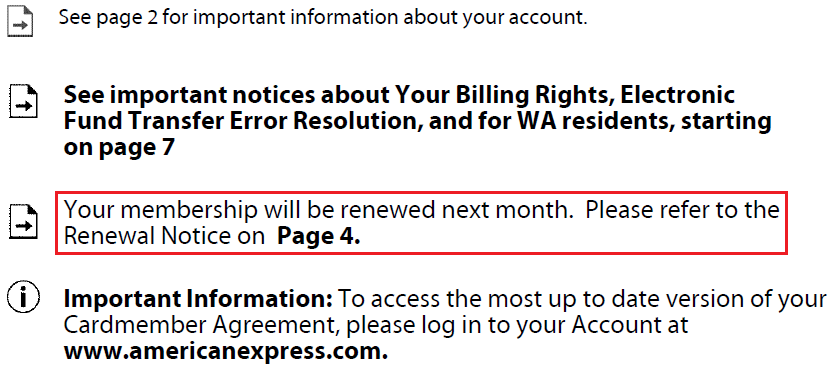

Good morning everyone. As part of my “Keep, Cancel or Convert?” series, I like to evaluate and reevaluate credit cards to make sure they still deserve a spot in my wallet (or credit card drawer). In today’s post, I will share my thoughts regarding my American Express Hilton Aspire Credit Card. I was reviewing my recent credit card statement and spotted a reference to the annual fee (it was very subtle and is probably overlooked by most people). I decided to check out page 4…

Page 4 had more details about the $450 annual fee.

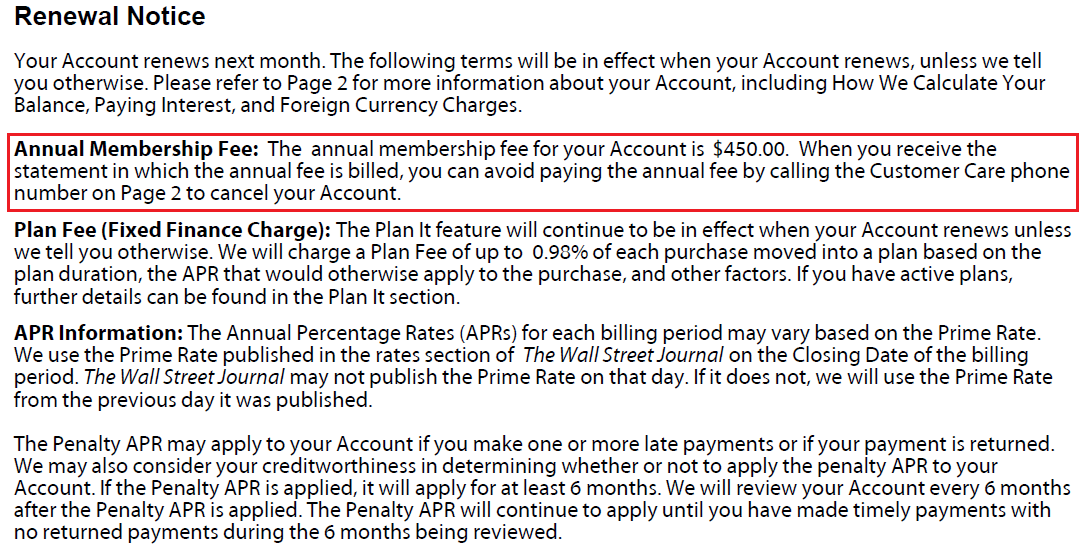

At this point, it is important to decide if a credit card is worth keeping. Even if you don’t have an answer right away, you have a month to mull it over and think about the pros and cons of the credit card. To refresh my memory, I went to the benefits section and reviewed the top benefits of the American Express Hilton Aspire Credit Card. Here are the first 3 benefits:

- Hilton Honors Bonus Points – it’s nice to earn bonus Hilton Points, but I don’t put much value on the ability to earn bonus Hilton Points since I only put a few Hilton purchases on the credit card.

- Complimentary Diamond Status – this is a nice benefit that gets me room upgrades, early check in, late check out, free wifi, free breakfast, and free lounge access.

- Annual Weekend Night Rewards – I used my free weekend night certificate for a $150-$200 night in San Diego.

Here are the next 3 benefits:

- Earn a Weekend Night Reward – this was easy when I had the Citi Hilton Reserve Credit Card, since I only needed to spend $10,000 to earn a free weekend night certificate, but spending $60,000 to earn a free weekend night certificate is just too much spending for me.

- $250 Hilton Resort Credit – I was able to stack $250 Resort Credit with a DoubleTree AMEX Offer ($45 Off $225). That was a good combo!

- $100 Property Credit – I did not use this benefit because you need a 2 night paid stay at a Waldorf Astoria property – that sounds too pricey for me!

