Updated 5:15am PT on 1/29: I uploaded an image of the letter I received from my retention call to Barclays. Scroll down to the bottom of the post for more info.

Good morning everyone, another day, another blog post about free money from Barclays. On Monday, I wrote a blog post regarding a $10 statement credit I received from Barclays for adding an authorized user to my Barclays Arrival Plus Credit Card. Yesterday, I called Barclays about my Barclays JetBlue Plus Credit Card. The $99 annual fee posted a few days ago, so I called Barclays to see if there were any retention offers available. I haven’t put much spend on the credit card since meeting the minimum spend but I have racked up thousands of JetBlue TrueBlue points with Amazon.

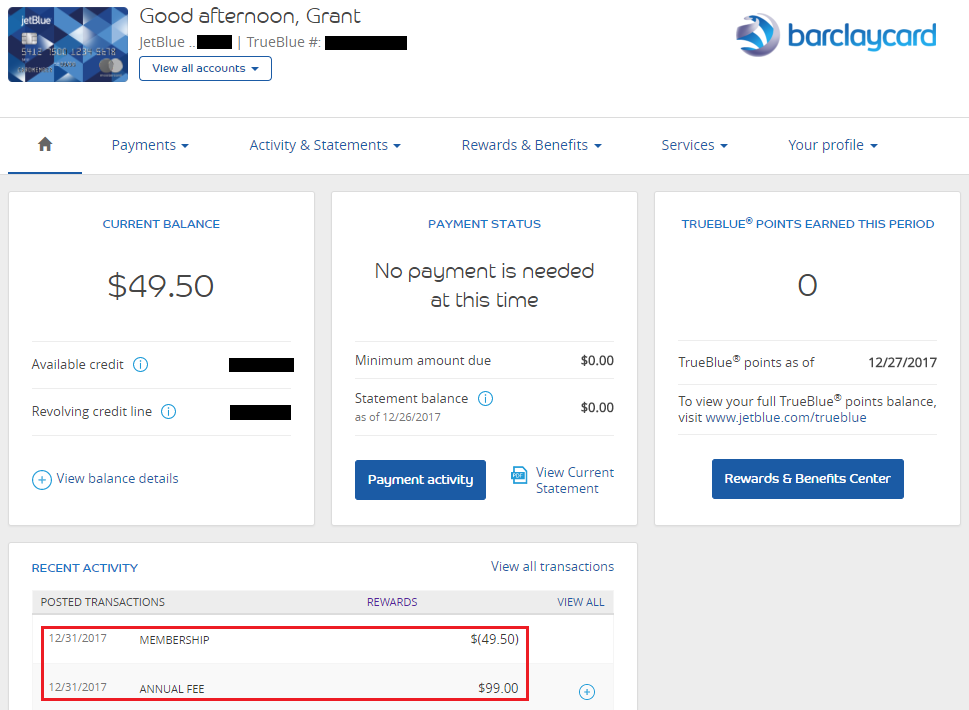

The first offer I received was for half the annual fee to be waived ($49.50). That was pretty good, but then I asked if there were any other offers available. Yes, she could also tack on a targeted spending offer to get 5,000 bonus JetBlue TrueBlue points for spending $1,000 in the next 90 days. Sold! I accepted that offer. The $49.50 statement credit posted to my account the next day.

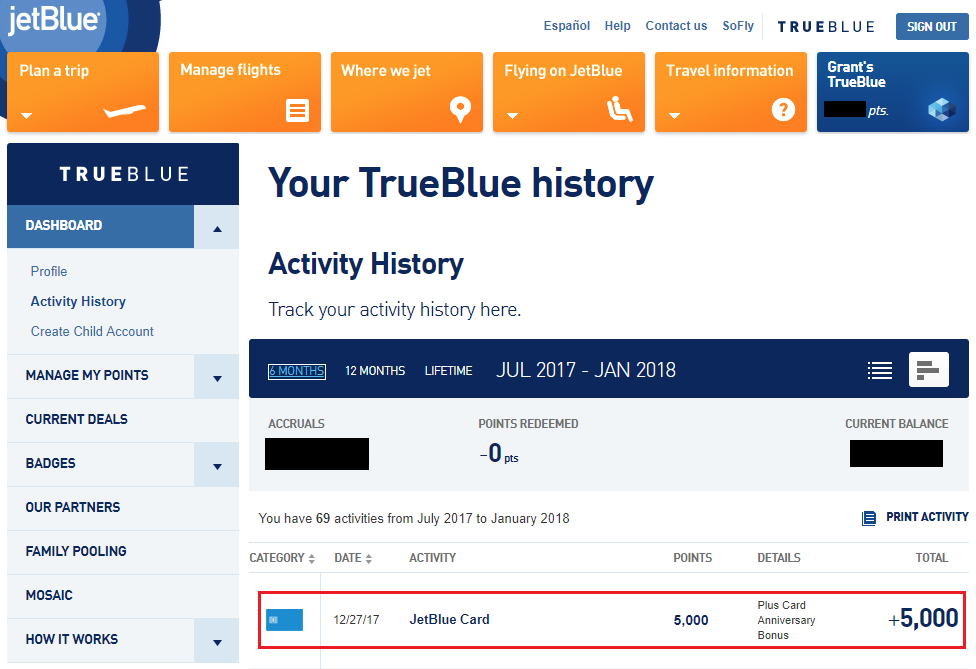

I already received the 5,000 anniversary JetBlue TrueBlue points from the Barclays JetBlue Plus Credit Card, so another 5,000 bonus JetBlue TrueBlue points will be a nice bonus.

