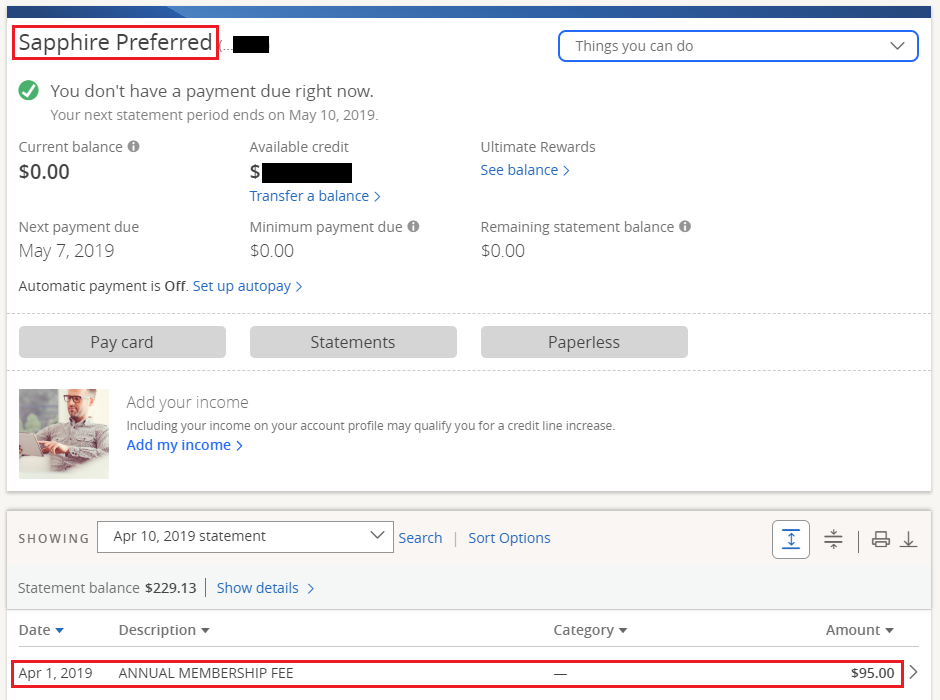

Good afternoon everyone. As part of my “Keep, Cancel or Convert?” series, I like to evaluate and reevaluate credit cards to make sure they still deserve a spot in my wallet (or my fiance’s wallet, in this case). Last year, my fiance was approved for the Chase Sapphire Preferred Credit Card and she used it heavily when she first got the credit card (to meet the $4,000 minimum spending requirement), but that credit card hasn’t gotten much use lately. This is mainly because I have the Chase Sapphire Reserve Credit Card that offers 3x on travel and dining vs. the Chase Sapphire Preferred’s 2x on travel and dining. And since my March App-O-Rama, I have been using my American Express Gold Card since that credit card offers 4x on dining. Long story short, my fiance’s Chase Sapphire Preferred was not worth the $95 annual fee. This is hard to believe since the Chase Sapphire Preferred was one of the best travel rewards credit cards just a few years ago. We decided the best thing to do would be to convert her Chase Sapphire Preferred Credit Card into a Chase Freedom Credit Card, since we did not have a Chase Freedom between the two of us and the 5% rotating cash back categories would be easy to use.

