(Hat Tip to Free-Quent Flyer Book’s post from yesterday)

2 nights ago, I was at the SF Travel Hackers March Meetup and I was talking to a few friends about my second quarter rotating cash back category credit card strategy (that is a mouthful). I wanted to see what everyone’s strategy was for Q2 and that thought process led to this post. As a reminder, there are currently 4 rotating cash back category credit cards: Chase Freedom, Citi Dividend, Discover It, and US Bank Cash+. Even though I have around 30 credit cards, I am a minimalist at heart. I have an iPhone case that can hold a few cards. Currently, my “iPhone wallet” (Verus iPhone card case on Amazon) holds my drivers license, my Citi Forward (5% cash back at restaurants) and my AMEX Old Blue Cash (5% cash back at grocery stores, pharmacies and gas stations).

Since I want to remain a credit card minimalist, I want to carry only 2 credit cards in my “iPhone Wallet.” Which credit cards will I carry for Q2?

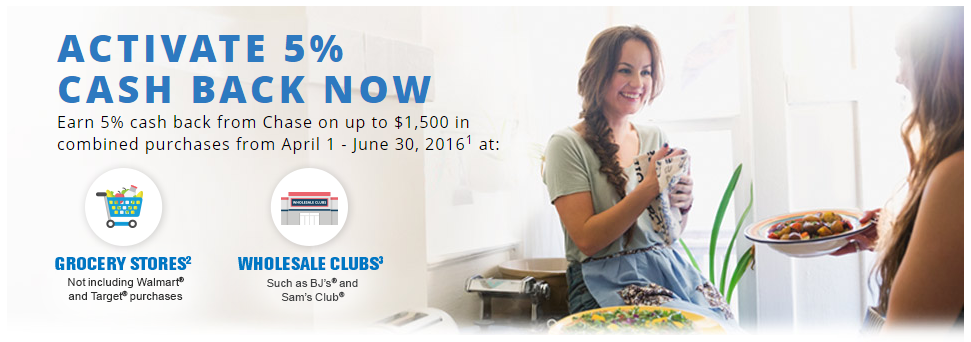

Chase Freedom Q2 Link: grocery stores (excluding Walmart & Target) and wholesale clubs (including BJ’s and Sam’s club). Since I live in San Francisco, there are no wholesale clubs nearby and my closest grocery store is Trader Joe’s. I recently checked on Gift Card Granny and Trader Joe’s gift cards rarely show up, and if they do, they are only discounted by 1-2%. One of the great things about Trader Joe’s is that they accept ApplePay, so I can add my Chase Freedom Credit Card to my iPhone and not carry my Chase Freedom Credit Card with me, leaving 2 credit card slots available. When there are only a few weeks left in Q2, I plan on buying Trader Joe’s gift cards until I max out on the $1,500 quarterly bonus for my Chase Freedom.

