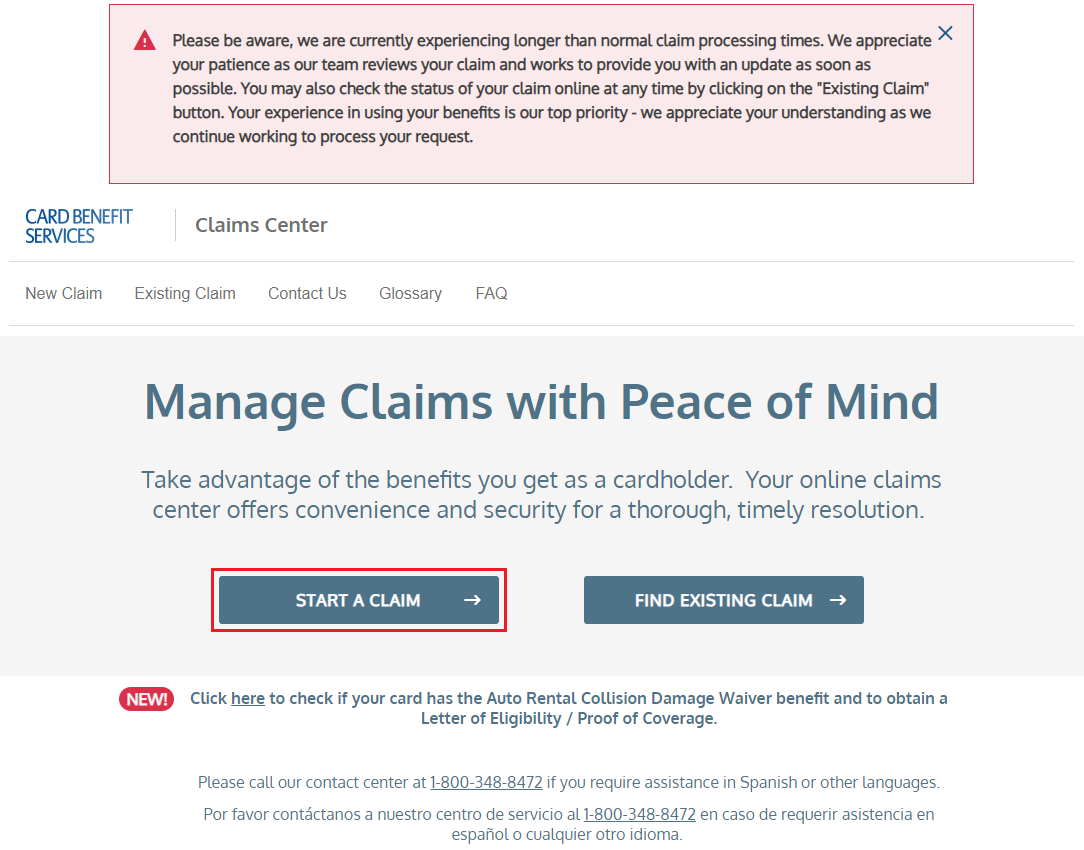

On December 31, I started the claim process. I went to Card Benefit Services (https://www.eclaimsline.com/) and clicked the Start A Claim button.

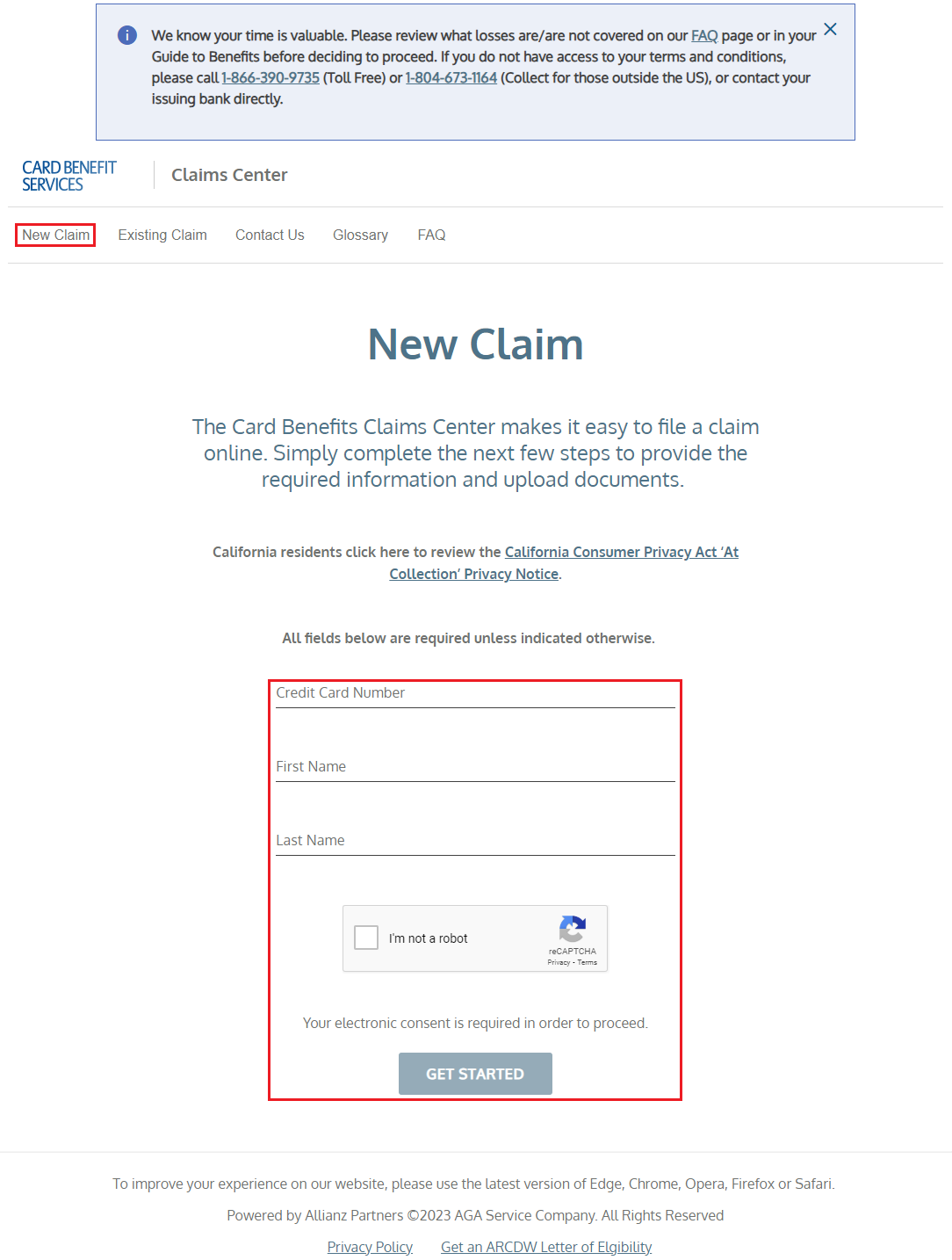

I entered my name, US Bank Altitude Reserve credit card number, confirmed I am not a robot, and clicked the Get Started button.

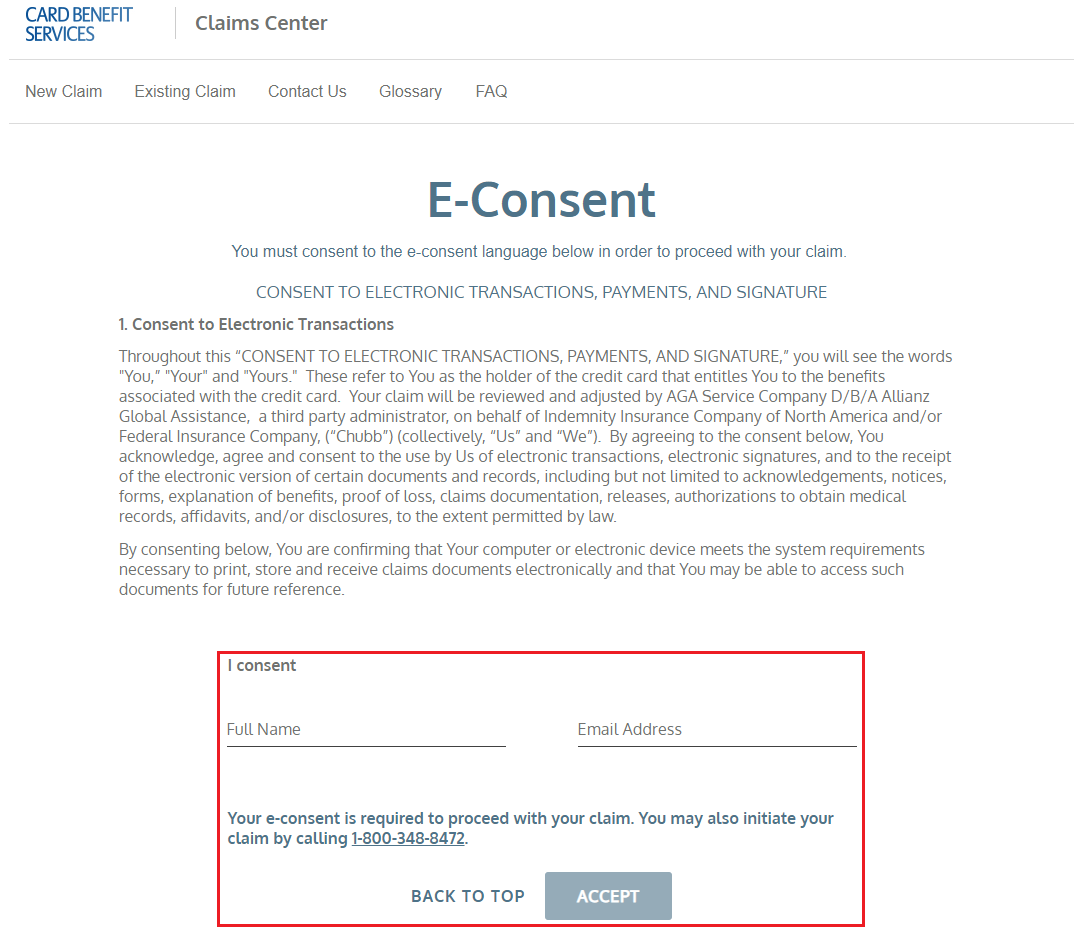

I agreed to the E-Consent form, filled in my name and email address, then clicked the Accept button.

