(Hat Tip to Doctor of Credit’s US Bank Checking Account post)

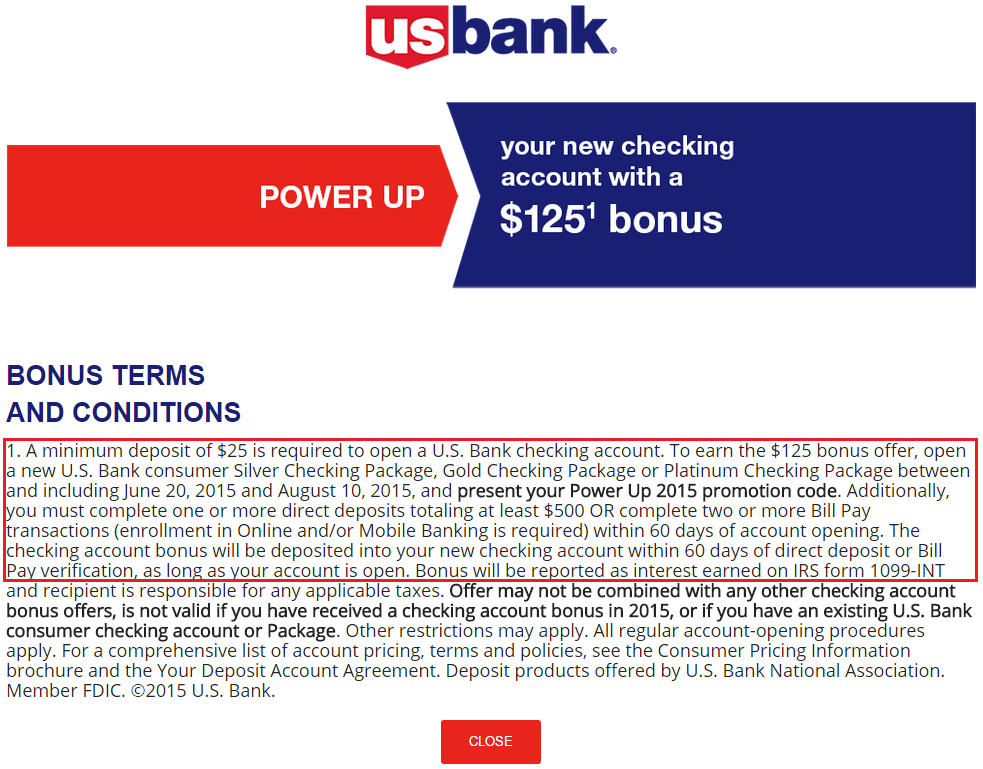

Good afternoon everyone, if you don’t read Doctor of Credit’s many daily posts, you are definitely missing some great cash back and MS news. He is also my go-to source for bank account bonuses and I recently started taking advantage of some of the bank account bonuses available to CA residents. If you are skeptical about bank account bonuses, please read DOC’s post Common Bank Bonus Misconceptions + Why You Should Give Them A Go. Currently, US Bank has a $125 bonus for opening a checking account, which you can view here.

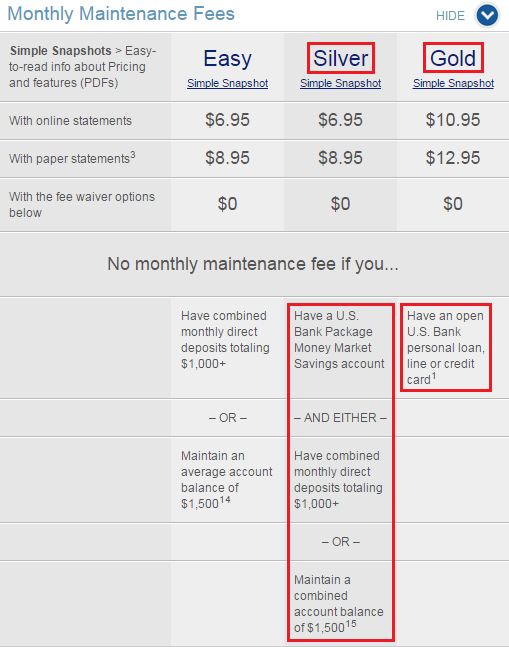

If you sign up for a Gold Checking Account, the $10.95-$12.95 monthly fee is waived just for having a US Bank credit card (I have 4 US Bank credit cards open at the moment). If you do not have any US Bank credit cards, you can sign up for a Silver Checking Account and have the $6.95-$8.95 monthly fee waived by having a money market account and $1,000+ in direct deposits or $1,500+ monthly minimum daily balance.

