Good afternoon everyone. I have been a big fan of the US Bank FlexPerks Rewards program for a long time and have been earning and burning US Bank FlexPoints since the 2014 Winter Olympics promo when US Bank offered a larger than average sign up bonus based on the number of medals won by Team USA. Back in March 2016, US Bank changed the number of FlexPoints you could transfer from 120,000 FlexPoints to 20,000 FlexPoints per year. There is now another change to the way you transfer FlexPoints from one member to another. Previously, you only needed the FlexPerks account number to transfer FlexPoints to another account, but now you need the FlexPerks account number and FlexPerks credit card number.

I believe there are 2 reasons for this change. This change acts as a double authentication to make sure you are transferring FlexPoints to the correct FlexPerks account. Before, it was easy to mistype the FlexPerks account number and your FlexPoints would be sent to a complete stranger. This change also encourages cardholders to keep a US Bank FlexPerks earning credit card. If you have a FlexPerks credit card with an annual fee, you can convert to the no annual fee US Bank FlexPerks Select+ American Express Credit Card.

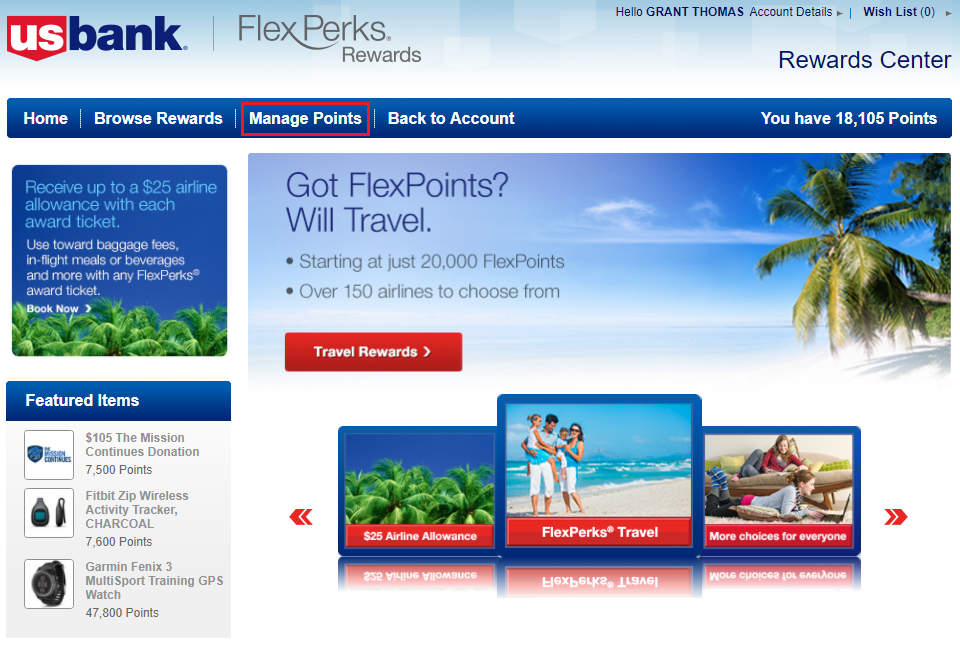

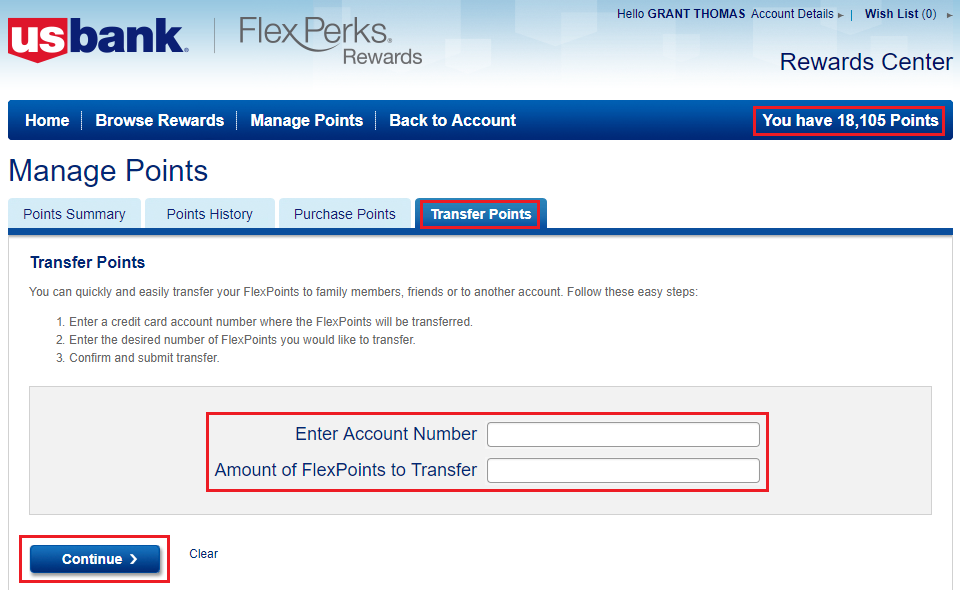

With that said, here is the new US Bank FlexPerks transfer process. First, sign into your US Bank online account and go to the FlexPerks Rewards Portal. Then click the Manage Points tab and then click the Transfer Points tab. Then enter the FlexPerks account number and the number of FlexPoints you want to transfer. Lastly, click the Continue button.

