Good morning everyone. A few weeks ago, I did an 8 card App-O-Rama. One of my top credit cards to apply for was the Chase Sapphire Preferred Credit Card. I previously opened a Chase Sapphire Preferred Credit Card back in August 2012 which I then downgraded to the Chase Sapphire (Basic) Credit Card in August 2013 which I then converted to the Chase Freedom Credit Card in November 2013. Since I received the sign up bonus back in August 2012, I waited the necessary 24 months to reapply.

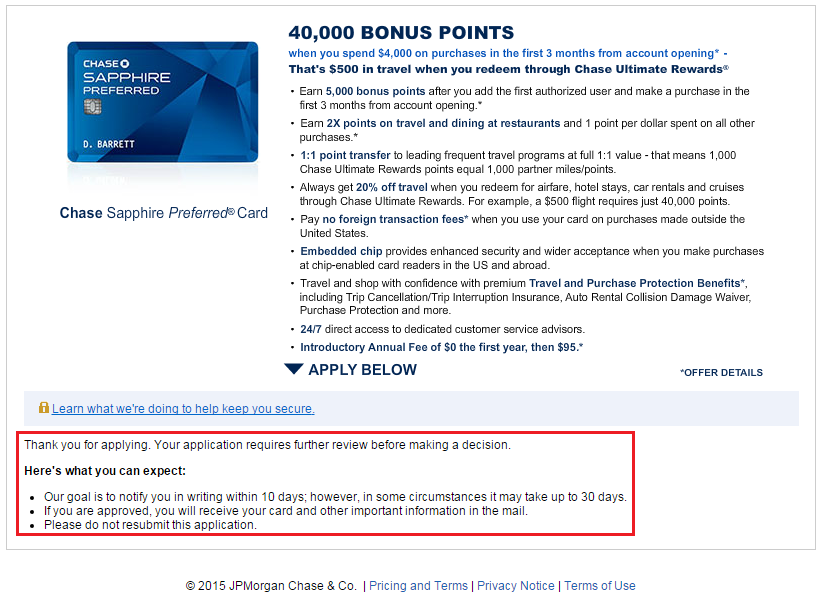

When I first received the Chase Sapphire Preferred Credit Card, the sign up bonus was 40,000 Chase Ultimate Rewards Points after spending $3,000 in 3 months. The current sign up bonus is 40,000 Chase Ultimate Rewards Points after spending $4,000 in 3 months. Long story short, I was low on Chase Ultimate Rewards Points (aren’t we all?) and I had waited long enough to reapply, so I was ready to apply for my second Chase Sapphire Preferred Credit Card.

