Good morning everyone. As a result of my recent July Credit Card App-O-Rama, I now had 2 Citi Premier Credit Cards. The plan all along was to product change the first / oldest Citi Premier Credit Card into a new Citi Rewards+ Credit Card. I will keep the second / newest Citi Premier Credit Card as is because I need access to the Citi Thank You Point airline transfer partners. I called Citi and asked the rep to convert my Citi Premier Credit Card into a Citi Rewards+ Credit Card. The rep processed the conversion and stated the following:

- The conversion process would take a total of 51 days, starting on September 5, 2019.

- The conversion process would be completed on October 26, 2019 (if I wanted to stop the conversion process, I needed to call back before this date).

- My credit card account number would not change (but the credit card expiration date and CVV code would most likely change).

- It would take up to 11 days for benefits to kick in (I’m not sure if that is true, by credit card benefits seemed to kick in right away).

- My new Citi Rewards+ Credit Card would arrive in 10-14 days (but I could continue to use my existing Citi Premier Credit Card until the new credit card arrived).

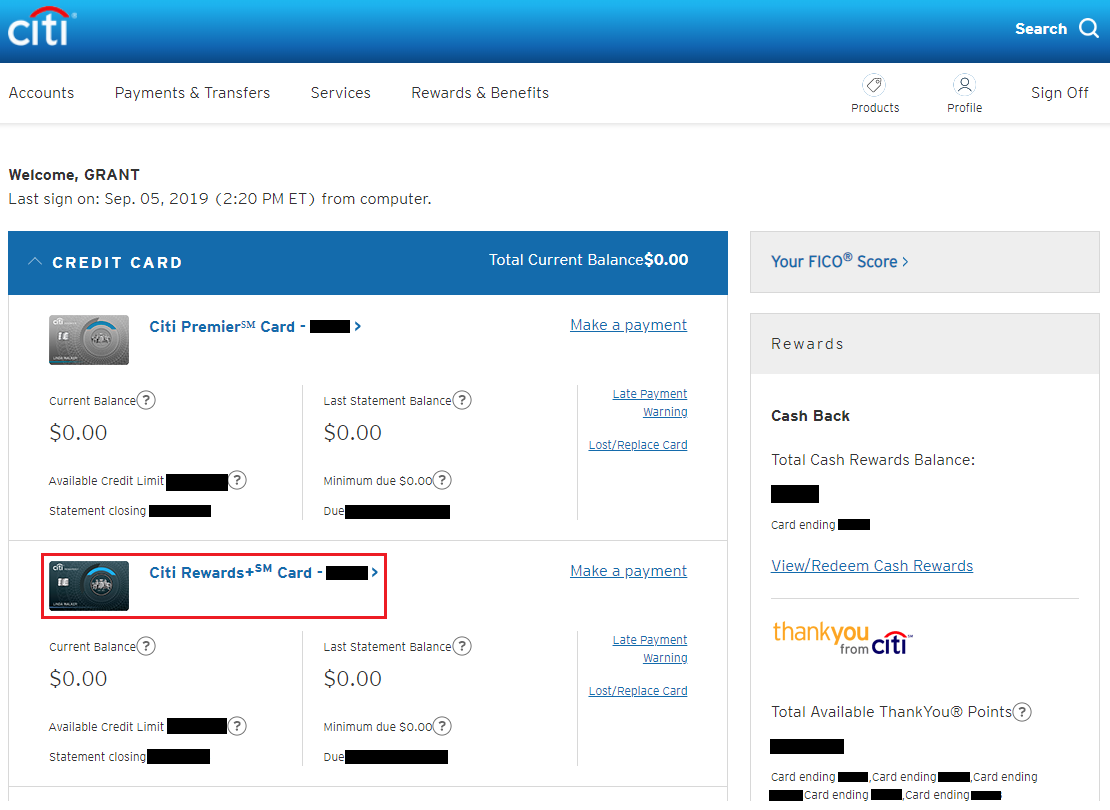

After the call, I logged into my Citi online account and spotted my new Citi Rewards+ Credit Card beneath my Citi Premier Credit Card.