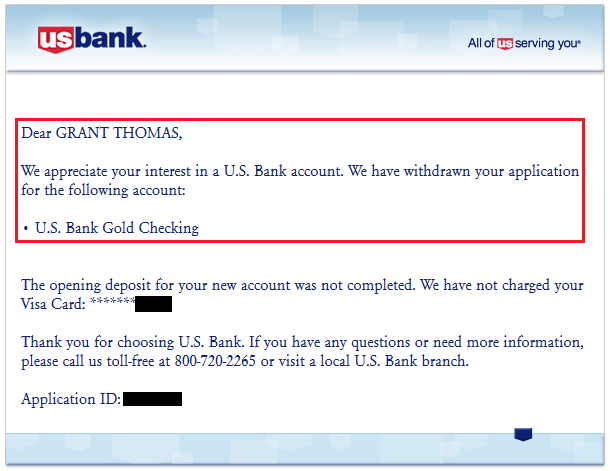

After I applied for the US Bank Gold Checking Account online, a few days went by and I received this email from US Bank. Apparently my US Bank Gold Checking Account application was withdrawn. I called the number and asked why. Apparently US Bank could not verify some information since my credit report was frozen. I asked which credit bureau they were using, but was told that they could not tell me. I figured my frozen ARS and IDA credit reports were to blame, since that seems to be the go to source for US Bank. The rep said that I could apply in-branch and they would not need to use the frozen credit report to approve the application.

I applied in-branch, but could not use a credit card as a funding source, so I brought a check the following day. To get the $125 bonus for opening a US Bank Checking Account, you need to complete one of these requirements:

- 1 direct deposit of $500+

- 2 bill payments

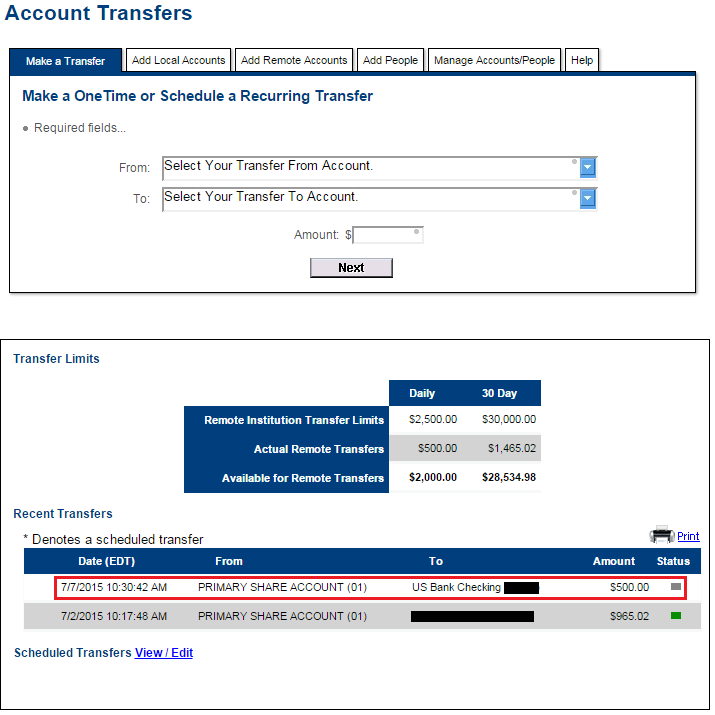

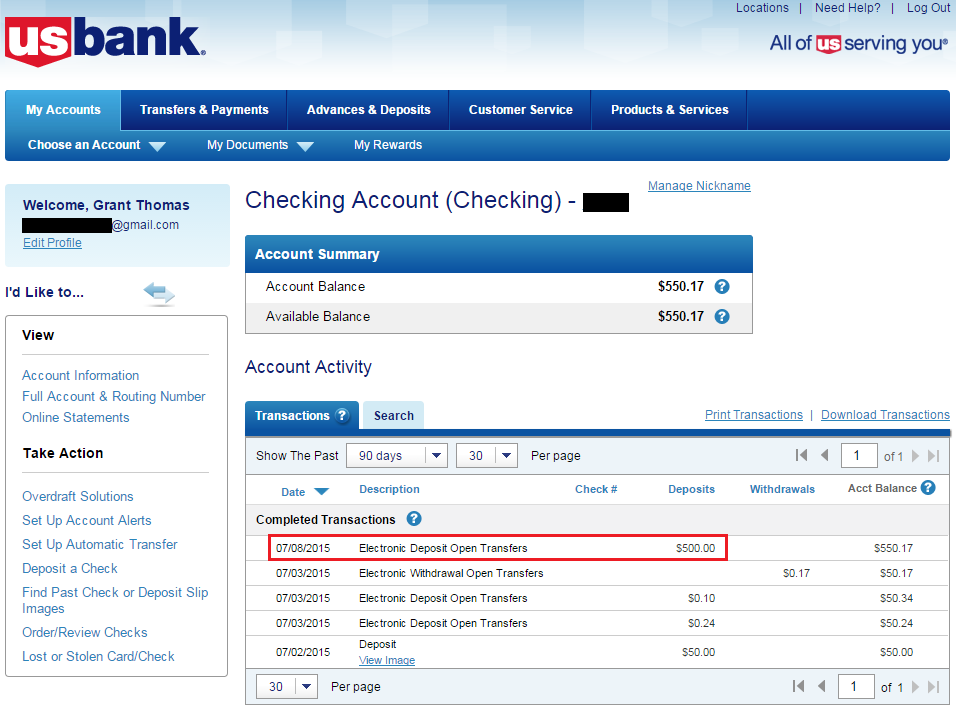

I tried moving $500 from my AgFed Credit Union Checking Account to my US Bank Gold Checking Account to see if that would count as a direct deposit…

But it doesn’t look like that worked, based on the name of the transaction (Electronic Deposit vs. Direct Deposit). I could be wrong, but I wanted to make 2 bill payments just to be safe…