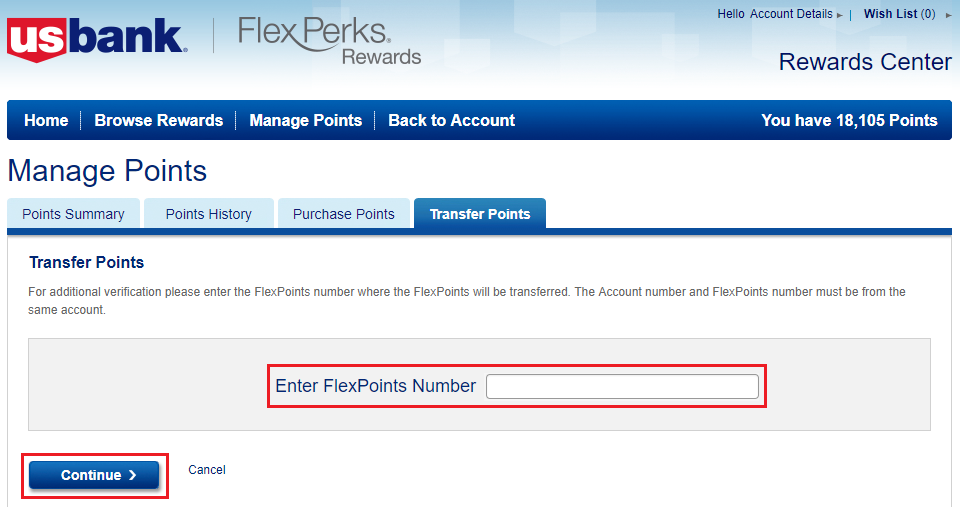

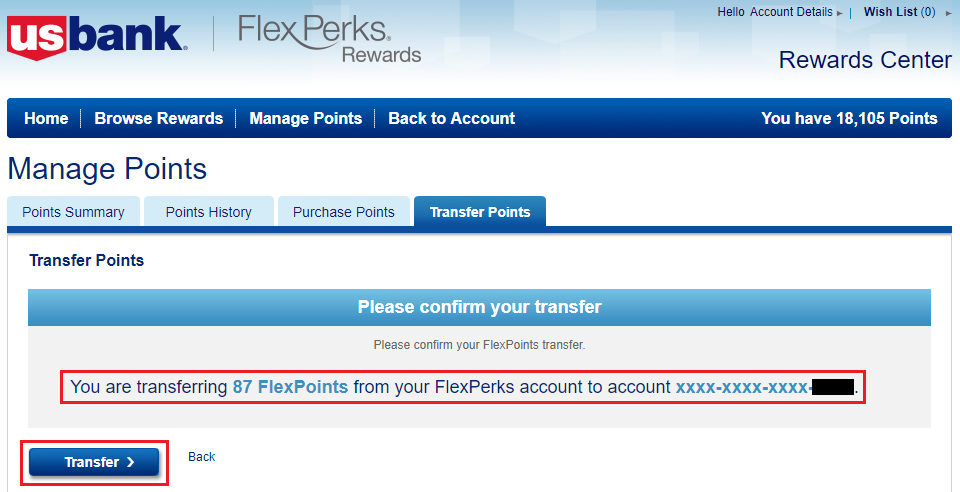

Here is the new change. You now need to enter the US Bank FlexPerks credit card number associated with the US Bank FlexPerks account number. Then click the Continue button. Review the FlexPerks transfer details and click the Transfer button.

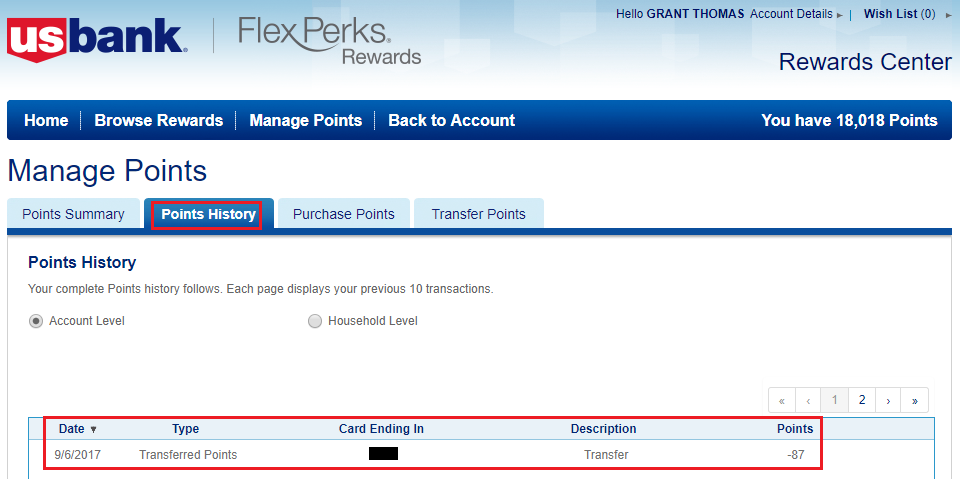

Congratulations, your US Bank FlexPerks transfer is now complete and the other FlexPerks account should receive the FlexPoints immediately. To view your previous FlexPerks transfers, click the Points History tab. If you do not see the transfer, click the circle for Household Level to view all FlexPerks account activity.

