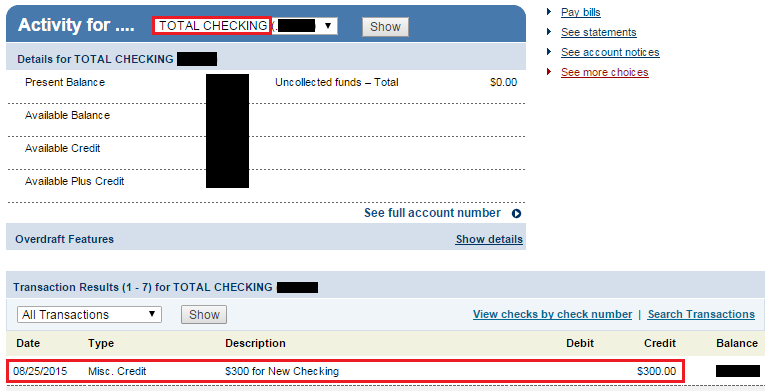

Good evening everyone. There is no hiding my love for bank account bonuses. Doctor of Credit got me hooked and there is no cure (except more cowbell bank account bonuses). I recently shared my experience with US Bank’s checking and savings account bonuses and I just received my $300 bonus for my Chase Total Checking account bonus (read about the sign up bonus at Doctor of Credit).

Some people are not interested in bank account bonuses (I wasn’t either, not even after Doctor of Credit did a guest post for me back in March 2014). It took me a while to warm up to the idea, but I have embraced bank account bonuses with open arms. Every time I mention bank account bonuses, I always hear about the dreaded 1099-INT tax forms, but I will gladly pay tax on my bank account bonuses, since I still come out way ahead at the end of the day.

Here are some of my recent bank account bonuses:

- US Bank Gold Checking – $125 bonus

- Discover Checking – $50 bonus

- US Bank START Saving – $50 Visa Gift Card bonus

- Chase Total Checking – $300 bonus

Here are the bank account bonuses that I am still waiting to post:

- Citi Gold Interest Checking – 40,000 Citi Thank You Points bonus

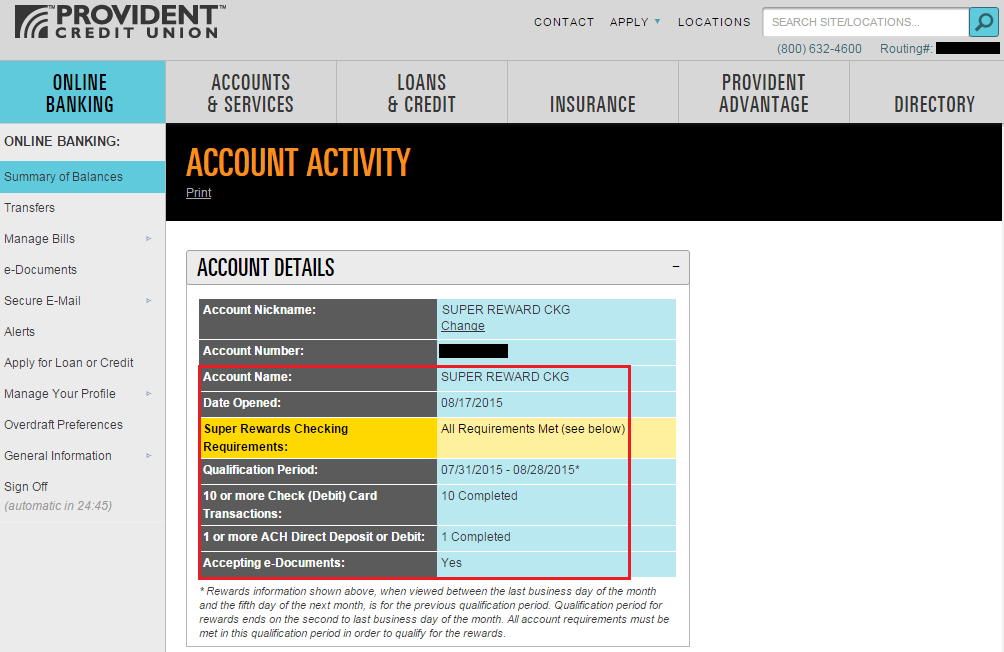

- Provident Credit Union Super Rewards Checking – $150 bonus

- Bank of America Core Checking – 25,000 Alaska Airlines miles

Here are the bank account bonuses that I have my eye on but have not applied for yet:

- BMO Harris Select Checking – $200 bonus

- Bank of America Business Advantage Checking – $1,000 bonus

- PNC Performance Select Checking – $400 bonus (DOC’s post isn’t live right now, but I will link to it tomorrow morning)

