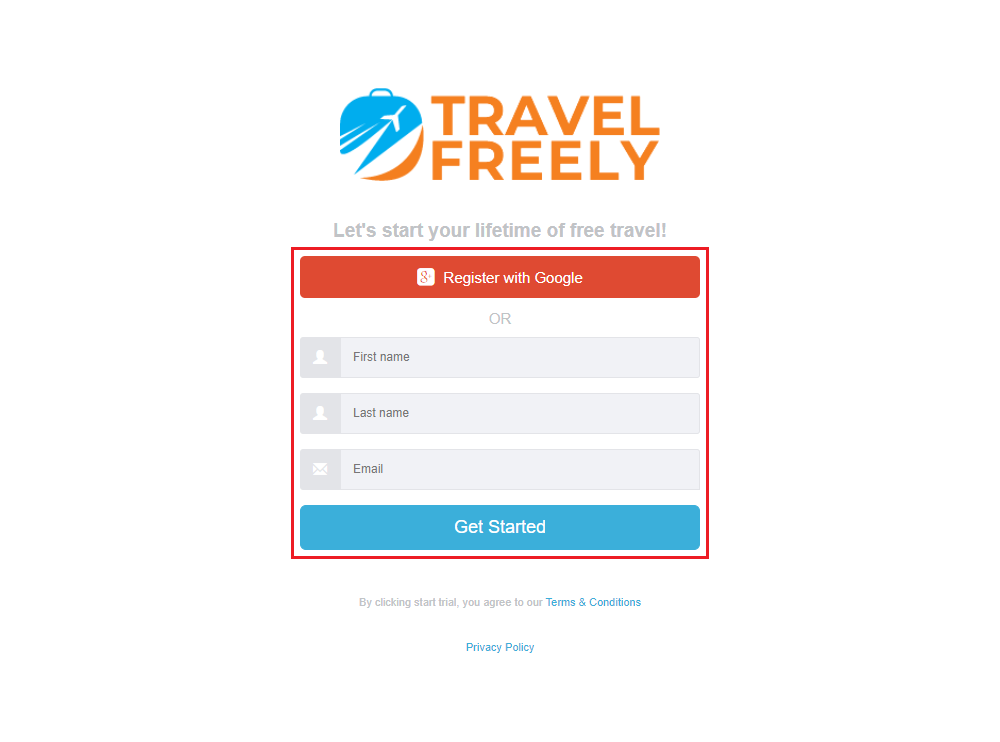

Good morning everyone, I hope you had a great weekend. A few weeks ago, I was in Denver and went to the Front Range Travel Hackers Meetup Group. At the meetup, I met Zac, the founder of TravelFreely, a website he created to track credit card sign up bonuses (deadlines to complete the minimum spending requirements), track credit card annual fees, calculate your 5/24 Score, and make it easy for you to track your credit cards along with your spouse / companion’s credit cards. And by the way, the service is completely free and you can set up your account in a few minutes (unless you have 30+ credit cards like me, in which case, it could take a little longer). Without further ado, here is how TravelFreely works. To get started, sign up for your free TravelFreely account here. Enter your name, email address, and click the Get Started button.

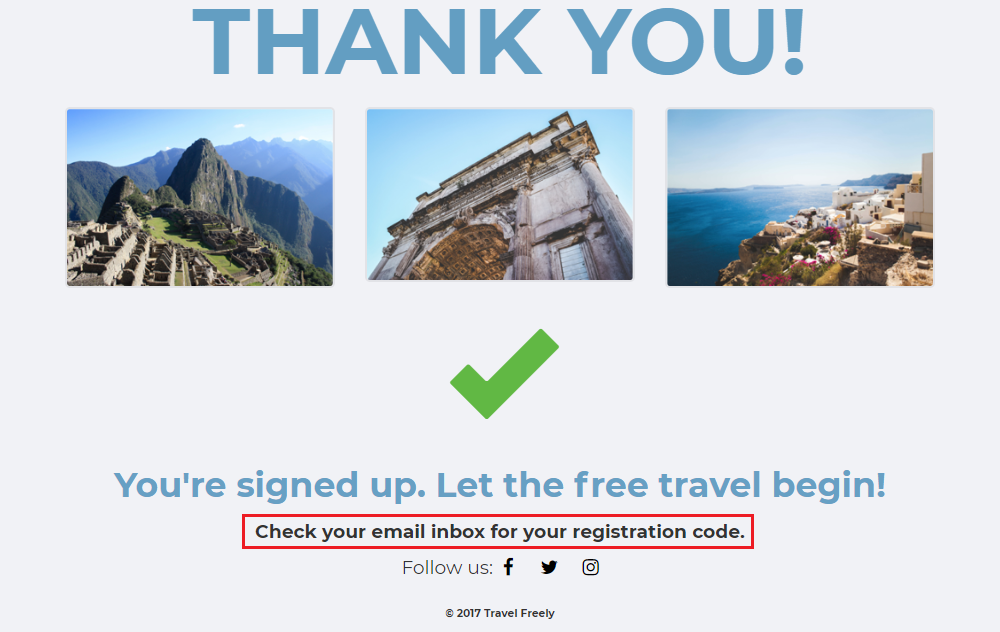

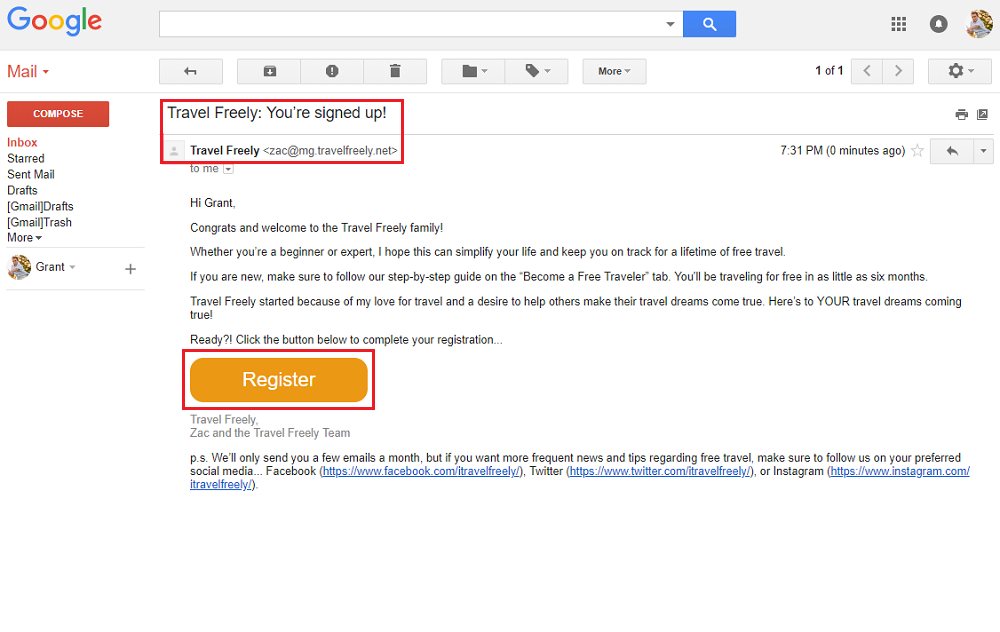

Then check your email for the registration link. Click the Register button in the email.

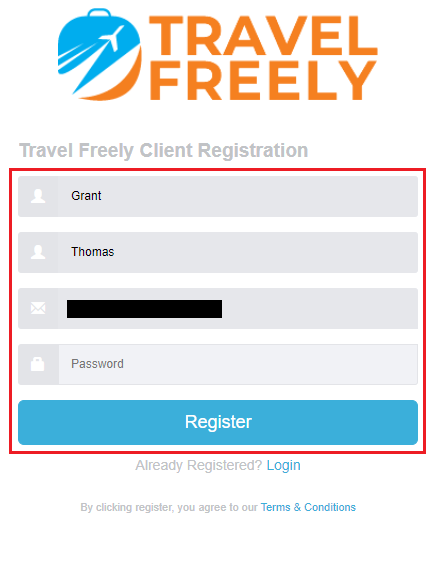

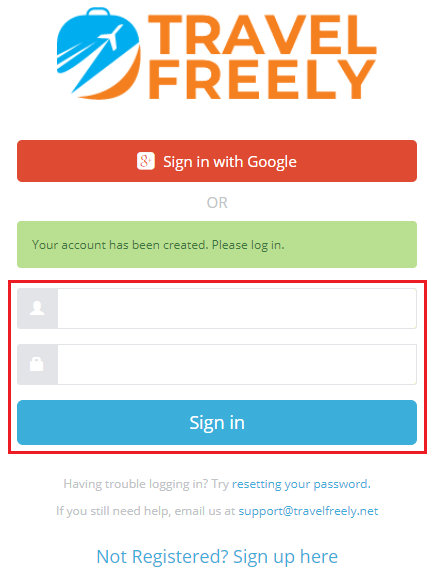

Create a password and click the Register button. Then sign into your TravelFreely account.

