Good morning everyone, happy Friday! I am flying to Phoenix this weekend to watch some Spring Training baseball games, go to a Phoenix Suns basketball game, and maybe catch a Phoenix Coyotes hockey game – lots of sports in my future!

In credit card related news, both my US Bank FlexPerks Travel Rewards Visa Signature Credit Card and US Bank FlexPerks Travel Rewards American Express Credit Card had $49 annual fees that just posted. I got both credit cards during various Summer / Winter Olympic promos and have since spent down the majority of my FlexPoints. The only reason to keep the FlexPerks Visa Signature card is for 3x at charity (making Kiva loans) or 2x at gas stations and grocery stores. You do get 10 Gogo Wifi Passes every cardmember year, but I seem to earn them faster than I can redeem them (plus the American Express Business Platinum Charge Card gave me 10 free Gogo Wifi Passes that I have yet to use either). As for the FlexPerks American Express card (no longer offered – it has since been replaced by the US Bank FlexPerks Gold American Express Credit Card), I really never use that card either.

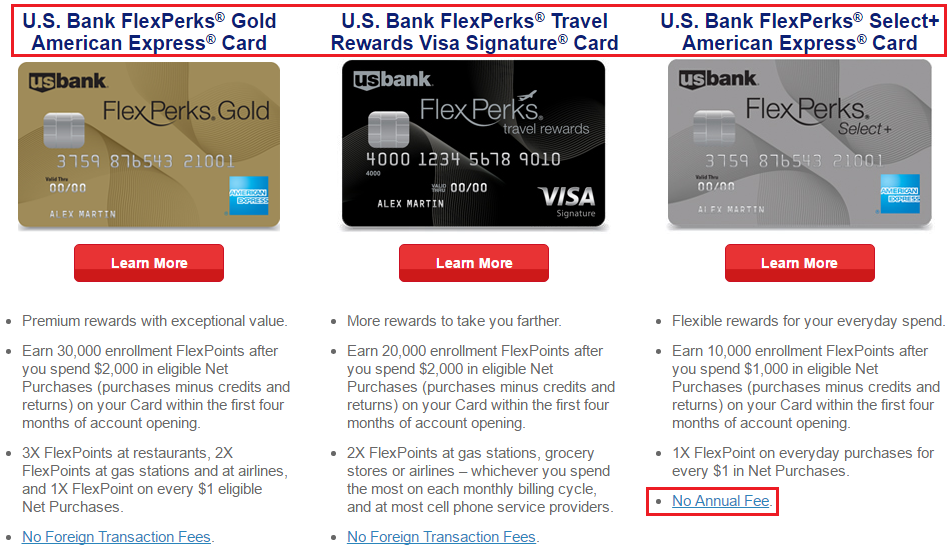

Long story short, both credit cards had annual fees that posted and I wanted to downgrade / convert to credit cards with no annual fees. Here is my journey calling US Bank and figuring out which credit cards you can downgrade / convert to. The obvious choice is the US Bank FlexPerks Select Plus American Express Credit Card that earns FlexPoints and has no annual fee.

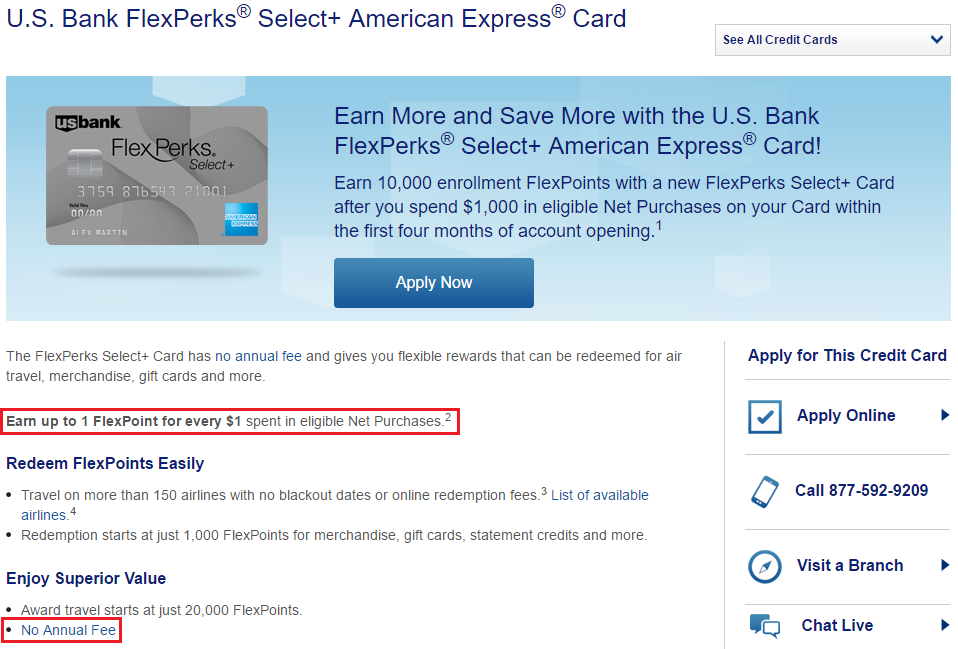

Option 1: US Bank FlexPerks Select Plus American Express Credit Card – this is your standard no annual fee credit card. It earns 1x on all purchases with no bonus categories, but has all the same FlexPoint redemption capabilities, including redeeming for flights starting at 20,000 FlexPoints. (Click here to learn how to redeem FlexPoints for travel redemptions.)

