Good morning everyone, I hope you had a great Father’s Day Weekend. As I mentioned a few days ago, I’m getting ready for my Greece and Malta vacation. As part of my packing process, I call my banks and credit card companies, tell them I’m traveling internationally, and ask them to put travel notifications on my cards. During my recent call to Discover, I “discovered” 3 surprising facts about using Discover credit and debit cards internationally. In today’s post, I discovered some disappointing information about using US Bank credit cards internationally.

I’m staying at the beautiful Radisson Blu Crete using Club Carlson Radisson Rewards Points. I figured I would bring my US Bank Radisson Rewards Premier Visa Signature Credit Card on the trip and use it for hotel incidentals in Crete. During my call to US Bank, the agent informed me that my US Bank Radisson Rewards Premier Visa Signature Credit Card charges 3% foreign transaction/exchange (FOREX) fees.

I was surprised to hear that so I asked him to double check. Yup, my US Bank Radisson Rewards Premier Visa Signature Credit Card does charge FOREX fees. I was very disappointed to hear this, so I shared my disappointment with US Bank and Radisson Rewards on Twitter (please like or retweet if you agree with me):

So glad I called @AskUSBank regarding my @RadissonGroup Premier Visa Signature Card to learn that this card charges 3% FOREX fees. This is so dumb for a “travel card” to charge FOREX fees. This card is staying home on my upcoming international trip :( #DoBetter pic.twitter.com/WUxuGNcglc

— Grant Thomas (@travelwithgrant) June 14, 2018

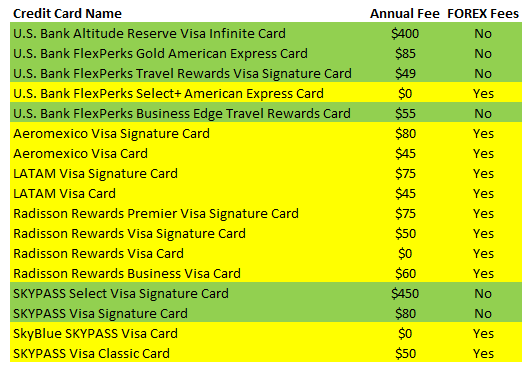

I then decided to look at other US Bank credit cards to see if they all had FOREX fees. There are 15 “Travel Cards” and 2 business credit cards that earn travel rewards. Out of those 17 travel rewards cards, only 6 *DO NOT* charge FOREX fees.

All Radisson Rewards, Aeromexico and LATAM credit cards charge FOREX fees; half of the Korean Air SKYPASS credit cards do charge FOREX fees; and most FlexPerks credit cards do not charge FOREX fees. It makes no sense why most of these travel rewards cards would charge FOREX fees, so the only assumption I can make is that the loyalty program or US Bank did not want to pay for the FOREX fees incurred by cardholders.

The next time you travel internationally or make an international purchase using your US Bank credit cards, check this list to make sure you won’t be charged a FOREX fee. If you have any questions, please leave a comment below. Have a great day everyone!

In order of “screw-ness,” or (as you gently call it, dumbness):

1) foreign hotels, restaurants, shops that offer to run your charge in $$ rather than their local currency. Cost to you for this favor (called “dynamic currency conversion!”) = 4% plus

2) CCs that add 3% to the exchange rate

3) Visa, MC, or Amex mark-ups on the official exchange rate — nothing like #1 or #2 or the guy in the booth at the airport, but a little extra for the CC company.

I agree 100% with you. Number 2 is easy to avoid, assuming you bring and use the right credit cards. Number 1 is tricky since some retailers and restaurants will try to screw you, so you have to pay attention every transaction. Nothing you can do about Number 3.

yes…that is exactly the reason why I never applied for this card. Also the SPG I only got as soon as Amex killed the forex fees…. for me that use the cards 90% outside the US a card that charges forex fees does not belong in my wallet.

It’s almost illegal for an airline or travel credit card to charge FOREX fees. Someday we will get to the point where every credit card will not charge FOREX fees.

Pingback: Inside Chase Sapphire Reserve, Star Alliance Flight Status, Free Divers of Jeju Island - Rapid Travel Chai