I am going to walk you through all the pages on TravelFreely, then go through the process of adding a few credit cards to my Card Dashboard. Here is the Home page. Right now, it is empty, but it will start filling up with information as I start adding more cards to my Card Dashboard. If you have specific travel goals, like “Hawaii Spring 2019” or “South Africa Summer 2020”, you can click the green plus icons to list your travel goals.

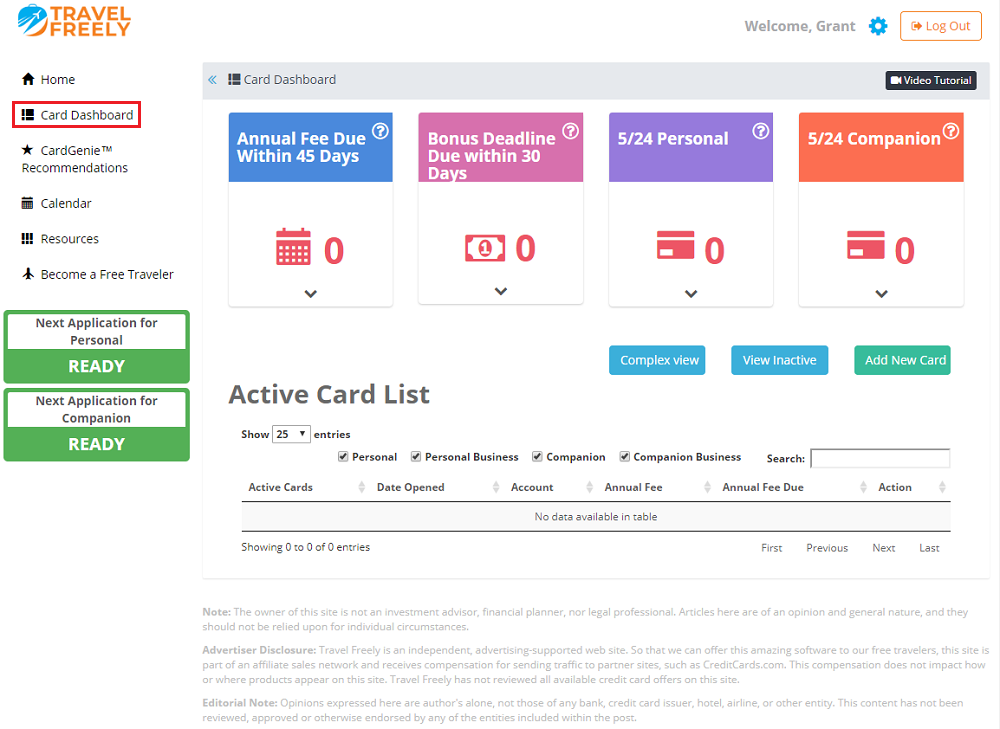

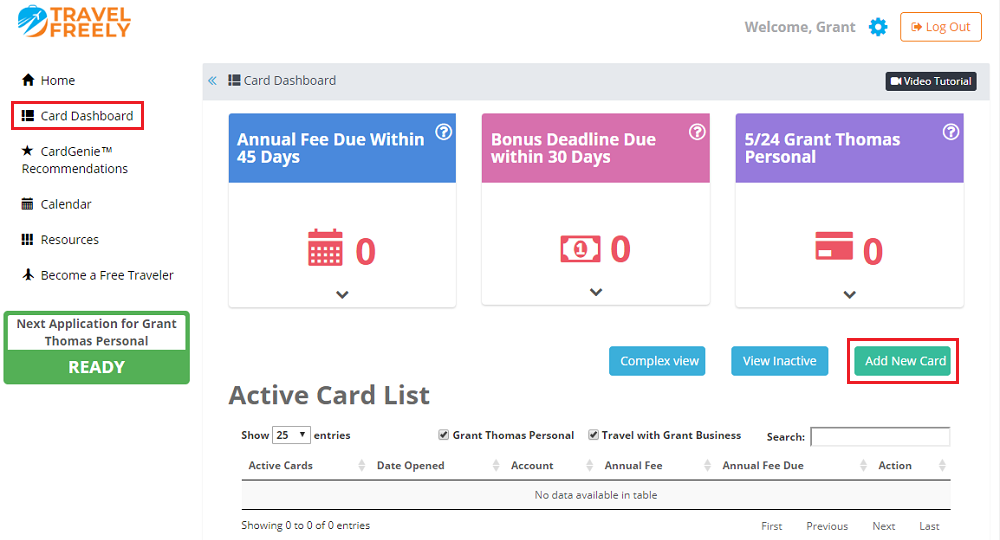

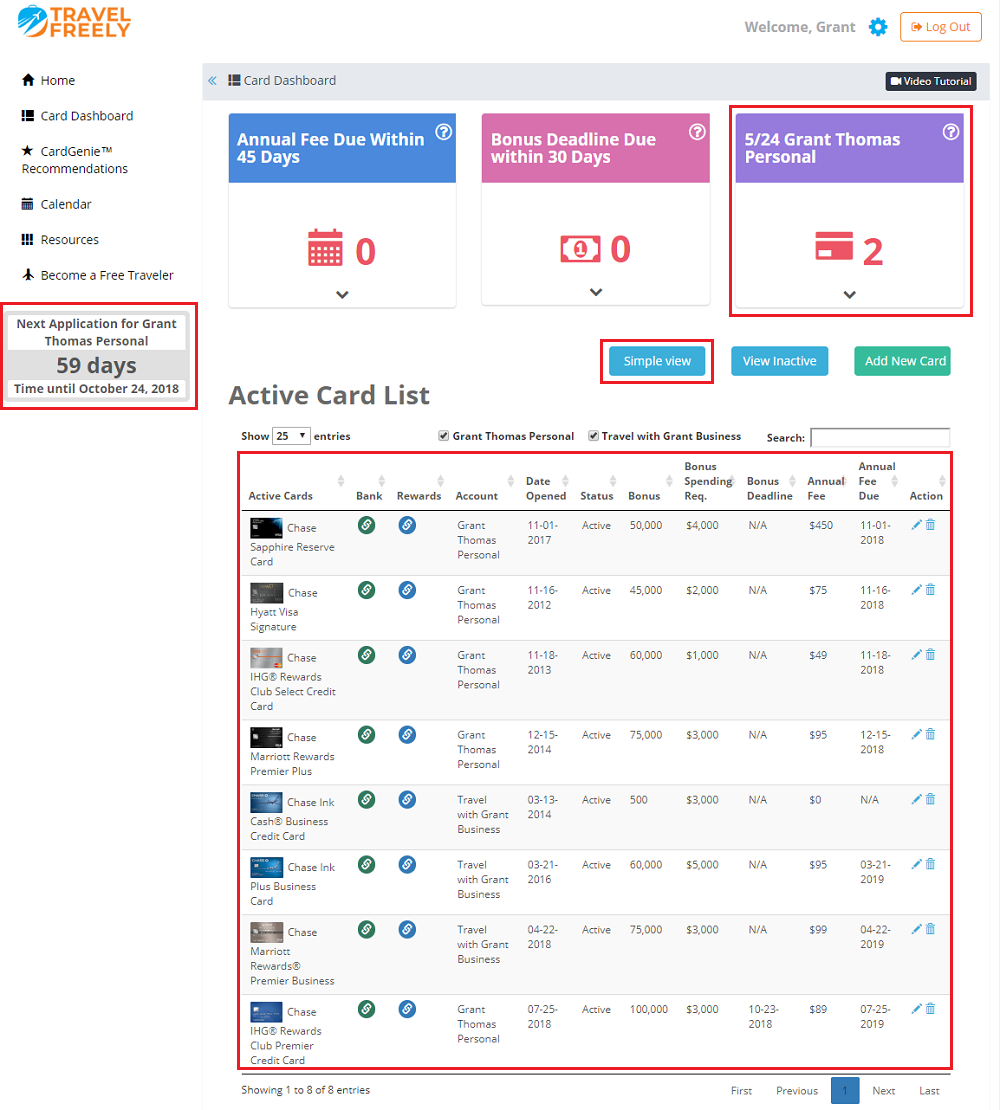

Here is the Card Dashboard page. The whole idea of TravelFreely is that you list every credit card you currently have open and have closed in the last 2 years, plus your spouse / companion’s credit cards, and it will calculate both 5/24 Scores. If you just signed up for a new credit card, you can enter the sign up bonus along with the date you were approved for the credit card, and TravelFreely will calculate when you must complete the minimum spending requirement and when your annual fee will be billed. I will show how this works later in this post.

