Good morning everyone, my younger brother (a recent UCLA graduate with a masters in engineering) had no credit cards 2 weeks ago. I would often get text messages from him late at night asking me to buy something for him on Amazon or to pay for his apartment’s electricity bill. He would then Venmo money to me for the exact amount that I paid. He would argue that he was helping me earn “points” and would guilt trip me into helping him. From a profit point of view, the “points” I would earn would be less profitable than 1 $500 VGC, therefore not a big deal to me.

Shortly after graduating and starting his first real job, he asked me to help him get a credit card. When I was home for the 4th of July weekend, I talked to him about credit cards. Even though he loves to travel (like his big brother), I told him to get a few cash back credit cards that have no annual fees (therefore you can keep them open forever). These credit cards will be the basis for his credit report and will help him establish relationships with the credit card companies. He commutes to work by car, so getting a gas credit card was a high priority. After comparing all the no annual fee credit card options, here were his final 3 choices:

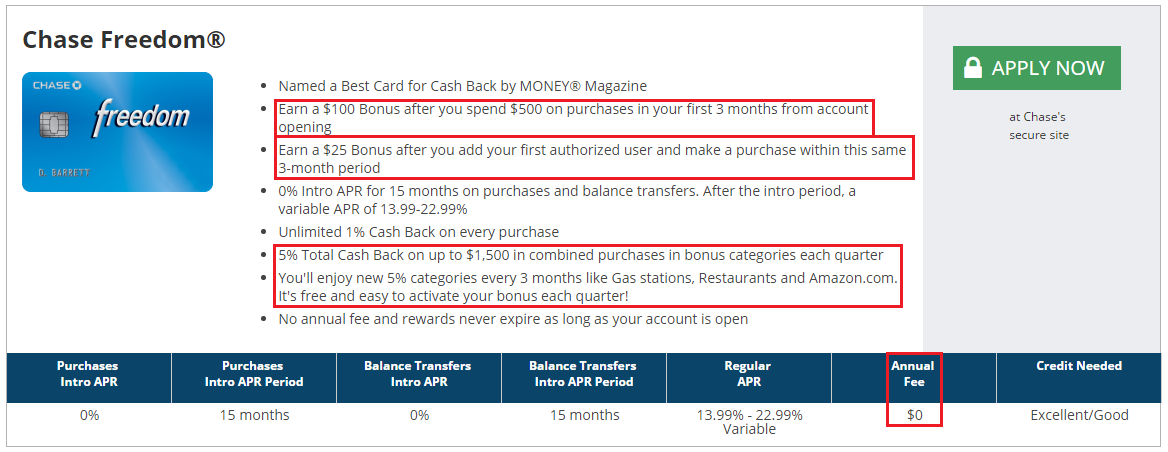

Chase Freedom Credit Card

- Get a $100 bonus after spending $500 in 3 months (actually paid in 10,000 Chase Ultimate Reward Points).

- Get a $25 bonus after adding an authorized user to your card and making 1 purchase on that credit card.

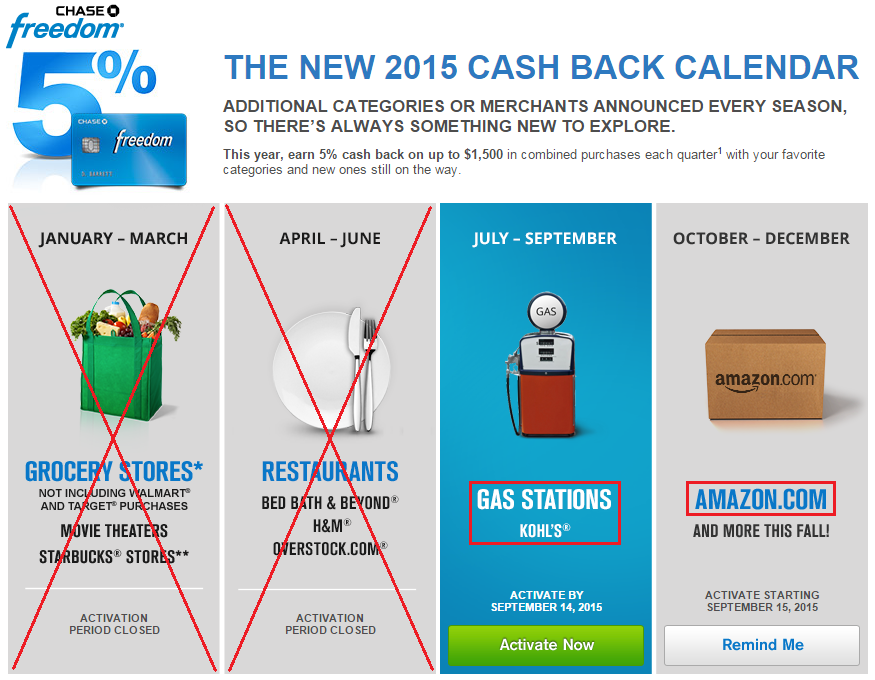

- Get 5% cash back at rotating categories (Q3: gas stations and Kohl’s).