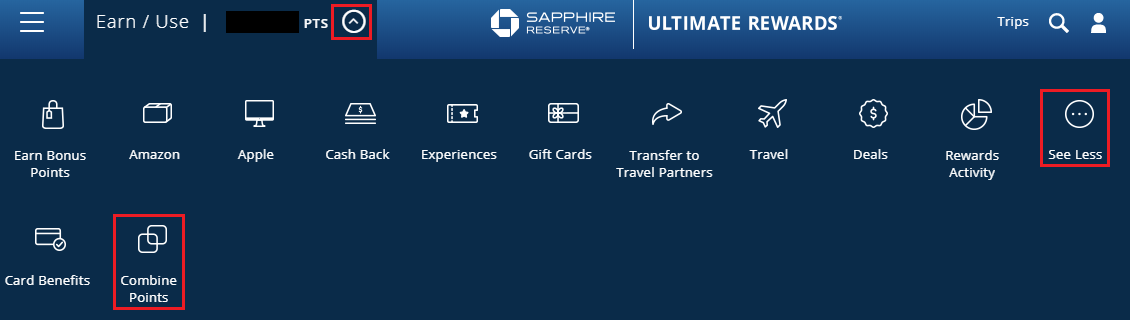

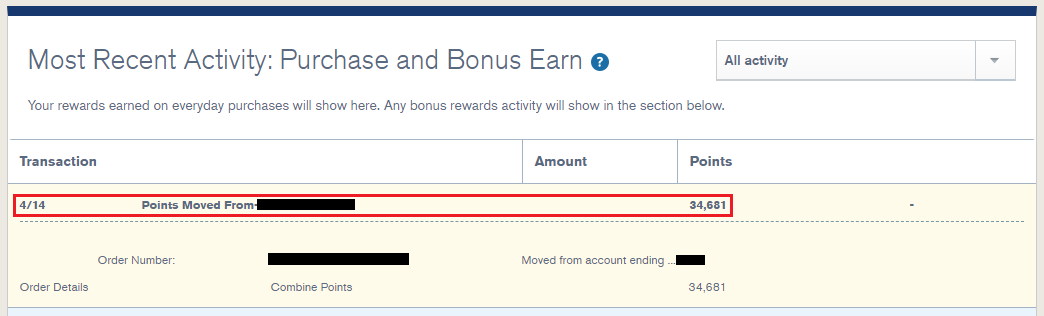

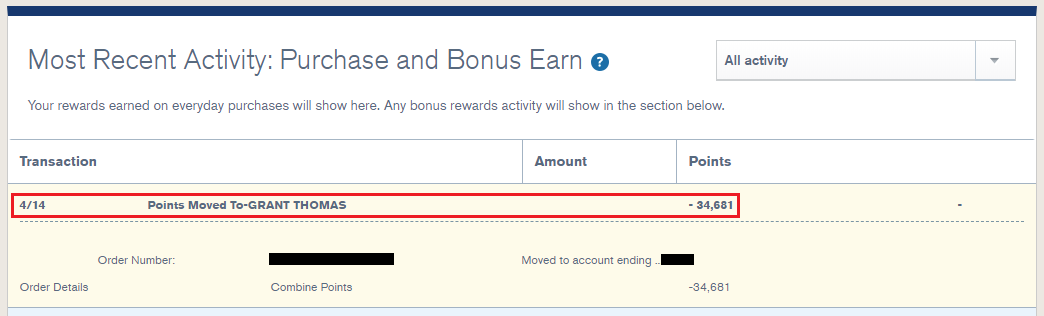

Before we called Chase, my fiance logged into her Chase Ultimate Rewards account and transferred all her Chase Ultimate Rewards Points to my Chase Ultimate Rewards account. You can do this instantly online by clicking the arrow near your Chase Ultimate Rewards Points balance, then clicking the See More/Less button on the right side, and then clicking the Combine Points button.

According to the Chase Ultimate Rewards terms, “You can move your points, but only to another Chase card with Ultimate Rewards belonging to you, or one member of your household.” Here are the complete terms:

Combine points with other Chase cards with Ultimate Rewards

You can move your points, but only to another Chase card with Ultimate Rewards belonging to you, or one member of your household. If we suspect that you’ve engaged in fraudulent activity related to your credit card account or Ultimate Rewards, or that you’ve misused Ultimate Rewards in any way (for example by buying or selling points, moving or transferring points with or to an ineligible third party or account, or repeatedly opening or otherwise maintaining credit card accounts for the sole purpose of generating rewards) we may temporarily prohibit you from earning points or using points you’ve already earned. If we believe you’ve engaged in any of these acts, we’ll close your credit card account and you’ll lose all your points.

My fiance entered my 16 digit Chase Sapphire Reserve Credit Card number, checked the box to transfer all of her Chase Ultimate Rewards Points and clicked the Submit button. Her Chase Ultimate Rewards Points were instantly transferred to my Chase Ultimate Rewards account. (Thank you Babe!)

She signed out of her Chase account and I signed into my Chase account. There they were, all of her Chase Ultimate Rewards Points in my Chase Ultimate Rewards account.