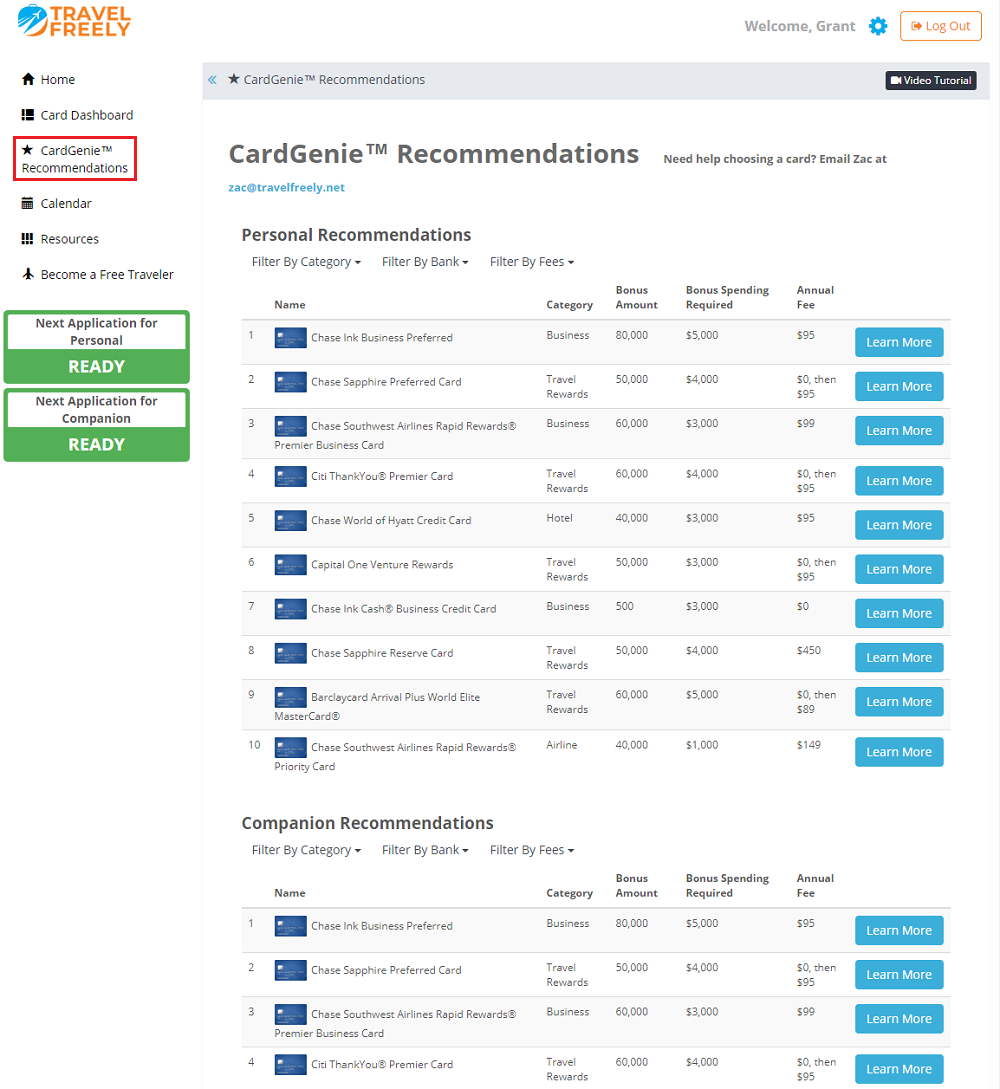

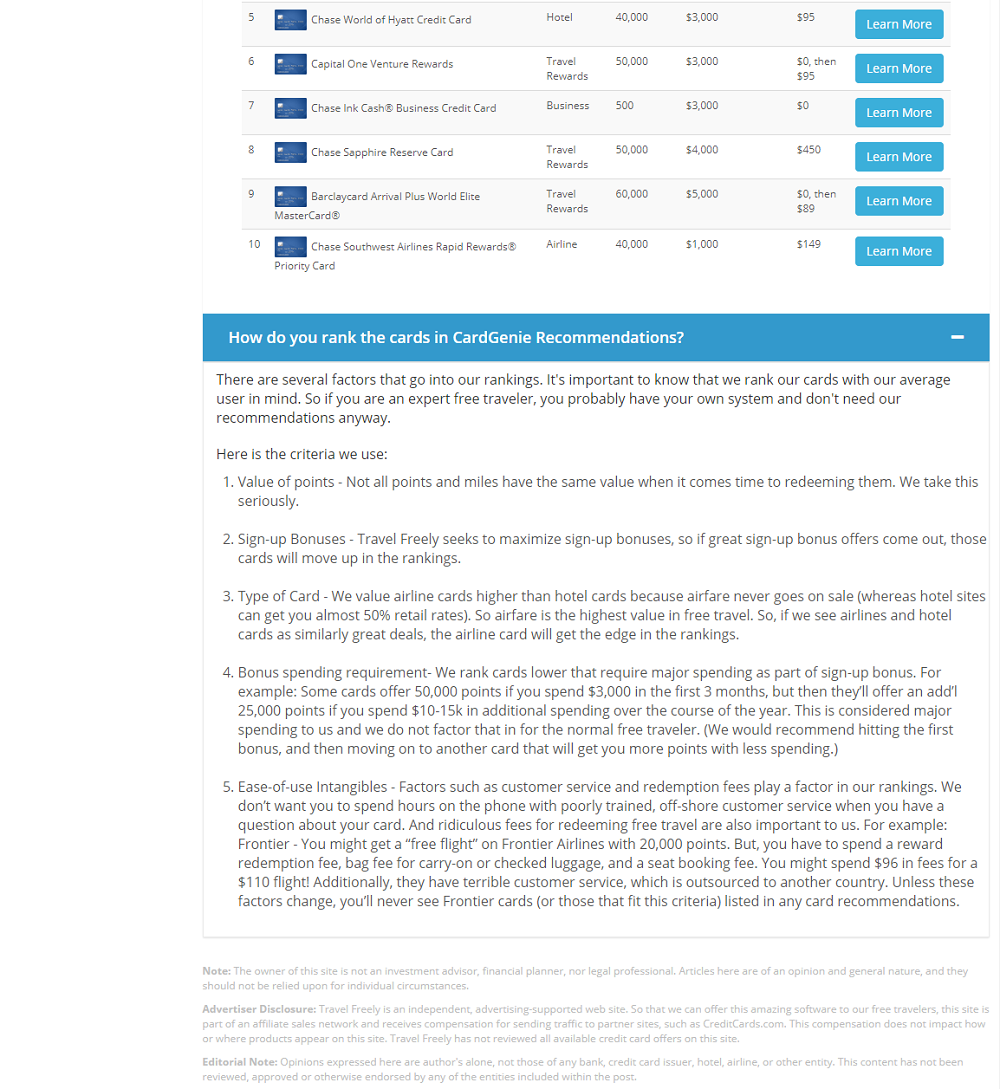

On the CardGenie Recommendation page, you can see which credit cards TravelFreely recommends to you, based on which credit cards you have open, and what your 5/24 Score is. The more information you provide to TravelFreely, the better the CardGenie Recommendations will be. Full disclosure, these are credit card affiliate links and this is how TravelFreely provides this service for free.

