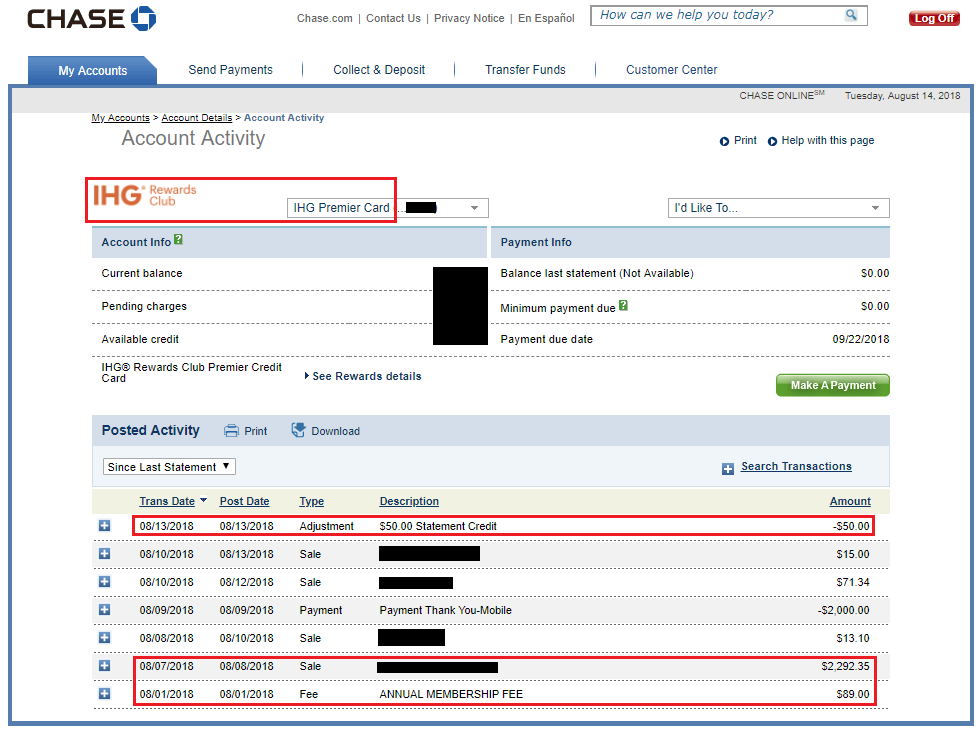

Good afternoon everyone, I have a quick update to my recent post: Get Matched to the New Chase IHG Rewards Premier 100,000 Point Sign Up Bonus. In that post, I sent Chase a Secure Message (SM) and got matched from the 80,000 IHG Points sign up bonus to the 100,000 IHG Points sign up bonus. In the comments section of that post, readers wanted to know if I would still get the $50 statement credit after my first purchase if I accepted the higher sign up bonus offer. I’m happy to report that the $50 statement credit posted a few days ago. My first purchase posted on August 7 and the $50 statement credit posted on August 13, roughly 1 week later. My $89 annual fee posted on August 1, which is roughly 2 weeks before the $50 statement credit posted.