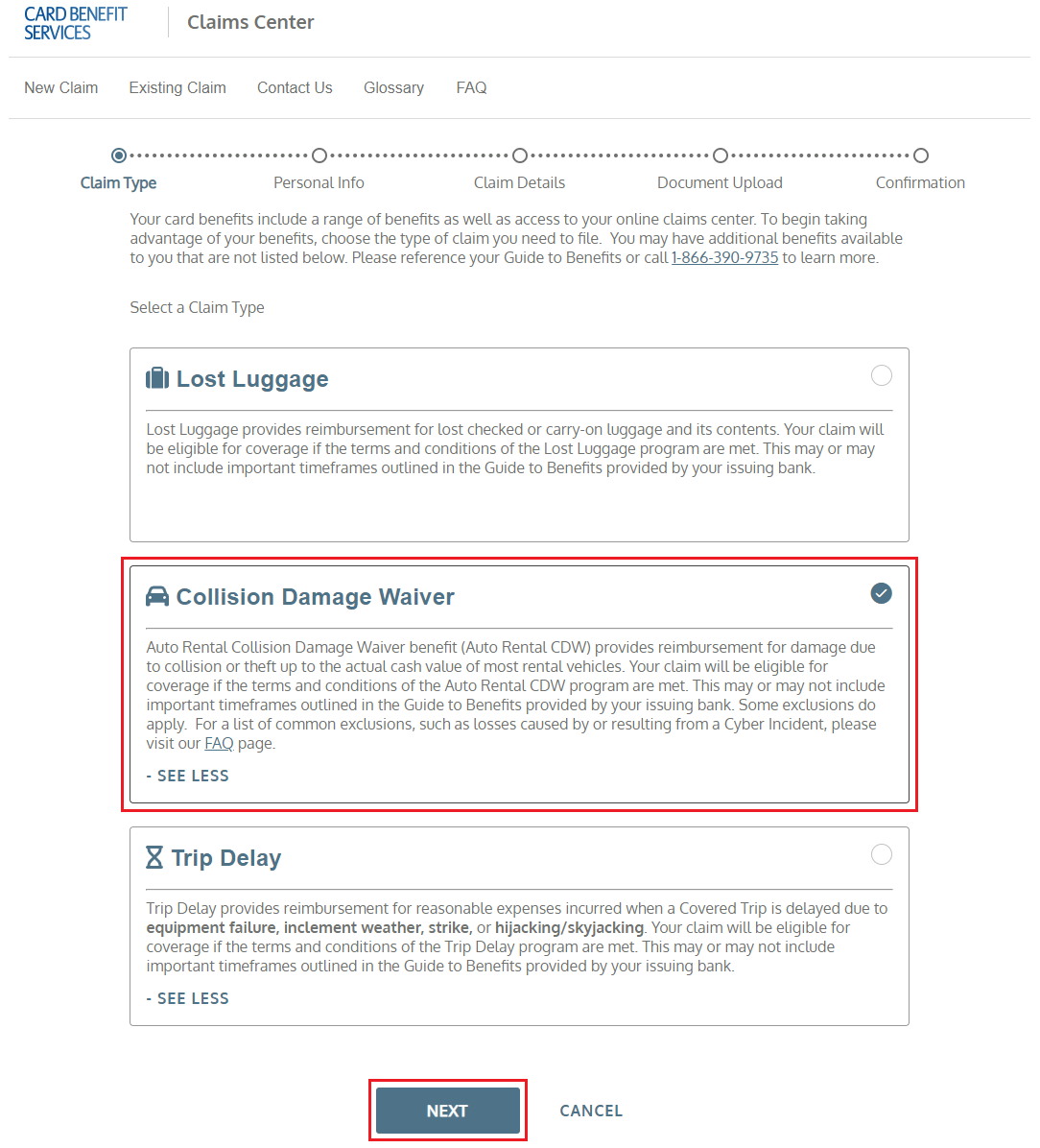

By entering my credit card number, the system was able to pull up the available benefits for my credit card. I selected the Collision Damage Waiver option and clicked the Next button.

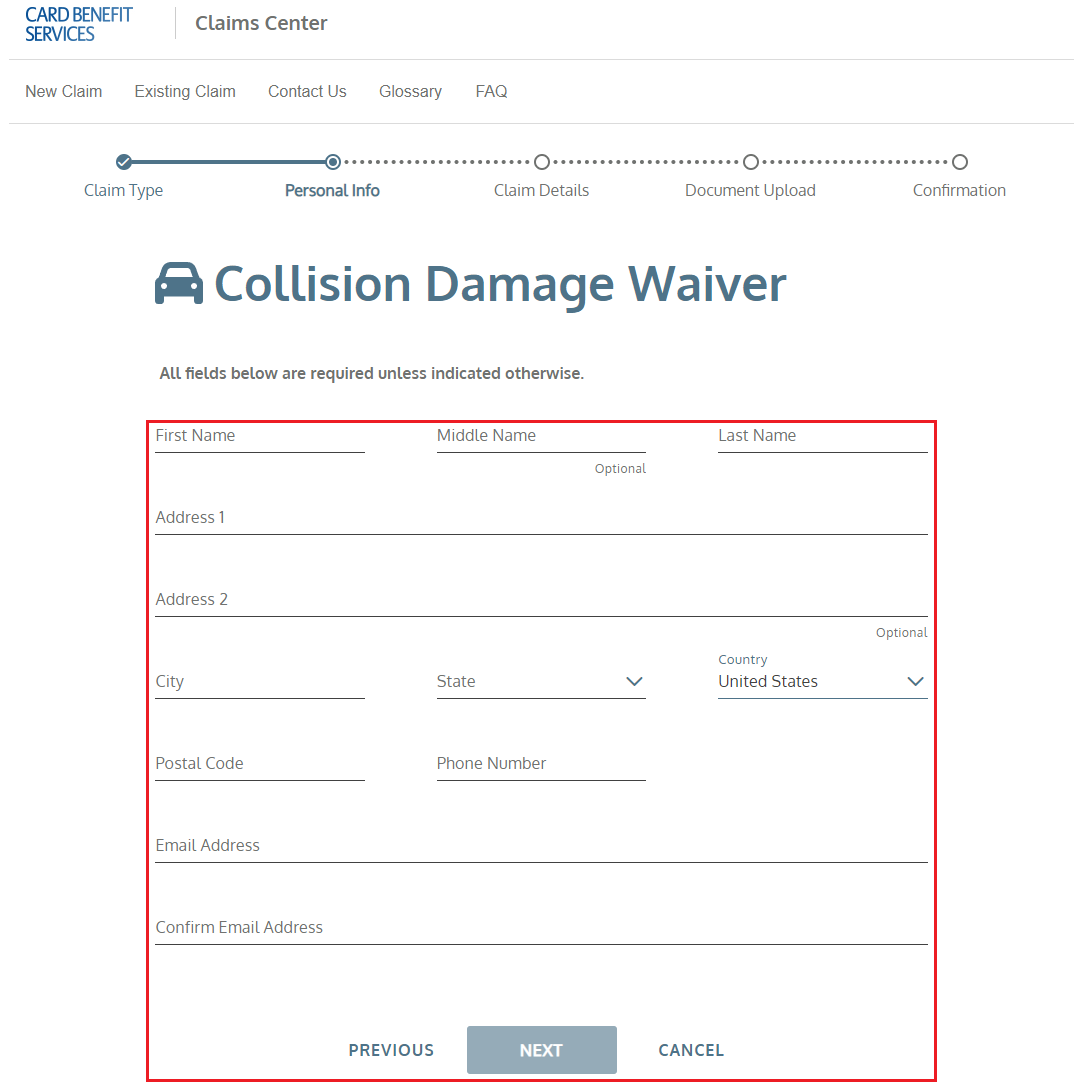

I filled in my personal information and clicked the Next button.

