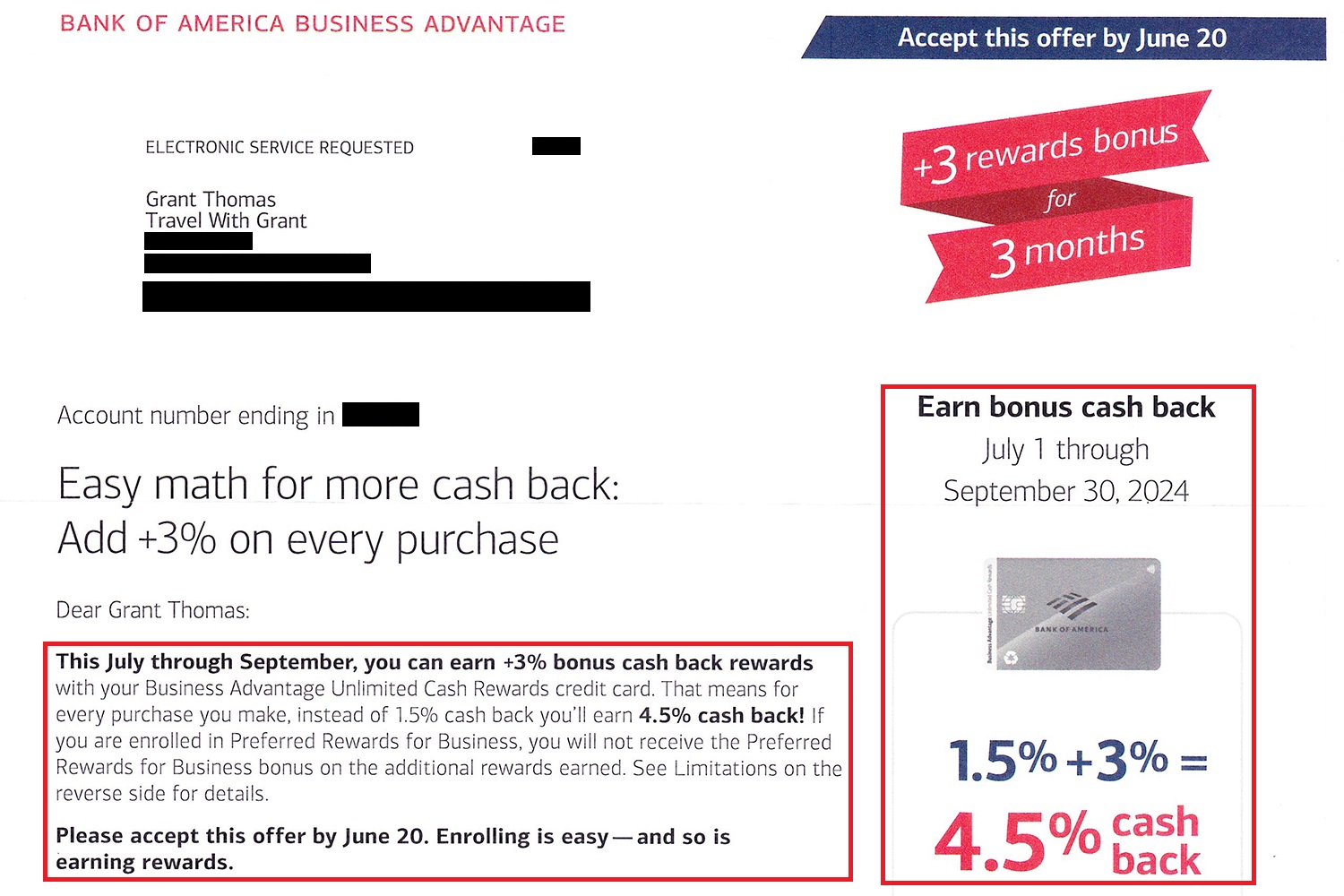

Good evening everyone. I just received an interesting spending offer in the mail on my Bank of America Business Advantage Unlimited Cash Rewards Credit Card (direct link). From July 1 through September 30, I can get an extra 3% cash back on top of the standard 1.5% cash back on all purchases, for a combined total of 4.5% cash back (any category with no cap in spending or earning). Unfortunately, this is a targeted offer with a unique QR code and registration code. The offer also states that you will not earn addition rewards if you are enrolled in Preferred Rewards for Business.

For background context, I received this credit card in October 2022 when there was a $500 sign up bonus. After receiving the sign up bonus, I didn’t use the credit card at all, so I decided to close this credit card in November 2023. During the call, the rep offered me a $50 statement credit if I kept the credit card open. I accepted the retention offer and that was the last activity on this credit card since November 2023. This offer might be targeted to cardholders who have not spent on this credit card in the last 6+ months.

