Good morning everyone. A few days ago, the $95 annual fee posted to my Citi Strata Premier Credit Card. I never use this credit card for purchases (I have other Citi and non Citi credit cards that have better bonus categories and bonus multiples), but I keep this credit card for the ability to transfer my Citi ThankYou Points (TYPs) out to transfer partners. As part of my routine, whenever a credit card annual fee posts to any of my accounts, I call the credit card company and ask for a retention offer (read my recent post Midyear Review: My Credit Card Retention Offer Thought Process & Results).

Since I haven’t put any purchases on this credit card in several months, I was doubtful that I would receive any retention offers, but I wouldn’t know for sure until I called. During the call, I told the rep that I was considering closing the account due to the $95 annual fee. The rep transferred me to the retention offer department. Surprisingly, the retention offer rep had 2 decent offers available:

1: Receive a $95 statement credit + 1,000 TYPs after spending $1,000 on the credit card each month for 3 consecutive months

2: Receive 10,000 TYPs after spending $3,000 on the credit card in the next 6 months

Both retention offers require $3,000 in spending and provide a bonus of $100 – $105 (assuming 1 cent per point value for each TYP). I chose the first option since the total payout is $105 vs. $100, but now I am second guessing my decision. To complicate matters, I am currently working toward meeting the $8,000 minimum spending requirement on my new American Express Marriott Bonvoy Business Credit Card, so I don’t have a lot of free spend available. I might not be able to complete the retention offer spending requirements anyway.

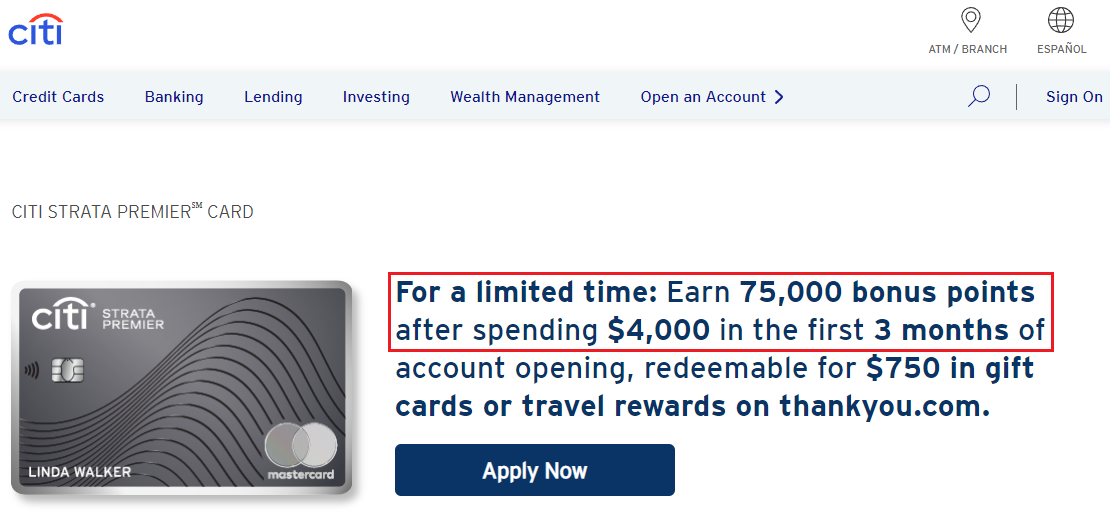

Alternatively, I am also considering applying for a new Citi Strata Premier, since I have had my current card since July 2019. The current sign up bonus for the Citi Strata Premier is 75,000 TYPs after spending $4,000 in 3 months. If I get approved for a new card, I would only need to spend $1,000 more than the retention offer spending to earn 65,000 more TYPs. In my opinion, it seems like a no brainer to go for the new card and downgrade the old card to a Citi Custom Cash (which would be my 4th Citi Custom Cash).

I started worrying that I made the wrong decision by picking the first retention offer, but now I have changed my mind and think I will forgo the retention offers completely and go for a new card instead. If you think that is a good or bad strategy, please let me know by leaving a comment below. I really appreciate your insights. Have a great day everyone!

Grant, Does Citi has 48months rule before you can get a new bonus? Thanks!

Hi Kay, yes, Citi has a 48 Month Rule: With most Citi cards, you can only receive a welcome offer every 48 months. This applies to the same exact card, not families of cards.

Thank you for your reply! Now I know as I am looking to maybe get the Strata card.

You’re welcome, good luck on your CC application :)

Comments as to this decision – 5/24 status and impact. Anything on the horizon for near-future cards that would be better than the 75k TYP? Aside – what single categories do you use for your three Custom Cash cards? And curious – then, what categories do you have left for transferrable currency cards?

I am well over Chase 5/24, so I focus on all the non-Chase credit cards out there. The only other CC on my horizon is the Bank of America Sonesta CC with 125K point sign up bonus. I alternate which CCs I use for different purchases on my Citi Custom Cash CCs. Sometimes it is restaurants, home improvement stores, entertainment (like musicals), and public transportation (Clipper Card in the Bay Area). I rarely max out the $500 monthly spend on any specific category.

Gotcha! Thank you for the info. Cheers.

Definitely apply for Strata Premier, if you are approved downgrade. If not approved complete the retention offer.

Yes, agreed, that is my plan :)

+1 for applying to a new card. It will also help not to rotate Custom Cash cards, but keep each one on designated category.

Yes, I agree. Sometimes it is hard to remember which CC is for which bonus category, so I usually check the Citi app to refresh my memory on which category I use with each CC.