This “don’t leave home without two of these” story began when I received an email from a friend. It was titled, “Big Request.” Let me start by saying my friend is an experienced traveler and spends six months a year in Mexico, yet still she made a big mistake. Here’s what she wrote:

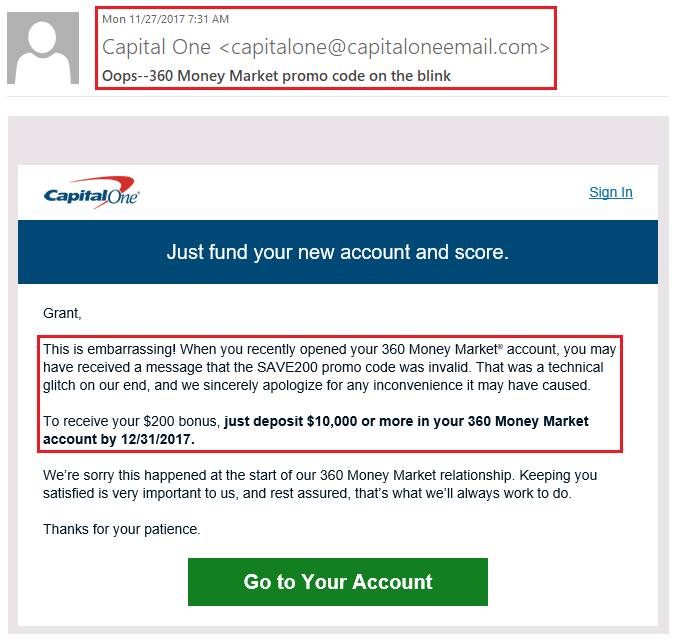

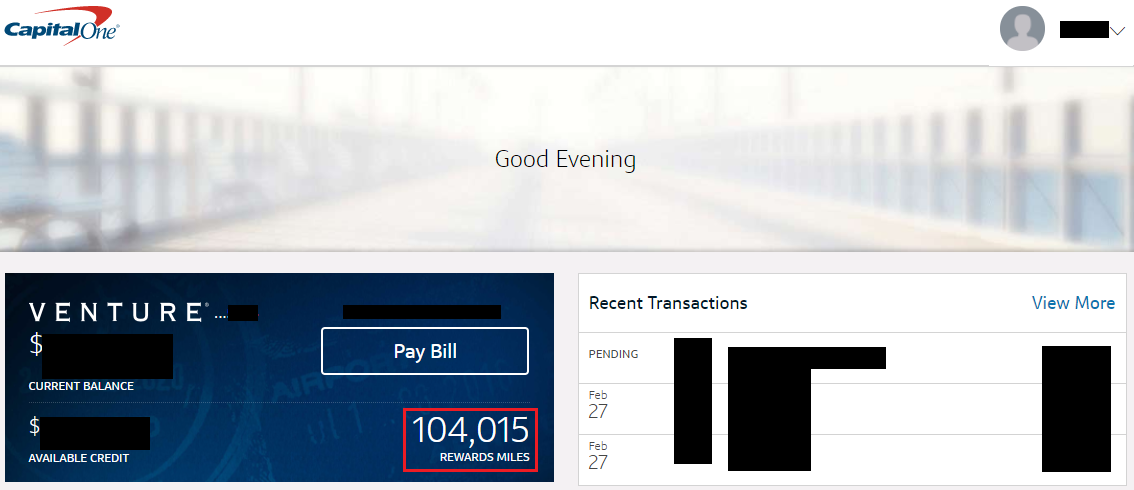

“I have a big request for you: My Capital One Visa credit card was hacked, so I had to cancel that account. However, that is an important card for me to have in Mexico, because they do not charge a foreign currency exchange fee on purchases. So, they are sending me a new card in the mail, and say it should arrive in 4-6 days. Capital One does everything online and it was difficult to tell them to send it here to Mexico. Please check all mail from Capital One, find the card, and FedEx it to me here in Mexico. I am sorry to burden you with this, but there are levels of bureaucracy involved here that are daunting.”

Image source: http://sundowntraveler.com/travel/gear/top-3-travel-items-to-keep-in-your-pocket/

Continue reading →