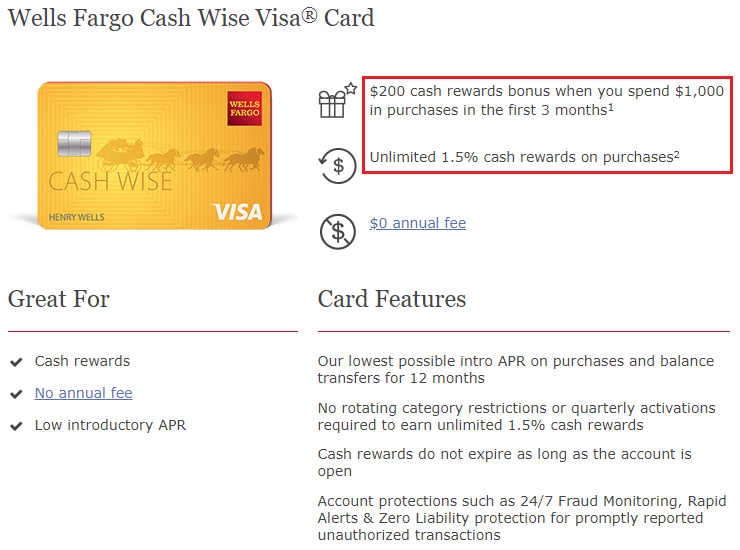

Good morning everyone. During my recent App-O-Rama (final tally: 4 approved and 2 declined), I planned on applying for the Wells Fargo Cash Wise Visa Credit Card. The credit card earns 1.5% cash back everywhere, has no annual fee, and offers a $200 cash back sign up bonus. I planned on meeting the minimum spend requirements to get the sign up bonus and then putting the credit card in the drawer. I had an older Wells Fargo Propel World World American Express Credit Card that had the $175 annual fee billed. I planned on applying for the Wells Fargo Cash Wise Visa Credit Card and then move all the credit from the Wells Fargo Propel World World American Express Credit Card to the Wells Fargo Cash Wise Visa Credit Card. Unfortunately, while I was applying for the Wells Fargo Cash Wise Visa Credit Card, I was stopped by the 15 Month Rule…

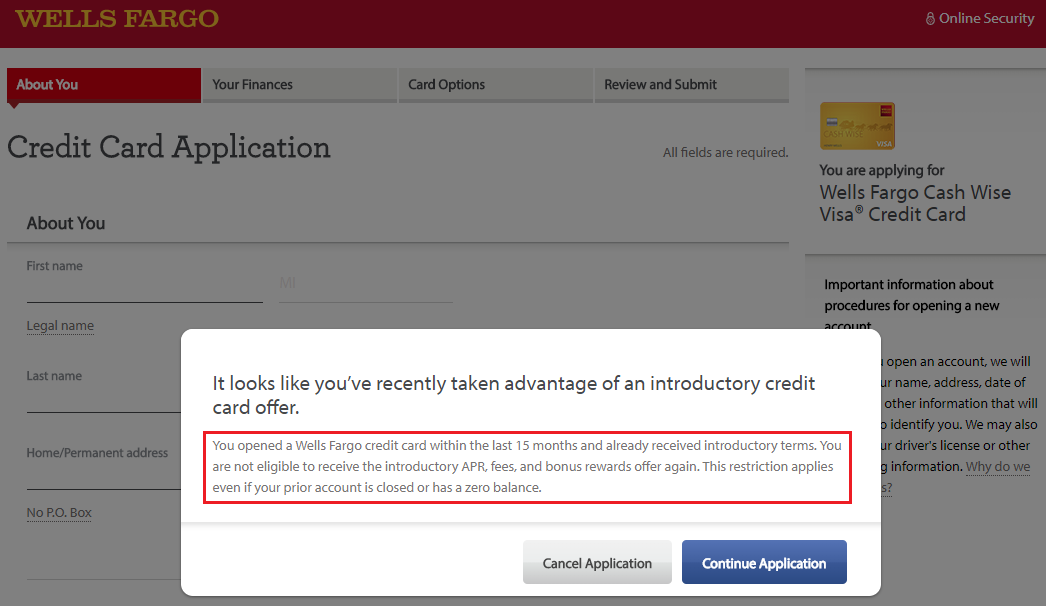

So what is the 15 Month Rule? Doctor of Credit wrote about the 15 Month Rule in April 2017 but it is not talked about often, probably since Wells Fargo does not have that many good credit cards to sign up for. Basically, you cannot get a new credit card that has a sign up bonus if you received a sign up bonus within the last 15 months. Well darn, that messed up my plans. I originally got the Wells Fargo Propel World World American Express Credit Card on March 28, 2017, so I would need to wait 15 months from that date (June 28, 2018). I considered product changing the Wells Fargo Propel World World American Express Credit Card into a no annual fee card, but I was worries that would reset the 15 month period, so I decided to close the credit card instead.

Long story short, I bailed on the Wells Fargo Cash Wise Visa Credit Card after the 15 Month Rule popped up on my screen. I will add the Wells Fargo Cash Wise Visa Credit Card to my next App-O-Rama after June 28, 2018, assuming the sign up bonus is still enticing. Has this credit card application rule messed up your plans? If you have any questions, please leave a comment below. Have a great day everyone!

sorry, why were you burning an app slot on a $200 bonus?

I’ve got so many credit cards that I’m scratching the bottom of the barrel. Since I’m way over 5/24, I just go fir the cards I want from the other banks.

Do you have confidence around the exact dates? I opened a card 2/20/2017. From the doc article it didn’t sound 100% certain if that just means exactly 5/20/2018, perhaps 6/1/2018, or perhaps once I’ve had 15 statements generated (probably 6/8?). Wanting to get the world propel before it expires so trying to be as tight as possible, but also ensure I get the bonus.

You could try calling Wells Fargo and asking if they can tell you the exact date that your 15 month anniversary is. It’s worth a shot. You could also try applying online and see if you get the same warning message that I got.

Pingback: Whatever National Park, Airline Reducing Award Surcharges, The Man with the Golden Arm - Rapid Travel Chai