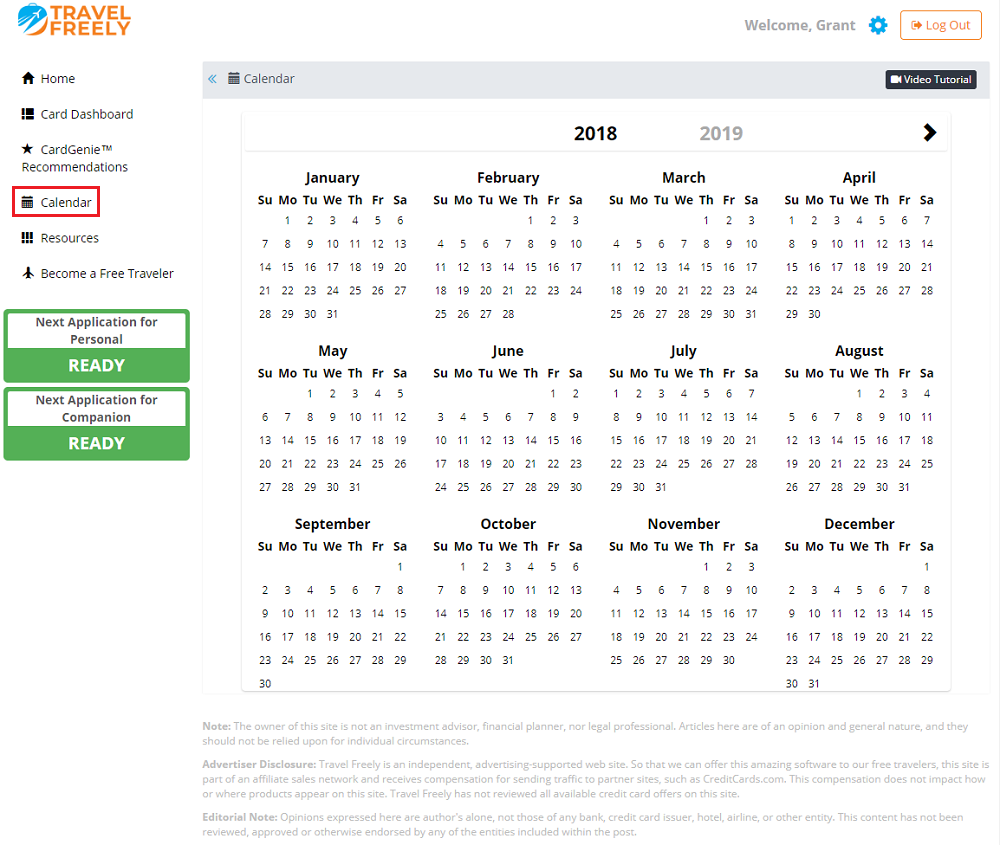

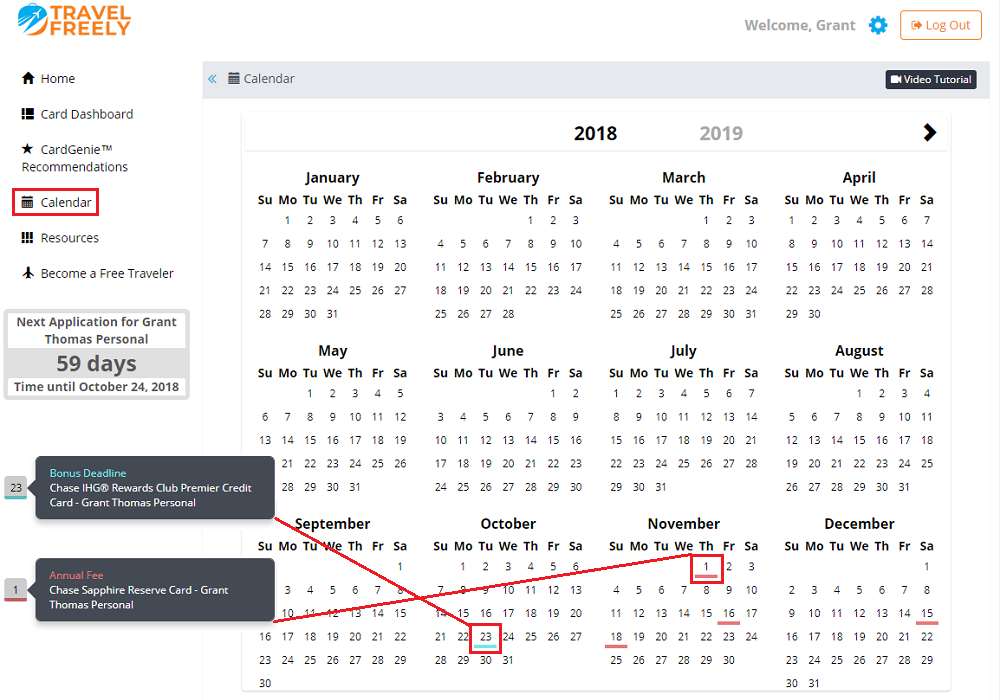

Here is the Calendar page. Since I have not entered any credit cards into my Card Dashboard, there are no dates on my calendar. The more credit cards you add to the Card Dashboard, the more calendar dates will be added, assuming your credit cards carry annual fees.