At the bottom of the letter, there is a unique QR code and registration code.

Here is the back of the letter.

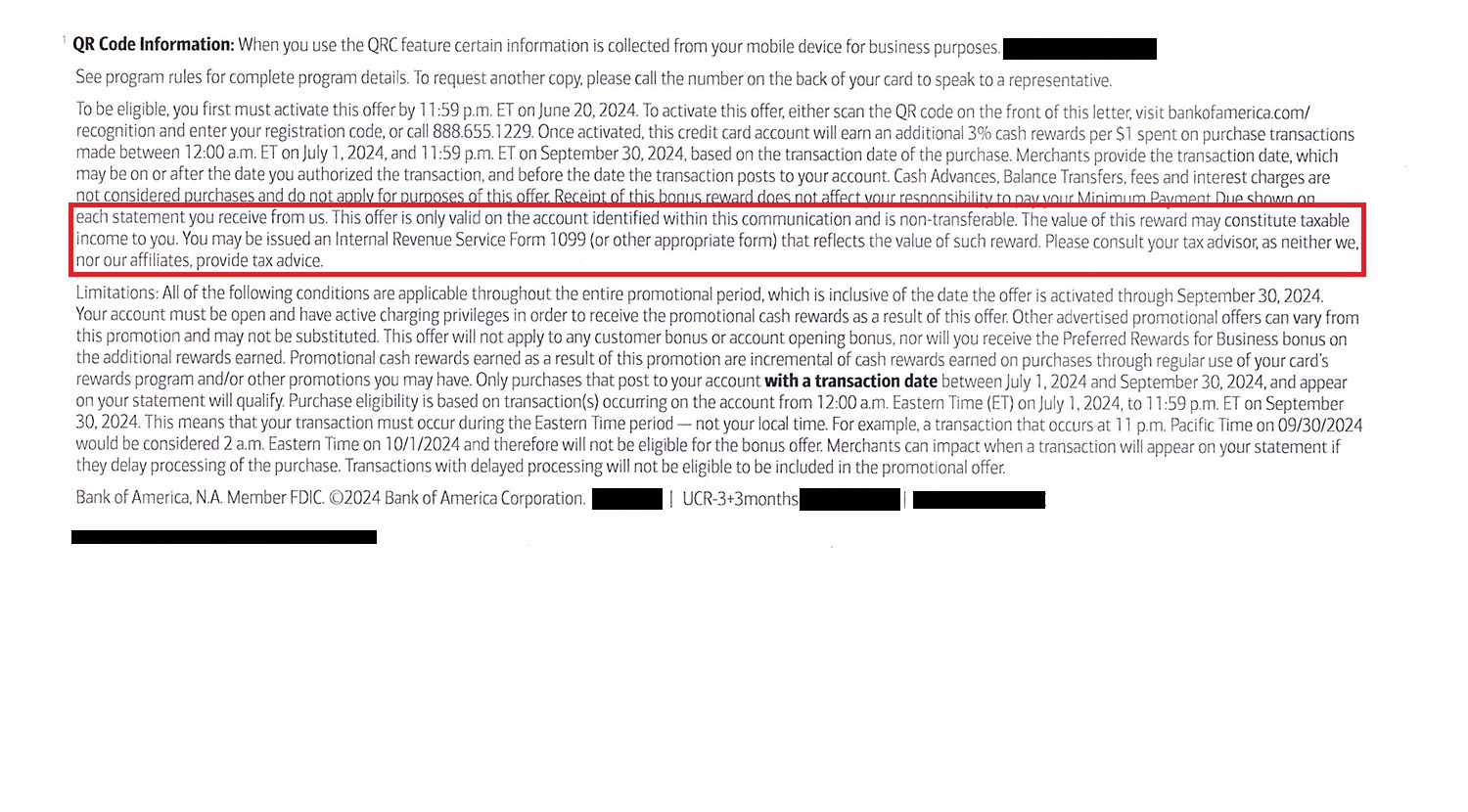

In the terms, it does say that “The value of this reward may constitute taxable income to you. You may be issued an Internal Revenue Service Form 1099 (or other appropriate form) that reflects that value of such reward.” I wonder if those terms were accidentally included since cash back earned from spend should be considered a rebate and should not be considered taxable income. We will see what happens here.

