Good morning everyone, I hope you had a festive Drinko Cinco de Mayo yesterday. A few weeks ago, I called Citi to convert my Citi Prestige Credit Card into a Citi Dividend Credit Card. During that call, I asked the rep if it were possible to convert my Citi Forward Credit Card to another Citi Dividend Credit Card. She checked the card’s offers and told me that no product change / conversion offers were available. Undeterred, I asked if she saw any other offers on the credit card and she read off a few retention / targeted spending offers. After going through all available offers, I accepted an offer for 3,000 bonus Citi Thank You Points after spending $300 in the next 30-90 days (I don’t remember the exact number of days, since I was planning on completing the spending requirement the following day).

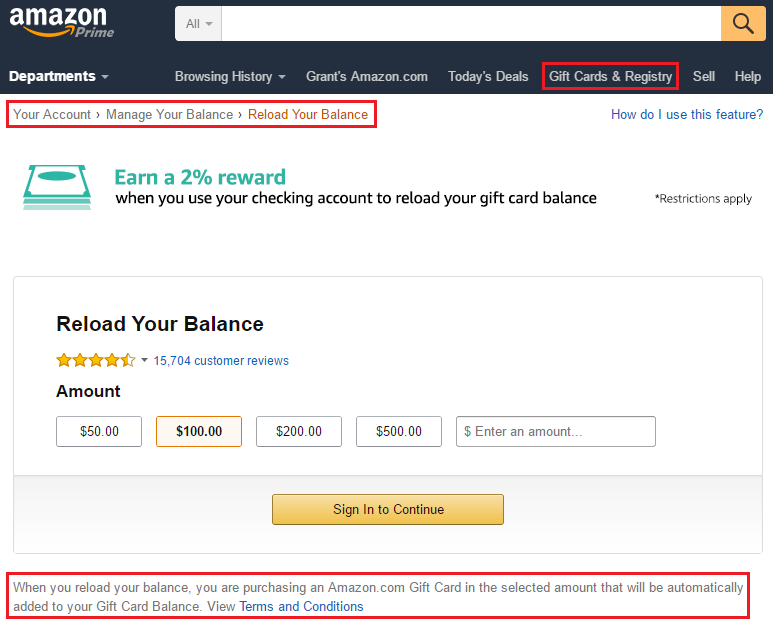

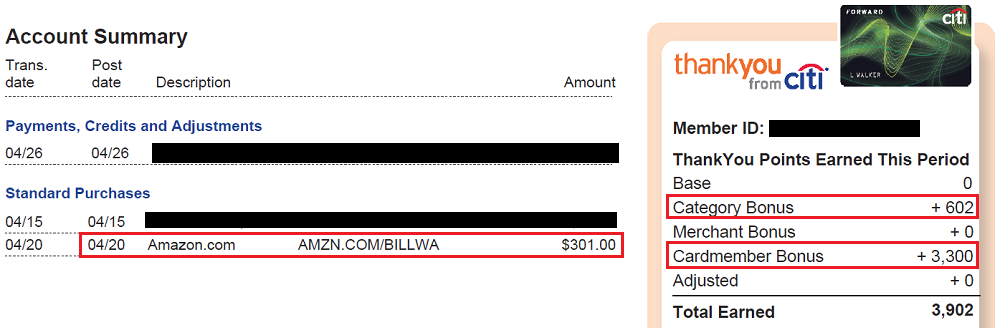

To complete the spending requirement, I loaded / reloaded my Amazon gift card balance with $301 using my Citi Forward Credit Card. A long time ago, the Citi Forward Credit Card used to offer 5x Citi Thank You Points at restaurants and bookstores (including Amazon). But unfortunately, on June 4, 2016, Citi changed the earning rate of the Citi Forward Credit Card from 5x to 2x at restaurants and bookstores, thereby reducing my spending on the card from a lot to $0.

Fun fact: The rep mentioned that as long as there is a purchase once every 25 statement cycles (~2 years), Citi will not close the credit card for inactivity.

My Citi Forward Credit Card statement closed a few days ago and I was happily surprised that the retention / targeted spending offer bonus Citi Thank You Points posted so quickly. I received 3,902 Citi Thank You Points (worth $64.43 in American Airlines travel if redeemed for flights with a Citi Prestige Credit Card).

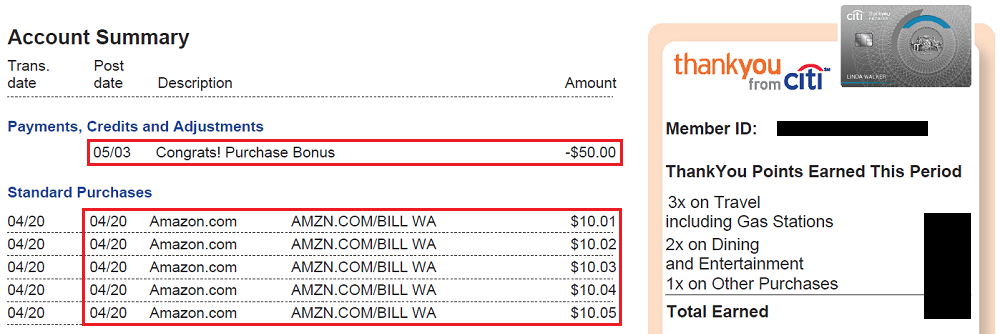

Going back to the call from a few weeks ago with the Citi rep, I asked her to look at my Citi Premier Credit Card and see if there were any retention / targeted spending offers available. After reading through a few offers (mostly 0% balance transfer and 0% APR offers), she finally mentioned an offer that grabbed my attention. I accepted an offer for a $50 statement credit after making 5 transactions of $10 or more in the next 30-90 days (I don’t remember the exact number of days, since I was planning on completing the spending requirement the following day).

To complete the spending requirement, I loaded / reloaded my Amazon gift card balance with 5 charges ranging from $10.01 through $10.05 using my Citi Premier Credit Card. I like to make the charges 1 penny different so if one of the reload charges doesn’t go through, I know exactly which charge to blame. Another reason that I make the charges slightly different amounts is that some credit cards flag multiple charges that are the exact same amount (thinking that the charges are duplicates). Anyway, I was happy to see all 5 charges go through successfully and the $50 statement credit on my recent statement.

While on the same call that I mentioned earlier, I asked the rep to look for offers on my Citi Double Cash Credit Card, Citi AT&T Access More Credit Card and 2 (yes, 2!) Citi Hilton Honors Reserve Credit Cards. Unfortunately, there were no decent offers on any of those credit cards. I will call back in a month and seeing if I have better offers / luck then.

Have you had any decent Citi retention / targeted spending offers lately? Share your data points in the comments below. If you have any questions about retention calls or offers, please leave a comment below. Have a great weekend everyone!

P.S. When I talk to reps and fish for retention / targeted spending offers, I give them my spiel: “I have a few large purchases coming up in the next week and I was wondering if you had any targeted spending offers available for this credit card.”