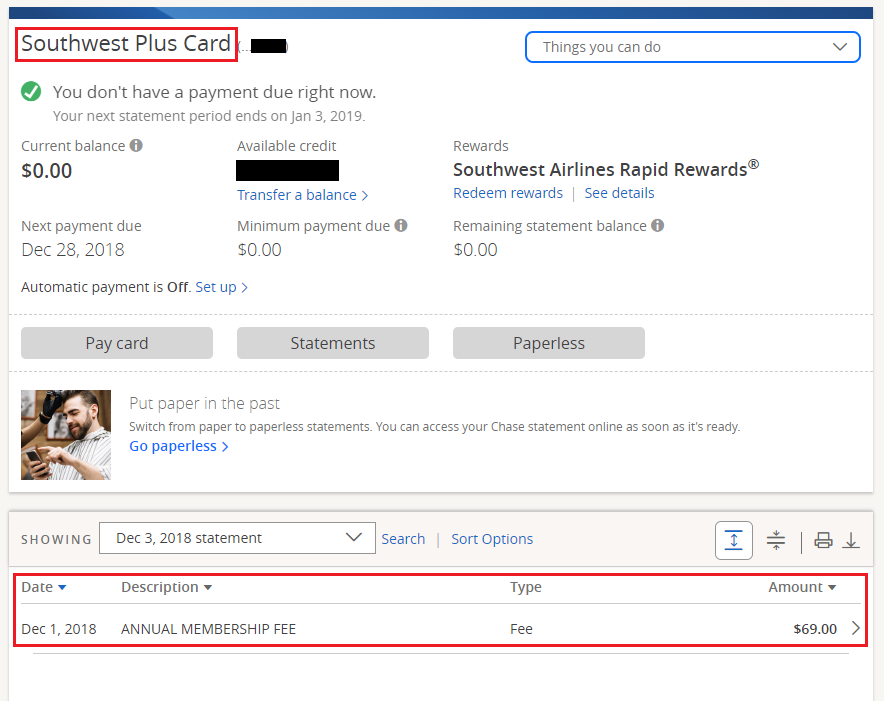

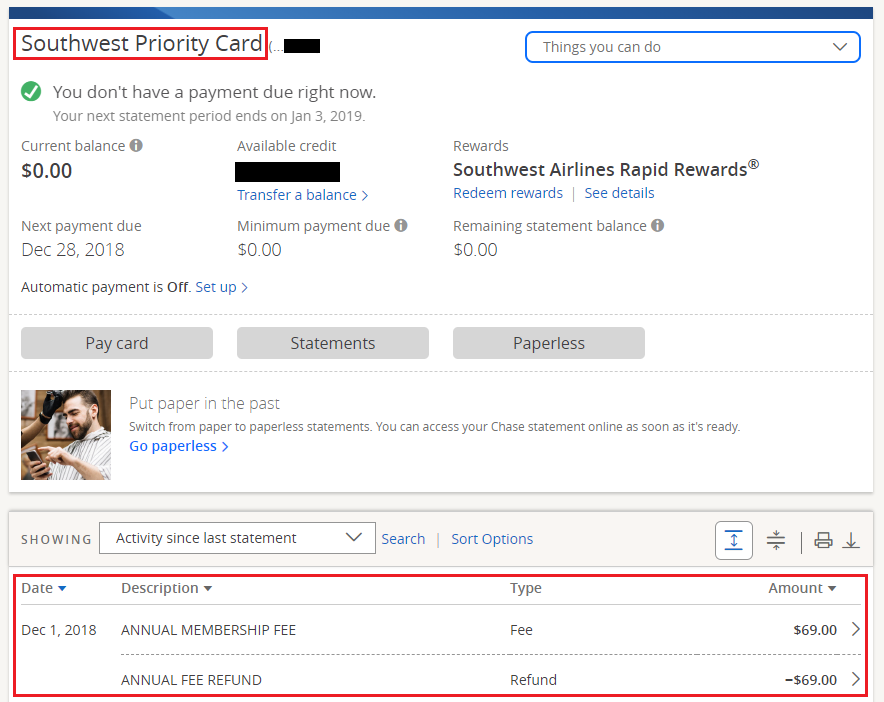

Good morning everyone. As part of my “Keep, Cancel or Convert?” series, I like to evaluate and reevaluate credit cards to make sure they still deserve a spot in my wallet. This post is a little different because this post is about my girlfriend’s Chase Southwest Airlines Plus Credit Card. She got this credit card last November when Chase & Southwest Airlines were running a promo for California residents: Sign up for the Chase Southwest Airlines Plus Credit Card, make 1 purchase and get a Southwest Airlines Companion Pass. It was a no brainer. The 50,000 Southwest Airlines Rapid Rewards Points sign up bonus was just gravy. We got great use out of the Southwest Airlines Companion Pass this year, but sadly, the $69 annual fee just posted and it’s time to decide if she should keep, cancel, or convert this credit card.