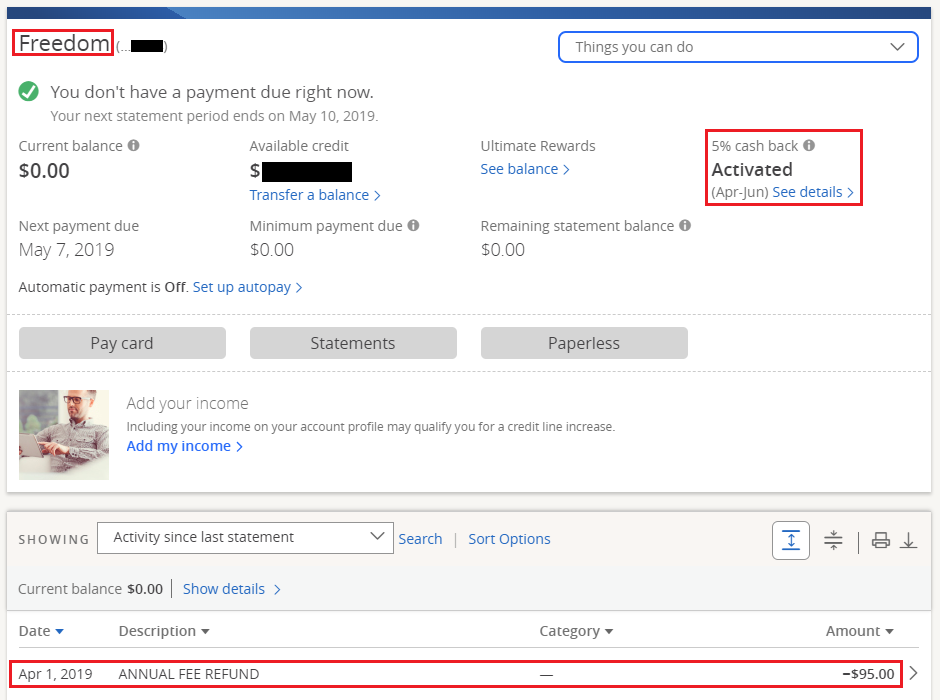

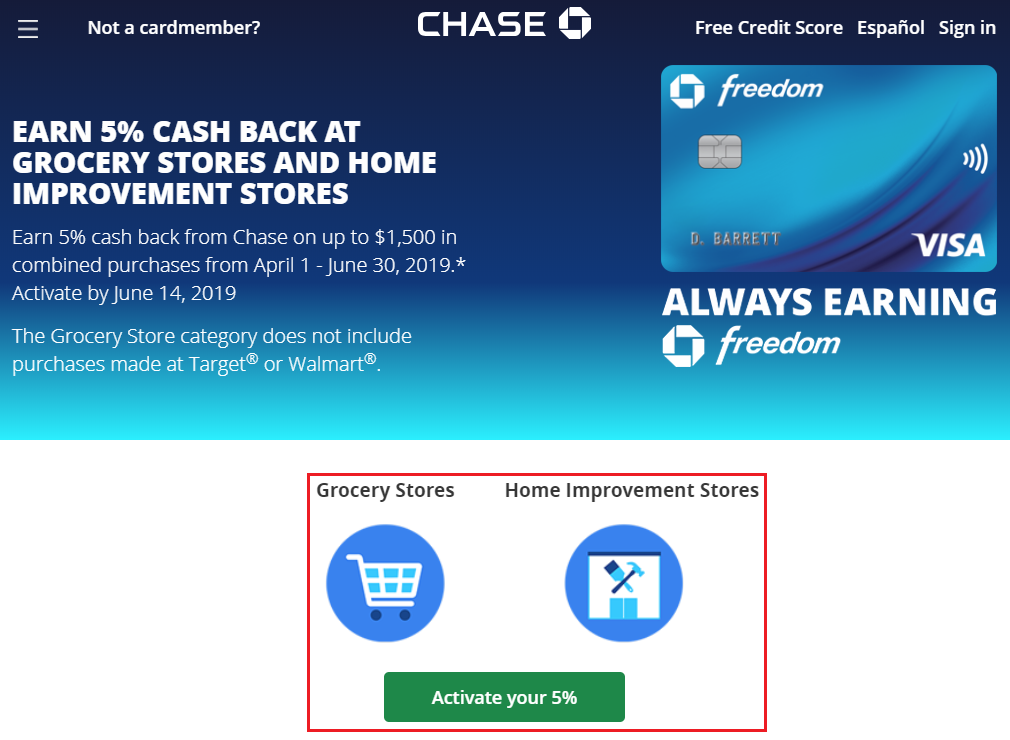

She then called the number on the back of her Chase Sapphire Preferred Credit Card and asked the rep to convert her credit card into a Chase Freedom Credit Card. The process was very easy and her new Chase Freedom Credit Card should arrive in the mail in the next few days. The rep also enrolled her card in the Chase Freedom Q2 5% cash back categories (grocery stores and home improvement stores). A few days later, the $95 annual fee was refunded and backdated to match the same date that the $95 annual fee posted.

