Good morning everyone. As you all probably know by now, the Chase Sapphire Reserve Credit Card will be adding 2 new benefits (Lyft Pink Membership & DoorDash’s DashPass with a $60 yearly credit) along with raising the annual fee from $450 to $550, beginning on January 12. Doctor of Credit has all the details on the key dates:

- Annual fee will increase to $550 for new users on January 12, 2020

- Annual fee will increase to $550 for existing users in April 2020

- Not possible to product change to the card until after January 12, 2020 (new $550 annual fee will be charged)

- Complimentary Lyft pink membership to be added on January 12, 2020

- $60 DoorDash credit to be added for 2020 and 2021 (this is is an annual credit that is valid from 1/12 – 12/31 each year)

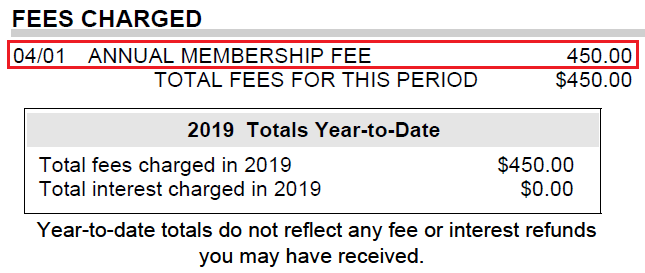

The first thing I wanted to do was take a look at my 2019 credit card statements and see when the $450 annual fee posted to my Chase Sapphire Reserve. It looks like my annual fee posted on April 1, 2019. The new $550 annual fee will increase in April 2020, but no specific date is listed. If I am really unlucky, the $550 annual fee will post on my April 2020 statement, but if I am really lucky, the $550 annual fee will post next year on my April 2021 statement. I should have my answer in 3 months…

The next thing I did was look at all my Chase credit cards. I have 3 business credit cards and 5 personal credit cards. In total, I pay Chase $1,307 in annual fees every year. If you think that is high, you should read my post: I Paid $4,588 in Credit Card Annual Fees in 2019 & Was it Worth it?