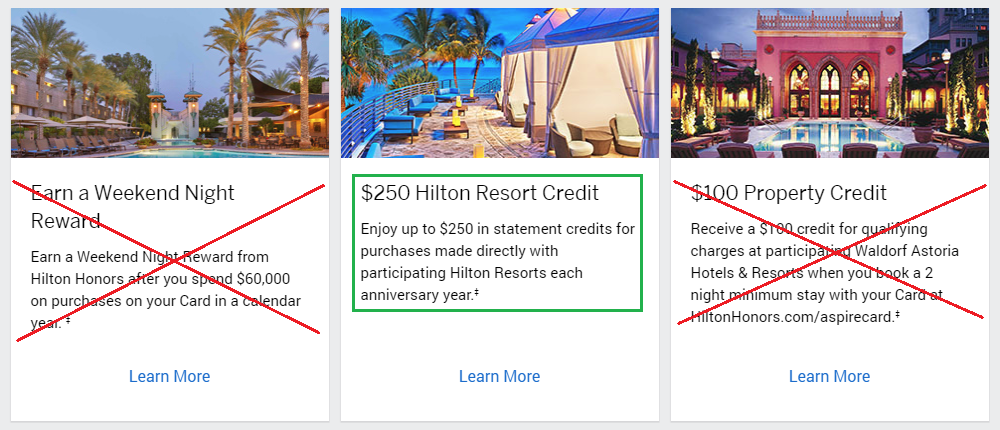

Here are the next 3 benefits (the rest of the benefits are boring and not worth anything to me):

- $250 Airline Fee Credit – I bought $250 in Southwest Airlines eGCs and got reimbursed by AMEX.

- Priority Pass Select – I have Priority Pass membership with several credit card, so another membership does not give any value.

- AMEX Concierge – I used the concierge service once, but I think this is free on all AMEX cards.

Let’s add up the value of the 4 credit card benefits that I used this year:

- Complimentary Diamond Status – I would easily pay $100 for Hilton Diamond Elite Status

- Annual Weekend Night Rewards – I value my free weekend night certificate at $150

- $250 Hilton Resort Credit – I value the $250 Hilton resort credit at 80% of face value ($200)

- $250 Airline Fee Credit – I value the $250 airline gift cards at 80% of face value ($200)

As you can see, I get about $650 in value from paying the $450 annual fee on my American Express Hilton Aspire Credit Card. The benefits you use and the value you get out of those benefits will determine how much value you get out of your American Express Hilton Aspire Credit Card.

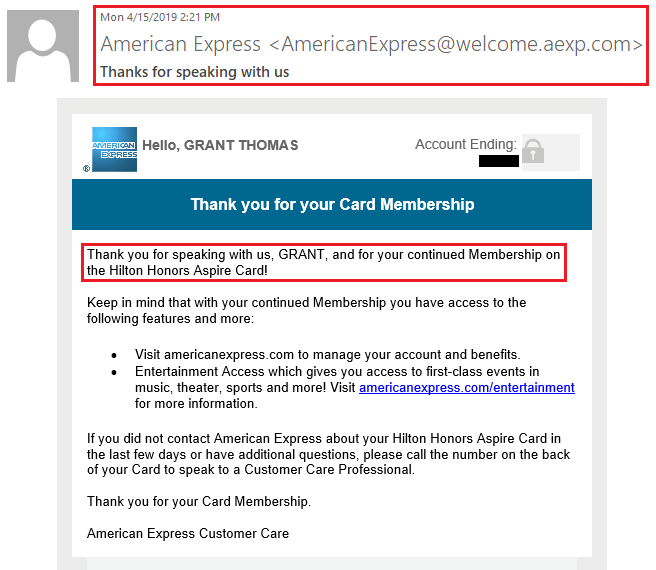

This credit card is definitely a keeper for me, but I decided to call American Express and ask if there were any decent retention offers available on my account. After getting transferred to the retention department, and after the rep read me all the card benefits, she finally gave me a retention offer: Earn 10,000 bonus Hilton Honors points after spending $2,000 in 3 months. 10,000 Hilton Honors points is worth about $50 to me. It was not a huge retention offer, but since I planned on keeping the credit card anyway, I gladly accepted the offer. Shortly after the call, I receive an email from American Express thanking me for my continued membership. No, thank you American Express!

If you have this credit card, do you plan on keeping this credit card, or are you more likely to downgrade to another Hilton credit card or just cancel this credit card? Let me know what you would do in the comments section. If you have any questions about the American Express Hilton Aspire Credit Card, please leave a comment below. Have a great day everyone!

Just curiosity, since you didn’t plan on closing the card, what’s exactly wording you told the rep? Something, I’d like to close my account? Or could you see if there’s any retention offer for me? I always don’t know what to say to them.

I told them that I saw a message on my credit card statement that my $450 annual fee was going to post on my next statement and I wasn’t sure if I was going to keep the credit card open. Then I asked if there were any retention offers available. Something along those lines should work for most retention calls.