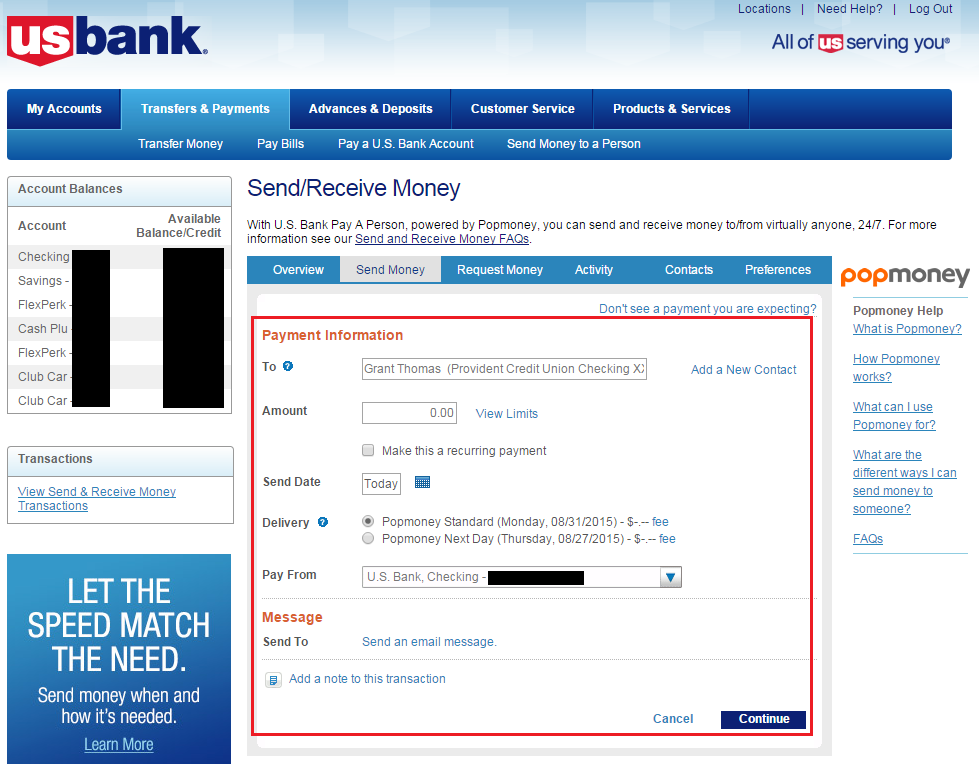

Anyway, here are a few important things I have learned since embarking on this bank account bonus sign up binge. With my recent Provident Credit Union Super Rewards Checking account, I needed to get 1 direct deposit of $500, make 10 debit card transactions (non-ATM), and enroll in e-documents. Enrolling in e-documents was easy and so were the other 2 requirements.

Most banks and credit unions have a peer-2-peer money transfer service. One of the more popular services available is called Pop Money. You can transfer money from your bank account to another person, all you need is their email address. You can also enter the other person’s routing and account number to have the funds directly deposited into their account. Since I have a Citigold Checking and US Bank Gold Checking account, I can send a Pop Money payment to another account, even if that account is owned by the same person. Most of these transfers count/post as a direct deposit.

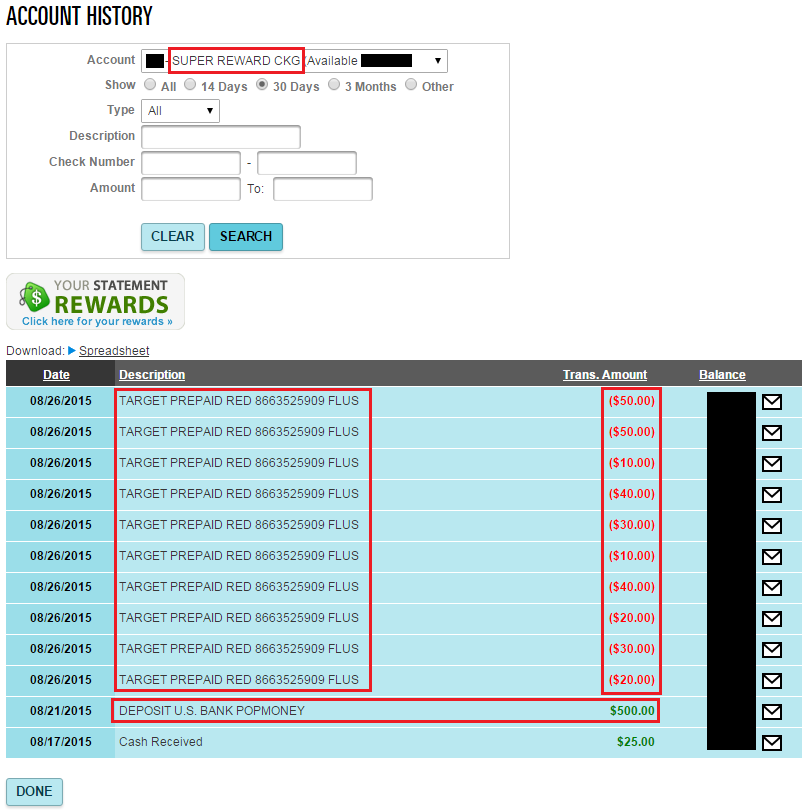

For the 10 debit card transactions, I decided to add my Provident Credit Union debit card to my Redbird account. Once added and verified by the Redcard Account Protection Department, I used my debit card to add funds to my Redbird card, up to $200 per day. The nice thing is that you can make several transactions on the same day, as long as the total loaded is less than $200. I did half the reloads on 8/25 and the other half on 8/26, so I am not sure why all the transactions show up as 8/26. These reloads were all made online, not in-store.

