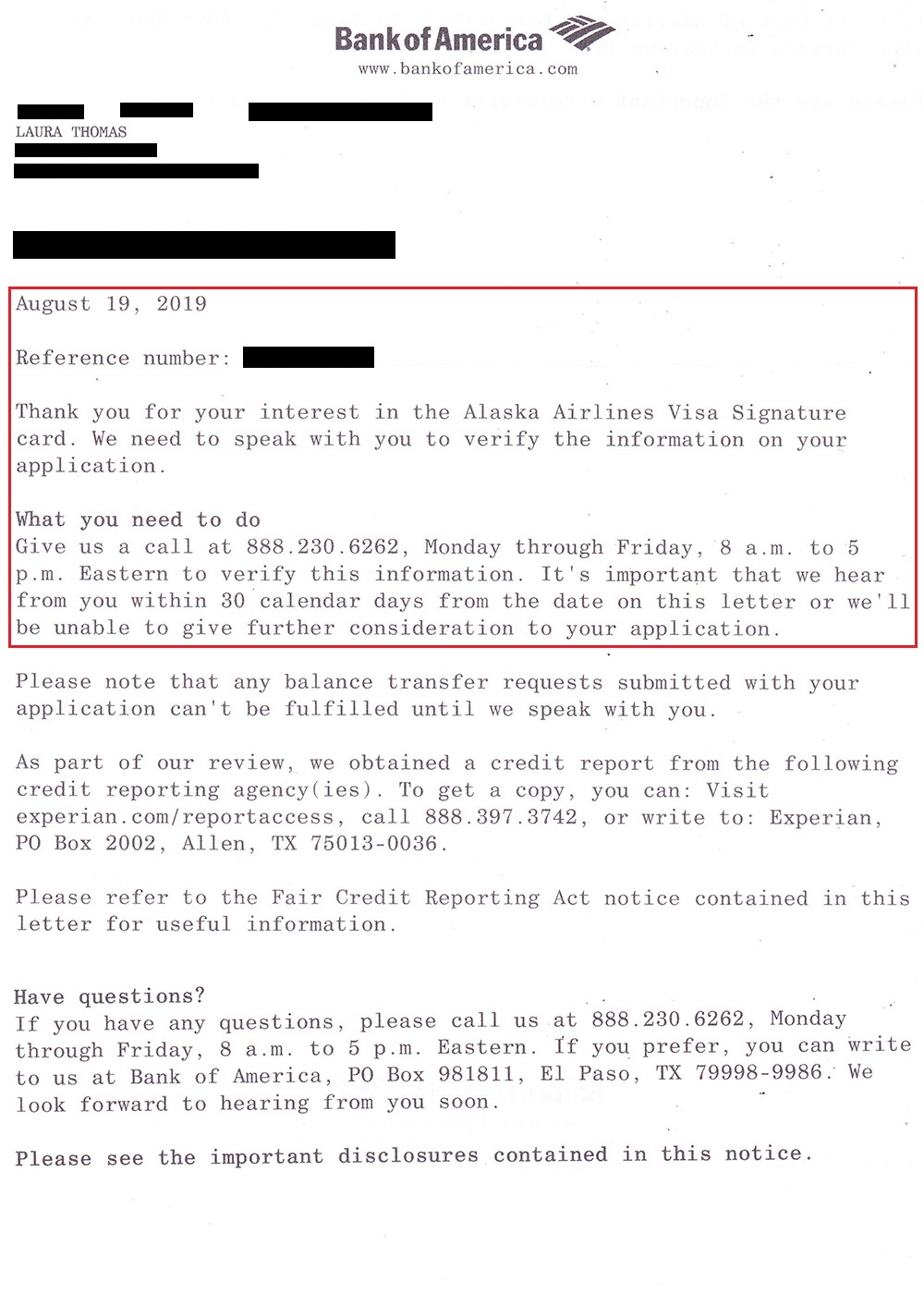

Good morning everyone, I hope you had a great weekend. A few weeks ago, my wife Laura decided to apply for the Bank of America Alaska Airlines Credit Card. Her credit report is great and she is a very responsible credit card user, so I figured it would be an easy instant approval for her. Unfortunately, it took several weeks and a few phone calls to get approved for this credit card. The reason? After we got married at the end of July, she was in the middle of changing her name on her passport, driver license, social security card, bank accounts, credit cards, etc. She also recently got promoted to a new position, so she had a higher salary than before. I believe both reasons resulted in Bank of America requiring additional documentation because her new name and new salary were not showing up on her credit report (yet). In this post, I will share with you the process she went through to ultimately be approved for the Bank of America Alaska Airlines Credit Card.