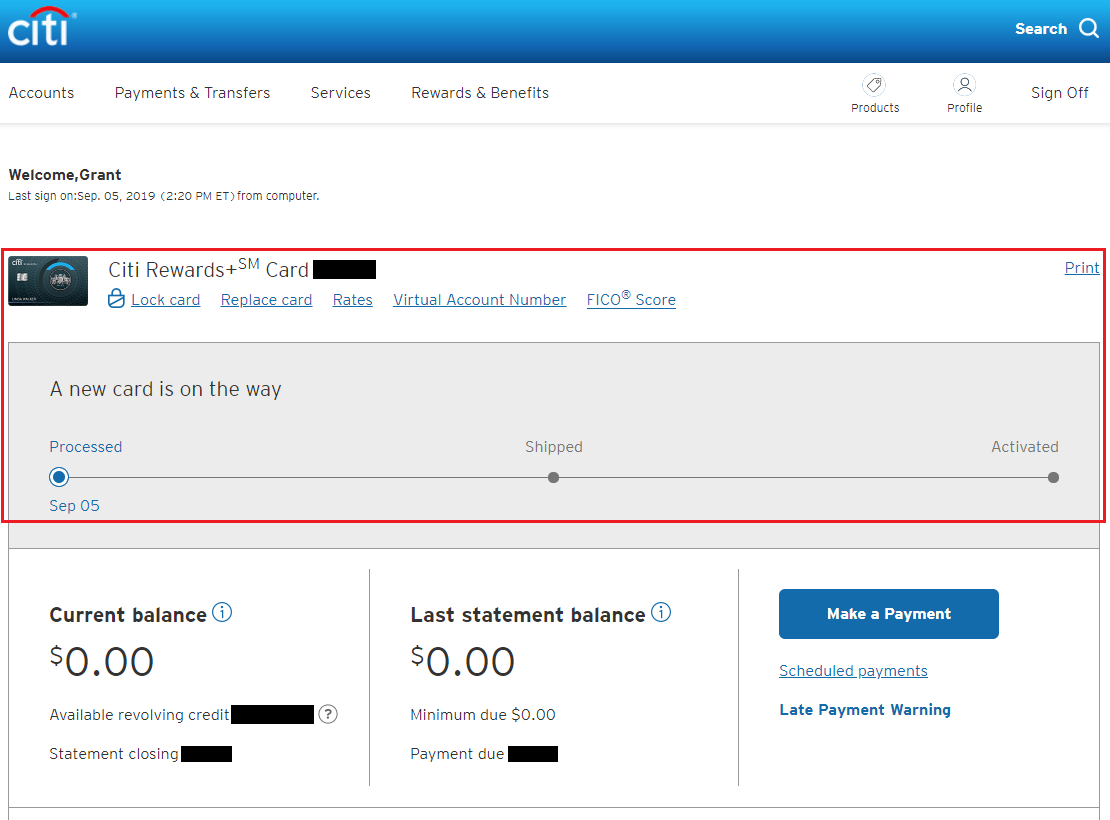

I clicked on the Citi Rewards+ Credit Card account and it said a new credit card was on its way.

