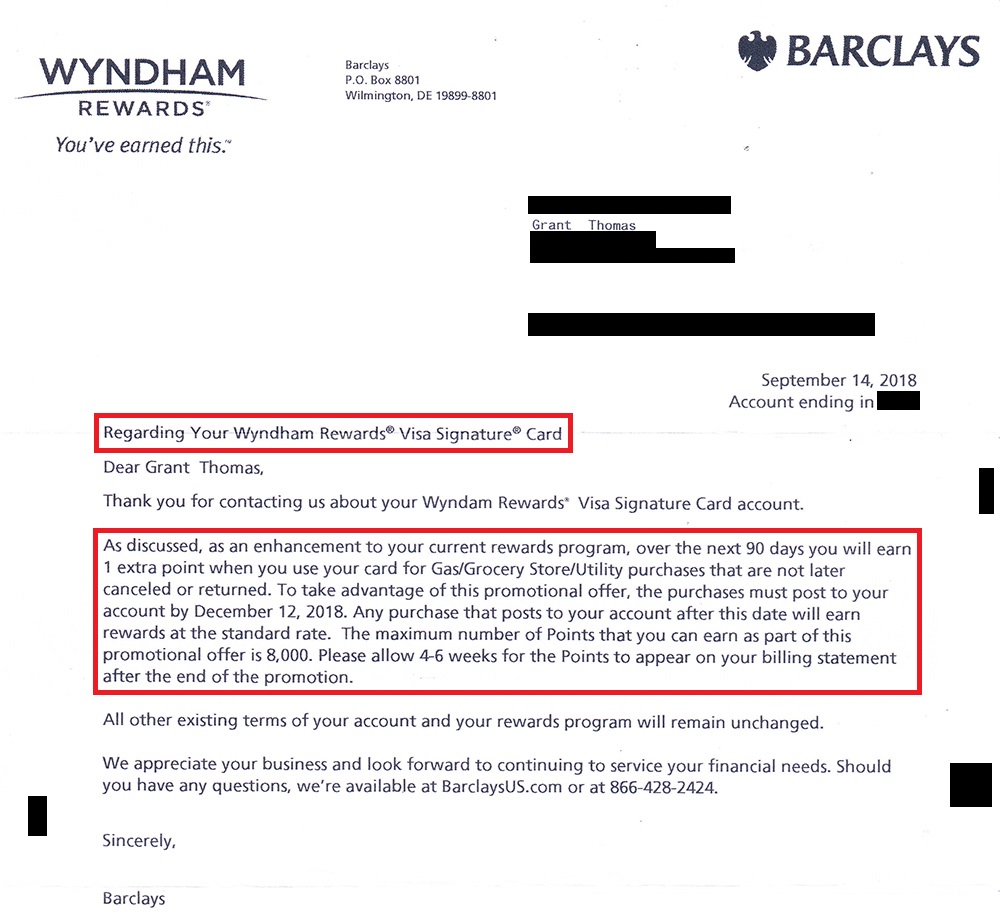

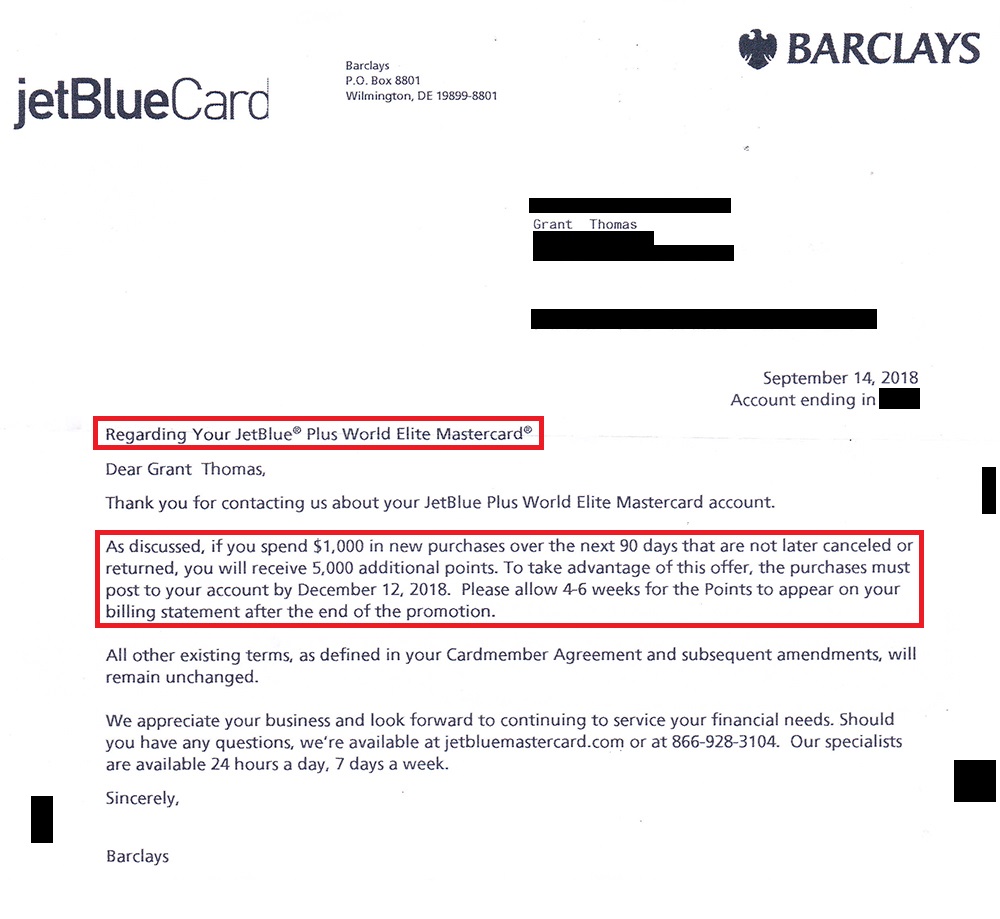

Updated 8PM PT on 9/18/18: I just received the confirmation letters from Barclays and added both letters to this post.