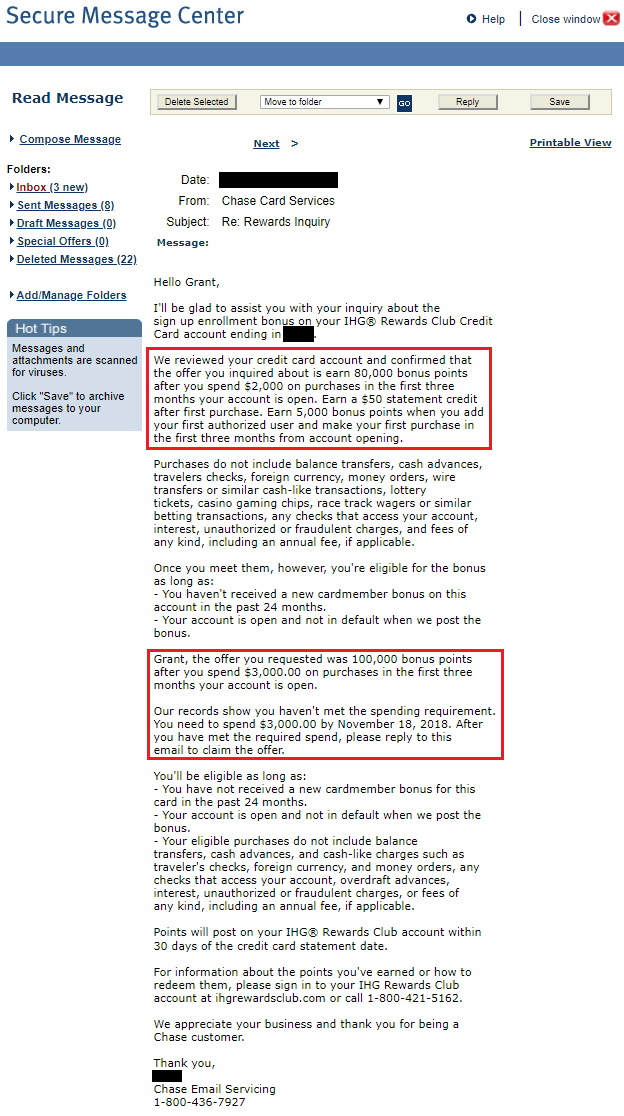

Since I signed up for the Chase IHG Rewards Premier Credit Card with 80,000 IHG Points + $50 statement credit sign up bonus offer, I was still able to earn the $50 statement credit. Here is my Secure Message (SM) response from Chase. Carefully read the wording of the SM, since it sounds like I wasn’t technically matched to the higher offer. After completing the $3,000 minimum spending requirement, I need to respond to the SM and Chase will give me an extra 20,000 IHG Points.

If you have the old Chase IHG Rewards Select Credit Card, I recommend keeping that credit card open. If you have any questions about the Chase IHG Rewards Premier Credit Card, please leave a comment below. Have a great day everyone!

I called Chase on Aug. 2 after the new signup bonus was announced to see if they would match me to the 100,000 point offer if I spent the extra $1000 in the original three month window (had already met the $2000 spend but had yet to receive the 80,000 points as the statement hadn’t closed yet). The agent flatly refused to match me to the 100,000 offer after putting me on a brief hold and checking with someone. Maybe I’ll try the secure message approach!

Yes, definitely try the Secure Message approach and let me know how it goes. Provide the increased sign up bonus link in the message. Good luck!

Great that you got the $50. I wonder why they agreed to match me to the 100K but not the $50? Oh well….quibbling.

If you signed up for the 80K + $50 Statement Credit, I think the $50 Statement Credit will still post to your account. I’m rooting for you.

Chase seems to be targeting customers that have the old Ihg card and then applies for the new Premier IHG card. What has happened to me and my wife is once we applied for the new account, Chase closed all are credit card with them. I was originally approved and my wife was denied. I logged in one day to see both my wife’s and my account s closed. We both had 13 inquiries in the past 2 years and chase indicated we now became a risk. We both have a credit score over 800. I was able to get all my account reopened but still working on my wife’s. Never been late on a payment and always over 800 on my credit score. Not sure since I already had the IHG card that the new card some how shows as a risk.

That is scary. How many of the 13 inquiries from the last 2 years were for Chase CCs? Are you spending lots of money on your Chase CCs?

I had 4 with Chase and my wife had 3 with Chase. I do charge on my Chase cards. I have the Hyatt and the two IHG cards. When I talked to Chase they agreed to reopen my accounts if I have no new inquiries in the next year. I luckily have accumulated a lot of point in the last 10 years so maybe a good time to slow down.

Yikes, at least Chase reopened you CCs. I hope you can get your wife’s CCs reopened too.

Pingback: Keep, Cancel or Convert? Chase IHG Rewards Select & Hyatt Credit Cards