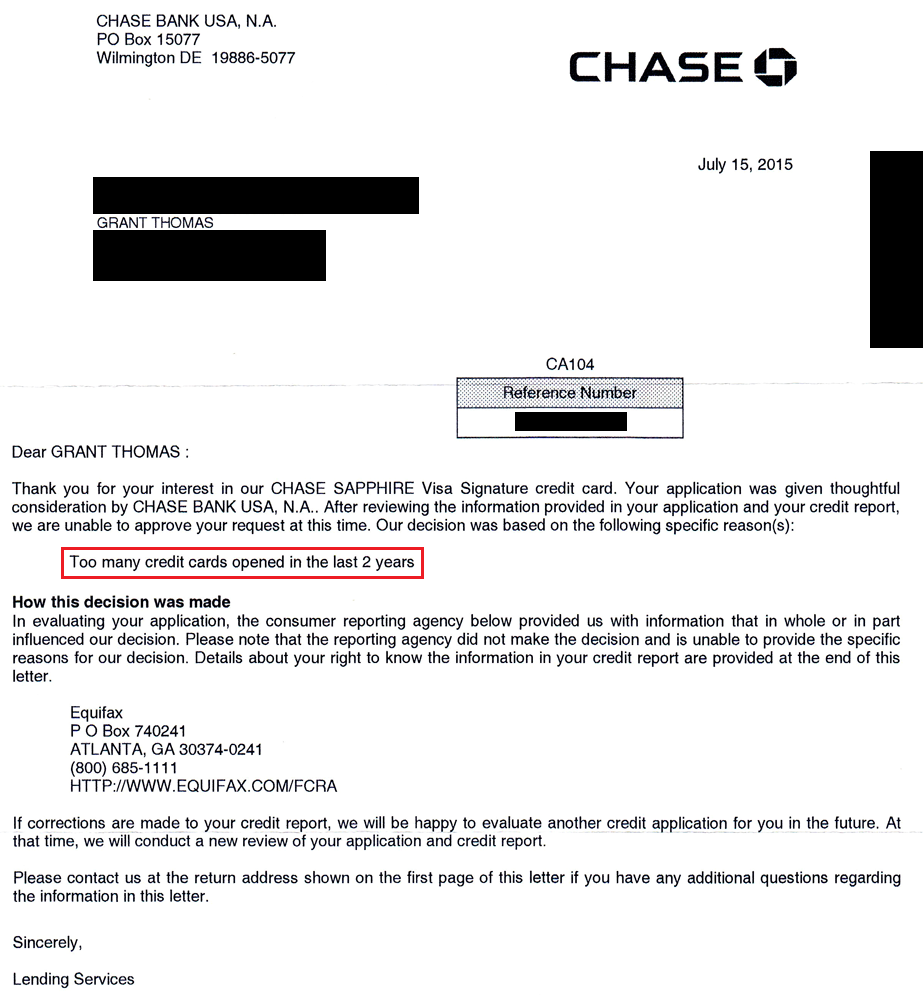

Side note: Doctor of Credit and a few other blogs and forums are reporting that Chase has really cracked down on approving applications for people that have more than 5 credit inquiries total during the last 2 years. I (foolishly) ignored those warnings and insisted that my previous 3 years with Chase, 16 total approved Chase credit cards (8 currently open), and reconsideration call skills would be enough to get approved for the Chase Sapphire Preferred Credit Card.

Spoiler alert: it wasn’t enough.

I like to learn from other people’s successes and failures, but I also like to try things myself and see how they go. I sort of live by the philosophy that nothing is impossible unless I try and fail on my own. I know that sounds foolish, but my overconfidence has worked occasionally in the past. Anyway, when I applied for the Chase Sapphire Preferred Credit Card online, my application immediately went to pending status.

I googled Chase’s reconsideration number (found on Doctor of Credit) and called them up. I insisted that I did not want/need any more available credit and that I was more than happy to move available credit from 1 or more existing Chase personal credit cards. I told the rep I wanted to consolidate a few airline credit cards into 1 travel rewards credit card (being the Chase Sapphire Preferred Credit Card). The rep took that information, placed me on hold for a few minutes, and came back with bad news that I had too many recent inquiries. I offered to transfer available credit or close my Southwest Plus, British Airways, and United MileagePlus credit cards if that would help, but she said that would not make a difference in my application status. I politely thanked her for her time and hung up. It is important to stay positive even if things don’t go according to plan. I decided to wait for the Chase Sapphire Preferred Credit Card denial letter to come in the mail and try my luck again.

During the time since applying for the Chase Sapphire Preferred Credit Card and receiving the denial letter, I opened a Chase Total Checking Account ($300 opening bonus, found on Doctor of Credit). I brought the denial letter to the Chase branch where I opened my Chase Total Checking Account along with my Chase Debit Card, Freedom, British Airways, and United MileagePlus credit cards. I spoke to a personal banker and asked if she would help me overturn my credit card denial. We went to her office and she called Chase. After a 5-6 minute wait, she asked the rep to have the application reopened and reviewed. I mentioned that I was willing to move credit lines around or close some existing Chase personal credit cards, if necessary. A few minutes later, the personal banker handed the phone to me. The rep gave me the same answer as before: too many recent credit inquiries. The rep didn’t ask why I had so many recent credit inquiries or why I wanted the Chase Sapphire Preferred Credit Card. I naively asked when the next best time to reapply for the Chase Sapphire Preferred Credit Card was, but she did not give me a good answer. Instead, she insisted that I should keep all my current Chase credit cards in good standing and reapply sometime in the future. Her suggestion was extremely vague and not helpful at all. Dejected by another Chase rejection, I tweeted my disappoint to Chase:

@ChaseSupport sad day for me. I couldn’t get approved for the Sapphire Preferred. I have too many other Chase credit cards #chaseaddict

The twitter team was very fast at responding and tweeted me back, saying:

@travelwithgrant Thank you for being a loyal Chase customer! For us to review your application, please DM your name and zip. [name]

I immediately sent Chase a DM (direct message). Here is our Twitter conversation:

Grant: Hi [name], my name is Grant Thomas and my zip code is [zipcode]. I was told I have too many credit inquiries on my credit report.

Chase: Thank you for responding! I am going to take a moment to review your application. I will follow up with you soon. [name]

Grant: Thank you for taking a second look. I’d love to get the CSP and move credit lines from British Airways and United credit cards.

Chase: 1/2 You’re welcome! I have tried speaking with a Credit Analyst directly and explained how you’re willing to close out your British Airways / 2/2 and United card to be approved, but they are still unable to override the decision. I am sorry; I wish I had better news. [name]

Grant: Thanks for trying [name], it just wasn’t meant to be, but I really appreciate your help. I will try again in a few months and see if my luck improves.

Chase: You are very welcome! Again, we thank you for being a customer and hope you will be approved for the card next time around. [name]

So there you have it, when Chase says you have too many recent credit inquiries, they really mean it and no amount of calling or tweeting can be done to overturn their decision.

I plan on calling the Chase reconsideration department soon and telling them that I have too many open Chase credit cards and that I need to close a few to improve my odds of being approved for the Chase Sapphire Preferred Credit Card. I wonder if any of the reps will offer me anything to keep the credit cards open. I’m not sure if I will apply for any more Chase credit cards in 2015, I may sit out the rest of the year and see what happens over the next few months. I will keep you posted on any further developments.

In the meantime, I was able to overturn my Bank of America Spirit Airlines Credit Card denial letter and am currently waiting for the results on my US Bank Cash Plus Credit Card reconsideration call. Stay tuned.

If you have any questions, please leave a comment below. Have a great day everyone!

Try cancellng the cards you offered anyway, and wait six months.

That is my plan, thank you Ralph.

Thats really bad. :-( Chase was the one from which I never got decline until now.

Btw, I applied for BofA Better Balance card and got declined yesterday. Then I called reconsideration, credit analyst told, I had lot many inquires in the past 6 months but because of loyalty with the bank, I was approved.

After that I also tried to apply Alaska Card and got declined again. Do you think I will have chances to get approved after calling?

Regarding BofA, wait until you get the denial letter and call them. I had good luck calling them later on after receiving the denial letter.

Thanks for the suggestion. Let me wait.

No one can say you didn’t try. Recon + tweet + Chase Banker. I love your relentlessness..Sorry to hear that it didn’t work out.

I was hoping the chase banker would be my best shot, but still no go.

Chase local branch personal bankers are useless. They would toot their own horn, saying that they have a secret “backdoor” to getting approvals. Our personal banker couldn’t get anywhere when my 2 family members’ Chase Freedom applications were denied for “too many inquiries.”

I called the reconsideration line and got both applications approved.

The “secret”? The Freedom card was their 1st Chase card, and the “too many inquiries” were from the rep seeing them as Additional users on other Chase cards. After explaining that, the approval didn’t take too much effort.

Days later, the personal banker called me “How did you do that? Even I couldn’t get my own application approved.” Such a newbie.

