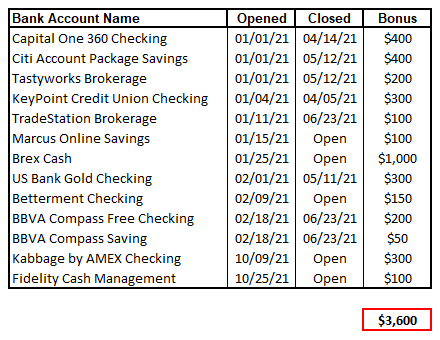

Good morning everyone, I hope your week is going well. Last year, I wrote How Much Did I Pay in Credit Card Annual Fees in 2020? I wanted to create a similar post for 2021, so I listed all of our credit cards that have annual fees and sorted them by when the annual fee posted. Whenever I see an annual fee post, I always call the credit card company to see if there are any retention offers available. At the bottom of this post, I will also share what retention offers I received this year, which credit cards I closed, and which credit cards I converted. As a starting point, if I kept every single credit card with an annual fee this year, I would have 26 credit cards and paid a total of $4,468 in annual fees. Here are our credit cards and annual fees (LT = Laura’s cards):