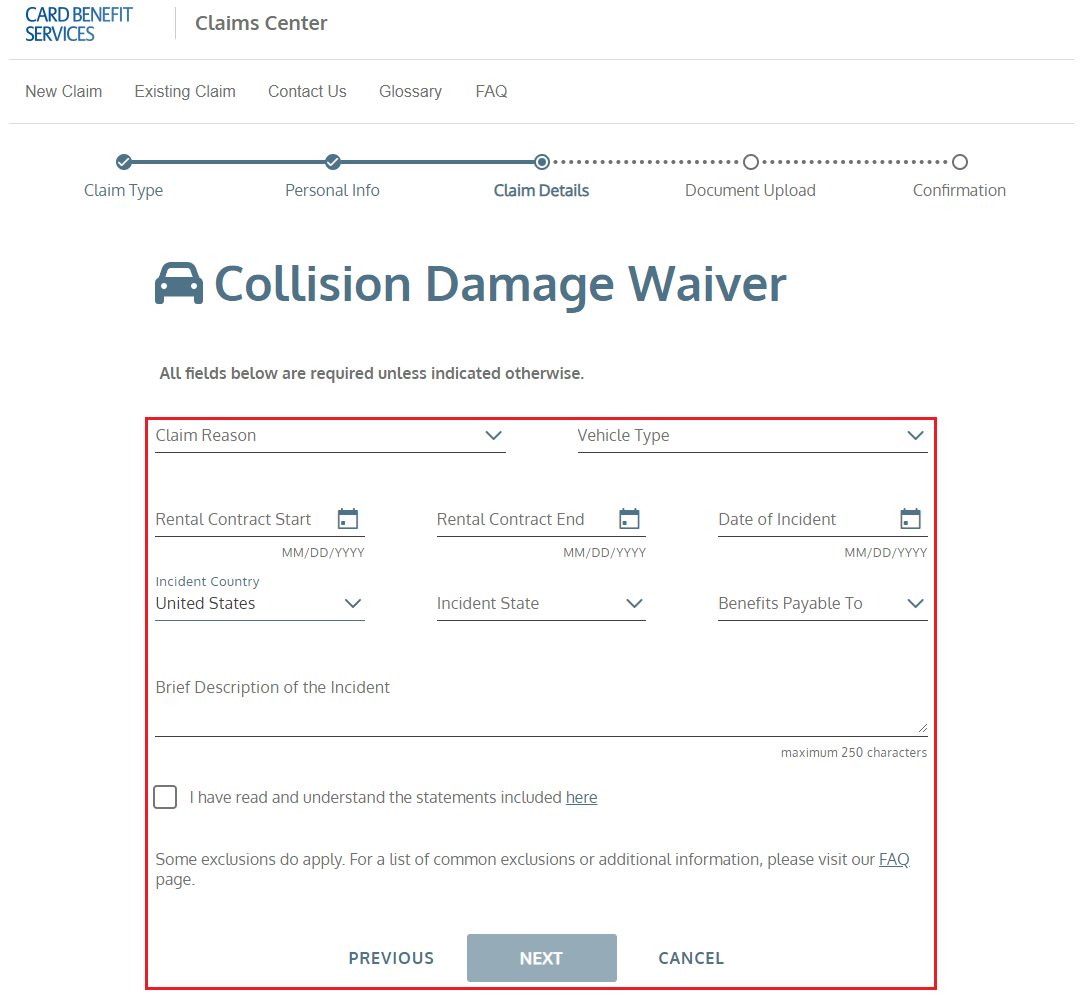

I entered the details of the rental car and damage, then clicked the Next button. I selected having the benefits paid to the rental car company directly.

