How to Book British Airways Avios Award Tickets

In this how-to guide, I will show you how to book a British Airways Avios award ticket. In my demo, I will book an American Airlines flight, but the steps below will work with US Airways, British Airways, and most OneWorld Alliance airlines. If you find a flight on AA.com but cannot find it on BA.com, you will have to call British Airways and have them book the award for you. It will cost $25 for a phone booking fee.

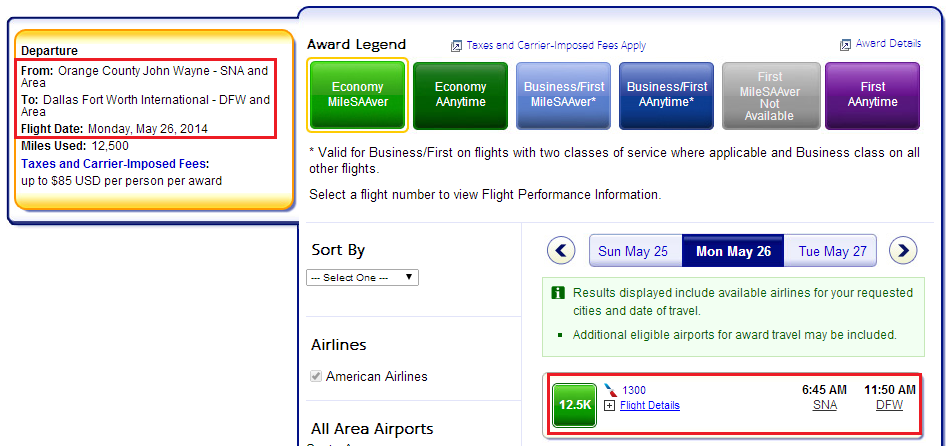

The first step is to search on American Airlines’ website (AA.com) for award space. In this example, I found an economy award from SNA to DFW during Memorial Day Weekend.

To read the entire article, please click here.