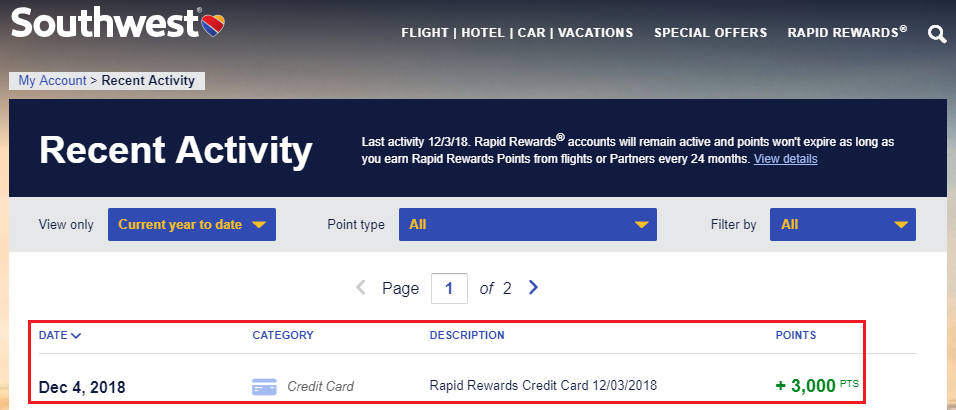

The only useful benefit of the Chase Southwest Airlines Plus Credit Card after the sign up bonus and Southwest Airlines Companion Pass is the 3,000 anniversary Southwest Airlines Rapid Rewards Points that post after the annual fee is billed. Unfortunately, 3,000 Southwest Airlines Rapid Rewards Points is worth ~$45, so it is not worth paying the $69 annual fee for ~$45 in Southwest Airlines Rapid Rewards Points.