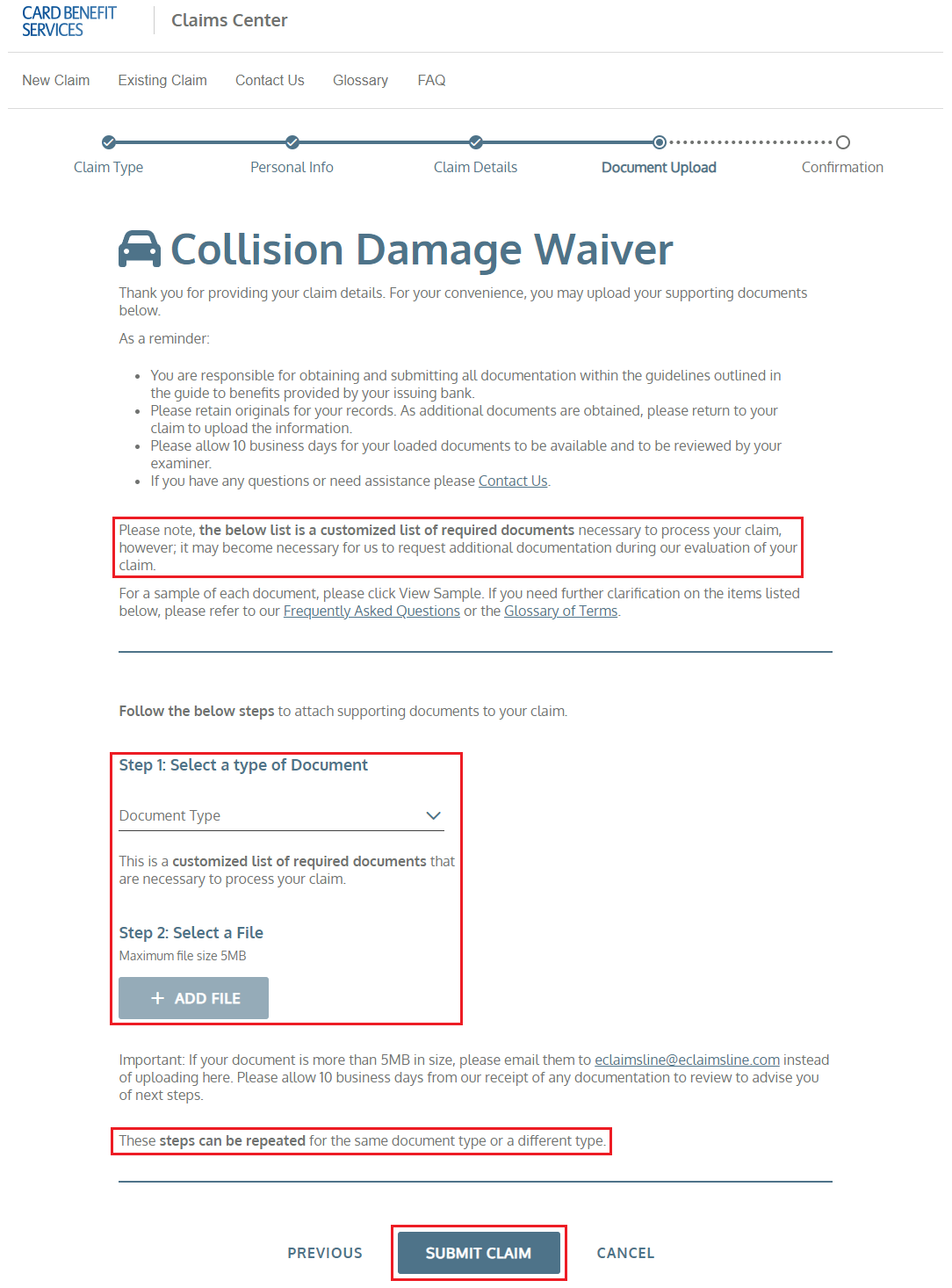

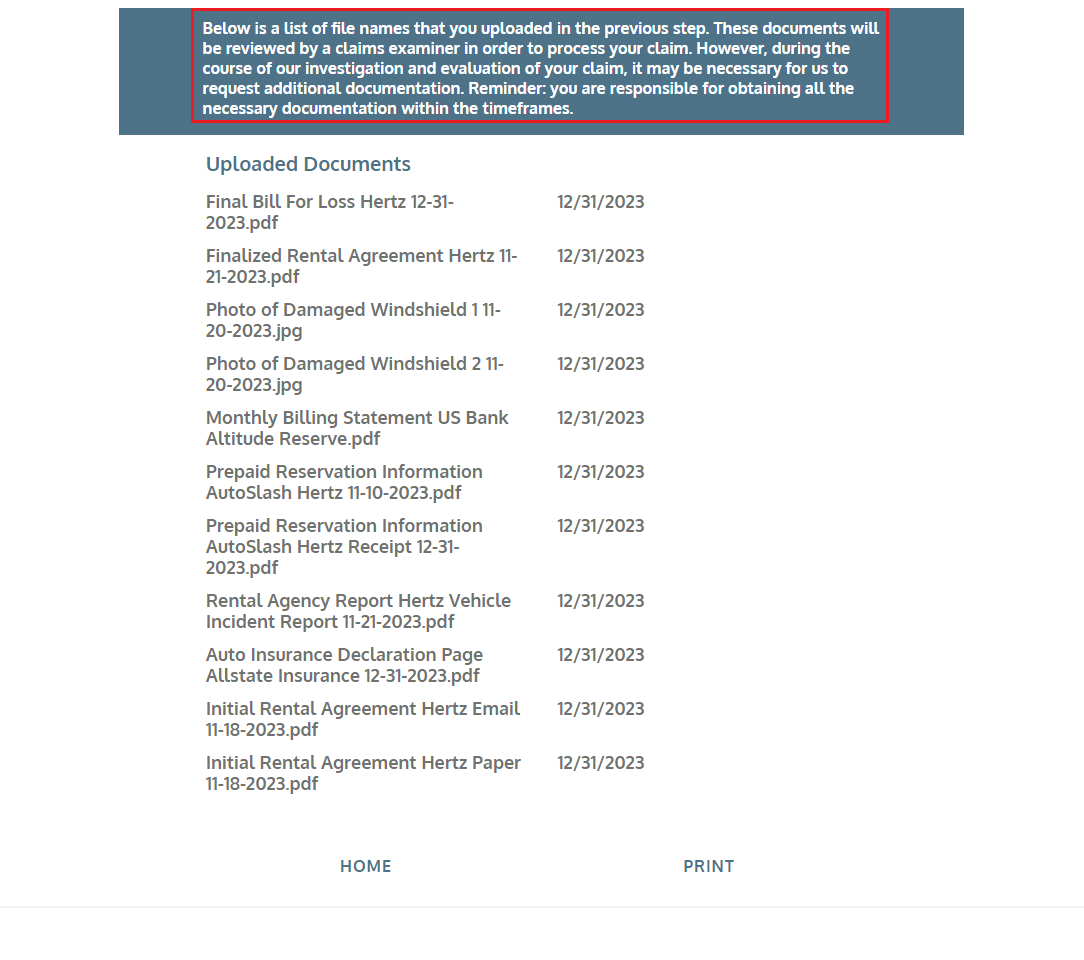

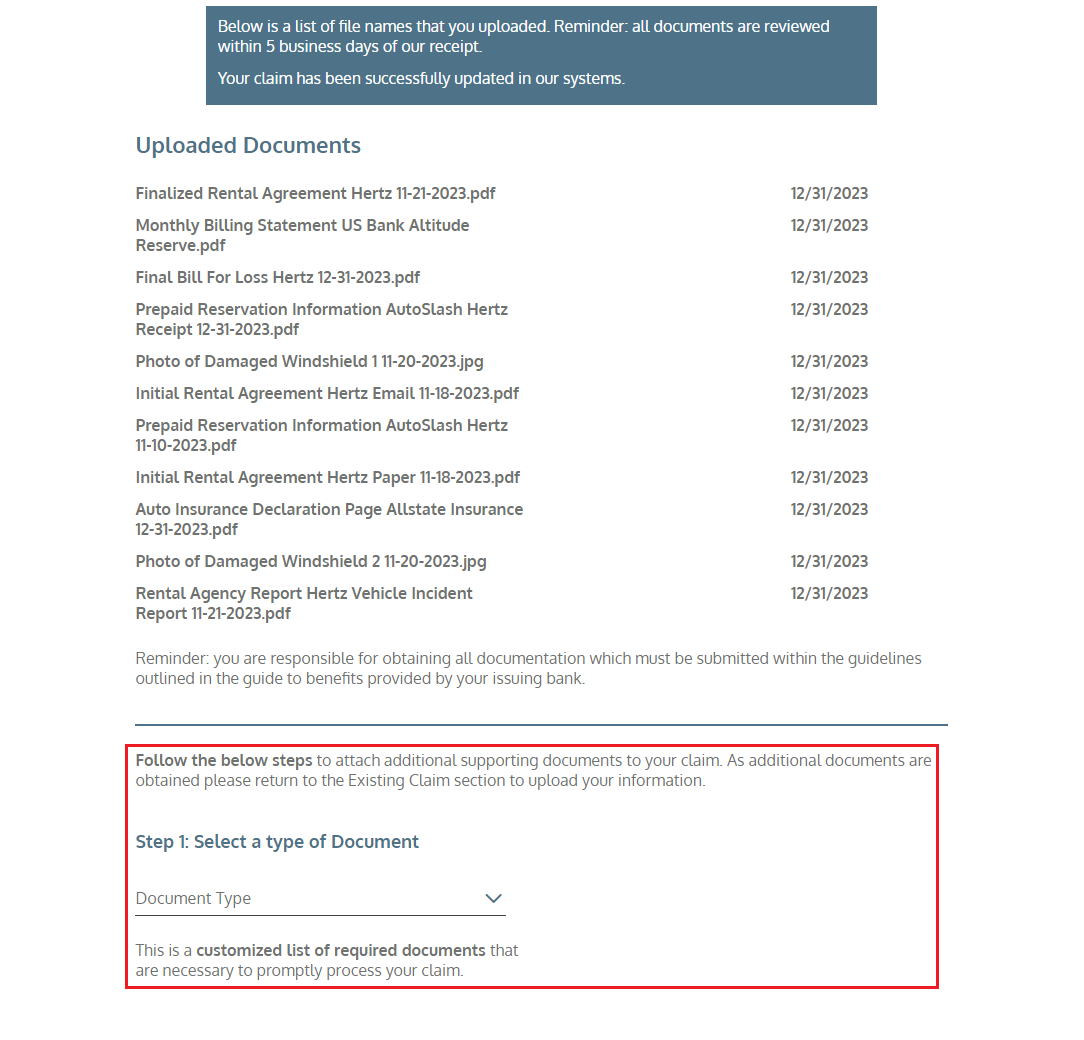

This step is the most time consuming part. You much upload all the required documents to process your claim. If you miss any documents, they will email you in a few days and ask for them, then you will end up at the back of the queue again. Select each item from the drop down menu, then upload the file, and then repeat the process until all documents are uploaded to your claim. When you are all done, click the Submit Claim button.