Haha, that personal banker sounds pretty new. Glad you were able to help out your relatives.

Grant, I had a similar experience. I have a FICO of 826 & I applied for CSP for first time ever. I currently have Marriott premier for 6yrs & United Club Card for 2 yrs. & explorer for 1 yr. They declined my App & I called the reconsider line, offered to realign credit line, but still no. I reached out to my personal banker at Chase, a VP, and he called , used all his influence, let me talk to rep, but still no! I don’t think I will try again for a few years.The new rule of 5 card apps in 24 months is very FIRM!

Dang, this is surprising that there is no way to over ride the Chase 5 card limit. For new users, it might be wise to apply for 5 chase credit cards first before applying for credit cards from any other bank.

Would you (or anyone) know if new rule of 5 card apps in 24 months is just personal cards – or would that include BUSINESS cards as well???

If you apply for a business credit card, you may have to provide your SSN if your business TIN/EIN does not have enough credit history. If you use your SSN to apply for a business card, that inquiry will show up on your personal credit report. That will probably count toward your 5 credit inquiries limit for Chase. I could be wrong, but play it safe and assume that it will count.

Expect this more and more. The bank CCs are cracking down on churning. It’s just a fact of life. This is why the bloggers who make their money from the CC apps are rushing to get the newbies to sign up. They don’t need those long time readers as they can’t churn. Amex is dead for that and Chase is on life support. The blogs reflect their new target audience and it is not me.

Citi and BofA look like the last 2 credit card companies left for churners. We will see how long that lasts.

Yup. With the countless new miles/points bloggers seeking credit card referral income out there and pushing this previously niche hobby into mainstream knowledge, it was only a matter of time before banks were forced into clamping down on handing out miles/points bonuses repeatedly. And with all these bloggers shouting from the rooftops, the only surprise is that there are still as many opportunities left to collect easy miles as there are. But not to worry, as the number and noise level of the bloggers goes up, those remaining ops will slowly but surely get shut down too. Just make hay with what sunshine is left…

I have a slightly more optimistic outlook for the future of credit card sign up bonuses. The terms change every year or so, sometimes for the better and sometimes for the worse.

That is such an arrogant attitude. What makes you so special that you should continually get special treatment? What a sense of entitlement.

Had the same issue here. Cancelling cards won’t help. If you have more than 5 credit inquiries or 5 or more accounts (closed or open) you will be denied. Recon won’t work. I had 5 accounts in the last two years in which 2 were closed and they didn’t care they were closed. I also knew of the 5 accounts or inquiry rule recently and also had to try for myself. Best of luck out there!

Thank you Jason, do you know when your next credit inquiry is going to drop off your report (~2 years after it posts)?

Have about 10 months to go. First they focused on the 5 inquiries. Then I said one of them was for a mortgage so they counted four. Then they counted 5 cards and said they were all in the last few years. I said two of them were closed and she said didn’t matter. Open or closed.

10 months is a long time to wait to get 1 credit card. Are you going to wait it out?

Nope don’t think so. Need to look at other card instead.

I know you hedge your post saying you wanted to try your own thing, and that it worked in the past….but, your readers told you the CSP was unattainable, and there was a long FT thread espousing the same advice.The evidence was strong. Kinda reminds me of my young and reckless days shrugging off advice… :-)

When the student is ready, the master appears.

Indeed young yedi

You live and learn. And then you get to right a long blog post about it :)

Smart not to confuse confidence with arrogance.

Sometimes it is hard to tell which is which.

Sometimes I’m arrogantly confident. The rest of the time I’m confidently arrogant.

That makes a lot of sense. Thanks for sharing :)

That is tough!! So strict now…

I know, it’s terrible. I haven’t been denied a new Chase credit card in such a long time.