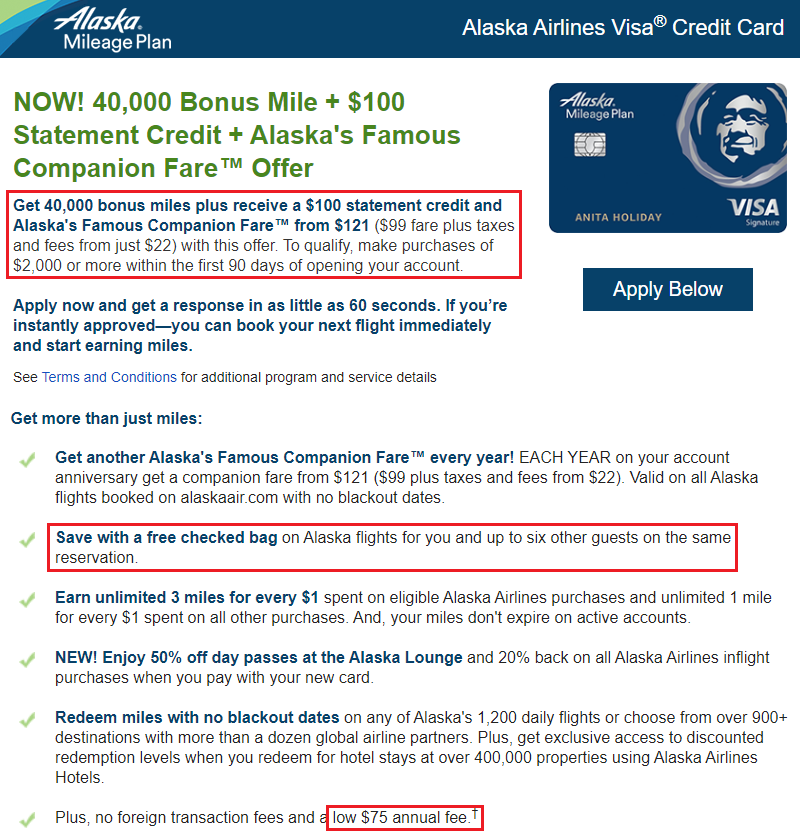

When we travel domestically from the Bay Area, we usually fly Southwest Airlines or Alaska Airlines. I loved the idea of the 40,000 Alaska Airlines miles sign up bonus and $121 Companion Fare; Laura loved the free checked bags. This credit card has a $75 annual fee, but offered a $100 statement credit the first year (Doctor of Credit has more info about this credit card).