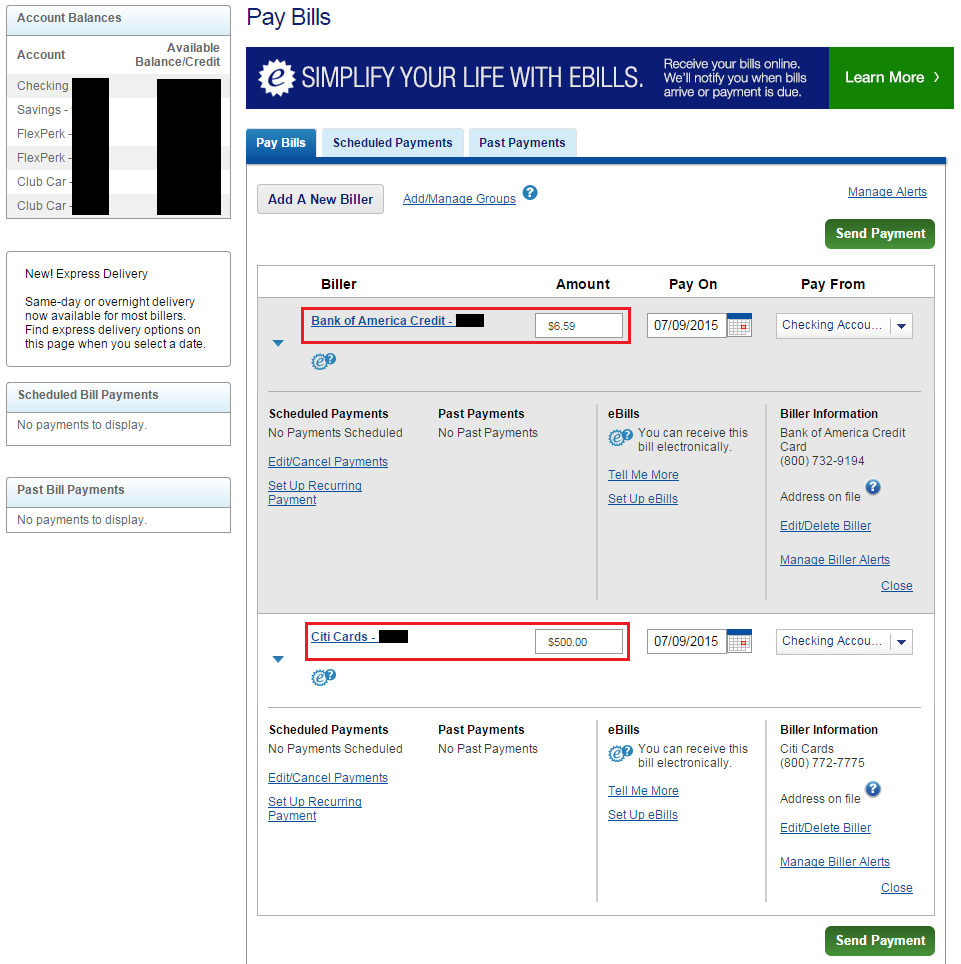

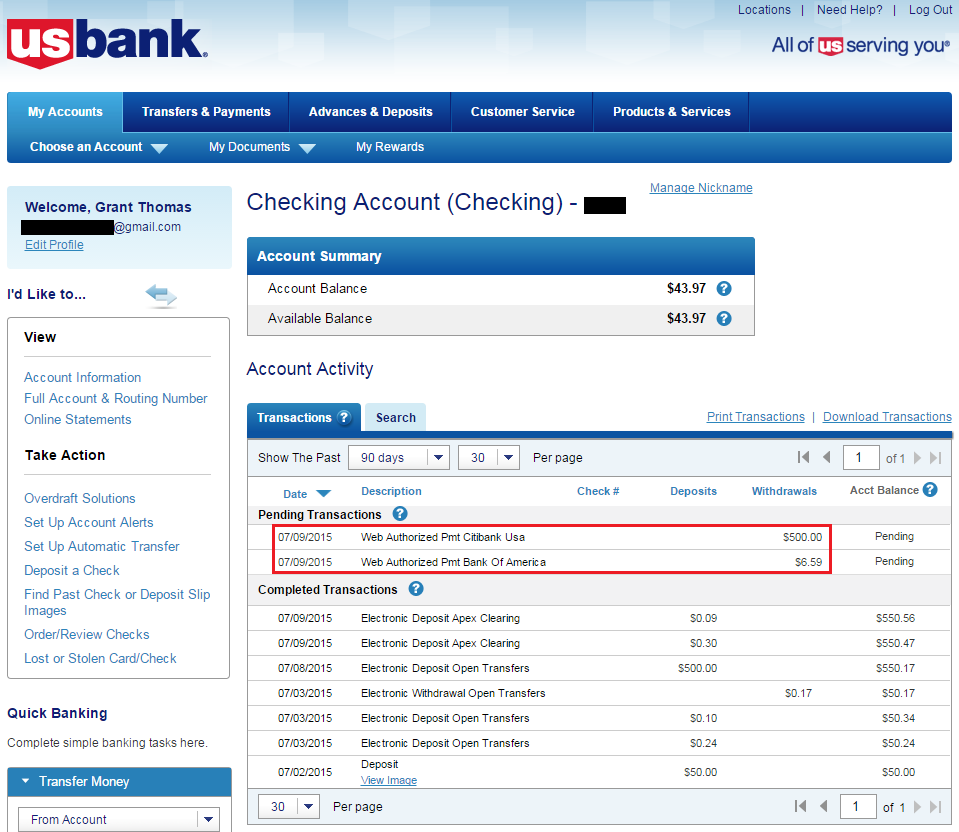

I made bill payments to my Bank of America Better Balance Rewards Credit Card and my Citi Hilton HHonors Reserve Credit Card.

The 2 bill payments are currently processing and should post to my credit card accounts within 2-3 business days.