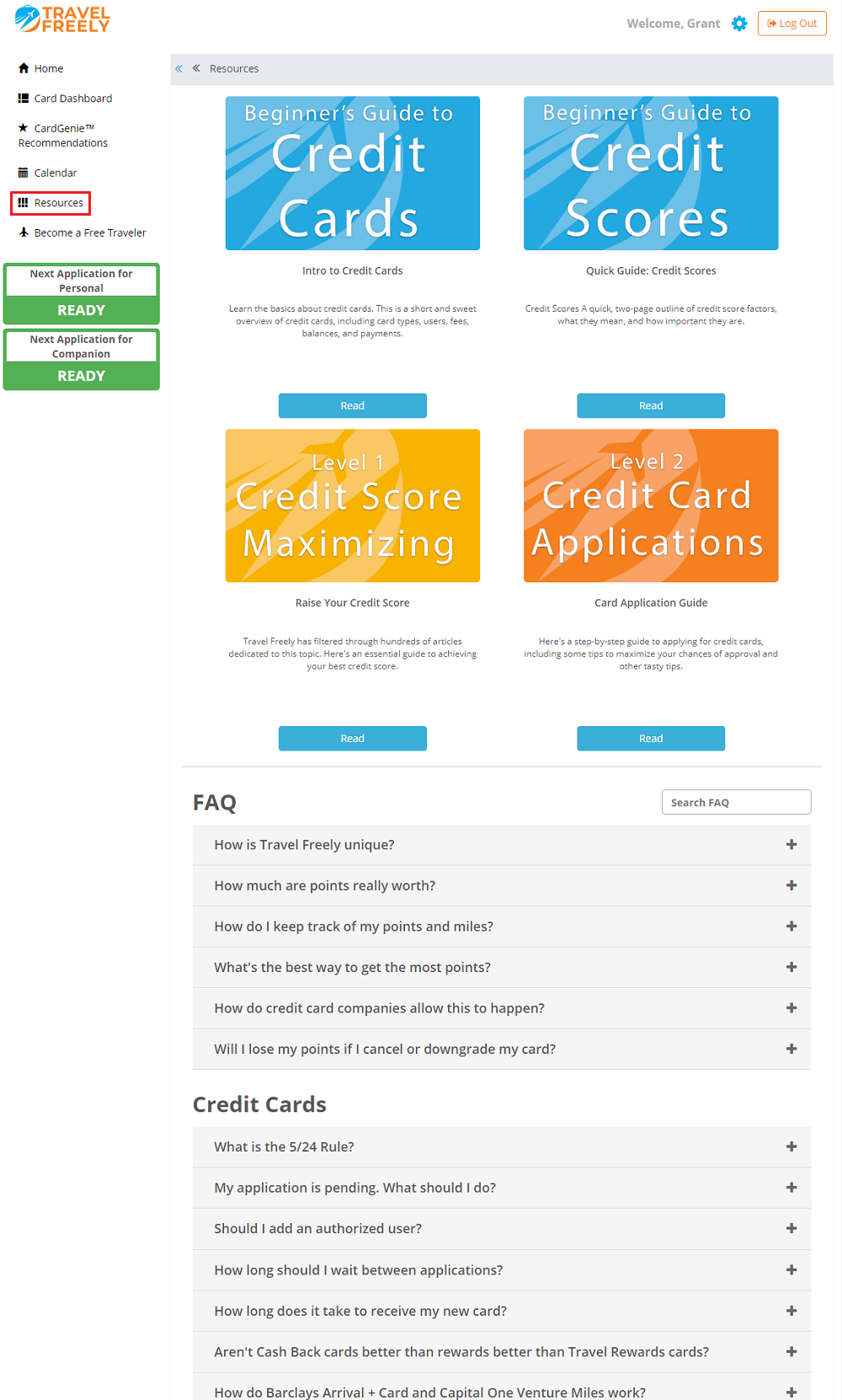

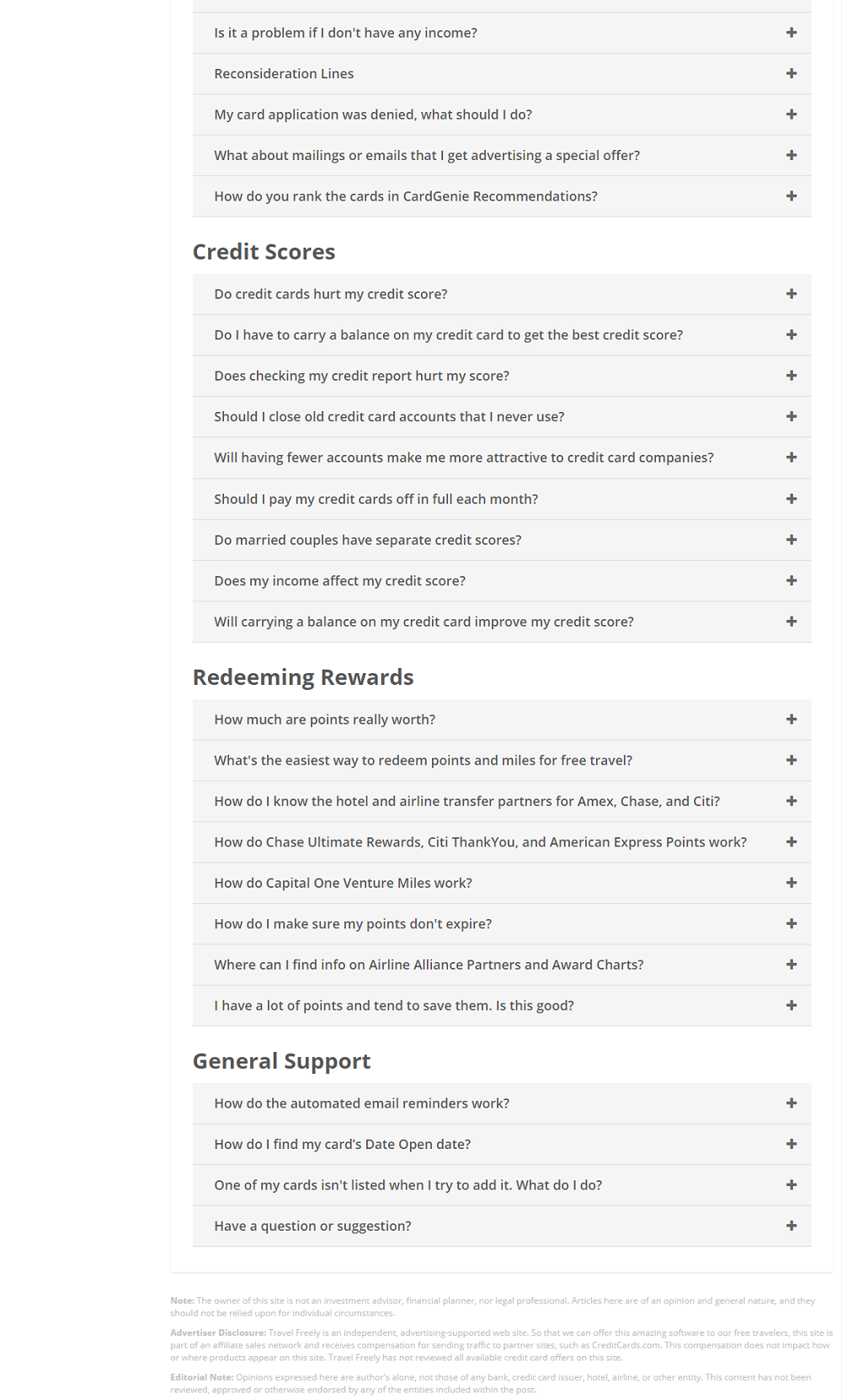

Here is the Resources page that has detailed answers to various questions about credit cards, credit scores, rewards and more.

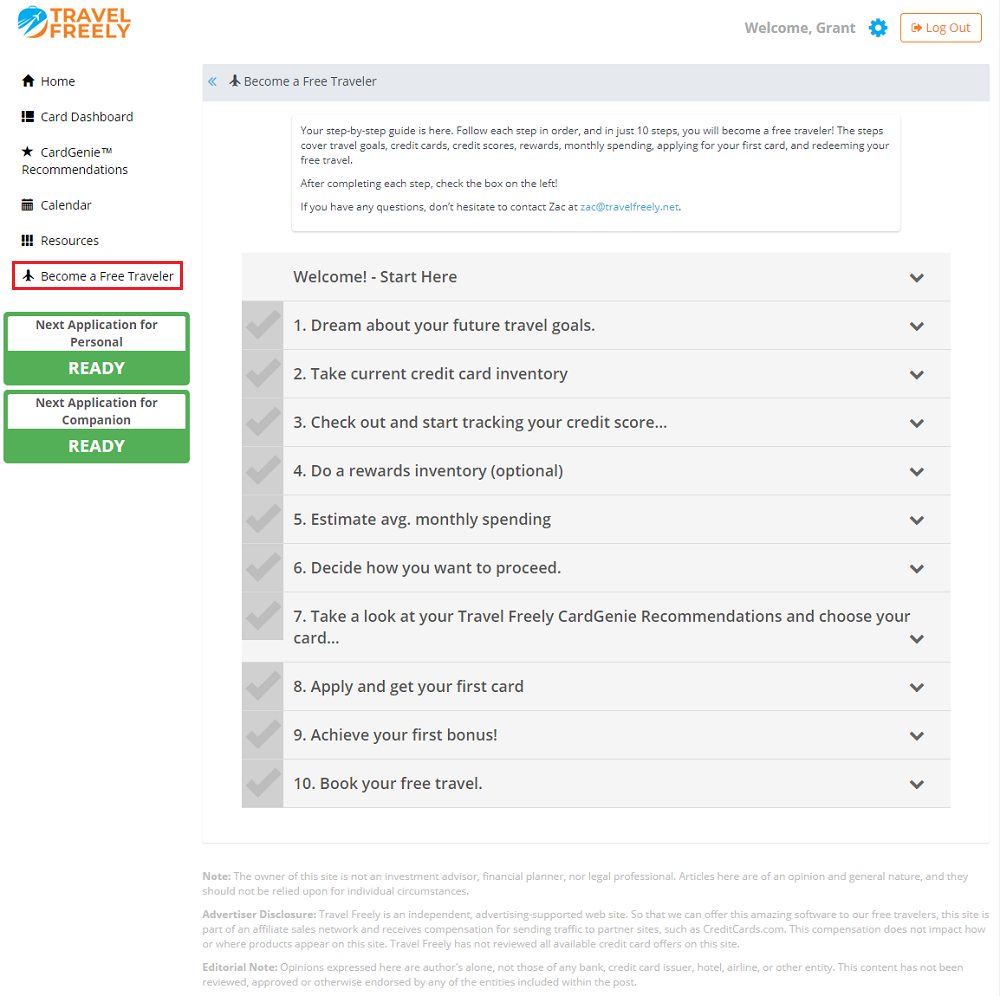

Here is the Become a Free Traveler page. Zac has created short videos for each topic along the journey to free travel.

