Good afternoon everyone, I hope your week is going well. As you know, I like to make Wild & Crazy Airline, Hotel & Credit Card Predictions. Today’s prediction missed the official 2023 deadline, but it just came to me, so I thought it was worth sharing. As I reminder, I am 100% correct 1% correct on my predictions, so take this with a grain of salt.

As a reminder, the Chase Freedom Unlimited Credit Card currently earns 1.5% cash back everywhere (1.5X Chase Ultimate Rewards per dollar). That used to be great until the likes of the Citi Double Cash Credit Card (2% cash back everyone / 2x Citi ThankYou Points), American Express Blue Business Plus Credit Card (2X Membership Rewards Points everywhere), Capital One Venture X Credit Card (2X Capital One Miles everywhere), and the handful of other 2% cash back cards came onto the scene.

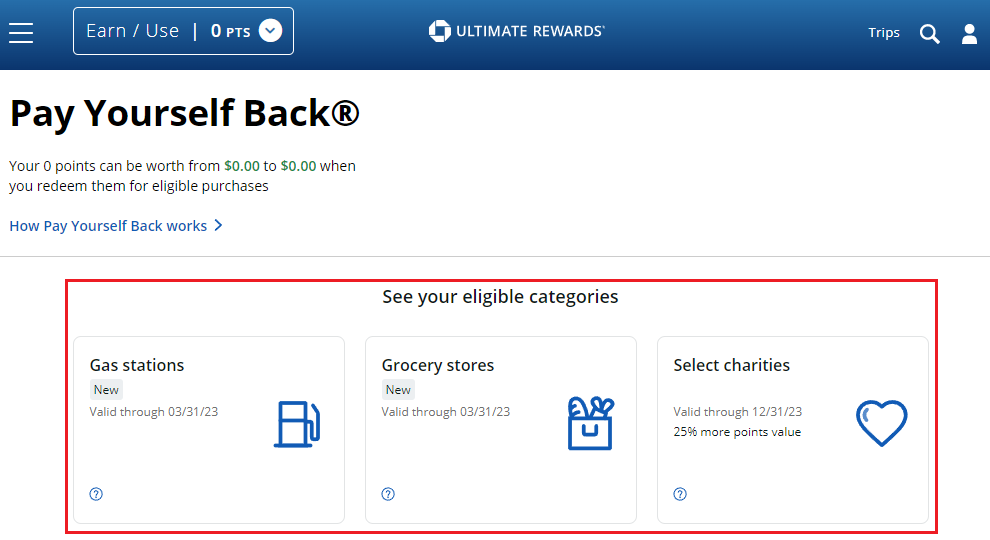

You can still transfer your Chase Ultimate Rewards Points from your Chase Freedom Unlimited to your Chase Sapphire Preferred or Chase Sapphire Reserve, but the Pay Yourself Back categories recently dropped (see Doctor of Credit’s post outlining the changes). My hypothesis is that Chase has planned to increase the Chase Freedom Unlimited from a 1.5X everywhere card to a 2X everywhere card (to keep up with the competing 2% / 2X credit cards), but they knew cardmembers would transfer those Chase Ultimate Rewards Points to Chase Sapphire Preferred or Chase Sapphire Reserve and get outsized value with the Pay Yourself Back categories. Therefore, Chase had to decrease the Pay Yourself Back categories to offset the increased earning on the Chase Freedom Unlimited.

I might be on to something or completely off base, but I thought my prediction was worth sharing – only time will tell if I am right or wrong. If you agree or disagree with my prediction, please leave a comment below. Have a great day everyone!

3% would be better. Glad I have USBANK for utilities and Ink Cash for Internet as well as others with Visa gift cards.

Agreed that 3% cash back would be better but that seems unlikely. The US Bank Cash+ is great for utilities as well as the Barclays Wyndham Rewards Earner Business CC.

If it goes to 2x, expect a Hyatt deval around the corner.

Are you saying a devalue in the 1:1 transfer from Chase to Hyatt? I can’t imagine that ever happening.

I think that Hyatt will more likely adjust the World of Hyatt card earning structure

Hi Joanna, I closed the old Hyatt CC and haven’t applied for the new World of Hyatt CC. Which categories / bonus structure do you think will change?

I am hopeful that the rate on everything else will go to 1.5. If you spend $15000 a year on random stuff you will get a free 1-4 night plus in addition a 1.5 of spend which would make it 2.5 earnings at $15000

That would be a nice change. Let’s see if that happens in the near future.

Sure hope your right

Thanks CJ :)