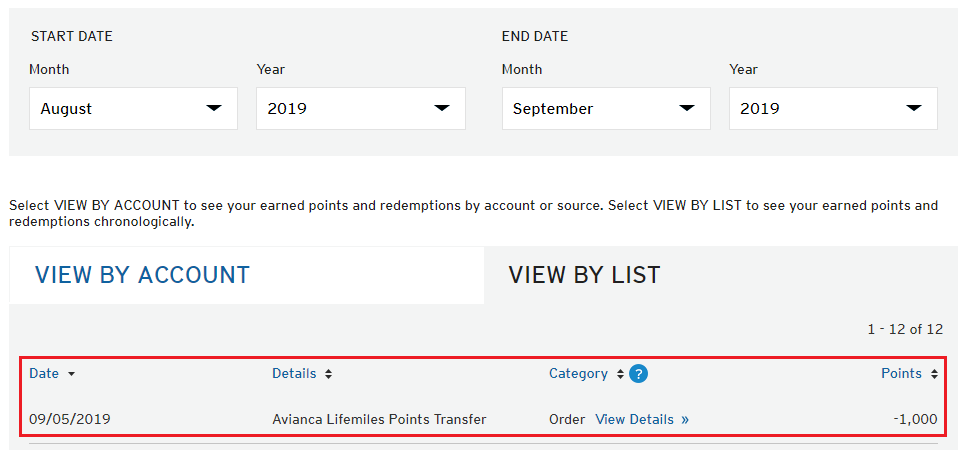

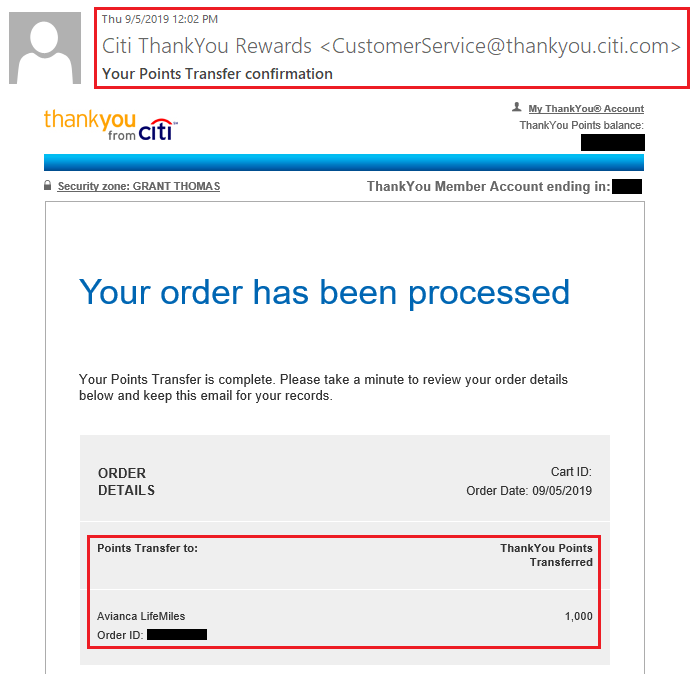

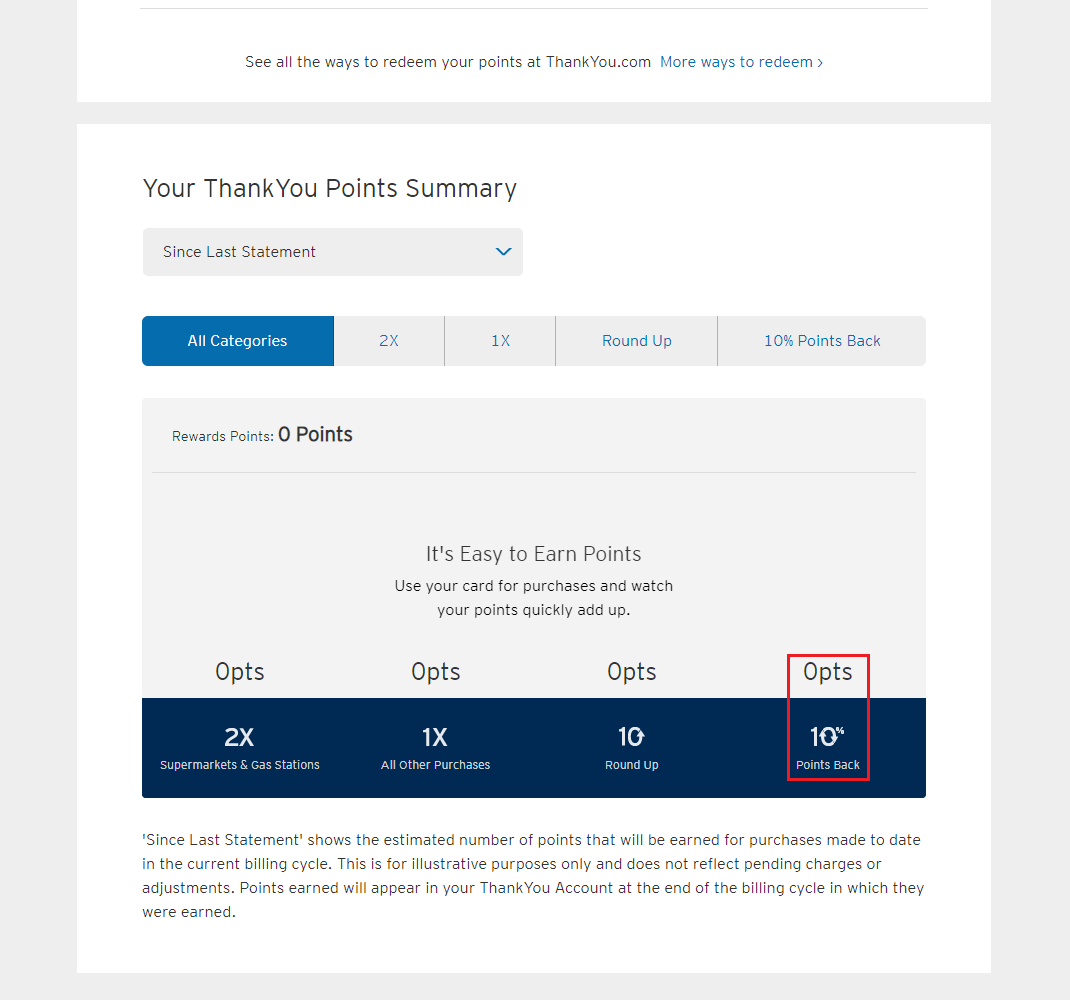

I was curious if the 10% rebate on redeemed Citi Thank You Points would kick in right away, so I immediately did a test transfer of 1,000 Citi Thank You Points to my Avianca LifeMiles account.

The Citi Thank You Points transfer was processed around 12pm on September 5.