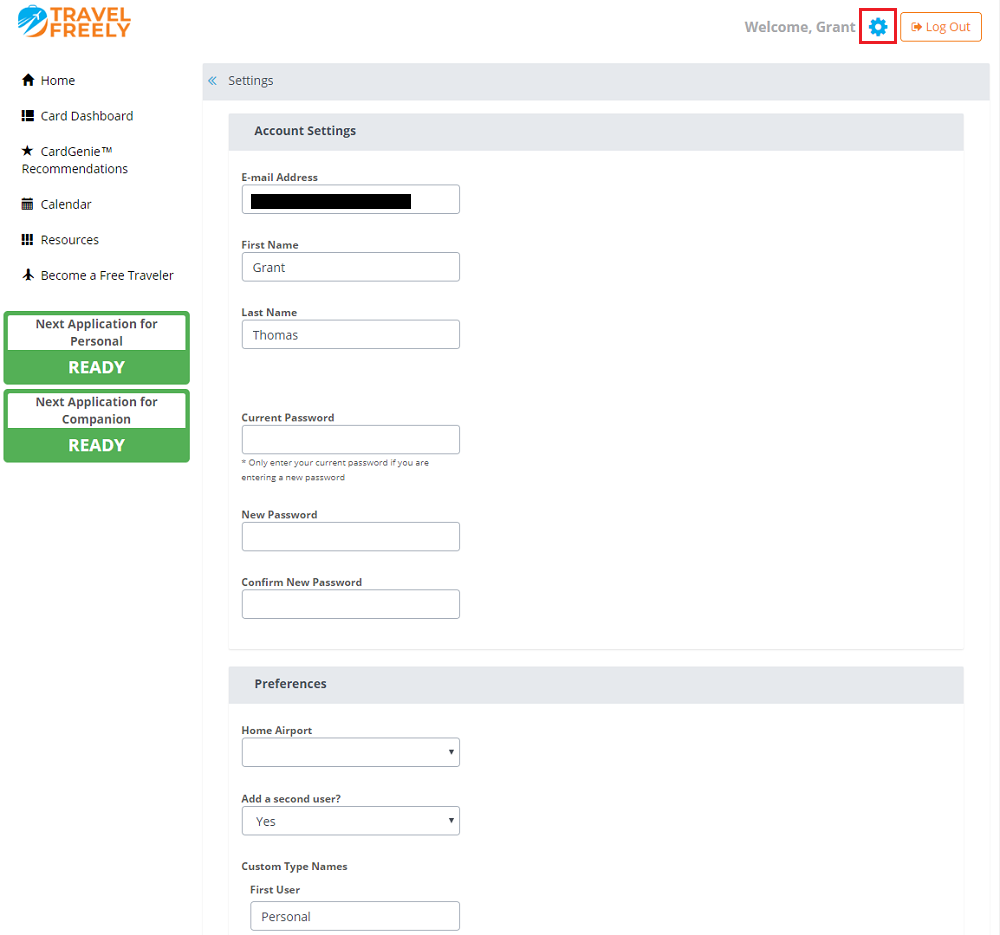

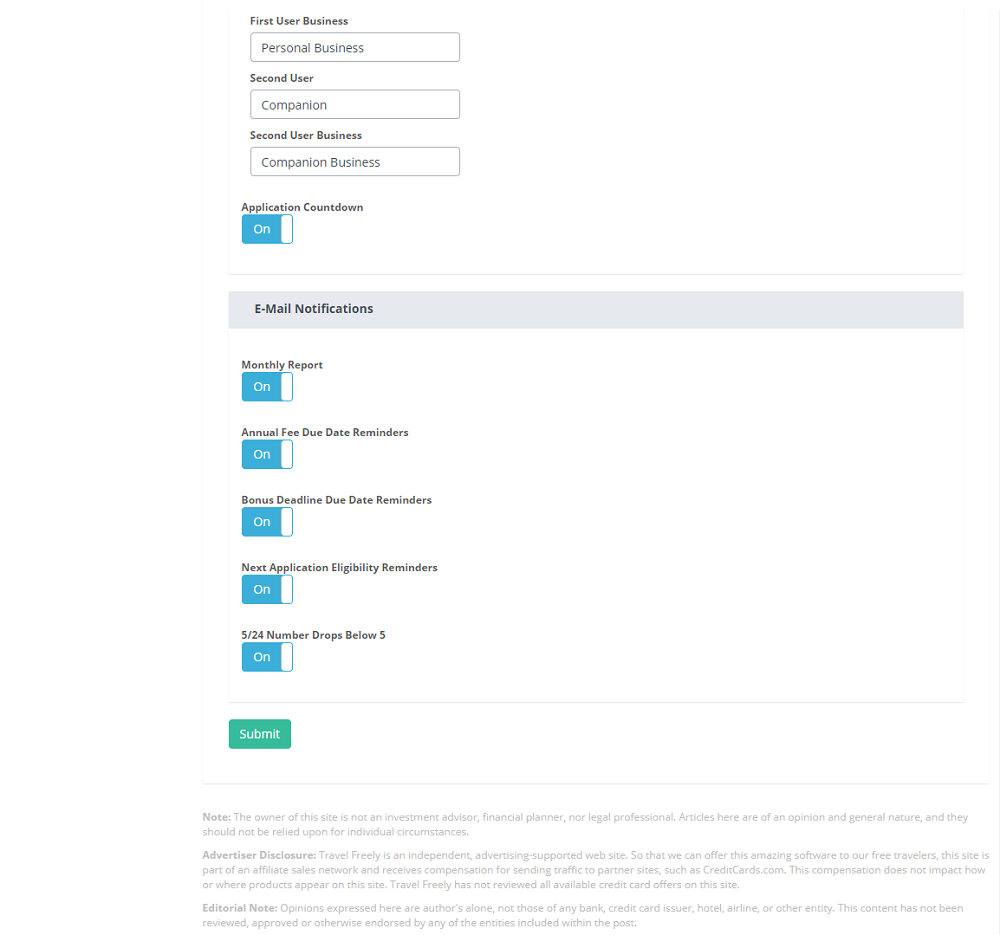

Lastly, I clicked the gear icon in the upper right corner to view my Account Settings. From here, you can change your account details, turn on and off emails or alerts, and more.

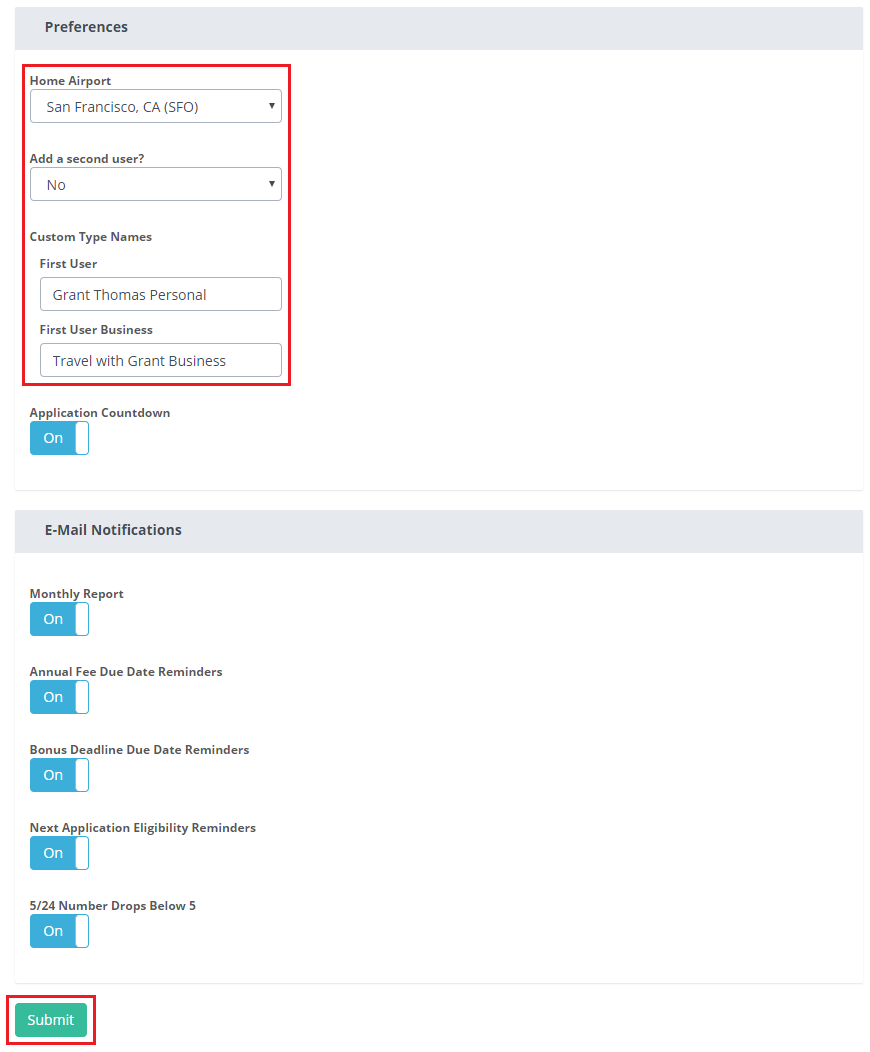

I actually started on the Account Settings page and scrolled down to the Preferences section. I added my home airport of SFO, turned off the second user, and renamed my personal & business credit cards. I then clicked the Submit button to save my settings.