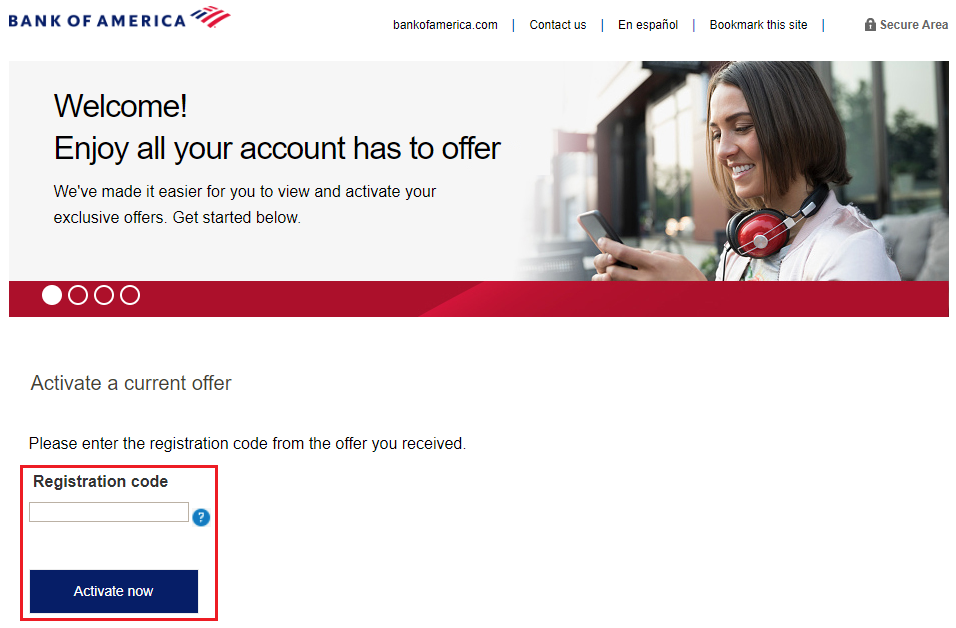

I went to the registration website and entered the registration code.

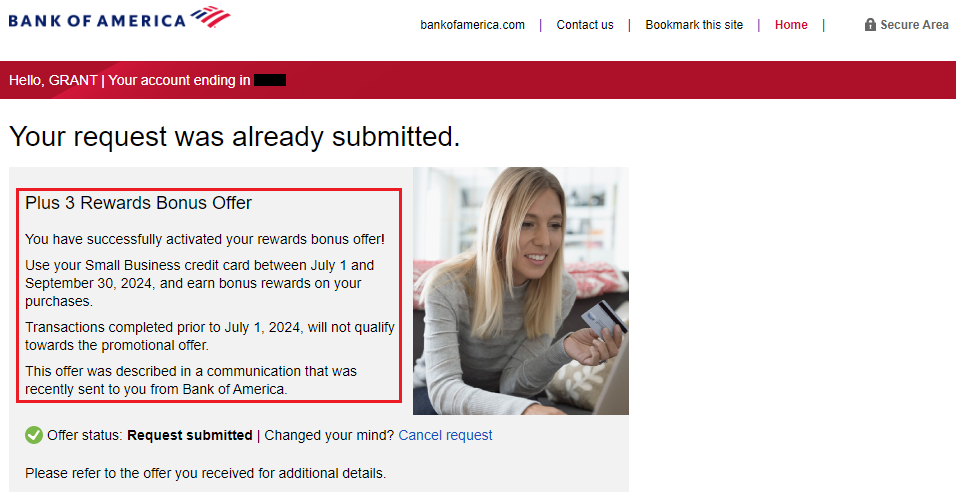

My offer was submitted and I am now successfully enrolled in the spending offer.