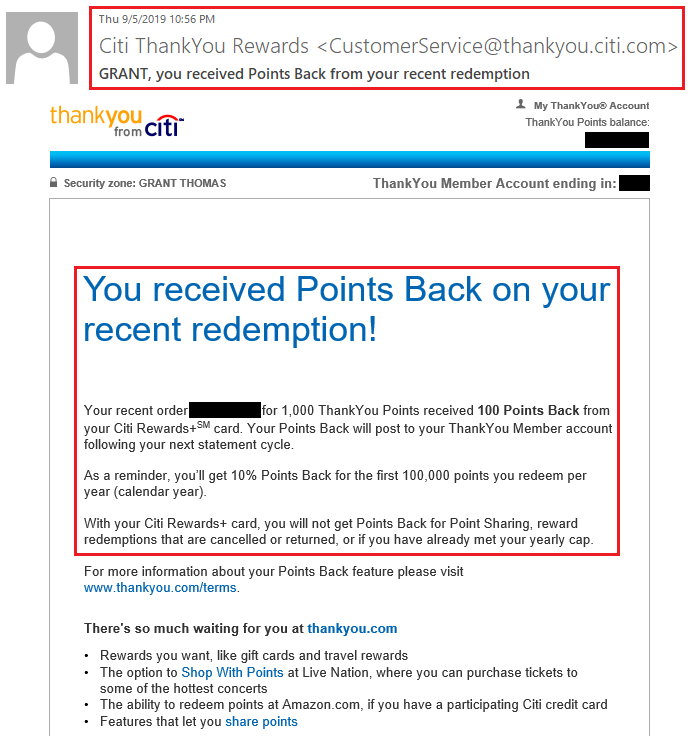

Roughly 11 hours later, I received this email from Citi stating that I would receive 100 Citi Thank You Points (part of the 10% rebate up to 10,000 Citi Thank You Points per calendar year).

I kept checking to see if the 100 Citi Thank You Points posted to my Citi Thank You account, but nothing has posted yet. I think I need to wait for my first Citi Rewards+ Credit Card statement to close before I will see the rebated Citi Thank You Points in my account.

Here is the front and back of the Citi Rewards+ Credit Card:

If you have any questions about the conversion process or the 10% rebate, please leave a comment below. Have a great day everyone!

Seems Citi are really pushing the rewards plus card. I have got several emails from them offering to PC from the TY Preferred card.

On an unrelated question. You had a recent post about the AV credit card. Do you know how the 50% discount on award travel works? Is it valid for multiple passengers on the same booking or just for 1 person?

Are you referring to the Banco Popular Avianca Vuela CC? I really have never looked into the 50% discount, but I think it has to be on Avianca, not a partner, but I don’t know much else about the discount.

Yep thats the one. Thanks for the follow-up. Trying to figure out if its worth putting spend on the card beyond the initial sign-up. Cannot find much data about this particular benefit. T&C are not clear

I would probably assume it’s not worth the additional spend on that CC.

GRANT —

Did you see when your combined TY points expire?

Many people have reported that their TY points from the converted card expire within 7 days!

I think you had better check this out!

Hi Hadley, sorry for the delay. I have clicked every link in my Thank You account and do not see anything related to points expiring. The points from my original Citi Premier CC must have been used years ago, so I don’t have to worry about that.

I’d love for you to go into the advantages of the Rewards+ card. I have two premier cards and I’m trying to figure what to do. Maybe change one to a double cash? Any thoughts would be welcome.

You definitely need to keep 1 Citi Premier CC so you have access to Citi’s Thank You Point transfer parters. Then you need to decide if converting to the Citi Double Cash CC is better than the Citi Rewards+ CC. I would probably wait 1-2 months to see what new card benefits/features are added to the Citi Double Cash CC then decide then.

Citi allows for holding multiple Premiers for the same social? Do you receive bonuses on each?

I did.

Yes, as long as you meet the Citi application rules. DOC explains it well: https://www.doctorofcredit.com/citi-24-month-churning-rule-explained-detail/

A bit tangential to this, but, does anyone know if you can product change from a Citi AAdvantage card to a TY Points card?

I think it’s possible, just give them a call. You might need to product change to a Citi Double Cash or Citi Rewards+, then upgrade to a Citi Premier.

So did you you have to combine thank you points accounts from both Premier Cards? When combining accounts do the points expire in 90 days? I currently have 2 Premier cards and 2 thank you points accounts. I want to combine them into one account, but unsure how the process works?

I have several Thank You Point earning CCs linked to the same account. I called Citi to have the TYPs go to the same account. I don’t think there is any expiration date issue when combining accounts, that only kicks in when transferring TYPs to another person.

The terms read to me when I called to convert said points will expire in 60 days. So I am going to hold off till I transfer the points.

Yes, if you want to be safe, redeem or transfer your Citi Thank You Points before converting to a Citi Rewards+ CC.

Pingback: Prorated Annual Fee Refund Posted After Converting Citi Premier into Citi Rewards+