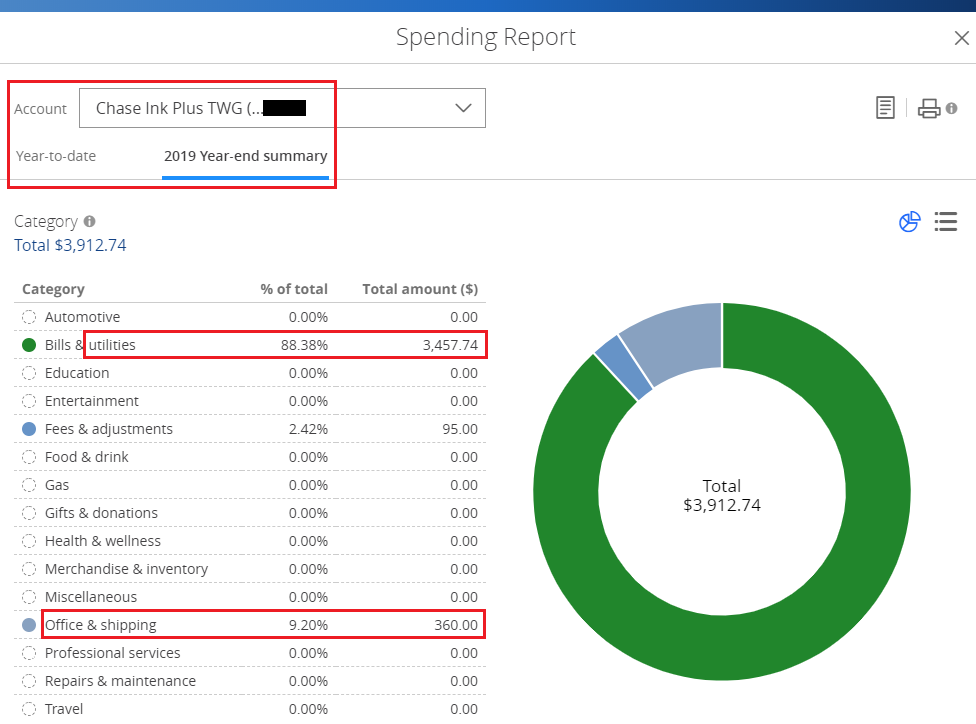

The first idea that came to mind was that I could downgrade my Chase Ink Plus Business Credit Card to another Chase Ink Cash Business Credit Card and save myself the $95 annual fee, which would basically cancel out the $100 annual fee increase on the Chase Sapphire Reserve. The Chase Ink Plus is no longer available, but the only real difference between that credit card and the no annual fee Chase Ink Cash is that the Chase Ink Plus allows $50,000 of 5x transactions, compared to the Chase Ink Cash which only allows $25,000 of 5x transactions. I checked out my 2019 spending report on my Chase Ink Plus and it said I only spent $3,912.74. If I remove the $95 annual fee, I only spent a total of $3,817.74 in 2019.

I am 100% confident that all of those transactions earned 5x, so my Chase Ink Plus earned 19,089 Chase Ultimate Rewards Points last year. When I transfer those points to my Chase Sapphire Reserve, they are worth $286.34 in travel. After accounting for the $95 annual fee, I only generated $191.34 in value from this credit card. Since I am nowhere near maxing out the $50,000 in 5x categories, I would not be giving up anything by downgrading to the Chase Ink Cash. And don’t forget, I have another Chase Ink Cash (previously this card was a Chase Ink Bold), so I have access to another $25,000 in 5x categories, if I ever need it.

Even though I’m not super excited about these new changes, I still plan on keeping my Chase Sapphire Reserve. I like the primary car rental coverage, the 1.5 CPP travel redemptions, and the $300 annual travel credit. I don’t use Lyft very often when I’m home, but I do tend to use Uber and Lyft often when I travel, so I’m looking forward to my Lyft Pink Membership and the discounted rides and 10x earning. I’ve never used DoorDash, but I’ll figure out a way to use the $60 annual credit.

Do you think it makes sense to keep the Chase Sapphire Reserve and downgrade my Chase Ink Plus to the no annual fee Chase Ink Cash? What would you do in my situation? Please let me know in the comments section. Also, if you have any questions, please leave a comment below. Have a great day everyone.

My wife & I both downgraded from the Ink Plus to the fee free ink cash a couple of years ago. Saving those 2 annual fees was a good move. When Office Max has fee free gift card sales I sometimes hit them hard at the 6 stores in my town but I’ve only once gotten close to the 25k limit on office stores cable and cellphone bills. We have a second card if we ever needed another 25k. I consider my decision re keep or cut my CSR as a totally separate issue. I’m very attached to CSR so I’ll probably keep at least another year and try to get some use from Doordash and Lyft Pink. If I can get at least 50 of my extra 100 annual fee back I can live with that for now.

Hi Larry, sounds like you made the decision to downgrade from the Chase Ink Plus to the no annual fee Chase Ink Cash much sooner than I did. Glad it has worked out well for you. I also have an irrational attachment to my Chase Sapphire Reserve. I barely use it in the US, unless renting cars or at restaurants that do not take my AMEX Gold, but it is my go to card for international purchases. Like you said, if I can get $50-$60 of value out of the new Lyft and DoorDash perks, I will be happy.

I was already planning to get rid of my CSR this year, and recently signed up for the Ink Preferred to preserve 3x on travel and the ability to transfer UR points. I’ll gladly take advantage of these new benefits until my annual fee hits in August, and then cancel the card.

Sounds like a good strategy regarding your CSR and CIP. I don’t think Lyft or DoorDash are in MEX, right?

That’s correct. Postmates used to be here, but they pulled out of the market last month. There’s Uber (though Amex credits only work in the US), Didi, Cabify, and Bolt for transportation, and for food it’s Uber Eats, Didi Food, Rappi, SinDelantal (a subsidiary of Just Eat), and probably some others I haven’t encountered yet.

Lots of options, but many I’ve never used or heard of before. I don’t blame you for not wanting to keep your CSR when the benefits are not available in Mexico.