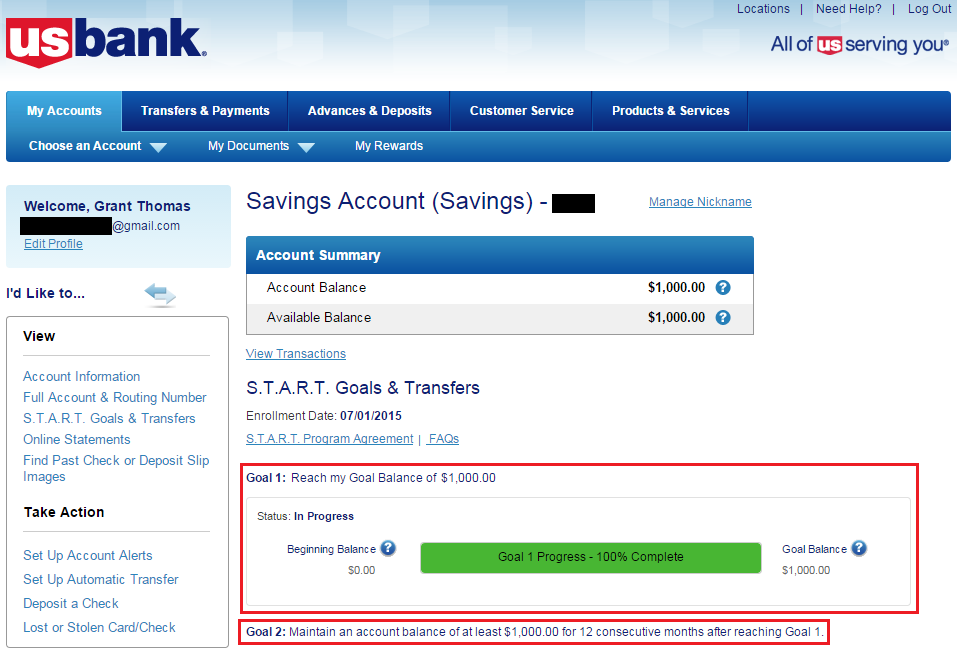

Last but not least, when I was applying for the US Bank Gold Checking Account in-branch, the personal banker recommended that I also sign up for a US Bank Savings Account. US Bank has a START program that gives you a $50 Visa Gift Card when you reach $1,000 in savings. I decided to make my initial deposit of $1,000 to my savings account. I should receive a $50 Visa Gift Card in the next week. If you decide to keep $1,000 or more in your savings account for the next 12 months, US Bank will send you another $50 Visa Gift Card. I will probably move the money out when the first $50 Visa Gift Card arrives so that I can put the money to good use for other bank account bonuses.

If you have any questions, please leave a comment below. Have a great day everyone!

whats the limits on credit card initial funding when applying online ?

You have to do the credit card funding right away online.

Just went through the same process, but mine was slightly different (and easier and more profitable)…

1st, I got a call yesterday from a USBank account specialist asking me if I still wanted to complete my application. She was nice enough to tell me it was the SageBrush (?), formerly IDA, that had the freeze (this took a little prodding….”so you’re telling me there is a freeze, but won’t tell me who I should contact to remove it…?”).

Then she told me USBank needed a copy of my driver’s license and confirmation that the freeze was lifted. I took a cellphone picture of my license then emailed it back to the CSR. Then I called IDA and temporarily (I did 60 days, but it’s up to you) lifted the security freeze using the PIN # IDA assigned to me when I initiated the freeze. It took until midnight to go into effect, but there is no confirmation email/letter from IDA. I emailed the same CSR back today and I confirmed to her that I had lifted the freeze. She called me back and she re-applied for me over the phone (she verified that the $125 offer code was in place). She was also able to take initial funding payment with my Arrival+.

The phone # I used is: 800-572-2659

I repeatedly verified with her that it was only a soft pull. Pretty interesting insight into how USBank verification process works differently for credit cards and checking accounts.

Thanks for sharing. I didn’t think of unfreezing my IDA report, but I’m glad you were able to do a temporary unfreeze.

Hi Ben,

Did you get through to US Bank directly, or did you have to leave a message after they contacted you the first time?

I missed the call and called them back, and it had me leave a message. Just wondering how long it took for them to call back.

Thanks!

Grant, how long do you think the $50 US Bank GC will take to arrive? I opened an account as well and did the S.T.A.R.T program.

The banker who opened the account said U.S. bank would send out the $50 VGC within 2-3 days funding the account within $1,000. I’ll let you know when I receive that GC.

Sounds good. Thanks!

Thanks, @Grant. I funded my S.T.A.R.T program today and I hope to receive it as well.

Good luck. I’ll let you know when/if the $50 VGC comes

When I talked with a CSR today, she stated that the transfers for the START have to be scheduled and maintained. I asked for clarification and she stated that you have to schedule transfers (various options available) that total $1000 over time.

She further explained that you have to transfer $1000 in total above the balance your savings is at when you begin START. She claimed you cannot just fund the account with a $1000 to satisfy the requirements.

Were you given different information Grant?

Hmm, I was told a $1000 deposit was all that was needed. I’ve since moved the initial $1000 deposit to my checking and did a bill payment. If I get the VGC, I’ll let you know.

May I fund the accounts by credit card in branch?

Not in branch, only online.

If I have my ARS/IDA frozen, would I still need to unfreeze them if I plan to open in branch?

If you apply in a US Bank branch, they do not do check ARS/IDA. They only check those credit bureaus if you apply online. If you want to apply online, you can temporarily unfreeze those reports.

Grant, I just wanted to report that I got my checking account bonus a few days ago. Thanks to you (and Will from DoC) for reporting about this. Keep up the good work!

Thank you, I got my US Bank checking account bonus around 3 weeks after opening. I’m still waiting for my savings account bonus, but I just finished that requirement a few days ago.

Pingback: Update on US Bank's $125 Power Up Checking and $50 START Savings Account Bonus | Travel with Grant

Pingback: My Week in Points: Bad Math, Fun Math and more