Good evening everyone, this is just a short post before I go to bed. I currently have a love-hate relationship with Club Carlson. At first I loved them, but now it seems like Club Carlson hates me. Let me explain…

As you all know, the Last Night Free perk ended June 1 and everyone redeemed as many Club Carlson points as humanly possible (I even borrowed leftover points from friends so I could scrap together enough Club Carlson points to squeeze out one last reservation). With low Club Carlson point balances and no more spending on their personal and business Club Carlson credit cards, I was expecting a few targeted spending offers from US Bank / Club Carlson. Well, today is the day I got my first targeted spending offer and it is… TERRIBLE! Let me explain…

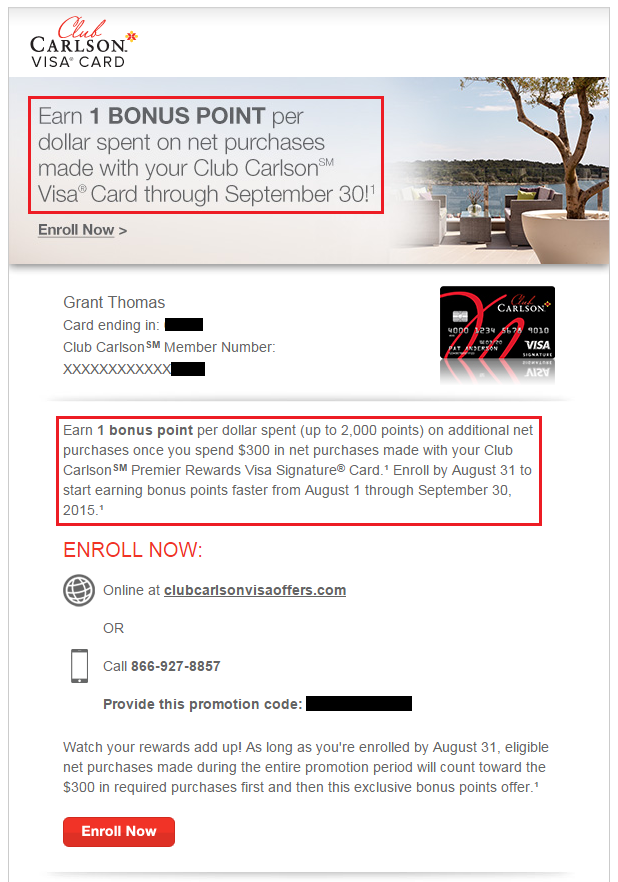

- I can earn 1 bonus Club Carlson point for every dollar I spend (Club Carlson points are worth around 0.2 CPP, so it is definitely not worth the effort)

- I am limited to a grand total of 2,000 bonus Club Carlson points (what can I even get for 2,000 Club Carlson points, a 99 cent iTunes song?)

- I only start earning bonus points after I spend $300 on the credit card (so to earn the full 2,000 bonus Club Carlson points, I have to spend $2,300; that’s never going to happen)