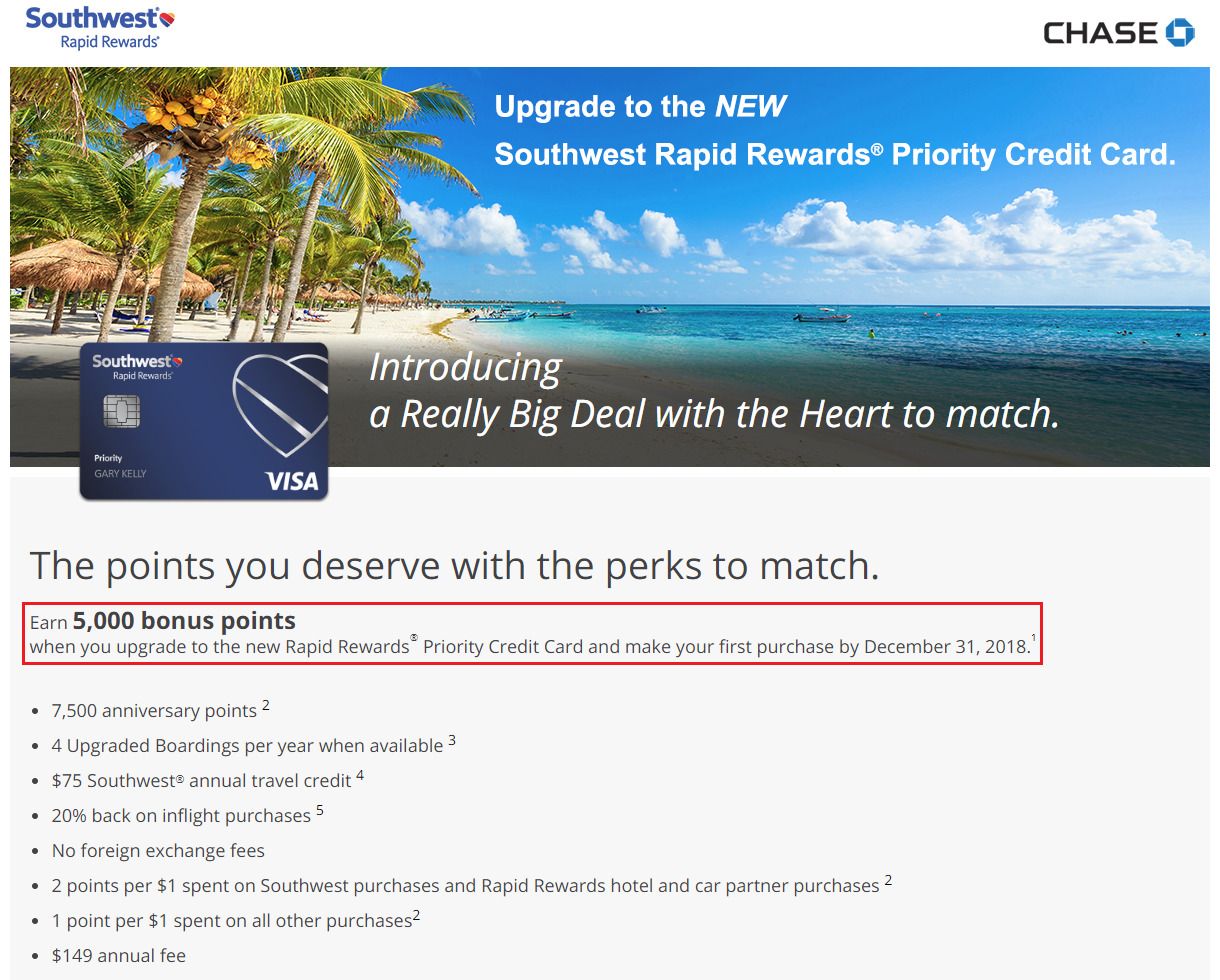

Doctor of Credit wrote a post a few months ago about a targeted upgrade offer where you can get 5,000 Southwest Airlines Rapid Rewards Points for upgrading to the new Chase Southwest Airlines Priority Credit Card. Unfortunately, my girlfriend was not targeted for the upgrade offer.

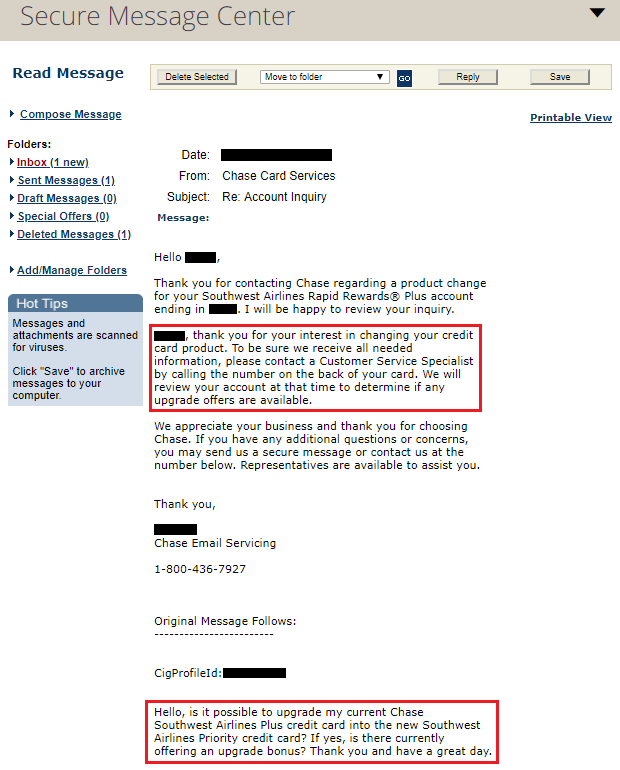

I then told her to try sending a Secure Message (SM) to Chase asking if there were any upgrade offers available. Unfortunately, the Chase rep told her to call the number on the back of her credit card to inquire about upgrade offers.

Unfortunately, the Chase phone rep did not see any upgrade offers either. I told my girlfriend to upgrade anyway since the benefits of the Chase Southwest Airlines Priority Credit Card were worth the higher $149 annual fee. After confirming the upgrade, the original $69 annual fee was refunded. I assume the $149 annual fee will be billed on her next credit card statement.