Redbird transactions showing 4 debit card reloads on 8/25 and 6 debit card reloads on 8/26 (all from home in my pajamas). #pajamaMS

I highly recommend you check out Doctor of Credit’s bank account bonus posts, they are incredibly detailed and very easy to follow. Join me on the bank account bonus journey!

If you have any questions, please leave a comment below. Have a great evening everyone!

Good post but please enlighten me up a bit here… so every bank has POPMONEY option to transfer to another bank account and it will count as “direct deposit”?

Also, on loading the Redcard using the debit card…I saw you load different amounts there in each transaction, what about if I load $1 for every transaction for 6 times?

I’m not sure if every bank/credit union has Pop Money – most do. For Redbird debit card reloads, if you do the same reload about ($1) several times on the same day, the debit card might start blocking the transaction since it looks like a duplicate charge. You might want to mix it up slightly.

Thanks for the advice!

Grant – Have you verified that ‘PopMoney = Direct Deposit’ at banks/CUs other than Provident? Every month I seem to qualify with an unusually high number of transactions being counted as ACH/DDs in my Prov. Acct. (seems they count all deposits and maybe even bill payments).

I think Provident counts any deposit/ACH/transfer as a “direct deposit.” I have not verified that Pop Money works for other banks/credit unions, but I will try to find out.

Discover Checking – $50 bonus — I got the $50 bonus, too. Then they offered an additional $75 for direct deposit (offer ends in November).

Awesome, do you know if that $75 direct deposit offer is still available? Do you have a link to that offer? Thank you!

I’m up to $700 and 25k Alaska miles for the year….Dr of Credit got me hooked too :D

Nice job, you are beating me right now. I gotta step it up :)

Yes, Grant, you need to step it up!

When travelling, it’s a great chance to tack on a bonus you wouldn’t otherwise qualify for as a non-resident. Most institutions will let you open the account if you’re IN PERSON.

I don’t live in the south, but collected on SunTrust and Regions bank promotions while I was on vacation.

That’s a good idea. I’m going to Zion National Park this weekend so it may be too off the beaten path to get a sign up bonus.

Nice trip to Utah. You may be right; I only see Key Bank offering incentives that your home state might not offer.

What’s the bonus for Key Bank?

Key Bank is running a promotion for $100 for a “Hassle Free” account, or $300 for their “Key Advantage” account with a higher minimum balance. I haven’t done that offer yet, so I can’t comment on how easy it is to collect the bonus.

http://www.doctorofcredit.com/keybank-300-checking-promotion-ak-co-id-in-me-mi-ny-oh-or-ut-vt-or-wa-only/

Interesting but I’m probably not going to be close enough to a Key Bank branch when they are open this weekend :(

How much time it took to get 25 K miles after completing 2k deposit ?

I’m not sure how long it takes. I’m still waiting for my bonus to post.

have we figured out if an ACH transfer works for this?

Are you specifically asking about the Provident Credit Union bank account bonus? I believe so, at least a Pop Money transfer worked.

Grant, my bad, I was referring to the Alaska 25K offer

Oh, well in that case, I am still waiting for my 25,000 bonus Alaska Airlines miles to post.

Great post Grant. Do you close these bank accounts after getting the bonuses, or just leave them open forever (or for a certain amount of time)??

I will keep the free bank accounts open forever (keeping a $5 balance in there). The ones that charge a monthly fee will be either converted to a no monthly fee version or closed entirely.

Could you check your site for hacks? Every time I visit your site, the first time always results in being redirected to malware sites which play horrible sounds. Closing that tab and open again, it’s gone. This issue has persisted for several weeks.

Hi Duan, thank you for the heads up. I’m aware of the issue and Boarding Area is working on hard on determining the cause of the issue and will resolve the issue ASAP. I’m sorry for the inconvenience and I appreciate your readership. Have a great weekend.

Do you know if the Discover bank bonuses will be eligible for the double cash back promo?

I don’t think so, but that would be a nice surprise.

Now if only there was a way to open accounts in a state you don’t live in…

Take a look at the offer. Some offers are online-only, others are in-branch only, and others can be obtained either way.

While opening an account online may allow for credit card funding, if the incentive is enticing enough, and the offer allows the account to be opened in a branch, perhaps some of the offers are worth driving to, visiting while on work, or vacation trips?

If they ask why I’d want an account with a branch nowhere near where I live, quite often I’ll explain that it’s nice to have an account where you vacation, have family, work, etc. Truthfully, if the account is free of service charges, it’s nice to get off an airplane and access an ATM just like it was local.

Those are very good points, Bill. I will have to remember those points if I join an out of state bank.

Most credit unions allow you to make a small payment to join a local organization that participates at the credit union (see Agricultural Federal Credit Union in DC, which you can join by joining a DC-based dance organization).