Any takers? I didn’t think so…

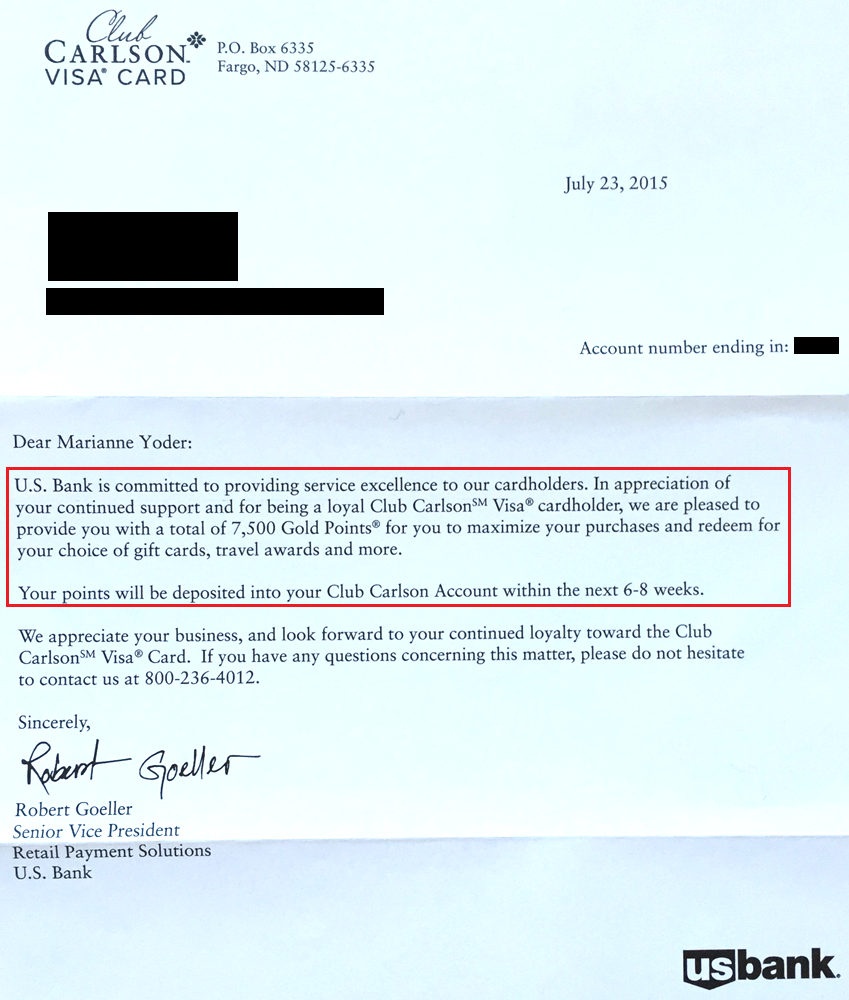

In other news, my friend received a letter today from US Bank stating that Club Carlson is going to deposit 7,500 bonus Club Carlson points into his account within 6-8 weeks. I don’t know about you, but I worked really hard to call US Bank and politely ask for 7,500 bonus points for my personal and business Club Carlson credit cards. Now they are just giving points away to anyone with a credit card. My friend told me that he didn’t call US Bank to ask for any compensation, they just sent him this letter completely out of the blue.

This doesn’t make any sense to me. Does anyone know what US Bank / Club Carlson is doing? If you have any questions, please leave a comment below. Have a great evening everyone!

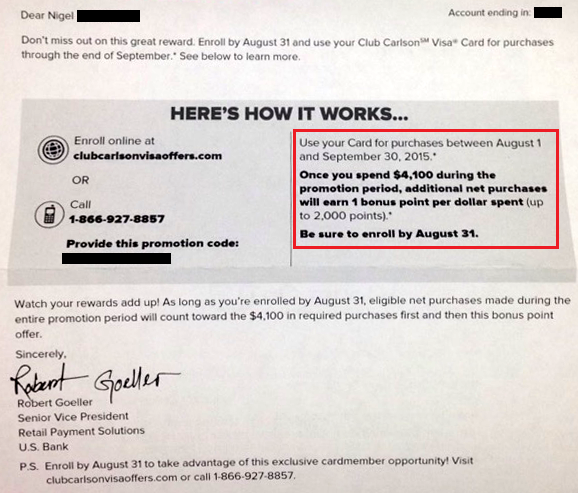

Update 7/31/2015 @ 9pm PT: My friend, Nigel, got an offer from US Bank too, but his offer is much worse than mine. He can get 2,000 bonus Club Carlson points, but only after he spends $4,100 on the credit card. I thought $300 was crazy, but $4,100 is insane. Did anyone receive a more absurd US Bank Club Carlson targeted offer?

My guess is that the 7500 is a courtesy bonus for the devaluation. Some called, other didn’t. Maybe the ones that didn’t get the letter (in the interest of being fair). FWIW, I had politely asked when the whole devaluation thing came down, but I wasn’t given anything even though I’ve been paying my annual fees for like 3 years. I did ended up getting the letter a couple of days ago.