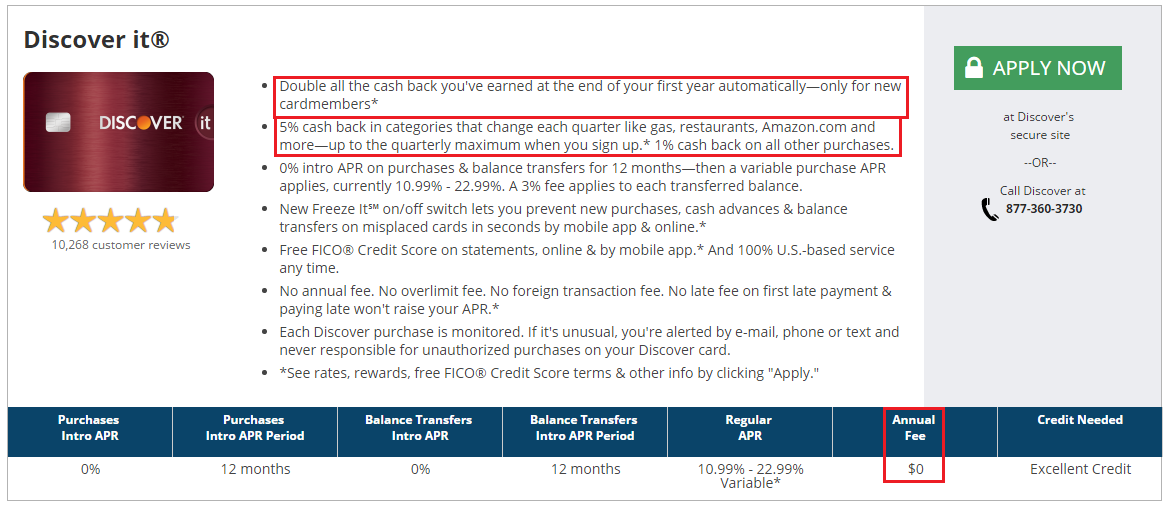

Discover It Credit Card

- Double cash back at the end of the year.

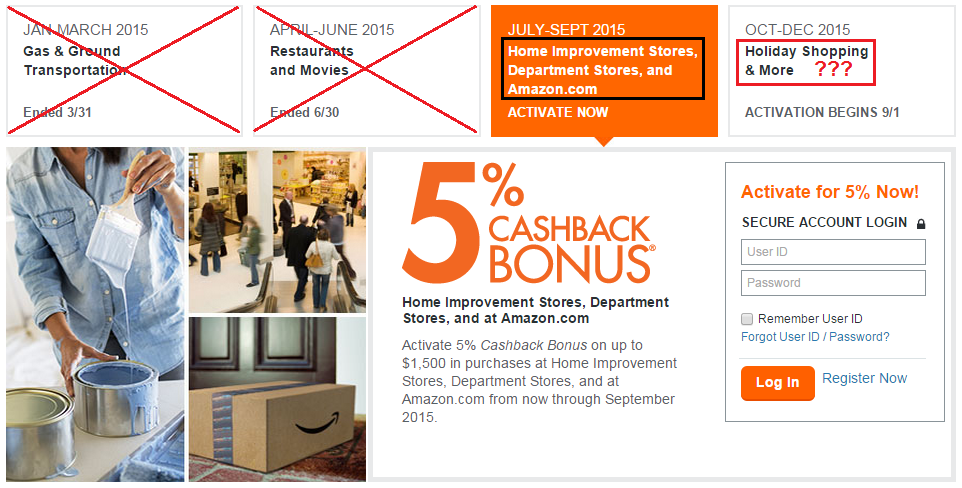

- Get 5% cash back at rotating categories (Q3: home improvement stores, department stores, and Amazon.com). (Gas was 5% cash back in Q1)