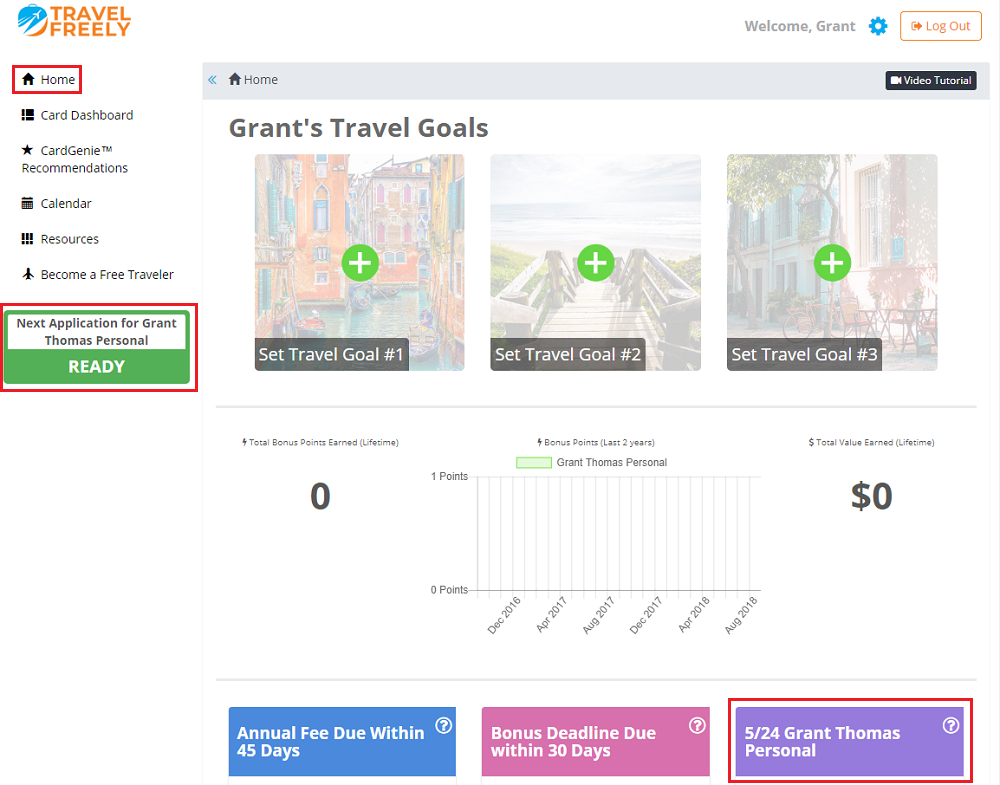

After the settings were saved, I went back to the Home page. Not much has changed here, but now it only shows my 5/24 Score and is more personalized to me.

The Card Dashboard is where TravelFreely shines. For best results, list all open credit cards and closed credit cards from the last 2 years. To get started, click the Add New Card button.

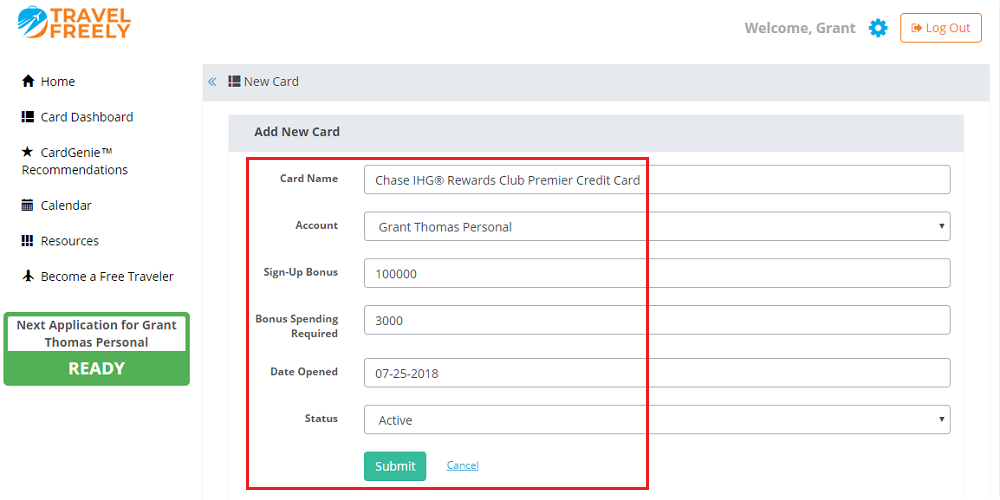

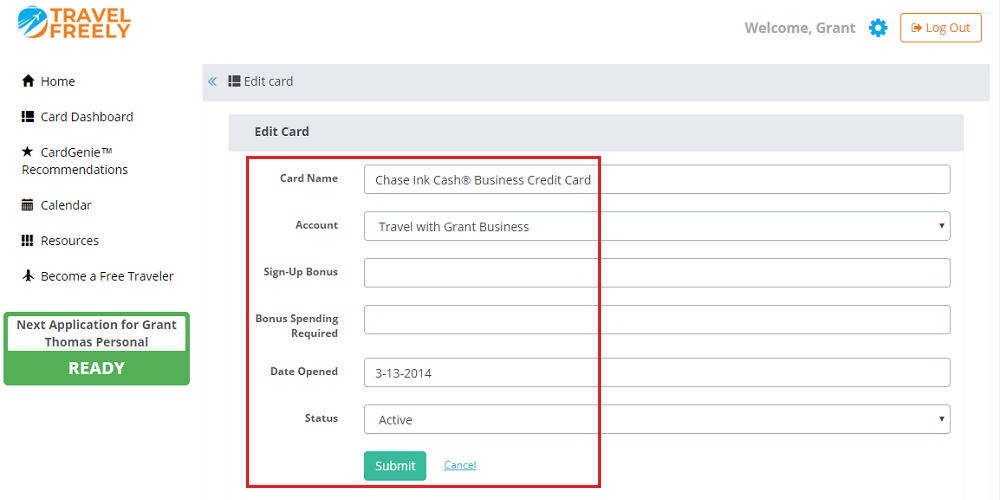

Start typing the credit card name and the drop down menu will find the credit card. If it is a personal or business credit card, select the account from the drop down menu. If you are working on a sign up bonus, enter the details of the sign up bonus and the minimum spending requirement. Then enter the date the credit card was opened (if you do not have the exact date, just guess). Lastly, select whether the credit card is active (open) or closed, then click the Submit button. Complete the same process for every credit card you have open and all credit cards you have closed in the last 2 years.

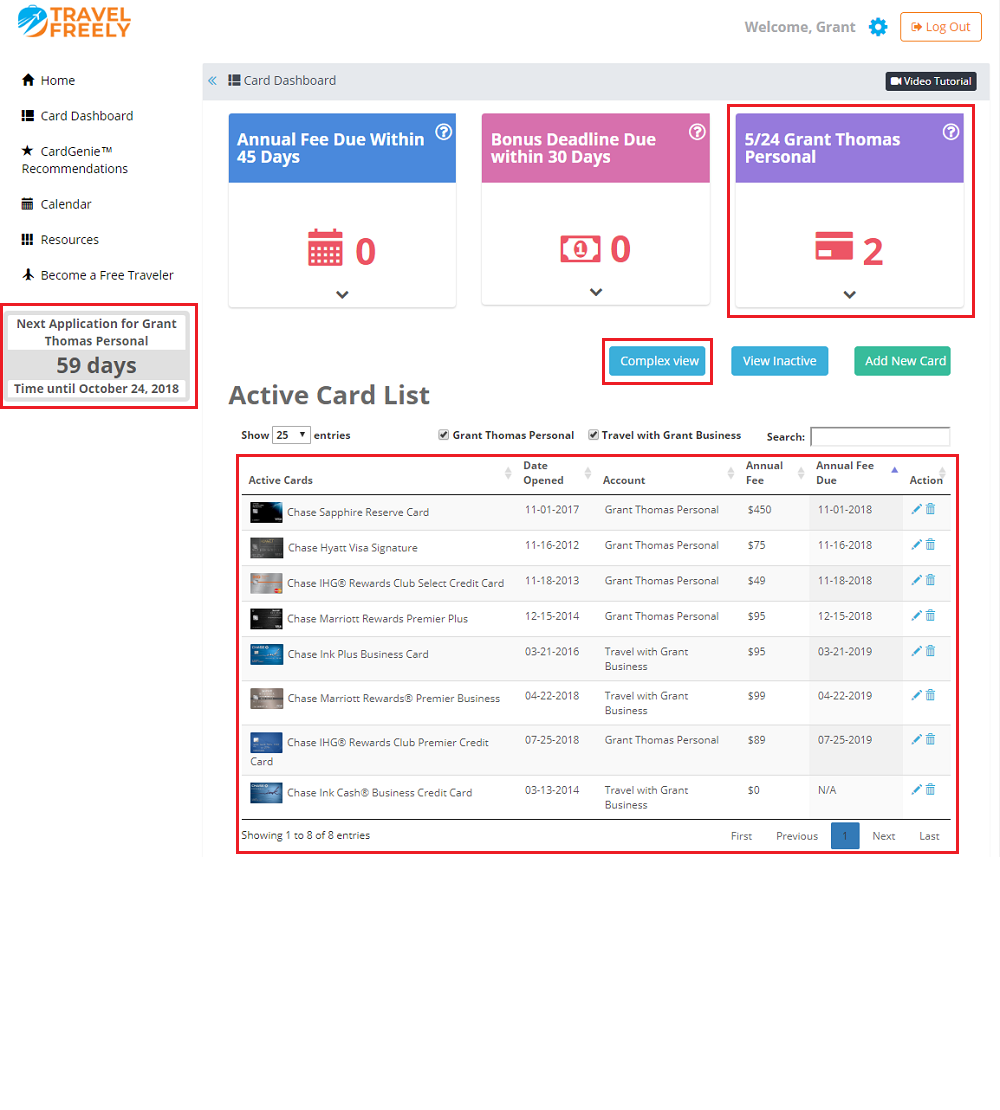

For this demo, I only listed my open Chase credit cards. If these were the only credit cards I have open and haven’t closed any credit cards in the last 2 years, my 5/24 Score would be 2/24, and my next application date is anytime after October 24 (since I was approved for the Chase IHG Rewards Premier Credit Card on July 25). You can also toggle between the Complex View and the Simple View to see more details of each credit card.