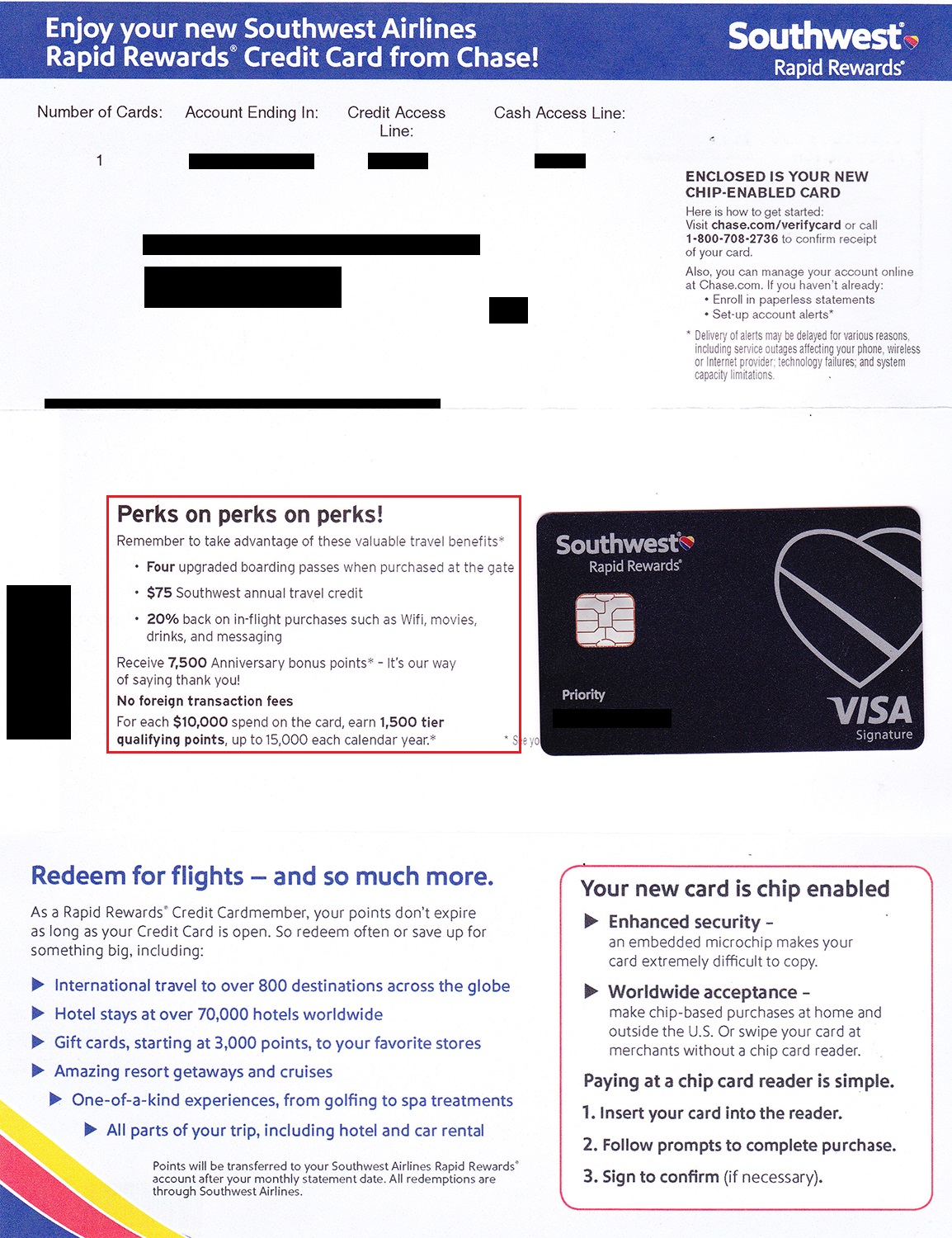

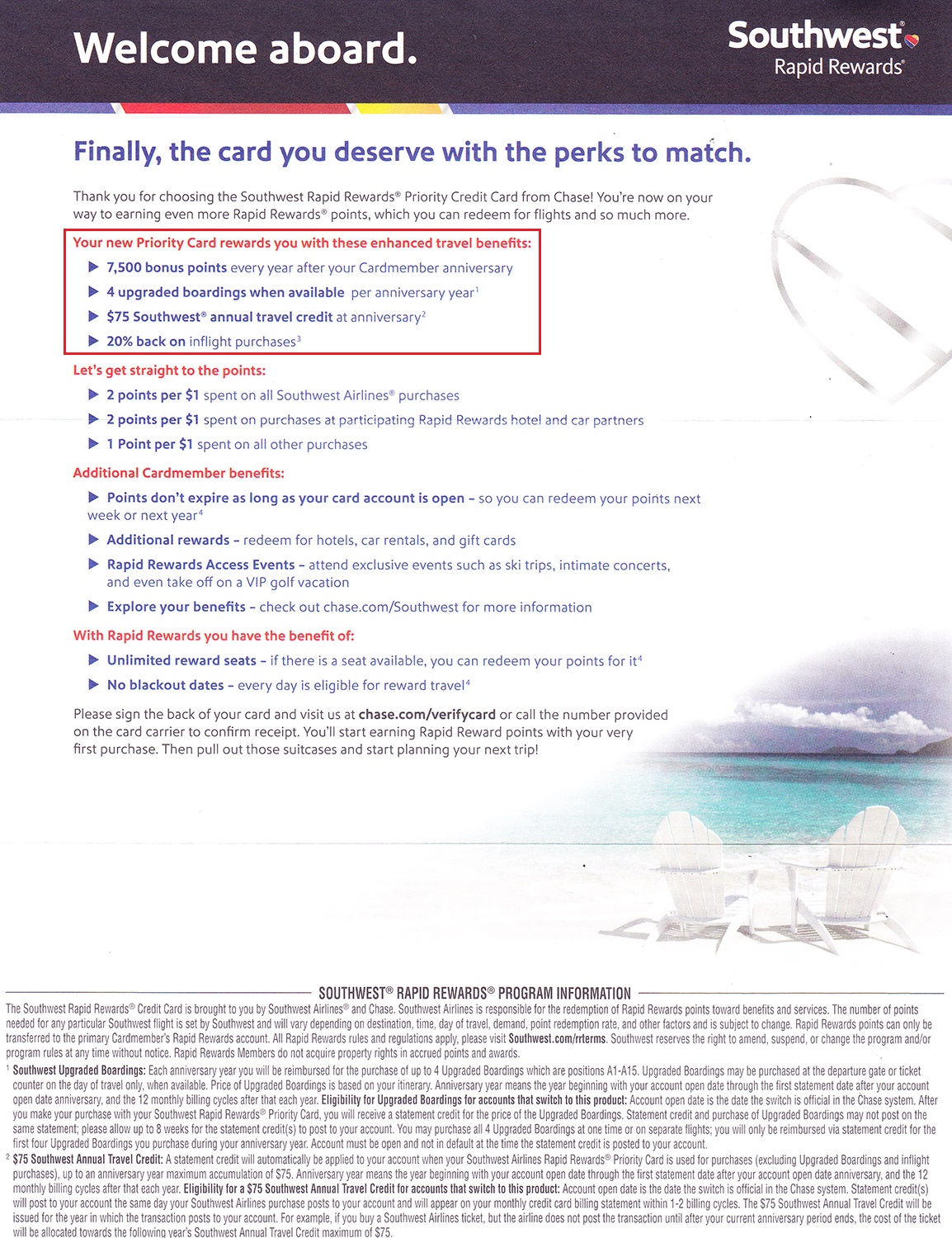

A few days later, her new Chase Southwest Airlines Priority Credit Card arrived in the mail. There are 3 main benefits of the Chase Southwest Airlines Priority Credit Card:

- 4 upgraded boarding passes, similar to Early Bird Boarding (~$60 value since each Early Bird Boarding costs $15 – $25)

- $75 Southwest travel credit (good for $75 of travel on Southwest Airlines, posts as a statement credit)

- 7,500 anniversary Southwest Airlines Rapid Rewards Points (~$112.50 value since Southwest Rapid Rewards Points are worth roughly 1.5 cents per point)

These 3 benefits are worth ~$247.50, depending on how you value the boarding passes, travel credit, and anniversary points. That more than makes up for the $149 annual fee.