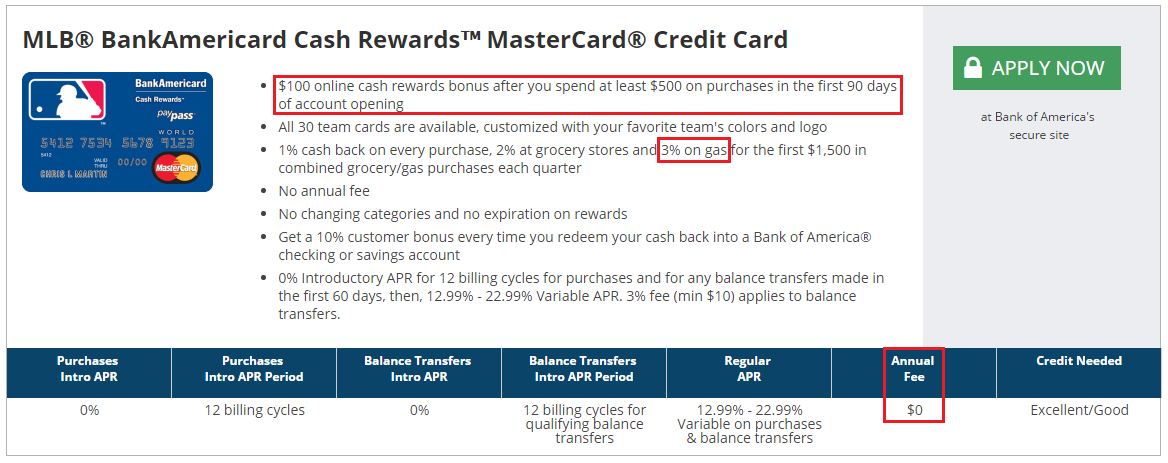

Bank of America MLB BankAmeriCard Cash Rewards Credit Card

- Get a $100 bonus after spending $500 in 3 months.

- 3% cash back at gas stations, year round.

[side note: my go to credit card for gas is my Old AMEX Blue, which offers 5% cash back at gas stations, year round, with no annual fee. The only downside is the $6,500 hurdle to activate the 5% cash back. My brother will probably spend about $6,000/year on credit cards, so I thought he should pass on this card. Plus, he lives at home and my parents do all the grocery shopping.]

After reviewing all the cash back details, I helped him fill out the online applications. I knew all his personal information except his SSN, so entering the info was very easy. After entering in the information for all 3 credit card applications, I submitted them all at the same time.

- Chase Freedom was instantly approved with a $13,000 credit line (he has been an authorized user on my mom’s Chase Freedom and my dad’s Chase Sapphire Preferred for almost 2 years).

- Discover It was also instantly approved with a $1,000 credit line (no previous banking history with Discover).

- Bank of America MLB BankAmeriCard went to pending. I google Bank of America’s reconsideration phone number (Doctor of Credit) and dialed the number. This was Sunday afternoon (not the best time to speak with a credit analyst) and the rep who answered the phone told him to call back in a few days to check on the status of the application.

I quickly learned that my brother is pretty awkward on the phone and doesn’t do a very good job of befriending customer service reps (essential if you want to get a positive result from the reconsideration call). Anyway, a few days later, he received his Chase Freedom Credit Card, Discover It Credit Card, and a denial letter from Bank of America. The denial letter said that his credit history was not long enough.

A few days after that, I get another text from my brother asking if I can buy him something online. Hello? You have credit cards now, use them! He tells me he hasn’t activated the credit cards yet and I walk him through the activation process. Here are the steps:

- Call the number on the sticker to activate your credit card.

- Tell the rep to enroll you in the rotating cash back categories (Q3 just started).

- Ask the rep to lower your cash advance limit to $0 (you don’t want to accidentally get hit with a cash advance fee).

- Lastly, ask the rep to change the bill due date to the first of the month (so your statement closes sooner and you get your cash back rewards faster).

Apparently the Chase and Discover reps give him a hard time about lowering the cash advance limit and he forgets to ask about changing the bill due date (you can lead a horse to water, but you can’t make him drink). Since the Chase Freedom Credit Card has a $100 bonus after spending $500 in 3 months, I tell my brother to keep track of his purchases so he doesn’t miss out on the $100 bonus.

Here is some good brotherly advice (which everyone can use) to increase your credit score:

- Stay under 30% of your credit utilization ratio (Chase Freedom $3,900/$13,000 = 30%, Discover it $300/$1,000 = 30%) to increase your credit score.

- Better yet, stay under 10% of your credit utilization ratio (Chase Freedom $1,300/$13,000 = 10%, Discover It $100/$1,000 = 10%) to watch your credit score really go up.

- If for whatever reason, you spend over the 30% credit utilization mark, try to pay down/off your balance right away.