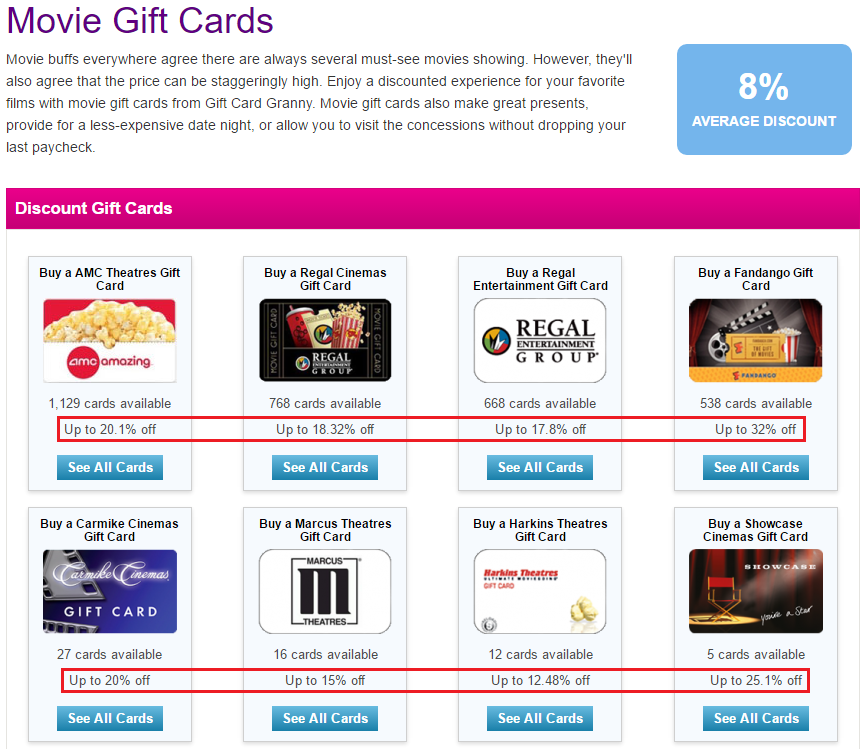

Discover It Q2 Link: restaurants and movie theaters. Assuming you signed up for Discover’s Double Cash Back promo, you will earn 10% cash back at restaurants and movie theaters.

10% cash back for restaurants and movie theaters is really great, but it is possible to do even better. If you eat at chain restaurants or go to larger movie theater chains, you can often purchase restaurant gift cards and movie theater gift cards from Gift Card Granny for more than a 10% discount.

However, not every restaurant has gift cards available for purchase, so it is a good idea to carry your Discover It Credit Card with you. Unfortunately, not every restaurant accepts Discover, so I will continue to carry my Citi Forward Credit Card for such occasions.

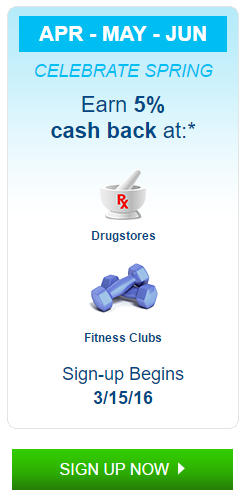

Citi Dividend Q2 Link: drug stores and fitness centers. Even though I no longer have this credit card (I converted to a Citi Double Cash Credit Card last year), this quarter’s bonus is good for those that still have this credit card. Since you are not capped per quarter, you can spend up to $6,000 this quarter and earn 5% cash back, for a total of $300 in earned cash back. Last year, I wrote how to Request your Citi Dividend Cash Back Check. Stock up on those “prescriptions”.