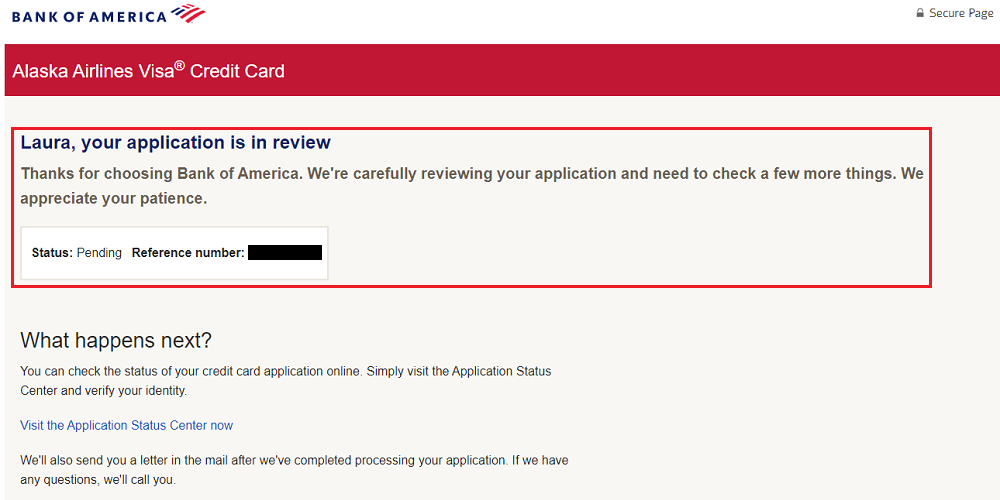

Laura filled out the application and clicked submit. I eagerly awaited an instant approval, but she got a pending decision. For reference, she applied for the credit card on August 12.

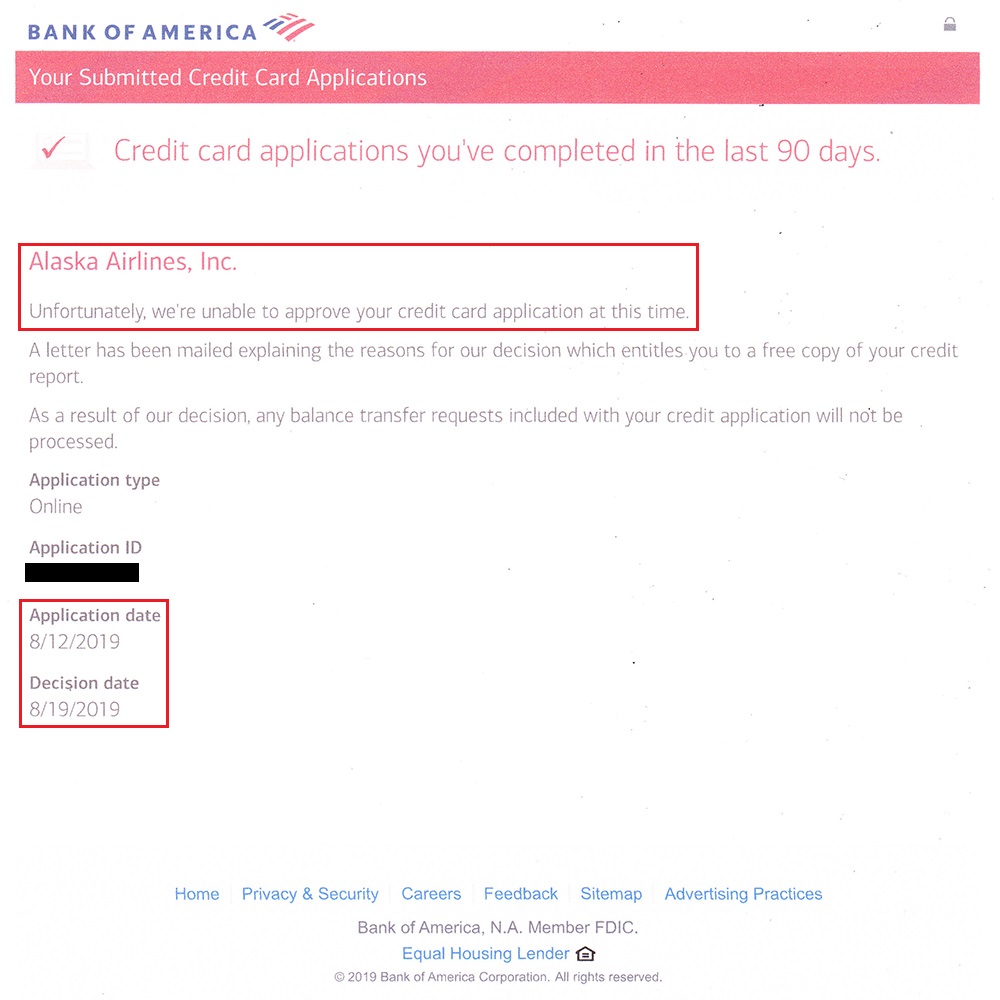

After a week passed, I checked the online application status and saw that she was declined for the credit card. I told her that we might be able to overturn the decision, we just needed to wait for the denial letter to arrive.