My CSP and Ink annual fee is coming up, tried HUCA…..no retentio offer and the agent even offer to close my card if I want to…..weird……with recent changes like this, looks like I have to pay annual fee and keep the cards ….. :(

It is extremely rare to get the CSP annual fee waived or get any compensation. If you have a CSP and a Chase Ink Bold/Plus, why do you need both? No need to pay 2 annual fees. You can convert CSP to Freedom or Ink Bold/Plus to Cash. Let me know if need more info before you do anything.

I believe Chase won’t approve you on CSP or any other Chase Freedom, Ink Plus, etc. Only the other Chase cards like British Airways, IHG, Hyatt, etc.

They are tightening that you can not get approved as long as you have 5 new credit cards with anyone in the past 2 years! Not just Chase cards!!

I was planning on getting the Ink Plus, but now I will likely get just the British Airways card.

I believe that is true, but who knows how long that will be allowed.

Co-branded Chase cards are still game though, no?

I believe so, but who knows for how much longer.

Who knows. They have to be more accommodating because they are partner cards, not just directly through chase

That’s a good point, Jason. I hope you’re right.

They are not in the game any more. Just denied on a business Marriott. In doing this for 20+ years I have never been denied, ever. I had called recon told yes I’d get it but the people higher up said NO Reason in letter I got too many chase cards, inquiries, etc. played HUACA and no dice. Went into branch where I have business and personal accts and branch manager called and again, no. She was told also that I don’t use my current cards enough. Churning chase is over. I hope the bloggers with links let readers know what is happening. Btw I have an 829 FICO which I was told they don’t really consider that as important as we have been told.

Thanks for sharing your experience with the Chase Marriott Business Rewards Credit Card. Sounds like the good ol’ days of getting Chase Cards every 3 months are over. It was a nice run, but I am hoping the rules become more lax over the upcoming months.

What a bunch of jerks! I can’t believe I devoted a whole week to that card.

Seriously though, thanks for trying and documenting, it’s interesting to see.

I’m glad my failures are not in vain. This is a terrible Chase Sapphire Preferred Week. I prefer Shark Week instead.

Grant, I love’d your “Indeed young yedi” comment. Keep the faith as things may turn around with Chase and hopefully they ease up.

That is what I hope happens (sooner rather than later, preferably). If we all hope and pray hard enough, we can make this happen :)

I really wanted a CSP too since it’s been 24 months and I really miss my 5% cashback on dining from US Bank Cash+ (now I wish I had a Citi Forward). Well, hope they loosen up again in the near future!

Me too Star, me too. I’m glad I got the CSP back then since it seems like I may never get it again :(

Pingback: $10 Into $1,000, Getting Approved For CSP, Chase IHG 80k, AwardWallet Compromised & Much More - Doctor Of Credit

Is it five new cards or five new inquiries? So much confusion. Half of the people talking throught their ass.

I believe it is 5 credit inquiries, which does not mean 5 credit cards unless you get approved for all 5 credit cards.

What credit agency do they pull from? The inquiries differ at each of the big 3 for me?

I believe it depends what state you are living in. I think Credit Boards may say which bank pulls from which credit bureau for each state.

I believe they look at both. Could vary by Rep. She brought up the fact that we had 5 inquiries and 5 accounts open or closed. Most folks on the boards are saying 5 accounts.

Gotcha, thank you for clarifying. I have way more than 5 accounts and credit inquiries over the last 6 months, so I am totally screwed going forward.

I am confused. I’ve opened a dozen new accounts in the past two years, and Chase approved me last month in-branch for a Freedom with a $10K CL. By the way, what state do you live in? I’ve seen nothing but TU inquiries from Chase, including for the Freedom in June.

I’m in California. I think Chase used to pull Experian but they might have switched. I’m glad you were approved for a Chase Freedom Credit Card in-branch. How many total Chase cards do you have open at the moment?