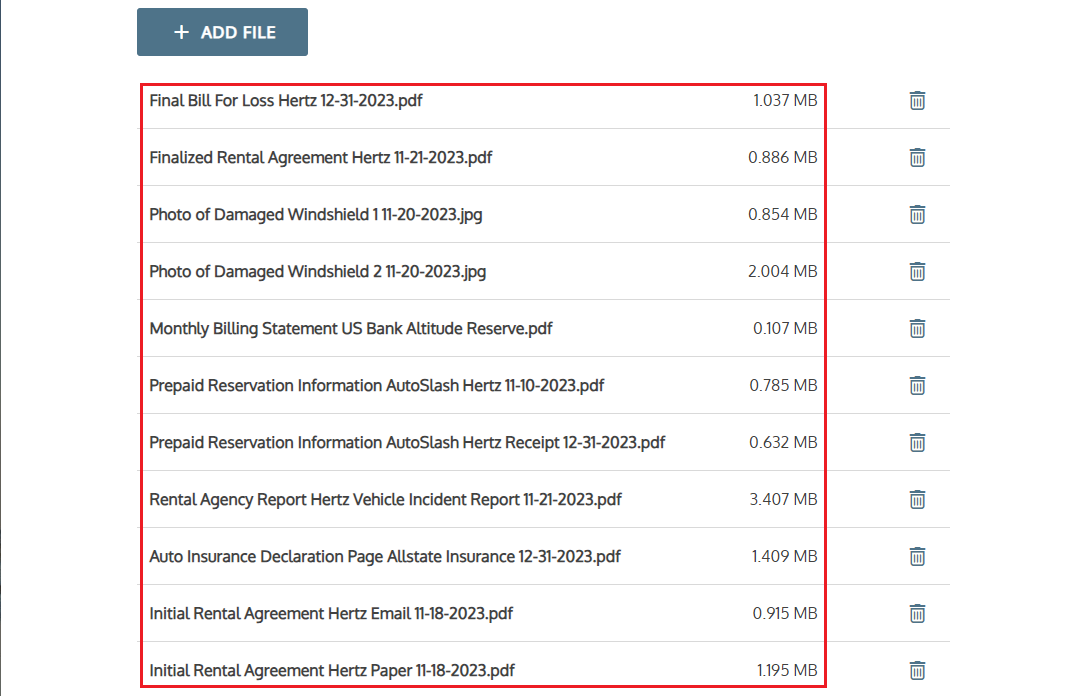

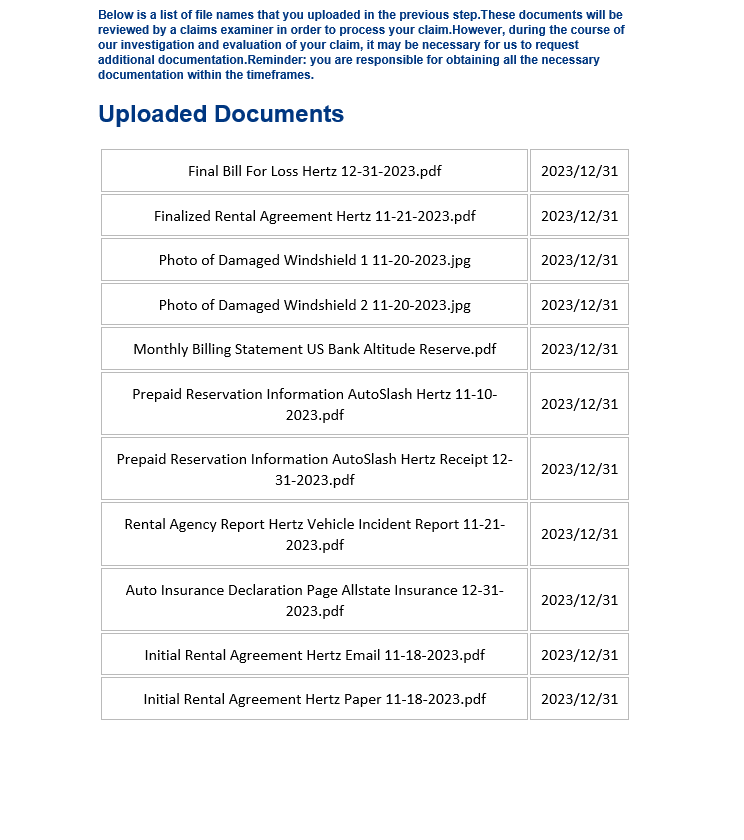

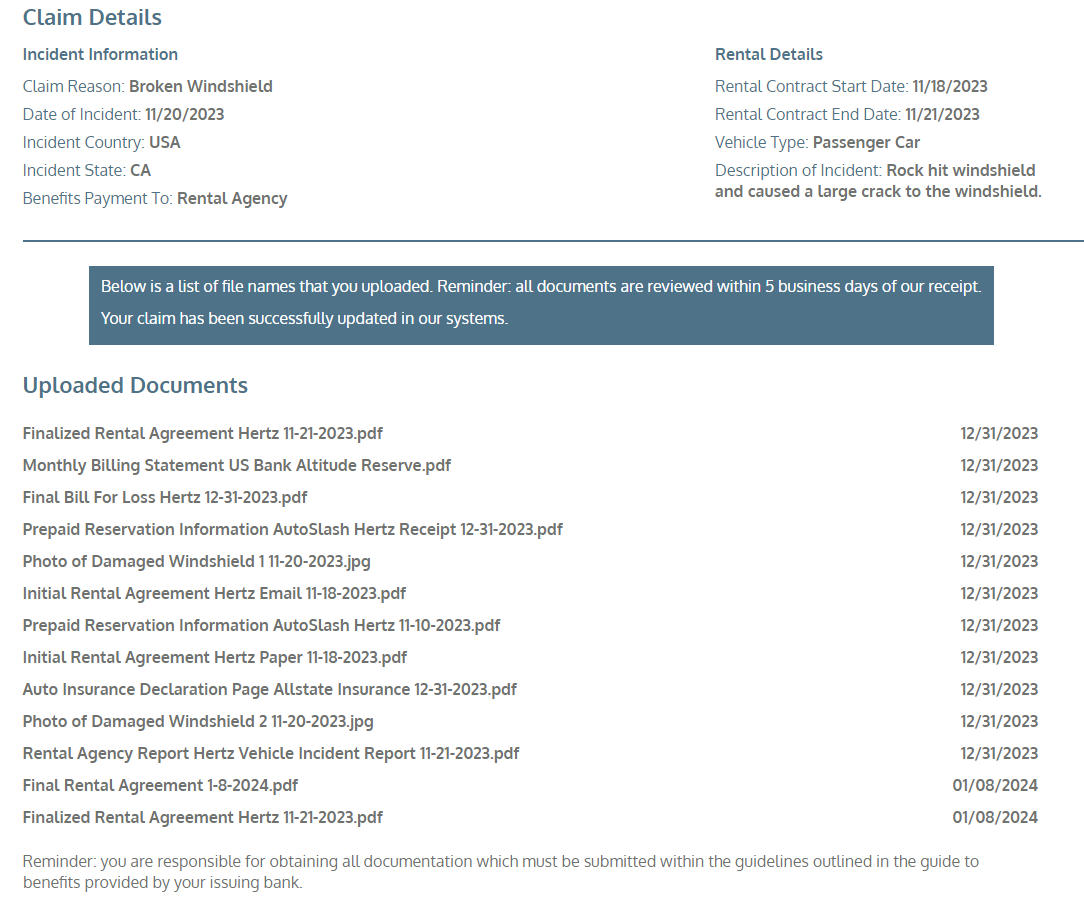

As you can see, I uploaded 11 documents to my claim. You may have more or less depending on which items are required for your claim.

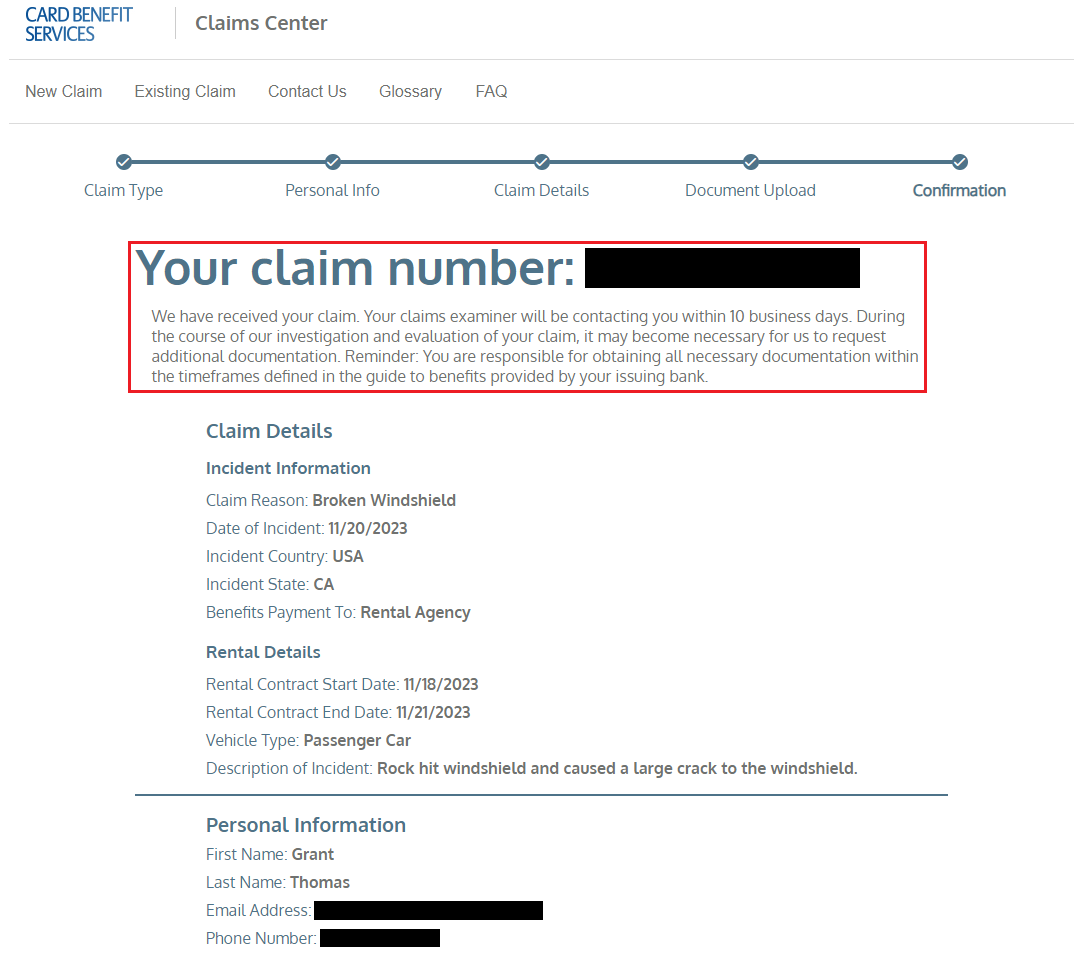

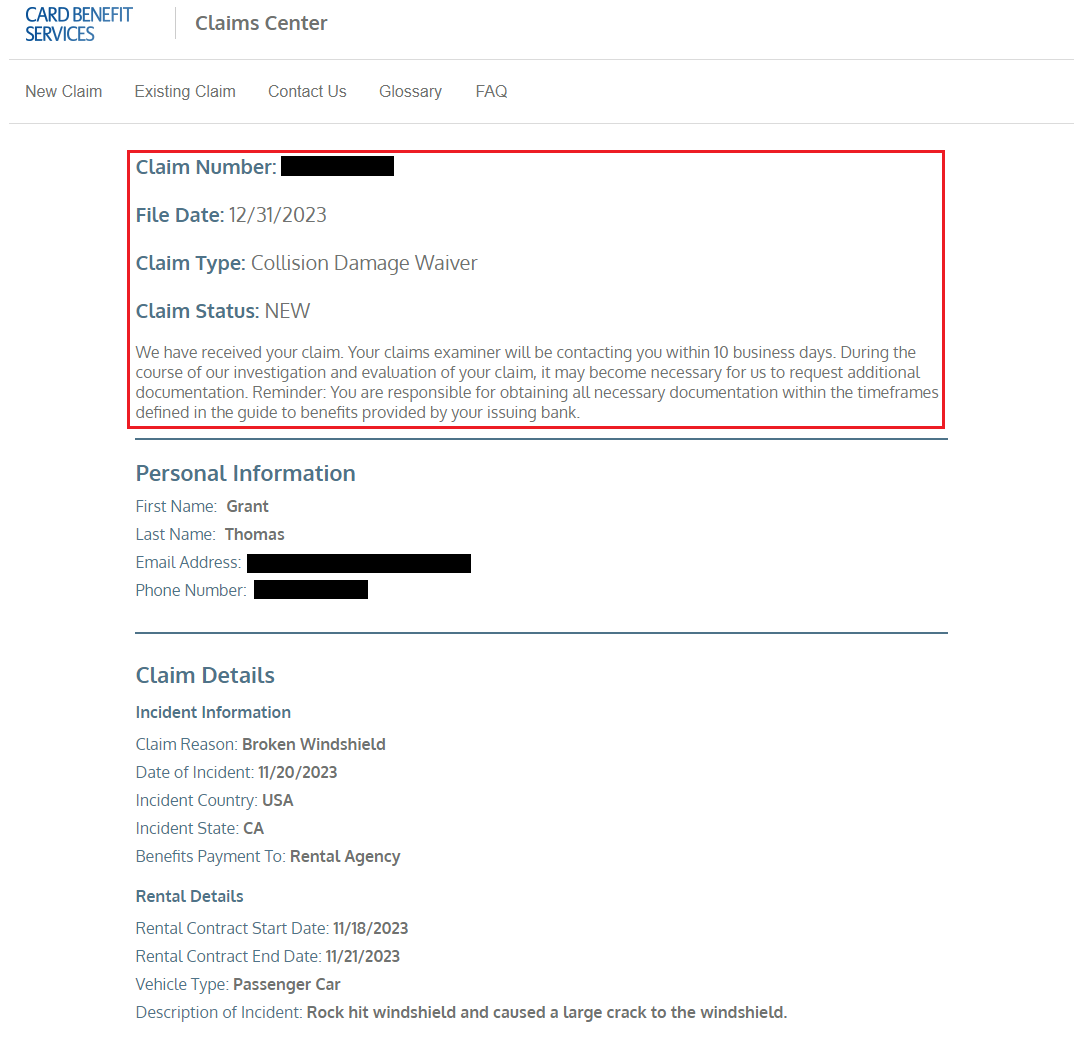

After you submit your claim, you will receive a claim number and see a summary of your claim.