A few days later, the denial letter arrived. It was a soft decline, she just needed to speak to a Bank of America rep and provide information to verify who she was. After she explained that she recently got married and started changing her name on all her personal and financial accounts, the rep said that she was approved for the credit card. Woo hoo!

A few days later, I went back to the online application status website and the application was approved on August 30 (almost 3 weeks after initially applying for this credit card).

A few days later, the welcome letter and new credit card arrived.

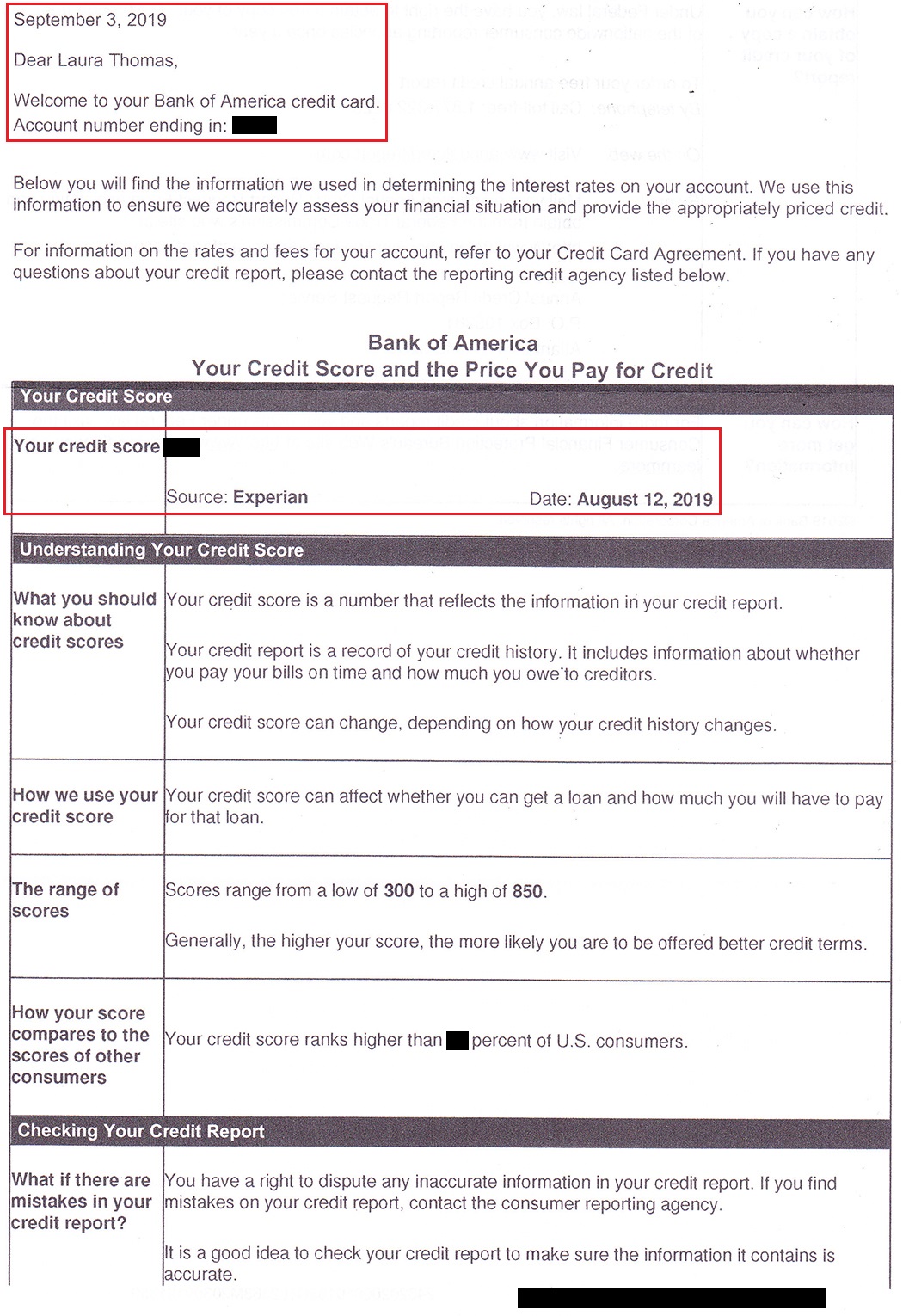

She also received a copy of her Experian credit score in the mail.