Good effort. I agree, many supposedly impossible things are possible if you try. After getting my first irreversible denial with Chase recently, I went around and applied about 400K miles worth of CCs for family members. I’d say I came out ahead ;-)

I have success stories about my US Bank Cash Plus and Bank of America Spirit Airlines credit cards. Both were declined, but I waited for the denial letter to come in the mail. I was able to get both cards approved by a reconsideration call. I will go into more details in an upcoming blog post. Stay tuned…

It will be interesting to see if Chase keeps this policy. This not only weeds out the churners but also people who legitimately get a card on occasion. If this affects the bottom line, hopefully they review their policy and open it up

I think over time, the policy will get less strict. Changing from 5 to 7 to 10 credit inquiries over a 2 year period. It will be interesting to see what happens.

What about upgrading a Freedom card back to a Sapphire? I downgraded last winter thinking the Mrs. Could get the card. Has anyone tried to reverse the downgrade?

I think it would be possible, but without the sign up bonus, it’s pointless to upgrade from Freedom to CSP.

unless you need the partner transfer ability.

I’m trying to figure out if I just want to cash my points out or try the upgrade, pay the fee and no bonus.

It’s worth upgrading if you transfer your Chase Ultimate Reward Points to a transfer partner. You can always downgrade afterwards.

Damn, this makes me not want to apply for any more Chase cards anytime soon. I think in the last two years, I got 10 of their cards, with the most recent cards in June.

Personally, I’ve been a Chase customer since I was a teenager, and they have that in their system (I was surprised to hear it from one of the reps on the phone). They love me, and I love them back and owe much of my East Asia travel to them :D

What’s your plan for Chase cards moving forward?

I feel much the same way as you. Chase has approved me for 16 credit cards over the last 3-4 years and I have never had a problem until the recent CSP application. I just called Chase to inquire about a retention offer on my Chase United MileagePlus Credit Card. No offer was given, so I transfer the $5,000 credit line to my Chase Freedom Credit Card. I now have 7 Chase credit cars open: Ink Bold, Ink Plus, Freedom, IHG, Hyatt, Ritz Carlton, and British Airways. I will probably close British Airways and Ritz Carlton if I don’t get a decent retention offer and move the credit lines to my Chase Freedom. I have really stopped using most of my Chase credit cards, with the exception of my Ink Bold. Chase is slowly losing my business to Citi.

Grant–I’m curious about the mechanics of Chase checking on your credit history. I know some banks only get credit pulls from a specific bureau. Is Chase checking these pulls at a particular bureau? Or do all companies report new accounts to all bureaus and Chase is checking this information? Thanks for any clarification you can provide. I have six applications in the past couple of years and am wondering if they are just checking inquiries, then they may not see more than five at the bureau they check with.

I believe Chase pulls 1 credit bureau (depending on the state you live in) and they can see open accounts and recent credit inquiries. When a new credit card is opened, I believe the credit card company has to report it to all credit bureaus.

Got it, doesn’t seem worth applying for it then. Thanks for the clarification.

Had a similar experience. Have excellent credit 750+ and never carry a balance. Have the chase slate and amazon cards and have opened 4 cards in the past 24 months. Unfortunately my Macy’s Amex shows up twice once as a macy’s card and again as an amex one of which they’ve even discontinued.

Called a few times for reconsideration and they kept coming back to me with the too many cards line. Quite irritating , i even asked if i could convert my slate into the CSP and they’re like the system doesn’t give them an option to do that.

Never been denied before, such a pain. That Capital one quicksilver i just got for the 20% cashback on uber rides was still worth it though :)

Thanks for sharing your experience, KRP. It is very annoying and I hope Chase changes their 5 credit inquiries policy soon. I miss the good ole days :)

5 months since i first applied, i got an invitation to apply for the chase sapphire and when i did, was approved this time around. one of the 4 cards i’d applied for in the past 2 years may have dropped out of the window so that couldve changed it, but interesting nonetheless!