Good morning everyone, I hope you had a great weekend. Last week, I noticed that my $75 annual fee posted on my Barclays Wyndham Rewards Credit Card. I signed up for this credit card during my September 2017 App-O-Rama and received 45,000 Wyndham Rewards Points as a welcome bonus (enough for 3 free nights, which I still haven’t used yet). I wrote a similar post about my Barclays Credit Card Targeted / Spending Offers for May 2018. In today’s post, I will share my retention / targeted spending offers on my 3 Barclays credit cards.

Let’s start with my Barclays Wyndham Rewards Credit Card. I haven’t put a single dollar of spend on this credit card in the last 10-11 months since I received the sign up bonus, so I wasn’t expecting any retention offers. After calling Barclays and directly asking for the annual fee to be waived, the rep said that I could downgrade to the no annual fee version of the credit card, but I would miss out on the 6,000 anniversary Wyndham Rewards Points (which she stated would post 45 days from the date the annual fee posted). I decided that 6,000 Wyndham points was worth $75 and kept the credit card as is. I then asked if there were any targeted spending offers available and the rep said there was an offer to earn an extra Wyndham Rewards point on gas and grocery purchases. I wasn’t paying very close attention because that wasn’t the type of offer I wanted. I was looking for a “Spend $X, get Y bonus Wyndham Rewards Points” type offer. I asked the rep if there were any other offers and she stated there was only a 0% balance transfer offer available. I declined the balance transfer offer and told her I would accept the spending offer. I then asked if she could check my other Barclays credit cards to see if any of those credit cards had targeted spending offers available.

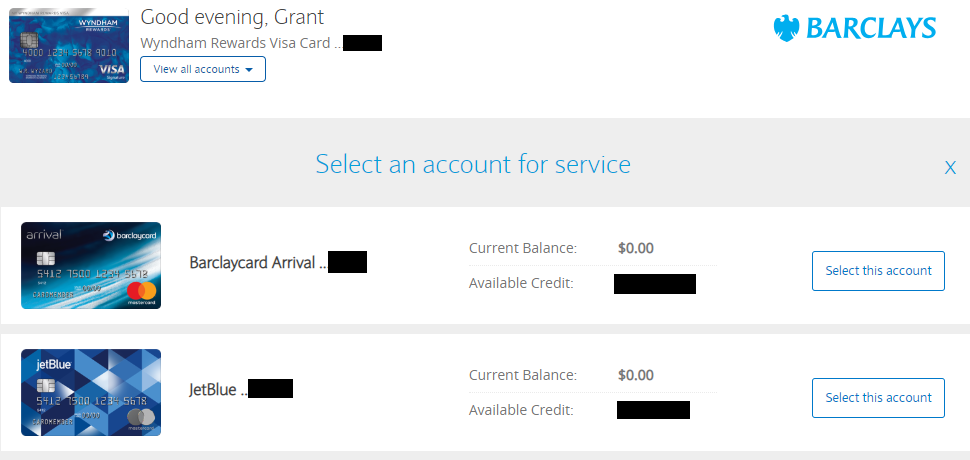

Up next, the rep looked into my no annual fee Barclays Arrival Credit Card. I downgraded to the no annual fee credit card to keep my remaining Barclays Arrival Miles alive, but I don’t use this credit card at all. Not surprising, there was only a 0% balance transfer offer available, so I declined that offer and asked the rep to look at my last Barclays credit card.

Lastly, the rep looked at my Barclays JetBlue Plus Credit Card. Third time was the charm since the rep did find a good targeted spending offer. If I spend at least $1,000 in the next 90 days, I will get 5,000 bonus JetBlue TrueBlue Points. I don’t spend much money on this credit card, just the occasional $5.60 in taxes/fees on JetBlue flights. Maybe that was the key to get that targeted spending offer, who knows.

None of these retention / targeted spending offers are amazing this time around, but if you use your Barclays credit cards a lot, you might get much better offers. Have you called Barclays lately for retention / targeted spending offers? If so, share your data points. If you have any questions, please leave a comment below. Have a great day everyone!

$75 for 6000 Wyndham points? If you bought points at that price it would cost $187.50 for a one night stay. Maybe you know something about Wyndham I don’t, but it seems to me that you would have to do a lot of spending on a crap credit card to come up with the additional 9000 points you’d need to get an award night. Am I missing something? This chains footprint has a few bright spots, but finding award availability at those properties is like find a needle in a box of Australian stawberries.

You make a good point. If I had 0 Wyndham Rewards Points, I wouldn’t bother with these 6000 points. But as it turns out, I’m actually ~6000 Wyndham Rewards Points short of a free night, so the other ~9000 points came at almost 0 cost.

Pingback: Why Can't I Remove Closed Barclays Credit Card from my Online Account?