Lastly, you can view all merchants participating in the Chase Freedom Q2 5% cash back categories.

If you have any questions about transferring Chase Ultimate Rewards Points to another Chase Ultimate Rewards account or about converting a Chase Sapphire Preferred Credit Card into a Chase Freedom Credit Card, please leave a comment below. Have a great day everyone!

I product changed to a Freedom last year when I realized that my CSP could only guarantee a return of 2.5% in travel and dining, while my USAA Limitless guarantees 2.5% on everything. I had hoped to later get a CSR, but that plan went out the window with the 48-month rule.

Yes, my fiance wanted to get the CSR too, but the 48 month rule messed up that plan. Do you still have a premium Chase Ultimate Rewards CC so you can transfer to airline and hotel partners?

I’m a solo household/traveler and currently have a Chase CC trifecta (CSR, CSP, and regular Freedom card) – any reason in keeping it as I won’t ever be able to hold a CSR and CSP together again? The CSR is my main CC at the moment with my CSP getting little to no spend so probably not worth the annual fee. Definitely thinking of dropping down to the Freedom Unlimited but is there any reason at all to keep all three?

You are right, the CSP is pretty worthless considering you have the CSR. I would normally suggest the Freedom Unlimited, unless you think you will get more value out of having a second Freedom – do you tend to max out the 5% rotating cash back categories? If so, I would get 2 Freedom CCs.

Not usually as some of the rotating categories just don’t apply to my lifestyle. Sounds like a downgrade to Freedom Unlimited is in my future. Thanks!

Same here, I can usually max out 1-2 quarters and barely touch the other quarters. You will be happy with your Chase Freedom Unlimited CC :)

Grant…I’ve had the Sapphire Preffered now for 8 yrs….yes it used to be one of the best cards before..but now too many competitors with better benefits. Do you think its worth it for me to get the CSR and then downgrade to the CFU?

If you qualify and can get approved for the Chase Sapphire Reserve, I think it is a good card. Then you can downgrade to a Chase Freedom Unlimited. Sounds like a solid plan :)

Hello Grant!

Quick question. My gf needs to do a big balance transfer and we were looking at the zero fee 0% Apr offer chase has for the Slate card. Thing is that she currently has 2 cards with chase and one is a Slate and the other a Freedom card. Their combined CL is under 7k and has zero balances there.

I hear that she can’t apply to get the same Slate card if she has one (unless I am wrong and then we can apply right away), so my question to you would be:

1) What card would you convert the existing Slate card to (in order to then get a slate once it converts out)

2) How long after she converts the slate to something else can she apply for a new slate and have no issues with them saying she already has a Slate card?

Any advise on this very much appreciated as we are just 3 weeks apart from a deadline to pay off a big balance. (counted on Amex Everyday offer but they say she won’t get the offer and now this is back up plan #1, then it would be Bankof America zero fee card)

Thanks

Hi Pete, your girlfriend can convert her Slate CC to another Chase Freedom CC or to the Chase Freedom Unlimited CC. After you do that, wait for the new CC to arrive in the mail and for the new CC statement to close. After that, your girlfriend should be able to apply for another Slate CC. Let me know if you have any other questions. Thank you.

Thanks Grant!

Just to confirm then, so it is correct that she can’t get another Slate approved if she has one already, BUT it is ok to convert the Slate to a Freedom even though she has a Freedom already?

Also, her next statement period ends August 13th, so it should be safe to apply on August 14th?

Thanks again and that would be my last question :)

Yes correct. You can have 2 Chase Freedoms. I’m not sure if you product change if your statement close date will change. It should stay the same.

Hi Grant,

I would like to close my CSP card before the annual fee in September. I plan to apply for a CSR in a few years (2 years probably due to the 48 month rule). Can I open a CF or CFU now and transfer my Ultimate Rewards points to it before I close the CSP? I don’t have anyone I can transfer my rewards to for me to then ‘convert’ the CSP to CF.

Thanks!

Hi Nicole, you can actually convert / downgrade your CSP to a CF or CFU. You can also apply for a CF or CFU, assuming you do not currently have the same exact CF or CFU card. If you want one of each (CF and CFU), you can downgrade the CSP to the CF and apply for the CFU, or vice versa. If you want 2 CF, you will need to apply for a CF now and then later in September, you can downgrade your CSP to another CF. I hope that makes sense. Let me know if you have any questions.