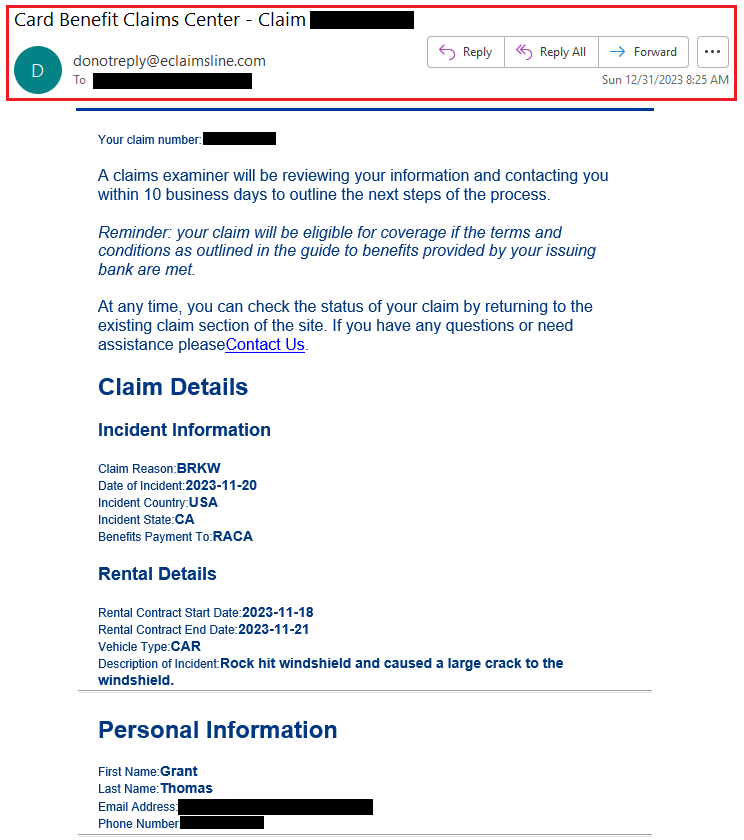

You will also receive an email confirmation with the same details of your claim.

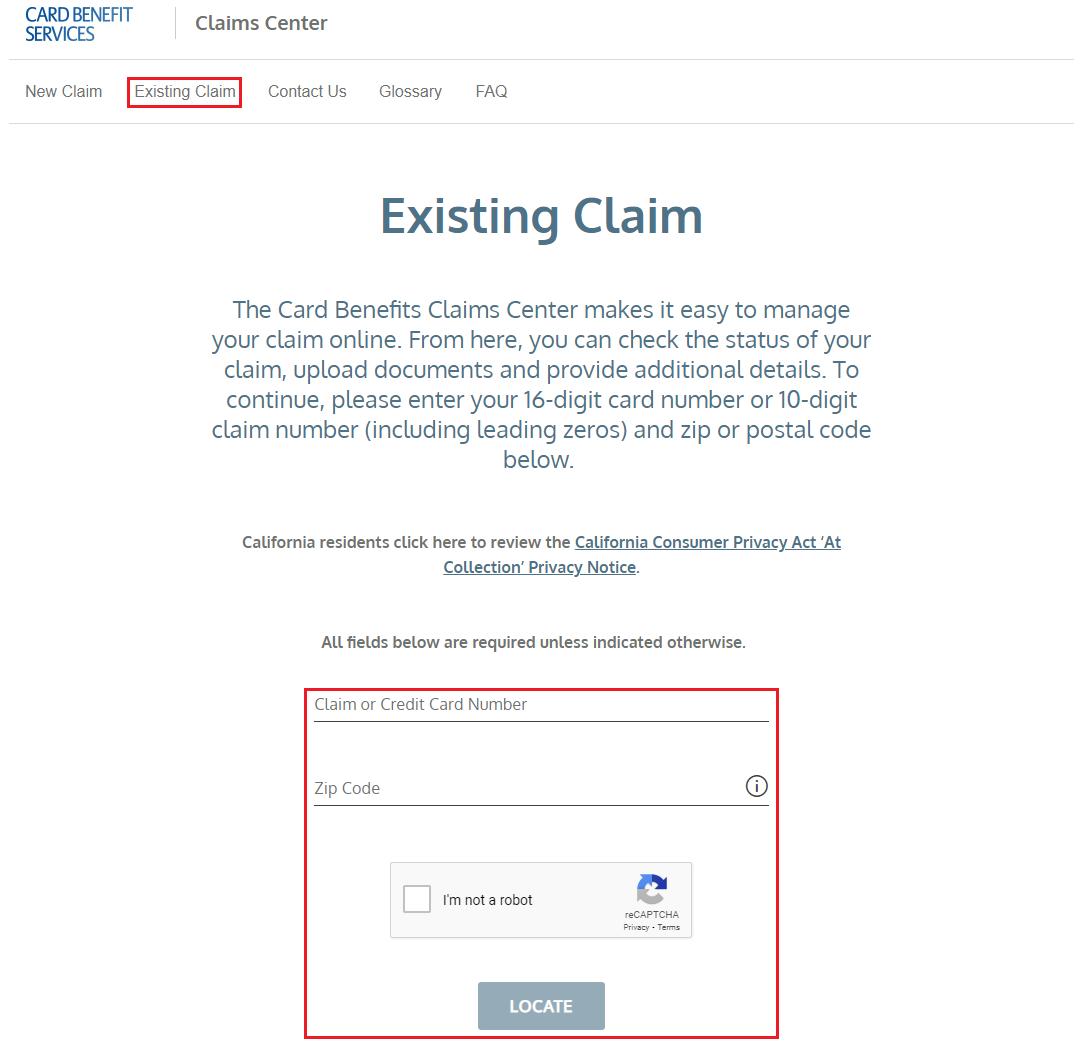

To check the status of your claim, go back to Card Benefit Services (https://www.eclaimsline.com/), click the Existing Claim link at the top, enter your credit card number and zip code, check the box, and click the Locate button.

You will now see the details of your claim. If you forgot to upload a document, you can add another document to your claim.

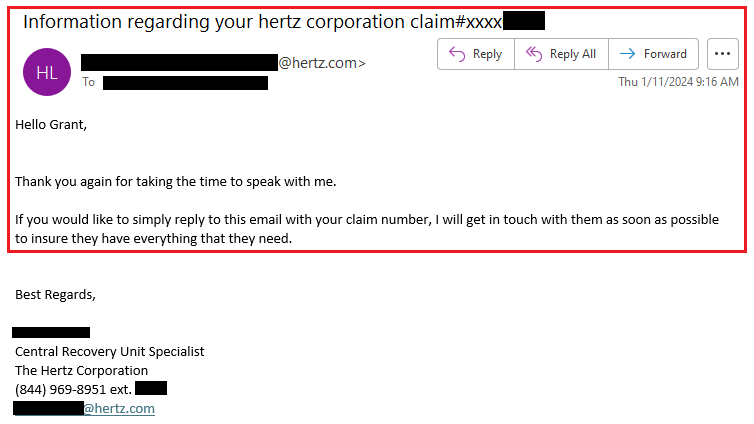

I submitted the claim on December 31 and did not hear anything from Card Benefit Services for 2+ weeks. In the meantime, on January 11, I got a call from Hertz checking in on the bill. I explained that I received the bill and submitted the claim on December 31. The Hertz rep was very friendly and understanding about the process and offered to help speed up the claims process. I told the rep to send me an email and I would respond with the claim number, so that they could reach out to Card Benefit Services.