Here are more details regarding those 3 main benefits and some of the lesser credit card benefits:

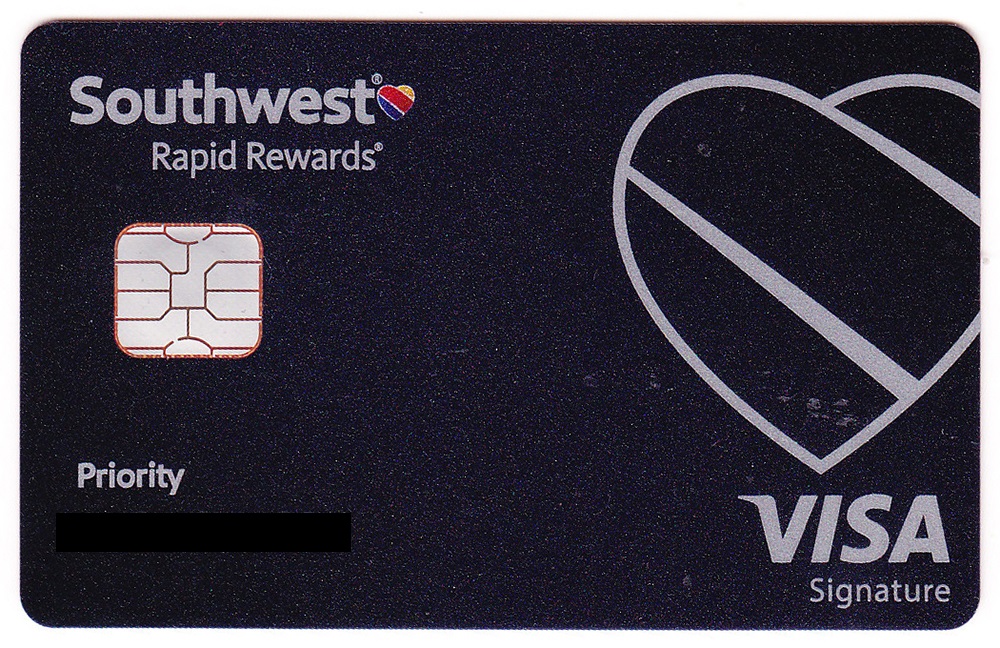

Last but not least, here is what the new Chase Southwest Airlines Priority Credit Card (top) looks like in comparison to the old Chase Southwest Airlines Plus Credit Card (bottom). The only major difference is that the credit card number and Rapid Rewards number are moved to the back on the Chase Southwest Airlines Priority Credit Card.

- Chase Southwest Airlines Priority Credit Card Front

- Chase Southwest Airlines Priority Credit Card Back

- Chase Southwest Airlines Plus Credit Card Front

- Chase Southwest Airlines Plus Credit Card Back

If you have any questions about the Chase Southwest Airlines Priority Credit Card or the conversion process, please leave a comment below. Have a great day everyone!

P.S. Check out my other “Keep, Cancel or Convert?” blog posts here.

Just signed up for the SW Plus card as the personal half of my Companion Pass strategy for 2019/2020. In thinking about this strategy for after the first year, I came to the conclusion that upgrading to th Priority Card is the wrong move for me. As great as the priority boarding is, I don’t put value to it. The real reason, though, is that the Priority Card does NOT offer a referral bonus! As long as you can get a single referral bonus per year, the Prioirty Card isn’t as valuable to keep. When referrals dry up, things change.

I’m sure Chase will start offering referrals on the Priority CC soon. Chase offers referrals on all of the other currently available credit cards.

My annual fee is about to post. Can I cancel my sw card within 30 days of the annual fee posting to get a refund on the annual fee and keep the anniversary bonus points?

Yes, your SWA anniversary points should post 2-3 days after your statement closes. After you see the SWA points in your SWA account, you can close the CC.

I have a personal and business SW card and just received my companion pass. I think I should cancel both cards so I can begin the 2 year downtime before applying for more cards from them, which isn’t bad because my companion pass is good for a year and a half. It’s pointless to keep the card with minimal benefits and pushing off the massive sign on bonuses that will give me another companion pass in the future. Thoughts?

Did you just open up those 2 credit cards with Chase? I would recommend keeping the CCs for 11-12 months and not closing the CCs right away. You do not want Chase to blacklist you from getting new CCs in the future.

If your companion is old enough to get CCs, they should apply for the SWA CCs when your companion pass expires.