Thanks for the datapoint KRP. Glad you got approved for the CSP :)

Pingback: Chase Sapphire Preferred Week, Credit Karma Folds Affiliates, Travel Masters, Award Wallet Hack, IHG Rewards 80k Offer, Pay for College with Miles

The end of the road came for me too. 825 FICO but denied for sapphire. Had it about 3 years ago but have opened maybe 8 cards in the past 2 years. I wonder how long I’ll have to wait.

You can try again in 6 months for the CSP. Better luck next time!

Thank you! Will try again in June :)

Good luck in June :)

I wonder if just applying in vane will count against your max limit… if it does one should not try unless the limit has not been reached. Right?

There are mixed reports of the 5/24 limit is applied toward everyone or only certain people. I’m not sure what you should do, but if you want it, you should go for it and hope for the best.

My name is Shelley, not Shellet! Lol

I will make the name change, thank you Shelly.

I have 5 hard inquiries on Equifax/Exp that are from mortgage pulls, and 7 from Transunion from 5 mortgage and 2 card pulls. Instant approval on CSP online. It appears that mortgage pulls do not affect your CSP approval.

Thanks for the data points. I’m glad your mortgage credit pulls didn’t impact your CSP approval.

Hi, I am a bit confused about this Chase rule of 5 inquiries in 24 months. Are these inquiries for any credit card or just for Chase cards? I read your post about being unsuccessful in getting the Chase Sapphire card, regardless of what you did. However, although you had too many inquiries already, you went ahead and got some other cards from other banks all while thinking of reapplying in a few months for the Chase Sapphire card. So that is what confused me. Could you clarify please? thank you very much

The Chase 5/24 rule means you can’t have more than 5 credit inquires from any bank in the last 24 months. I may have been confused at the time I wrote the original CSP post. Does that make sense?

Ok, that is what I thought. I guess I will have to wait several months then till some of the inquiries are older than 24 months. No point getting denied. Thanks

I believe Chase business credit cards and Chase co-branded credit cards are currently excluded from the 5/24 rule.

I think there may be some confusion by the term “inquiries”. I believe the rule is that you cannot have *opened* five or more cards in the past two years which as Grant mentions get reported to all bureaus. Inquiries don’t usually go to every bureau plus you might have had inquiries for many other reasons.

I know only credit card inquiries count toward the 5/24 rule, not credit checks for auto loans, mortgage loans or other credit checks.

The trick with getting anything from chase is MONEY, Once you become a private client they will give you whatever you want. I was prepared for everything and the basis of my credit limit was my annual income not my credit score.

Agreed, I’m a private client and 5/24 rule doesn’t apply to me, have no problem getting approved with over 15 applications in last 24 months

Nice, being a private client seems to be the secret with Chase. Now I just need $250K to become a private client…

Do they check the assets on the call or is there some kind of flag that comes up? I’m a private client and wanted to know what they say on reconsideration or you approved by the system?

I think you need to go in branch and speak to a private client banker.

It appears my experience 5/24 rules only impact open or closed credit accounts within 24 months. I have more than 9 applications (hard pulls) within 24 months but I was approved for CSP but denied for United explorer. Recon no help.

I applied both cards same time. Hit submit button on CSP first then Explorer.

My credit only a year old. I have a Cap one, Discover. In the past I opened and closed KOHLS card within 30 days and my old utility company reported open and closed account. Never miss a payment. All my past and present / open and closed accounts squeaky clean. Never carry balance.

1. CapOne (open)

2. discover (open)

3. KOHLS (closed)

4 Utility (closed) this was my electric company while I was renting an apartment for about 5 months.

5. CSP (Newly open)

6. Explorer (Denied)

I tried to explain to Recon that my utility should not be consider as credit card. I was still denied because that account reported as a credit account. Yearly income $120k. zero debt, all three score 768 and above

Wait 3 months and reapply for the Chase United MileagePlus Explorer Credit Card.

Thanks. I will give it a try. Given chase approval and denial happened same day what are the chances for qualifying for Citi AA Advantage card. Received several offers.

You should be good to get a Citi AA CC.