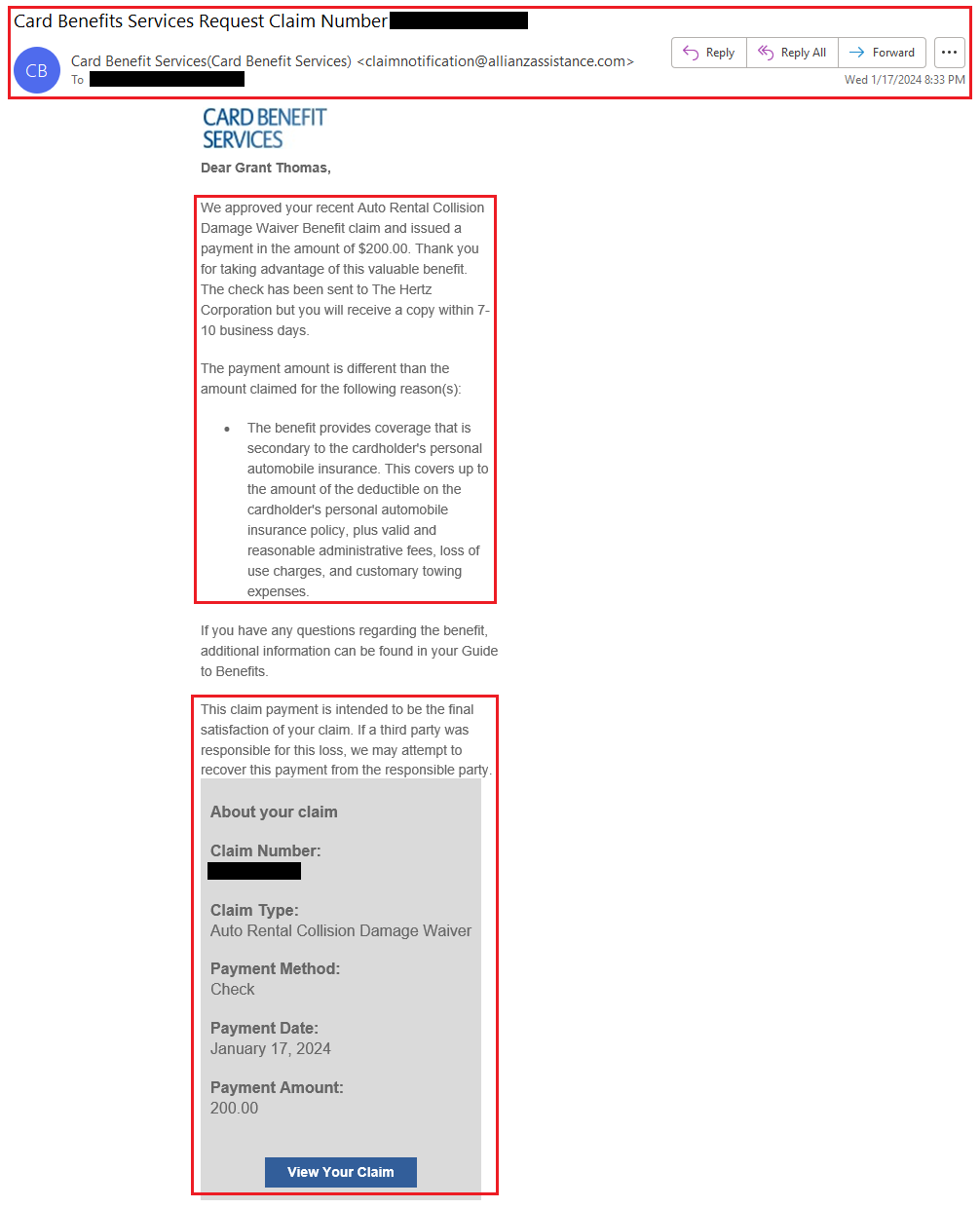

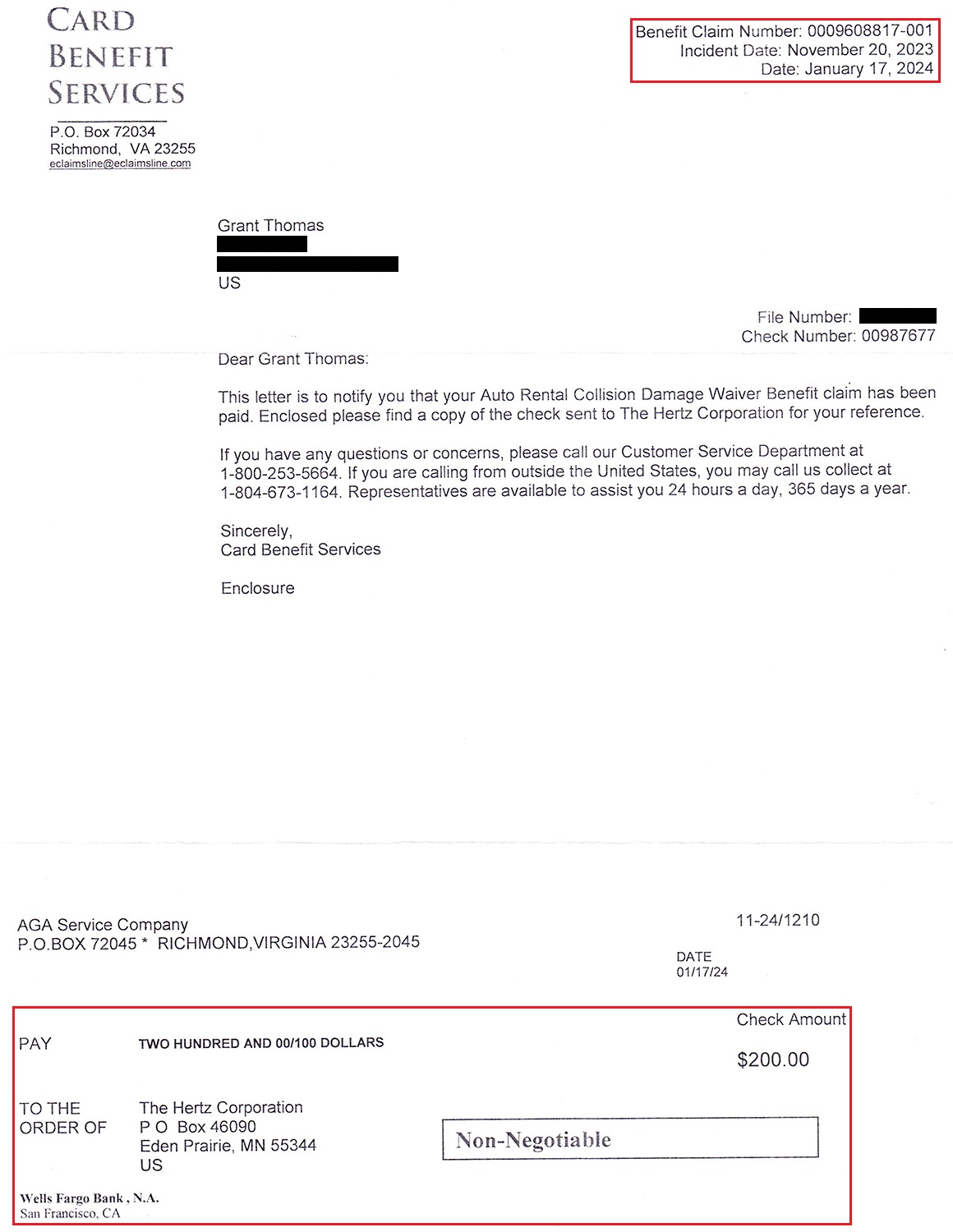

About a week later, I got an email from Card Benefit Services that said my claim was approved… for only $200.00. The email stated that the cover was “secondary to the cardholder’s personal automobile insurance.” I called the phone number listed in the email (1-800-253-5664) and asked the rep to check on my claim. I told them that my credit card offers primary coverage, so the full amount of the damage ($685.00) should be covered. The rep put me on hold for 10 minutes to review the claim and then said that the previous rep made a mistake. A second check for $485.00 would be sent out in the next few days.