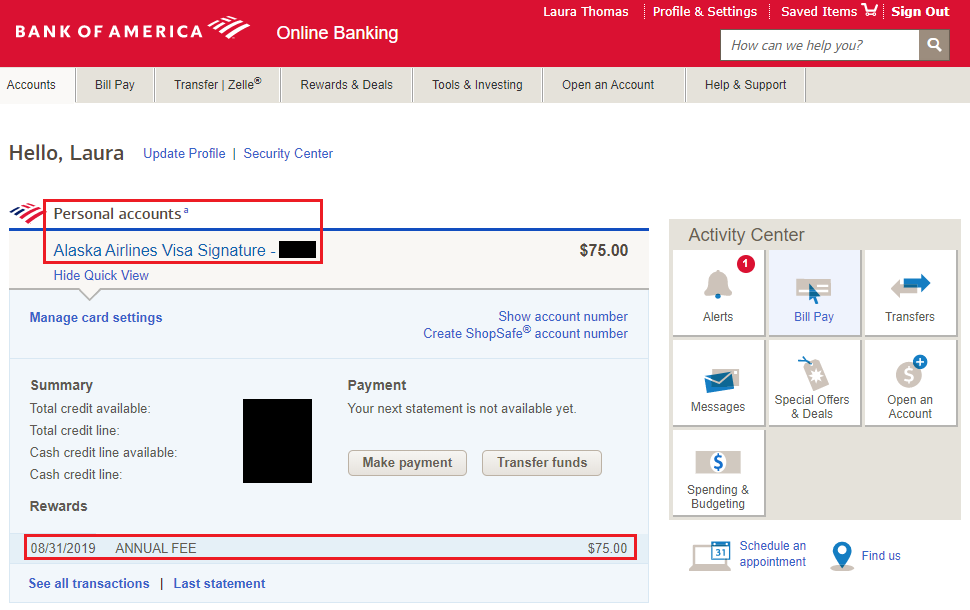

This was her first Bank of America credit card (hopefully first of many), so she set up her online account. After she logged in, she saw the $75 annual fee waiting for her. The annual fee posted on August 31, which is 1 day after the credit card was approved. She has to spend $2,000 in the next 3 months to get the 40,000 Alaska Airlines miles.

Lessons Learned

I think the process would have been a lot easier if she applied for the credit card before she started to change her name on all her personal and financial accounts. After getting approved, she could call the credit card company and tell them that she got married and changed her name. She actually did this with her other credit cards – Citi and Capital One only required a phone call, but Chase wanted her to stop by the branch with her marriage license.

I am really hoping her next credit card application goes more smoothly. Since she changed her name on her credit cards and with the Social Security Administration, that info should start to show up on her credit reports. After a few months, she should be able to get instant approvals on credit card applications. If you have any questions, please leave a comment below. Have a great day everyone!

I’ve been married for 1 year now. I’m still dreading changing my name. It’s so much work!

Yes, I had no idea how much work it would be, but I’ve seen it first hand. She often says it’s not fair that I don’t need to change my name on anything :)

I am wondering how my name change is going to affect my Chase business credit cards when the business name is my maiden name as I am a sole proprietor. Wondering if I should even tell them.

Hmm, that is interesting. If you change your drivers license, you should update the name on your business credit card. I’m not sure if you will need to update the business name with Chase too.

I had to update my name with all my chase accounts. They wouldn’t approve my new business card as my business was under my maiden name. Will have to try again soon. My business card still shows my maiden name as the business name and my married name as the card holder. Who knows if they are going to deny me again.

Yikes, that is a little messy. I’m sorry Chase is not making things easy for you.

Why change names ? It’s optional and is an antiquated custom

Doesn’t everyone want to have the last name ‘Thomas’? Maybe I am biased…