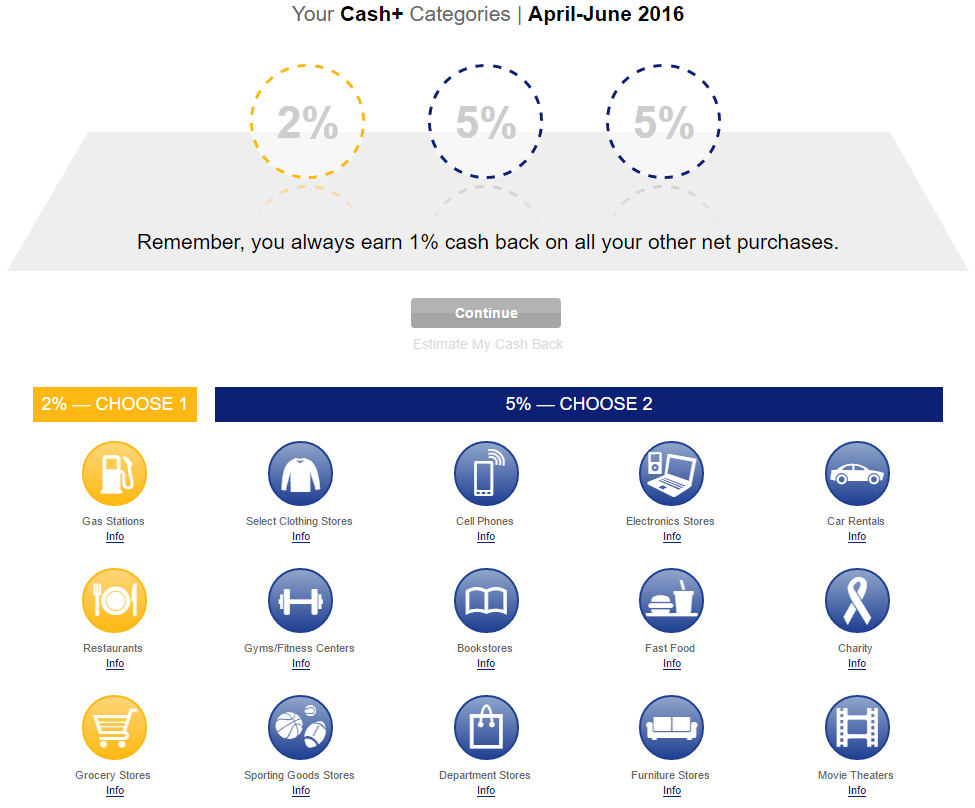

US Bank Cash+ Q2 Link: I’ll be honest, I never use my US Bank Cash+ Credit Card since the categories are boring and several other credit cards offer the same rewards at the same categories. Does anyone know if Amazon is considered a bookstore by US Bank? Is KIVA considered a charity with US Bank? It is interesting that fast food restaurants are at 5%, but the broader restaurant category is only at 2%. You can earn 5% on the first $2,000 of purchases at 5% merchants, but there is no limit at 2% merchants. Either way, I am passing on this credit card… again.

Long story short, I will carry my Discover It and Citi Forward card for Q2 and use my Chase Freedom at Trader Joe’s with ApplePay. What is your credit card strategy for Q2? If you have any questions, please leave a comment below. Have a great day everyone!

P.S. If you are interested in a Chase Freedom, Discover It, or US Bank Cash+ Credit Card, please consider using my credit card affiliate link. If you want the Citi Dividend Credit Card, you will need to call Citi and ask them to convert a card to the Citi Dividend Credit Card. The conversion process can take up to 60 days, so you will want to call sooner rather than later.

P.P.S. My friends are looking for 2 FTU Las Vegas tickets that include the MS section. If you have 1-2 tickets available, please let me know. Thank you.

Yes to both questions about US Bank :) but I prefer to use Sallie Mae 5% on Amazon! I don’t do Kiva much anymore due to delinquencies…doesn’t make up for 5% CB.

Good to know. I’m not a fan of KIVA and floating money for a long time. 5% back at Amazon is easy with Citi Forward and Chase Ink + Staples/OD.

Citi Forward is going to be devalued soon…..

http://frequentmiler.boardingarea.com/2016/03/24/no-citi-devalues-forward-card/

Whhhhhat? Let me check that out.

Hubby and I each have Freedoms and Discover It cards. We will max out the Freedoms buying GCs at Whole Foods, Trader Joe’s, Aldi’s (does Aldi’s sell GCs?) and a local grocery chain to use during the rest of the year… for groceries.

We live in a city that Zagat named #1 for foodies. We eat out a lot and will use our Discover cards where they are accepted. If we haven’t maxed out our Discover cards by the end of Q2 (which is hard to believe), I’ll run around to our favorite spots to buy gift cards to use later in the year.

Great strategy. By the way, which city is ranked #1 by Zagat? Sounds like some place I should visit…

I’m planning on MSing the Q2 on my 1 Freedom card. Go to grocery store that sells Visa GCs w/CC (In SoCal that would be Ralphs). Buy 3x$500 Visa GCs. Purchase 2 MOs at WM. Done.

Careful buying VGCs at Ralph’s. Lots of fraud from VGCs sold at SoCal Ralph’s. Check out this post: http://travelwithgrant.boardingarea.com/2015/05/13/psa-dont-buy-us-bank-visa-gift-cards-from-ralphs-kroger-gc-numbers-compromised/

Thanks for the PSA! I’m aware of this problem, since I was the victim of fraud at Ralphs last year and it was a PITA to get reimbursed. I stopped buying GCs at Ralphs for a while. What I do now is immediately change the PIN as soon as I leave the store, once I get to my car. Then, I liquidate the entire card within 30-45 min. of purchase. So far, so good. But this is very important advice so thanks for mentioning it.

If you know the risks, and you have a good game plan, you should be fine. Good luck!

I also make sure to purchase each card at a different Ralph store, so that I’m lowering the risk. In other words, if I get hit w/fraud and a drained card, my thinking is that the fraudsters will hit up one store and not coincidentally the specific three where I bought each card. Therefore, if I get hit w/fraud it would likely only affect 1 card. But again, I’m well aware this is risky and I can float the money, so it’s a good game plan not for everyone…

I couldn’t have said it any better myself…

Pingback: Several New AMEX Offers: Best Buy, Target, Gap, Neiman Marcus & More | Travel with Grant

Pingback: Which Credit Cards will Replace my Citi Forward Credit Card after June 4? | Travel with Grant