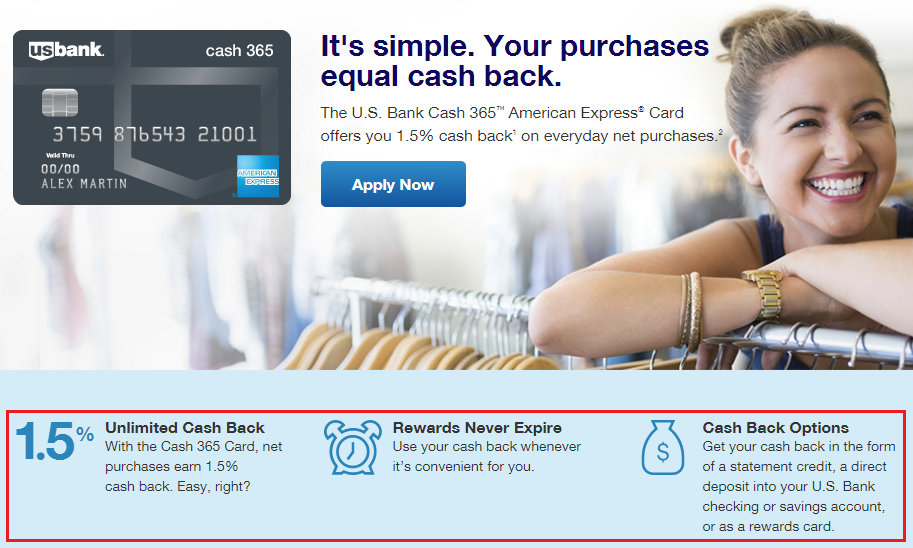

Option 2: US Bank Cash 365 American Express Credit Card – this is your basic 1.5% cash back on everything credit card. No categories, no limits, and probably no fun to use. I’m not sure why anyone would ever use this credit card when you can earn 2% cash back with a Citi Double Cash Credit Card. But since this is an American Express credit card, you are eligible for AMEX Offers if you can link them to this credit card.

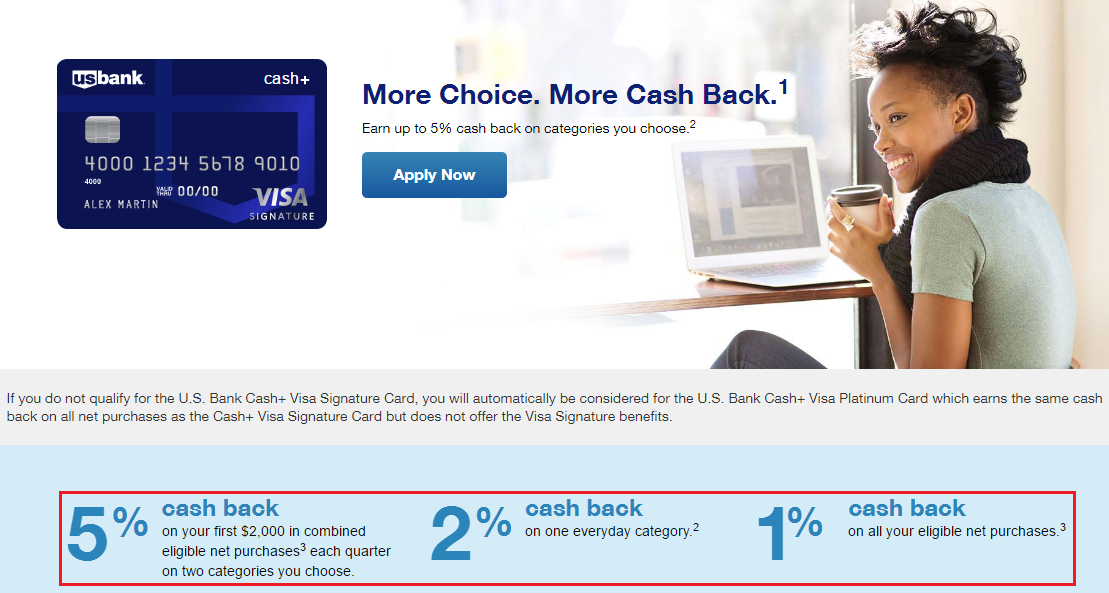

Option 3: US Bank Cash Plus Visa Signature Credit Card – this credit card offers 1% cash back on everything, 2% cash back on 1 category you select (usually restaurants, gas stations, and grocery stores) and 5% cash back on 2 categories you select (I wrote about the Q2 2017 bonus categories here). This credit card is a good alternative or companion to the Chase Freedom, Discover It, and Citi Dividend credit cards.