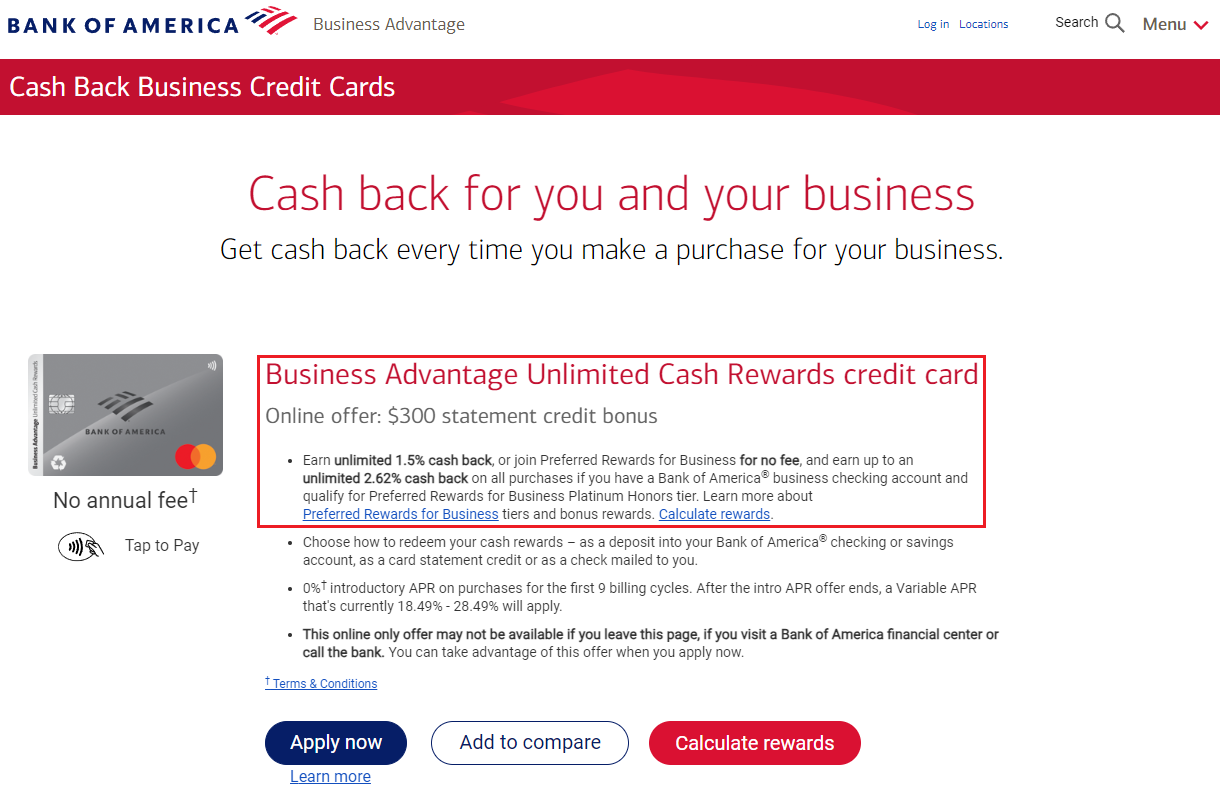

This credit card does not have many benefits, aside from the sign up bonus (that was $500 at the time I applied in October 2022). I am travelling to Dublin, Helsinki, and Stockholm this Summer and this credit card charges 3% FOREX fees, so I will not bring this credit card on the trip. I don’t have any planned large purchases in the coming 3 months either.

I was working on completing the trifecta of Bank of America Business Advantage credit cards: Unlimited Cash Rewards (UCR), Customized Cash Rewards (CCR), and Travel Rewards (TR). I completed the trifecta and closed the other 2 credit cards when I didn’t receive a retention offer.

If you have any of the Bank of America Business Advantage credit cards, let me know if you received a spending offer. If you have any questions, please leave a comment below. Have a great day everyone!

Why block the QR code? What’s one of your readers going to do, activate the offer for you?

Haha, you could actually unenroll me from the offer if you had access to the QR code…

I received the offer on my Business Customized Cash card. I haven’t put any spend on this card in some time. The timing might be good for me as I have multiple kids tuitions to pay for in the coming months, although I was originally planning to get new a couple of new bonuses. I was also trying to research last night what might fall into the computer services or business consulting services categories.

Hi JS, I would still recommend applying for 1 or more new CCs since the sign up bonus will far exceed the 4.5% cash back you would get from this offer, but this is great offer if you have a large unexpected expense and don’t have time to get a new CC.

Yes I will probably do some of both since I can split payments for tuition. I wish drugstores was one of the 3% bonus categories with the card (becomes 6% with this deal), then I could buy Gift of College gift cards at CVS to help fund kids 529 accounts. I don’t have any gas stations locally that sell them.

Oh ya, I loved buying those Gift of College GCs for my wife when she went to grad school. The money only sat in the account for a few months but I earned lots of cash back and points from my local grocery store.

If I’m reading the sentence correctly, you’d earn the 3% on top of the 1.5% base rate, and they’re including that reference to Preferred Rewards for Business because the PRB acts as a multiplier of the base. So, if you qualified for the PRB tier for 2.62, you might earn a total of 5.62, because this 3% offer doesn’t get multiplied by the PRB tier.

Another key point, in your offer letter, is that you have to opt-in for the offer by June 20th (wow, short lead time to sign up!) and the 3% doesn’t actually start until July 1st. Drat, I had a large charge that I have to complete by June 28th that can’t wait until July 1st.

Your understanding of how the PRB might be correct in don’t have PRB so I didn’t spend too much time trying to decipher the terms. Bummer that you missed the spending window by a few days.