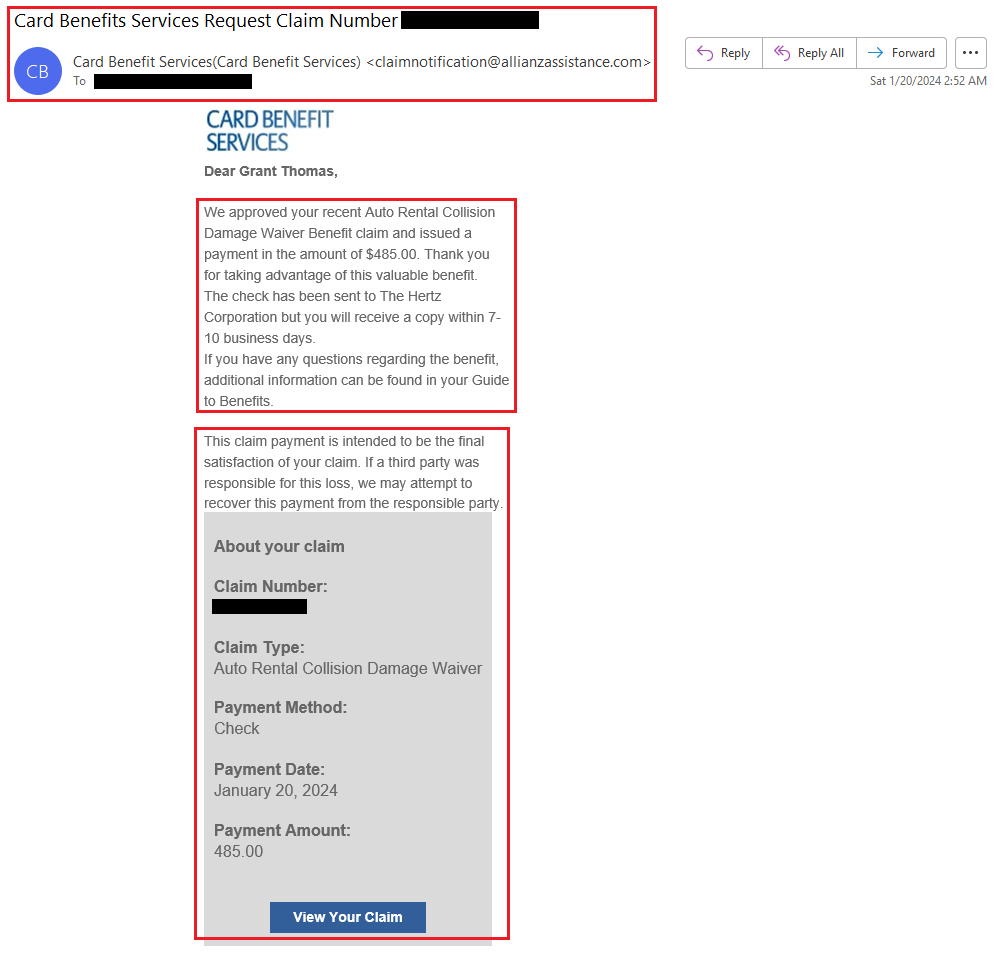

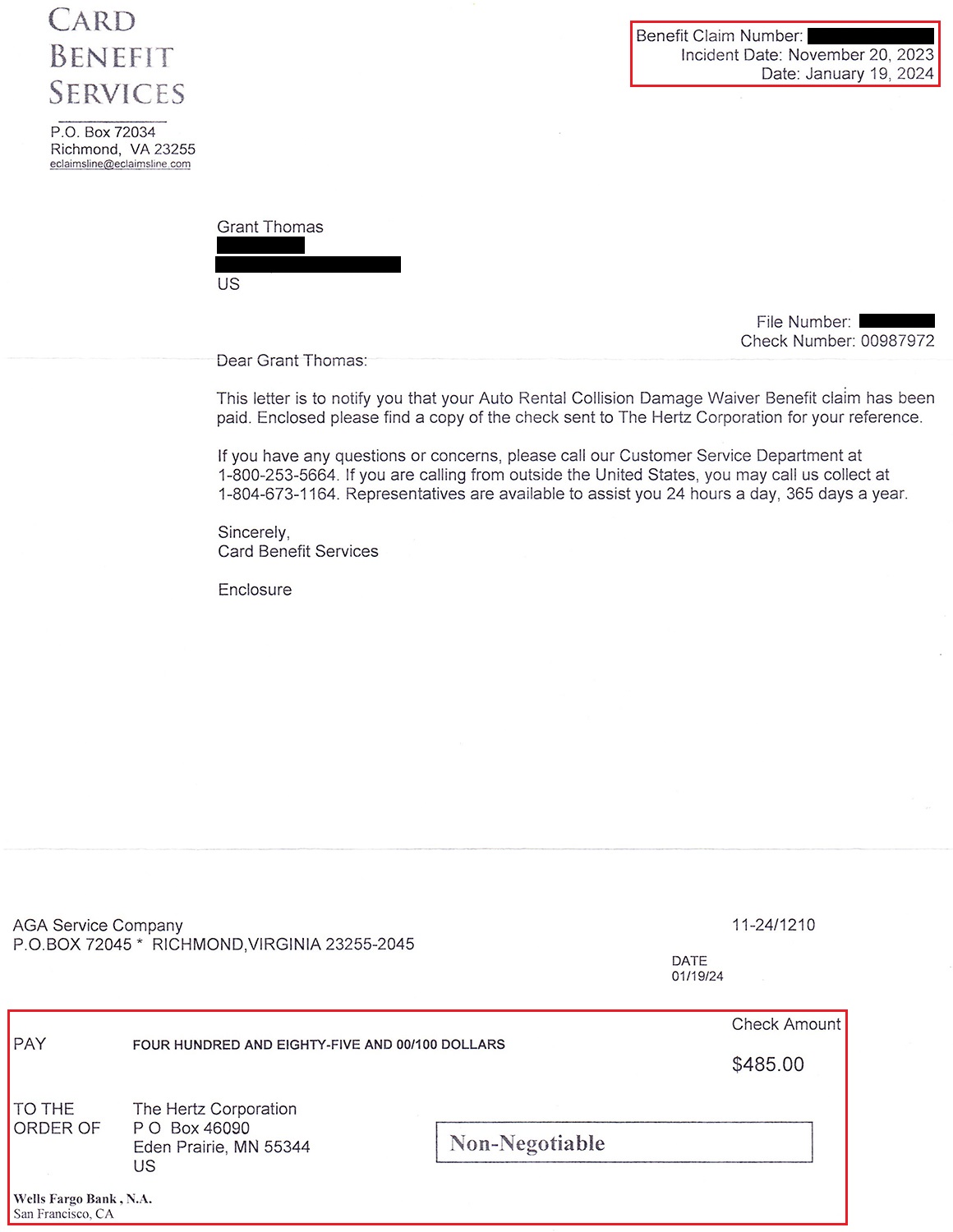

As promised, the second check for $485.00 was sent out a few days later.

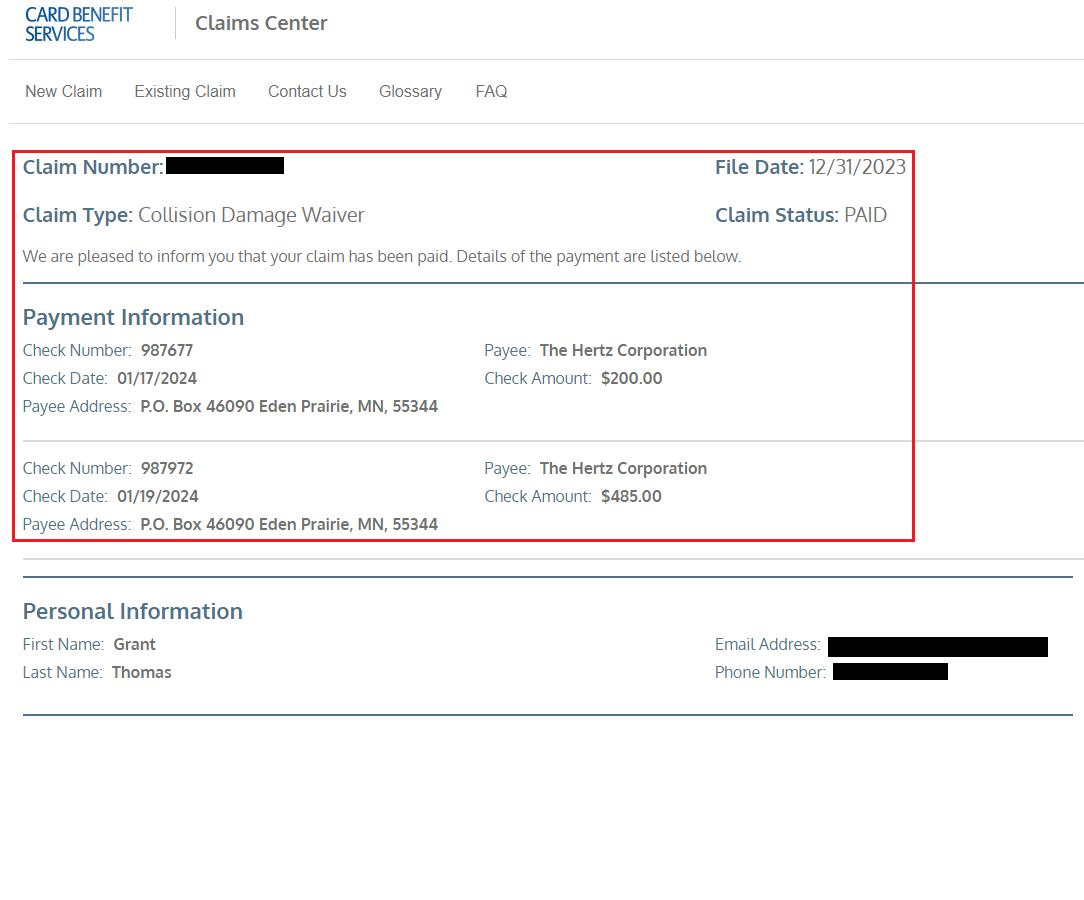

When I went back to check my claim online, I could see 2 checks were sent to Hertz on January 17 and January 19.

I then emailed back the Hertz rep to let them know that 2 checks were on their way ($200.00 and $485.00). Card Benefit Services also sent me a confirmation letter for each check.

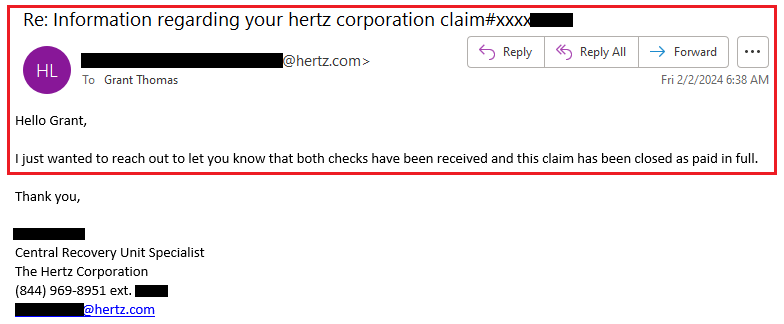

On February 2, the Hertz rep informed me that both checks were received and my Hertz claim was closed as paid in full.

To summarize the key dates, the cracked windshield happened on November 20, I received the Hertz bill and submitted the claim on December 31, and the claim was officially paid and closed on February 2. Filing a rental car insurance claim, like any other insurance claim, took a lot of effort and time, but at the end of the day, I am glad I had the coverage and didn’t have to pay anything out of pocket. If you have any questions about the claim process, please leave a comment below. Have a great weekend everyone!

good post Grant. i will punctuate for the readers that I also had a claim with these guys and it took a lot of follow up to get it paid. but in the end, it worked out ok for me.

Hi Mark, I am glad you had success with your claim too. Did you have a damaged windshield or some other issue?