My Plan of Attach

Arguably, the US Bank Cash Plus Visa Signature Credit Card is the best option, but since I currently have that credit card, I cannot get a second card. With the remaining limited options, I converted my US Bank FlexPerks Travel Rewards American Express Credit Card into the US Bank Cash 365 American Express Credit Card to have the ability to use the credit card for AMEX Offers. Lastly, I downgraded my US Bank FlexPerks Travel Rewards Visa Signature Credit Card into the US Bank FlexPerks Select Plus American Express Credit Card to keep my small stash of FlexPoints alive and have the ability to use the credit card for AMEX Offers.

The US Bank customer service supervisor mentioned that there used to be a US Bank FlexPerks Visa Credit Card that had no annual fee, but that credit card is no longer offered as a product change. There was no problem converting a credit card from a Visa to American Express or vice versa. The supervisor also stated that I should try calling back in ~6 months to see what other downgrade / upgrade / conversion options are available for any of my US Bank credit cards.

Have your annual fees posted recently on your US Bank FlexPerks credit cards? Are you paying the $49 annual fee? Are you redeeming 3,500 FlexPoints to pay the annual fee? Are you downgrading or converting the credit cards? Or are you outright closing the credit cards? I would love to hear your reasoning and experience below. If you have any questions, please leave a comment below. Have a great weekend everyone!

This is great information. I think I would have just cancelled the card and moved on. Just me though.

Thanks

I considered that, but I’ve had these US Bank credit cards for 2+ years and wanted to keep them open to improve my credit score.

Did they specifically tell you that you can’t have 2 Cash+? Does that work with all of their cards or just that one? Do I need to have a USB card for a certain amount of time before I am allowed to downgrade?

Technically, I think you can get multiple Cash Plus CCs, you just have to convince the rep to product change to that CC. I think you need to have the CC open for at least 1 year before you can downgrade or convert to a different CC.

Grant —

I had read on FlyerTalk some time ago, that the Flexperks accounts for the AMEX and Visa cards are kept separate.

Are you sure that your small stash of Flexperks have been transitioned from the Visa card to your new AMEX card?

Please report back when you have a chance.

Thanks!

Will do. It will probably take me 1-2 weeks to get the new credit cards and see my updated online account access.

Can you confirm Flexperks Visa points are kept alive after converting the card to Amex? Thanks

I cannot 100% confirm if that is true, but your FlexPerks account should remain open and active, so your FlexPoints should be kept alive if you convert / product change to a no annual fee US Bank FlexPerks Select+ American Express Credit Card.

Weren’t you targeted for a bunch of spend promotions recently? Did you meet them and did you get your bonus flexpoints yet?

Yes, I was targeted for a few offers, I have yet to complete the spend, but I will try to meet those spends quickly and see if they post to the cards.

I pay the $49 Visa flexperks annual fee with flexpoints. US Bank usually seems to offer some spend bonus every now and then that kind of makes up for the deduction. I also have a flexperks Amex, but because my mortgage is with US Bank, that “relationship” gets me a pass on that annual fee. FlexPerks have come in handy when trying to get my family of four on free flights if I don’t have enough miles for everyone.

That’s great that they waive the Af on your AMEX. Why not on the Visa Sig CC too? Yes, it was great using FlexPoints for flights priced just below $400.

If you cancel a flexperk card Do you lose all remaining flexpoints in your account

yes you do Rich!

yes you do Rich! Redeem your points before you cancel!

Anyone have experience with what earning rate is if > $120k annual spend on USBFPTRVSC?

No experience, but I would assume 1x for all purchases above $120,000.

I just called to try to downgrade my FlexPerks Amex (the old one, not the Gold Amex) and was told that they haven’t offered card conversion as an option since Fall 2016. What number did you call?

Thanks!

That is so weird. I called the number on the back of my US Bank FlexPerks Travel Rewards AMEX. Another friend of mine said she got the same response you did. I’m not sure what is going on with US Bank, but you can try contacting US Bank on twitter and asking them to help.

When you converted /downgraded the flex perks gold to flex perks select were you still able to receive the 10,000 enrollment points bonus offer for the flex perks select card after meeting the $1000 spending requirement?

No, you do not get the sign up bonus offer when you convert to the FlexPerks Select CC.