That is the new (and improved?) US Bank FlexPerks transfer process. The transfer process takes a little longer than normal, but the FlexPoints transfer is instant. I wish there were a way to save transfer details so you could easily transfer FlexPoints from one account to another, but I am sure US Bank does not want to encourage cardholders to move FlexPoints around too much. If you have any questions, please leave a comment below. Have a great day everyone!

Are you not aware that comes 1/1/18 each pt will be worth only 1 1/2 cents, meaning any 2% CC will be a better deal. This card has been my main CC all 3 times I got it. But comes 1/1/18 its been CXed

Yes I know charity contributions will be 2x (now 3x) and 2x will still be for either Groceries,gas or airline tkts whichever of the 3 is the major spend.I cashed in for a tkt tonight $797.96 used 40k after 1/1 40k will be good for a tkt for $600 so in this case it will take 25% more pts for the tkt I got tonight. No Thank You

l learnt the hard way if you purchase a tkt and realize 1 sec after clicking Confirm you put in the wrong date or chase the wrong carrier or flight, with any airline you have 24 hrs to CX for $0, Flex will charge you $30! yep and they will tell you had you purchased it with a carrier it would have been free

A few yrs ago they didnt charge , I found a set of flights I wanted but it didnt come up on Flexs site , called up and no problem they found the flights and would book it for me using my Flex pts, Oh it would be $25 for the agent to do it.

I plan to use up my 100s of 1000s of pts before 12/31 for tkts for ’18 before they devalue the pts and Im don ewith this outfit!

I will admit it was great while it lasted, but the party IMO is over

I am planning on using all my FlexPoints before 1/1/18, but good reminder for everyone.

In my experience, USBank will not allow conversion from Amex GOLD. I had to close the card and was offered the option to apply for the no AF card.

Hmm, interesting. I was able to convert my US Bank FlexPerks Travel Rewards American Express Credit Card to the US Bank FlexPerks Select+ American Express Credit Card a few months ago. I still have my US Bank FlexPerks Gold American Express Credit Card.

Grant how did you pull that off with WN? AFAIK, Flexs TA is qttravel and they use their own CC when they purchase the tkt.So if a carrier is gonna refund to the mode used to pay then it will go back to qt’s CC. i guess one can ask the carrier to put the funds into their travel bank if such exists, but tom CX youd need to contact qt so I have no idea how to pull it off as most carriers will see a CC was used along with a TA and tell you to contact your TA to cx or make changes ( I never flew on WN)

I was fortunate yrs ago to cx a tkt by calling qt(Flex) and the tkt was CXed w/o a fee and the pts took a week to go back into my acct. So by dealing with qt all you end up with is a $25 fee and pts worth 1 1/2,cents each. this was within T-24

I think the only way to pull this off Meg is if you can convince the carrier to CX the tkt and refund the funds into a travel bank with them, or keep the PMR alive, but I just dont see a carrier touching a tkt that was issued by a TA. I tried in the past with UA and AA and all I got was I must call and deal with the TA who did the tkting

To book a SWA ticket with FlexPoints, you need to call the FlexPerks Rewards department. Then they buy the ticket for you using their CC. Wait more than 24 hours and then cancel the ticket and the travel funds will be in your name, good for 1 year from the date of purchase.

WoW, I think WN then is the only carrier that will allow the passenger to CX a tkt w/o having to go via the issuing TA I know the US3 will only refund to the original means that was used. Ive had refunds go to a CC that I used that was CXed after I was tkted (Award Tkt = getting back the taxes). Yea I eventually got the funds but with no longer knowing the CCs full # , I was forced to wait till I got a statement from that CC and then call up and ask them to cut a check or move the funds as payment to another CC I had with them a Royal PITA

I guess a person could play HUCA and hope they get a csr that will work with you, I never had that luck as usually I got hit with ‘I must contact the issuing TA if I want to CX’ and that means with flex the pts going back into the acct

since I dont fly WN its of no use for me

I want to use all my flexpoints too – book and then cancel a delta flight within 24 hours. I believe they will refund the flight $$ to my Delta account and my out of pocket would only be the 30 dollar cancellation fee with flexperks. Anyone have experience with that? I don’t fly Southwest and Alaska, which I heard are other good ways to “cash out” the flexpoints.

I’ve only had experience with the buy and cancel trick with Southwest Airlines, but hopefully someone else can chime in on their experience with Delta.

Pingback: PSA: Error Transferring US Bank FlexPoints from FlexPerks Rewards Account to Altitude Reserve Account? Just Call