Gotcha, I wonder if US Bank / Club Carlson were planning on giving everyone 7,500 bonus Club Carlson points after the devaluation or if enough people called that they figured they should give it to everyone. Who knows. But it did take them almost 2 months to send out a letter after the June 1 devaluation.

I got a letter as well. I had also called but was only given 2500 points. Strange thing is befor the letter showed up I saw a mystery 5,000 points show up pending from us bank. Could be something unrelated or could be they were counting the first 2500 they gave me and giving me the difference to make it to the 7500.

That makes sense that US Bank / Club Carlson gave you the remaining 5,000 bonus Club Carlson points. What did your letter say? Did you get a 5,000 point bonus from US Bank / Club Carlson?

I got the same letter as pictured above, referencing 7500 points. The points popped up on my award wallet account under my us bank visa as 5000 but isn’t in my club Carlson account yet. I guess it is pending until statement close or something. Hard to tell as the us bank website is so terrible I can’t find anything on there.

The 5,000 bonus points are probably listed as pending in US Bank. There is a tab in your online account that shows pending points.

Why is this such a mystery? You called and received the 7,500 points for the downgraded to your card — your friend did not. Now, he is getting those points, and the poster above simply ratifies the obvious.

Their lawyers likely advised them to do this across the board so as not to have the perception that they are treating different classes of folks differently.

QED.

For full disclosure, this is what I did: I called US Bank the same day the devaluation was announced and they gave me 2,500 bonus Club Carlson points to keep my personal and business credit cards open. Then a few days later, people were reporting that by speaking with a supervisor, they got 7,500 bonus Club Carlson points. So I called back, spoke with a supervisor and got 7,500 more bonus Club Carlson points for both my personal and business credit cards. I have not closed or downgraded either of those Club Carlson credit cards and neither has my friend.

No letter, yet, but I found a moderately good use for my business Club Carlson card. On a recent business trip, I was perusing my (way too fat) pile of cards, and found that the only good business card for restaurants is the Chase Ink Cash, which I don’t have. Well, given that Chase is not going to issue me another Ultimate Rewards card any time soon because of their new policies, I found that the business Club Carlson card to have a reasonable return at 5 points per dollar. I certainly wouldn’t argue about how bad the recent double devaluation was, but for, say, Budapest, it’s still not bad at 15k/night. For spending that you’d do anyway, I can’t see anything that’s really better.

For international restaurant purchases, I use the (now unavailable) Citi Forward. Another option would be Citi Premier/Prestige that offers 2x at restaurants. I’m glad the Biz Club Carlson CC was able to help you out.

I paid my AF in DEC last year and even since they started removing the benefits, i called the, complained and got 25k bonus and than my $75 back and then canceled it for good.

This card is a useless junk card

Wow, that’s a huge retention offer. Did you spend a lot on that credit card?

I admit that CC points are certainly worth less following the recent the devaluation (last night free, point increases). With that said, valuing the points at 2 cents seems really low.

Even at the top hotels, which now require 70K points, you are saying that equivalent hotels are available for $140, after including all taxes and fees. I do not see it, even in the US in NYC or Chicago. Europe is often even more expensive. Rarely can you get less than 3 or 4 cents per point in value.

As someone that travels to either NYC, Chicago or VA Beach annually, my wife and I are both keeping the card for now but only putting $10K of spend on each. This gets us a total of 4 nights in NYC or 6 nights at VA beach for $150 out of pocket plus another $400 of missed benefits with a 2% cash back card.

I agree with the concept, but I value Club Carlson points at 0.2 CPP not 2 CPP (x 70,000 = $140, not $1,400). As long as the math works out, the Club Carlson credit cards can still be worth keeping and using.

My husband’s letter: spend $2k August 1 to September 30 and THEN net purchases earn 5 bonus points up to 5000. So spend $3000 and get 20,000. That is a measly 5000 point bonus for $3000 spend. Who cares?

Thanks for sharing Zippy. It’s interesting to hear about the wide variety of targeted offers. Still not worth the spend on the credit card.