- But… always keep a small balance on your card when your statement closes. This small balance will be reported to the credit bureaus and it will show them that you use credit responsibly. If you pay off your full statement before your statement closest, no balance is reported to the credit bureaus and it looks like you never used the credit card, therefore not improving your credit score.

If you have any questions, please leave a comment below. Have a great day everyone!

P.S. I am expecting to get a text from my brother in a few weeks asking about the cash back bonus and best ways to redeem cash back. If there is an interesting story, I will share it here.

What is the best way to not pay your balance in full and also not pay interest?

Get a credit card that offers 0% APR for the first year or so, that way no interest will be earned on your unpaid balance. That is a slippery slope though, the credit card company is hoping you rack up too much debt and won’t be able to pay if off by the time the 0% APR offer ends.

should we leave a balance on each card we have or just a small balance on one or two cards is enough to positively impact our credit score?

Let me clarify when I say leave a balance. Let’s say you spend $50 on your credit card from July 1-31, and your statement closes on August 1. After your statement closes on August 1, pay off the full $50 balance, so your new balance in August will be at $0. Does that make sense?

If you let your statement close with a balance ( which is the balance that reports to the credit bureaus) And pay off before your due date , you Will NOT pay interest.

http://www.creditcards.com/credit-card-news/grace-period-avoid-paying-interest.php

Yes, exactly, that’s the way to do it!

I’m with you, but I have two clarifying questions:

1. Of the 20 or so credit cards I have open, how many do I need to show a small balance on to have a positive effect on my credit? Each of them, one of them, a handful of them?

2. If I need multiple cards to show a balance and I would pay interest on most of them, and i’m MSing to some extent with a few of them, how would you manage the following: I purchase $2,000 worth of GCs and want to pay it in full in the same cycle so I don’t get an interest charge. If I only need a balance on one card I will obviously carry the balance on a different card to be safe. If I needed to carry a balance on this card, I guess I could pay it in full and then put an additional charge on the card some time after I confirm that the full payment has hit (I have made the mistake in the past of sending a payment in full with my Redcard, but continuing to use the CC for spend so that in the few days between payment sent and credited, I had more charges and I never actually paid the card in full) Am I missing some easier way to manage this carrying of a small balance thing?

There is a difference between “carrying a balance” and not having a small balance on your credit card statement than you pay off in full each month. You only need to use a handful of credit cards each month to improve your credit score.

Good brother’s advice.

Thank you :)

This was such a cute post :)

Thank you Star :)

Pingback: Houston Centurion Lounge, Double SYW Points, ANA Adds Australia Service, Intro To Shyp & Pay It Forward - Doctor Of Credit

Great brother’s advices! I would add that Sallie Mae also has a 5% card on gas, groceries and books up to $250/month/category, no annual fee.

That is a great cards as well, thanks for reminding me.

Yeah, it always surprises me how the SM 5% in grocery/gas/Amazon is always flying so far under the radar (almost as often as the CSP is over hyped).

$250/mo for gas is the equivalent of 2 full quarters from either Discover or Freedom. Better yet, it’s monthly so you don’t have to wait until Q3 or load up on gift cards in the interim (and waste investing that money into a HYS account).

What I’d currently recommend for anyone starting off:

1) Sallie Mae cc (do this one first, probably harder to get than the others)

2) Discover IT card (hurry and get the double cash back)

3) Freedom

Gives quite a few bonus categories and even a jump start in Chase points, even if he doesn’t have a CSP/Ink to help move the points to partners. When I started off I wanted the statement credit anyways.

Also worth mentioning if you withdraw/spend the SM cash back into Upromise and then into a Sallie Mae HYS account, you’ll receive a 10% bonus on all deposited funds, usually every February each year. It turns any of your 5% categories into 5.5%!

Pretty cool idea, I did not think of the Sallie May CC for my brother. Like you said, that credit card does not get much publicity on the blogs and unfortunately most people do not know it exists. Thanks for sharing this card info with me.

Yeah, I think the fact there isn’t that instant appeal such as a sign up bonus or opportunity to transfer points for travel at a higher value that it gets less attention than it deserves.

SM is that card that sits in the front of your wallet and is used as an everyday spend card, with $250 (or $750 for amazon) cap per statement period. It’s up there with the Fidelity Amex as far as ongoing utility. If I use my Amex BCP or am meeting a minimum spend then I perhaps don’t use the SM card. I can’t tell you how many times I’ve bought gift cards w/ the SM though to maximize the monthly limit.

Thanks for sharing. Sounds like a great credit card to use everyday. Have a great weekend.