Now when I go to the Calendar page, I see various dates marked on the calendar. October 23 is marked with green and corresponds to the date that I must complete the minimum spending requirement on my Chase IHG Rewards Premier Credit Card in order to get the sign up bonus. November 1 is marked with red and corresponds to the date when my Chase Sapphire Reserve Credit Card annual fee will be billed. As you can see, I have a few other credit cards with annual fees in November and December.

After adding my credit cards to my Card Dashboard, my Home page reflects the number of points I have earned from credit card sign up bonuses and the corresponding value of those points. It also shows my 5/24 Score (2/24) and when I can apply for my next credit card (anytime after October 24, 2018).

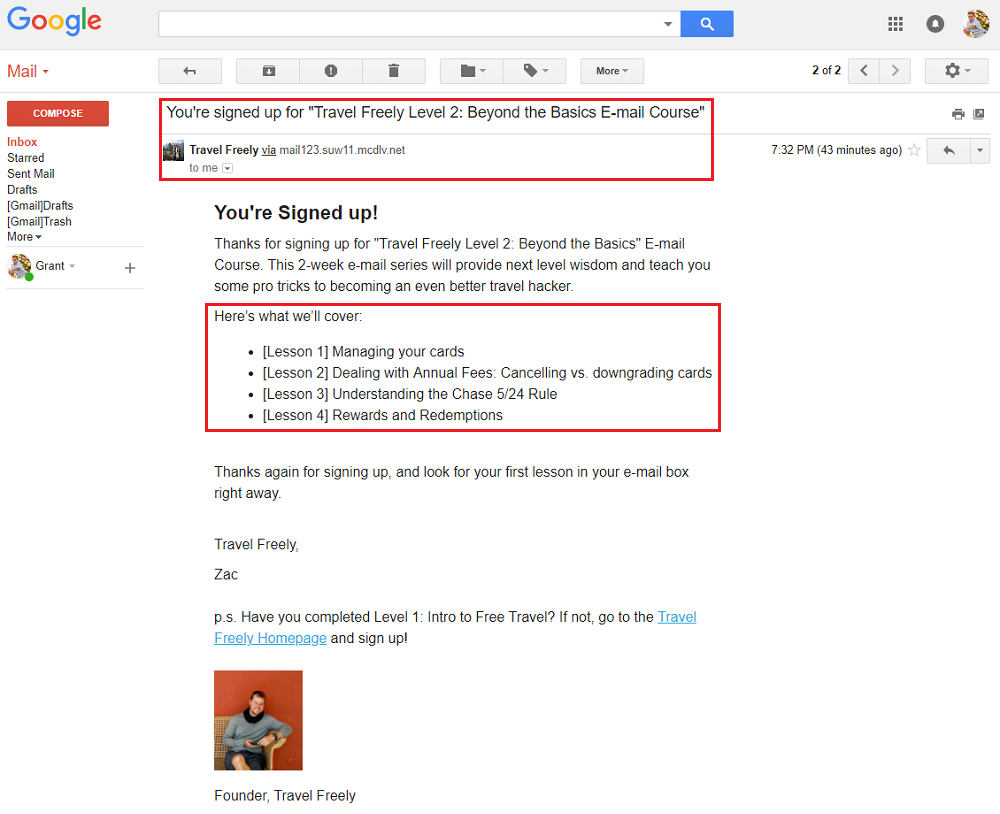

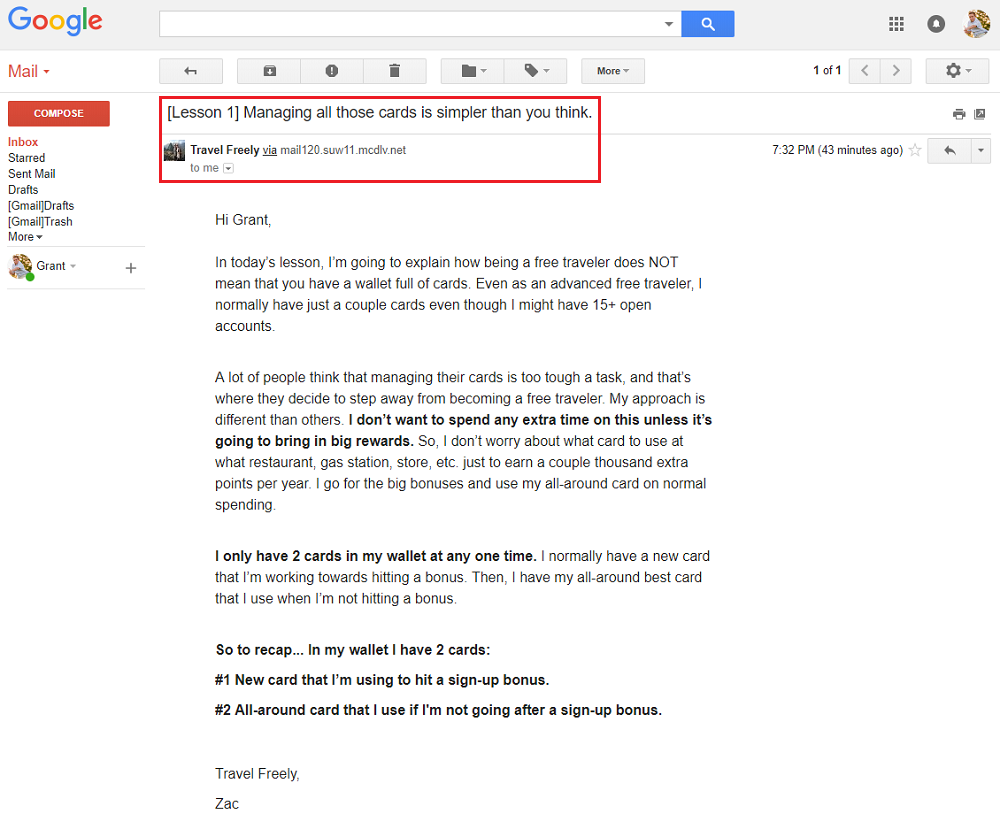

TravelFreely will also send you 2 emails after you register for the service. The first is an overview of how to use TravelFreely, and the second email is Lesson 1. If you do not want to receive these emails, you can click the gear icon in TravelFreely and change your email settings. I find the emails helpful, so I keep the emails turned on.

If you have any questions about TravelFreely, please leave a comment below. If there are any features missing or improvements you want to see, you can contact Zac directly (zac@travelfreely.net). So what are you waiting for, sign up for TravelFreely today and start tracking your credit card sign up bonuses, annual fees, and 5/24 Score today!

Is it safe? Who can really tell if even credit bureaus get hacked but still, volunteering sensitive I go to this outfit seems like asking for trouble

You are not providing any sensitive information, just card names and dates that you opened credit cards. This information is not tracked or shared with credit bureaus.

don’t believe everything you read….using my own spreadsheet is easier – more customizeable…

Don’t tell TravelFreely, but I keep a detailed spreadsheet too (credit card numbers, phone numbers, credit limits, etc.). I like having an online and offline tool to track credit cards and annual fees.

Why next application anytime after October 24?

I believe TravelFreely recommends waiting at least 90 days from your last credit card application.

Pingback: Valentine's Day Giveaway: Swag from BoardingArea, Travel Freely & Cash Back Monitor