Keeping even though I’ve experienced diamond upgrades as hit or miss, specifically misses at both waldorf’s I’ve stayed at.

The value outweighs fee by a ton

“Upgrades” is debatable for some of my stays too. Glad we both agree that the benefits outweigh the $450 annual fee.

Important – I think if one downgrades, it’s important to remember to wait a full year from when it was upgraded or approved, because of RAT. I never downgrade unless I have a full year to prevent claw back.

Yes, that is a good reminder about waiting a full year before downgrading.

Keeping for year two, but after that will cancel husband’s card, but keep mine. I’d value the resort credit at considerably less than $200 because I struggled to use it the first year. Also, dislike the “pressure “ I feel to use the free night for good redemption, finally used my for staycation at new Conrad in Washington. But diamond I’d value at way over $100. All in all, I anticipate keeping one card in our family as long as benefits remain the same.

Yes, you really only need 1 Aspire CC in the family. You can downgrade your husband’s card to the Ascend CC for $99 and get a free weekend night certificate.

According a fairly recent article by TPG (What Is Hilton Honors Elite Status Worth in 2019?), Hilton Diamond status is worth over $3000 assuming 72-night stays calculation. Although this method highly differs from CC-gained status, I believe the Hilton Diamond status is much more the $100 value you assigned it in your above article. Especially overseas, the status can get you awesome treatment and valuable benefits that more than pays for the Aspire card AF.

So, count me on the side to keep the HH Aspire AMEX card.

Dang, $3000 value for Hilton Diamond Status? I don’t get that much value, but it’s possible if you travel a ton. I wanted to keep my valuation conservative in the post, but the outcome is still the same – Aspire CC is a keeper.

Tpg valuations I always take w a microscopic nano fleck of salt.

$3k is nowhere near close for an average traveler.

Maybe 10% of that at best for a few stays thru the year. Upgrades are “fictitious money” in a sense.

Still worth keeping the card despite but $3k is pretty inflated

I agree. TPG values are often much higher than what most cardholders get out of the card. $300 value is much more realistic.

for an annual fee of $450 I am still getting $250 Delta’s gcs (why would you value them at 80%?? It still could be less if able to find much lower airfare with another airline instead but still $250 is 250 to me), $250 resort credit, weekend night that may be worth $150 but why not $200 or more, PriorityPass restaurant credits or lounge access as long as I am traveling a few times per year could be another $100-150, and Diamond status not differently gives me breakfasts so the more I stay with Hilton (meaning spend) the more I get back or so.

Therefore, this $450 could let me make some $250-300 or even more.

I wanted to show that even with very conservative estimates, I came out way ahead of the $450 annual fee. If you value the benefits very highly, you will get much more that $450 in value too.

Pingback: AMEX Hilton Aspire Credit Card Retention Offer: 10,000 Points After Spending $2,000 in 3 Months

Definitely a keeper for me! Although I wasn’t originally planning on using all the credits, I have received fantastic value for the first year.

Outside of the 150K signup bonus, I used the free weekend night at the Waldorf Astoria in Beverly Hills. The cash price for that night was $915 after taxes/fees for a standard room, and let me experience a very posh, very new hotel for very little. This single stay alone justified the whole annual fee for me. As Diamond, I received $50/night meal credit for 2 people (use for breakfast, lunch, or dinner).

I used $250 Southwest airline credit (e-gift card) in December & again in January, so $500 total, & I used them to cover all Southwest flights for myself & others that were going to be taken anyways.

Another stay was 3-nights Waldorf Astoria Las Vegas which used $250 Hilton resort credit & $150 in meal credits for 2 people (enabled 1 nearly free meal a day for breakfast or the bar) due to the Diamond status. Also used $100 Amex Offer credit. This brought the final cost per day under $180/day & including the 1 meal a day for 2, & I even used the chauffeured hotel Mercedes S-class.

I don’t think I would pay much for Diamond on its own unless I stayed at a lot of nicer Hiltons each year, but it did give me $200 meal credits for a modest 4 nights, so it would be worth $100 in real value & convenience.

I did NOT use the $100 credit for Waldorf on the card because the special booking prices were MORE than $100 higher to get the $100 credit, so there was NO value there.

$915 Waldorf free night + $500 airline credits + $250 resort credit + $200 Diamond meal credits=$1865

Even if I devalued the hotel cost & the meal credits, with these alone it is far above the annual fee for the first year & that ignores the $100 Amex Offer, the 150K signup bonus, & $100 Global Entry credit which I gifted to another person (which they appreciated, so it has value).

Even if second year was $600 hotel free night, $250 airline credit (since no double dip), $100 in meal credits or free breakfasts, & I didn’t use resort credit that year, it would still conservatively be $950, easily justifying the $450 fee for me.

Wow, you got great value from the Hilton Aspire CC. Thanks for sharing your experience. It is definitely a keeper for me for a long time :)

Pingback: My Recent American Express Hilton Aspire Credit Card Retention Offer