Have you received a similar or different retention offer on your Barclays JetBlue Plus Credit Card? Let me know. If you have any questions, please leave a comment below. Have a great day everyone!

P.S. Here is the targeted spending offer that resulted from my retention call:

When calling for retention offers, do you specifically say “I am calling to see if there are any retention offers available”, or do you say “I’m thinking of canceling card, blah blah blah” and thus not be so direct. For some reason I’ve always been concerned about being too “in the know” when calling for retention offers.

I’ve used different approaches in the past, but this time I was very direct with Barclays. “Good morning, I was reviewing my credit card statement and saw the $99 annual fee just posted. I’m calling to close my credit card.” And then after a short pause, I said, “Is there any way to waive the annual fee?” Then the rep immediately checks for retention offers. Sometimes that approach works well and sometimes it doesn’t.

This was for year 1 or year 2?

This is for my first anniversary.

Here is my question for you, and it’s my own inner debate since my fee is coming up in the next week or so.

Since Barclay allows you to get the bonus again after a year, why not close it and reopen it for the 30k miles for the same 1000 spend?

What was your thought behind paying the $50 for roughly 10k miles (annual bonus + spend bonus)?

Genuinely curious.

Getting approved again in the future is no guarantee with Barclays. If it was a sure thing, I would probably close all my Barclays credit cards and reapply in the future. Maybe I will do that, I’m not sure.

Pingback: Island that Switches Countries, Last Slave Ship Maybe Found, Japan Peak Season - Rapid Travel Chai

Thanks for the post Grant, it’ll be a while before my annual fee comes up but FlyerTalk is barren for Jetblue Plus retention offers so seeing this was reassuring that it won’t be tough to get the fee entirely offset.

I’m curious as to why you didn’t go for the $50k for mosaic?

The trifecta of $50k for mosaic, uncapped 2x grocery, and 10% back got me to jump on this card. Especially with AE adding in language to discourage PRG grocery “use”.

I don’t fly JetBlue often, maybe once a year, so I didn’t want to go for Mosaic status. I did have it for a year due to a status match, so that was nice, but I didn’t think it was worth spending $50,000 on.

DP – Received the same offer today of 50% annual fee waived and 5,000 points after $1,000 spend.

Sweet! I just got my bonus 5,000 JetBleu points recently :)

DP – same offer today

No luck for me today, was only given the option to downgrade the card to a no annual fee version.

Hmm, if your annual fee hasn’t posted yet, I would try calling back in a few weeks or months and trying again.

The last time I waited for an annual fee to post before canceling a card, they would only cancel effective the end of the following month. I got 10/12ths of the fee credited and had to pay the rest. Granted, it was a Discover card, so maybe they have different policies or I’m just a worse negotiator.

You had a Discover credit card with an annual fee?

Yep, it gave me like double the cash back or something. Discover was the only card our day care would take, and the annual fee more than paid for itself in extra cash back.

Received same offer today, the rep misunderstood/garbled the spending offer a bit, but was able to look here to confirm the meaning of the terms he read and that his informal description 3x$1k spend each month was most likely incorrect. Thanks!

Happy to help clarify the spending offer :)

I just got off the phone with them. They wouldn’t offer me a spending offer for any Jetblue points, BUT I did get them to waive the entire annual fee. I guess that’s still a win.

Waived annual fee is a win in my book :)

I just got off the phone with them. They wouldn’t waive the fee, give me bonus points, or even downgrade me to the free card. I canceled the card and I guess I’ll apply for the free card.

That is really stingy. Do you recall how much you have spent on the credit card over the last 12 months?

Not much. Which could explain it.

When I got the card, I asked and was assured that secondary cardholders (e.g. my spouse) got all the benefits, e.g. free checked luggage. After a couple years of gate agents manually applying that benefit, I finally got someone to tell me that they don’t. So a year ago, she got her own card, and the spending has been on that.

Other than buying JB flights, the card is at least third priority, behind our Fidelity Visa (2% cash back on everything) and Sears MasterCard (which keeps giving me offers of 10% cash back on targeted categories).

That’s good to know that the AU CCs do not get all the JetBlue benefits. I keep the card for the bonus anniversary points and the 10% rebate on redeemed points. I don’t fly JetBlue very often, but it works when I book flights for my parents using my points.